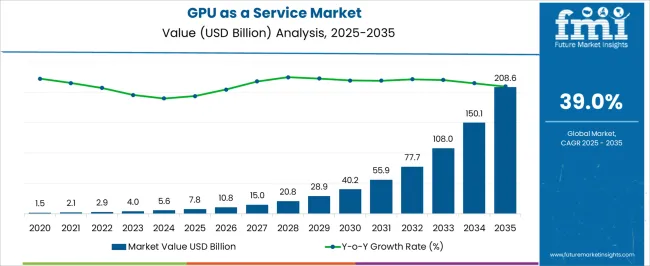

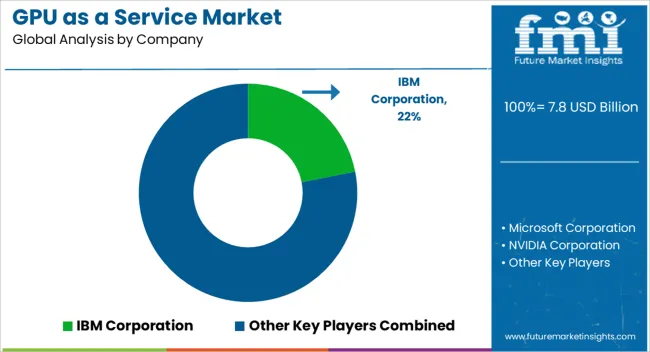

The GPU as a Service Market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 208.6 billion by 2035, registering a compound annual growth rate (CAGR) of 39.0% over the forecast period.

| Metric | Value |

|---|---|

| GPU as a Service Market Estimated Value in (2025 E) | USD 7.8 billion |

| GPU as a Service Market Forecast Value in (2035 F) | USD 208.6 billion |

| Forecast CAGR (2025 to 2035) | 39.0% |

The GPU as a Service market is witnessing accelerated growth as enterprises increasingly adopt high performance computing resources for artificial intelligence, machine learning, data analytics, and graphics intensive applications. The growing complexity of workloads, combined with the demand for cost efficient scalability, has reinforced the shift toward GPU powered cloud platforms.

Advancements in virtualization, deep learning frameworks, and high bandwidth interconnects are enabling service providers to deliver faster and more reliable GPU processing capabilities. Businesses are leveraging these services to eliminate the need for heavy upfront capital investment in hardware while still achieving flexibility and agility.

With public and private sector investments in AI infrastructure expanding globally, the market outlook remains strong, positioning GPU as a Service as a critical enabler of innovation across multiple industries including healthcare, gaming, automotive, and financial services.

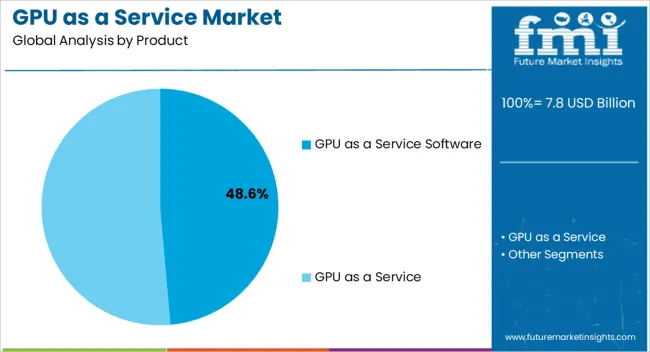

The GPU as a Service software segment is projected to contribute 48.60% of the total market revenue by 2025, making it the leading product category. Growth in this segment is being driven by the increasing adoption of software frameworks that support AI model training, simulation workloads, and real time rendering.

Software solutions enhance resource utilization and enable users to optimize GPU clusters for specific workloads without the need for extensive hardware management.

As enterprises prioritize flexibility and cost effectiveness, demand for software based GPU services continues to grow, positioning this segment as the key revenue contributor.

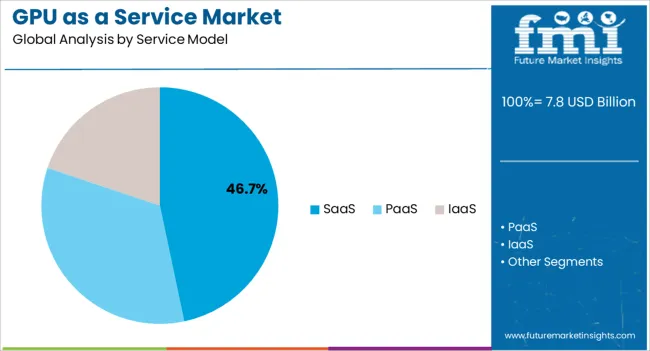

The SaaS model is expected to account for 46.70% of total revenue in 2025, reflecting its strong market positioning. Its dominance is attributed to the ability to deliver GPU resources through a subscription based approach, providing enterprises with accessible and scalable solutions.

SaaS eliminates the complexity of infrastructure management while enabling integration with diverse applications including AI training, cloud gaming, and advanced analytics.

Enterprises value the reduced upfront cost and simplified deployment that SaaS offers, making it the preferred service model within GPU as a Service.

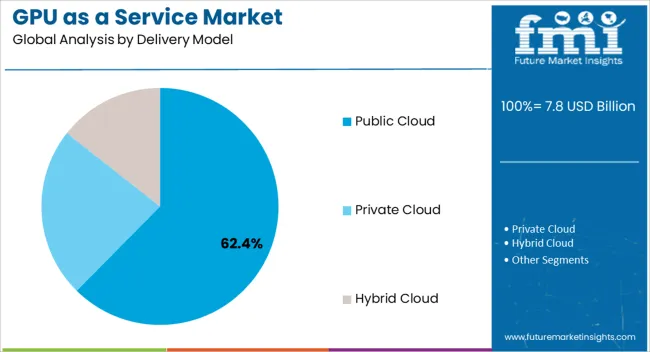

The public cloud segment is projected to hold 62.40% of total market revenue in 2025, establishing itself as the largest delivery model. This leadership is supported by the extensive reach of global cloud service providers and the rapid scalability offered to enterprises across industries.

Public cloud platforms provide on demand access to GPU resources, eliminating the need for physical infrastructure while ensuring performance flexibility. The widespread adoption of AI driven workloads and the need for global accessibility have further strengthened the preference for public cloud deployment.

As digital transformation accelerates, this segment continues to dominate due to its cost effectiveness, scalability, and ease of integration.

Increase in Number of Applications to Propel the Market Growth

The increasing popularity of GPU high-performance computing, self-driven cars, and other high-end AI applications is one of the major factors expected to accelerate the GPU as a Service industry growth during the forecast period. With the rising uptake of cloud computing, GPUs are being deployed with server CPUs to accelerate applications and improve performance. Customization and operational characteristics of the GPUaaS have created growth opportunities.

GPUaaS applications benefit from scaling to multi-GPU servers and then to GPU server clusters with network interconnects, thus augmenting the market statistics. In addition, a growing number of use cases on hardware, which include deep learning, speech recognition, natural language processing, data mining, and real-time information, are expected to fuel the market growth in the forthcoming years.

The increase in the number of applications and use cases on hardware, which includes deep learning, speech recognition, natural language processing, data mining, and real-time information, majorly drive the growth of the GPU as a Service industry. In addition, the adoption of integrated GPU used in desktops, workstations, and notebooks, attributed to the growing need for enhanced visual content by consumers, is anticipated to provide major opportunities for GPU as a Service industry growth.

Increasing Demand for IIoT to Drive the Market Growth

The growing acceptance of the Industrial Internet of Things (IIoT) in different sectors, such as manufacturing, automotive, consumer goods and others, is proliferating the trends of the GPUaaS industry and is expected to accelerate the growth of the GPU as a service industry over the analysis period.

The increasing demand for cloud-based applications, such as graphic designing, image processing, and 3D visualization, among others, is another factor expected to augment the growth of the GPU as a service during the forecast period. Industry participants offer assistance with the help of SaaS, PaaS & IaaS models for designing and developing advanced & innovative products. Additionally, supportive government initiatives for smart city development and accelerating digitalization across nations are providing significant growth opportunities for market growth.

High Incurrence of Cost and Lack of Awareness to Impede the Market Growth

A few factors are acting as roadblocks to the growth of GPU as a Service industry. One of the factors includes the high incurrence of costs, which is projected to hinder market growth.

Moreover, the need for more awareness of technologically advanced methods and their misunderstanding of the advantages of GPU as a Service are other factors limiting the market growth over the forecast period.

The lack of knowledge among the employees of industries and complex behavior of the GPU as a Service is another factor that is anticipated to hinder the growth of the GPU as a Service industry.

The global demand for GPU as a service is projected to increase at a CAGR of 40.8% in the next ten years, reaching a total of USD 119,643.4 million in 2035, according to a report from FMI. From 2020 to 2025, sales observed significant growth, registering a CAGR of 38.7%.

Surging adoption of AI across different verticals like BFSI, healthcare, and others, is considered one of the emerging trends. Major players across the GPU as a Service industry are integrating AI technology with the cloud to assist users in managing work by offering advanced security services.

The progress of big data diagnostics techniques, combined with cloud services and AI across the healthcare system, is propelling the demand for GPU as a Service. Integrating AI in GPU as a Service helps the organization improve graphics management, security, and overall productivity.

| Historical CAGR % (2020 to 2025) | 38.7% |

|---|---|

| Forecast CAGR % (2025 to 2035) | 40.8% |

Adoption of Advanced Technologies Like IoT and AI in the Region to Propel the Industry Growth

| Region | North America |

|---|---|

| Market Share % (2025) | 32.4% |

North America is slated to capture a significant chunk of the GPU as a service industry growth, flourishing at a 38% CAGR until 2035. North America is one of the earliest adopters of technologies, and the region is highly inclined toward integrating AI, IoT & robotics technologies into the manufacturing sector. Industry participants in the region are developing advanced technology products, such as IoT devices, AI chipsets, and industrial robots, with design & simulation using GPU technology, thus stimulating the regional market progress.

The GPU as a service industry demand from the public delivery model segment in the United States is estimated to register gains of nearly 25% through 2035. Growth is driven by the wide gamut of functions the public cloud model offers, ranging from basic storage, processing, and networking capabilities to artificial intelligence, Natural Language Processing (NLP), and standard office applications. The next-generation industrial solutions are focused on adopting GPU cloud-based technology to support their digital business solutions, buoying the GPUaaS public cloud market expansion.

High Traction in Gaming Applications to Fuel the Market Growth

The GPU as a Service market in the Asia Pacific is expected to capture a market share of 33.5% by 2035. The Asia Pacific is a robustly flourishing region in the GPU as a Service industry, attributed to countries such as Japan heading high in the gaming arena.

In Japan, the gaming application segment held a substantial market share in 2025. GPUaaS in Japan is gaining high traction in gaming applications owing to its capability to calculate vast information in a shorter duration, thereby enhancing gaming performance. GPUaaS platforms offer unmatched server uptime stability and amazing visual effects for gamers.

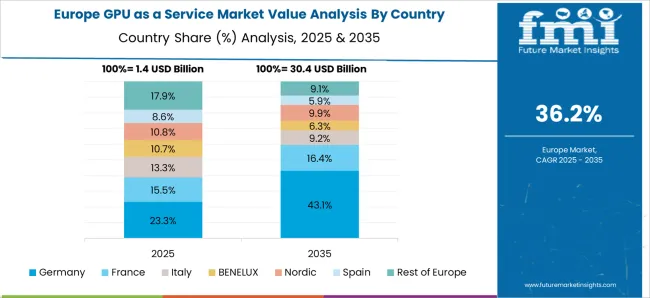

Rising Growth of Software Segment to Reaffirm Growth in Europe

| Region | Europe |

|---|---|

| Market Share % (2025) | 25.1% |

The GPU as a Service industry in Europe is projected to capture a market share of more than 25.1% in 2025, owing to the increasing software segment in the countries such as the United Kingdom and Germany.

The CAD/CAM software segment in the United Kingdom is poised to generate more than USD 208.6 million in revenue by 2035. The high demand for hardware performance among professional users (such as engineers and CAD designers) compared to gamers and general consumers is propelling the usage of GPUaaS across the CAD/CAM industry.

In Germany, the SaaS service model segment is likely to account for about 45% of the GPU as a service industry by 2035, impelled by the large-scale adoption of cloud-based GPU computing solutions by end-users. The usage of the SaaS model in the cloud computing market is also fueled by increased demand for Customer Relationship Management (CRM) software. SaaS has become a feasible choice for small & medium businesses with limited financial resources credited to low subscription prices and hardware flexibility.

Simulation Segment of GPU as a Service to Beat Competition in Untiring Markets

The simulation segment is projected to grow at around 39.3% CAGR over the analysis timeline, attributed to the surging adoption of advanced technologies such as augmented reality, 3D printing services, and virtual reality. In 2025, the digital video segment accounted for a market share of about 7.97%. The segment is slated to witness optimistic expansion through 2035.

Digital video enables the real-time acquisition, processing, and delivery of high-resolution videos in different video broadcast environments, which is likely to boost segmental growth in the coming years.

Updates and Maintenance to Constitute the Bulk of the GPU as a Service Market

By service, the updates and maintenance segment of the GPU as a service industry is expected to hold a market share of nearly 25% in 2025 and is speculated to showcase a solid growth trajectory during the forecast period. Companies operating in the GPUaaS market focus on regularly updating their product offerings with the latest improvements, which is anticipated to boost the growth of the GPU as a Service over the analysis period.

Real-Estate constitutes the Bulk of the Market

By application, the real-estate segment is poised to witness substantial growth at more than 36.1% CAGR during the analysis period, owing to the advent of new technologies in the real-estate sector, such as drones and augmented reality.

Providers of GPU as a Service such as Graphistry, Polystream, Cloudalize, Vectordash, HashPro, Run: AI, and MapD, among others, are employing marketing strategies like new product launches, merger and acquisitions, geographical expansions, collaboration, and partnerships. By doing so, the companies are expected to identify what piques consumer interest and create a larger customer base. For example,

In July 2025, Run:ai, the well-funded service for orchestrating AI workloads, partnered with NVIDIA, to support its customers in running their inferencing workloads as efficiently as possible, whether that’s in a private or public cloud or on the edge. With this partnership, the company’s platform also integrates with Nvidia’s Triton Inference Server software.

Prominent players in the GPU as a Service industry are IBM Corporation, Microsoft Corporation, Nvidia Corporation, Intel Corporation, Qualcomm Incorporated, Fujitsu Ltd., ARM Holdings PLC, Samsung Electronics Co., Ltd., Taiwan Semiconductor Manufacturing Company Ltd., and Imagination Technologies Ltd., among others.

Recent Developments:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 39.0% from 2025 to 2035 |

| Market Value in 2025 | USD 7.8 billion |

| Market Value in 2035 | USD 208.6 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product, Service Model, Delivery Model, Application, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | IBM Corporation; Microsoft Corporation; NVIDIA Corporation; Intel Corporation; Qualcomm Incorporated; Fujitsu Ltd.; ARM Holdings PLC; Samsung Electronics Co., Ltd.; Taiwan Semiconductor Manufacturing ; Company Ltd.; Imagination Technologies Ltd. |

The global GPU as a service market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the GPU as a service market is projected to reach USD 208.6 billion by 2035.

The GPU as a service market is expected to grow at a 39.0% CAGR between 2025 and 2035.

The key product types in GPU as a service market are GPU as a service software, _cad/cam, _simulation, _imaging, _digital video, _modeling & automation, _others, GPU as a service, _managed service, _updates & maintenance, _compliance & security and _others.

In terms of service model, saas segment to command 46.7% share in the GPU as a service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Center GPU Market Size and Share Forecast Outlook 2025 to 2035

Aseptic IBC Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Packaging Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Liquid Packaging Boards Market Size and Share Forecast Outlook 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Asphalt Mixing Plants Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Aspirating System Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Astringent Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Aseptic Containment Systems Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asphalt Mixing Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Aspirin Drug Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA