The gummed tape market is currently in a groove, with companies searching for eco-friendly, tamper-proof, and highly durable packaging solutions. Heavy demand has also sent manufacturers innovating into the production stream for reinforced adhesives from sustainable materials with high-strength fiber reinforcement for the e-commerce, logistics, food, and industrial sectors. Investment is flowing into water-based, activated adhesive, customized printing, and automation-ready tape solutions, which increase security for packaging as well as for operational efficiencies.

Manufacturers are modernizing production with AI-based quality controls, biodegradable glues, and recyclable paper substrates. The industry is moving toward the adoption of fiber-reinforced gummed tapes and water-activated packaging solutions with high performance bonding while consciously making an effort to reduce plastic waste.

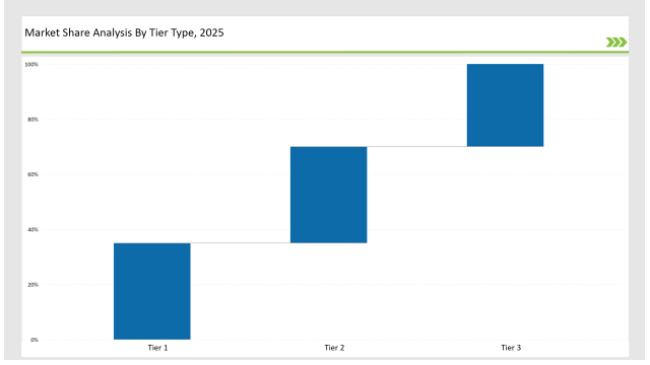

Tier 1 players control 35% of the market, with 3M, Intertape Polymer Group, and Shurtape Technologies leading in high-performance adhesives, sustainable tape solutions, and distribution channels.

Tier 2 players like Vibac Group, Tesa SE, and Berry Global account for 35% while producing large quantities of low-priced gummed and masking tapes that can be customized for diverse applications, with special emphasis on industrial-grade tapes.

The remaining market, about 30%, comprises regional and niche players specializing in biodegradable, tamper-evident, and fiber-reinforced tapes. These players are focused on localized production, innovative adhesive formulation, and automation-ready tape solutions.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Intertape Polymer Group, Shurtape Technologies) | 18% |

| Rest of Top 5 (Vibac Group, Tesa SE) | 10% |

| Next 5 of Top 10 (Berry Global, Papertec, Holland, Uline, Can-Do National Tape) | 7% |

Market Concentration (2025E)

The gummed tape industry caters to a wide range of industries that have demands of security, sustainability, and strength. Keeping this in view, companies continue to innovatively present better bonding capabilities with less waste and contemporary packaging regulations. The reinforcing of water-activated tapes results in an increasingly effective sealing performance for high-value shipments. Biodegradable materials have also been incorporated by manufacturers of gummed tape in line with global sustainability initiatives. Production efficiency optimization and adhesive waste reduction are actively done through AI-driven predictive analytics for businesses.

Manufacturers are optimizing gummed tapes with sustainability-focused solutions, high-tensile strength, and enhanced adhesion. They are incorporating advanced fiber reinforcements to improve durability and tear resistance. Additionally, companies are enhancing adhesive compositions to ensure superior bonding on various packaging surfaces. Businesses are also adopting heat-resistant gummed tapes for industrial applications requiring extreme temperature endurance.

Sustainability with automation is changing the face of the gummed tape industry. Organizations are investing in AI for defect detection, using plant-based adhesives, and using reinforced backing materials to increase the durability of products. Companies are designing ultra-thin yet high-strength tapes that use minimal material. Manufacturers are developing tamper-evident gummed tapes with embedded security features for e-commerce applications. Furthermore, companies are adopting water-based inks for environmentally friendly branding and printing on tapes.

Technology suppliers should focus on automation, eco-friendly adhesive advancements, and smart packaging enhancements to support the evolving gummed tape market. Partnering with e-commerce, logistics, and food packaging brands will drive adoption and market expansion.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Intertape Polymer Group, Shurtape Technologies |

| Tier 2 | Vibac Group, Tesa SE, Berry Global |

| Tier 3 | Papertec, Holland, Uline, Can-Do National Tape |

Leading manufacturers are advancing gummed tape technology with AI-powered automation, sustainable adhesives, and tamper-evident features. They are integrating next-generation fiber reinforcement to enhance durability and reduce breakage. Additionally, companies are developing ultra-thin, high-strength tapes that minimize material usage while maintaining performance. Businesses are also improving water-activated adhesives to create stronger bonds on a wider range of surfaces.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched high-strength, recyclable gummed tape in March 2024. |

| Intertape Polymer | Developed reinforced, water-activated security tapes in April 2024. |

| Shurtape Technologies | Expanded biodegradable adhesive tape solutions in May 2024. |

| Vibac Group | Released fiber-reinforced e-commerce tapes in June 2024. |

| Tesa SE | Strengthened tamper-evident tape solutions in July 2024. |

| Berry Global | Introduced compostable gummed tapes in August 2024. |

| Papertec | Pioneered digital-printed gummed tapes for branding in September 2024. |

The gummed tape market is evolving as companies invest in sustainable materials, AI-driven defect detection, and high-strength adhesives. They are enhancing tape durability by incorporating fiber reinforcements for added tensile strength. Additionally, manufacturers are improving adhesive formulations to ensure superior bonding on various surfaces. Businesses are also adopting water-based adhesives to reduce environmental impact while maintaining performance.

Manufacturers will continue to work on improvements that will include AI for quality control, countermate high-strength adhesives, and intelligent security features. More companies will be venturing into plant adhesives for compliance with environmental regulations. Firms will further improve automation compatibility with a view to increasing productivity and scalability. More applications of water-activated tamper-evident features in e-commerce will be seen. AI-powered analytics will further optimize adhesive formulas while reducing waste.

Leading players include 3M, Intertape Polymer Group, Shurtape Technologies, Vibac Group, Tesa SE, Berry Global, and Papertec.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 35%.

Key drivers include sustainability, automation, high-strength adhesives, and smart security solutions.

Explore Packaging Consumables and Supplies Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.