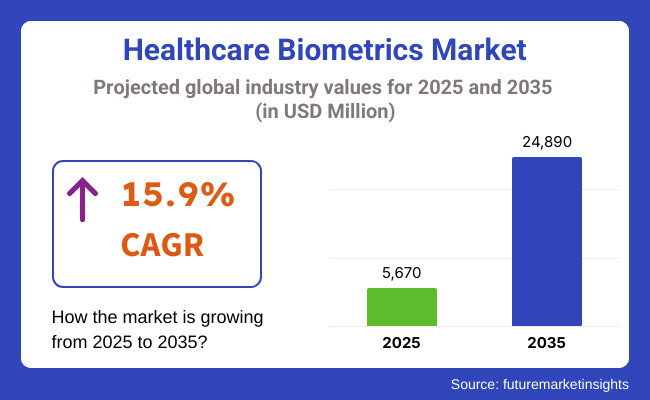

The healthcare biometrics market would be historic growth during the forecast period 2025 to 2035 with increased adoption of biometric authentication technology for patient identification, data security, and access security in hospitals. The market will be around USD 5,670 million in 2025 and can be around USD 24,890 million in 2035 with a compound annual growth rate (CAGR) of 15.9% during the period 2025 to 2035.

There are certain forces driving the change in the market. Some of them are rising demand for strong security to validate medical identity theft, abuse, and patient data breach. Biometric technology based on fingerprint scanning, iris scanning, and facial recognition is being extensively employed by healthcare organizations in an attempt to verify correct patient identification.

For example, the United States has adopted palm vein scanning technology in a bid to prevent patient misidentification mistakes, enhance therapy accuracy, and prevent duplicate health records. Compliance and privacy are highlighted, and this forces companies to invest in compliant and secure biometrics.

The market is segmented across different biometric modalities and applications. Fingerprint biometrics is the most prevalent because it is inexpensive and easy to integrate into patient identification and electronic health records (EHR). Face recognition is employed most in telemedicine and remote patient monitoring systems, but iris recognition is employed wherever high accuracy is needed in secure access control in healthcare.

Biometric technology is being used extensively in hospital drug-dispensing machines to ensure controlled drugs do not reach the wrong people. Biometric wearable technology, including heart rate and ECG pattern recognition, is also being increasingly utilized in patient monitoring.

North America is a high-end biometrics market for the healthcare industry because of the stringent regulation of healthcare security in the region, such as the Health Insurance Portability and Accountability Act (HIPAA).

The growing rate of electronic health record (EHR) and cases of healthcare identity theft has led Canadian and American hospitals and clinics to pursue biometric verification systems. Fingerprint and face-based multi-factor biometric identification has been integrated by large medical networks in order to safeguard patients' information. Beyond this, there is demand for interoperability standards from government bodies, driving costs into safe and scalable biometrics.

Europe is the strongest continent in terms of healthcare biometric market, and demand leaders in Europe are United Kingdom, France, and Germany.

Health care centers at the point when GDPR was going to take effect believe that data should be controlled and thus biometric authentication is one such parameter which one simply needs to possess so that one can recognize the patients. One such setup is of Swedish and Estonian national health care systems in the form of biometric smart cards. Apart from this, the pharma industry is adopting biometric access control to secure pharmaceutical manufacturing plants on the basis of quality and safety standards.

The Asia-Pacific region will be developing healthcare biometrics most because of fast digitalization, expansion in healthcare centers, and government patient identification programs with secure patients.

China, India, Japan, and South Korea are the gigantic consumers of healthcare biometric products. Aadhaar-based biometric authentication has been utilized in many healthcare programs in facilitating identity establishment and integrity of Indian public health programs. Expanded penetration of digital health care services and increased acceptance of telemedicine are driving demand for remote biometric authentication in India.

Challenge

Data Privacy and Compliance Challenges

Unregulated use of biometrics in healthcare is creating data privacy concerns, security risks, and tight regulatory compliance. Most biometric applications are used for patient information that is sensitive and hence vulnerable to cyber-attacks and unauthorized disclosure. Compliance imposes strict policy control over biometric data use at the cost of costly compliance for healthcare organizations and technology firms. Prevention is comprised of utilization of strong encryption protocols and privacy-focused biometric technology.

Opportunity

AI-Driven Biometric Innovations

Artificial intelligence (AI) and machine learning (ML) technologies are bringing new opportunities to healthcare biometric identification. AI-driven biometrics have the ability to accelerate anti-fraud analysis, ensure better accuracy in patient identification, and offer touchless authentication. For example, deep learning-based facial recognition is applied on patient check-in kiosks in hospitals to offer touchless auto-registration of patients. In addition, AI-driven continuous authentication-enabled biometric wearables are also increasing their popularity with remote patient monitoring, expanding healthcare biometrics use beyond access control.

Healthcare biometrics 2020 to 2024 made greater use via telemedicine, hospitals, and clinics due to contactless authentication needs mostly brought about by the COVID-19 pandemic. The facial recognition and iris scanning biometric technology were used more due to the fact that healthcare facilities were looking for non-contact patient identification methods. Spending on safe biometric encryption and decentralized authentication platforms did go up, however, due to greater cyberattacks and sophisticated regulation.

Adoption of biometric solutions based on AI, use of blockchain for secure storage of biometrics, and growth of remote healthcare behaviour biometrics will be among the major trends in the market from 2025 to 2035.

Decentralized biometric verification, where patient data is kept safe in end-user devices and not on centralized storage, will also imply greater data security and data privacy regulation. With increased need for personalization and streamlined experience of care, biometrics will be instrumental in facilitating patient-centric, secure, and economical health care services.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments made patient data protection laws such as HIPAA and GDPR a higher priority. Healthcare organizations relied more on biometric authentication for compliance. |

| Technological Advancements | Facial recognition and fingerprint technologies became the primary methods of patient authentication. AI-based biometric analytics usage accelerated. |

| Hospital and Clinical Applications | Hospitals applied biometric technologies to patient identification and access control, reducing medical identity theft. |

| Home Healthcare and Telemedicine | Telemedicine platforms integrated easy-to-use biometric authentication to remotely authenticate patient identities. |

| Pharmaceutical Sector Adoption | Biometric security was applied to controlled substance dispensation and clinical trials management. |

| Patient Data Protection | Healthcare data breaches highlighted the significance of advanced biometric authentication across hospitals and insurers. |

| Wearable and Mobile Biometrics | Wearable healthcare devices like fingerprint and ECG-based-verified smartwatches enabled broad adoption of biometrics. |

| Market Growth Drivers | Increases in demand for digital health tools and cybersecurity needs fueled early adoption of biometrics. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulations tighten, requiring biometric security for sensitive health information. Nations deploy national biometric patient identification systems to cut down on fraud and medical mistakes. |

| Technological Advancements | Multimodal biometric solutions such as iris, vein, and voice recognition become commonplace. Blockchain-enabled biometric systems improve security and interoperability. |

| Hospital and Clinical Applications | AI-driven biometrics enhance clinical workflow automation, improving personalized care and predictive analytics. Biometric wearables connect with electronic health records (EHRs) for unobtrusive monitoring. |

| Home Healthcare and Telemedicine | Advanced biometrics like continuous authentication and behavioural biometrics bolster security in remote patient monitoring as well as telemedicine. Drug distribution and manufacturing make use of biometric tracking to prevent counterfeiting and enhance regulatory compliance. Biometric-associated genetic information is a benefit for personalized medicine. |

| Pharmaceutical Sector Adoption | AI-based biometric encryption methods provide high-security data protection with minimal breaches and unauthorized access threats. |

| Patient Data Protection | Non-invasive biometrics like sweat-based and gait recognition go mainstream, allowing for continuous health monitoring and easy integration with medical AI assistants. |

| Wearable and Mobile Biometrics | Increased healthcare digitization, personalized medicine, and AI-driven diagnostics drive the mass deployment of biometric systems on global healthcare networks. |

| Market Growth Drivers | Regulations tighten, requiring biometric security for sensitive health information. Nations deploy national biometric patient identification systems to cut down on fraud and medical mistakes. |

The USA healthcare biometrics industry is expanding at a fast rate with increasing cybersecurity risks, government intervention, and expansion of the telehealth sector. Health Insurance Portability and Accountability Act (HIPAA) compliance processes have encouraged insurance companies and hospitals to adopt biometric security solutions for patient verification and data protection.

Biometric verification is also rapidly emerging as a powerful means to fight medical identity theft that is costing the financial sector billions of dollars annually. Clinics and hospitals apply sophisticated fingerprint and facial recognition technologies extensively to authenticate patients and manage access in a superior way. International pharma organizations also utilize biometrics for clinical trials so that patients could be traced to the letter with precision and manage compliances stringently.

In the future years, biometric security solutions that rely on AI will be of maximum importance to protect electronic health records (EHRs), restrict fraud, and improve patient experience. The USA government initiative towards a national biometric patient identification program will likely change the market forces to a gigantic extent.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 15.4% |

The biometrics market in the UK's health sector is expanding strongly based on the rigidity of NHS cybersecurity measures and increased investment in digital healthcare solutions. The General Data Protection Regulation (GDPR) provides stringent patient data protection compliance, pushing healthcare centers and hospitals further towards using biometric authentication.

Biometric identification of patients is gaining traction as a means of reversing medical errors and pharma fraud. Actions by the NHS to implement multimodal biometrics (iris, face recognition, and fingerprint) in patient identification systems further ignite the expansion of the market. Biometric authentication is being adopted by pharmaceutical companies in the UK to offer advanced authenticity for clinical trials and increase dispensing operations of drugs as well.

Increased activity towards AI-based biometric encryption methods promises enhanced healthcare cybersecurity and fraud defence in the next decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 15.2% |

EU healthcare biometrics are fueled by strong data protection legislation and increased investment in eHealth technology. GDPR regulations have encouraged mass-scale adoption of biometric authentication across hospitals, insurance providers, and telemedicine applications to enhance patient security.

Germany, France, and Italy are the top adopters of biometric technology in hospital access control solutions, electronic prescription security, and personalized medicine solutions. EU pharma companies utilize biometric identification to provide anti-counterfeiting and clinical research compliance.

With the European Commission spearheading digital health interoperability, demand for blockchain-based biometric patient authentication solutions will rise, enabling secure cross-border healthcare data exchange.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 15.8% |

The Japanese biometric healthcare industry is expanding with the development of AI-powered biometric verification systems and state-supported proposals for digital health infrastructure. Confronted with the aging population in Japan and the need for telemedicine services, voice and facial recognition-based biometric wearables are being more commonly utilized to monitor elderly patients.

Japan pharma sector is embracing biometric security when dealing with regulated trial handling and controlled substances, verifying patient identification authentication and national safety legislation compliance. Contactless interfaces biometric authentication is being used more and more in hospitals to improve patient satisfaction and infection prevention.

Japan will experience more and more biometric innovation when it comes to protecting personalized medicine and healthcare predictive analytics as it has its solid technology backup.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 15.5% |

South Korea's healthcare biometrics market is growing on the back of government Smart Hospital Initiatives and biometric-based digital health ID programs. South Korea has a developed telemedicine marketplace, and AI-based facial recognition and iris recognition technology is being used by hospitals and clinics to securely authenticate remote patient consultations.

Pharmaceutical companies are using biometric security to fight drug counterfeiting and facilitate auto-verification of prescriptions. Biometric wearables are also picking up pace in South Korea's digital health ecosystem, with real-time monitoring of patients and integration with telemedicine services via 5G networks.

With South Korea investing heavily in intelligent healthcare infrastructure, AI-driven biometric solutions will become the standard in the healthcare sector, enhancing patient security and clinical productivity.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 15.1% |

Single-factor authentication is the most prevalent biometric technology applied in the healthcare sector based on its ease of implementation as well as compatibility with the existing infrastructure. Fingerprints are the most prevalent technology under this category, which is an advantage as it is a low-cost and high-security level access control method for hospitals and clinics. Fingerprint biometrics is employed by most health care facilities, including Mayo Clinic and Cleveland Clinic, to verify employees and grant access to secured areas.

But with increased security risk, hospitals now consider iris and facial recognition technology. Facial recognition is becoming the norm in patient identification software to combat insurance fraud and right access to medical records. Although one-factor authentication is still common, the move toward multi-factor security looms large as healthcare cyber breaches keep rising.

Multi-factor authentication (MFA) is increasingly utilized within the health environment with an expectation of a greater level of security. Two-factor biometrics fingerprint and face scan or fingerprint and PIN is trending big among huge hospital networks such as Johns Hopkins and Mount Sinai, where security for data remains top priority.

Three-factor authentication with biometrics in the shape of smart cards and PINs is implemented in pharmaceutical firms and research institutions dealing with sensitive drug development data. As a result of increased cyberattacks on health care organizations, regulation departments like the USA Department of Health and Human Services (HHS) are enforcing more effective authentication policies in protecting the patients' data.

Health record protection and data center security are the most rapidly expanding health care biometrics use market. As more hospitals adopt EHRs, keeping sensitive patient data out of the wrong hands is imperative. Highly rated health networks such as Kaiser Permanente and HCA Healthcare are using biometric authentication to restrict access to EHR systems.

Speech and signature recognition are also being used more frequently in data security. Voice biometrics allow physicians to securely dictate medical history, with proper transcription and preventing unauthorized access. Signature recognition is being used more often in electronic consent forms, with authenticity in legal and medical documents. As healthcare data breaches continue to dominate news headlines, investment in biometric data security technology will continue to pick up speed.

Hospitals and clinics utilize biometric authentication most extensively due to the large volume of patient data and requirement for strict access control. Large healthcare providers such as the NHS and the Cleveland clinic are rolling out facial recognition technology at reception points to enable automatic registration and prevent identity theft. In addition, biometrics at hospital pharmacies provide assurance that controlled drugs can be dispensed by authorized individuals only, with a reduction in drug theft and mistakes.

Increasing requirements for remote authentication and patient monitoring are driving biometric expansion in home care and telemedicine. Fingerprint and facial recognition capabilities in remote patient monitoring equipment ensure that the correct patient is receiving telehealth. With digital healthcare solutions going global, the demand for biometric security across hospitals and clinics will dramatically increase.

Medical centers and drug research laboratories that handle high-stakes medical information and infectious disease cultures are spending more on advanced biometric authentication systems. The CDC and the WHO are employing multi-factor authentication to secure access to disease research information and vaccine labs. Retinal and iris scans are becoming essential security features of high-security bio-research labs that handle infectious disease cultures.

In addition, biometric authentication also enables regulatory compliance with acts such as HIPAA and GDPR. Biometrics is applied by genetic testing laboratories and precision medicine to guarantee data integrity, preserve patient confidentiality, and prevent sensitive genomic data from falling into the wrong hands. As precision medicine becomes increasingly important, biometric security in research laboratories will likely experience enormous growth.

The healthcare biometrics market is a rapidly expanding market with established global players and emerging players developing new biometric security devices. The industry is driven by advances in fingerprint recognition, facial recognition, vein pattern verification, and iris recognition technologies that enhance data security, patient verification, and access control within healthcare settings.

Core market players focus on enhancing biometric precision, regulatory adherence, and EHR compatibility. Competition is being headed by a mix of mature vendors and new vendors with the provision of solutions that are tailored with hospital-, clinic-, and telemedicine-focused.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| NEC Corporation | 13-18% |

| 3M Cogent, Inc. | 10-14% |

| Fujitsu Limited | 8-12% |

| Bio-Key International, Inc. | 6-10% |

| IDEMIA | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| NEC Corporation | Develops AI-powered facial and iris recognition systems for patient verification and hospital security. Focuses on deep learning technology to enhance accuracy. |

| 3M Cogent, Inc. | Provides fingerprint scanning solutions for secure access to medical records. Offers scalable biometric authentication for large healthcare networks. |

| Fujitsu Limited | Specializes in palm vein authentication for contactless patient identification and fraud prevention in medical insurance claims. |

| Bio-Key International, Inc. | Offers biometric cloud authentication services for remote patient monitoring and telemedicine applications. |

| IDEMIA | Develops multi-modal biometric systems, including facial and voice recognition, for healthcare staff authentication and compliance with HIPAA regulations. |

Key Company Insights

NEC Corporation (13-18%)

NEC Corporation is the leader in healthcare biometrics with cutting-edge AI-based facial recognition and iris recognition for patient identification and hospital security. Its biometric solutions are easily embedded as an integrated component of electronic health records (EHRs) for touchless authentication in high-risk areas such as intensive care units (ICUs). NEC collaborates extensively with healthcare professionals to add robust privacy protection and strengthen encryption to render it compliant with worldwide regulations such as GDPR and HIPAA.

3M Cogent, Inc. (10-14%)

3M Cogent is the market leader in healthcare fingerprint biometrics. Its solution provides secure patient medical information access without compromising on data loss through improper use. It is expertise in fast and scalable biometric verification in hospital institutions and insurance providers. 3M biometric solutions block Medicare and Medicaid fraud and also appropriate patient identity.

Fujitsu Limited (8-12%)

Fujitsu is the market leader in palm vein recognition, a cutting-edge biometric solution that simplifies contactless patient verification and counterfeiting prevention at time of medical claims settlement. Fujitsu's PalmSecure technology has extensive deployment in hospitals and chain pharmacies, providing hygienic and secure verification. Fujitsu's biometric technologies reduce medical record access error and billing error through the application of infrared technology.

Bio-Key International, Inc. (6-10%)

Bio-Key International is a worldwide provider of biometric authentication to cloud biometrics applicable for telemedicine and remote monitoring of patients. Its biometric authentication product combines fingerprint, face, and iris recognition to achieve secure patient login in virtual environments. Bio-Key International also works with digital health providers and wearables makers to increase its footing in the increasing e-health segment.

IDEMIA (5-9%)

IDEMIA is a global biometric solution provider of multi-modal solutions containing facial recognition, voice verification, and iris scan to enhance the security of the healthcare sector. IDEMIA is highly reputable for staff authentication and HIPAA and GDPR support, enabling solely the authorized workforce to view delicate patient data. IDEMIA biometric technology is common across hospitals, clinic labs, and pharma R&D labs with reduced intrusions in healthcare locations.

Other Important Players (45-55% Combined)

Other companies are also leading the way in the healthcare biometrics space, driving security, data privacy, and patient identification. Key players include:

The global healthcare biometrics market size was estimated at USD 5,670 million in 2025.

The healthcare biometrics market is projected to reach USD 24,890 million by 2035.

The increasing need for secure patient authentication, growing instances of data breaches, and the necessity for efficient patient identification systems are expected to fuel the demand for healthcare biometrics during the forecast period.

The top 5 countries driving the development of the healthcare biometrics market are the United States, China, United Kingdom, Japan, and South Korea.

Based on technology, the fingerprint recognition segment dominated the market.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Billion) Forecast by Technology, 2018 to 2033

Table 3: Global Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Billion) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Billion) Forecast by Technology, 2018 to 2033

Table 7: North America Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Billion) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Billion) Forecast by Technology, 2018 to 2033

Table 11: Latin America Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Billion) Forecast by End User, 2018 to 2033

Table 13: Western Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Billion) Forecast by Technology, 2018 to 2033

Table 15: Western Europe Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 16: Western Europe Market Value (US$ Billion) Forecast by End User, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Billion) Forecast by Technology, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Billion) Forecast by End User, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Billion) Forecast by Technology, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Billion) Forecast by End User, 2018 to 2033

Table 25: East Asia Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Billion) Forecast by Technology, 2018 to 2033

Table 27: East Asia Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 28: East Asia Market Value (US$ Billion) Forecast by End User, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Billion) Forecast by Technology, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Billion) Forecast by Application, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Billion) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Billion) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Billion) Analysis by Technology, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 11: Global Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Billion) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Technology, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Billion) by Technology, 2023 to 2033

Figure 22: North America Market Value (US$ Billion) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Billion) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Billion) Analysis by Technology, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 31: North America Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Billion) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Technology, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Billion) by Technology, 2023 to 2033

Figure 42: Latin America Market Value (US$ Billion) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Billion) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Billion) Analysis by Technology, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Billion) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Billion) by Technology, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Billion) by Application, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Billion) by End User, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Billion) Analysis by Technology, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Billion) Analysis by End User, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Billion) by Technology, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Billion) by Application, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Billion) by End User, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Billion) Analysis by Technology, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Billion) Analysis by End User, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Billion) by Technology, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Billion) by Application, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Billion) by End User, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Billion) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Billion) Analysis by Technology, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Billion) Analysis by End User, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Billion) by Technology, 2023 to 2033

Figure 122: East Asia Market Value (US$ Billion) by Application, 2023 to 2033

Figure 123: East Asia Market Value (US$ Billion) by End User, 2023 to 2033

Figure 124: East Asia Market Value (US$ Billion) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Billion) Analysis by Technology, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 131: East Asia Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: East Asia Market Value (US$ Billion) Analysis by End User, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Billion) by Technology, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Billion) by Application, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Billion) by End User, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Billion) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Billion) Analysis by Technology, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Billion) Analysis by Application, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Billion) Analysis by End User, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Healthcare Natural Language Processing (NLP) Market Insights – Trends & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA