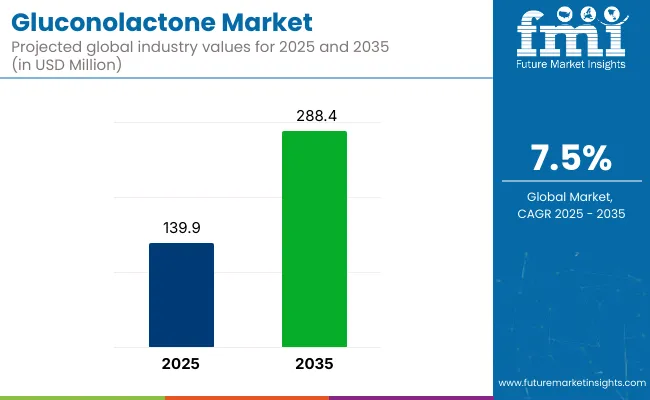

The gluconolactone market is valued at USD 139.9 million in 2025 and is expected to reach USD 288.4 million by 2035, registering a CAGR of 7.5%. The market expansion is being by increasing usage in food & beverages as a coagulant, preservative, and acidity regulator.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 139.9 Million |

| Projected Market Size (2035) | USD 288.4 Million |

| CAGR (2025 to 2035) | 7.5% |

The demand is rising as companies are increasingly adopting non-synthetic gluconolactone for clean-label food formulations and integrating high-purity grades in pharmaceuticals and cosmetics for their mild exfoliation and stabilization benefits.

The market holds an approximately 0.14% of the share global food additives market and around 0.93% of the share of the personal care ingredients market. Its share in the pharmaceutical excipients market stands at 1.17%, while it contributes about 0.25% of share in theclean-label ingredients market. In the skincare active ingredients segment, its presence is more prominent at roughly 4%. However, in the global specialty chemicals market, gluconolactone's share remains minimal, below 0.02%.

Government regulations impacting the market focus on safety and quality across applications in food, pharmaceuticals, and cosmetics. Regulatory bodies, such as the USA Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), have approved gluconolactone as a Generally Recognized as Safe (GRAS) substance for use in food products.

In the cosmetics sector, it must comply with guidelines set by the Cosmetic Ingredient Review (CIR) and EU Cosmetic Regulation (EC) No 1223/2009. Manufacturers must also adhere to Good Manufacturing Practices (GMP) and labeling standards to ensure compliance and consumer safety.

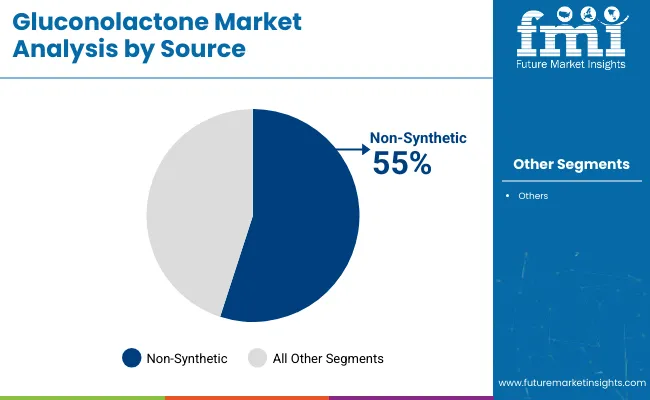

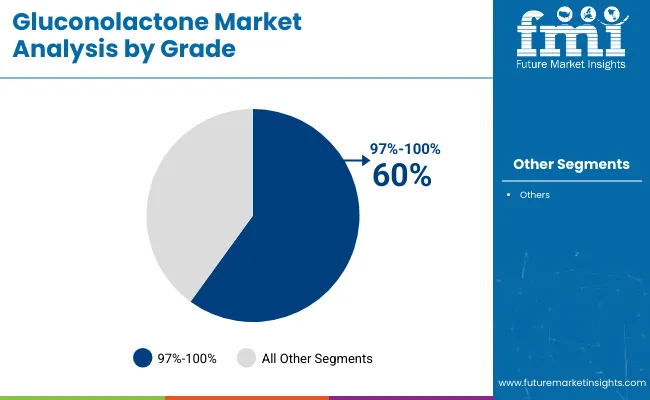

The gluconolactone market is segmented by source, grade, end-user, and region. By source, the market is divided into synthetic and non-synthetic. Based on grade, the market is bifurcated into 97%-100% and 100%-102%.

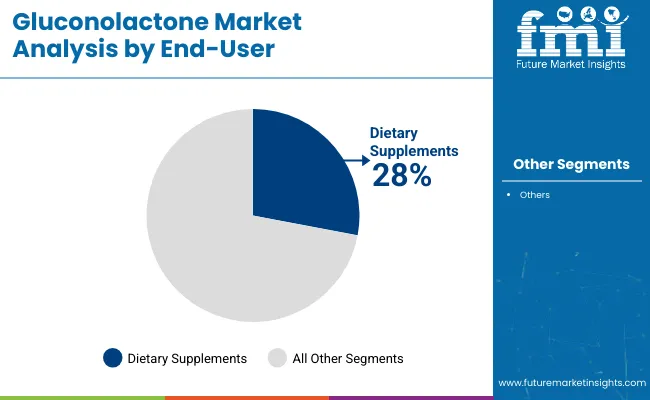

In terms of end-user, the market is segmented into dietary supplements, pharmaceuticals, cosmetics, energy drinks, and food (tofu, meat products, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

The non-synthetic is projected to lead the source category, accounting for over 55% of the market share by 2025. These are derived from natural fermentation processes, preferred for its clean-label positioning in food and beverages, and for use in mild, non-irritating cosmetics formulations.

The 97%-100% segment is expected to lead the grade segment, capturing approximately 60% of the market share by 2025. This grade is widely used in food applications as an acidity regulator and preservative, and in cosmetics for stable formulation performance.

The dietary supplements are expected to capture 28% of the market share in 2025.

The gluconolactone market is experiencing steady growth, driven by the rising demand in food & beverage preservation, clean-label cosmetics formulations, and pharmaceutical excipient applications.

Recent Trends in the Gluconolactone Market

Challenges in the Gluconolactone Market

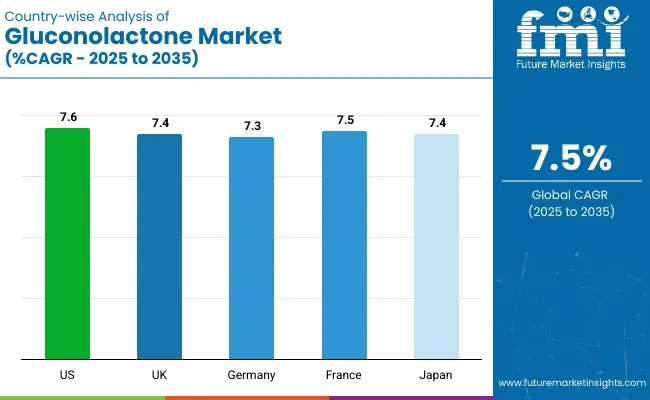

The USA leads the gluconolactone market driven by strong demand in clean-label food preservation and cosmetic formulations, supported by high-precision manufacturing and applications in tofu, skincare, and health supplements. France (7.5% CAGR) remains a key player due to rising cosmetic and pharmaceutical use, while Germany (7.3%) and the UK (7.4%) also contribute significantly.

Germany’s momentum stems from food processing and premium skincare, bolstered by EU Green Deal incentives, while the UK focuses on functional beverages and wellness-driven cosmetics. These developed economies not only generate domestic demand but also actively export and distribute gluconolactone for industrial and consumer use.

Regulatory alignment, smart manufacturing, and clean-label trends shape their strategies. With robust demand across sectors and countries maintaining growth rates between 7.3%-7.6%, the global gluconolactone supply landscape is led by technologically advanced and regulation-compliant markets..

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA gluconolactone revenue is growing at a CAGR of 7.6% from 2025 to 2035. Growth is driven by increasing use in clean-label food preservation, skincare formulations, and pharmaceutical excipients.

The UK gluconolactone market is forecast to expand at a CAGR of 7.4% over the forecast period.The demand is driven by food preservation, clean beauty trends, and increasing use in functional beverages.

The sales of gluconolactone in Germany are projected to grow at a CAGR of 7.3% from 2025 and 2035. The growth is driven by strong demand in the food processing and cosmetics sectors.

The French gluconolactone market is expected to grow at a CAGR of 7.5% from 2025 to 2035. The growth is supported by its use in cosmetics, pharmaceuticals, and specialty food applications.

The sale of gluconolactone is expected to grow at a CAGR of 7.4% from 2025 to 2035. Growth is driven by demand in tofu production, cosmetics, and functional food products.

The gluconolactone market is moderately consolidated, with a mix of global leaders and niche regional producers driving competitive dynamics through high-purity formulations, AI-integrated manufacturing processes, and efficient bio-based production techniques.

Tier-one companies such as Jungbunzlauer Suisse AG, Fuso Chemical Co., Ltd., Roquette Frères, Merck KGaA, and Sigma-Aldrich (Merck Group) are leading the way by investing in precision fermentation, pharmaceutical-grade purity, and clean-label compliance. These firms are expanding their applications in functional foods, personal care, and pharmaceutical excipients.

Their R&D strategies are focused on improving product stability, scalability, and safety certifications. With increasing demand for non-synthetic and vegan-compatible ingredients, these suppliers are also adopting circular sourcing models and enhancing their traceability frameworks to maintain regulatory alignment across major OECD and APAC countries.

Recent Gluconolactone Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 139.9 million |

| Projected Market Size (2035) | USD 288.4 million |

| CAGR (2025 to 2035) | 7.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million / Volume in metric tons |

| By Source | Synthetic and Non-Synthetic |

| By Grade | 97%-100% and 100%-102% |

| By End-use | Dietary Supplements, Pharmaceuticals, Cosmetics, Energy Drinks, and Food (tofu, meat products, etc.) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Key players in the gluconolactone market include Hubei Yitai Pharmaceutical Co. Ltd., Shandong Fuyuan Bio-Tech Co. Ltd., Roquette Frères, Shaoxing Marina Biotechnology Co. Ltd., Merck Millipore Corporation, Foodchem International Corporation, Anhui Fubore Pharmaceutical & Chemical Co. Ltd., Jungbunzlauer, Shandong Baisheng Biotechnology Co., Ltd., and Yuanming Group |

| Additional Attributes | Market share analysis by source and grade, country-wise CAGR analysis, and brand positioning insights |

The market is forecasted to reach USD 288.4 million by 2035.

The market is projected to expand at a CAGR of 7.5% during this period.

Non-synthetic source is expected to lead with over 55% market share in 2025.

The 97%-100% grade segment is expected to hold approximately 60% of the market share in 2025.

The USA is anticipated to be the fastest-growing market with a CAGR of 7.6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA