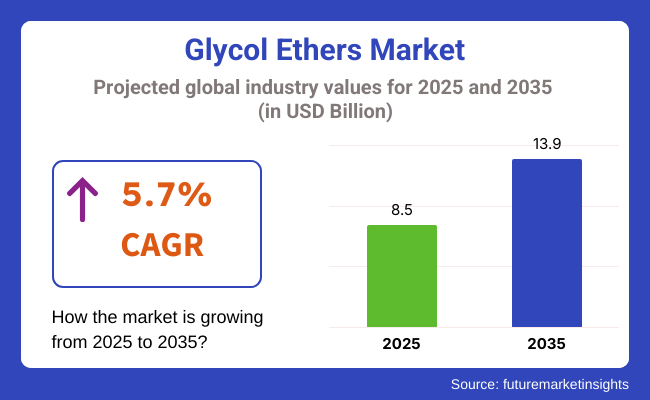

The global glycol ethers market is projected to grow from USD 8.5 billion in 2025 to USD 13.9 billion by 2035, progressing at a CAGR of 5.7%. This growth has been attributed to rising consumption across high-performance coatings, inks, and industrial cleaners. Demand has increased for glycol ethers such as propylene glycol methyl ether (PM) and ethylene glycol butyl ether (EB) due to their solvency, low toxicity, and evaporation control in formulation-intensive industries.

Use of glycol ether in water-based paints and coatings carries significant potential. Architectural coatings have adopted glycol ethers due to regulatory pressure on volatile organic compounds (VOCs). In a 2025 update, BASF confirmed that its latest formulation for low-VOC paints relies on methyl ether derivatives to meet EU Green Deal targets. Similarly, Sherwin-Williams noted in a Q1 2025 press release that glycol ethers contributed to their 12% growth in eco-efficient coatings for the European construction sector.

In the electronics industry, glycol ethers have been used in semiconductor photoresists and solder fluxes. Increasing semiconductor production across East Asia has driven demand. In a January 2025 briefing, Lotte Fine Chemical reported a 9.4% increase in glycol ether consumption in photolithographic applications. The trend reflects a shift toward high-reliability solvents required in microfabrication processes.

In pharmaceuticals, propylene-based glycol ethers have been used as carriers in topical formulations and transdermal patches. According to a March 2025 update from CRODA International, glycol ether derivatives have been integrated into new drug delivery systems aimed at enhanced dermal penetration with minimal irritation. These compounds, according to CRODA’s Head of R&D, “allow formulators to balance volatility, polarity, and safety-without compromising on drug efficacy.”

Regionally, Asia Pacific stands as a lucrative region for glycol ether demand, led by China and India’s industrial sectors. Strategic investments in glycol ether capacity have been reported. China’s Jiangsu Hualun Chemical confirmed the expansion of its EB and PM production units in April 2025, citing rising domestic demand from automotive OEMs and electronics manufacturers. In India, Aarti Industries disclosed in its 2025 earnings statement that glycol ethers formed a key component in its 17% year-over-year solvents segment growth.

However, regulatory scrutiny over workplace exposure and biodegradability has persisted in the industry. The European Chemicals Agency (ECHA) has continued evaluations under REACH for certain glycol ether types with reprotoxic concerns. Producers have responded with newer formulations prioritizing bio-based sources and faster degradation profiles.

Based on Type the glycol ethers segment is primarily bifurcated into E-series and P-series glycol ethers holds a 31.9% value share in global segment in 2025. The P-series segment usually dominates revenue generation, as it is widely employed in traditional uses such as paints and coatings, and cleaners. Its solid solvency properties make it a favourite across industries.

Conversely, the E-series segment is growing quite quickly and is aided by low toxicity and environmental compatibility. This has led to demand in sensitive applications including the pharmaceuticals, cosmetics and personal care product spaces. Growing manufacturer’s investment in R&D to enhance the performance & sustainability of E-series glycol ethers makes it attractive in the landscape with stringent environmental regulations.

In terms of application, the paints and coatings segment holds the majority share of the segment with approximately 53.7% value share in 2025. They enhance properties such as drying time, gloss, and stability, making them a mainstay in the formulation of architectural and automotive coatings. On the other hand, the pharmaceutical segment is projected to register significant growth since these solvents play an important role in drug formulation processes due to their striking purity and solvent strength.

The cosmetics and personal care segment is also witnessing growth as consumer preferences change toward eco-friendly and low-VOC ingredients. Other applications like printing inks and industrial cleaners also play a role in the sector, but to a lesser extent as compared to the dominant segments.

The end-use industries closely mirror the application segments, with paints and coatings being the leading consumer of glycol ethers worldwide. This sector thrives due to constant growth from infrastructure and automotive production. The pharmaceutical sector is becoming one of the most dynamic sectors due to the increasing healthcare spending coupled with the technological advancement demanding more efficient, high-quality, sustainable solvents.

Furthermore, the personal care and cosmetics industry is reflecting continued growth in the utilization of glycol ethers for their performance and environmental attributes. Industrial and automotive applications continue to experience strong demand for effective cleaning agents and protective coatings. However, together these trends tell a picture of a dynamic landscape where innovation and regulatory compliance are both keys to winning in leading segments and driving growth in a fast-moving sector.

This comprehensive survey and series of expert interviews with key stakeholders in the glycol ethers landscape, including manufacturers, end-users, and distributors, reveal that Future Segment insights has been at the forefront of conducting in-depth research on how the glycol ethers are used and what are the reasons of the growth of the glycol ethers industry over time.

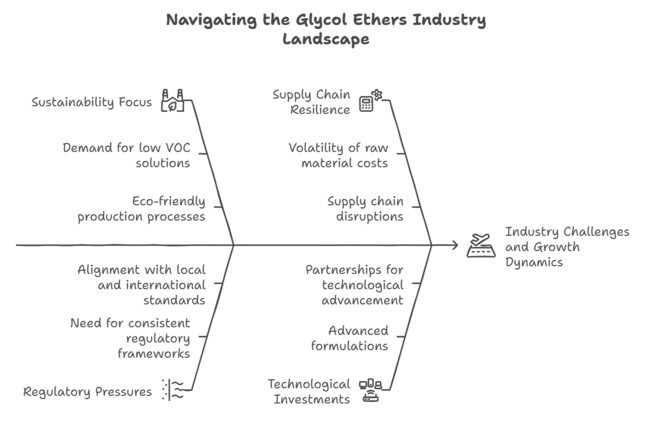

The survey findings also indicated that companies are placing more focus on sustainable production application processes, and continuously investing in advanced formulations to address the changing needs of end-use sectors like paints, coatings, and personal care products. According to stakeholders, supply chain resiliency/volatility of raw material costs are key challenges, while demand for low VOC, eco-friendly solutions is the main growth driver.

Interviews with insiders underlined a trend toward partnerships and technological investment as companies seek to meet tightening environmental rules. According to many respondents, regulatory pressures and consumer demand for greener chemicals have already forced them to realign production strategies. They also emphasized that proactive investments in R&D are key in sustaining a competitive edge and adhering to local and international standards.

And industry dynamics may stabilize, but the discussions highlighted regulators need a consistent framework instead of the push and pull of policies. Participants also called for a more coherent dialogue between industry players and regulatory agencies to help mitigate compliance challenges and foster on-going innovation. The news is also anticipated to move the segment forward, as these partnerships align production processes with essential sustainability goals of the future.

| Countries | Regulation |

|---|---|

| United States | EPA guidelines on VOC emissions require lower-VOC solvents and drive sustainable production practices. |

| European Union | REACH and CLP regulations restrict toxic substances, compelling reformulation towards eco-friendly options. |

| China | Stringent industrial emission standards, such as the Air Pollution Prevention and Control Action Plan, are driving cleaner manufacturing processes and enforcing stricter regulatory compliance. |

| India | Environmental thresholds for hazardous chemicals influence product formulation and safety standards. |

| 2020 to 2024 (Past Industry Trends) | 2025 to 2035 (Future Industry Projections) |

|---|---|

| The industry experienced volatility due to COVID-19, with supply chain disruptions and fluctuating raw material prices affecting production and pricing. | The industry is expected to achieve steady growth, driven by rising global demand for sustainable, low-VOC solvents across paints, coatings, pharmaceuticals, and personal care sectors. |

| Early shifts toward eco-friendly, low-VOC formulations were initiated as companies adapted to stricter environmental regulations. | Significant R&D investments and advanced technological innovations (e.g., catalyst improvements and energy-efficient processes) will enhance product performance and operational efficiency. |

| Moderate investments were made in digitalization, capacity expansion, and process optimization to stabilize operations during the recovery phase. | Expansion into emerging segments will be bolstered by supportive government policies and stricter environmental standards. |

| Adoption of initial sustainable practices set the foundation for later innovations. | Long-term strategic investments will reinforce supply chain resilience and sector competitiveness, ensuring robust growth through 2035. |

Industry leading organizations involved in glycol ethers are focusing on pricing, innovation, strategic partnerships as well as global expansion. While cost leadership, offering competitive prices based on production optimization, is a strategy pursued by some firms, other firms differentiate themselves by providing high-performance, eco-friendly glycol ethers designed for the increasingly competitive and sustainable sector.

Firms are investing heavily in R&D to create low-VOC glycol ethers, which are volatile organic compounds, as well as bio-based alternatives to meet the demand for more environmentally friendly solutions.

While growth strategies differ between the leading players, mergers and acquisitions, as well as joint ventures, have emerged as key components of penetration. Leading manufacturers are entering into collaborations with chemical distributors, automotive companies, and electronics manufacturing entities to develop their supply chain capabilities and realize enhanced industry penetration.

We are focusing on expanding into the emerging segments, specifically in Asia-pacific and Latin America, where industrialization and urbanization are key drivers. Additionally, some of the firms are increasing production and constructing new facilities to cater to increasing demand with supply chain resiliency. Digitalization and intelligent manufacturing is in an embryonic stage but picking up speed quickly, as companies can potentially streamline operations and surpass stakeholders in a cutthroat business environment.

Leading companies in the market include BASF SE, Dow, Eastman Chemical Company, Shell, and LyondellBasell Industries Holdings B.V. Through continued investments in innovation, partnerships, and expansion into developing segments, these companies will likely continue to hold their prominent positions.

Other key players in the glycol ethers segment as of 2024 include BASF SE, Dow, and Eastman Chemical Company, with BASF SE holding the largest share of the industry due to its strong production ability and variety of product absorption. In a similar fashion, Dow and Eastman Chemical Company placed second, increasing their sector share with strategic alliances and regional growth.

Shell and LyondellBasell also claimed some firm positions on the strength of their vertically integrated supply chains and international distribution networks. In 2025, these industry giants are expected to build on their leadership positions, spurred throughout the year by capacity expansions, acquisitions, and product development, especially in the environmentally friendly and high-performance glycol ethers industry, propelled by growing environmental regulations.

July 2024 was an extraordinary month for mergers and acquisitions within the pharmaceutical industry that can impact the glycol ethers industry. Merck also purchased Eyebiotech Limited (EyeBio) for a maximum of USD 3 billion, and Thermo Fisher Scientific Inc. finalized its USD 3.1 billion purchase of Olink Holding AB, a next-generation proteomics solutions provider.

These strategies are projected to create lucrative demand for glycol ethers, since they are used as key solvents in pharmaceutical production operations. The demand for window and door films is anticipated to rise across various industries, including but not limited to automotive, electronics, personal care, and pharmaceuticals, indicating the strong growth of the industry and the strategic efforts made by companies to cater to changing industry needs.

Dow Chemical Company (USA)

Lyondell Basell Industries (Netherlands)

BASF SE (Germany)

Eastman Chemical Company (USA)

Shell Chemicals (Netherlands/UK)

Sasol Limited (South Africa)

With its strong demand in multiple end-use sectors including paints & coatings, pharmaceuticals, and personal care and industrial cleaning, the United States is a critical for glycol ethers. In 2025, the United States will likely hold a 29% share of the global glycol ethers sector. In response to increasingly strict environmental regulation, USA manufacturers have invested in technology to decrease VOCs and improve sustainability.

The USA segment has a well-established R&D infrastructure and robust protections for intellectual property that incentivize on-going product development. The space is crowded with move, large multinationals and agile regional players, all using advanced manufacturing processes and supply chain optimization to control the price fluctuations of raw materials.

With growing consumer demand for green products, USA manufacturers will most likely further optimize their production capacities and improve the quality of products, thus strengthening the country’s competitive position in the global glycol ethers industry.

Glycol ethers market in the United Kingdom is characterized by a well-developed regulatory framework and an established chemical sector shows a 3.8% share of the global sector in 2025. UK firms have responded by investing in greener production technologies and collaborating with the international community to improve their competitive standing. The UK offers a geographical advantage as a gateway to Europe, enabling substantial export activity and attracting overseas investment.

Demand is supported by strong paints and coatings industry, as well as increasing requirements in personal care and other industrial applications. The UK firms, meanwhile, have also benefited from digital technologies that have enabled them to improve efficiency and optimize supply chains.

The opening of the new facility, coupled with a growing focus on sustainability, shows that local industry players are still prioritizing product quality, even among increasing post-Brexit challenges and regulations. By concentrating on innovation and efficiency, this aims to create long-term growth and ensure the UK emerges as a formidable player in the global glycol ethers segment.

The region which holds the second-largest share of the total landscape, France, acts as a landscape for glycol ethers due to the country's robust industrial sector and environmental sustainability initiatives. French firms have a long-standing reputation for high-quality chemical products and have continued to invest large amounts into R&D to create eco-friendly glycol ether formulations that adhere to strict EU legislation including REACH and CLP.

The country’s chemical business may be integrated and efficient, with a heavy concentration on the manufacture of solvents that play essential roles in paints and coatings, personal care and industrial merchandise. French manufacturers are increasingly adopting advanced, energy-efficient production techniques to reduce environmental impact while maintaining competitive prices.

In addition, partnerships between industry members and academia are driving innovations that improve solvent performance and sustainability. This transition towards greener technologies is further aided by government policies and financial incentives. France's involvement in the global glycol ethers industry reflects a balancing act between regulatory scrutiny and technological innovation, solidifying the country's role as a significant player in this competitive landscape.

Germany dominates the glycol ethers industry and is expected to hold a 9.9% share in the landscape, with its highly developed and world-class chemical industry and a focus on technology-driven solutions. Development of high-performance, low-VOC glycol ethers which meet the stringent requirements of critical end-use sectors, such as automotive, industrial coatings and electronic, is led by manufacturers in Germany.

Tight environmental controls in Germany and the rest of the European Union have led companies to make their production processes cleaner and more sustainable, so that not only do products perform well, but they also meet changing legal standards. In addition, Germany’s strong focus on exports deepens the competitive advantage, since high-grade, environmentally friendly glycol ethers are in demand all over the world.

Germany's Commitment to Innovation, Research and Development, Industry Collaborations, and Efficient Supply Chains Germany is well-positioned to maintain its leadership position in the global glycol ethers segment, with a focus on research and development, industry collaborations, and efficient supply chains driving innovation and sustained growth.

Italy’s glycol ethers market reflects the country’s long-established expertise in chemical design and manufacturing, with a particular focus on high-quality glycol ethers for applications in paints, coatings, and specialty formulations. Italy's tradition alluded that companies producing high-quality glycol ethers for paints, coatings, and specialty formulations successfully combine tradition with technology.

Higher investments in automation and process optimization have lessened energy consumption and improved product’s uniformity, aiding in cost competitiveness. The Italian sector also has the advantage of its position in Europe, allowing for both domestic and international access.

Technological capabilities have also been further enhanced by collaborative ventures in product innovation between local firms and multinational corporations. Italian manufacturers remain committed to mitigating the impact of inconsistent raw material prices and regulatory actions by focusing on sustainable and efficient business strategies that foster long-term industrial growth and stability in the glycol ethers industry.

South Korea, backed by advanced industrial infrastructure and increasing technological innovation, has become a key player in the glycol ethers sector. South Korean companies scaled production capacity in core sectors, including electronics, automotive, and high-performance coatings.

Domestic environment regulations have forced manufacturers to shift their focus towards low-VOC and sustainable glycol ether formulations that are necessary for use in sensitive applications like semiconductor fabrication. In addition, proactive governmental support, such as tax incentives and funding programs, has ensured that innovation in production processes and product quality has taken place even quicker.

Global strategic alliances and joint ventures with industry pioneers enhanced South Korea’s competitive strength in the global arena. Sustained investments in advanced technologies and sustainable practices will not only strengthen South Korea's competitiveness but also expand its global footprint in the glycol ethers industry.

The glycol ethers landscape in Japan has always been marked by precision, high quality, and continual evolution. Japanese companies focus on manufacturing high quality glycol ethers for high-end applications in automotive, electronics and personal care sectors. In 2025, Japan’s share is projected to reach 8.7%.

The emerging solvent formulations that offer no less than low VOC and high performance are a result of extensive R&D investments required to meet not only the country’s strict environmental regulations but also high consumer expectations. Japanese companies leveraged tech advancements throughout their manufacturing, aiming to streamline processes and lower their carbon footprints.

Collaborations with research institutions, both domestic and international, have played a key role in catalyzing product innovation. In addition, Japan has a long-established supply chain and logistical system, allowing for a reliable production and distribution. Japan is a leader in producing specialty chemicals with its meticulous quality control and continuous improvement tradition.

With an unwavering focus on sustainability, the country is poised to retain its competitive edge, ensuring that its glycol ethers align with international standards and remain a driving force in segment growth in an increasingly environmentally aware global landscape.

China's expanding presence in the construction, coatings, and cleaning products segments is expected to drive significant demand, with the country's market share projected to reach 4.5%. Ether-based solvents in China, one of the largest and growing industries for the specific chemical compound in the world. Chinese producers increased production to satisfy soaring domestic demand in high-technology sectors, including paints and coatings, electronics, and personal care.

The global government initiatives to tackle industrial pollution have further accelerated the transition to low-VOC glycol ethers, leading to prominent investments in new environmentally-friendly production processes. China’s extensive R&D efforts and pro-industry policy environment have allowed its companies to produce diverse types of glycol ether products suitable for all industrial and consumer applications.

China’s leverage in the supply chain, coupled with its logistics efficiency, has further enhanced its competitive advantage in relevant/global sector. Competition for segment shares is stiff, partly due to the held innovation and pricing, with rivalry from state-owned enterprises and private ones alike. With evolving regulatory frameworks and stricter environmental regulations, Chinese manufacturers are likely to further optimize their processes and improve product sustainability, reinforcing their place in the global glycol ethers sector.

In Australia and New Zealand, the glycol ethers market is driven by steady growth and commitment to environmental sustainability. Demand from paints and coatings, industrial cleaning, and personal care sectors provides strong support to the industry. Numerous companies invest in modern production technologies and sustainable practices due to the sophisticated regulatory landscapes and innovation culture in Australia and New Zealand.

Local companies have reduced waste and energy output in production, which increases product quality and improves cost-effectiveness. The strategic location of the region also allows for exports to Asia and other developed sector, further propelling the growth of the segment.

Green Chemistry and innovation through competition between industries and government undertaking are driving R&D in the area. The growth of the glycol ethers segment in Australia and New Zealand can be attributed to the rising consumer demand for environmentally friendly products and technologies, leading glycol ethers companies to invest in sustainable product development and innovation, further supporting industry expansion in Australia and New Zealand.

The glycol ethers landscape is categorized under specialty chemicals, which include solvents. This is vital for sectors that demand high-performance, low-VOC formulations for paint, coatings, pharmaceuticals, and personal care products.

he glycol ethers industry is driven both by industrial growth and global macro-economic trends and the gradual transformation of environmental regulation. Growing economic conditions in emerging industries are supporting infrastructure development and raising industrial growth, increased demand for high-quality solvents.

For instance, developed regions are focusing on sustainability and, therefore, promoting innovations that attract investments for sustainable and eco-friendly glycol ether formulations that could meet stringent regulations. This dual demand phenomenon stimulates industrial modernization of developing sectors & advanced sustainability initiatives of developed segment are driving the growth of the sector.

The dynamics of global trade matter quite a bit as well. Fluctuation in raw material prices, especially those related to petroleum derivatives, affects the cost of production and the potential profitability of the entire landscape directly. Furthermore, technological innovations and strategic alliances are helping manufacturers to streamline the supply chains and minimize price variation.

Manufacturers are forced to innovate for more R&D and production processes as environmental policies tighten throughout key regions, while governments provide a plethora of incentives for green technologies. In conclusion, these macro-economic drivers reflect a healthy, growing segment that is adapting to both technological changes as well as sustainability imperatives, which should ensure long-term competitive viability across global industries.

As more industries embrace the need for sustainable and high-performing solvents, the glycol ethers industry is projected for dramatic advancement. Increasing global environment concerns and stringent regulatory standards are forming a decisive movement toward low-VOC, greener glycol ethers particularly in the sectors of paints & coatings, pharmaceuticals and personal care.

Also, process and catalyst advancements in technology have provided opportunities to improve production efficiency and lower operating costs. Industrialization in emerging industries, especially Asia-Pacific has fueled this growth as the country never stops the construction of infrastructure and consumer products remain an undisputed factor in all markets. R&D spending is on the rise, allowing the development of new formulations customized to specific end-use needs, which is generating opportunities in niche industries for specialized glycol ethers.

To capitalize on these growth prospects, industry players should focus on sustainable innovation and process efficiency. Companies must invest in advanced R&D to develop next-generation, low-VOC glycol ether products that not only comply with evolving regulations but also offer superior performance.

Optimizing supply chains and diversifying raw material sourcing can help mitigate the impact of price volatility and ensure operational resilience. Strategic partnerships with technology firms and regional distributors can broaden sector reach and accelerate product commercialization.

Moreover, leveraging digital transformation tools for data analytics and process automation will enable better decision-making and improved competitiveness. By aligning their strategies with industry trends and regulatory demands, companies can secure a competitive edge and drive long-term, profitable growth in the rapidly evolving glycol ethers segment.

E-series, P-series, Propylene Glycol Methyl Ether, Propylene Glycol Propyl Ether, Propylene Glycol Methyl Ether Acetate, Propylene Glycol Phenyl Ether, Others

Solvent, Anti-icing, Hydraulic & Brake Fluid, Chemical Intermediates

Semiconductors, Paints and Coatings, Printing, Pharmaceuticals, Cosmetics & Personal Care, Others

North America, Europe, Asia Pacific, Middle East & Africa, Latin America

The increasing demand from the paints & coatings, pharmaceuticals, and cosmetics industries, along with the shift toward eco-friendly solvents, is fuelling industry expansion are the key factors driving the growth of glycol ethers.

The paints & coatings, printing, pharmaceuticals, and cosmetics industries are major consumers due to glycol ethers’ solvent properties and low toxicity.

With stricter environmental regulations and growing industrial applications, demand is projected to rise, particularly for low-VOC and bio-based glycol ethers.

Asia-Pacific is leading the growth due to rapid industrialization, while North America and Europe are seeing increasing demand for sustainable and regulatory-compliant alternatives.

Fluctuating raw material prices, regulatory restrictions on certain glycol ether types, and the availability of alternative green solvents could pose challenges to industry expansion.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use Industry, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use Industry, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use Industry, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glycolic Acid Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Glycol Monostearate Market Insights – Growth & Industrial Applications 2025 to 2035

Glycolic Acid Peel Market Insights – Growth & Forecast 2024-2034

Thioglycolate Market Analysis Size and Share Forecast Outlook 2025 to 2035

Polyglycolic Acid Market

Thioglycolic Acid Market

Hydroglycolic Extracts Market

Water Glycol Based Electric Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

Butyl Glycol Market Growth - Trends & Forecast 2025 to 2035

Ethylene Glycol Market Forecast and Outlook 2025 to 2035

E-Series Glycol Ether Market Size and Share Forecast Outlook 2025 to 2035

Hexylene Glycol Market Trends 2025 to 2035

Caprylyl Glycol Market Growth – Trends & Forecast 2024-2034

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Global Neopentyl Glycol (NPG) Market Analysis – Size, Share & Forecast 2025–2035

Propylene Glycol Methyl Ether Market

1,3-Butylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Monoethylene Glycol MEG Market Size and Share Forecast Outlook 2025 to 2035

Polyalkylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA