The green building materials industry is expected to reach USD 461 billion in 2025. The industry is expected to reach USD 1,222 billion by 2035, representing a CAGR of 11.2% during the forecast period.

In 2024, the global green building materials industry grew rapidly due to expanding awareness about climate change, robust government regulations urging sustainable development, and heightened demand for energy-saving buildings. The industry was dominated by insulation materials based on their greater thermal resistance and energy-saving advantage.

Technological innovations brought new materials such as cross-laminated timber, which promoted sustainability in construction activities. The residential industry led the way, with homeowners opting for green materials to minimize carbon footprints and energy bills.

The green building materials industry is expected to continue its strong growth during the forecast period from 2025 to 2035. This growth is driven by continuous technology advancements, heightened investment in sustainable building, and government policies favourable to sustainability.

The Asia-Pacific region is forecasted to be a major industry force, supported by accelerated urbanization and escalating focus on sustainability in the environment. Strategic collaborations in the building sector are also likely to strengthen product portfolios and supply chain optimization, which will bring sustainable products closer to industries across different sectors.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 461 Billion |

| Industry Size (2035F) | USD 1,222 Billion |

| CAGR (2025 to 2035) | 11.2% |

Explore FMI!

Book a free demo

The industry for green building products is set for robust growth through more stringent environmental laws, greater energy-efficient buildings demand, and innovations in environmentally friendly construction techniques.

Businesses manufacturing green insulation, cross-laminated wood, and reused products will reap the benefits, However, conventional material suppliers will lose if they do not diversify.

The change will be supported by governments, green builders, and ecologically aware buyers, who will drive green material demand to industry standard from current exceptions.

Invest in Sustainable Innovation

Prioritize R&D in eco-friendly materials like bio-based composites, recycled content, and carbon-neutral concrete to stay competitive. Partner with research institutions and startups to accelerate breakthroughs and differentiate product offerings.

Align with Regulatory and Market Trends

Adapt to evolving sustainability mandates by ensuring compliance with green building certifications (LEED, BREEAM) and government incentives. Develop products that align with net-zero carbon goals to capture growing demand from developers and corporate ESG initiatives.

Expand Strategic Partnerships and Supply Chain Resilience

Strengthen collaborations with sustainable construction firms, architects, and policymakers to drive industry adoption. Invest in localized production and raw material sourcing to mitigate supply chain disruptions and reduce carbon footprints.

| Risk | Probability & Impact |

|---|---|

| Regulatory Uncertainty: Shifting government policies or inconsistent green building standards may create compliance challenges. | Medium Probability, High Impact |

| High Material Costs: The price volatility of sustainable raw materials could limit affordability and adoption. | High Probability, Medium Impact |

| Slow Market Adoption: Resistance from traditional builders and developers may delay widespread implementation. | Medium Probability, High Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Sustainable Material Sourcing: Ensure a stable supply of eco-friendly raw materials. | Run a feasibility study on regional sourcing for recycled and bio-based materials. |

| Regulatory Compliance & Certifications: Stay ahead of evolving green building mandates. | Initiate legal and market review to align with upcoming LEED and BREEAM updates. |

| Market Adoption Acceleration: Drive demand for green materials among developers. | Launch targeted incentive program for builders adopting sustainable products. |

In order to maintain competitiveness, companies must need to step up investment in green innovation, enhance regulatory harmonization, and deepen strategic alliances. As green building regulations are becoming stricter and there is growing demand for environmentally friendly products, the time to scale carbon-neutral and recycled material R&D and secure low-cost supply chains is now. Prioritizing adaptation to changing LEED and BREEAM standards will open new revenue streams, and a push into incentives for builders and developers can accelerate industry take-up.

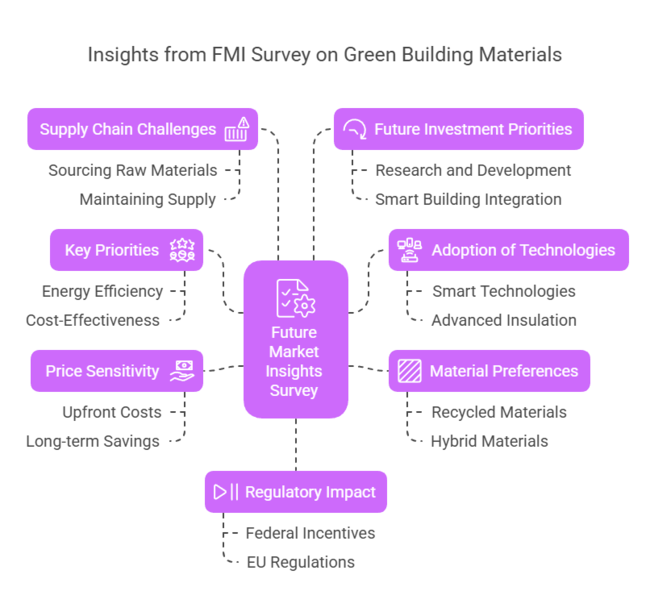

In Q4 2024, Future Market Insights (FMI) conducted a comprehensive survey involving 450 stakeholders from the green building materials sector, including manufacturers, distributors, architects, and developers across the United States, Western Europe, Japan, and South Korea. The survey revealed the following key insights:

Regional Variations

Recycled and Renewable Materials: Globally, 68% of stakeholders preferred materials made from recycled or rapidly renewable resources.

Regional Variations

Global Challenge: 80% of respondents cited the higher upfront costs of green building materials as a significant barrier to adoption.

Regional Insights

Research and Development: 70% of global manufacturers plan to invest in R&D to innovate and improve the performance and affordability of green building materials.

Regional Focus

| Countries | Policies and Regulations |

|---|---|

| United States |

|

| United Kingdom |

|

| India |

|

| Japan |

|

| Singapore |

|

| Malaysia |

|

| Qatar |

|

The American green building materials industry is driven by strict environmental policies, growing consumer awareness, and a high-performing building industry.

The American industry is expected to hold a major share in the global industry. The Leadership in Energy and Environmental Design (LEED) certification continues to support green construction practices, further fuelling industry growth.

FMI opines that the United States' green building materials sales will grow at nearly 12.5% CAGR through 2025 to 2035.

The industry for green building materials in the UK is forecasted to increase at a CAGR of about 10.8% from 2025 to 2035.

The industry growth in the UK is an indication of the country's interest in sustainable development. The Building Research Establishment Environmental Assessment Method (BREEAM) certification has been instrumental in driving the use of green materials.

FMI opines that the United Kingdom's green building materials sales will grow at nearly 10.8% CAGR through 2025 to 2035.

France's green building materials industry is expected to expand rapidly during 2025 to 2035. The French government's focus on minimizing carbon emissions and sustainable urban growth propels the industry.

Policies like the HQE (Haute Qualité Environnementale) certification support the utilization of eco-friendly materials in buildings.

FMI opines that the France green building materials sales will grow at nearly 11.0% CAGR through 2025 to 2035.

Germany is expected to experience a significant growth in the green building materials industry over the projection period.

The engineering prowess of the country and policy push towards the Energiewende program to move towards a sustainable energy system supports the sales of green building materials.

The DGNB (Deutsche Gesellschaft für Nachhaltiges Bauen) certification also encourages sustainable building activities.

FMI opines that the Germany green building materials sales will grow at nearly 11.5% CAGR through 2025 to 2035.

Italy's industry for green building materials will increase at a CAGR of approximately 10.5% between 2025 and 2035. The country's high level of architectural heritage, along with its rising emphasis on sustainable tourism and resulting efforts towards renovating ancient structures utilizing environment-friendly products, enhances the industry.

Embracing procedures such as ITACA promotes the integration of sustainability in the building sector.

FMI opines that Italy's green building materials sales will grow at nearly 10.5% CAGR through 2025 to 2035.

South Korea is estimated to witness a CAGR of about 10.7% during 2025 to 2035 in its green building materials industry. The industry is powered by government policies favoring energy-efficient buildings and smart city initiatives.

G-SEED (Green Standard for Energy and Environmental Design) certification stimulates the adoption of sustainable materials across the construction industry.

FMI opines that South Korea green building materials sales will grow at nearly 10.7% CAGR through 2025 to 2035.

The industry size for green building materials in Japan is expected to expand rapidly from 2025 to 2035. The industry is driven by the implementation of green building materials to reduce natural disaster risks and enhance public health.

The Comprehensive Assessment System for Built Environment Efficiency (CASBEE) certification encourages the incorporation of environmentally friendly building materials into construction activities.

FMI opines that the Japan green building materials sales will grow at nearly 9.8% CAGR through 2025 to 2035.

China is anticipated to register a strong growth in the green building materials industry during 2025 to 2035.

The industry is spurred by escalating urbanization and government policies supporting sustainable construction. Initiatives such as the Green Building Evaluation Standard facilitate the use of green materials.

FMI opines that the China green building materials sales will grow at nearly 13.2% CAGR through 2025 to 2035.

The Australia and New Zealand green building materials industry is estimated to expand at a CAGR of approximately 11.3% from 2025 to 2035.

Both nations have shown considerable commitment to sustainability, with products such as Green Star in Australia and Homestar in New Zealand encouraging the incorporation of environmentally friendly materials in construction.

Government policies and increasing awareness among consumers of environmental concerns are further fuelling the growth of the industry.

These nation-specific insights underscore the differential growth paths of the green building materials industry at the global level, determined by domestic policies, certifications, and industry conditions.

FMI opines that Australia-NZ green building materials sales will grow at nearly 11.3% CAGR through 2025 to 2035.

Between 2025 and 2035, the demand for structural green building materials will rise significantly. This growth is due to the increasing need for eco-friendly materials in the construction of houses and office buildings.

Builders will choose sustainable options like recycled steel, engineered wood, and low-carbon concrete to comply with new laws and cater to consumer preferences for environmentally friendly products.

The use of modular and prefabricated building parts will become more common because they help in cutting down waste and speeding up construction time.

Inside buildings, green materials will gain popularity as people seek healthier indoor environments. Everyone wants spaces free from harmful chemicals.

Non-toxic paints, bamboo flooring, reclaimed wood, and bio-based composites will be preferred for interiors because there's a growing awareness of living sustainably. Hotels and businesses will favor these materials to improve air quality and promote wellness for their guests and workers.

Exterior green building materials will also see greater use. Cladding, facades, and weather-resistant composites will become essential for energy-efficient buildings.

Innovations like solar-integrated roofing and self-cleaning materials will support this growth, especially in commercial buildings and tall residential structures. Green facades and living walls will become trendy for their sustainability and attractive appearance.

Other eco-friendly materials like biodegradable insulation, recycled glass surfaces, and hempcrete will continue to emerge as practical options.

Research and development in bio-based materials will open doors to new applications, providing better energy efficiency and durability in various building designs.

Builders are seeking environmentally friendly materials to replace traditional wood and steel, which produce a lot of carbon emissions. Engineered timber, cross-laminated timber (CLT), and recycled steel are becoming popular, especially for large commercial projects that focus on being eco-friendly. Using prefabricated framing systems also helps, as it cuts down on material waste and lowers labor costs.

Demand for insulation materials is rising as energy-saving rules become stricter. New insulation types made from natural fibers, aerogels, and plant-based foams are replacing the old fiberglass and synthetic foams because they offer better thermal performance and are more sustainable.

The push for net-zero buildings, which create as much energy as they use, is speeding up investment in advanced insulation technologies.

Roofing materials are going through changes, too. Cool roofs, solar tiles, and green roofs are becoming standard choices for homes and businesses. Innovations in reflective coatings and solar systems will improve energy efficiency and help reduce the environmental impact of buildings. Government policies encouraging urban cooling will support the growth of these roofing options.

Both interior and exterior finishes are using more green building materials. Recycled, upcycled, and low-impact products are becoming more popular.

People are choosing reclaimed wood, eco-friendly tiles, and alternatives to natural stone because they are attractive and sustainable. Low-VOC paints, water-based adhesives, and bio-resins are shaping the industry for finishing materials as regulations tighten on chemical emissions indoors.

Green building materials are increasingly used in residential construction, as homeowners and developers aim for more energy-efficient, durable and health-focused homes.

This shift means modern houses are now often built with smart insulation, passive cooling systems, and eco-friendly finishes.

There's a growing demand for sustainable housing, and as people update older homes, they're choosing green materials to meet new environmental standards.

In commercial buildings and offices, there's a significant shift towards sustainability. Companies are setting ambitious energy goals and pursuing green certifications such as LEED and BREEAM, which push developers to use energy-efficient insulation, green facades, and innovative materials in office designs.

Institutions such as schools, hospitals, and government buildings are rapidly adopting green building practices due to regulatory requirements and the potential for long-term savings. Schools focus on using materials that emit low levels of harmful chemicals and prioritize energy-efficient insulation to create healthier learning environments.

Hospitals are turning to antibacterial and low-emission materials to ensure safe spaces for patients. Government-led projects increasingly demand sustainable building practices, which helps expand the industry for green materials in these sectors.

The industry for green building materials is led by a few major companies trying to expand their reach. They are growing their businesses by acquiring other companies and forming partnerships, all to provide more environmentally friendly products.

These companies focus on making new and better products, keeping costs competitive, and expanding by merging with or buying out other businesses.

For example, in February 2024, Holcim, a notable company, acquired ZinCo, which is famous for its green roofing systems. This acquisition aimed to strengthen Holcim's business in the sustainable roofing sector.

Stricter regulations, sustainability goals, and cost savings fuel adoption.

They enhance insulation, reduce heat absorption, and lower energy use.

Residential, commercial, and institutional buildings lead adoption.

Self-healing concrete, bio-based insulation, and solar-integrated roofing.

Yes, tax credits, grants, and subsidies promote eco-friendly construction.

Structural, Interior, Exterior and others

Framing, Insulation, Roofing and Interior and Exterior Finishing

Residential, Commercial Offices and Buildings and Institutions

North America, Latin America, Europe, Asia Pacific and the Middle East and Africa

Swellable Packers Market Growth – Trends & Forecast 2025 to 2035

CNG Tanks Cylinders Market Growth - Trends & Forecast 2025 to 2035

Sand Control Screens Market Growth - Trends & Forecast 2025 to 2035

Oil and Gas Hose Assemblies Market Growth - Trends & Forecast 2025 to 2035

Non-Concentrating Solar Collectors Market Growth - Trends & Forecast 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.