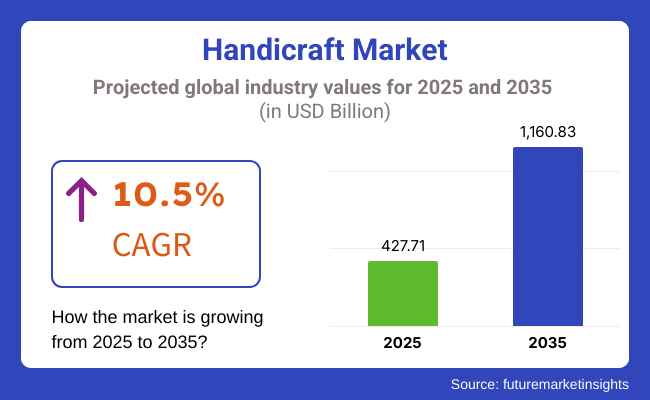

The production of handicraft alternatives will become very popular and by 2025 it is expected to be worth USD 427.71 billion, and in 2035 it will be worth USD 1,160.83 billion. The market is slated to showcase 10.5% CAGR from 2025 to 2035.

As per FMI analysis, the majority of the consumers' choices in home adornment revolve around handmade and eco-friendly products, besides the fact that they usually are mutually exclusive to the sustainable and ethical sourcing of the goods. Digital platforms playing a major role in increasing the international market access, are mainly documented to be the cause of this scenario.

The consumer trends are now showing a marked preference for the adoption of such materials as jute, and bamboo that are ecological, sustainable, and ethically produced, and the use of recycled materials as well. In fact, consumers are increasingly choosing to consume consciously instead of the mass-produced items they are now preferring handmade crafts.

Alongside this, the option of buying directly from artisans instead of big retail chains has become available. The change is caused by consumers' increased awareness of environmental protection and their wish to own unique goods. The urge for individuality and personalization is a key driver in the growth of the handicrafts market.

As a result, limited-edition and similar products become highly valued. The development of e-commerce alongside social networks has served to create more opportunities for this process, as the small businesses can promote and sell their products to a wider group of people while giving customers the chance to find and buy unique items regardless of place.

The market saw a significant growth from 2020 to 2024 as consumer demands increased for handmade, environment-friendly and culturally relevant products. The widening market access at the hands of social media and e-commerce platforms made it easier for artisans to connect directly with global consumers.

Governments and organizations introduced small-scale industry policies to make local crafts popular. Ethically sourced materials increased in demand. However, artisans or microenterprises faced other problems such as interruptions in supply chains, competition from mass-produced replicas, and fluctuating costs of raw materials.

Between 2025 and 2035, the industry will continue to transform with digitalization, sustainability, and customization driving consumer demand. AI-based platforms will enhance the personalized shopping experience, while blockchain will enhance transparency in fair trade. The need for sustainable and upcycled materials will compel artisans toward sustainable production.

Moreover, the partnership between artisans and luxury companies will grow, placing handicrafts as high-end products. As there is increased global recognition of traditional crafts, the market will keep on growing, mixing heritage with innovation.

| 2020 to 2024 Trends | 2025 to 2035 Projected Trends |

|---|---|

| AI adoption, cloud computing, IoT, 5G expansion | AI autonomy, quantum computing, 6G, neurotech |

| E-Commerce boom, subscription economy, remote work | Hyper-personalization, Web3, decentralized economy |

| Digital influencers, mental health awareness, sustainability | AI-human collaboration, longevity tech, post-social media |

| Digital transformation, gig economy, fintech rise | AI-driven automation, decentralized workforces, crypto-native economies |

| Streaming wars, short-form content (TikTok, Reels) | AR/VR experiences, metaverse expansion, AI-generated content |

| Green energy push, electric vehicles (EVs), ESG focus | Carbon-negative tech, fusion energy, regenerative AI |

| Telemedicine, wearable health tech, COVID-driven innovation | AI drug discovery, longevity research, bioengineering |

| Crypto volatility, DeFi experimentation, digital payments | CBDCs, AI-driven finance, tokenized assets |

| EV acceleration, micro-mobility, autonomous driving tests | Smart cities, full self-driving, hyperloop & air taxis |

| Hybrid work, online learning, upskilling | AI tutors, immersive education, job automation |

The handicraft market is both highly competitive and highly fragmented. Mass-produced decor items, which are machine-made but designed to have a “handmade look,” compete at the lower end, putting pressure on handmade items that serve a similar function. Artisans are responding by focusing on differentiation-emphasizing cultural authenticity, superior quality, or the bespoke nature of their goods, which mass products cannot replicate.

This differentiation is an emerging practice that affects pricing, essentially moving products out of direct competition and enabling firmer pricing. For example, a factory-made rug might be USD 50, while a similar-sized handwoven rug is USD 200. Rather than cutting the price to USD 75 to compete, the artisan highlights that their rug is naturally dyed, one-of-a-kind, and supports a village community-finding buyers who value those aspects.

This storytelling approach, combined with limited editions, is a trend ensuring handicrafts remain perceived as worth their higher price. Additionally, some manufacturers in developing countries are blending handmade craftsmanship with machine finishing to hit a middle price point, satisfying a segment of consumers who want something handcrafted but at a moderate price. This hybrid production approach could influence pricing tiers in the market going forward.

| Raw Material | Cost Volatility Impact |

|---|---|

| Wood (Furniture, Sculptures, Décor) | High |

| Textiles and Natural Fibers (Cotton, Wool, Silk, Jute, Sisal Rugs) | High |

| Metals and Jewelry Materials (Brass, Silver, Copper, Steel, Aluminum) | High |

| Ceramics and Glass (Clay, Silica) | Medium |

| Leather (Hides, Tanned Goods) | Medium |

| Bamboo and Rattan (Basketry, Furniture) | Low |

Woodwork is one of the main segments in the handicraft market which has high craftsmanship and cultural importance. Woodworks refers to substances made by wood such as carved furniture, decorative objects, and spoon and fork functions.

The contents are compellingly blending old-world artistry with functional use, a threefold reason that makes them highly sought after for their sturdiness, beauty, and organic elegance. Woodworks are preferred by consumers for their ability to add warmth and authenticity to home décor and furniture.

With the homeowners leading the charge in the handicraft market around the world, residential sector takes a major share in the market owing to increasing demand for customized products to decorate living spaces. Decorative elements such as designer wall art, furniture, and textiles allow consumers to craft spaces that are distinct to their aesthetic and their appreciation for culture.

Such products enhance the look of homes, while at the same time connecting homeowners with the traditional craft and facilitating a sense of heritage and uniqueness. The increasing popularity of using eco-friendly and sustainable materials in homes also contributes to the growing demand for artisanal products, since they cater to the interests of eco-conscious consumers.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 14% |

| Australia | 12.1% |

| China | 10.6% |

| Germany | 9.7% |

| USA | 7.4% |

The invention of artisan platforms and boutique shops play a very important role in achieving significant progress, notwithstanding that the main attractive items are textile, pottery, and woodwork. As a result, customers are becoming more and more ethical and support small enterprises which both of these factors encourage.

Handcrafted items which also include textured fabrics are a popular choice for home furnishings and gift giving. FMI is of the opinion that the USA handicraft market is slated to depict 7.4% CAGR during the study period.

Growth Factors in The USA

| Growth Factors | Details |

|---|---|

| Consumer Preference for Sustainability | Increasing demand for eco-friendly and locally made products. |

| E-commerce Expansion | Online platforms enabling artisans to reach a broader audience. |

| DIY Culture | Growing interest in personalized and handmade goods among millennials and Gen Z. |

Bespoke and vintage items are the main factors boosting the UK market. The consumers are ready to pay for the eco-friendly locally produced items, which are sold by independent retailers & online markets. The demand for handwoven textiles, ceramic art, and metal crafts is on the rise. A surge in ethical consumerism has made the sector grow further, with craft fairs and campaigns promoting locally made articles with government support.

Growth Factors in The UK

| Growth Factors | Details |

|---|---|

| Artisan Engagement | British designers utilizing trunk shows in the USA to expand their market reach. |

| Post-Brexit Market Diversification | UK brands seeking new markets due to changes in European sales dynamics. |

| Cultural Appreciation | Increased consumer interest in unique, artisanal homeware products. |

The traditional crafts like washi, lacquer, and ceramics are still sought after. The market is sustained by the demand for such goods both at home and abroad, particularly among those who appreciate Japanese aesthetics. These heritage techniques combined with the contemporary innovation is the reason why Japan is often the leader among the other countries in the market segment.

Growth Factors in Japan

| Growth Factors | Details |

|---|---|

| Cultural Heritage Preservation | Strong emphasis on traditional crafts and techniques. |

| Tourism Influence | Tourists purchasing traditional crafts as souvenirs, boosting local artisans. |

| Government Support | Initiatives promoting traditional arts and crafts. |

Germany blends historical artisanal skills and the latest creativity into one. The buyers are looking for durable goods, so the craftspeople seem to be making a lot of wood products, glass, and textile goods as per customer requirements.

Seasonal markets are playing a vital role in attracting customers and promoting handcrafted articles and gifts. With sustainability at the forefront, German artisans are making the transition to using renewable materials which the conscious consumers appreciate. FMI is of the opinion that the German industry is expected to witness 9.7% CAGR during the study period.

Growth Factors in Germany

| Growth Factors | Details |

|---|---|

| Sustainability Focus | Consumer preference for sustainable and locally produced goods. |

| Rich Craftsmanship Tradition | Long-standing appreciation for high-quality, handmade products. |

| Market for Artisanal Goods | Growing demand for unique, handcrafted items in home decor and fashion. |

India is widely acclaimed the world's main hub for the manufactured goods market, boasting the contribution of its deep-rooted artistic traditions and numerous creative people. The local crafts are going well as they are sold all around the world and the demand is for painted textiles, clay items, metal crafts, and imitation jewelry.

Together with the expansion of the electronic commerce sector, the government initiatives have made progress on the goal to support and uplift the rural artisans. India with economical pricing, heritage value, and high-quality products is unrenowned as the most prominent player in the global industry. FMI is of the opinion that the Indian market is expected to witness 14% CAGR during the study period.

Growth Factors in India

| Growth Factors | Details |

|---|---|

| Government Initiatives | Programs supporting artisans and promoting traditional crafts. |

| E-commerce Growth | Online platforms expanding the reach of Indian products globally. |

| Tourism and Cultural Exports | Tourists and international markets driving demand for Indian crafts. |

The market is competitive, where major players innovate their products and sources and target new markets globally. Such major players in the handicraft market are Fabindia, Craftsvilla, Varnam, Ten Thousand Villages, and Novica. These firms dominate the market using their vast artisan networks and e-commerce platforms.

By bringing homemade and culturally inspired products of ethical sources, these companies target consumers seeking unique, high-quality, and eco-friendly products. The above-mentioned changes in market trends, i.e., sustainable and fair trade-products, have made many brands develop their collections using recycled resources, natural dyes, and traditional craftsmanship techniques that would entice conscious consumers.

Key company insights

Asian Handicrafts Pvt. Ltd.

Works to revive traditional Indian handcrafts by sourcing directly from artisans and presenting the wealth of handcrafted artifacts.

Fakih Group of Companies

Enters the handicraft business and markets artisanal products from the Middle East, especially accentuating cultural history and quality craftsmanship.

Shandong Laizhou Arts and Crafts Imp & Exp Co. Ltd.

Specializes in exporting Chinese products by utilizing local materials and traditional techniques for the international market.

Ten Thousand Villages

Operates as a non-profit fair-trade organization that uses 35 countries in partnership with artisans to market handmade products while providing fair wages and sustainable practices.

Oriental Handicrafts Pte. Ltd.

Focuses on quality and authenticity rather than merely having categories of a diverse range of Asian handicrafts, aimed both at the local and international audience.

The market includes woodworks, metal artworks, handprinted textiles & embroider goods, imitation jewelry, and others.

By end users, the market is divided into residential and commercial.

Handicrafts are sold through specialty stores, independent retailers, online stores, and others.

The market spans across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by End-user, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End-user, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by End-user, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by End-user, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by End-user, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by End-user, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by End-user, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by End-user, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by End-user, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by End-user, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by End-user, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by End-user, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by End-user, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by End-user, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

In 2025, the market is estimated to reach USD 427.71 billion.

By 2035, the market is forecasted to reach USD 1,160.83 billion.

The growing demand for sustainable products made of materials such as bamboo, jute, and other earthy materials are boosting the demand for the product, impelling market growth.

Asian Handicrafts Pvt. Ltd., Fakih Group of Companies, Shandong Laizhou Arts and Crafts Imp & Exp Co. Ltd., Ten Thousand Villages, Oriental Handicrafts Pte. Ltd., NGOC Dong Ha Nam, Minhou Minxing Weaving Co., Ltd. are some important key market players in the industry.

Woodworks are being widely purchased by customers.

India, poised to expand at 14% CAGR during the study period, is slated to depict fastest growth.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.