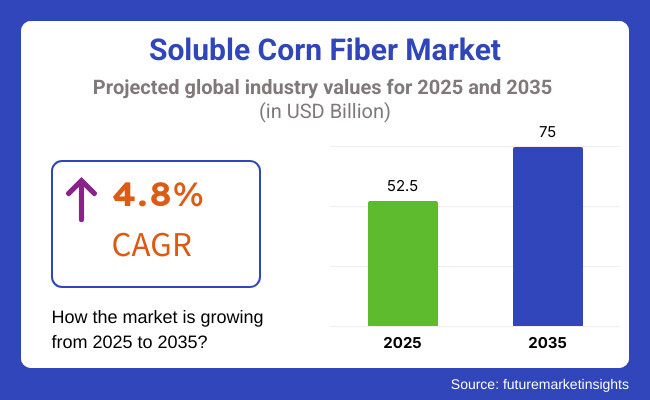

The demand for global Soluble Corn Fiber market is expected to be valued at USD 52.5 Billion in 2025, forecasted at a CAGR of 4.8% to have an estimated value of USD 75.0 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 4.6% was registered for the market.

One type of nondigestible carbohydrate used in a variety of foods is soluble corn fiber. It is used to improve product texture and thickness in addition to providing sweetness and reducing the sugar and calorie content of many processed foods. Corn starch that has undergone enzymatic hydrolysis yields soluble corn fiber.

The most common application for soluble corn fiber is as a food additive, but it can also be taken as a dietary supplement on its own. Corn is the source of soluble corn fiber a type of dietary fiber. Indigestible fiber is resistant maltodextrin while digestible carbohydrates are maltodextrin. Soluble corn fiber is produced when heat and acid are added to regular corn syrup.

Growth in the market for soluble corn fiber is anticipated to be driven by innovations in product formulations particularly those that improve the fibers health benefits. In an effort to meet the growing demand manufacturers are also refining their production methods which may result in cheaper prices and more supply.

Explore FMI!

Book a free demo

Increase in Diseases is Driving the Market Growth

Consumer awareness of the value of eating a healthy diet has increased as lifestyle-related diseases like diabetes and obesity are becoming more common. Customers are actively looking for food and drink items that can improve their health which is fueling the demand for functional ingredients like soluble corn fiber worldwide and propelling market expansion.

Demand for Clean Lebel Products is Driving the Market Growth

Increased market demand is anticipated as a result of consumers growing preference for clean-label products such as soluble corn fiber. Soluble corn fiber adoption in a variety of applications is probably going to be driven by consumers looking for products with identifiable processed ingredients.

Companies can gain a competitive edge by positioning their products as cleaner alternatives by highlighting the natural qualities of soluble corn fiber. By adding soluble corn fiber to clean-label products you can reach a wider audience and open up new business prospects. By diversifying their product lines and increasing their global footprint manufacturers are likely to invest in R&D to produce new formulations and applications that satisfy clean label preferences.

During the period 2020 to 2024, the sales grew at a CAGR of 4.6%, and it is predicted to continue to grow at a CAGR of 4.8% during the forecast period of 2025-2035.

The market for soluble corn fiber experienced brief production and supply chain interruptions. Despite these obstacles there was still a strong emphasis on health and wellbeing which could help ingredients like soluble corn fibers.

Businesses in the food sector showed resiliency during the pandemic by adjusting to shifting consumer tastes and market conditions. As producers looked for ingredients to improve product formulations and satisfy changing consumer demands soluble corn fibers adaptability and functional qualities kept encouraging its use.

The market for soluble corn fiber saws a recovery along with the food and beverage sector as economies slowly reopened and consumer confidence increased. Soluble corn fiber demand continued to rise as a result of growing interest in functional foods and a greater emphasis on health and wellbeing. In order to meet the changing demands of consumers who are health-conscious manufacturers have persisted in innovating and launching new products with SCF.

Tier 1 companies comprises industry leaders acquiring a 70% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 20%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and China come under the exhibit of high consumption, recording CAGRs of 3.9%, 3.2% and 5.3%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.9% |

| Germany | 3.2% |

| China | 5.3% |

Due to growing interest in digestive health there is a growing need for clean-label and functional ingredients in the US. This trend is supported by the use of soluble corn fiber as a prebiotic fiber. Its uses in lowering sugar and improving the nutritional value of different food items appeal to Americans who are concerned about their health.

The market for soluble corn fiber in China is expanding significantly due to consumers growing desire for healthier food options. Chinese consumers are growing more health-conscious and the markets trend toward nutritionally enhanced products is well-suited to the functional and prebiotic qualities of soluble corn fiber. Since it enhances digestive health and can be used in lower-calorie and sugar-free formulations soluble corn fiber is a preferred ingredient in the Chinese food industry.

The growing demand for the product has been fueled by the German consumers preference for natural and healthful ingredients as well as their attention to digestive health. The German food industry prefers soluble corn fiber because of its prebiotic and functional qualities.

| Segment | Value Share (2025) |

|---|---|

| Food (Application) | 53% |

With over a 53% market share in the soluble corn fiber market Food and Beverages maintained a leading position. This industry remains at the forefront as consumer tastes in common food and drink products change toward healthier fiber-rich options.

Because it can enhance texture sweetness and fiber content without changing flavor soluble corn fiber is frequently used in drinks snacks and prepared foods. The food and beverage industrys strong position is largely due to the growing demand for low-calorie and clean-label foods particularly from health-conscious consumers.

| Segment | Value Share (2025) |

|---|---|

| Powder (Form) | 80% |

The market for soluble corn fiber powder has expanded in popularity. Numerous elements that satisfy the preferences of the industry and consumers can be blamed for this. The market is expanding as a result of powdered soluble corn fibers convenience and adaptability.

It can be used as an ingredient in a wide variety of food and beverage products without changing the final products texture or flavor because it is easily mixed and soluble in a variety of liquids. The consumer trend toward convenience and busy lives is well suited to the powdered form of soluble corn fiber.

It offers consumers a hassle-free method to boost their fiber intake without drastically changing their daily routine by being easily added to smoothies shakes and baked goods. As manufacturers and consumers look for easy-to-use ways to improve the nutritional profile of their products powdered soluble corn fiber has become more and more popular due to its accessibility.

In order to expand their market share and develop new soluble corn fiber formulations that satisfy consumer preferences like clean labels lower sugar content and better digestive health food companies heavily invest in research and development.

In order to increase public awareness of the advantages and adaptability of soluble corn fiber they also run marketing and educational initiatives. The market is growing and the companies positions in the industry are being strengthened by partnerships with industry stakeholders that help position soluble corn fiber as a preferred ingredient in a variety of products.

The market is expected to grow at a CAGR of 4.8% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 75.0 Billion.

Rise in health concerns is increasing demand for Soluble Corn Fiber.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Tate & Lyle, General Mills, Roquette Freres and more.

By product type, methods industry has been categorized into powder and liquid

By form, industry has been categorized into Dairy Products, Food, Dietary supplements and Animal Nutrition

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.