The hammer mill market is forecasted to touch USD 1,135.3 million in 2035, with a CAGR of 4.2%. The main drivers for the growth will be the increasing demand for efficient grinding solutions versatile in application in the different sectors as well, which include mining, food processing, recycling, and agriculture. Hammer mills are integral for modern production and processing facilities since they are widely used in different industries for coarse, fine, and ultra-fine milling.

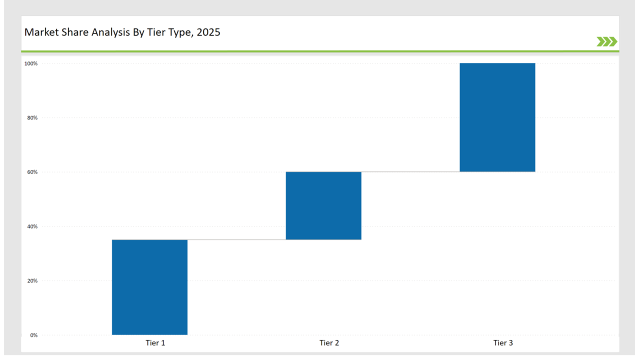

The market is moderately fragmented, with Tier 1 players (Fitzpatrick, Hosokawa Micron, and Hosokawa Micron Corp) accounting for approximately 35% of the global share. These players dominate the market by offering innovative and application-specific hammer mill solutions.

Coarse milling applications dominate with a 45% market share, driven by their extensive use in agriculture and scrap recycling. In terms of end use, the agriculture segment leads with a 30% market share, reflecting the growing demand for efficient feed production and crop residue management.

The market is steady, with leading companies emphasizing advanced plug designs and maintaining a broad distribution network. North America and Europe remain the main markets. However, Asia-Pacific is becoming more popular due to new infrastructure projects and the growing use of machinery in agriculture.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 1,135.3 million |

| CAGR (2025 to 2035) | 4.2% |

Explore FMI!

Book a free demo

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top 3 (Hosokawa Micron Powder System; Andritz; Buhler Group) | 25% |

| Rest of Top 5 (Schenck Process Holding Ltd GmbH; Hosokawa Micron Corp; L.B. Bohle Maschinen & Verfahren GmbH; NSK Lessine; Filtra Vibracion) | 30% |

| Rest of Top 10 | 55% |

The market is fragmented with top players influencing industry trends, pricing, and technological advancements. Regional and niche players continue to thrive by addressing specific local and sectoral demands.

Coarse milling, which holds a dominant 45% market share, is primarily used in agriculture, scrap recycling, and mining for size reduction of bulky materials. Leading manufacturers like Hosokawa Micron Powder Systems, Andritz, and Buhler Group offer advanced coarse milling solutions for high-capacity operations.

Fine milling is seeing steady growth, driven by the increasing need for precise particle size reduction in industries such as food, chemicals, and pharmaceuticals, with companies like Hosokawa Micron providing specialized systems that meet food safety and pharmaceutical compliance standards.

Ultra-fine milling, crucial for applications requiring extremely fine particle sizes in sectors like energy, power, and specialty chemicals, is also gaining prominence, with Stedman Machine Company offering tailored solutions to meet these specific needs.

The hammer mill market is significantly influenced by various end-use sectors. Agriculture leads with a 30% market share, driven by the demand for feed production, crop residue management, and biofuel generation, with Schutte Hammermill offering durable, high-capacity systems for grinding grains, husks, and residues.

In the food and beverage industry, hammer mills are used for grinding grains, spices, and other ingredients, with Hosokawa Micron leading the segment by ensuring food safety and quality. The metals and mining sector also relies on hammer mills for metal processing and ore crushing, with Williams Patent Crusher providing rugged solutions for heavy-duty mining applications.

The energy and power sector utilizes hammer mills for biomass grinding and waste-to-energy conversion, with Fitzpatrick offering advanced solutions tailored to renewable energy projects. These sectors collectively highlight the growing versatility and demand for hammer mills across industries.

Fitzpatrick

Fitzpatrick has expanded its product portfolio by launching specialized hammer mills tailored for biomass grinding and renewable energy applications.

These advanced systems are designed to efficiently process biomass materials for use in energy generation. In addition, Fitzpatrick has broadened its offerings for coarse milling, catering to the needs of the agriculture and energy sectors.

By focusing on high-capacity, durable solutions, Fitzpatrick aims to support efficient feed production, crop residue management, and waste-to-energy conversion, addressing the growing demand for sustainable practices in both industries. The company’s innovations help optimize performance and maintain energy efficiency across applications.

Hosokawa Micron

Hosokawa Micron has focused on advancing fine and ultra-fine milling technologies, particularly in the food and pharmaceutical industries. The company introduced specialized systems designed to meet stringent food safety and pharmaceutical compliance standards, ensuring high-quality particle size reduction.

Additionally, Hosokawa Micron has heavily invested in research and development to enhance particle size control, improve milling efficiency, and reduce energy consumption.

These innovations have helped the company stay at the forefront of the milling market, providing tailored solutions that meet the precise demands of industries requiring high-performance, energy-efficient systems for fine and ultra-fine milling applications.

Schulte Hammer mill

Schulte Hammer mill has expanded its product range to include specialized solutions for coarse milling applications in agriculture and scrap recycling. These new offerings are designed to efficiently process agricultural feeds, such as grains and husks, as well as materials for scrap recycling, addressing growing demands in both sectors.

To further strengthen its market presence, Schulte Hammer mill has also enhanced its distribution network across North America, ensuring better accessibility to its high-capacity, durable milling systems. These efforts support the company's goal to provide reliable, versatile milling solutions while catering to the evolving needs of agricultural and recycling industries.

| By Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Hosokawa Micron Powder System; Andritz; Buhler Group |

| Tier 2 | chenck Process Holding Ltd GmbH; Hosokawa Micron Corp; L.B. Bohle Maschinen & Verfahren GmbH |

| Tier 3 | Regional players, startups |

Key performance indicators in the hammer mill market include:

| Company | Initiative |

|---|---|

| Fitzpatrick | Launched high-capacity hammer mills for biomass and agriculture applications, focusing on renewable energy projects. |

| Hosokawa Micron | Expanded its portfolio for fine milling in the food and pharmaceutical sectors, investing in energy-efficient solutions. |

| Schutte Hammermill | Strengthened its offerings for coarse milling in agriculture and scrap recycling, enhancing its North American distribution. |

| Stedman Machine Company | Introduced ultra-fine milling systems for the chemical and energy industries, emphasizing modularity. |

| Williams Patent Crusher | Focused on heavy-duty hammer mills for mining and metal recycling, offering customized solutions for large-scale operations. |

Growth in the hammer mill market is expected to be steady as industries look for advanced milling solutions that increase efficiency, sustainability, and safety in operations. Companies need to focus on coarse milling systems for both agricultural and recycling sectors.

Investing in fine and ultra-fine milling technologies will be critical for applications in the food, pharmaceuticals, and chemicals sector. Maintaining leadership positions will depend upon more tie-ups with distributors and increased R&D in modular and energy-efficient designs.

The largest market share is held by key players such as Hosokawa Micron Powder System; Andritz; Buhler Group; Schenck Process Holding Ltd GmbH, collectively controlling a significant portion of the global market.

Regional companies, like Hosokawa Micron Corp; L.B. Bohle Maschinen & Verfahren GmbH; NSK Lessine, hold a notable portion of the market, catering to specific regions and applications.

Startups and emerging players, focusing on innovations in sustainability and niche applications, hold a smaller yet growing share of the market, contributing to around 10-15%.

Private labels, primarily in niche markets or through distributors, account for a smaller portion, generally under 5% of the market.

The market concentration in 2025 is expected to be high for the top 5-6 global players controlling over 40% of the market, medium for the next tier of players, and low for smaller regional or specialized players.

Electrostatic Precipitator Market Growth - Trends & Forecast 2025 to 2035

EMC Shielding and Test Equipment Market Growth - Trends & Forecast 2025 to 2035

End Suction Pump Market Growth - Trends & Forecast 2025 to 2035

Electrostatic Coalescers Market Growth - Trends & Forecast 2025 to 2035

Electrical Enclosure Market Growth – Trends & Forecast 2025 to 2035

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.