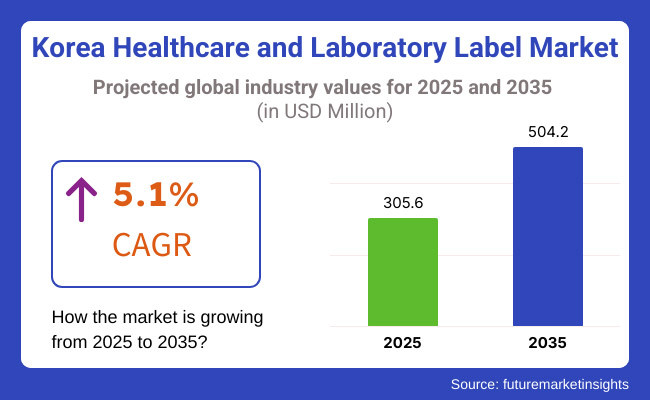

The Korea healthcare and laboratory label market is estimated to account for USD 305.6 million in 2025. It is anticipated to grow at a CAGR of 5.1% during the assessment period and reach a value of USD 504.2 million by 2035.

Industry Introduction

As per FMI analysis, the growing use of laboratory automation systems requires specialty labels for automated processes, including specimen and sample labeling. Additionally, greater patient safety consciousness emphasizes the value of accurate labeling to prevent errors in healthcare settings. The growth of e-commerce in the healthcare sector, including online pharmacies, also creates the need for effective shipping, tracking, and verification labeling solutions for product authenticity.

In addition, the increased demand for targeted therapies and personalized medicine requires labels for individualized treatments and patient data. The growth of telehealth services and remote patient monitoring also enhances the demand for labeling of medical devices and remote test kits used with these services.

Geographically, areas such as North Jeolla and Jeju will be growing on the back of government incentives and investment in modernization and research in healthcare. The competitive landscape has a mix of local and international players including Avery Dennison Corporation and CCL Industries Inc., focusing on compliance, resilience, and creative labeling solutions to meet evolving industry needs.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased healthcare spending, adoption of digital healthcare solutions, and government regulations for improved labeling accuracy. | Rising demand for personalized medicine, AI-driven labeling solutions, and stricter compliance regulations. |

| Gradual shift towards automation in laboratories and hospitals. | Widespread integration of AI, blockchain for tracking, and smart labels with embedded sensors. |

| Stricter policies introduced for pharmaceutical labeling and patient safety. | More stringent regulations expected, including digital tracking and serialization for supply chain transparency. |

| The rise of e-commerce in healthcare began, increasing demand for secure and trackable labeling solutions. | E-commerce dominance expected to continue, requiring advanced security features like tamper-evident and anti-counterfeit labels. |

| Telehealth adoption accelerated post-pandemic, with some integration of home healthcare labeling. | Full-scale adoption of remote patient monitoring and medical device labeling for home healthcare solutions. |

| Traditional paper and plastic labels dominated, with limited innovation in materials. | High demand for sustainable, eco-friendly labels and RFID-enabled smart labels. |

| Initial adoption of automated systems for sample labeling in laboratories. | Automation will be a key driver, with advanced robotic and AI-integrated labeling systems for accuracy and efficiency. |

| Growth in demand for patient-specific labels, but not yet a major market driver. | Rapid expansion of precision medicine will increase demand for highly customized labeling solutions. |

| Dominated by established players like Avery Dennison and CCL Industries, with limited local competition. | Greater competition from both domestic and international companies, leading to innovations and price competitiveness. |

| Growth concentrated in major cities like Seoul and Busan. | Expansion into emerging healthcare hubs such as North Jeolla and Jeju due to government incentives. |

| Limited focus on sustainability; use of traditional labeling materials. | Increased push for eco-friendly, biodegradable, and recyclable labels in response to environmental concerns. |

Growing Demand for Personalized and Smart Labels

More patient-centric healthcare solutions are being sought after by consumers, and therefore highly tailored labels are required. Targeted therapies and precision medicine raise the need for labels that offer personalized patient information, dosage instructions, and safety notices. RFID and NFC-based smart labels are becoming more common so that patients and medical practitioners can scan real-time information about drugs and lab samples electronically.

Prioritizing Patient Safety and Minimizing Errors

Korean consumers are emphasizing patient safety, and this has resulted in increased focus on correct and compliant labeling. Laboratories and hospitals are adopting tamper-proof, barcoded, and color-coded labels to minimize medication errors and lab sample misidentification. Regulatory agencies are encouraging more elaborate and traceable labeling solutions, which will improve patient outcomes and minimize risks due to improper labeling.

E-Commerce and Digital Healthcare Growth

Increasing growth in online pharmacy business and telemedicine is driving the need for secure and dependable labeling solutions. Online shoppers now expect labels to be tracking-enabled, tamper-evident, and authenticity-verified on drugs and medical devices bought online. Demand for easy-to-follow instructions and multilingual labels is also growing, particularly with growing cross-border e-commerce in healthcare.

Use of Sustainable and Eco-Friendly Labels

Korean shoppers are becoming increasingly eco-friendly, which has led to a change in trend towards biodegradable, recyclable, and low-impact label materials in healthcare. Hospitals and lab facilities are now proactively swapping conventional plastic labels with green versions to minimize their carbon footprint. Companies are reacting by launching water-soluble adhesives, soy-based ink, and compostable label materials in line with the expanding green movement.

Based on material, the market is divided into nylon, polyester, polyolefin, vinyl, paper, and others. Polyester labels are widely used in Korea's laboratory and healthcare label market because of their resistance to chemicals, durability, and ability to work in many different medical and laboratory settings.

Polyester labels resist extreme temperatures, water, chemicals, and sterilization, making them well-suited for use in specimen labeling, pharmaceutical packaging, and identification of medical devices. Their durability and resistance to tearing guarantee that patient and sample information will be intact even in the most severe conditions.

Based on end-user, the market is divided into pharmaceuticals, nutraceuticals, medical devices, blood banks, hospital services, and laboratories. Pharmaceutical labels are most popular in Korea's laboratory and healthcare label market because of the country's rigorous regulatory standards, booming pharmaceutical business, and high demand for accurate medication labeling.

Labels are critically dependent on the pharmaceutical industry for identifying drugs, dosage instructions, compliance with regulations, and preventing counterfeiting. As a major pharmaceutical production and export center, businesses spend on tamper-evident, serialization, and track-and-trace labels to comply with international standards and maintain patient safety.

The Korean healthcare and laboratory label market is moderately to highly concentrated, with a handful of major players holding a considerable market share. Major players such as Avery Dennison, CCL Industries, and local manufacturers prioritize compliance, toughness, and innovation, providing top-notch labeling solutions that are in line with stringent regulatory standards and industry norms.

Key players utilize sophisticated technology including RFID, smart labels, and tamper-proofing to ensure continued market leadership. They invest in automation, eco-friendly materials, and computer vision-based tracking to enhance efficiency and traceability in pharmaceuticals, hospitals, and labs. Their robust distribution networks and regulatory acumen bolster their competitive advantage in the expanding market.

Despite this focus, small and medium-sized businesses (SMEs) are emerging, providing affordable and personalized solutions. Local firms emphasize environment-friendly labeling, localization, and elastic production in order to challenge the global titans. Government efforts towards healthcare modernization and electronic tracking systems further promote new players, escalating competition and innovation within the labeling business.

The concentration in the market is expected to continue being strong with increasing regulatory needs and technology innovation fueling consolidation. Bigger companies will continue to purchase creative startups to beef up their ability, whereas smaller companies will benefit from regional growth and customization in order to capture niche markets. This balance of dominance and competition will dictate the future of Korea's labeling industry.

Major Developments

The Korean healthcare and laboratory label industry is characterized by a competitive landscape controlled by worldwide majors and domestic players. Consolidated players such as Avery Dennison, CCL Industries, and 3M hold a major market share with their high-quality, regulation-adherent labels used for pharmaceuticals, hospitals, and laboratories that help ensure the safety and traceability of the products.

Korean domestic enterprises are growing their market share through the provision of affordable, tailor-made, and environmentally friendly solutions. They emphasize localized production, government-sponsored initiatives, and versatile manufacturing processes, which enable them to compete with multinational firms. Their capability to rapidly adjust to regulatory demands and customer-specific requirements provides them with a competitive edge in specialty labeling applications.

The industry is seeing technological innovations, with businesses incorporating RFID, blockchain, and AI-based tracking systems into labeling solutions. Intelligent labels with real-time tracking and anti-counterfeiting capabilities are becoming increasingly popular. Companies investing in automation, serialization, and digital labeling technologies are building their presence in the rapidly changing Korean healthcare market.

The emergence of sustainable labeling solutions is redefining the competition, as global and local players alike create biodegradable, recyclable, and low-impact materials. Businesses that focus on green initiatives and compliance with regulations are winning long-term contracts with hospitals, pharmaceutical companies, and laboratories, placing them ahead in this increasingly environmentally conscious market.

The competitive pressure is increasing, with smaller companies targeting niche markets and larger companies diversifying their product lines through acquisitions and alliances. The future of Korea's healthcare and laboratory label market will be shaped by technological innovation, sustainability, and the capacity to address changing regulatory requirements and industry needs.

The market is anticipated to reach USD 305.6 million in 2025.

The market is predicted to reach a size of USD 504.2 million by 2035.

Prominent players include Avery Dennison Corporation, CCL Industries Inc., Weber Packaging Solutions, Inc., General Data Co. Inc., and others.

With respect to material, the market is classified into nylon, polyester, polyolefin, vinyl, paper, and others.

In terms of end-user, the market is segmented into pharmaceuticals, nutraceuticals, medical devices, blood banks, hospital services, and laboratories.

In terms of province, the market is segmented into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and Rest of Korea.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.