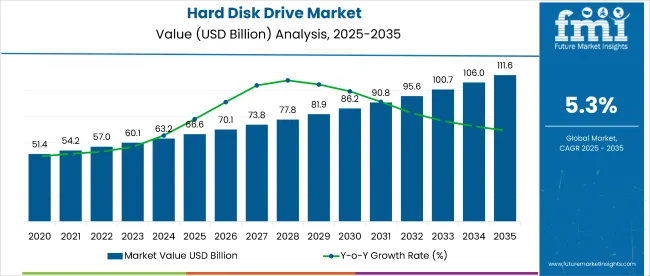

The global hard disk drive (HDD) market is projected to grow from USD 66.6 billion in 2025 to USD 111.2 billion by 2035, expanding at a steady CAGR of 5.3%. The market is growing steadily due to the increasing demand for large-capacity, cost-effective data storage solutions across various industries. Despite the rising popularity of solid-state drives (SSDs), HDDs continue to be preferred for archival storage, cloud data centers, and enterprise applications because of their high storage capacity at a lower cost per gigabyte.

The expansion of big data, artificial intelligence, and Internet of Things (IoT) applications has led to exponential data generation, requiring scalable and reliable storage infrastructure. Cloud service providers and hyperscale data centers are increasingly adopting high-capacity HDDs to manage massive datasets efficiently while optimizing operational expenses.

Additionally, advancements in HDD technology, such as heat-assisted magnetic recording (HAMR) and microwave-assisted magnetic recording (MAMR), are pushing storage densities higher, extending the lifespan and performance of HDDs. These innovations make HDDs more competitive and suitable for long-term data retention.

Emerging markets are also witnessing rapid digital transformation, increasing the need for affordable storage devices for personal computing, surveillance systems, and small to medium-sized enterprises. Furthermore, regulatory requirements for data retention and backup are driving consistent HDD demand. Together, these factors contribute to sustained growth in the HDD market despite evolving storage technologies.

Government regulations impacting the HDD market are increasingly focused on data security, electronic waste management, and energy efficiency. Many countries are implementing stricter guidelines around the disposal and recycling of electronic components to minimize environmental impact.

In the European Union, directives such as the Waste Electrical and Electronic Equipment (WEEE) and Restriction of Hazardous Substances (RoHS) regulations mandate recycling and restrict the use of hazardous substances in HDD manufacturing.

Similarly, the United States promotes sustainable electronics through EPA programs and energy efficiency standards. These regulations encourage manufacturers to innovate in product design, adopt greener manufacturing processes, and enhance the recyclability of HDD components to meet environmental compliance and consumer demand for sustainable technology.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 66.6 billion |

| Industry Value (2035F) | USD 111.2 billion |

| CAGR (2025 to 2035) | 5.3% |

The hard disk drive (HDD) market is integrating advanced technologies to enhance storage performance, reliability, and predictive maintenance capabilities. AI, ML, IoT, sensors, and Industry 4.0 are shaping both manufacturing processes and operational intelligence in this sector.

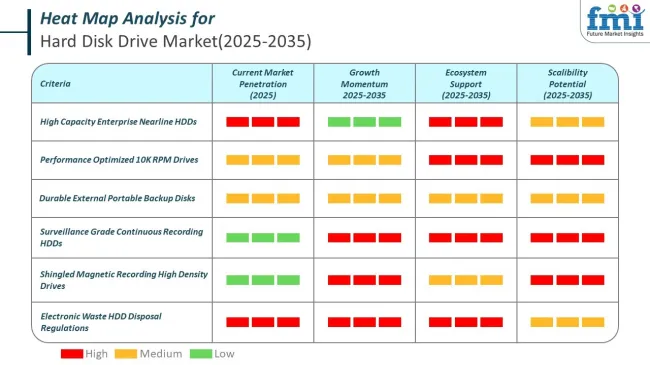

Self-Encrypting Drive (SED) adoption is a critical data protection metric in the hard disk drive market, aligning with regulatory requirements and growing demand for endpoint security. Hardware-based encryption and cryptographic erase features are increasingly standard in enterprise environments.

REACH SVHC declaration rate is a key regulatory indicator in the hard disk drive market, reflecting supplier transparency and risk mitigation in materials sourcing. Consistent disclosure supports downstream compliance, particularly for assemblies integrating drives and enclosures.

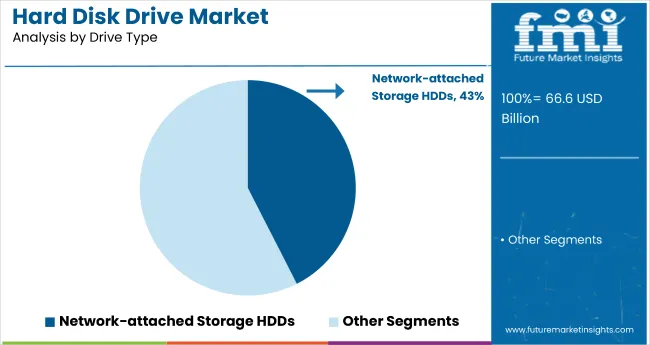

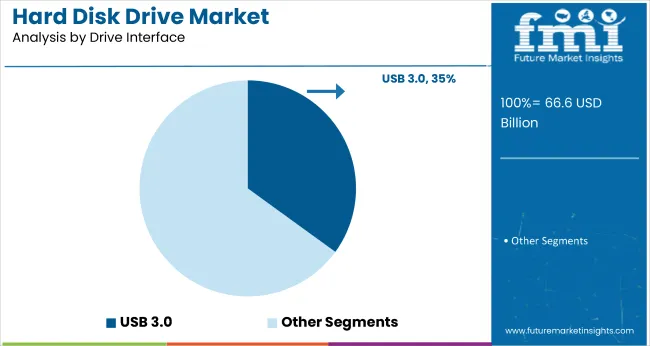

The market is segmented by drive type into portable HDDs, desktop HDDs, and network-attached storage HDDs; by storage capacity: less than 250GB, 250GB - 1TB, and above 1TB; by drive interface: USB 3.0, USB 2.0, USB 3.1 Gen1, USB 3.1 Gen2, ethernet, others (thunderbolt, firewire, SATA, eSATA, PCIe, fiber channel); by region: North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East and Africa.

The portable HDDs segment emerges as the most lucrative with the expected CAGR of 6.1% over the forecast period. The accelerating demand for portable storage solutions, driven by increasing convenience demand, the proliferation of high-resolution media content, and the widespread adoption of remote work trend, contributes to this robust growth.

The segment benefits from a favorable combination of affordability, high capacity, and convenience, which continues to attract individual consumers and small businesses alike. Desktop HDDs maintain a steady presence due to their entrenched role in desktop computing and enterprise storage infrastructure.

However, their growth is more moderate given competition from solid-state drives and cloud storage alternatives. Network-attached storage (NAS) HDDs are experiencing promising adoption in the enterprise and SME segments due to growing data centralization needs and the expansion of cloud services; however, their overall market share remains smaller compared to portable devices.

| Drive Type | CAGR |

|---|---|

| Portable HDDs | 6.1% |

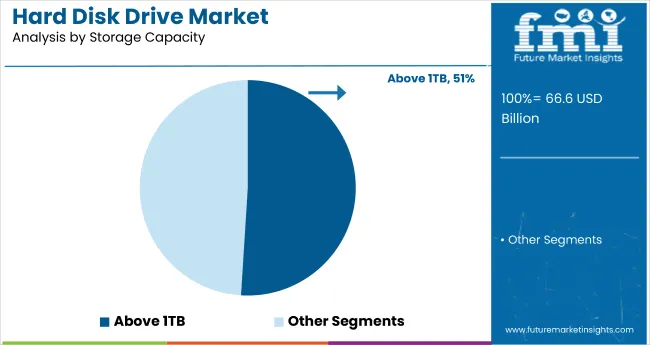

The above 1TB storage capacity segment stands out as the most lucrative and fastest-growing category with a CAGR of 6.4%. The expansion is driven by escalating demand for large-scale data storage in enterprise environments, data centers, and cloud infrastructure, which require cost-effective, high-capacity drives to support the exponential growth of data. The increasing demand for digital content creation, video streaming, and data backup further reinforces the surge in the adoption of higher-capacity HDDs.

The 250GB–1TB segment maintains a significant but comparatively stable market share, serving primarily mid-range consumers and small businesses where a balance between capacity and cost is essential. The less than 250GB segment continues to decline in relevance due to limited capacity and increasing affordability of larger drives and solid-state alternatives.

| Storage Capacity Segment | CAGR |

|---|---|

| Above 1TB | 6.4% |

The USB 3.1 Gen 2 interface segment emerges as the most lucrative and fastest-growing driver of revenue expansion, poised to grow at a CAGR of 6.8%. The superior data transfer speeds of USB 3.1 Gen2 (up to 10 Gbps), combined with backward compatibility and broad adoption across consumer electronics and enterprise devices, underpin this growth.

The rising demand for faster, more reliable external storage solutions in gaming, content creation, and enterprise backup scenarios continues to drive adoption rates, making this interface the preferred choice for both portable and desktop hard drives. Other interfaces, such as USB 3.0 and USB 3.1 Gen1, remain significant due to their established user base and widespread compatibility, which is being overtaken by slower speeds.

Ethernet interfaces are primarily associated with Network Attached Storage (NAS) drives, which serve niche enterprise applications, while legacy interfaces like USB 2.0 and FireWire continue to decline in use. “Others,” including Thunderbolt, SATA, eSATA, PCIe, and Fiber Channel, serve specialized or hybrid markets but do not match the scale or growth trajectory of USB 3.1 Gen2.

| Drive Interface | CAGR |

|---|---|

| USB 3.1 Gen2 | 6.8% |

Technological Advancements to Bolster Sales

The HDD market is being transformed by several emerging trends, including the adoption of advanced recording technologies such as Heat-Assisted Magnetic Recording (HAMR) and Microwave-Assisted Magnetic Recording (MAMR), which significantly increase storage density and performance.

There is a growing demand for high-capacity drives, driven by data-intensive applications such as AI, cloud computing, and video streaming. Additionally, the rise of hybrid storage solutions, which combine HDDs with SSDs in enterprise environments, is reshaping product portfolios.

Sustainability efforts, such as energy-efficient designs and recyclability, are also influencing the dynamics as regulatory pressure and consumer awareness increase.

Stiff Competition May Deter Adoption

The market faces several barriers, including strong competition from solid-state drives (SSDs) that offer faster speeds and declining costs, making them increasingly attractive for consumer and enterprise use. The inherent mechanical limitations of HDDs, such as fragility and slower data access times, restrict their adoption in high-performance computing scenarios.

Additionally, fluctuating raw material costs and supply chain disruptions can impact production costs and delivery timelines. Environmental regulations and sustainability mandates also challenge manufacturers to improve energy efficiency and recyclability, which may lead to increased operational expenses and slower product development cycles.

Rising Adoption of IoT Devices to Expedite Growth

Key growth drivers for the hard disk driver market include the exponential rise in global data generation, fueled by the increasing adoption of IoT devices, digital transformation, and cloud computing.

Enterprises and data centers are increasingly relying on cost-effective, high-capacity storage solutions, favoring HDDs over more expensive alternatives for archival and backup purposes. The expanding gaming and creative content markets also boost demand for portable and desktop HDDs with larger storage capacities.

Furthermore, emerging economies with increasing investments in digital infrastructure present significant opportunities for market expansion. Continuous technological innovation and strategic partnerships further enable companies to capture new customer segments and enhance product offerings.

Growing Data Security Concerns May Hinder Sales

The market is hampered by the increasing concerns over data security and reliability. HDDs, due to their mechanical components, are more prone to physical damage, wear and tear, and data loss compared to solid-state drives (SSDs).

This vulnerability raises issues in critical applications requiring high data integrity and uptime, such as financial services, healthcare, and government sectors. Moreover, the noise and heat generated by HDDs can pose challenges in compact or mobile devices, limiting their adoption.

As businesses and consumers prioritize robust and secure storage solutions, many are shifting toward SSDs or cloud-based alternatives that offer enhanced reliability and lower failure rates. These factors are constraining HDD market growth, especially in segments demanding high performance and durability.

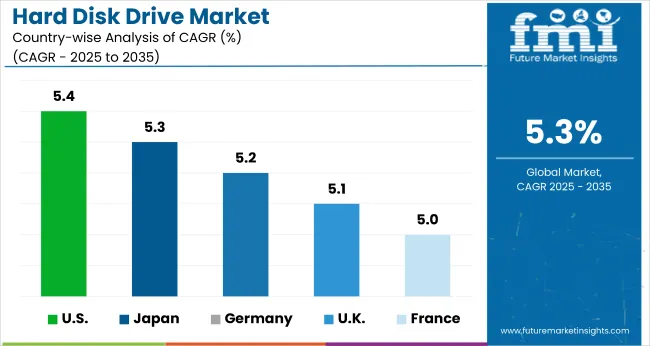

| Countries | CAGR (2025-2035) |

|---|---|

| France | 5.0% |

| Germany | 5.2% |

| Japan | 5.3% |

| United States | 5.4% |

| United Kingdom | 5.1% |

The United States hard disk drive market represents one of the most mature and lucrative markets at a CAGR of 5.4%, driven by strong demand from hyperscale data centers, cloud providers, and enterprise IT infrastructure.

The country is home to leading global tech firms that rely on high-capacity hard disk drives (HDDs) for storage efficiency and data redundancy. The ongoing shift toward AI-powered applications and big data analytics further amplifies storage needs, positioning HDDs as a cost-effective solution for large-scale data storage, despite the rising adoption of SSDs. Regulatory frameworks in the USA, such as those under the Environmental Protection Agency (EPA), emphasize sustainability and electronic waste management.

However, the USA. remains relatively industry-friendly, offering strong IP protection and tax incentives for tech innovation. Extended Producer Responsibility (EPR) schemes are gaining momentum, prompting HDD manufacturers to invest in greener product lines and recycling infrastructure. Market competition is high, with firms differentiating themselves through partnerships with data center operators and original equipment manufacturers (OEMs). Additionally, federal investments in digital infrastructure and cybersecurity support long-term stability of demand.

The United Kingdom's hard disk drive industry provides a moderate yet stable growth environment for the HDD market, with a CAGR of 5.1%, supported by a mature IT services sector and increasing demand for data storage in government, healthcare, and finance. The UK's push for digital transformation, through initiatives like "Digital Britain" and the expansion of edge computing infrastructure, drives sustained HDD adoption, particularly in enterprise and hybrid cloud environments.

Regulatory compliance is a key market feature; the UK enforces strict data protection laws under the UK GDPR and mandates energy-efficient hardware under its environmental legislation. This regulatory pressure prompts manufacturers to adhere to design-for-recyclability principles and low-power hardware requirements.

The UK’s competitive landscape is shaped by close partnerships between OEMs and managed IT service providers. The rise of mid-tier data centers and cloud-native businesses further drives HDD consumption, especially in the 1 TB+ and NAS categories. Although the rising penetration of SSDs somewhat constrains the market, HDDs remain the preferred choice for archival and backup purposes due to their cost advantages.

Sales of hard disk drives in France are poised for steady growth at a CAGR of 5.0%, underpinned by national initiatives focused on digital sovereignty, data localization, and public sector digitization. Government programs, such as “France Numérique,” and investments in sovereign cloud ecosystems are directly stimulating demand for enterprise-level storage infrastructure, providing a strong growth base for HDD vendors.

Despite the rise of SSDs in consumer markets, HDDs remain essential for high-volume, low-cost data storage, especially for archival, compliance, and cold storage applications. Regulatory compliance is a critical market factor in France, with stringent adherence required under frameworks such as the WEEE (Waste Electrical and Electronic Equipment) and RoHS directives, both of which drive innovation in recyclable and energy-efficient storage design. The surge in digital health infrastructure, smart manufacturing, and AI-based research is further driving demand for high-capacity hard disk drives (HDDs).

Small and medium-sized enterprises (SMEs) are increasingly adopting NAS and desktop-based HDD solutions to strike a balance between performance and cost in hybrid storage environments. Although local HDD manufacturing is limited, foreign brands with compliant products and strong after-sales support maintain a dominant position. Overall, France offers a balanced mix of policy-driven opportunity and consistent enterprise demand.

Germany's hard disk drive demand is positioned as one of the most attractive and strategically vital markets, posting a CAGR of 5.2%, driven by its advanced industrial ecosystem, stringent regulatory environment, and commitment to digital infrastructure.

As the backbone of the EU economy, Germany’s aggressive implementation of Industry 4.0, combined with data localization and cybersecurity mandates, is creating sustained demand for scalable, high-capacity HDD storage across manufacturing, automotive, healthcare, and financial sectors.

Enterprises are deploying hybrid and private cloud systems at scale, where HDDs remain indispensable for backend storage, archival, and disaster recovery due to their cost efficiency at high volumes.

Regulatory frameworks, especially the GDPR and WEEE directives, are strictly enforced. The German Environmental Agency mandates rigorous energy efficiency and e-waste standards, making sustainability an operational requirement rather than a competitive differentiator.

HDD manufacturers are increasingly aligning with these regulations through closed-loop recycling models, energy-optimized hardware, and transparent supply chains.

Germany also offers significant R&D incentives, encouraging tech partnerships between global OEMs and local automation firms. Foreign players with advanced green technologies and secure hardware solutions are particularly well-positioned.

The Japanese hard disk drive market represents a mature yet high-potential market, achieving a CAGR of 5.3%, fueled by its deep-rooted manufacturing expertise, high-tech infrastructure, and continuous investment in enterprise IT systems.

The country’s aging population and shift toward digital healthcare, smart cities, and e-governance are generating sustained demand for data storage, particularly in high-density applications like surveillance, telecommunications, and public records management. HDDs remain a critical component in these sectors due to their cost-efficiency and reliability in large-scale, long-term data retention.

While SSD penetration is accelerating in consumer electronics, HDDs continue to dominate in institutional and industrial use cases, where capacity and durability are prioritized over speed. Japan’s regulatory climate, governed by the Ministry of Economy, Trade, and Industry (METI) and the Ministry of the Environment, mandates strict compliance with safety, recyclability, and material content standards.

HDD manufacturers operating in Japan must ensure that their designs are low-noise, low-emission, and environmentally friendly to remain compliant with regulations. The country’s strength in robotics and automated testing enables the greater integration of HDDs into advanced systems, presenting opportunities for differentiation among local and international players.

The hard disk drive (HDD) market is moderately consolidated, dominated by a few key players that control the majority of the global market share, specialized manufacturers continue to operate in niche segments.

The competitive landscape is shaped by continuous innovation, strategic partnerships, aggressive pricing, and geographic expansion, enabling companies to capture emerging markets.

Leading companies compete primarily through technological advancements, such as increasing storage density and improving reliability with new recording technologies.

They also focus on cost leadership by optimizing manufacturing efficiency to offer competitive pricing. Strategic collaborations with cloud service providers, PC manufacturers, and data center operators are pivotal for segment penetration. Additionally, expanding into high-growth regions, such as the Asia Pacific, through local partnerships and investments enables firms to tap into the rising demand from enterprises and consumers. Overall, innovation combined with cost-effective production and strategic alliances forms the cornerstone of competitive strategies in the market.

Top companies compete primarily through innovation, developing higher-capacity and faster drives using advanced technologies like HAMR and MAMR. Pricing strategies remain aggressive to sustain volume sales, especially in consumer and enterprise segments. Strategic partnerships with cloud service providers, PC manufacturers, and data center operators help secure long-term contracts and expand market reach.

Geographic expansion into emerging sectors, particularly in Asia Pacific, is also a key focus to leverage growing digital infrastructure and rising data storage needs. Together, these strategies enable leading firms to reinforce their market positions while driving growth.

Recent Hard Disk Drive Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 66.6 billion |

| Projected Market Size (2035) | USD 111.2 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Drive Type | Portable HDDs, Desktop HDDs, Network-attached Storage HDDs |

| By Storage Capacity | Less than 250GB, 250GB - 1TB, Above 1TB |

| By Drive Interface | USB 3.0, USB 2.0, USB 3.1 Gen1, USB 3.1 Gen2, Ethernet, Others |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East and Africa (thunderbolt, firewire, SATA, eSATA, PCIe, fiber channel) |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Seagate Technology Holdings PLC, Western Digital Corporation, Toshiba Corporation, Hitachi Global Storage Technologies (HGST) (Acquired by Western Digital), Samsung Electronics Co., Ltd., Quantum Corporation, Fujitsu Ltd. (HDD Division - Acquired by Toshiba), IBM Corporation (Enterprise HDD Solutions), Hewlett Packard Enterprise (HPE) (Storage Solutions), Dell Technologies Inc. (Enterprise Storage) |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is projected to grow at a CAGR of 5.3% between 2025 and 2035, driven by rising data storage needs across sectors.

In 2025, the global hard disk drive market is valued at approximately USD 66.6 billion.

By the end of 2035, hard disk drive is anticipated to reach a market size of USD 111.2 billion.

East Asia is expected to register the highest growth, with a projected CAGR of 5.8% from 2025 to 2035.

Key players include Seagate Technology Holdings PLC, Western Digital Corporation, Toshiba Corporation, Hitachi Global Storage Technologies (HGST) (acquired by Western Digital), Samsung Electronics Co., Ltd., and Quantum Corporation, among others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Drive Interface, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Drive Interface, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Drive Interface, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Drive Interface, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Drive Interface, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Drive Interface, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Drive Interface, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Drive Interface, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Drive Interface, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Drive Interface, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Drive Interface, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Drive Interface, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Drive Interface, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Drive Interface, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Drive Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Drive Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Storage Capacity, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Storage Capacity, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Drive Interface, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Drive Interface, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Power Source, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Drive Interface, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Drive Interface, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Drive Interface, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Drive Interface, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Drive Interface, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 26: Global Market Attractiveness by Drive Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 28: Global Market Attractiveness by Drive Interface, 2023 to 2033

Figure 29: Global Market Attractiveness by Power Source, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Drive Interface, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Drive Interface, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Drive Interface, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Drive Interface, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Drive Interface, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 56: North America Market Attractiveness by Drive Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 58: North America Market Attractiveness by Drive Interface, 2023 to 2033

Figure 59: North America Market Attractiveness by Power Source, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Drive Interface, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Drive Interface, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Drive Interface, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Drive Interface, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Drive Interface, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Drive Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Drive Interface, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Power Source, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Drive Interface, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Drive Interface, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Drive Interface, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Drive Interface, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Drive Interface, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Drive Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Drive Interface, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Power Source, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Drive Interface, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Drive Interface, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Drive Interface, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Drive Interface, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Drive Interface, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Drive Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Drive Interface, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Power Source, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Drive Interface, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Drive Interface, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Drive Interface, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drive Interface, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drive Interface, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Drive Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Drive Interface, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Power Source, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Drive Interface, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Drive Interface, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Drive Interface, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Drive Interface, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Drive Interface, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Drive Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Drive Interface, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Power Source, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Drive Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Storage Capacity, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Drive Interface, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Drive Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Drive Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Drive Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drive Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Storage Capacity, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Storage Capacity, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Storage Capacity, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Storage Capacity, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Drive Interface, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Drive Interface, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Drive Interface, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drive Interface, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Drive Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Storage Capacity, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Drive Interface, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Power Source, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hardware Asset Management Industry Analysis in North America Forecast Outlook 2025 to 2035

Hardwood Pulp Market Size and Share Forecast Outlook 2025 to 2035

Hardness Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Hard-Wired Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Hardware-Assisted Verification Market Size and Share Forecast Outlook 2025 to 2035

Hardware Asset Management Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hard Gelatin Capsules Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hardware Security Module Market Analysis - Size, Share & Forecast 2025 to 2035

Hard Seltzer Market Analysis by ABV Content, Packaging and Distribution Channel Through 2035

Industry Share Analysis for Hardwood Pulp Companies

Hard Tea Market

Hardgel Liquid Capsule Filling Machines Market

Hardware Encryption Market

Chardonnay Market Trends - Growth & Industry Forecast 2025 to 2035

Orchard Tractors Market Size and Share Forecast Outlook 2025 to 2035

Microhardness Testing System Market Size and Share Forecast Outlook 2025 to 2035

Soil Hardening Agent Market Size and Share Forecast Outlook 2025 to 2035

Door Hardware Market

Amine Hardener Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA