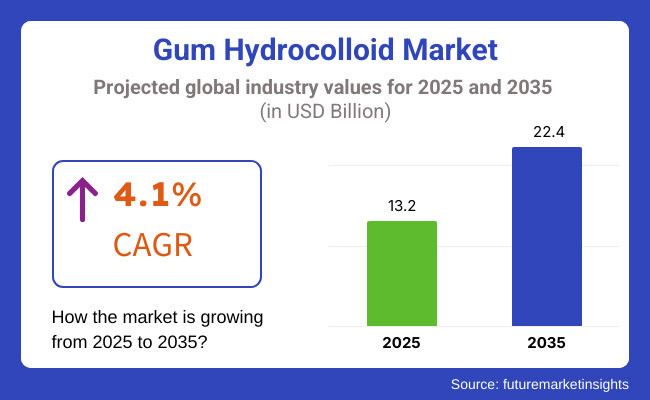

The global gum hydrocolloid market is set to observe USD 13.2 billion in 2025. The industry is poised to register 4.1% CAGR from 2025 to 2035, reaching USD 22.4 billion by 2035.

The increasing consumer preference for clean-label products in the food & beverage and pharmaceutical & personal care industries drives the market growth. Manufacturers are building capacity, adopting technology, and forming alliances. Hydrocolloid gums have various functions and benefits on food and beverage products and play critical roles as an essential component of food products.

The growing industrial adoption of guar gum, xanthan gum, agar, and carrageenan algal-based, and plant-derived hydrocolloids drives the industry. Research and innovation for development of hydrocolloid offerings is also being performed by players such as CP Kelco, Ingredion, Cargill, and Tate & Lyle. Regional expansions, particularly across Asia Pacific and Latin America, enable the companies to improve the efficiency of supply chains and address the rising demand for natural and functional food ingredients.

The increase in the adoption of natural & sustainable food formulation is one of the global industry growth drivers. With clean-label trends gaining traction, consumers increasingly gravitate toward products with fewer artificial additives and preservatives.

These have also driven interest in naturally-sourced hydrocolloids, which enhance gelling, thickening, and stabilizing properties for other food and beverage industries. The use of gum hydrocolloids as active components in drug applications, skincare and beauty products, pharmaceuticals, and personal care industries additionally fuels the continuous development and growth of the industry.

The gum hydrocolloid industry has a few restraints, such as price variability of the material and disruptions in the supply chain.

Explore FMI!

Book a free demo

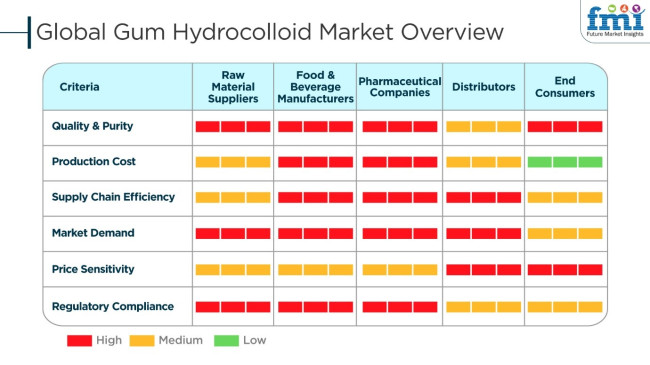

The global industry for gum hydrocolloid is fueled by mounting demand for natural stabilizers, emulsifiers, and thickeners from food, pharma, and cosmetics. The food & beverages industry gives prominence to hydrocolloids in texture improvement, moisture maintenance, and shelf-life extension, thereby making them pivotal for dairy products, bakery products, and confectionery products.

Hydrocolloids are used by the pharmaceutical industry for drug delivery systems in controlled release formulations and gel-forming drugs to guarantee their potency and patient compliance. Distributors also have a large role to play in keeping cost-effective supply chains and ensuring regulatory standards as hydrocolloids fall strictly under quality management.

Clean-label and plant-based end-users have created massive demand for natural hydrocolloids like xanthan gum, guar gum, and pectin. Trend in the industry is toward mounting demand for sustainable, non-GMO, and organic hydrocolloids that push manufacturers toward adopting new manufacturing techniques.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.9% |

| H2 (2024 to 2034) | 5.1% |

| H1 (2025 to 2035) | 5.0% |

| H2 (2025 to 2035) | 5.3% |

The table presents a comparative assessment of the semi-annual CAGR variations for the base year (2024) and the current year (2025) for the global gum hydrocolloid market. This analysis highlights key performance shifts and revenue realization trends, helping stakeholders gain a clearer perspective on the industry's growth trajectory.

The first half of each year (H1) spans from January to June, while the second half (H2) covers July to December. In the first half of the decade from 2025 to 2035, the industry is projected to expand at a CAGR of 5.0%, followed by an increase to 5.3% in the second half of the decade.

The industry is witnessing growing demand for natural and functional hydrocolloids across food, pharmaceutical, and personal care applications, fueling this upward trajectory. With rising consumer preference for clean-label products and enhanced production capabilities, the industry is expected to continue its steady growth over the forecast period.

Application-Specific Pricing Strategies

The pricing dynamics of gum hydrocolloids are increasingly influenced by their end-use applications. Different industries, including food and beverage, pharmaceuticals, and cosmetics, require hydrocolloids with specific functionalities, leading to varied pricing structures. The food sector demands cost-effective thickening agents, whereas pharmaceutical-grade hydrocolloids with stringent quality requirements are priced at a premium.

Additionally, fluctuations in raw material availability, such as guar gum and carrageenan, are impacting cost adjustments. Manufacturers are adopting value-based pricing strategies to cater to specialized applications, ensuring better industry penetration. Premium-priced hydrocolloids with enhanced functionalities, such as improved texture or stability, are gaining traction in niche markets, particularly in plant-based formulations.

Meanwhile, demand-driven pricing mechanisms are becoming prevalent, with businesses adjusting costs based on bulk procurement by large food processors and formulators. The focus on high-value applications is expected to reshape pricing strategies, allowing businesses to balance affordability with profitability.

Responsible Sourcing and Green Processing

The gum hydrocolloid market is witnessing a growing emphasis on responsible sourcing and sustainable processing methods. Consumers and industries are demanding eco-friendly hydrocolloids sourced through ethical and traceable supply chains. Seaweed-derived hydrocolloids, such as agar and carrageenan, are particularly under scrutiny, leading to increased adoption of responsible harvesting practices.

Similarly, guar gum suppliers are investing in community-driven sourcing models to promote fair trade and ensure long-term supply stability. To minimize environmental impact, manufacturers are exploring water-efficient extraction processes and reducing energy consumption in hydrocolloid production. Additionally, regulatory bodies are enforcing stricter sustainability requirements, pushing manufacturers to adopt biodegradable packaging and carbon-neutral processing facilities.

The shift toward sustainability is also driving research into alternative plant-based hydrocolloids that can replace synthetic stabilizers, further accelerating the industry’s eco-conscious evolution. These industry-wide efforts are making hydrocolloids more appealing to brands prioritizing clean-label and environmentally friendly formulations.

Digital Commerce and Subscription-Based Supply

The expansion of digital commerce is transforming the way gum hydrocolloids are marketed and distributed across industries. With the increasing reliance on e-commerce platforms, hydrocolloid suppliers are streamlining direct-to-business sales channels. Online marketplaces now offer bulk purchasing options, enabling small-scale food and beverage manufacturers to source specialty hydrocolloids efficiently.

Subscription-based supply models are also gaining traction, where businesses secure a steady supply of hydrocolloids through automated recurring purchases. This approach is particularly beneficial for formulators requiring consistent ingredient quality and uninterrupted supply chains. Moreover, digital platforms allow manufacturers to educate customers on hydrocolloid functionalities, showcasing application-specific benefits through virtual product demonstrations.

The convenience of online procurement and customized supply agreements is reshaping the distribution landscape, reducing dependency on traditional sourcing methods. As digital platforms evolve, businesses leveraging e-commerce and automated supply solutions are expected to gain a competitive edge in catering to dynamic industry demands.

The increasing demand for natural stabilizers, texturizers, and emulsifiers in the food and beverage industry has driven significant growth in recent years. The demand for cleaner-label products has consumers looking for more plant-based and seaweed-sourced hydrocolloids like guar gum, xanthan gum, and carrageenan.

With increasing awareness of functional food ingredients, players are leaning toward hydrocolloids that are improving texture, stability, and shelf life without the use of synthetic additives. The drug and cosmetic industries have also contributed to growth in the industry since hydrocolloids find application in drug and cosmetic formulation. In the future, developments in extraction and processing technology will increase efficiency of production, and hydrocolloids will become more available.

Marketing efforts emphasizing the natural and multi-functional appeal of hydrocolloids will also further enhance brand positioning. Companies are also likely to make investments in sustainable sourcing and environmentally friendly manufacturing processes in order to keep pace with changing consumer attitudes. The trend is expected to fuel additional industry penetration, further solidifying gum hydrocolloids as a key ingredient in various industries.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for gum hydrocolloids as thickening, stabilizing, and gelling agents. | Growing use in plant-based, functional, and clean-label foods to improve texture and stability. |

| North America and Europe led the trend because of their extremely developed processed food industries and clean-label trends. | Asia-Pacific and Latin America recorded increased growth spurts spurred by the establishment of emerging food processing industries and a growing convenience food demand. |

| Processes within dairy, bakery, confectionery, and sauces are largely encountered. | Widening applications into new dairy, meat substitutions, and protein-rich food openings. |

| Supply constrictions due to impacts from weather on gum trees and geopolitical reasons. | Sustainable extraction, substitute sources, and innovative synthetic hydrocolloid to stabilize supply. |

| Regulatory limitations on food additives and clean-label demands stimulating reformulation activity. | Heightened regulatory emphasis on origin clarity, environmental impact, and natural positioning. |

| R&D focused on developing hydrocolloid functionality and interaction with other stabilizers. | Increased research on multifunctional hydrocolloids with improved emulsification, fat reduction, and dietary fiber benefit. |

The worldwide hydrocolloid gum market is subjected to threats arising from factors such as the unavailability of raw materials, regulatory issues, price instability, new technologies, and competition from synthetics.

The regulatory compliance issue is yet another problem, as the hydrocolloids in question have to pass rigorous food safety, labeling, and environmental regulations in several markets, for example, the USA (FDA), EU (EFSA), and China (SAMR). There may be a disruption in the industry demand for some hydrocolloids like those concerning the fears over health effects.

Fluctuation in price is a result of the variation in raw material cost, transport cost, and supply-demand discrepancies. For example, the price of guar gum may vary widely because it is based on the seasonal crop yields. Producers need to come out with cost-effective formulations to tackle the price changes.

Innovations in food processing and formulation may change the demand for some hydrocolloids. While food manufacturers test out new agents for texturization and stabilization, they might utilize hydrocolloids less if the traditional ones are not kept updated.

The alternative and synthetic ingredient competition poses a threat to gum manufacturers since companies that substitute conventional gum with cheaper and eco-friendly alternatives dominate the industry. The application of synthetic hydrocolloids and vegetable-based alternatives could restrict the reliance on conventional gum, thereby making industry dynamics varied.

Xanthan gum leads owing to its ability to thicken, stabilize, and texture food, pharma, and personal care products. The popularity of gluten-free and plant-based diets, especially in North America and Europe has driven up demand, making it an important ingredient in sauces, dairy substitutes, and baked goods. Many of the major players such as CP Kelco, Cargill, ADM, Jungbunzlauer and Fufeng Group are focused on harnessing microbial fermentation technology to enable cost and efficiency.

Aside from food, pharma and cosmetics also use xanthan for stabilizing drug formulations and skin creams. It is also used by L’Oréal, Unilever and Procter & Gamble, among other brands, for its ability to help stabilize lotions, creams and serums.

Seaweed-based hydrocolloids have gained high demand owing to their natural origin, multifunctionality, and clean-label appeal. Carrageenan dominates in dairy, plant-based meats, and also, beverages, while agar is critical in confectionery, bakery, and microbiology. Some of the key players in these markets include CP Kelco, DuPont, FMC Corporation, W Hydrocolloids, and others, all of which are directing efforts toward sustainable harvesting and solvent-free extraction methods to cater to rising demand, particularly in Asian and European markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| Japan | 13.0% |

| Germany | 14.0% |

| Australia | 12.2% |

| China | 2.8% |

As per FMI, the USA industry for gum hydrocolloids is poised to grow at a CAGR of 5.4% during 2025 to 2035 due to the mounting demand for natural stabilizers and clean-label food. Plant food revolution and functional food are driving consumer trends, and consequently, there is greater application of hydrocolloids from guar, xanthan, and carrageenan.

The pharmaceutical industry utilizes hydrocolloids in controlled-release drug formulation, driving demand and industry growth. The organic and sustainable sourcing movement has forced manufacturers to invest in ethical production practices.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Growth in clean-label foods | Customers demand natural stabilizers for functional and processed foods. |

| Adoption of plant-based food | Hydrocolloids improve the texture and stability of meat and dairy alternatives. |

| Pharmaceutical applications | Hydrocolloids allow the controlled release of medications and enhance formulation effectiveness. |

| Sustainability drive | Companies invest in sustainably as well as ethically sourced hydrocolloids. |

As per FMI, the Japanese industry for gum hydrocolloids is expected to grow at a CAGR of 13.0% between 2025 and 2035 due to rising demand for functional and traditional foods. Seaweed hydrocolloids such as agar and carrageenan are used on a large scale in desserts, dairy, and convenience foods. The personal care industry applies gum hydrocolloids in cosmetics and skincare. Greater efficiency because of new methods of extraction and broader application of products is taking place.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Functional food demand | Hydrocolloids provide texture in traditional and processed foods. |

| Personal care growth | Gum hydrocolloids improve cosmetic and skin care product stability. |

| Technical innovations | Improved quality of products and efficacy with advanced extraction methods. |

| Pure-seeking consumers | Japanese consumers prefer clean-label and quality ingredients. |

The industry for gum hydrocolloids in Australia is anticipated to expand at 12.2% CAGR during 2025 to 2035, cites FMI. Hydrocolloids are utilized by Australia's food and beverages industry to manufacture more stable products with increased shelf life. Hydrocolloids are extremely important in the dairy sector and the meat alternatives industry, and they are responsible for mouthfeel and emulsification.

The pharmaceutical industry continues to adopt them for new medicine development. Increased consumer awareness regarding natural and plant-based products drives hydrocolloid usage.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Food applications growth | Hydrocolloids improve the texture, stability, and shelf life of processed foods. |

| Dairy alternative growth | Hydrocolloids provide enhanced consistency in plant dairy products. |

| Pharmaceutical development | Hydrocolloids enable drug formulation performance and controlled release. |

| Naturalness preference of consumers | Naturalness awareness of plant hydrocolloids is increasing. |

FMI states that the China's gum hydrocolloid industry is expected to grow at a CAGR of 2.8% between 2025 to 2035, with increasing demand for food additives to add texture and stability. The hydrocolloids are used in the food processing industry to provide consistency to the product and improve mouthfeel.

The high growth of China's pharmaceutical and nutraceutical industries leads to the demand for hydrocolloids in formulations. The personal care industry also applies gum hydrocolloids to cosmetics and skincare.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Expansion of the processed food industry | Keeping packaged foods stable and in texture. |

| Pharmaceutical applications expansion | Hydrocolloids enable drug formulations to enhance efficacy and release. |

| Expansion of nutraceuticals demand | Functional hydrocolloids enhance dietary supplement formulation. |

| Expansion of personal care application | Hydrocolloids bring consistency to cosmetics and skin care products. |

The shift toward organic and vegan food has increased demand for natural hydrocolloids. Hydrocolloids find application in the pharmaceutical and nutraceutical industries for drug delivery systems and nutritional supplements. The producers emphasize sustainable and traceable hydrocolloid sourcing, particularly from seaweed and plant origin, in conformity with strict European Union food safety and environmental requirements.

Functional hydrocolloid development with enhanced textural and stabilizing properties strengthens industry penetration. FMI is of the opinion that the German industry is slated to grow at 14.0% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Vegan and organic food production | Hydrocolloids provide texture and stability to plant foods. |

| Pharmaceutical applications are on the rise. | Hydrocolloids enable controlled release drug delivery and formulation optimization. |

| Sustainable sourcing focus | Manufacturers focus on traceable and sustainable hydrocolloid manufacturing. |

| Functional ingredient development | R&D optimizes hydrocolloid performance in a wide range of applications. |

The global gum hydrocolloid market is highly competitive, mainly due to the demand for natural stabilizers, texturizers, and thickening agents across food & beverages, pharmaceuticals, and personal care industries. The rise in the consumer demand for clean-label and plant-based ingredients has also fueled the industry growth.

Cargill, Ingredion Incorporated, DuPont (IFF), Tate & Lyle PLC, and CP Kelco are the key players. They hold industry dominance through a diversified product portfolio, strategic acquisitions, and local-global distribution networks.

Key offerings for the various product formulations include ingredients from xanthan gum, guar gum, and carrageenan to specialty hydrocolloids to improve texture, stability, and emulsification in food, pharmaceutical, and cosmetic formulations. Companies are also focusing on renewable sources for hydrocolloids, especially those with organic certification, keeping in mind the shifting consumer expectations.

The evolution of the industry has been impacted by advances in extraction technology, increased applications in plant-based & gluten-free food formulations, and regulations pushing for the use of natural ingredient solutions. Functional benefits like fat replacement and enhancement of dietary fibers are guiding the innovation of these products.

Strategic factors consist of R&D investment in new formulations of hydrocolloids, alliances with local suppliers of raw materials, and increasing production capacities in new markets. The other area where big companies are gaining is the advancement of hydrocolloid functionality and sustainability through AI optimization of ingredients as well as precision fermentation.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Cargill, Incorporated | 18-22% |

| Ingredion Incorporated | 12-16% |

| Tate & Lyle PLC | 10-14% |

| DuPont | 9-13% |

| CP Kelco | 8-12% |

| Other Companies (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | A leading supplier of natural hydrocolloids, focusing on sustainable sourcing and clean-label formulations. |

| Ingredion Incorporated | Develops innovative hydrocolloid solutions for texture enhancement and stability in food & beverage applications. |

| Tate & Lyle PLC | Specializes in functional hydrocolloids with a strong emphasis on health and wellness applications. |

| DuPont | Offers a diverse range of hydrocolloids with advanced processing technologies for various industrial uses. |

| CP Kelco | Focuses on fermentation-based hydrocolloids with a commitment to sustainability and supply chain optimization. |

Key Company Insights

Cargill, Incorporated (18-22%)

The largest player in the hydrocolloid field, providing plant-derived and sustainable solutions for various applications.

Ingredion Incorporated (12-16%)

Building its hydrocolloid business with innovative texture-modifying solutions and natural stabilizers to its product portfolio.

Tate & Lyle PLC (10-14%)

Applied to developing functional hydrocolloids for health benefits and sensory experiences of food products.

DuPont (9-13%)

It strengthens the hydrocolloid division through technologies and its presence across many industry sectors.

CP Kelco (8-12%)

A global leader in natural hydrocolloids focused on clean labeling and sustainable methods of processing.

Other Key Players (25-35% Combined)

The industry is expected to reach USD 13.2 billion in 2025.

The industry is projected to reach USD 22.4 billion by 2035.

Key companies include Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, DuPont, CP Kelco, Kerry Group, FMC Corporation, Royal DSM, Archer Daniels Midland Company (ADM), and Ashland Global Holdings.

Germany, slated to grow at a CAGR of 14.0% during the forecast period, is expected to see the fastest growth.

Xanthan gum is being widely used.

By product type, the market is segmented into gelatin, xanthan gum, carrageenan, alginates, agar, pectin, guar gum, lupus bean gum (LBG), gum Arabic, carboxymethylcellulose (CMC), and microcrystallinecellulose (MCC).

By source, the market is segmented into plant, microbial, animal, seaweed, and synthetic.

By region, the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.