The gravity conveyor system market is expanding steadily due to increasing automation across warehousing, manufacturing, and logistics industries. Rising demand for efficient material handling, reduced operational costs, and streamlined intralogistics processes is driving adoption. Current market conditions reflect growing integration of modular and scalable conveyor designs that optimize floor space and improve throughput efficiency.

Industrial modernization, along with expanding e-commerce and retail distribution networks, is stimulating the requirement for flexible gravity-based conveying solutions. The future outlook indicates sustained growth as manufacturers focus on product durability, low maintenance, and compatibility with automated systems.

Rising investments in warehouse automation and industrial infrastructure are also creating strong growth prospects Market expansion is further supported by advancements in material technologies and design precision that enhance load-handling capability and operational lifespan, ensuring consistent performance across diverse industrial environments.

| Metric | Value |

|---|---|

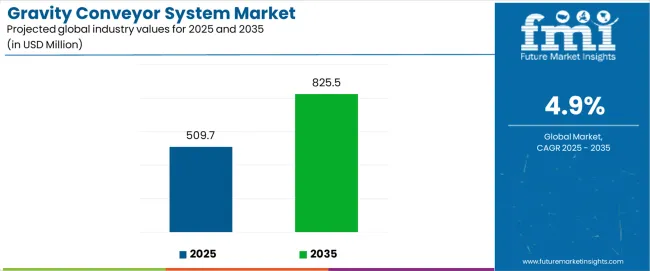

| Gravity Conveyor System Market Estimated Value in (2025 E) | USD 509.7 million |

| Gravity Conveyor System Market Forecast Value in (2035 F) | USD 825.5 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

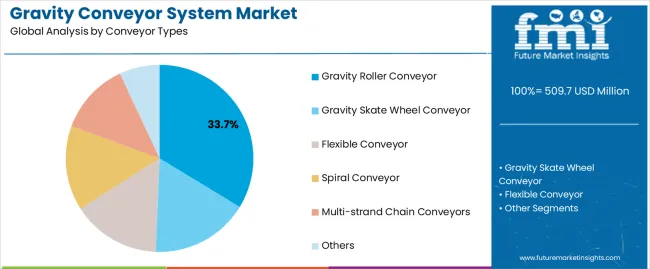

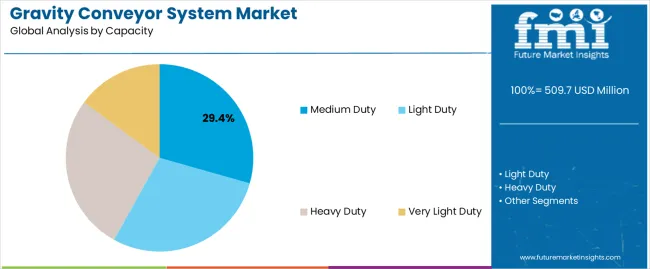

The market is segmented by Conveyor Types, Capacity, Material, Sales Channel, and End-Use and region. By Conveyor Types, the market is divided into Gravity Roller Conveyor, Gravity Skate Wheel Conveyor, Flexible Conveyor, Spiral Conveyor, Multi-strand Chain Conveyors, and Others. In terms of Capacity, the market is classified into Medium Duty, Light Duty, Heavy Duty, and Very Light Duty. Based on Material, the market is segmented into Metal, Plastic, and Others. By Sales Channel, the market is divided into Direct Channel and Indirect Channel. By End-Use, the market is segmented into Automotive, Food and Beverage, Agriculture, Industrial Machinery, Pharmaceutical, Retail, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gravity roller conveyor segment, accounting for 33.70% of the conveyor types category, has maintained dominance owing to its broad application range and cost-effective operation in industrial and warehouse settings. Its design simplicity, minimal power requirement, and adaptability to various layouts have strengthened its adoption.

Continuous improvement in roller surface finish and bearing quality has enhanced durability and reduced friction losses, leading to improved performance efficiency. The segment benefits from strong usage in packaging, assembly, and distribution centers where smooth product transfer is essential.

Customization options and modular construction have increased user preference, allowing seamless integration into both manual and semi-automated lines The segment’s sustained market leadership is expected to continue as industries prioritize energy-efficient and low-maintenance solutions to optimize workflow and productivity.

The medium duty segment, representing 29.40% of the capacity category, has emerged as the preferred configuration for industries requiring balance between load capacity and operational flexibility. Its capability to handle a wide range of product weights without compromising speed or safety has reinforced its demand across logistics, food processing, and manufacturing sectors.

Improved frame construction and precision-engineered rollers have strengthened structural reliability under medium-load conditions. Market adoption is being supported by cost efficiency and ease of installation, enabling scalability in both small and large facilities.

The segment’s steady growth is driven by increasing replacement of traditional manual handling methods with modular conveyor systems that ensure consistent throughput The medium duty configuration continues to represent a strategic choice for operators seeking efficient handling without the higher cost and complexity of heavy-duty systems.

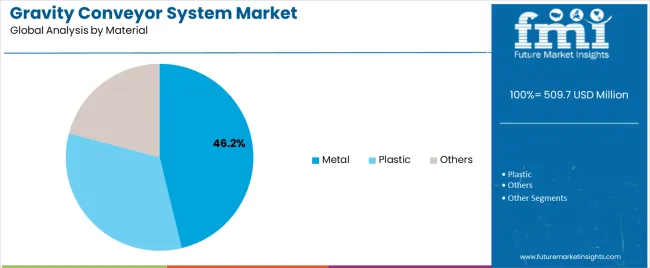

The metal segment, holding 46.20% of the material category, dominates the market due to its superior strength, durability, and ability to withstand high mechanical stress in continuous operations. Metal-based conveyors are preferred in industrial environments requiring long operational life and minimal downtime.

Corrosion-resistant coatings and advancements in steel fabrication have improved performance under demanding conditions. The segment’s market share is also reinforced by growing adoption in sectors such as automotive, packaging, and heavy manufacturing, where reliability and safety are critical.

Recent developments in lightweight metal alloys have enhanced design efficiency while reducing structural weight, enabling better portability and ease of installation Continuous investment in metal treatment and finishing technologies is anticipated to further optimize product longevity and operational stability, ensuring that the segment remains a cornerstone of gravity conveyor system deployment globally.

Market to Expand about 1.5X through 2035

The global gravity conveyor system market is predicted to expand around 1.5X through 2035, amid a 1.2% increase in expected CAGR compared to the historical one. This is due to growing demand for efficient material handling processes in several industries, including retail, manufacturing, logistics, and e-commerce.

The gravity skatewheel conveyor market is projected to continue to expand in terms of popularity. This is due to their versatility, cost-effectiveness, and ability to enhance efficiency in material handling processes across diverse industries worldwide. By 2035, the total market revenue is set to reach USD 804.4 million.

East Asia to Remain the Hotbed for Gravity Conveyor System Manufacturers

East Asia is expected to showcase considerable growth in the global gravity conveyor system market during the forecast period. It is set to hold around 41.5% of the global market share in 2025. This is attributed to the following factors:

Abundant Manufacturing Infrastructure: China and Japan offer an abundance of manufacturing infrastructure, including extensive facilities, skilled labor, and new technologies. This allows manufacturers to produce gravity conveyor systems at a competitive cost without compromising on quality standards. This strategy is likely to make China and Japan attractive locations for production.

Established Supply Chain Networks: China has a well-established supply chain network that facilitates the smooth transportation of raw materials and components. It ensures timely production and delivery of gravity conveyor systems to global markets. This enhances the country's appeal as a manufacturing hub.

Continuous Industry Growth: China's industries, such as e-commerce, logistics, and manufacturing, are experiencing robust growth. These create a consistent demand for efficient material handling solutions like gravity wheel conveyors. This further develops a fertile environment for manufacturers to flourish and innovate to meet evolving needs.

Superiority of Gravity Conveyor Rollers in Several Applications

Gravity roller conveyors are expected to be the leading type of conveyor due to their inherent simplicity, versatility, and cost-effectiveness. Compared to other conveyor types, gravity roller conveyors are more durable and can be used in a variety of applications.

Versatility of gravity roller conveyors allows them to handle a wide range of products in varying shapes and sizes. This makes them suitable for several industries, such as warehousing, distribution centers, manufacturing facilities, and retail environments.

Whether handling cartons, totes, pallets, or irregularly shaped items, gravity roller conveyors provide reliable and efficient transportation. These help in enhancing workflow efficiency and optimizing space utilization in facilities. The aforementioned factors are expected to augment the gravity conveyor roller market.

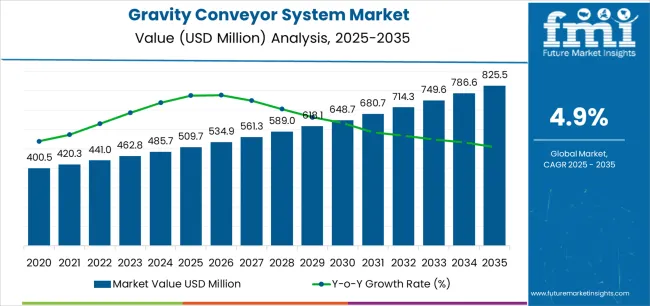

Global sales of gravity conveyor systems grew at a CAGR of 4.5% between 2020 and 2025. Total market revenue reached about USD 509.7 million in 2025. In the forecast period, the worldwide gravity conveyor system industry is set to thrive at a CAGR of 5.2%.

| Historical CAGR (2020 to 2025) | 4.5% |

|---|---|

| Forecast CAGR (2025 to 2035) | 5.2% |

Increasing Adoption by the E-commerce Sector

The global e-commerce and retail sectors are growing rapidly, which has LED to an unprecedented demand for efficient material handling solutions. Gravity conveyors have become essential assets in this landscape. These are serving as linchpins in the complex logistics operations of distribution centers and warehouses.

Innovations in gravity conveyor roller systems facilitate seamless sorting, transportation, and fulfillment of orders. This ensures a smooth and continuous flow of products, enabling firm to meet the ever-increasing expectations of customers for timely delivery.

The e-commerce sector is projected to expand, driven by increasing internet penetration, changing consumer preferences, and technological advancements. Hence, the adoption of gravity conveyors is poised to witness substantial growth.

Novel conveyors offer scalability, flexibility, and cost-effectiveness. These are set to be an ideal choice for e-commerce companies striving to optimize their operations and remain competitive in the dynamic marketplace. Ability of gravity conveyors to handle several types of products with minimal manual intervention enhances their appeal in the e-commerce sector.

As the e-commerce industry continues its upward trajectory, significance of gravity conveyors as essential components of efficient material handling solutions is set to solidify. This is anticipated to push their continued adoption and integration into warehouses.

Small and Medium Enterprises to Propel Growth

The gravity conveyor system market is witnessing significant growth, driven by increasing number of small and medium-sized enterprises (SMEs) operating across different industries. SMEs are increasingly recognizing the importance of streamlined material handling processes.

They are striving to stay competitive and meet customer demands. To do so, they are adopting gravity conveyors as a cost-effective solution. These conveyor systems enable SMEs to automate their operations efficiently. These further help in enhancing workflow efficiency and productivity, while freeing up resources to focus on core business activities.

Gravity conveyors further offer scalability, flexibility, and ease of implementation, making them an attractive option for SMEs looking to expand their operations. They can adapt to evolving company needs.

They are also set to empower SMEs to optimize their material handling processes without incurring significant upfront costs. As a result, adoption of gravity conveyors among SMEs is on the rise, augmenting the gravity skatewheel system market.

Competition from Alternative Material Handling Solutions

Although gravity conveyor systems have several advantages, they are facing stiff competition from other material handling solutions. These include powered conveyors, robotic systems, and manual handling methods.

Powered conveyors, even though they are more expensive to install and maintain, offer higher throughput rates and greater flexibility in routing & controlling the flow of products. Similarly, robotic systems provide advanced automation capabilities, allowing for intricate task handling and adaptive workflows.

Manual handling methods, even though they require more labor, are still prevalent in certain applications. These are mainly used in small-scale operations where investing in conveyor systems may not be feasible.

Gravity conveyor systems must contend with these alternatives, particularly in industries where speed, precision, or specialized handling requirements are critical. Gravity conveyor manufacturers are expected to enhance versatility, efficiency, and adaptability of their systems.

Economic Uncertainty and Volatility

Economic uncertainty and volatility pose significant restraints on the gravity conveyor system market. These are projected to influence investment decisions and capital expenditures across industries.

Fluctuations in macroeconomic factors such as GDP growth, interest rates, and consumer spending can impact demand for manufactured goods. During periods of economic downturn or instability, companies may defer or scale back investments in conveyor systems to conserve capital.

Uncertainties surrounding trade policies, geopolitical tensions, and supply chain disruptions can further exacerbate market volatility. These are likely to affect business confidence and investment sentiments.

To mitigate this restraint, manufacturers in the gravity feed roller conveyor market may need to adapt their strategies to navigate economic fluctuations. They are also focusing on diversifying their customer base and offering flexible pricing & financing options.

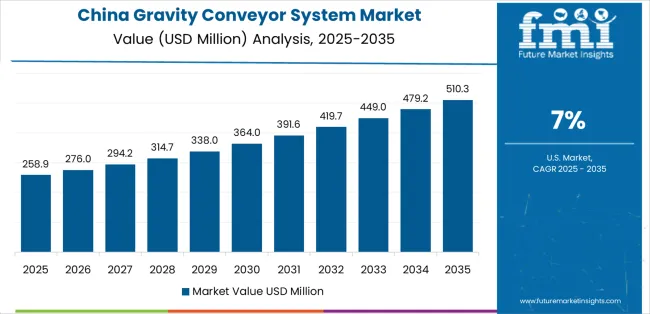

The table below highlights gravity conveyor system market revenues of several countries. China, the United States, and India are expected to remain the top three consumers of gravity conveyor systems, with expected valuations of USD 825.5 million, USD 94.9 million, and USD 86.9 million, respectively, in 2035.

| Countries | Gravity Conveyor System Market Revenue (2035) |

|---|---|

| China | USD 825.5 million |

| United States | USD 94.9 million |

| India | USD 86.9 million |

| Germany | USD 79.6 million |

| Japan | USD 68.4 million |

| United Kingdom | USD 39.4 million |

The table below shows the estimated growth rates of several countries. India, China, and Germany are set to record high CAGRs of 5.7%, 5.4%, and 4.5%, respectively, through 2035.

| Countries | Projected Gravity Conveyor System Market CAGR (2025 to 2035) |

|---|---|

| India | 5.7% |

| China | 5.4% |

| Germany | 4.5% |

| United States | 4.2% |

| United Kingdom | 4.0% |

| Japan | 3.9% |

The section below shows the gravity roller conveyor segment dominating by conveyor type. It is forecast to thrive at 5.0% CAGR between 2025 and 2035.

Based on end-use, the industrial machinery segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 5.4% during the forecast period.

| Top Segment (Conveyor Types) | Gravity Roller Conveyor |

|---|---|

| Predicted CAGR (2025 to 2035) | 5.0% |

| Top Segment (By End-use) | Industrial Machinery |

|---|---|

| Projected CAGR (2025 to 2035) | 5.4% |

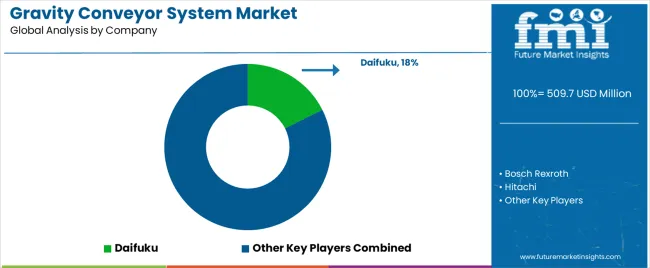

The global gravity conveyor system market is moderately consolidated, with leading players accounting for about 40% to 45% share. Bosch Rexroth, Siemens, Dematic, Rexnord, Durr AG, and Buhler Group are the leading manufacturers and suppliers of gravity conveyor systems listed in the report.

Key gravity conveyor system manufacturers are investing in research & development activities to discover novel products. They are also focusing on mergers and acquisitions to come up with innovative solutions and cater to high consumer demands.

Recent Developments in Gravity Conveyor System Market

| Attribute | Details |

|---|---|

| Estimated Gravity Conveyor System Market Size (2025) | USD 484.5 million |

| Projected Gravity Conveyor System Market Size (2035) | USD 804.4 million |

| Anticipated Growth Rate (2025 to 2035) | 5.2% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (Units) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Gravity Conveyor System Market Segments Covered | By Conveyor Types, By Capacity, By Material, By Sales Channel, By End-use, By Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, BENELUX, NORDICS, Poland, Hungary, Balkan and Baltics, Russia, India, Association of Southeast Asian Nations, Australia and New Zealand, China, Japan, Germany, Kingdom of Saudi Arabia, Other GCC Countries, Türkiye, Other African Union, South Africa |

| Key Companies Profiled | Bosch Rexroth; Hitachi; Siemens; Dematic; Rexnord; Durr AG; Buhler Group; Daifuku; FlexLink; Jungheinrich; Liebherr Group; Dorner Conveyors; Hytrol Conveyor; Fujian Gao Chuang Machinery Co.; Kardex; LEWCO |

The global gravity conveyor system market is estimated to be valued at USD 509.7 million in 2025.

The market size for the gravity conveyor system market is projected to reach USD 825.5 million by 2035.

The gravity conveyor system market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in gravity conveyor system market are gravity roller conveyor, gravity skate wheel conveyor, flexible conveyor, spiral conveyor, multi-strand chain conveyors and others.

In terms of capacity, medium duty segment to command 29.4% share in the gravity conveyor system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gravity Conveyor Market

Specific Gravity Bench Apparatus Market Growth – Trends & Forecast 2018-2027

Vibrating Gravity Feeder Market Size and Share Forecast Outlook 2025 to 2035

IV Infusion Gravity Bags Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Belt Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Conveyor Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Conveyor Maintenance Industry Analysis in Australia - Size, Share, and Forecast Outlook 2025 to 2035

Conveyor Dryer Market Growth, Trends & Forecast 2025 to 2035

Conveyors and Belt Loaders Market Growth - Trends & Forecast 2025 to 2035

Conveyor Ovens & Impinger Ovens Market

Conveyor Belt Materials Market

Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

UV Conveyor Systems Market

Pack Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Screw Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Chain Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Screw Conveyor Industry

ASEAN Conveyor System Market Growth - Trends & Forecast 2024 to 2034

Smart Conveyor Packaging Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA