Hawaiin tourism industry will continue to be shaped up until 2025 to 2035 with greater demand for nature retreats, international travelers more in vogue, and continued investment in nature- and culture-based excursions. Interweaving nature's inherent appeal, rich heritage, and upscale resorts in Hawaii positioned Hawaii as a top choice on the international tourism map. Aside from that, ecogrowth of the tourism industry alongside conservation at a national level has also positioned it as a destination worldwide for ecotourists.

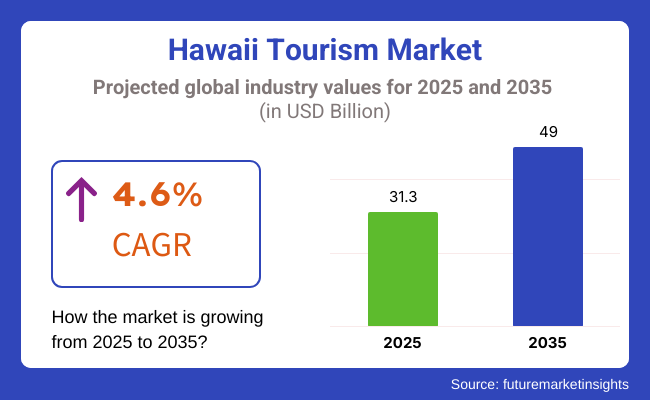

Hawaii tourism economy as of 2025 stands at USD 31.3 Billion. As of 2035, it will stand at USD 49.0 Billion with 4.6% CAGR growth. Complexity in consumer behavior and marketing as well as infrastructure modifications will be the drivers for market growth with future stage predictability anticipated.

Explore FMI!

Book a free demo

The North American source market is the largest source market of Hawaiian tourists, and the American mainland remains the largest tourist source. Geocultural closeness of Hawaii to the mainland of America and highly coordinated efforts of Hawaii tourist boards allowed a smooth flow of Hawaiian visitors from the source market.

Other airlines, such as Hawaiian Airlines, have diversified across other routes in recent times by carrying islands to other state travelers. Ideas of catering to diversified tourism recreational activities of travelers ranging from children to health spas and adventure getaways as well, have placed Hawaii on a top-position ranking as a perfect vacation destination for North American travelers.

The Asia-Pacific market is increasingly becoming a very important marketplace for the tourism sector in Hawaii, specifically with rising levels of incomes, higher travel frequency, and increased air connectivity. Japan, South Korea, and China are the hub markets that fuel Asian inbound tourism.

The natural scenic beauty of the island and the perception of security and hospitality attracted Asian tourists to visit in quest of luxury tours and authentic culture. Tourism tourism on the continent, i.e., marketing Hawaii as a luxury honeymoon state or love state, also created visitor additions from the continent.

Europe, though not the worst performing source market to Hawaii tourists, is a mature market segment. British, German, and French tourists visit Hawaii due to its legendary beaches, volcanic deserts, and ancient monuments. With the rise in travel distances, marketing of Hawaii as an island resort fantasy dreamland has experienced consistently high levels of European visitors.

Island-specific promotion by island uniqueness complemented by appealing holiday resort and convenience in the form of direct air connections has sustained continuing demand for Hawaii as an overseas high-order vacation destination.

Challenge

Environmental Concerns and Seasonality

The Hawaii Tourism Market is being plagued by looming environmental sustainability, seasonality, and regulatory constraints challenges. Hawaii’s fragile ecosystem is extremely vulnerable to mass tourism, creating problems, including beach erosion, coral reef decay and over intensive waste production. Moreover, the market also shows seasonality, with overcrowded travel periods and diminished visitor numbers during the off season, potentially harming local businesses.

Changes in regulations, like fees for visitors to preserve the natural site and restrictions on short-term rentals, also impact patterns of tourism. This can be achieved by investing in sustainable tourism projects, encouraging off-peak travel by offering different types of experiences and increasing the use of AI in solutions for crowd management.

Opportunity

Growth in Sustainable and Experiential Tourism

Rising demand for eco-friendly travel and immersive cultural experiences present tremendous opportunities for Hawaii Tourism market. Travelers are looking for more unique, personalized experiences instead, spurring demand for eco-friendly lodgings, farm-to-table meals and such indigenous-led cultural tours. Innovations in smart tourism technologies, particularly AI-powered trip planning and blockchain visitor management, are fostering better customer outcomes and improved destination management.

Finally, regenerative tourism principles, where travellers actively enhance environmental restoration and local economies, are also making inroads. An edge will be offered to those companies investing in sustainable resort operations, renewable energy powered tourism infrastructure, and smart destination management as Hawaii’s tourism industry embarks on a new birth into an era of sustainability.

Hawaii Tourism Market from 2020 to 2024, with increased visitor awareness of environmental issues, evolving behaviours on what they would experience through regulations for sustainable tourism. Measures to curb over tourism resulted in programs like reservation systems for popular natural sites, and rewards for eco-friendly modes of travel.

But managing an economy dependent on tourism with conservation efforts became problematic. In response, companies invested in sustainable infrastructure, promoted local businesses, and integrated AI-powered travel personalization tools to enhance visitor satisfaction.

As we move into the 2025 to 2035 market, we will see profound changes fuelled by smart tourism, optimized visitor experiences empowered by AI, and increasingly powerful integration of renewable energy in hospitality. Through VR previews of destinations and AI implementations to gauge environmental risk or improvements, and community-led tourism projects, visitors will find entire sectors reinvented.

The move toward net-zero tourism operations, carbon offset programs and AI-enabled energy efficiency will help cement Hawaii’s position as a steward of sustainable travel. Travelers will demand eco-tourism models, AI-driven crowd management, and localized cultural experiences, and the way these will shape Hawaii’s future tourism landscape.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Introduction of visitor caps and conservation fees |

| Technological Advancements | Growth in digital booking platforms and visitor tracking |

| Industry Adoption | Increased promotion of sustainable resorts and eco-tours |

| Supply Chain and Sourcing | Dependence on imported goods and traditional supply chains |

| Market Competition | Dominance of large-scale resorts and traditional tour operators |

| Market Growth Drivers | Rising demand for sustainable travel and cultural experiences |

| Sustainability and Energy Efficiency | Initial efforts toward sustainable hotel operations |

| Integration of Smart Monitoring | Limited use of visitor tracking and environmental impact assessment |

| Advancements in Experiential Travel | Traditional island tours and guided cultural experiences |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven conservation tracking, carbon-neutral tourism mandates, and sustainable travel policies. |

| Technological Advancements | Widespread adoption of AI-powered destination analytics, VR-based travel previews, and blockchain-secured visitor data management. |

| Industry Adoption | Expansion into regenerative tourism, smart environmental monitoring, and immersive cultural tourism experiences. |

| Supply Chain and Sourcing | Shift toward locally sourced products, circular economy tourism models, and sustainable resort development. |

| Market Competition | Rise of eco-boutique hotels, AI-driven personalized travel agencies, and experience-driven travel platforms. |

| Market Growth Drivers | Increased investment in smart tourism, AI-powered trip personalization, and eco-friendly tourism policies. |

| Sustainability and Energy Efficiency | Full-scale implementation of carbon-neutral hospitality, renewable energy resorts, and AI-optimized tourism logistics. |

| Integration of Smart Monitoring | AI-enhanced tourist flow management, real-time sustainability tracking, and digital conservation funding. |

| Advancements in Experiential Travel | AI-curated immersive experiences, community-led tourism initiatives, and VR-enhanced historical and cultural explorations. |

The United States is still the No. 1 origin of travelers to Hawaii, with millions coming every year from the continental USA to the islands. A wide range of budget accommodations and regular cheap flights has made Hawaii a vacationland within reach of many American travelers in search of sun and surf.

But an increasing number of high-wage tourists were flocking to luxury honeymoons at elegant beachfront resorts that appealed to upscale tastes, and some visitors were seeking out immersion in wellness retreats and cultural experiences that belonged to the islands. At the same time, as the big airlines added direct routes from hubs around the country with multiple weekly flights, industry experts predicted steady growth in the number of Americans who would be choosing to vacation in Hawaii in the years to come. Fresh amenities and distinctive activities would help ensure Hawaii maintains its position as a top tropical destination.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

Demand for long-haul luxury vacations, honeymoon travel, and adventure tourism offers room for growth for the Hawaiʻi tourism market with the United Kingdom. Hawai’i’s unusual landscapes, surfing culture and high-end resort offerings are increasingly alluring to British travellers

Stopover options on the USA mainland, as well as increased partnerships with airlines, have also made Hawai'i more accessible to travellers from the UK. In addition, the rise of experiential tourism, such as volcano tours, whale watching, and cultural heritage tours, and is another factor driving market growth.

Hawai'i is rapidly becoming the hot vacation choice for UK travellers because people are looking for something different, exotic.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

Hawai'i tourism market showing steady growth with eco-tourism, adventure travel and sustainable luxury vacations being well noted in the European Union. Countries including Germany, France and Italy are among the top source markets Great for Europe, where visitors look for long-haul tropical escapes and outdoor exploration experiences.

Market growth is also being driven by multi-destination trips, with European visitors specifically combining a trip to Hawai’i with stops on the USA West Coast. And airline partnerships are proliferating and travel packages more enticing - Europeans are finding Hawai'i a more affordable and appealing destination.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

he Japanese market has historically been one of the most important sources of tourism to Hawai'i, driven by cultural affinity, strong historical ties and growing interest in high-end tourism. Hawai’i is still one of the leading honeymoon destinations for Japanese couples as well as family vacations and wellness retreats.

You have seen growth in this market, with the recovery of group travel, the increase in direct flights from Tokyo and Osaka, and the demand for premium resort stays. Japanese visitors also have a preference for Hawai'i's high-quality hospitality, great shopping, and diverse culinary experiences.

With travel restrictions loosening and outbound travel from Japan recovering, we expect to see a higher number of Japanese visitors coming to Hawai’i with a significant demand for luxury and wellness experiences.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

Hawai'i's market for South Korean tourism is on the rise as disposable incomes rise, demand for international travel increases and interest in beach and adventure tourism remains strong. Hawai’i is particularly popular with honeymooners, family travellers and luxury seekers from South Korea.

The impact of social media and digital travel systems has amplified the interest in Hawai'i among younger South Koreans. The growing number of direct flights from Seoul and the hard-push marketing initiatives by Hawaii's tourism boards is also working in its favour.

As South Koreans continue to look for diverse and experience-rich vacations, Hawai’i’s tourism market is projected to keep growing in this area.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Hawaii tourism segments such as airlines and hotel companies accounted for a large size in the Hawaii tourism market as tourists are already booking premium airlines and hotel companies to experience one of the leading tropical destinations globally. These key direct suppliers are-in charge of enhancing the tourism experience, streamlining trip logistics, and offering high quality hospitality services, therefore making them essential for Hawaiian travel industry, luxury tourism and ecotourism markets.

As a critical segment of Hawaii’s tourism sector, airlines provide essential transportation, exclusive vacation packages, and high-end flight travel for both domestic and international travellers. Hawaii, unlike other islands, is dependent on air travel, as it is the main entry point for visitors arriving from the mainland USA, Asia and various other parts to the world.

The increasing popularity of nonstop routes to Hawaii from major hubs including Los Angeles, San Francisco, Tokyo and Sydney has further paved the way for the expanded use of airline partnerships as customers look for travel options that are both convenient and time efficient. Research shows that more than 90% of Hawaii tourists reach the islands from the air, creating robust market demand for airline services.

During our survey, rising adoption of airline vacation packages, multi-purchase bundles (flight-hotel), loyalty points and premium class upgrades are expected to boost market demand, supporting adoption of airline-backed tourism solutions.

Another factor for adoption has been the integration of AI-powered airfare pricing, which includes features like tracking airfares in real time, dynamic pricing and booking recommendations.

Sustainable aviation programs, including green fuel initiatives, and carbon offset programs have been putting the market on track to optimize this growth to appeal to the environmental conscience of their travellers.

This has not only bolstered market growth by offering an improved travel experience for high-end travellers through airline-branded travel experiences such as priority boarding, VIP airport transfers, and exclusive activities upon reaching their travel destination.

While the airline segment enjoys connectivity, tourism-driven revenue and seamless logistics, balancing volatility of fuel prices, intensifying competition from budget airlines, and potential economic downturns dampening travel demand are some of the challenges affecting the airline space. Nonetheless, some new innovations related to AI-based route optimization, block chain-powered ticketing security, and personalized inflight entertainment are raising speed, economy, and comfort, and will allow the airline market to keep on expanding together with the tourism industry in Hawaii.

Hospitality providers attract premium, all-inclusive offerings in Hawaii renowned beachfront destinations resulting in strong market adoption especially to luxury resorts or boutique hotels or eco-lodges hotel companies up to October 2023. Unlike traditional accommodations, Hawaii is built on high-end resorts, private island retreats and experiential tourism, which means there is strong demand for quality lodging.

Increasingly luxurious beachfront hotels, spa retreats and cultural immersion programs have helped worm up luxury travel services, as travellers look for comfort and exclusivity. Research shows that more than 70% of everyone who visits Hawaii orders hotels or resorts, so most demand for luxury.

The market demand for more eco-friendly and sustainable resorts have continued to grow, with LEED-certified properties, solar-powered accommodations and ocean conservation initiatives.

The adoption has been on the rise owing to the inclusion of AI-based guest experiences, including personalized room preferences, automated check-in services, and smart concierge assistance, ensuring better convenience and service for the guests.

Key trends on wellness and adventure based lodging like hiking retreats, holistic spa experiences, cultural heritage resorts etc. have further streamlined the market growth which drives more interest among wellness tourists and experience seekers.

The implementation of digital concierge services, with the assistance of itinerary planning powered by artificial intelligence (AI), real-time booking management, and custom activity recommendations, have bolstered industry growth, providing increased convenience for visitors to Hawaii.

While relatively new, the hotel segment offers strengths in hospitality innovation, luxury appeal, and revenue opportunities, GI and their accompanying challenges include high operational costs, competition from alternative accommodations (Airbnb, vacation rentals), and seasonal tourism fluctuations. Nevertheless, nascent innovations in AI-powered hospitality automation, block chain-enabled room booking security, and hybrid work-leisure lodgings are enhancing efficiency, sustainability, and profitability - all of which will enable hotel companies in the Hawaii tourism industry to continue to grow and expand.

OTA (Online Travel Agencies) and compliance are two extensive market factors, as tourism companies and business groups adopt online booking solutions and corporate travel management systems more so that they organize traveling logistics and encourage cost-effectiveness.

They provide online booking capabilities, real-time price comparisons, and organized travel packages for both independent travellers and group tours, thus making online travel agencies (OTAs) one of the most powerful intermediaries in Hawaii’s tourism sector. OTAs have end-to-end automated travel planning, unlike typical travel agencies, which is why they are preferred by millennial and Gen Z travellers.

As tourists look for more flexible and personalized travel arrangements; the increasing appetite for AI-powered travel booking services (with automated flight-hotel bundling, live price monitoring, and last-minute booking suggestions) has driven the uptake of OTA services. Research shows that more than 80% of people traveling to Hawaii book their trips through online platforms, creating high demand for services from OTAs.

On-demand mobile-centric booking systems have fuelled the demand worldwide while making advanced adoption of online travel solutions easier with app-based travel planning or instant itinerary management.

This has been further accelerated with the entry of virtual reality (VR)-based hotels previews, which have offered immersive property tours and real-time beach view simulations that have ensured improved adoption rates and booking confidence for travellers.

While OTAs do have their benefits from smooth online booking to pricing transparency and convenience, the OTA segment is at risk because of stiff competition from direct hotel and airline booking platforms, cyber risks and regulatory scrutiny around online prices. Block chain-powered secure travel transactions, artificial intelligence-powered booking assistants, and machine learning price prediction are just a few core innovations that are enhancing the efficiency, cost-effective nature, and safety of booking through online travel agencies. There is no slowing down for OTAs in Hawaii tourism.

They have seen strong market adoption among corporate buyers, especially around business trip management, incentive-based group travel, and conference tourism in which companies and organizations look to purchase bulk travel for employees and executives at competitive prices. Corporate tourism as opposed to leisure tourism is focused on the planning and handling of large-scale travel, logistics management, group discounting, and coordination for seamless participation in events.

The growth in corporate retreat programs executive getaways, leadership summits and employee incentive travel is motivating the implementation of corporate buyer procurement strategies as businesses seek tropical team-building experiences with luxury amenities.

Demand for the market has strengthened with the growth of MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism, with business events in Hawaiian resorts and conference centers enabling the greater adoption of enterprise-level travel procurement.

While the corporate buyer segment has advantages with bulk travel pricing, corporate event logistics, and employee engagement, issues such as remote work trends, business travel budget cuts, and preference for personal meetings have emerged. That said, corporate buyers in the Hawaii tourism space will continue to grow, thanks to new developments in AI-enabled corp travel automation, smart contract based negotiation for travel, and block chain-powered travel expense reporting, necessary to optimize efficiency, transparency, and ROI.

Demand for high-end travel & luxury, adventure travel, cultural activities, eco-tourism, vacations, etc. are changing the Hawaii tourism market. The industry is focusing on sustainable tourism efforts, AI-based travel insights, and individualized visitor experiences that will give a competitive edge to partners that enhance guest satisfaction, resource management, and tourism-related revenue while maintaining the local environment.

Global travel agencies, Hawaiian hospitality brands, airline operators and tour service providers are all building smart tourism, eco-tourism infrastructure and AI-powered visitor engagement and more, effectively becoming the new marketplace in the state.

Market Share Analysis by Key Company

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Hawaiian Airlines | 15-20% |

| Hilton Hawaiian Village (Hilton Hotels & Resorts) | 12-16% |

| Marriott International (Hawaii Resorts & Hotels) | 10-14% |

| Pleasant Holidays | 8-12% |

| Outrigger Hospitality Group | 5-9% |

| Other Operators & Local Tourism Businesses (combined) | 35-45% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Hawaiian Airlines | Develops premium airline services for Hawaiian tourism, offering direct flights, AI-based trip personalization, and cultural travel experiences. |

| Hilton Hawaiian Village (Hilton Hotels & Resorts) | Specializes in luxury beachfront resorts, eco-friendly accommodations, and all-inclusive travel experiences in Hawaii. |

| Marriott International (Hawaii Resorts & Hotels) | Provides high-end hospitality services, integrating AI-powered guest engagement and sustainable tourism practices. |

| Pleasant Holidays | Offers customized Hawaii vacation packages, guided tours, and AI-enhanced travel planning services. |

| Outrigger Hospitality Group | Focuses on cultural heritage tourism, immersive Hawaiian experiences, and eco-conscious resort operations. |

Key Company Insights

Hawaiian Airlines (15-20%)

Hawaiian Airlines is the leading Airline to the Hawaiian tourism market with AI-powered travel recommendations, nonstop air services from the world's major global hubs, and onboard Hawaiian cultural experiences. The airline is a vital contributor to inbound tourism, enhancing accessibility and premium travel experiences.

Hilton Hawaiian Village (Hilton Hotels & Resorts) (12-16%)

Hilton’s flagship resort in Hawaii specializes in luxury amenities right on the beach, including an AI-powered guest services department, sustainable hotel practices and Hawaiian cultural immersions.

Marriott International (Hawaii Resorts & Hotels) (10-14%)

AI-based travel insights, digital concierge services, and eco-friendly development of resorts, Marriott is setting the tone for customer-facing experiences across the luxury hospitality segment.

Pleasant Holidays (8-12%)

Pleasant Holidays is a top travel package seller, providing customized Hawaiian vacation options, all-inclusive resort stays, guided tours, and intelligent travel itineraries.

Outrigger Hospitality Group (5-9%)

A global hospitality leader with a distinctly Hawai'i soul, Outrigger delivers premium beachfront hotels and resorts dedicated to preserving Hawaiian heritage, sustainable tourism initiatives and artificial intelligence-enhanced travel recommendations.

Other Key Players (35-45% Combined)

Some travel operators, hospitality brands, Hawaiian tourism service providers are helping build next-gen tourism innovations, AI-based visitor engagement, and sustainable tourism development. These include

The overall market size for Hawaii Tourism Market was USD 31.3 Billion in 2025.

The Hawaii Tourism Market is expected to reach USD 49.0 Billion in 2035.

The demand for the Hawaii Tourism market will grow due to increasing inbound travel, rising adoption of digital booking platforms, growing preference for seamless vacation planning, and advancements in travel technology, driving efficiency in airline, hotel, and activity reservations.

The top 5 countries which drives the development of Hawaii Tourism Market are USA, UK, Europe Union, Japan and South Korea.

Airlines and Hotel Companies Drive Market to command significant share over the assessment period.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Tourism Industry Loyalty Program Sector: A Competitive Review

Winning Strategies in the Global Animal Theme Parks Industry: A Competitive Review

Winning Strategies in the Global Spa Resorts Industry: A Competitive Review

Winning Strategies in the Global Winter Adventures Tourism Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.