Healthcare IT outsourcing Market is expected to see a growth during 2025 to 2035 with growing requirements for cost-efficient, scalable, and innovative IT solutions for healthcare. As with greater pressure building up on the healthcare industry for the optimization of operations, patients' outcomes, and overall lowering of costs, the healthcare businesses, in response, are searching more and more for their outsourcing partners in the outsourcing of non-core IT activities

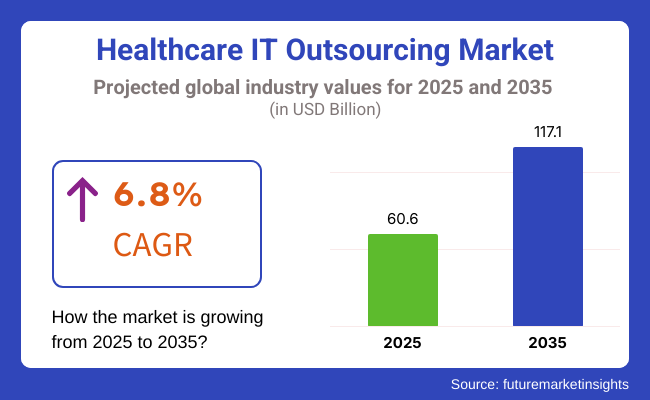

Market would be USD 60.6 Billion by 2025 and another USD 117.1 Billion by 2035 with a compound annual growth rate (CAGR) of 6.8% during the forecast period, because of adoption in cloud-based solutions, electronic health records (EHRs), healthcare analytics platforms, telemedicine infrastructure, and cybersecurity solutions.

With hospitals, clinics, and healthcare organizations investing in digital transformation, outsourcing is more and more regarded as a way of achieving timely implementation and cost savings without having to employ large in-house IT personnel.

Advances in technology, including the use of artificial intelligence (AI), machine learning (ML), and block chain technologies, are also driving healthcare IT functions out of their buildings. These new technologies enable providers to manage effectively large data analysis, predictive models, and secure sharing of patient data.

Moreover, changing regulation needs and data privacy laws like HIPAA in the USA and GDPR across Europe are also encouraging healthcare organizations to depend on professional vendors to facilitate compliance and secure data.

The healthcare IT outsourcing industry is also affected by increased acceptance of population health management methods, which demand more intense data combining and analysis capability. Such specialization by the outsourcing companies helps healthcare providers coordinate care, identify at-risk populations, and maximize resource allocation.

In the next decade, the industry is expected to experience a surge of new service products, from cloud-hosted EHRs and remote patient monitoring services to artificial intelligence-based medical coding and billing solutions. Growing emphasis on value-based care models and the need for real-time access to patient data will also drive the healthcare IT outsourcing market further.

Explore FMI!

Book a free demo

North America is among the largest healthcare IT outsourcing markets with the region having a well-established health infrastructure, very high adoption of e-health solutions, and technology-friendly regulatory environments that support improvements.

The United States alone is spearheading this, with hospitals and health systems outsourcing services such as revenue cycle management, claims processing, patient engagement services, and analytics.

Medical caregivers in North America are increasingly allocating investments in cloud platforms and artificial intelligence-driven decision support systems. This trend is generating demand for dedicated outsourcing vendors that can offer scalable, compliant, and secure IT solutions.

value-based reimbursement models popular in the region are encouraging medical care organizations to embrace outsourced analytics services to compute outcomes, patient satisfaction, and cost-effectiveness.

Cybersecurity and data privacy concerns are also influencing outsourcing plans. With rising ransomware attacks and data breaches, healthcare organizations are outsourcing cybersecurity services to offer end-to-end protection of sensitive patient data. Outsourcing partners will most likely be tasked with implementing robust data encryption, real-time threat detection, and secure network infrastructure.

As telehealth services and remote patient monitoring become more in demand, North America will remain a leading healthcare IT outsourcing market, driven by advanced technologies, regulatory requirements, and the need for continuous innovation.

In Europe, the European health IT outsourcing market is spurred by a combination of government policy, regulatory requirements, and digitalization pressures. Germany, the United Kingdom, and France are among the contributor countries, where healthcare organizations are offshoring EHR management, IT infrastructure services, and data analytics solutions to remain in compliance with strict data privacy laws and interoperability standards.

Implementation of the General Data Protection Regulation (GDPR) has led to substantially rising demand for business partners capable of handling sensitive patient information to ultimate security and transparencies standards. In a reaction to this, vendors provide bespoke IT solutions attuned to area regulations with efficient integration among quite a few varying healthcare systems

Population health management programs are on the increase across Europe, driving healthcare organizations towards outsourcing predictive model and advanced analytics solutions. Relying on external expertise, European health providers can spot impending health trends, automate treatment functions, and advance patient outcomes.

Another driver of outsourcing across Europe is the continued growth of telehealth and remote consultation services. Health sector organizations are partnering with IT services companies to implement simple-to-use telemedicine platforms, secure data exchange interoperability, and maintain video communication networks.

These outsourced services allow health care companies to focus on providing care and outsourcing IT burdens in their facilities.

Region is expected to increase as the fastest-growing healthcare IT outsourcing market due to the exponential growth of healthcare infrastructure, increasing use of digital health technology, and increasing demand for low-cost IT solutions.

Countries like China, India and Japan the major players, and the healthcare organizations outsource different services like EHR implementation, medical billing and coding, cloud hosting, and data analytics.

Expansion in the middle class and healthcare expenditure in the region are compelling Asia-Pacific clinics and hospitals to implement advanced IT infrastructure that automates administrative functions and improves patient management.

Outsourcing partners are meeting this with scalable, flexible, and localized solutions that can meet Asia-Pacific's multicultural healthcare markets.

Chinese government policies such as the Healthy China 2030 initiative are promoting health information exchange platform investments and smart hospital solutions. The outsourcing of IT functions allows Chinese healthcare providers to achieve these aggressive targets without going through the intensive internal IT development process.

India, with its abundance of skilled IT personnel and cost benefits, has become both a buyer and a seller of healthcare IT outsourcing services. Indian healthcare organizations are offshoring tasks such as claims processing, data entry, and application development, and also exporting these services to international clients.

The increasing need for telemedicine and mobile health apps across the Asia-Pacific region is motivating the providers to outsource digital health platform development and management. Outsourcing firms with experience in app development, user experience design, and cybersecurity are assisting healthcare centers in providing remote consultation services and digital health monitoring services.

Healthcare IT Outsourcing: DataSecurity and Compliance

Data security, regulatorycompliance, and interoperability continue to be significant challenges associated with the Healthcare IT Outsourcing Market. As more and more healthcare information becomes digital, organizations musthave strong cybersecurity in place to avoid data losses or breaches. Governments and regulatory authorities impose strict dataprotection regulations like HIPAA and GDPR obliging the outsourcing services to comply with high security and compliance standards. Second, smooth integration of disparate healthcare systems is complicated, resulting in inefficiency in data transfer and workflow management. From this, companies have to implement, forinstance, advanced encryption, AI, powered security solutions and the systems that keep compliance management in check.

TechnologicalAdvancements Driving the Growth of the Market

Rapid adoption of emerging technologies such as cloud computing, artificialintelligence, and block chain create lucrative opportunities in the Healthcare IT Outsourcing Market. Cloud-based solutions allow healthcare professionals to store, manage, andanalyse large amounts of patient data, all while ensuring scalability and accessibility. AI-poweredanalytics helps to increase diagnostic accuracy, improve workflow, and enhance patient care. Data security improves with medical records becoming transparent and tamper-freethrough block chain technology. Also, increasing need for low-cost IT infrastructure, telehealth service, and remote patient monitoring solution is propelling the market growth. In the changing healthcarelandscape, companies investing in digital transformation and innovative IT outsourcing models will have a strategic advantage.

From 2020 to 2024, the Healthcare IT Outsourcing Market grew exponentially dueto healthcare's growing demand for digital transformation. As healthcare organizations encountered escalating cyber threats to sensitive patient information, the need for cybersecurity solutions skyrocketed.

Datamanagement on cloud systems became the norm as they provided more scalability and less cost. We also saw outsourcing companies specializing inAI-powered solutions for predictive analytics, automated diagnostics, and workflow optimization, resulting in improved healthcare delivery.

Forecast for Healthcare IT Outsourcing Market (2025 to 2035): As per the report, the Healthcare IT Outsourcing Market is expected to flourish in period of 2025-2035, the report reveal that AI, Interoperability and Decentralized data management will be the key trends todominate the Healthcare IT Outsourcing market. AI-Based Automation Automating Administrative Workflows: AI will automate administrative tasksin healthcare facilities, leading to reduced operational costs and faster decision-making.

The growth of block chain-based solutions will improve datasecurity and patient record transparency and, in turn, reduce healthcare fraud significantly. As value-based care models emerge, IT outsourcing companies will design advanced analytics platforms for monitoringpatient outcomes and resource utilization.

Data analytics tools will also beintegrated and data scientists will help make sense of the data in its most raw form. The futureof healthcare IT outsourcing is expected to be driven by AI-powered automation and data security. These changing trends set the Healthcare IT Outsourcing Market Other thanothers in the market.

Enhanced Interoperability and Security: Healthcare providers must ensure that anydata is protected, compliant, and easily transferable as discussed in this blog, with the help of IT companies & regulatory bodies.

In conclusion, the future ofhealthcare IT is in AI-led automation, cybersecurity, and new concept cloud solutions that will transform healthcare IT by delivering solutions that are faster and secure. Personalized and value-based care are becoming common, which would lead to higher demand for outsourcing solutions that enhance patient engagement, streamline operations, and optimizeclinical decision-making.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with HIPAA, GDPR, and regional data protection laws |

| Technological Advancements | Adoption of cloud computing and AI-driven analytics |

| Telehealth and Remote Care | Surge in telemedicine adoption due to COVID-19 |

| Cybersecurity Challenges | Increase in cyberattacks targeting healthcare IT systems |

| EHR & Data Interoperability | Challenges in seamless data exchange between different systems |

| Market Competition | Growth in IT outsourcing firms offering cloud-based solutions |

| Supply Chain Dynamics | Dependency on third-party vendors for IT infrastructure |

| Market Growth Drivers | Increased digital transformation in healthcare, demand for remote patient monitoring |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global data privacy regulations and advanced compliance management systems |

| Technological Advancements | Expansion of block chain, AI-powered automation, and decentralized health data management |

| Telehealth and Remote Care | Widespread integration of AI-powered telehealth and real-time remote patient monitoring |

| Cybersecurity Challenges | Advanced AI-driven threat detection and block chain-enhanced security solutions |

| EHR & Data Interoperability | Fully interoperable health data ecosystems using AI-driven standardization techniques |

| Market Competition | Rise of specialized AI-focused outsourcing providers revolutionizing healthcare IT services |

| Supply Chain Dynamics | Shift towards in-house AI-driven automation for enhanced operational control |

| Market Growth Drivers | AI-driven predictive analytics, real-time health tracking, and block chain-integrated medical records |

The United States healthcare IT outsourcing market is one of the most advanced, driven by strict regulatory requirements, increasing healthcare costs, and the rapid adoption of digital health solutions. The Health Insurance Portability and Accountability Act (HIPAA) mandates strict compliance for patient data security, leading to increased outsourcing of cybersecurity, cloud computing, and data management services.

The growing need for EHR management has made outsourcing a cost-effective solution for hospitals and healthcare providers. Companies are increasingly relying on third-party IT service providers to manage data interoperability, automate administrative workflows, and implement AI-driven healthcare analytics. The rise of telehealth services post-pandemic has also fueled demand for outsourced IT infrastructure and cloud solutions.

Additionally, healthcare payers and providers are outsourcing revenue cycle management (RCM) and medical billing services to optimize operations and reduce costs. The USA is also seeing a rise in outsourced AI-powered diagnostics and blockchain solutions for patient record management, creating new growth opportunities for IT firms.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The United Kingdom healthcare IT outsourcing market is growing with the National Health Service (NHS) digitization, growing cybersecurity emphasis, and need for affordable IT solutions. The UK government has initiated several digital transformation programs, forcing healthcare organizations to implement cloud-based electronic health records (EHR) systems, artificial intelligence-based diagnostics, and remote patient monitoring solutions.

One of the strongest drivers for UK IT outsourcing is the NHS Long Term Plan that targets digital transformation in health, AI in clinical decision-making, and interoperability between healthcare information systems. Owing to finance pressures, the NHS and private healthcare providers are outsourcing IT infrastructure management, cyber security, and software development to specialist firms.

Additionally, GDPR compliance has increased data protection and cybersecurity outsourcing as a priority, that is, the patient information is secure while it allows smooth digital experiences within healthcare networks. Telemedicine and AI-based diagnostics in ascendance are also generating demand for cloud computing and data analytics from third-party providers' services.

With more use of digital health being made, the UK will be one of the leading markets for outsourced healthcare IT solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The European Union healthcare IT outsourcing market is evolving at a fast pace with regulatory mandate-led drivers (GDPR, MDR), investment in digital health, and increasing healthcare spending. The most important markets for healthcare IT outsourcing are Germany, France, and Italy because they possess a huge healthcare infrastructure and digitalization policies.

The EU emphasis on data protection and interoperability has propelled demand for outsourced cybersecurity, AI-powered patient data management, and cloud computing. Further, greater investments in telemedicine, eHealth solutions, and digital therapeutics are opening new doors for IT companies with healthcare solutions to outsource

The second key impetus for outsourcing in the EU is speeding up dependence on big data and artificial intelligence to support clinical decision-making, predictive analytics, and drug development. EU pharmaceutical firms increasingly outsource AI-based research as well as bioinformatics services so that they could maximize the speed of drug discovery.

With there being unflinching governmental drives to make a change to healthcare IT, outsourcing will only become more and more imperative in an effort to further optimize the optimization of operations and decrease the monetary costs of EU healthcare organizations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.9% |

Japan's health IT outsourcing industry is growing well with the rise in Japan's aging population, enormous healthcare spending, and healthcare application of artificial intelligence for clinical diagnosis. Since over 28% of the population in Japan is over the age of 65, the demand for electronic health record management, remote patient monitoring, and AI-powered healthcare solutions is higher.

Japan has a well-developed medical infrastructure but not sufficient medical staff, and thus the application of automation and IT outsourcing to increase efficiency in hospital administration and treatment of patients. Japanese hospitals are outsourcing IT services for data management, security, and cloud-based telehealth platforms to improve operations.

On the other hand, Japanese biotechnology and pharmaceutical firms are investing a lot in research and development related to AI-based drug discovery, and this further triggers more bioinformatics outsourcing, clinical trials management, and AI-based diagnostics outsourcing.

With investments by the government in digital healthcare initiatives and vast amounts of funding for AI-based healthcare solutions, huge growth for healthcare IT outsourcing is anticipated to be seen in Japan in the near future.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.7% |

South Korea's healthcare IT outsourcing business is increasing due to swift digitalization, favorable state policies regarding AI-based healthcare, and growing demand for telemedicine services. South Korea has been a pioneer of healthcare technology since long, with the government actively implementing smart hospitals, AI-based diagnosis, and digital patient management systems.

With medical expenditures rising and the population growing older, hospitals and clinics outsource EHR systems, cloud-based health data management, and medical billing for enhanced efficiency. South Korea's well-established 5G infrastructure also is fueling telemedicine and remote patient monitoring on high-speed internet, necessitating outsourced IT infrastructure and security.

The South Korean biopharmaceutical industry is not resting in catching up with the bandwagon of growth around the world with growing demand for drug discovery using AI, bioinformatics, and clinical data outsourcing. While South Korea can be the World Leader in health care innovation, IT outsourcing will be the essential gear in propelling its smart healthcare community.

As long as South Korea continues to invest in cloud computing, blockchain, and AI, its health IT outsourcing market will remain bigger.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

The hospital IT systems and pharmaceutical & life science research segments command a large percentage of the healthcare IT outsourcing market, as health providers and research centres increasingly utilize outsourced IT services to streamline operational efficiency, increase patient outcomes, and maximize data management. The services contribute enormously to providing secure, scalable, and cost-efficient healthcare technology solutions and foster digital transformation for hospitals, research establishments, and pharmaceutical firms.

Hospital information systems (HIS) are among the most commonly outsourced healthcare IT solutions, providing advanced clinical workflows, improved patient data management, and better interoperability within healthcare networks. As opposed to maintaining in-house IT, outsourced HIS solutions offer hospitals efficient, high-performance IT infrastructure at a lower cost, facilitating uncomplicated integration of electronic health records (EHRs), revenue cycle management (RCM), and patient engagement platforms.

The increasing adoption of outsourced HIS services has also been triggered due to the rising need among hospitals, specialty clinics, and ambulatory care facilities for cloud-based HIS platforms, ashealth providers are constantly looking for scalable, secure, and compliant solutions that can help in simplifying clinical and administrative workflows. According to the research, it is confirmed that the cloud-based solution of HIS reduces cost, retrieves enhanceddata access, and interoperability among the systems that improve efficiency in hospitals and proper co-ordinating care.

AI-powered hospital information systems, suchas machine learning-driven CDSS and predictive analytics, have created a market that drives demand and enhances usage of CDSS in patient-centric care and hospital workflow automation.

The combination of block chain-powered HIS solutions such as more advanced data security, non-alterable medicalhistory, and decentralized patient data sharing, all further quicken acceptance by ensuring better data integrity and adherence to regulation bodies such as HIPAA and GDPR.

Next-generationHIS platform emergence—coupled with real-time patient monitoring, remote healthcare access, and administrative automation via AI—has thus been progressively optimizing market growth, propelling HIS adoption in digital hospitals and smart healthcare infrastructures.

The market growth is characterized by rising adoption of HIS outsourcing servicesby revenue cycle management (RCM) and hospital billing automation, AI-assisted claim processing, automated denial management, and real time financial analytics, ensuring increased revenue efficiency and lowered administrative burden on healthcare providers.

Although HIS outsourcing has potential benefits for improving hospitals' efficiency and digital transformation, there arechallenges that include the high initial investment, cybersecurity threats, and difficulty of integration with legacy systems. But innovations in AI-assisted data security, cloud-nativeHIS platforms and AI-driven predictive analytics are, among others, improving scalability, security and adaptiveness of the system, making sure the demand will continue to grow for outsourced hospital information systems in the market.

There is strongmarket penetration when it comes to pharmaceutical and life science research organizations, particularly in drug development, clinical trials and biomedical research, as companies play into outsourced IT solutions to drive efficiency around data analytics, research and regulatory compliance.

Contrary to traditional IT systems, third-party healthcare IT solutions specifically tailored for drugdevelopment offer cloud-based infrastructures, artificial intelligence-powered data analysis, and block chain-embedded management of clinical trial data, thereby refining the drug discovery process and hastening regulatory approvals.

Rising adoption of outsourced IT services in pharmaceutical R&D can be primarily attributed to upcoming demand for AI-based drug discovery platforms, including deep learning models for on-screen molecules, virtual drug simulations and predictivetoxicity analysis, as companies look for faster, cost-effective and data-driven drug development solutions.

According to studies, AI-based pharmaceuticalIT outsourcing shortens research time, improves the efficiency of clinical trials, and guarantees a higher probability of success in the drug approval process.

Growing adoption of big data analytics in genomics and personalized medicine research is expected to drive the market owing to the presence of HPC for genome sequencing and AI-driven biomarker identification, which isfurther strengthening global demand for precision medicine and targeted drug therapies.

Sunrise on transformed cloud-based electronic lab notebooks (ELNs) and laboratory information managementsystems (LIMS), with secure, scalable and interoperable research data storage, has accelerated an adoption encouraging much greater collaboration between research institutions, biotech firms, and regulatory agencies.

Optimized market growth in this segment is ensured because of the tamper-proof patient records, smart contract-enabled trial protocol, and decentralizedtrial data sharing facilitated by block chain-based clinical trial management systems promoting a high level of transparency and compliance with global regulatory frameworks such as FDA, EMA, and WHO.

Life sciences research has already started adopting IT outsourcing for regulatory submission automation, which would help make the research IT compliant and would apply AI-assisted regulatory compliance tracking, automated dossier preparation coupled with predictive analytics for drugsafety evaluation.

While it brings benefits in terms of research efficiency and accelerating drug discovery, IT outsourcing in pharmaceutical and life science research comes with challenges like dataprivacy issues, regulatory compliance complexity and integration of disparate research systems.… But new technologies such as AI-driven clinical trial analytics, quantum computing in drug discovery and cloud-native bioinformatics platforms can enhance data accuracy, security and scalability, which guarantees that the market for outsourced pharmaceutical and life scienceIT solutions will continue to grow.

Healthcare providers and research institutions have increasingly adopted outsourced IT solutions to improve operational efficiency and provide better patient outcomes, while also driving innovation in the field of biomedical research. As such, the provider IT outsourcing and life science IT outsourcing segments are two of the keydrivers behind this market.

One of the mostadopted provider IT outsourcing is on the rise as a healthcare IT solution, providing enhanced interoperability, cost savings, and improved patient engagement technologies. Outsourced provider IT services offer solutions that are scalable, secure, and regulatory-compliant, enablingclinical data exchange, EHR integration, and AI-powered patient analytics, while in-house IT infrastructure does not.

Growth in the need for AI-enabled healthcare ITapplications, including ML algorithms for clinical diagnostics, predictive analytics in patient risk identification, and automated administrative workflow optimizations, has contributed to provider IT outsourcing adoption, as hospitals and clinics pursue digital transformation initiatives to improve patient care.

While telemedicine platforms utilizing HIPAA-compliant video consultations and AI-guided remote patient monitoring have strengthened with integrated digital health records, not all have embraced the expansion of cloud-based virtual care. Still, the advantages for hospitals and engagement with patients, especially in primary care, specialist opinions, and home healthcare, have helped drive greater adoption.

At the same time, outsourcing provider technologies presents challenges beyond improving efficiencies, such as concerns with systems interoperating, safeguarding private records from online threats, and the high costs of rollout.

However, novel defences using artificial intelligence, distributed ledger approaches to patient data security, and quantum computing aiding radiological imaging are enhancing protections, streamlining processes, and cutting expenditures, thus ensuring continued expansion for outsourcing provider technologies amidst lingering issues.

Life science IT outsourcing has achieved robust market acceptance, especially in clinical research, biotech, and personalized medicine, as firms increasingly adopt cloud-based computing, AI-based data analytics, and high-performance bioinformatics platforms to enhance R&D productivity.

In contrast to conventional in-house IT infrastructure, outsourced life science IT solutions provide secure, scalable, and regulatory-compliant data management systems that optimize drug discovery, patient recruitment, and clinical trial analytics.

Increased need for AI-enabled biomedical research platforms, with deep learning in drug repurposing, real-time monitoring of clinical trials, and genomics-based identification of drug targets, has fuelled take-up of outsourced life science IT solutions as biotech companies pursue data-driven precision medicine technologies.

The growth of block chain technology in life sciences, including decentralized sharing of clinical trial data, research collaborations enabled by smart contracts, and tamper-evident drug safety tracking, has fortified market demand, guaranteeing increased adoption in regulatory-compliant research settings.

Not with standing its strengths in biomedical innovation and research scalability, life science IT outsourcing is also plagued by weaknesses such as prohibitively high costs of implementation, concerns over data privacy, and restrictions on the use of AI for drug research due to regulation.

Nevertheless, innovative developments in AI-augmented bioinformatics, quantum computation for molecular modelling, and block chain-protected clinical research data are enhancing accuracy, security, and efficiency, warranting sustained growth in the outsourced life science IT solutions market.

Due to the rising need to maintain the IT centers,the Healthcare IT Outsourcing Market is expanding quickly. Key driving factors includerising adoption of electronic health records (EHR), healthcare analytics, and cloud computing.

Healthcare providers are leveraging outsourcing service to manage IT infrastructure, agile software development, data analytics, and cybersecurity services that improve patientcare and comply with regulatory demands.

Key Drivers for the AI Healthcare Market Advancements in AI-Based Health Care Solutions: One of the main drivers for this market is the new developmentsin AI-based health care techs, telemedicine tools, HIPAA and other data privacy regulations.

As its standing furthers, global IT service providers and healthcare specific outsourcing firmsare dominating the healthcare outsourcing industry by providing customized solutions for healthcare institution

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Accenture | 18-22% |

| IBM Corporation | 15-19% |

| Cognizant Technology Solutions | 10-14% |

| TCS (Tata Consultancy Services) | 8-12% |

| Infosys Limited | 6-10% |

| Other Companies (combined) | 30-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Accenture | Provides comprehensive IT outsourcing solutions for EHR management, data analytics, cloud services, and healthcare process automation. |

| IBM Corporation | Focuses on healthcare AI solutions, data analytics, and cybersecurity, offering cloud-based services and healthcare blockchain technology. |

| Cognizant Technology Solutions | Specializes in EHR management, IT infrastructure outsourcing, and digital healthcare transformation, helping organizations adopt cloud and data-driven solutions. |

| TCS (Tata Consultancy Services) | Offers IT outsourcing services focusing on healthcare data analytics, digital health platforms, and telemedicine integration for better patient care. |

| Infosys Limited | Provides healthcare IT outsourcing solutions with a focus on AI-driven analytics, cloud platforms, and regulatory compliance. |

Key Company Insights

Accenture (18-22%)

Accenture, which caters to a multitude of healthcare technologies -- EHR analytics, healthcare data analytics, cloud migration and more. The company is a significant player in the sectorand has established itself as a go-to name in healthcare solutions powered by digital health and artificial intelligence. They are also oneof the foremost players in automating healthcare organizations with their innovative IT structure as well.

IBM Corporation (15-19%)

IBM has cloud-based solutions, AI-based healthcare analytics, and cybersecurity businessfor healthcare enterprises. IBM’s AI-powered Watson Health platform aids in betterdecision-making, lower operational costs and greater patient care. IBM has also designed healthcare blockchain solutions forthe secure exchange of data.

Cognizant Technology Solutions (10-14%)

End-to-end healthcare IT outsourcing services ranging from EHR and IT infrastructure managementto cloud solutions and digital transformation are offered by Cognizant.

TCS (Tata Consultancy Services) (8-12%)

The TCS services include IT outsourcing and Healthcare, Analytics and AI, Digital solutions for healthcare, IoT, andtelemedicine. Overall the company uses its cloud expertise to help healthcare organizations optimize costs and increase the effectiveness and efficiency of patient caredelivery.

Infosys Limited (6-10%)

Infosys healthcare IT outsourcing Solutions cloud platformsand Data analytics and compliance. Infosys offers economizing ITdriven solutions that assist healthcare providers in strengthening efficiency and patient care with AI driven services

There are severalother players in the healthcare IT outsourcing market, and the focus of these companies is primarily on cloud computing, data security, and regulatory compliance. These include:

The overall market size for Healthcare IT Outsourcing Market was USD 60.6 Billion in 2025.

The Healthcare IT Outsourcing Market is expected to reach USD 117.1 Billion in 2035.

The demand for the Healthcare IT Outsourcing Market will be driven by the need for cost-effective solutions, increasing adoption of digital health technologies, and rising pressure on healthcare providers to streamline operations. Advancements in data security, AI integration, and regulatory compliance will further boost market growth.

The top 5 countries which drives the development of Healthcare IT Outsourcing Market are USA, UK, Europe Union, Japan and South Korea.

Hospital Information Systems and Pharmaceutical & Life Science Research Drive Market to command significant share over the assessment period.

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.