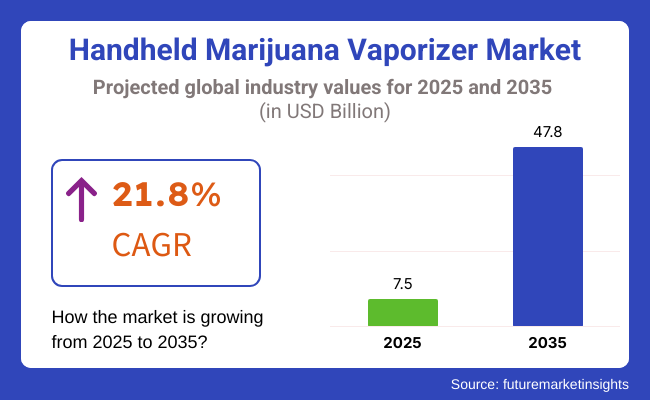

The handheld marijuana vaporizer market is expected to evolve amazingly between 2025 and 2035 due to rampant cannabis legalization, growing convenience and stealth consumption needs, and improving vaporization technology. The industry will grow from USD 7.5 billion in 2025 to USD 47.8 billion in 2035 with a compound annual growth rate (CAGR) of 21.8% during the forecast period.

Greater demand for healthier alternatives to conventional smoking and increased popularity of cannabis culture in mainstream wellness will drive industry growth. Advances in technology such as temperature control, battery life, and smart connectivity will drive product acceptance. Increased usage of e-commerce and direct-to-consumer sales will enhance accessibility and penetration into the industry.

North America will lead the industry through comprehensive legalization and increased consumer consciousness, while Europe will experience stable expansion as rules come more favorable toward cannabis. The Asia-Pacific space, although laggard behind, will also offer large-term opportunities as legal trends in terms of cannabis persist to transform.

Explore FMI!

Book a free demo

The industry is growing fast turmoil of the ongoing increasing legalization and acceptance of cannabis use in both medical and recreational ways. Priority for medical users is battery life, temperature control, and durability in order to secure a vaping experience that is safe and well controlled, on the other hand, recreational users are looking for such things as portability, design, and of course, low cost for usage away from home. Retailers and dispensaries require high-quality, user-friendly hardware equipment with long lifespan that translates to customer satisfaction and regulatory compliance.

Online retailers have expanded due to e-commerce, which provide products to price-sensitive consumers who are looking for a combination of low-cost and premium products. The industry is trending towards producing intelligent temperature management, USB-C quick charging, and discreet issues that make it easier and desirable for vaporizers. Coupled with the technologically driven innovations and focus on healthier consumption avenues, the handheld vaporizer demand is likely to increase, particularly in areas that have increasing legalizations of marijuana.

From 2020 to 2024, the industry grew substantially due to expanding cannabis legalization, changing consumer demand for smokeless consumption, and vaporizer technology advancements. Consumers preferred portable, discreet products with accurate temperature control and improved vapor quality.

Companies launched convection and hybrid heating technologies, maximizing flavor and performance. Smart vaporizers with Bluetooth allowed consumers to personalize settings and track use via mobile applications. Even in the face of regulatory ambiguity and increasing production costs, the industry grew as companies focused on product innovation and extended battery life.

From 2025 to 2035, AI-powered vaporizers, eco-friendly materials, and customized user experience will drive industry expansion. Future vaporizers will have AI-powered heating profile control by preference and strain for delivering maximum strength and flavor. Eco-friendly designs with recyclable parts and biodegradable cartridges will be in harmony with sustainable practices.

The functions like strain-specific recommendations and inhalation tracking will deliver the best user experience. Blockchain-based permission systems will offer quality of products and traceability, and the medical-grade vaporizers will allow cannabis-based wellness and medicine consumption.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Brands launched temperature-control vaporizers with convection heating for better flavor and efficiency. USB-C charging and extended battery life became central requirements. | AI-controlled vaporizers tailor heating profiles to users' tastes. Quantum heating tech facilitates almost instant vaporization while preserving cannabinoids. |

| Businesses adopted recyclable, sustainable materials and refillable cartridges. Biodegradable vape pods and hemp casings gained traction. | Modular, repairable zero-waste vaporizers are the new standard in the industry. AI optimizes energy efficiency and environmentally friendly material use. |

| Mobile app-controlled, Bluetooth-enabled vaporizers allowed real-time temperature control. Dose tracking allowed consumers to track usage. | AI-based vaporizers interface with biometric wearables to enhance dosage and experience. Blockchain guarantees transparency of strain sourcing and authenticity of products. |

| Growing legalization and acceptance in mainstream culture fueled industry expansion. Direct-to-consumer (DTC) and dispensary partnerships increased sales. | Emerging industries witness high growth with local product variants. AI-based consumer intelligence streamlines vaporizer recommendations for medical and recreational consumers. |

| Greater regulation of vape emissions and ingredient declarations resulted in safer, laboratory-tested products. Compliance monitoring was maximized with the use of QR codes on packages. | Global regulations demand biodegradable and toxin-free vaping products. Blockchain enhances compliance tracking and ensures quality control in cannabis supply chains. |

| Firms launched interchangeable mouthpieces, variable airflow levels, and personalized temperature controls. Limited-series co-brands became huge hits. | AI-driven customization modulates vapor density, cannabinoid balance, and terpene release. On-demand 3D printing makes the possibility of fully customized vape parts a reality. |

| Influencer cannabis, wellness experts, and lifestyle brands pushed high-end vaporizers. Instagram, YouTube, and cannabis-oriented websites fueled awareness. | Metaverse-based cannabis lounges and virtual influencers reshape marketing. Product demonstrations using AR enable consumers to sample vaporizer functionalities prior to purchase. |

| Portability, discretion, and healthy vaporization were priorities for consumers. Flavor-enhancing and medical-grade vaporizers became more in demand. | Biohacking-inspired devices incorporate real-time monitoring of cannabinoids for maximized effects. Consumers adopt AI-optimized vaping experiences for wellness and recreational purposes. |

The portable marijuana vaporizers segment is at risk of being affected by government withholding and legal fears because various areas have cannabis laws that are in opposition. It is a little bit like how countries and states deal with it, on one side, there are those that let it go both for recreational and medical purposes, but the others have tough restrictions. The firms really need to keep up to date with the regulations of both the state and the federal government to stay away from any legal dangers.

Main risk areas are health and safety of the products. The issues of vaping diseases and the worry about toxic elements in vaporizer cartridges have driven the advent of stricter health regulations. It is an obligation for production houses to ensure the use of superior material, implement rigorous testing, and full disclosure of ingredients to sustain consumer trust.

Even the stability of the industry and economic issues, factors that form one more class of the challenge, have their implications on demand. The cannabis arena is most vulnerable during periods of economic downturn, shifts in tax policy, as well as rise and fall in consumer buying behavior. For the purpose of securitization, companies must broaden their product ranges to include the likes of accessories and subscription-based services.

Furthermore, along with the present-day companies, the new entries be it clothing or other appliances, are a threat and have reached high popularity which has disturbed the price industry and has created differentiation in the brands offered. Corporations have to set variable marketing strategies like the level of gas control, the durability of the battery, and the gadget being light in kind in order to win the trust of their customers.

The primary product segmentation in the industry is done based on convection vaporizers and conduction vaporizers catering to the unique consumer preference and tastes. The Conduction vaporizers are one of the top and dominant segments, accounting for nearly 65-70% value of total sales as they are inexpensive, user-friendly, and portable.

Concentrate vaporizers work by instantly heating the material with direct contact with a heating element, giving it a rapid heat-up time and uniform output, which is great for beginner and casual users. Key brands, including Pax Labs, G Pen, and DaVinci segment continue to lead growth by providing portable, effective, and easy to use models across a range of prices.

This explosion in popularity also comes on the heels of the rise of disposable and entry-level vape devices available for purchase at retail and online stores. In contrast, convection vaporizers have close to 30-35% industry share and are tentatively carving away at more mainstream/health-oriented segments, especially among more premium brands.

These devices heat material by circulating hot air. Convection vaporizers are typically a bit more expensive. They aren't as portable as conduction vaporizers, but they are effective at preserving terpenes and cannabinoids, which is why most enthusiasts or medical users prefer this type. These high-performance models come equipped with advanced temperature controls and hybrid heating technology that puts top brands like Storz & Bickel (Volcano), Firefly, and Arizer in their class.

In the industry, the charger type segment is also witnessing the trend to be the same, where manufacturers are endorsing Micro USB chargers owing to their low price, dependability, and compatibility with a broader range of vaporizers available. Micro USB chargers are expected to hold a dominant position in this segment as well, with a 60-65% share by 2025.

Pax Labs, DaVinci, G Pen, and others are utilizing Micro USB charging in their devices; not only is this design choice affordable for manufacturers but it has also been well-received by the general public. As most portable vaporizers are oriented towards casual users, it makes more sense for vaporizers to be compatible with existing charging cables, which is why Micro USB is most manufacturers' preferred standard.

USB-C chargers, however, are on the rise and by 2025, are expected to capture 35-40% of the industry. The need for efficient charging has fueled this, as well as improved life span and greater energy efficiency.

The use of USB-C charging has become more common within premium brands such as Storz & Bickel, Firefly, and Arizer, with models providing a fast charge and those that appeal to consumers wanting good performance over time with their devices. This comes as the wider consumer electronics industry continues to adopt USB-C, spurred by regulations and a push to universalize charging standards.

Even though micro USB still makes up the majority of the industry in 2025, the gradual movement toward USB-C adoption is anticipated in the next few years as consumers lean toward more net-positive efficiency and convenience. Within premium and next-gen vaporizers, USB-C will likely be adopted much at a higher pace, revolutionizing the charging standard in the industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.4% |

| Canada | 8.1% |

| Germany | 7.9% |

| India | 7.2% |

| China | 8.6% |

The USA industry is increasing with increased marijuana legalization, increasing demand for portability of vaping products, and advances in the vaporization science.

Innovators such as Pax Labs, Storz & Bickel, and DaVinci control the industry by offering cutting-edge products that cater to medical and recreational consumer needs. Buyers continue to demand vaporizers that have precise temperature control, high-performance heaters, and odor reduction. Specialty stores and web pages are the primary sources of industry availability, making mass acceptance possible.

FMI is of the opinion that the USA industry is slated to grow at 8.4% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Cannabis legalization | Expanding recreational and medical cannabis legislation encourages the use of vaporizers. |

| Discreet consumption popularity | Micro, odor-reducing vaporizers are popular among urban commuters and working professionals. |

| Internet and specialty diversification | Increased availability and wider distribution of products through internet websites. |

The Canadian industry is being fueled by the legalization of cannabis in its full potential, health-conscious consumption demand, and vaping technology advancements. Companies such as Arizer, Boundless, and AirVape have designed high-quality vaporizers with interchangeable features that are savored by newbies and veterans alike.

Government-sanctioned cannabis sales outlet stores and websites ensure transparency and trust building for customers. FMI is of the opinion that the Canadian industry is slated to grow at 8.1% CAGR during the study period.

Growth Factors in Canada

| Key Drivers | Details |

|---|---|

| Preference for healthier options | Consumers perceive vaporizers as a healthier option for smoking. |

| Premium vaporizer demand | Stores desire temperature control and high-end products. |

| Growing regulated sales | Government-backed store-and-web stores encourage more genuine sales. |

Germany's industry is growing, as there is a rise in cannabis prescriptions and demand for quality, medically approved vaporization products by consumers. Industry leaders such as Storz & Bickel, Mighty Vaporizer, and Firefly dominate the industry with dosing-controlled and vaporization-specialized products.

Smart-connected vaporizer technology offers an enhanced user experience, which means high-end device demand. FMI is of the opinion that the German industry is slated to grow at 7.9% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Growing demand for medically approved vaporizers | Patients require precise doses and stable devices. |

| Expansion of prescriptions for medicinal marijuana | Government policy in support of the adoption of medicinal cannabis. |

| Advancements in vaporizing technologies | Quality products retailing via smart connectivity and sophisticated options. |

India's portable marijuana vaporizer industry is currently in the formative stage, driven by rising awareness around the medicinal and herbal consumption of cannabis. Flowermate, Dynavap, and VapCap are a few companies addressing a niche client segment seeking portability and subtlety in vape products.

Urban-based working-class professionals and young consumer cohorts increasingly view vaporizers as an option to regular smoking, with the regulatory ban and an emerging industry posing challenges. FMI is of the opinion that the Indian industry is slated to grow at 7.2% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Growing demand for herbal vaporization | Product uptake is influenced by trends in Ayurvedic and herbal medicine. |

| Increased demand for convenient and portable products | Urban users demand portable, easy-to-use vaporizers. |

| Exploding in online and grey industry sales | Regulatory issues notwithstanding, online platforms offer products that are easily and conveniently accessible. |

China's industry is increasingly humongous, driven by China's status as a manufacturing giant globally and increased global demand for vaporizers. Top industry players are XVAPE, Vaporesso, and Smoore International, which have heavily invested in battery duration and advanced heat technology. Cross-border e-commerce is forcing China to go international, with domestically made vaporizers exported abroad. FMI is of the opinion that the Chinese industry is slated to grow at 8.6% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Continuing strong demand for vaporizer manufacture | China dominates OEM and ODM vaporizer manufacturing. |

| Cross-border e-commerce development | Chinese vaporizers are widely exported all over the world. |

| Development of battery and heating technology | Research and development drive efficiency and innovation. |

The industry is witnessing unprecedented growth, owing to the fast-track legalization of cannabis, increased consumer preference for smokeless options, and improvements in the technologies used for vaporization. Portability, temperature control, and discreet use are some of the conveniences driving both medical and recreational consumers toward widespread acceptance of vaporizers.

The major companies in the world include Storz & Bickel, Arizer, Ghost Herbal, DaVinci Vaporizers, and Pax Labs, which manufacture convection and conduction-based vaporizers, smart temperature controls, and high-efficiency heating chambers. Among new entrants and niche providers, there are app-connected vaporizers along with micro-dosing and recyclable pod-based systems to improve user experience.

The evolution of the industry is underpinned by technology-enhanced functions of precision heating, Bluetooth connectivity, and hybrid heating systems. Increasingly, consumers look at health-conscious designs, longer battery lives, and premium materials while purchasing for better vapor quality.

Strategic considerations shaping competition include device efficiency, heating consistency, regulatory compliance, and product differentiation. Early investments in medical-grade materials, modular designs, and sustainability initiatives like biodegradable cartridges will pay off for replacing manufacturers in this growing industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Storz & Bickel GmbH & Co. | 5-7% |

| Arizer | 4-6% |

| Ghost Herbal Concepts Ltd. | 3-5% |

| Davinci | 3-5% |

| PAX Labs, Inc. | 5-8% |

| Other Companies | 70-80% |

| Company Name | Key Offerings/Activities |

|---|---|

| Storz & Bickel GmbH & Co. | Renowned for high-quality vaporizers like the Crafty and Mighty, focusing on durability and performance. |

| Arizer | Offers a range of portable vaporizers known for their efficient heating and user-friendly designs. |

| Ghost Herbal Concepts Ltd. | Known for the Ghost MV1 vaporizer, emphasizing advanced technology and customizable vaping experiences. |

| Davinci | Provides sleek, portable vaporizers with precision temperature control and innovative features. |

| PAX Labs, Inc. | Offers the PAX series of vaporizers, known for their sleek design and advanced features. |

Key Companies Insights

Storz & Bickel GmbH & Co. (5-7%)

Storz & Bickel GmbH & Co. continues to make a strong industry impression with its durable and performance-oriented, high-quality vaporizers. The focus on innovation is high to keep pace with emerging consumer preferences.

Arizer (4-6%)

With convenient designs and the best heating systems, Arizer manufactures portable vaporizers under the name of efficiency. Quality and satisfaction are the keys to making a huge share of the industry for this company.

Ghost Herbal Concepts Ltd. (3-5%)

Ghost MV1 vaporizer is designed and touted for using advanced technology in a customizable vaping experience by Ghost Herbal Concepts Ltd. The company's focus on innovation goes well with the interest of tech-savvy consumers desiring high-performance devices in the industry.

Davinci (3-5%)

Davinci manufactures ultra-compact portable vaporizers with very accurate temperature control and some unique features. Quality resonates with the design aesthetics to thrill before consumption in the minds of consumers seeking value in premium vaping experiences.

PAX Labs, Inc. (5-8%)

PAX Labs, Inc. owns the vaporizers under the PAX series. These devices are recognized for their sleek designs and advanced features. The consumer experience-oriented innovations and products have now put the company in a very stable industry position.

The industry is slated to reach USD 7.5 billion in 2025.

The industry is predicted to reach a size of USD 47.8 billion by 2035.

FireFly, Crafty, Hound Labs, Inc., Lobo Genetics, Planet of the Vapes, Boundless CF/CFX, MyNextVape, Da Buddha Vaporizers, Tera, tCheck, Kassi Labs Inc., Leaf, Puffco, Syqe Medical, Resolve Digital Health, Vapir Rise Vaporizers, and Wisp are the key players in the industry.

China, slated to grow at 8.6% CAGR during the forecast period, is poised for the fastest growth.

Convection vaporizers are among the most widely used due to their efficient and even heating mechanisms.

The industry is segmented into convection and conduction vaporizers, each offering different heating mechanisms for cannabis consumption.

The industry includes USB and micro-USB chargers, catering to varying consumer preferences for charging convenience.

In terms of temperature control, the industry is divided into fixed and variable temperature vaporizers.

The industry is categorized into online and offline sales channels, with online platforms gaining traction due to convenience and product variety.

In terms of region, the industry spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa, with North America leading due to the widespread legalization of cannabis.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.