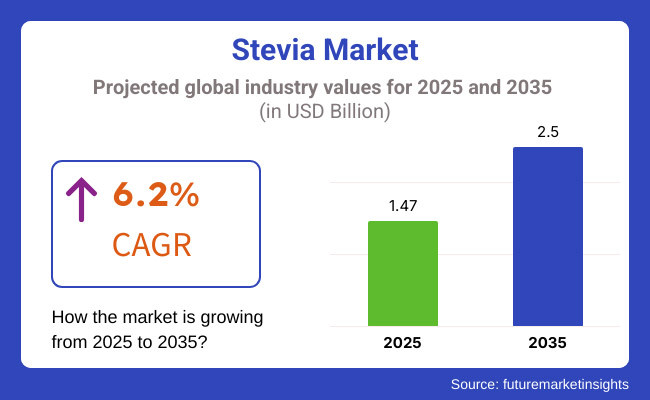

The demand for global Stevia market is expected to be valued at USD 1.47 Billion in 2025, forecasted at a CAGR of 6.2% to have an estimated value of USD 2.50 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 5.9% was registered for the market.

Growing consumer health consciousness and the desire for healthier eating are the main factors propelling market expansion. A substantial market opportunity has been created by the growing popularity of stevia as a natural substitute for artificial sweeteners especially among people trying to control their blood sugar levels or cut back on calories.

The market for stevia products is growing as consumers look for natural low-calorie sweeteners to replace sugar and artificial sweeteners. This trend is especially noticeable in the food and beverage industry where producers are repurposing goods to have less sugar while still being sweet which encourages stevia to become a popular ingredient.

Another major factor driving the stevia market is regulatory support as laws intended to lower dietary sugar intake push producers to use healthier substitutes like stevia. Furthermore, as consumers grow more interested in clean-label products and natural ingredients the demand for stevia is being driven by trends in natural ingredients. For people trying to control their weight without compromising flavour stevia’s zero-calorie profile makes it especially alluring.

Last but not least developments in extraction and processing techniques are enhancing the flavor and cost of stevia products increasing their appeal to a wider range of consumers. The market is also growing in developing areas like South America and Asia-Pacific where demand for natural sweeteners is being driven by rising disposable incomes and health consciousness.

Explore FMI!

Book a free demo

Demand for Natural Sweetners is Driving the Market Growth

Consumers are actively looking for substitute ingredients to replace sugar or artificial sweeteners as a result of growing awareness of the detrimental effects sugar consumption has on their health. Product developers are under a lot of pressure to reduce or eliminate the amount of sugar in their products while using natural sweeteners like stevia as a result of this growing awareness.

Prominent market participants have introduced products containing natural low-calorie sweeteners especially stevia in response to the significant increase in demand for low-calorie sweeteners in food and beverages. For example, in January 2023 the Greek soda company Green Cola reached more than 1000 stores in the USA selling goods that are naturally sweetened with stevia and infused with green coffee beans.

Demand for Organic stevia Driving the Market Growth

The clean-label movement has accelerated as consumers demand greater transparency and information from producers regarding the goods they buy. Nowadays a sizable portion of consumers choose natural and well-known products so product labels are important when choosing foods.

Customers belief that well-known ingredients are healthier is what is driving this trend toward healthier more natural products and minimally processed food and drink options. The market has seen a notable increase in demand for organic stevia extracts.

During the period 2020 to 2024, the sales grew at a CAGR of 5.9%, and it is predicted to continue to grow at a CAGR of 6.2% during the forecast period of 2025 to 2035.

A shift toward sugar substitutes has resulted from growing concerns about the negative health effects of excessive sugar consumption brought on by the rise in chronic conditions. Furthermore, although artificial sweeteners have been widely used for many years questions have been raised about their safety and possible negative effects.

Consequently, stevia and other natural or plant-based sugar substitutes have become popular among health-conscious consumers. These sweeteners are thought to be healthier than artificial sweeteners because they come from natural sources. Further promise as workable sugar substitutes with little to no calorie content comes from the creation of novel sweeteners derived from plants that have strong sweetness and taste-modifying qualities.

Tier 1 companies comprises industry leaders acquiring a 60% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and China come under the exhibit of high consumption, recording CAGRs of 5.1%, 4.1% and 6.9%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 5.1% |

| Germany | 4.1% |

| China | 6.9% |

The stevia market in North America is dominated by the United States. The high demand for stevia ingredients from the beverage industry primarily as a result of the growing number of people with diabetes is the main driver of the US markets growth. With producers concentrating on enhancing flavor profiles and broadening uses the nation has seen notable product innovations in stevia-based sweeteners.

Stevias market position has been reinforced by its growing use in a variety of food and beverage categories such as dairy confections and baked goods. Large American food and beverage corporations are aggressively introducing new goods that include stevia as a primary component especially in the reduced-sugar and zero-calorie categories.

China continues to hold the top spot in the Asia-Pacific stevia market thanks to its vast production capacity and rising domestic demand. The nation has made a name for itself as a significant supplier of stevia worldwide satisfying about 80% of demand.

The preference for stevia sweeteners over other high-intensity sweeteners is higher among Chinese consumers who are influenced by natural products and traditional Chinese medicine. Large sums of money have been spent on research and development specially to enhance extraction technologies and product quality.

The European market for stevia is dominated by Germany. The market in the nation is distinguished by a thriving food and beverage sector and a high level of consumer awareness regarding natural sweeteners. The demand for stevia products is driven by German consumers strong preference for plant-based sugar substitutes and low sugar intake.

With numerous businesses providing certified organic stevia ingredients the market has seen notable advancements in organic stevia products. The nations market leadership has been facilitated by the existence of significant market players and a strong distribution network.

| Segment | Value Share (2025) |

|---|---|

| Powder Extract (Form) | 60% |

Stevia powder is utilized in a number of culinary applications including baking mixes. For food and beverage producers who want to use high-shelf-life raw materials in their products powdered stevia is becoming increasingly popular due to its extended shelf life.

| Segment | Value Share (2025) |

|---|---|

| Conventional Stevia (Product Type) | 63% |

Due to its natural source low calorie count and capacity to mimic the flavor of sugar conventional stevia is an ideal option for meeting these changing consumer demands. It is therefore expected to drive the segments growth over the projected period.

To satisfy consumer demand major companies in the global stevia market are continuously introducing new products. To obtain a competitive edge in the market major corporations and stevia producers are also concentrating on merger and acquisition efforts. Brands highlight the health advantages of stevia such as its low glycemic index calorie-free nature and suitability for diabetics.

Companies that produce stevia are partnering with well-known food and beverage companies to incorporate stevia into commonplace goods. This aids in expanding both consumer adoption and distribution reach. Companies are spending money on cutting-edge extraction techniques to lower the cost of producing premium stevia extracts.

The market is expected to grow at a CAGR of 6.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 2.50 Billion.

Demand for organic stevia is increasing demand for Stevia.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Tate & Lyle, Cargill, Incorporated., Evolva Holding SA and more.

By form, methods industry has been categorized into Powder Extract, Liquid and Leaf

By product type, industry has been categorized into conventional stevia and unconventional stevia

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.