Market projections show that green tea extracts will expand uniformly from 2025 to 2035 since customers have become more informed about natural health supplements and desire functional beverages while cosmetics and pharmaceuticals extend their applications. The antioxidants found in green tea extracts together with polyphenols and catechism deliver health benefits for weight management and cardiovascular health and anti-aging results.

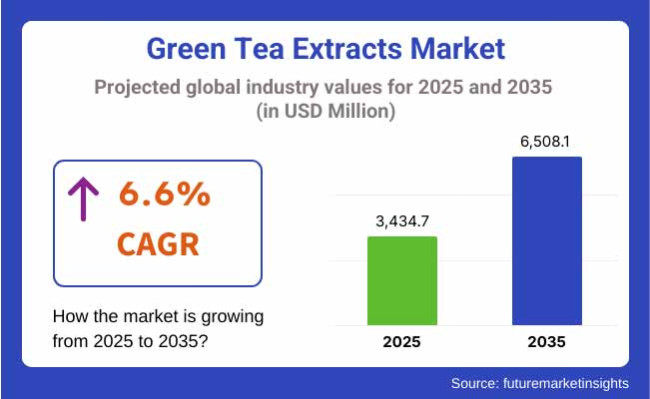

The market analysis predicts USD 3,434.7 million revenue for 2025 which is projected to grow to USD 6,508.1 million through 2035 with a 6.6% compound annual growth rate (CAGR).

The market experiences expansion because consumers prefer plant-based ingredients and businesses adopt green tea extract for dietary supplements and there is increased demand for clean-label products. The development of advanced extraction methods leads to better effectiveness and superior quality of green tea extracts that expands their use in pharmaceuticals and personal care and nutraceutical applications.

The market faces obstacles due to changing raw material prices and regulatory barriers in addition to the challenge of formulating products with satisfactory taste compatibility. These challenges require manufacturers to pursue sustainable material acquisition and enhanced manufacturing practices and customized product development solutions for various consumer segments.

The green tea extracts market divides its segments according to form and application while facing increasing interest from food, beverage and pharmaceutical sectors. Green tea extract exists in three principal forms which are powder formulation and liquid and soft gel derivatives.

Because manufacturers find it convenient to add powder extracts to dietary supplements and functional foods as well as skincare items.The market promotes liquid extract solutions rapidly because they absorb quickly into beverages and personal care uses.

Consumers opt for dietary supplements as their foremost choice for market demand because green tea extract boosts metabolism while supplying antioxidants. Manufacturers in the cosmetic industry combine green tea extract with anti-aging ingredients and skin-brightening products.

The pharmaceutical industry incorporates green tea extract as part of their pharmaceutical treatments for cardiovascular health needs together with anti-inflammatory responses. The increasing consumer interest in natural elements drives manufacturers to create high-potency extracts with residue-free production that comes from sustainable sources for better marketplace reception.

North America green tea extracts market is propelled by growing consumer demand for organic and clean-label products, increasing demand for functional beverages, and growing applications as skincare and nutraceuticals. Increased use of green tea extract in weight management supplements and as a beauty ingredient further driving market growth in United States and Canada.

The Europe green tea extracts market is also driven by strict regulatory support pertaining to plant-based supplement, rising preference towards natural cosmetics and well-established demand for functional foods.

Germany, France, and the UK are at the forefront of market growth increasing adoption of green tea extract in herbal supplements, fortified beverages, and skincare formulations are sustaining this growth. European manufacturers focus on sustainable sourcing and high-quality extraction methods.

The green tea extracts market is majorly driven by the strong tea culture in Asia-Pacific followed by the increasing disposable income in the countries of Asia-Pacific, along with a growing number of health-conscious consumers. High consumption of Green Tea supplements and cosmetics can be found in China, India, Japan and South Korea.

Market growth is further supported by government initiatives promoting herbal medicine and organic agriculture. Though supply chain hurdles remain, ongoing focus on quality control and product development keeps the long-term marketer viable.

Challenge: Supply Chain Volatility and Quality Standardization

Regional issues regarding supply chain volatility and varied quality standards can challenge the global growth of green tea extracts market. Seasonal growth of tea, climatic conditions and regional farming practices being the determining factors for Green Tea Extract production it enters into seasonal variations regarding availability and pricing.

Another factor impacting this category is the market availability of under dosed/ sub-standard extracts which hurts consumer confidence requiring manufacturers to deliver high amounts of poly phenols, catechins and EGCG (epigallocatechin gallate) in their formulations. Regulatory agencies are now mandating rigorous quality control measures for dietary supplements, functional foods and cosmetic applications, which inspires companies to invest in improved testing and certification processes.

Opportunity: Rising Demand for Functional Foods and Natural Health Supplements

With more and more consumers looking for plant-based and antioxidant-rich ingredients, it has a major opportunity when it comes to including green tea extracts. The demand for natural alternatives to synthetic additives especially for Weight management products, Cardiovascular health and cognitive wellness, is likely to soar.

Because of their anti-inflammatory and metabolism-enhancing characteristics, green tea extracts are now commonly found in functional beverages, energy drinks, dietary supplements, and skincare products. High-quality and high-purity extracts due to the evolution of extraction methods and organic green tea farming have found their applications in high-value added products as per the requirement of customers emphasizing on health-conscious lifestyle.

This was evident during 2020 to 2024 where the demand for green tea extracts rose in the nutraceutical, weight management, and anti-aging skincare product segment. Sales were fuelled by the proliferation of ready-to-drink (RTD) functional beverages and natural energy boosters, while e-commerce distribution grew due to online health and wellness trends. Yet, with supply chain breakages and heavy metal contamination fear with tea leaves, scrutiny increased and regulatory interventions were planned.

From 2025 to 2035, the market will shift toward the use of precision-formulated, highly bioavailable green tea extracts delivering targeted health benefits in areas like cognitive support, gut health and athletic performance. The advent of sustainable and carbon-free tea plantation and solvent-free extraction technologies will enhance the purity and environment footprint of green tea extracts.

Moreover, these technological advancements will fuel consumer adoption coupled with AI-driven nutraceutical recommendations and personalized supplement formulations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter testing for heavy metal content and purity. |

| Technological Advancements | Growth of high-polyphenol extraction and decaffeinated formulations. |

| Sustainability Trends | Initial investments in organic and pesticide-free tea farming. |

| Market Competition | Dominated by nutraceutical brands and functional beverage manufacturers. |

| Industry Adoption | Used in energy drinks, weight-loss supplements, and anti-aging skincare. |

| Consumer Preferences | Demand for natural antioxidants, metabolism boosters, and skincare ingredients. |

| Market Growth Drivers | Growing by boosting health awareness and need of green products of wellness. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter global regulations on extract standardization and organic certification. |

| Technological Advancements | Expansion of AI-driven supplement personalization and solvent-free extraction technologies. |

| Sustainability Trends | Large-scale adoption of regenerative agriculture and carbon-neutral tea extraction methods. |

| Market Competition | Entry of biotech firms specializing in enhanced bioavailability and plant-based bioactive. |

| Industry Adoption | Expansion into cognitive enhancers, gut health solutions, and personalized nutrition products. |

| Consumer Preferences | Preference for customized health solutions, high-absorption extracts, and sustainable sourcing. |

| Market Growth Drivers | Expansion propelled by scientific innovations, precision nutrition, and environmentally aware consumer trends. |

The USA green tea extracts market is currently growing at a steady pace, supported by rising consumers demand for natural health supplements, increasing knowledge about antioxidant-rich diets, and increasing usage in functional beverages and beauty products in the USA Increasing preference for plant-based nutraceuticals along with clean label ingredients has accelerated the market for green tea extracts in dietary supplements, weight management products and herbal teas.

Moreover, the increasing popularity of functional beverages, like RTD (ready-to-drink) green tea-based energy drinks and detox teas, galvanizes the market demand. The growth of the market is also driven by the presence of key nutraceutical manufacturers and investments in research and development to analyze the benefits of green tea polyphenols (EGCG) on cardiovascular and metabolic health.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

The UK green tea extracts market is witnessing growth owing to surge in consumer interest in herbal wellness, increase in usage of green tea extracts in skincare products and rise in demand for organic functional foods. The country’s robust herbal supplement industry and strict controls on synthetic ingredients in food and cosmetics are driving interest in natural green tea extracts.

Furthermore, the increasing trend of leading healthy and active lifestyle is propelling the demand for green tea based sports drinks, weight loss products and herbal infusions. Increased e-commerce, and direct-to-consumer brands focused on natural health products also fuels growth in this sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The growth of the European Union green tea extracts market is augmenting on account of increasing consumer inclination towards organic and the polyphenols enriched dietary products, growing requirement of plant-based nutraceuticals, and strict regulatory landscape pertaining to unnatural raw ingredients used in food products. The demand for tea extracts for functional foods, dietary supplements, and cosmetics are particularly high in Germany, France, and Italy.

Regulatory measures from the European Food Safety Authority (EFSA) and demand for plant-based bioactive ingredients have also driven EGCG extracts from green tea into wellness-oriented product lines. Moreover, green tea extracts are being incorporated into anti-aging cosmetics formulations launched by cosmetic and personal care industries in the European Union, further propelling the market demand within the beauty sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.7% |

Japan's green tea extracts market is showing stable growth thanks to the traditional tea culture in the country, the increasing demand for functional foods and the rising incorporation of green tea extracts in pharmaceuticals and cosmetics. Market growth is driven by the rising adoption of match-based health drinks, green tea infused dietary supplements, and anti-aging skincare products.

Furthermore, Japan's expertise in a variety of research and innovation within the field of polyphenol extraction techniques has resulted in high-potency green tea extract formulations with improved bioavailability. Market elevation in food and beverage segment is also being fuelled by growing preferment towards premium, organic and ceremonial-grade green tea products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.6% |

South Korea green tea extracts market is booming on the back of increasing consumer inclination towards herbal wellness products, growing usage of green tea extracts in K-beauty skincare and burgeoning functional health beverage sector. India’s robust footprint in herbal cosmetics and nutraceuticals has prompted demand for green tea-based creative formulations to promote skin health, weight management, and anti-aging solutions.

Also, South Korea has created innovative fermentation and biotechnology industries, which has resulted in fermented green tea extracts that contain more potent antioxidant properties. Market growth is further driven by a rise in premium and organic tea brands and increased exports of Korean green tea-infused cosmetics and supplements.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

Green tea extracts market is experiencing significant growth as various industries are relying on tea-derived bioactive compounds for health, wellness, and functional purposes. Tea polyphenols and tea catechins are among the leading product types, attributed to the various antioxidant, anti-inflammatory, and metabolic advantages of these compounds extensively utilized in nutraceuticals, functional foods, and pharmaceuticals. As consumers embrace natural health solutions, plant-based ingredients, and disease-preventive nutrition, the market for high-purity green tea extracts has gained new momentum.

The growing scientific evidence pertaining to the health benefits of green tea, coupled with advancements in extraction processes and the AI-boosted optimization of constituents, has provided further impetus for the commercial adoption of tea polyphenols and catechins across food, beverage and wellness applications. The potential applications of the green tea extract will expand across various health-focused products as industries continue to explore formulations for sustainable, high-potency, and bioavailable green tea extract.

Tea polyphenols are one of the most popular bioactive compounds because their powerful antioxidant capacity, cell protection and metabolic health. These compounds found in green tea fight free radical damage, support cardiovascular health, and regulate glucose metabolism, which are critical components of functional foods or dietary supplements and pharmaceutical products.

Although they are associated with several advantageous effects, polyphenol compounds demonstrate limitations, particularly instability, insolubility, and astringency in food and beverage applications. However, improvements in the fields of nano-encapsulation, plant-based emulsification, and hybrid formulation technologies are progressing to overcome those challenges, thus assuring better consumer acceptance and continued industry demand.

Tea polyphenols' applications have extended to pharmaceuticals, therapeutic dietary supplements, and functional foods. Tea polyphenols for cholesterol management and immune support are also used by many nutraceutical brands, wellness beverage companies, and pharmaceutical companies that manufacture fermented and unfermented teas to help reduce inflammation. The long-term growth of tea polyphenol-based formulations is expected to be driven by the increasing demand for clean-label, natural, and scientifically backed ingredients.

With consumers increasingly searching for functional nutrition, weight management options, and natural energy boosters, green tea extracts have burgeoned in food, beverages, and dietary supplements. Growing demand for premium green tea extracts in health-oriented formulations has been driven by the popularity of functional foods, wellness drinks and plant-based dietary supplements.

Given the increasing global awareness of the significant health benefits associated with green tea and the advancements surrounding AI-powered ingredient optimization, and regulatory approvals related to natural health ingredients, companies are looking to green tea extracts for clean-label, consumer preferred product lines.

In the food and beverage industry, the demand for green tea extract has skyrocketed, commonly seen in functional teas, RTD beverages, and plant-based health drinks. Health-focused consumers are becoming increasingly aware of the health(both short and long term) benefits of consuming these sustainable and natural alternatives to energy drinks, leading brands to innovate tea-based energy drinks, RTD teas packed with antioxidants and a new wave of low caffeine 'functional' beverages.

Tea catechins, polyphenols, and EGCG compounds are commonly employed to enhance beverage formulations, enhance metabolic function, and promote gut health. With the popularity of sugar-less, organic, and herbal-infused drinks, green tea extracts have proven their cosmetic application appeal, especially in sports recovery beverages, cognitive-enhancing teas, and detox wellness products.

There are taste-related challenges and the potential for formulation stability, but companies are taking their strides through AI-linked flavour and taste masking, technologies for microencapsulation, and formulations with enhanced solubility, they are all overcoming these challenges. The growing trend for functional beverages that offer gut-friendly, anti-inflammatory, and adaptogenic properties is anticipated to boost the growth of the market for green tea extracts used in functional beverage applications.

Dietary supplements have emerged as a major driver of the green tea extract market, especially in weight loss formulations, cognitive health products, and antioxidant-rich wellness supplements. Consumers are embracing plant-based, natural supplement ingredients, with a growing demand for green tea extracts in nutraceutical formulations.

The growing incorporation of green tea extracts into formulations for functional food, beverage, and supplements reflects the industry’s moving toward plant-forward, natural health solutions. The increasing popularity of research-oriented, AI-optimized ingredient formulations that include green tea extracts for metabolic, cognitive and immune health applications should continue to be fuelled by various healthimensional consumer segments.

The green tea extracts market comprises a singular competitive landscape as increasing consumer awareness around natural antioxidants, functional ingredients, and a plant-oriented approach to wellness are being manifested in nutraceuticals, cosmetics, food & beverages and pharmaceuticals.

Rich in Green Tea Extracts Green tea green tea extracts have catechins, poly phenols & EGCG (Epigallocatechin gallate) that offer antioxidant, anti-inflammatory, anti-aging & metabolism-boosting properties. Among all the strategies undertaken by the players to cater to the needs of health-conscious consumers are high-purity extraction methods, organic certification, and scientifically backed formulations. It includes behemoth global botanicals extract suppliers, nutraceutical gradient manufacturers, and specialty beverage processes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Taiyo International | 18-22% |

| DSM Nutritional Products | 15-19% |

| Indena S.p.A. | 12-16% |

| Tate & Lyle PLC | 8-12% |

| Nexira | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Taiyo International | Produces Sunphenon® green tea extracts, offering high-purity catechins and polyphenols for nutraceuticals and functional beverages. |

| DSM Nutritional Products | Develops EGCG-rich green tea extracts, focusing on immune health, weight management, and cognitive benefits. |

| Indena S.p.A. | Specializes in pharmaceutical-grade green tea extracts, ensuring standardized polyphenol content for medical and nutraceutical applications. |

| Tate & Lyle PLC | Manufactures botanical green tea extracts, integrating clean-label ingredients for beverages, dietary supplements, and sports nutrition. |

| Nexira | Offers organic and sustainably sourced green tea extracts, targeting functional food and beauty-from-within applications. |

Key Company Insights

Taiyo International

Taiyo International – Manufacturer of Sunphenon® Green Tea Extracts for High-Potency Catechins and Polyphenols for Nutraceuticals and Functional Drinks.

DSM Nutritional Products

DSM specializes in EGCG-rich green tea extracts and has created formulations designed to promote immune health, metabolism and cognitive function.

Indena S.p.A.

Much on awarding a good level of polyphenols (standardized) green tea extracts are offered for clinical or medical use, specialist in this is Indena.

Tate & Lyle PLC

Tate & Lyle manufactures botanical green tea extracts that are clean label and improve sports nutrition, wellness beverages, and dietary supplements.

Nexira

Nexira specializes in organic green tea extracts for functional foods, skincare supplements and holistic wellness.

Other Major Participants (30-40% Total)

Some other contributors to the green tea extracts industry provide high potency antioxidant extracts often from sustainable and bioavailable sources:

The overall market size for the green tea extracts market was USD 3,434.7 million in 2025.

The green tea extracts market is expected to reach USD 6,508.1 million in 2035.

The increasing consumer preference for natural and functional ingredients, rising adoption in the food and beverage industry, and growing demand for dietary supplements fuel the green tea extracts market during the forecast period.

The top 5 countries driving the development of the green tea extracts market are the USA, UK, European Union, Japan, and South Korea.

Food & beverages and dietary supplements lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green and Bio-based Polyol Market Size and Share Forecast Outlook 2025 to 2035

Green Ammonia Market Size and Share Forecast Outlook 2025 to 2035

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Green Power Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Green Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Green Data Center Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Green Methanol Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Greenwrap Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Green UPS Market - Trends & Forecast 2025 to 2035

Green Tire Market Growth – Trends & Forecast 2025 to 2035

Green Banana Flour Market Analysis - Growth & Demand 2025 to 2035

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Green Electronics Manufacturing Market – Sustainability & Trends 2025 to 2035

Green Coffee Bean Extract Market Analysis by Form, Application, and Distribution Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA