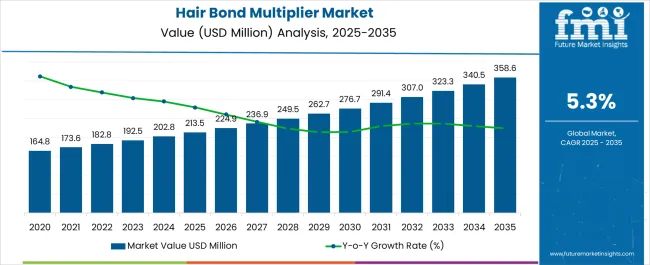

The Hair Bond Multiplier Market is estimated to be valued at USD 213.5 million in 2025 and is projected to reach USD 358.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Hair Bond Multiplier Market Estimated Value in (2025 E) | USD 213.5 million |

| Hair Bond Multiplier Market Forecast Value in (2035 F) | USD 358.6 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The hair bond multiplier market is expanding steadily, supported by the rising demand for premium hair care solutions and increased consumer focus on hair health during chemical treatments. Industry reports and brand announcements have emphasized the growing popularity of products that repair and protect hair bonds from damage caused by coloring, bleaching, and heat styling.

Product innovation has been a major driver, with companies introducing advanced formulations enriched with strengthening and conditioning agents. Rising disposable incomes and lifestyle changes have led to greater consumer spending on salon-based treatments, further accelerating adoption.

Marketing campaigns highlighting professional-grade results and long-term hair protection have enhanced product visibility across global markets. Additionally, the trend of frequent hair coloring and chemical styling has increased consumer reliance on bond multipliers to minimize hair damage. Looking forward, continuous advancements in product formulations, coupled with growing penetration in emerging economies through e-commerce and salon partnerships, are expected to sustain strong growth momentum.

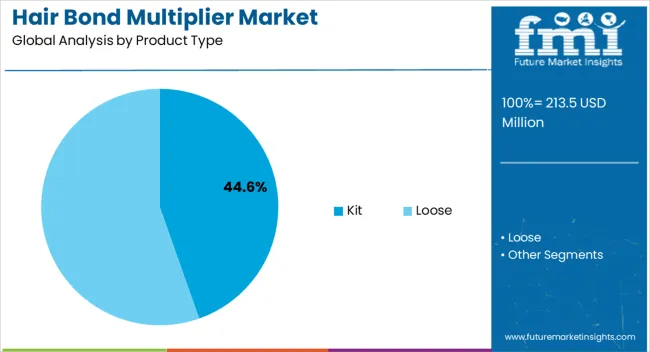

The Kit segment is projected to contribute 44.60% of the hair bond multiplier market revenue in 2025, establishing itself as the leading product type. Growth of this segment has been driven by the convenience offered to both professionals and consumers, as kits typically include multiple components that work in sequence to repair and protect hair bonds.

Brands have promoted kit formats as comprehensive solutions that enhance treatment outcomes, appealing to salons for professional use and consumers seeking salon-like results at home. The combination of ease of application, bundled value, and consistent results has fueled their widespread adoption.

Furthermore, product kits have gained traction in promotional campaigns and retail packaging strategies, making them a preferred choice for gifting and repeat purchases. With consumer interest in complete, ready-to-use hair care solutions continuing to rise, the Kit segment is expected to maintain its dominant position in the product type category.

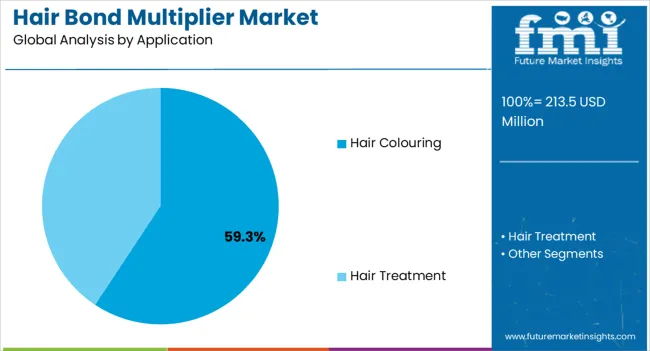

The Hair Colouring segment is projected to account for 59.30% of the hair bond multiplier market revenue in 2025, positioning itself as the dominant application. This segment’s strength has been shaped by the increasing frequency of hair dyeing and bleaching, which are known to cause structural hair damage.

Bond multipliers have become integral in coloring services, as they protect the hair shaft and maintain strength during chemical exposure. Professional stylists and salons have integrated these products into standard coloring protocols, responding to consumer demand for safe, damage-free color treatments.

Industry updates have emphasized how product efficacy in reducing breakage and improving hair texture has driven higher adoption rates. Additionally, marketing efforts showcasing before-and-after results of hair coloring with bond multipliers have reinforced their importance. As hair coloring trends continue to grow globally, the Hair Colouring segment is expected to sustain its leadership in application use.

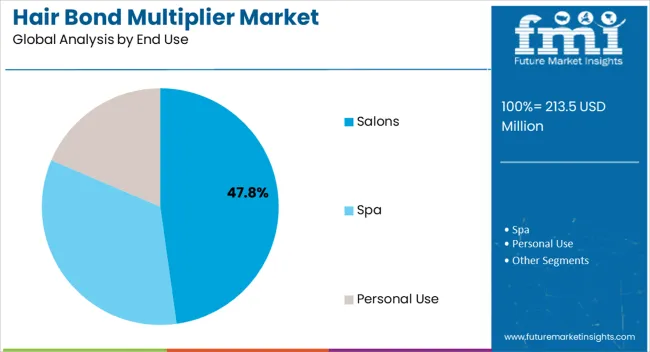

The Salons segment is projected to hold 47.80% of the hair bond multiplier market revenue in 2025, confirming its role as the primary end-use channel. Growth of this segment has been attributed to the reliance of professional hairstylists on bond multipliers to deliver high-quality results in coloring, bleaching, and chemical treatments.

Salons have increasingly adopted bond multipliers to enhance client satisfaction by reducing hair damage and improving post-treatment hair health. Annual reports and press releases from beauty brands have highlighted collaborations with salon chains to introduce specialized bond protection services.

The salon environment also provides a platform for direct consumer education, where stylists recommend bond multipliers for at-home maintenance, thereby driving repeat purchases. As the demand for premium hair care experiences rises, particularly in urban centers, salons are expected to remain the dominant end-use channel, supported by professional expertise and client trust.

The hair bond multiplier market was valued at USD 213.5 million in 2025. The market was driven by the growing interest of consumers in haircare brands and maintaining hair health.

The market is expected to be driven by the increasing awareness about the harsh chemicals used in hair styling and the rising preference for natural hair care and grooming products. The demand for these products is expected to reach USD 358.6 million by 2035.

Consumption Analysis of Hair Bond Multiplier Products

Factors Driving Expansion of Hair Bond Multipliers Market

Hair Experimentation: A lot of youth these days are very flexible when it comes to frequently changing their hairstyles, hair color, and hair orientation. Hair bond multipliers help them lessen the damage during these transitions by rejuvenating the hydrogen-sulphide bond present in the hair.

Celebrity Endorsements: Social media influencers with millions of virtual followers are one of the key promoters of hair bond multipliers in the market. Their influence plays a major role in bringing a large number of potential customers under the purview of leading players in the market.Easy Advertisements: Thanks to the short video platforms, brands can easily target their audience with product benefits, thus making the advertisements more easy, effective, and insightful. A lot of the millennial population is on these platforms and gets attracted to these products because of this.

Surging Disposable Incomes: The rise in the disposable incomes of individuals all over the world is also considered a prime factor in the growth of the hair bond multiplier market. With individuals paying more attention to hair health, these numbers are bound to grow in the upcoming years.

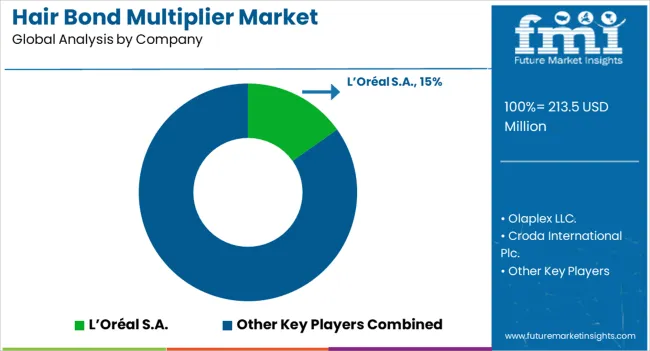

Influx of Big Brands: Hair Bond Multiplier was a patented product of Olaplex, a US-based hair treatment company with over 100 worldwide patents. With time, the market has experienced an influx of companies, which include L’Oréal S.A., Croda International Plc., Lakme Lever Private Limited, Earthly Body Inc., and many more.

Factors Restraining Hair Bond Multiplier Market

High Costs: Although very effective, hair bond multiplier products are very expensive as compared to other hair care products. This will keep a large number of people who fall into the low-income bracket away from using such products. The current recessionary economy in prominent countries can lead to people spending very little on luxurious hair care items.

Emphasis on Chemical-Free Hair: In these subsequent years, the shift in focus toward treatment-free, natural hair can be another major factor that can slow down the market expansion of hair bond multipliers in the long term. As hair bond multipliers are only used when the hair undergoes regular treatment, this rising trend can lead to reduced consumer demand in the coming years.

Availability of Options: Hair care consists of a plethora of products and treatments. With already a lot of options for individuals to choose from, hair bond multiplier companies have to put a lot of effort into instilling trust in people’s minds regarding the benefits of their product.

Cheaper Substitutes: The market is already filled with inexpensive products such as deep conditioning shampoos, protein treatments, and natural DIY remedies that have a strong foothold in the hearts of people. Their effectiveness at a cheaper cost will definitely be a limiting factor for the growth in revenue of the hair bond multiplier market.

Geographically speaking, the North American region has been the largest user of hair bond multiplier products. It holds a revenue share of 43.1% of the global hair bond multiplier market. The presence of internationally renowned influencers and the tendency of people to follow their fashion idols are the major reasons for this region to top the list.

| Attributes | Market Share |

|---|---|

| North America Market Share (2025) | 43.1% |

The presence of pollutants in the air, coupled with high individual incomes, is also one of the driving forces behind the expansion of the market in this region.

Urbanization, the large youth population in countries like India and China, and exposure to Western culture are considered to be some of the major reasons for the popularity of hair bond multiplier products in this region. With awareness towards hair care, even among men, the Asia-Pacific region has experienced a significant surge in the usage of hair care products in recent years.

| Attributes | Market Share |

|---|---|

| Asia Pacific Market Share (2025) | 26.7% |

The Asia-Pacific Belt is the second-largest geographical region, followed by the European countries. A lot of credit goes to the social media influencers on the internet as well for this market growth.

The United States is leading the hair bond multiplier market with a revenue share of 36.8%, followed by China and then Japan. These countries will play a crucial role in the market expansion of bond enhancers in and around the world.

| Countries | Value Share in 2025 |

|---|---|

| United States | 36.8% |

| China | 7.8% |

| Japan | 6.9% |

| Canada | 6.3% |

| United Kingdom | 5.2% |

The presence of Hollywood and celebrities who are renowned worldwide and have fan followings in the millions are some of the major reasons why the United States ranks number one with a market share of 36.8% in the hair bond multiplier market. With the majority of residents following the ongoing trend when it comes to fashion, these numbers seem unprecedented.

Olaplex, one of the pioneers of hair bond multiplier technology, is based in California and plays a very important role in the promotion of products associated with bond enhancement. Research and development in the hair care industry is also crucial and has a positive impact on the overall bond multiplier market.

The United States is followed by China with a revenue share of 7.8% in the hair bond enhancer market, securing the top-most position in the Asia-Pacific region. The growing population and the emphasis on grooming and self-care can drive great demand for products related to hair treatment in the near future.

Social media platforms like WeChat play a very crucial role in promoting beauty products, where fashion bloggers and even dermatologists share valuable insights, addressing the virtual fan following of millions.

Japan has always had a diverse beauty culture, and with changing times, there has been a general shift toward hair coloring, thanks to more Westernized beauty standards. The country is also blessed with a thriving salon industry, which gives a lot of importance to innovation. Japan contributes a share of 6.9% to the global market.

Japan also has a very rich consumer base that can afford premium brands and expensive hair care products. As more and more people move towards coloring their hair, the demand for hair bond multipliers is bound to increase.

The hair bond multiplier market in Canada has been experiencing steady growth as more people have turned to professional hair coloring and styling services. The demand for products that protect and strengthen hair has increased. Canada accounts for a share of 6.3% of the global market in 2025.

Consumer awareness about the benefits of hair bond multipliers is rising in Canada. Many consumers are willing to pay premium prices for these products, considering the long-term benefits for their hair health.

The United Kingdom has a well-developed market for haircare products, including hair bond multipliers with a share of 5.2% of the global market. Consumers in the United Kingdom are generally well-informed about these products. These products are popular in professional salons for various hair treatments. Additionally, many consumers in the United Kingdom use them at home as part of their regular haircare routines.

The rise of e-commerce in the United Kingdom has facilitated the easy purchase of hair bond multipliers online. Many brands have a strong online presence and sell their products through e-commerce platforms.

A typical hair bond multiplier kit includes all the products that are curated to strengthen the hair bonds that are damaged due to the regular use of chemicals and hair bleaches. With a market share of 63.40%, this is the most preferred choice among the users of hair bond multiplier products.

| Top Product Type | Kit |

|---|---|

| Market Share | 63.40% |

The kit offers a comprehensive solution where users can get all the products required to repair their damaged hair in one package. Many salons have also incorporated these kit treatments into their services, which again boosts the sales of these kits on the market. These kits are also available in the leading supermarket stores, making the process very easy for customers.

By application, the hair bond multiplier market is segmented into hair coloring, hair treatment, and other applications. The hair coloring segment dominates the market with a global revenue share of 45.20%.

| Top Application | Hair Colouring |

|---|---|

| Market Share | 45.20% |

There has been a global trend of highlighting hair with different colors in recent years. This process usually involves a significant use of chemical colors and bleaches, which, in the long term, are very detrimental to the health of the user’s hair.

With continuous usage of such colorants, there is a very likely chance that the hydrogen-sulfide bond weakens, leading to thinner and damaged hair. Hair bond multipliers repair this damage and prevent breakage during and after coloring.

Key Players in the Global Hair Bond Multiplier Market

The global hair bond multiplier market is estimated to be valued at USD 213.5 million in 2025.

The market size for the hair bond multiplier market is projected to reach USD 358.6 million by 2035.

The hair bond multiplier market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in hair bond multiplier market are kit and loose.

In terms of application, hair colouring segment to command 59.3% share in the hair bond multiplier market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA