The global hand tools market is projected to grow at a CAGR of 5.7%, reaching a market size of USD 26,897.1 million by 2035. This growth is primarily driven by the increasing demand for versatile, durable, and ergonomically designed tools across residential, professional, and industrial applications. The rising popularity of DIY trends, advancements in tool materials, and the rapid adoption of e-commerce platforms also contribute to market growth.

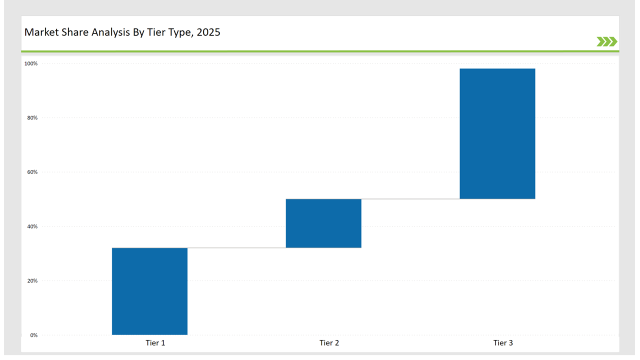

The market is fragmented, with Top 3 players (Stanley Black & Decker, Snap-On Incorporated, Apex Tool Group) collectively holding 32% of the market share, the Next 2 of 5 players (Makita Corporation, Klein Tools) contributing 18%, and the remaining 48% shared among regional and niche manufacturers.

Among product types, wrenches and pliers dominate with a combined 40% market share, reflecting their essential roles in automotive, construction, and repair activities. The online sales channel is growing rapidly due to consumer preference for convenience and diverse product availability.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 26,897.1 million |

| CAGR (2025 to 2035) | 5.7% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Stanley Black & Decker, Snap-On Incorporated, Apex Tool Group) | 32% |

| Rest of Top 5 (Makita Corporation, Klein Tools) | 18% |

| Rest of Top 10 | 50% |

The market is fragmented with the dominant Tier-I players are focused on manufacturing hand tools with a long lifespan and using state-of-the-art assembly technologies. The Tier-II and Tier-III operations compete by offering application-specific and cost-effective solutions.

In the market for hand tools, wrenches comprise 26% of the total. Wrenches are essential tools across various industries, including automotive, construction, plumbing, and manufacturing. Their versatility in tightening and loosening bolts, nuts, and fasteners makes them indispensable in both professional and DIY settings.

The automotive and construction sectors, where wrenches are used extensively for assembly, maintenance, and repairs, drive a large portion of the market. The increasing number of construction projects and vehicle production continues to fuel the demand for wrenches.

There are various types of wrenches (e.g., adjustable, socket, pipe, and torque wrenches), catering to specific needs across different industries. This variety broadens their appeal and increases their market share.

Wrenches are often made from durable materials like steel and alloy, making them long-lasting and cost-effective. Their robustness and ability to withstand high torque also contribute to their high market share. Wrenches are relatively simple to use, requiring minimal training or expertise, making them popular for both professional tradespeople and home users.

DIY end use made up the significant part of the market, with 31% of sales. There has been a significant rise in the interest in home improvement, gardening, and personal projects. People increasingly prefer to undertake DIY tasks like furniture assembly, home repairs, and renovations, which require a variety of hand tools, including wrenches, hammers, screwdrivers, and more.

DIY projects allow individuals to save money on labor costs by doing the work themselves. As a result, more people are investing in hand tools to complete home improvements, repairs, and maintenance independently.

The growth of DIY culture, fueled by social media platforms, online tutorials, and communities, encourages people to take on projects themselves. This has led to increased sales in hand tools, as DIYers often seek tools for smaller-scale repairs and custom projects.

The availability of a wide range of affordable, user-friendly hand tools has made it easier for DIYers to access the tools they need. With tools designed for non-professionals, DIYers can complete projects without needing high-end, specialized equipment.

More people are becoming aware of the importance of home maintenance and the satisfaction that comes with completing a project on their own. This has led to an increase in the number of individuals purchasing hand tools for various tasks around the house.

Stanley Black and Decker

Stanley Black & Decker continued to solidify its position as a market leader in 2024, particularly through its focus on innovation, product quality, and extensive global distribution networks. The company was highly successful in expanding its product portfolio in both consumer and professional hand tools sectors.

Stanley Black & Decker introduced a new line of advanced cordless hand tools, incorporating lithium-ion battery technology, which significantly enhanced the performance and efficiency of tools like drills, saws, and screwdrivers.

In addition to product innovation, Stanley Black & Decker focused on incorporating smart technology into its hand tools. With the rise of smart homes and IoT (Internet of Things), the company launched tools equipped with Bluetooth technology that allowed users to track tool usage, monitor performance, and ensure precise measurements remotely through mobile apps. This integration of digital capabilities into traditional hand tools was pivotal for customers seeking enhanced productivity and better tool management.

The company’s sustainability initiatives in 2024 also gained significant attention. It increased its efforts in reducing carbon emissions across its production facilities and focused on producing more energy-efficient tools. This commitment to environmental responsibility, alongside the expansion of the product range, ensured Stanley Black & Decker’s continued dominance in the hand tools market.

Robert Bosch GmbH

Robert Bosch GmbH made major strides in 2024, particularly with the expansion of its hand tool portfolio and its focus on precision engineering. Known for its strong foothold in the power tool segment, Bosch further extended its presence in the hand tools sector, emphasizing tools designed for both professional craftsmen and DIY enthusiasts.

Bosch introduced a new line of ergonomic hand tools that addressed common pain points for users, such as improving comfort, reducing fatigue, and enhancing control during extended use.

Bosch’s hand tools division focused heavily on professional-grade products designed for construction, automotive, and home improvement applications. The company introduced a new set of precision tools aimed at improving the efficiency of assembly lines and manufacturing processes.

Bosch’s hand tools were equipped with high-quality materials, including advanced composites and durable metals, ensuring long-lasting performance even under harsh conditions.

One of the standout innovations from Bosch in 2024 was its collaboration with smart technology developers to create tools that provided real-time data on user activities. These tools utilized advanced sensors to track and monitor force application, ensuring accuracy and reducing the risk of errors in high-precision jobs.

Bosch’s ability to combine traditional craftsmanship with cutting-edge technology ensured that its products were in high demand in both professional and consumer markets.

MISUMI Group Inc

MISUMI Group Inc. made significant headway in 2024, gaining recognition for its customization capabilities and comprehensive product range in the hand tools market. The company’s focus on providing customers with tailored solutions helped it stand out in a competitive market.

MISUMI's ability to offer high-quality, customized hand tools for industrial applications made it a preferred choice for manufacturers across sectors such as automotive, electronics, and machinery.

In 2024, MISUMI placed a strong emphasis on improving the usability and precision of hand tools used in automated production environments. The company introduced tools with enhanced durability and resistance to wear and tear, which were particularly useful in high-volume production lines.

Additionally, MISUMI continued to expand its global supply chain, ensuring that businesses worldwide had access to its wide array of precision hand tools.

The company also embraced sustainability by sourcing eco-friendly materials and introducing environmentally conscious packaging solutions. MISUMI’s continued commitment to precision and customizability ensured that it remained a leader in industrial hand tools, particularly in sectors that required high levels of detail and accuracy.

Klein Tools

Klein Tools, renowned for its high-performance hand tools for electricians and other trades, continued to grow in 2024 by focusing on specialized tools for both professional contractors and DIY enthusiasts.

The company’s market success was largely due to its deep understanding of the needs of tradespeople, particularly in the electrical and construction industries. Klein Tools maintained its reputation for delivering durable, reliable, and ergonomically designed hand tools that catered to specific professional requirements.

In 2024, Klein Tools introduced a new series of insulated hand tools that enhanced worker safety in environments with high electrical risk. These tools were tested and certified to provide maximum protection against electrical hazards, making them particularly popular among electricians and construction workers.

Additionally, Klein expanded its line of power tools and accessories, which complemented its existing hand tool offerings and allowed the company to provide a complete solution for electrical work.

The company also focused on improving the overall user experience with tools designed to minimize strain and maximize precision. For example, Klein introduced new pliers, wire cutters, and screwdrivers with optimized grips that provided better control and reduced hand fatigue during long workdays. With a focus on product quality and safety, Klein Tools continued to capture a loyal customer base in North America and internationally.

North America Maintains Market Leadership

North America continues to lead the hand tools market, expected to maintain its dominant position with a significant share through 2035. The region's robust infrastructure, construction, and manufacturing industries are driving the demand for hand tools.

In particular, ongoing developments in residential, commercial, and industrial projects ensure a steady requirement for high-quality hand tools. The USA market, being the largest, is expected to maintain its strong position due to continued investments in construction, home improvement, and automotive industries.

Additionally, there is a consistent demand from both professionals and DIY enthusiasts, which strengthens the overall market in North America. Technological innovation in hand tools, including smart tool integration and ergonomic design, is also boosting their adoption in this region.

Technology-Driven Adoption

The hand tools market is seeing a transformative shift, largely driven by technological advancements that are making tools smarter, more efficient, and versatile. New innovations, such as Bluetooth-enabled tools, integrated sensors, and digital tracking features, are changing the way professionals and consumers use hand tools.

These advancements not only improve user experience but also enhance precision and productivity, making tools more attractive to both professionals and hobbyists. For instance, Stanley Black & Decker's smart tools allow users to track usage data, while Bosch’s precision hand tools incorporate sensors for improved accuracy.

Furthermore, the development of more durable materials, such as advanced composites and high-grade alloys, has made hand tools more resistant to wear and tear, extending their longevity and ensuring better performance in demanding environments.

These technological improvements are increasing the overall appeal of hand tools across different sectors, from construction and automotive to electronics and DIY projects.

Asia-Pacific Shows Rapid Growth

The Asia-Pacific (APAC) region is experiencing the fastest growth in the hand tools market, driven by expanding infrastructure and industrialization. Countries like China, India, and Japan are major players in this growth, with significant investments in urbanization, road construction, and infrastructure development fueling demand for hand tools.

Additionally, the increasing mechanization in agriculture, especially in emerging markets, is contributing to the rising demand for tools such as trenchers, pliers, and wrenches used in farming and irrigation systems.

The rapid industrialization in countries like India and Vietnam, coupled with a growing middle class that is becoming more DIY-oriented, is further driving market expansion in the region.

The development of affordable, high-quality hand tools that cater to both professional contractors and DIY enthusiasts has bolstered market growth, making APAC a key region for manufacturers looking to expand their market presence.

| Tier | Examples |

|---|---|

| Tier 1 | Stanley Black and Decker, Robert Bosch GmbH, and MISUMI Group Inc. |

| Tier 2 | Milwaukee Tool Corporation, Snap-On Inc., and Klein Tools |

| Tier 3 | Regional and niche players |

| Company | Key Focus |

|---|---|

| Stanley Black and Decker | Stanley Black and Decker has focused on enhancing the performance and ergonomic design of their hand tools. The company has introduced a line of power tools and hand tools with advanced safety features and improved user comfort. Their tools are designed to withstand demanding conditions in construction and automotive sectors, with a growing emphasis on tools that integrate smart technology, such as Bluetooth-enabled systems for inventory management. |

| Robert Bosch GmbH | Bosch has expanded its hand tools range by focusing on incorporating cutting-edge technology, such as brushless motors and precision engineering, to improve efficiency and durability. Their tools are designed to cater to both professional and DIY markets, with a growing trend toward cordless, high-performance options. Bosch is also introducing smart tools with connectivity features, allowing users to customize settings and track tool performance in real-time. |

| MISUMI Group Inc | MISUMI Group focuses on providing high-quality, customizable hand tools tailored to the needs of industrial and manufacturing sectors. The company has developed a robust line of tools designed for precise assembly and maintenance tasks. Their key focus is on offering customizable options with quick lead times, ensuring efficiency for customers in sectors like electronics, machinery, and automation. |

| Milwaukee Tool Corporation | Milwaukee Tool is known for its innovation in the hand tools market, particularly with a focus on durability and high performance. The company has introduced a range of heavy-duty hand tools designed for professional trades, with features like shock-absorbing handles and high-torque performance. They continue to invest in expanding their cordless tool lineup and incorporating smart technology, such as real-time diagnostics and performance tracking. |

| Snap-On Inc | Snap-On has focused on offering high-end, precision tools designed for automotive, industrial, and aerospace applications. Their products are known for quality, and they continue to innovate with ergonomically designed tools and solutions that reduce user fatigue. Snap-On has also introduced mobile solutions, offering integrated tool storage and management systems that allow for easy inventory tracking and efficient tool organization. |

| Klein Tools | Klein Tools continues to enhance its product lineup, with an emphasis on hand tools tailored for electricians and construction professionals. Their tools are known for their durability and performance in high-stress environments. The company has expanded its range of electrical tools, including multifunctional screwdrivers, pliers, and wire cutters, designed to increase precision and safety during installations and repairs. |

| Fluke Corporation | Fluke specializes in high-precision diagnostic tools used by professionals in industries such as electrical, HVAC, and industrial maintenance. The company focuses on the development of handheld electrical testing instruments, with key offerings such as digital multimeters, clamp meters, and thermal imagers. Fluke continues to integrate IoT and smart capabilities into its products, enabling real-time diagnostics and remote monitoring for enhanced operational efficiency. |

| KNIPEX Group | KNIPEX is a leading manufacturer of pliers and hand tools with a strong focus on quality and innovation. The company has launched a variety of ergonomic hand tools designed for precise cutting, gripping, and crimping. KNIPEX is also focusing on expanding its range of pliers with integrated features that improve functionality, such as multi-function pliers designed to work across various applications in electrical, mechanical, and automotive industries. |

| Weidmuller Interface GmbH and Co. KG | Weidmuller is recognized for its range of hand tools specifically designed for industrial automation and electrical industries. The company’s focus lies in offering precision tools for wire processing, crimping, and electrical installations. Weidmuller has also innovated by developing tools that offer faster and more secure connections, improving efficiency in electrical assembly and maintenance tasks. |

| Emil Lux GmbH & Co. KG | Emil Lux is known for producing high-quality hand tools for the automotive and industrial sectors. The company has focused on developing tools that meet the stringent demands of the automotive industry, with specialized solutions for mechanics and repair technicians. Emil Lux’s focus is on providing precision tools that enhance productivity, with a particular emphasis on high-performance torque wrenches and ratchets. |

The hand tools market is poised for significant growth driven by the increasing demand in industries such as construction, automotive, manufacturing, and home improvement.

To maintain a competitive edge, companies must focus on expanding their presence in emerging markets, offering exceptional after-sales services, and prioritizing continuous innovation in their product offerings.

As the market becomes more globalized, the focus will be on tapping into high-growth regions such as Asia-Pacific, Latin America, and Africa, where industrialization, urbanization, and the DIY trend are accelerating.

North America and Europe will continue to be key players in the market, but the rapid growth of Asia-Pacific will be a driving force for market expansion. To capitalize on this shift, hand tool manufacturers should forge strategic partnerships with regional distributors and local suppliers to improve accessibility and product availability in these emerging markets.

Stanley Black and Decker, Robert Bosch GmbH, and Milwaukee Tool Corporation command a significant share in the overall hand tools market, with these companies holding a combined market share of approximately 35-40%.

Wrenches comprise nearly 35% of the overall market.

Regional and domestic companies hold approximately 30-35% of the overall market. These companies typically focus on serving local needs, offering more affordable and accessible hand tools compared to global players.

The market is moderately concentrated, with the top 10 players commanding a significant share. While global brands dominate the market, there is also space for regional players and smaller manufacturers who cater to niche markets or offer specialized tools.

DIY end use offering significant growth prospects to market players.

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.