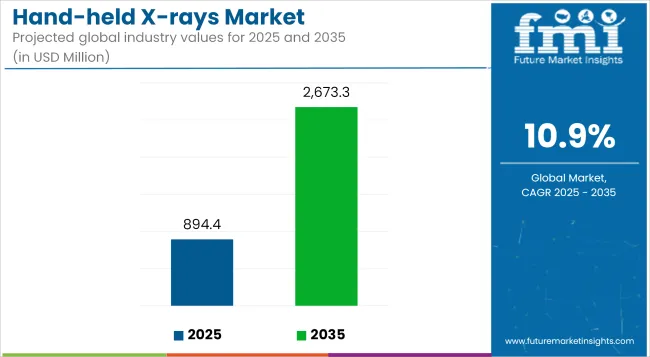

The global Hand-held X-rays Industry is valued at USD 894.44 million in 2025. It is expected to grow at a CAGR of 10.9% and reach USD 2,673.27 million by 2035. In 2024, the industry witnessed significant advancements in portable X-ray technology, with increased adoption in point-of-care diagnostics. Regulatory approvals and strategic partnerships drove industry growth. Additionally, investments in AI-driven imaging solutions gained traction, enhancing diagnostic accuracy.

From 2025 to 2035, the global hand-held X-rays industry is expected to maintain steady growth, driven by rising demand for portable medical imaging solutions. Increasing healthcare infrastructure investments and the growing prevalence of chronic diseases will fuel industry expansion. Technological innovations, including AI integration and wireless connectivity, will enhance device efficiency and usability.

Emerging economies will contribute significantly to industry growth due to improving healthcare access. Furthermore, stringent regulatory policies and safety advancements will shape product development and adoption trends. Continued advancements in imaging technology and expanding applications across dental, orthopedic, and veterinary sectors will sustain long-term demand.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 894.44 million |

| Industry Value (2035F) | USD 2,673.27 million |

| CAGR (2025 to 2035) | 10.9% |

The global hand-held X-rays industry is poised for strong growth, driven by increasing demand for portable diagnostic solutions, advancements in imaging technology, and expanding healthcare access in emerging economies.

Key beneficiaries include medical device manufacturers, healthcare providers, and diagnostic centers, while traditional stationary X-ray equipment may face reduced demand. Regulatory developments and technological innovations, particularly in AI integration and wireless connectivity, will shape industry dynamics over the next decade.

The hand-held X-rays industry is expected to experience significant growth, with the dental segment likely to dominate and hold a industry share of 93.5% in 2025. The adoption of hand-held X-rays across various medical applications is expected to accelerate over the forecast period, driven by their portability and efficiency.

In the dental sector, these devices are becoming essential for quick diagnostics in clinics, facilitating faster patient turnaround and improved workflow. In orthopedics, hand-held X-rays are gaining traction for point-of-care imaging, particularly in emergency settings where immediate assessments of fractures and musculoskeletal conditions are critical.

The other categories, including veterinary, forensic, and security applications, is also witnessing significant growth, supported by advancements in imaging technology. As these devices continue to evolve with better resolution, wireless connectivity, and AI-powered image analysis, their use in diverse medical and non-medical fields is expected to expand.

The increasing focus on radiation safety and regulatory compliance will further shape product innovation, ensuring that Hand-held X-rays devices meet the evolving demands of healthcare professionals across multiple disciplines.

The Hospitals Segment: The hospitals segment is expected to hold a significant industry share of 47.2% in 2025. The increasing demand for portable imaging solutions is transforming the way hand-held X-rays are utilized across different healthcare and industrial settings.

Hospitals are emerging as major adopters, integrating these devices into emergency departments and surgical units for rapid diagnostics, reducing patient movement and improving overall efficiency. Outpatient facilities, including urgent care centers and dental clinics, are also driving market growth as they seek cost-effective, high-performance imaging solutions that enhance patient convenience.

The research and manufacturing sector is leveraging hand-held X-rays for quality control, material analysis, and medical research, with growing applications in product development and forensic investigations.

As miniaturization and AI-driven enhancements continue to improve the accuracy and usability of these devices, their adoption will expand further. Regulatory bodies are also playing a key role in ensuring safety and standardization, which will influence purchasing decisions and drive competition among industry players.

Invest in AI-Enabled Imaging Solutions

Stakeholders should prioritize R&D and partnerships to integrate artificial intelligence into Hand-held X-rays devices. AI-powered imaging enhances diagnostic accuracy, streamlines workflows, and reduces human error, making these devices more valuable in clinical and emergency settings. Early adoption of AI-driven solutions will position companies at the forefront of technological innovation, securing a competitive edge.

Align with Shifting Healthcare Regulations and Safety Standards

As regulatory bodies tighten safety protocols for medical imaging, stakeholders must proactively ensure compliance with radiation safety, portability guidelines, and device standardization. Investing in regulatory expertise and certification processes will mitigate risks, accelerate industry entry, and enhance brand trust among healthcare providers. Keeping pace with evolving standards will also ensure long-term sustainability in the industry.

Expand Global Distribution and Strategic Partnerships

Market players should strengthen distribution networks and form strategic partnerships with hospitals, outpatient centers, and dental clinics to drive adoption. Expansion into emerging economies through collaborations with local healthcare providers will unlock new revenue streams. Additionally, partnerships with telemedicine platforms and AI developers can enhance the utility and marketability of Hand-held X-rays solutions.

| Risk | Probability-Impact |

|---|---|

| Regulatory Compliance Challenges | High-High |

| Technological Obsolescence | Medium-High |

| Supply Chain Disruptions | Medium-Medium |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| AI Integration in Hand-held X-rays | Initiate strategic partnerships with AI firms to enhance imaging capabilities |

| Regulatory Preparedness | Develop an internal task force to monitor and adapt to changing global compliance standards |

| Emerging Market Penetration | Expand distribution networks in Latin America and South Asia through local collaborations |

Stakeholders must take a proactive approach in integrating AI-driven imaging, ensuring compliance with evolving regulations, and expanding global reach. The Hand-held X-rays industry is poised for significant growth, but success will depend on innovation, strategic distribution, and regulatory agility.

Executives should prioritize R&D investments, streamline regulatory approvals, and form high-impact partnerships to accelerate adoption. By leveraging AI, strengthening industry presence in emerging economies, and reinforcing supply chain resilience, companies can secure long-term competitive advantage and capitalize on the rising demand for portable imaging solutions.

Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, hospitals, outpatient facilities, and research centers in North America, Europe, East Asia, and South Asia & Pacific

Compliance with Radiation Safety Standards: 85% of stakeholders globally identified adherence to radiation safety regulations as a critical priority, given increasing scrutiny of portable medical imaging devices.

Portability & Wireless Functionality: 79% of stakeholders highlighted the importance of lightweight, wireless Hand-held X-rays devices to improve workflow efficiency in clinical settings.

Regional Variance

High Variance in Adoption

Convergent and Divergent Perspectives on ROI

69% of North American stakeholders viewed AI integration as a high-return investment, whereas 40% in East Asia preferred cost-effective, conventional X-ray solutions.

Consensus

Lightweight, durable materials were favored across regions, with a focus on balancing cost, radiation safety, and device longevity.

Regional Variance

Shared Challenges

90% of stakeholders cited rising manufacturing costs (due to semiconductor shortages and battery price inflation) as a major concern.

Regional Differences

Manufacturers

Distributors

End-Users (Hospitals, Clinics, Research Centers)

Alignment

76% of global manufacturers plan to invest in R&D for AI-powered hand-held X-rays and improved battery efficiency.

Divergence

North America

70% of stakeholders stated that FDA’s evolving radiation safety regulations would significantly impact product innovation and compliance costs.

Europe

83% viewed the EU Medical Device Regulation (MDR) as a key driver of innovation, ensuring safer and more reliable X-ray technology.

East Asia

Only 35% felt that regulatory changes would influence purchasing decisions, citing lenient enforcement in certain regions.

South Asia & Pacific

46% believed that government subsidies for diagnostic equipment would drive industry growth, particularly in rural healthcare expansion programs.

High Consensus: Safety compliance, portability, and rising manufacturing costs are key concerns globally.

Key Variances

Strategic Insight: A one-size-fits-all approach will not work in this industry. Companies need region-specific strategies-premium AI-enhanced solutions for North America, sustainable designs for Europe, ultra-compact systems for East Asia, and affordable, durable devices for South Asia & Pacific.

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The FDA regulates Hand-held X-rays devices under 21 CFR Part 892, requiring pre-market approval (PMA) or 510(k) clearance. Compliance with Radiation Control for Health and Safety Act (RCHSA) is mandatory. Devices must meet ANSI/HPS N43.17 safety standards for radiation exposure limits. |

| Canada | Health Canada requires medical device licensing under CMDR (Canadian Medical Devices Regulations). Manufacturers must obtain a Medical Device Establishment License (MDEL) and comply with Radiation Emitting Devices Act (REDA) for radiation protection. |

| European Union | The EU Medical Device Regulation (MDR 2017/745) governs Hand-held X-rays systems, requiring CE marking for industry entry. Devices must also meet IEC 60601-1-3 for radiation safety. Compliance with EU Radiation Protection Directive 2013/59/ Euratom is essential. |

| United Kingdom | Post- Brexit, the UK requires UKCA (UK Conformity Assessed) marking instead of CE marking. Devices must comply with Ionising Radiations Regulations 2017 (IRR17) and undergo MHRA (Medicines and Healthcare products Regulatory Agency) approval. |

| China | Regulated under NMPA (National Medical Products Administration). Companies must obtain Class II or Class III medical device registration and meet the GB 9706.1 to 2020 safety standard. Strict post- industry surveillance applies. |

| Japan | Overseen by the PMDA (Pharmaceuticals and Medical Devices Agency) under the Medical Device Act. Hand-held X-rays require a Shonin (pre- industry approval) or Ninsho (certification) from a registered third party. Compliance with JIS T0601-1 (Japanese adaptation of IEC 60601) is mandatory. |

| South Korea | The MFDS (Ministry of Food and Drug Safety) regulates medical imaging devices. Companies must obtain a K-GMP (Korean Good Manufacturing Practice) certification and comply with KS P 60601 radiation safety standards. |

| India | The CDSCO (Central Drugs Standard Control Organization) classifies hand-held X-rays as Class C medical devices, requiring registration under the Medical Device Rules (2017). Bureau of Indian Standards (BIS) certification is needed for import and manufacturing. |

| Australia | The TGA (Therapeutic Goods Administration) requires hand-held X-rays to be listed in the Australian Register of Therapeutic Goods (ARTG). Compliance with AS/NZS IEC 60601-1-3 radiation protection standards is necessary. |

| Brazil | Regulated by ANVISA (Agência Nacional de Vigilância Sanitária), requiring Class III registration. Compliance with RDC 185/2001 medical device regulations and CNEN (National Nuclear Energy Commission) radiation safety standards is mandatory. |

| Middle East (UAE, Saudi Arabia) | The SFDA (Saudi Food and Drug Authority) and MOH (UAE Ministry of Health & Prevention) require compliance with ISO 13485 for quality management and IAEA Basic Safety Standards for radiation control. Local registration is mandatory before importation. |

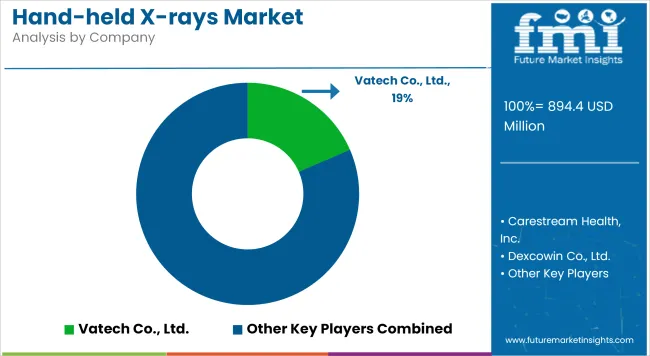

| Company | Market Share (%) |

|---|---|

| Vatech Co., Ltd. | 18.5% |

| Carestream Health, Inc. | 16.2% |

| Dexcowin Co., Ltd. | 12.8% |

| KaVo Dental GmbH | 10.5% |

| Acteon Group | 9.3% |

| Owandy Radiology | 7.6% |

| Genoray Co., Ltd. | 6.8% |

| Rayence Co., Ltd. | 5.9% |

| MyRay ( Cefla Group) | 5.4% |

| Others | 7.0% |

Key Developments (Mergers, Acquisitions, Partnerships) in 2024

USA Hand-held X-rays market is expected to be valued at USD 695.8 million by the end of 2025, with a CAGR of 11.5% from 2025 to 2035, owing to increasing demand for general imaging applications such as dental, orthopedic, and outpatient.

Increasing prevalence of dental disorders and musculoskeletal injury is propelling the demand for portable imaging solutions. Manufacturers are obliged to obtain 510(k) clearances under strict FDA regulations, leading to a competitive marketplace in which innovation is crucial. Market leaders like Carestream Health and KaVo Dental GmbH, are investing in AI-integrated imaging and cloud-based diagnostics for efficacy.

Moreover, government reimbursement policies backing digital radiography are inserting advanced imaging through hospitals and outpatient facilities. Increasing applications across veterinary care and sports medicine are also driving market growth.

Battery-efficient, lightweight designs are of great interest, especially for mobile healthcare services. Despite this, the USA is still a highly ripe market for manufacturers tapping into high-quality, portable diagnostic solutions, with ever increasing capabilities thanks to developments in sensor tech and wireless connectivity.

The hand-held X-ray market in the UK is anticipated to grow at a 10.2% CAGR between 2025 and 2035 owing to increasing demand for handheld portable x-ray devices in both dental and emergency care environments. Owing to the expansion of digital radiography, and because of this, the NHS is an important driver of adoption.

The country’s determination to minimize radiation exposure and use it efficiently for diagnosis is driving hospitals and outpatient clinics toward lightweight, portable X-ray devices. Regulatory frameworks like UKCA marking post-Brexit guarantee stringent adherence to safety and performance requirements. Companies such as the Acteon Group and My Ray (Cefla Group) are extending their footprint, emphasizing ergonomic shapes and wireless features.

Moreover, the rising geriatric population, which requires frequent imaging for various age-related disorders, is also aiding the growth of this market.

In addition, the focus on pet health is enabling the growth of handheld X-ray systems in veterinary applications as well. Ongoing investment by the Government in digital healthcare infrastructure is likely to see continued adoption growth in the UK market.

Hence, the demand for French Hand-held X-rays market will grow at a CAGR of 9.8% during the forecast period (2025 to 2035) as the European government promotes public healthcare by facilitating the implementation of digital radiography.

France’s medical device regulator, closely watches medical imaging devices, enforcing stringent compliance before any can operate. Hospitals and outpatient centers are moving to low-dose radiation and artificial intelligence-based diagnostic tools to improve imaging accuracy. Dental applications account for most of the Hand-held X-rays device market, as more and more dental clinics began using these devices, owing to their capability of faster and more accurate diagnostics.

This has driven companies to the forefront such as Owandy Radiology to offer new solutions with wireless and cloud storage capabilities. The veterinary industry is following suit as pet ownership continues to rise, and demand for fast diagnosis increases. France´s market for portable X-ray solutions should remain robust and growing, backed by investments in healthcare digitalization.

In the following years, from 2025 to 2035, the overall market for Hand-held X-rays in Germany will augment at a double digital CAGR of 10.5%, owing to significant government support for medical technology innovations. Germany is among the top country having one of the most developed healthcare systems in Europe, digital imaging solutions is widely adopted here.

So, following with the Federal Institute for Drugs and Medical Devices (BfArM): EU MDR and IEC 60601 safety-related standards allow no faulty device left on the market. Dental applications are a key contributor as private and public dental clinics progressively adopt Hand-held X-rays devices to improve the patient experience.

KaVo Dental GmbH has a strong foothold in the German market owing to its intense research and development capabilities. The increasing adoption of Hand-held X-rays systems in orthopedic and trauma applications is further propelling market growth. With increasing demand for AI driven imaging and mobile diagnostics solutions, the German market retains its attractiveness for manufacturers focusing on the European region.

With Investments in digital healthcare solutions surging The Italian hand-held X Ray market is anticipated to have a CAGR of 9.3% between 2025 and 2035.

Aging Italian population is an important driver, with increasing demand for diagnostic imaging in osteoporosis, arthritis and dental care. Medical devices are under the strict scrutiny of the Italian Ministry of Health, which requires rigorous regulatory approvals to ensure their safety, quality, and efficacy.

By generating an image on the mobile, 3-D hand-held devices need less time to take a picture. Stand: Acteon Group: Coming to Italy with compact, easy-to-use imaging solutions for dental and medical applications.

The country’s emphasis on mobile healthcare services is also driving demand for portable radiography solutions in homecare and emergency settings. AI-integrated imaging systems are also becoming increasingly adopted in healthcare systems, as providers seek improved diagnostic accuracy and workflow efficiency.

New Zealand Hand-held X-rays market will rise with a CAGR of 8.9% from 2025 to 2035 due to growing healthcare budget and demand for portable diagnostic data. All medical imaging devices must comply with Med safe regulations.

Their camera-like design enables work in dental clinics, rural hospitals, and veterinary practices, which makes hand-held Xray system increasingly common. The government’s efforts to boost access to health care in remote areas is a driving factor, encouraging hospitals and clinics to make use of lightweight, battery-powered X-ray devices.

New Zealand has a smaller but very advanced health care system than many other countries in the world, making it ideal for specific applications like sports medicine and mobile health services require less investment.

From 2025 and 2035, the South Korea Hand-held X-rays marketplace is predicted to develop at a CAGR of 10.8%, because of medical imaging technological developments. The Ministry of Food and Drug Safety (MFDS) implements rigorous regulations, mandating manufacturers to meet stringent safety and performance criteria.

There are strong domestic players such as Vatech and Rayence in the Korean market and the combined strength allows Korea to gain such a competitive edge in terms of technological development. Government support for AI-powered medical imaging and smart hospital infrastructure is increasing the adoption of portable X-ray solutions.

The dental field continues to be one of the most dominant applications, wherein increasing number of hospitals and outpatient facilities are expected to rapidly integrate wireless, high resolution imaging systems in order to get accurate diagnosis.

Key drivers propelling growth in the Japanese device market for hand-held X-ray systems include the country’s commitment to advanced healthcare technology and the increasing needs of its aging population. The market for Japanese Hand-held X-rays systems is forecast to expand at a compound annual growth rate (CAGR) of 9.7% over the 2025 to 2035 timeframe.

The Pharmaceuticals and Medical Devices Agency (PMDA) requires strict safety approvals, leading to high-quality products in the industry. Other trends include advancement in AI-enabled imaging and radiation dose reduction technologies. Some of the fastest-growing hand-held X-ray solution adopters include dental clinics, orthopedic hospitals and mobile care providers.

By 2025, it is anticipated that the Chinese Hand-held X-rays industry will grow at a CAGR of 12.0%, signifying one of the fastest-growing industries in the world. New Regulations by the National Medical Products Administration (NMPA) for Safety of Medical Imaging Devices Dentistic demand is being fueled by the rapid expansion of dental and orthopedic clinics and government-backed healthcare reforms. Local manufacturers are more likely to invest in AI-enabled X-ray solutions for themselves, which makes it more affordable and promotes the industry's growth.

The Australian hand-held X-ray market is projected to expand at a compound annual growth rate (CAGR) of 9.5%, from 2025 to 2035. Medical imaging devices are regulated by the Therapeutic Goods Administration (TGA), which is subject to stringent safety standards.

One of the main drivers for industry growth is through remote healthcare services for rural and indigenous communities. This places Australia in the forefront for portable imaging solutions for the hospital or the clinic, as wireless, battery-efficient X-ray devices rapidly take hold of this industry.

Dental, Orthopedic, Others

Hospitals, Outpatient Facilities, Research & Manufacturing

North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA)

The increasing demand for portable and efficient imaging solutions, advancements in digital radiography, and the rising prevalence of dental and orthopedic conditions are major growth drivers. Additionally, technological innovations such as AI-powered imaging and improved battery life enhance usability and adoption.

Healthcare professionals, including dentists, orthopedic specialists, and emergency medical teams, benefit significantly from these devices. They are also widely used in research institutions and manufacturing sectors that require non-destructive testing and quality inspections.

Some challenges include high initial costs, concerns over radiation exposure, and the need for specialized training to operate these devices effectively. Additionally, regulatory compliance and certification requirements vary across regions, impacting accessibility.

Recent innovations, such as wireless connectivity, AI integration, and enhanced image processing, improve diagnostic accuracy and workflow efficiency. These advancements enable real-time image sharing, better portability, and faster diagnosis.

Compliance with safety and quality standards is essential, with requirements varying by region. In the USA, FDA approval is mandatory, while in Europe, CE marking ensures compliance with health and safety regulations. Other regions have their own certification frameworks to ensure device safety and effectiveness.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Technology, 2023 to 2033

Figure 19: Global Market Attractiveness by End-use, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 37: North America Market Attractiveness by Application, 2023 to 2033

Figure 38: North America Market Attractiveness by Technology, 2023 to 2033

Figure 39: North America Market Attractiveness by End-use, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 77: Europe Market Attractiveness by Application, 2023 to 2033

Figure 78: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 79: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End-use, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End-use, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End-use, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End-use, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 157: MEA Market Attractiveness by Application, 2023 to 2033

Figure 158: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 159: MEA Market Attractiveness by End-use, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Handheld Chemical and Metal Detector Market Size and Share Forecast Outlook 2025 to 2035

Handheld Dental X-Ray Systems Market Analysis - Size, Share, and Forecast 2025 to 2035

Handheld Concrete Saws Market Size and Share Forecast Outlook 2025 to 2035

Handheld Point of Sale Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Arthroscopic Instruments Market Growth – Trends & Forecast 2025 to 2035

Rugged Handheld Electronic Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Handheld Marijuana Vaporizer Market Insights – Demand & Forecast 2025-2035

Handheld Ultrasound Scanner Market Analysis – Trends & Forecast 2024-2034

Handheld Tagging Gun Market Growth & Industry Forecast 2024-2034

Handheld Device Accessories Market

Handheld GPS Units Market

Handheld Retinal Scanners Market

Wireless Handheld Spectrometer Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA