Global consumption with such industries as automotive, construction and industrial manufacturing requiring long-life performance coatings, there is every reason to anticipate that the global polyurethane resins paints and coatings market from 2025 to 2035 will grow steadily.

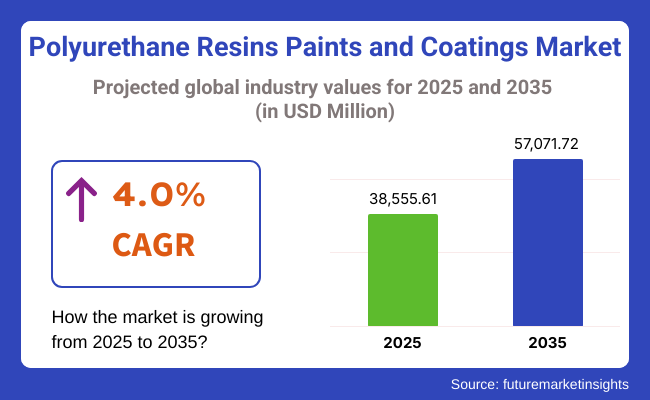

By replacing solvents and methodizing production in a factory, it is possible to eliminate the dust generated from gratifying environmental needs while creating eco-friendly ii and low-VOC alternatives for aging infrastructure-serving nations. The market is projected to surpass USD 57,071.72 Million by 2035, growing at a CAGR of 4.0% during the forecast period.

A steady surge in the Polyurethane Resins Paints and Coatings Market is being driven by high-performance coatings demand. Industrial, automotive, and architectural applications have become growing areas of consumption worldwide for polyurethane-based coatings that offer such extraordinary characteristics as exceptional durability, chemical resistance, and weather ability.

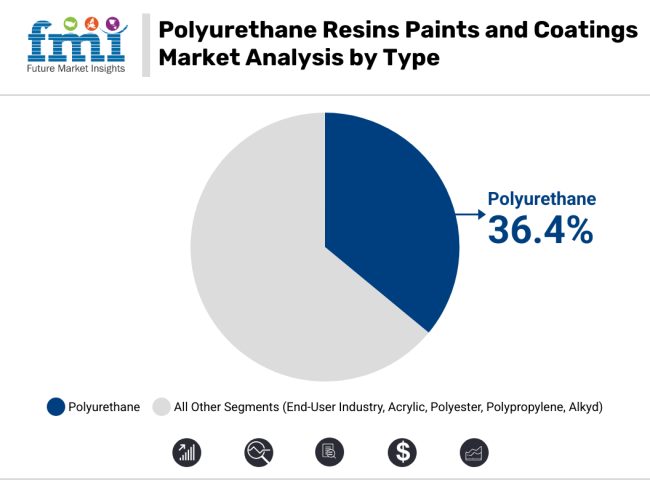

According to projections, 36.4% of all coatings types (including adhesives) will be polyurethane coatings. They offer better gloss retention, resistance to scratches, and flexibility characteristics making Polyurethanem a suitable material for long-term surface protective applications. Its wide use in productions including automotive refinishing, industrial machinery production, aerospace and marine coatings are all making a significant contribution as well.

Moreover, polyurethane coatings are also circulating into environmentally friendly formulations such as water-based or low-VOC products in accordance with strict environmental regulations for emissions and sustainability aspirations. With the demand for eco-friendly products from consumers rising constantly, UV-curable coatings are increasingly investing in bio-based and hybrid polyurethane preparations.

Over the next few years, it is expected that the Polyurethane Coatings for High Performance products will continue to be the market leader because they provide excellent corrosion protection, bear coatings on floors that are smooth with either high abrasion resistance or low co-Efficient of friction compared to other methods offered today.

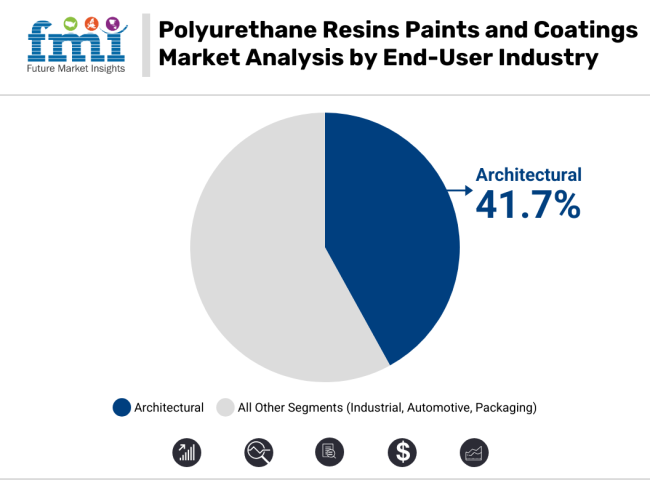

Architectural resins continue to account for the largest market share in the paint and coating industry using Polyurethane resins, at 41.7% by 2025.Ongoing urbanization, infrastructure expansion and various construction activities will certainly raise the bar, making architectural coatings in ever greater demand.

Polyurethane-based coatings are used in a variety of exterior or interior applications. They are water- and UV-resistant, can keep surfaces free from dirt build-ups for long periods, and help cut warmth loss during winter periods as well as reduce building temperatures in summer. For all these reasons it is extremely popular among architects and developers.

The impetus of low-VOC waterborne polyurethane coatings has mainly come from the growing emphasis on eco-friendly and sustainable technologies. At the same time, a move to 'smart' paints which have their own self-cleaning capabilities and possess antibacterial properties is further driving forward this market. Once again, similar investments in smart city infrastructures, commercial complexes and environmentally friendly buildings will surely further the development of architectural coatings in the coming years to come.

In North America, from construction and automotive markets with large purchase amounts continuing to pour into these products forms. With infrastructure modernization underway the USA leads the way in developments, relying on high-performance coatings. The widespread practice of green, low-emission coatings is spurring research and development into sustainable polyurethane formulations.

Moreover, as more governments move towards low-VOC and water-based paints driven by regulations-heavy policies in this direction, it is influencing trends overall. Also, growing demand from industrial manufacturing and aerospace industries for polyurethane coating.

Europe’s market for polyurethane resins and coatings is sustained by strict environmental regulations and an emphasis on sustainable paints. The forefront of polyurethane technology lies in water-based formulations and biomaterials, with countries like Germany, France and the UK leading the way.

The construction sector, particularly large commercial and residential refurbishment projects where the building market has shown the greatest capacity for expanding. Furthermore trend of people using lighter and more robust coatings in car bodies is bringing demand from that sector up annually. The region’s commitment to cut carbon footprints and VOC emissions is pushing companies toward greener alternatives.

Asia-Pacific is expected to gather pace in the market for polyurethane resins, paints and coatings with rapid urbanisation, industrialisation and infrastructure development. This comes on top of such markets as manufacturing and in particular marine applications becoming consumers of high-performance coating materials.

Further still, governmental projects to encourage environmentally friendly paints and investment by multinationals in new production lines within the region are creating different landscapes at virtually every step Hormone.

High Production Costs and Raw Material Prices

The making of PVDF doesn't come cheap. With high raw materials, energy and maintenance costs, it is a relatively expensive polymer. Despite low operating profit margins for a number of companies in the industrial chain, raw materials like fluorine compounds had a chance to make manufacturers sweat.

Environmental Regulations and Disposal Issues

As a fluoropolymer, PVDF is strictly controlled abides by very strict regulations for environmental protection both in production and in handling after use. The high cost of doing so over saddled manufacturers.

Growing Demand in Renewable Energy and Electronics

PVDF is being increasingly used in solar panels, lithium batteries, and electrical coatings. With its outstanding chemical resistance and effective electrical resistance, it is the ideal material to suit these applications. And these are creating new opportunities for businesses and industries such as green alternatives companies, research and development.

Advancements in Sustainable and Recyclable PVDF

Eco-friendly, recyclable Chinese-launched PVDF projects are making a fresh profit for many a company. Firms that focus on green alternatives are likely to prevail in the market.

Ways in between 2020 years ago to 2024 years ago, PVDF market was experiencing rapid growth for reasons including increased uses of recycled energy equipment and electric car batteries. In addition, demand from other industries such as medical, aerospace and industrial-grade polymers was stoking this hot sector further.

Across 2025 to 2035: The market will be driven by sustainable PVDF production and new recycling technology further forces driving growth include 5G infrastructure, water treatment membranes. Alongside this metamorphosis are regulatory changes which shape industry trends.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with fluoropolymer regulations |

| Market Demand | Driven by renewable energy and EV battery adoption |

| Industry Adoption | Expanding use in electronics and coatings |

| Supply Chain and Sourcing | Dependence on select fluorine suppliers |

| Market Competition | Dominated by major chemical companies |

| Market Growth Drivers | Renewable energy and electric mobility trends |

| Sustainability and Energy Efficiency | Initial efforts towards green PVDF production |

| Integration of Digital Innovations | Limited impact of digitalization |

| Advancements in Product Design | Focus on performance and durability |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental controls and recycling mandates |

| Market Demand | Increased demand in high-tech applications and sustainable PVDF |

| Industry Adoption | Growth in medical, aerospace, and water treatment industries |

| Supply Chain and Sourcing | Diversification into bio-based and alternative fluorine sources |

| Market Competition | Entry of new players focusing on eco-friendly PVDF production |

| Market Growth Drivers | Increased demand for high-performance and sustainable polymers |

| Sustainability and Energy Efficiency | Full-scale adoption of recyclable and low-emission PVDF |

| Integration of Digital Innovations | Smart manufacturing and AI-driven quality control |

| Advancements in Product Design | Development of lightweight, eco-friendly PVDF variants |

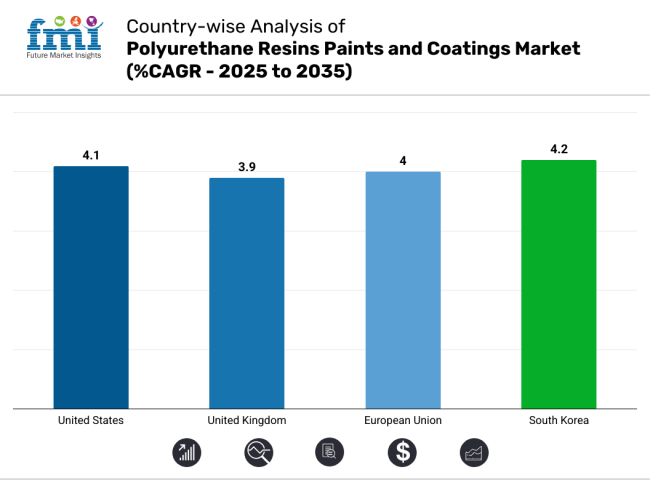

In the United States' market for polyurethane resins paints and coatings, demand continues to grow apace due in large part to expanding markets like construction and auto parts assembly. Environmental regulations are making ecologically capable, durable paints an important goal for factories all over the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

The market is especially large in the United Kingdom, where it is growing along with infrastructure projects and auto parts refinishing. Producers are developing innovative formulations to cater for environmentally friendly and high-performance--like some rain resistances in your new smart phone's coating.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.9% |

The European Union's market for polyurethane resins paints and coatings is characterized by strong demand and stringent environmental regulation turning toward the rise in smart coatings. Germany and France are in the front rank of innovation, focusing on energy-efficient weather-resistant coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

South Korea’s Polyurethane Resins Paints and Coatings Market is expanding as demand from industrial and automotive sectors climbs. New competitive edges are being created with nanotechnology and self-healing coatings ahead of foreign rivals: at home we import or go without. Other key factors include an increase in exports of high-quality coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

In the polyurethane resins plastics paint & coatings market, because of the ever increasing demands from automotive applications - construction and industry is also looking for follow suit. Such coatings have superior durability, weather resistance and chemical protection etc.. They are required in a variety of sectors. All over the world today leading companies are investing in high quality formulations, green options as well as advanced performance polyurethanes for the coating market.

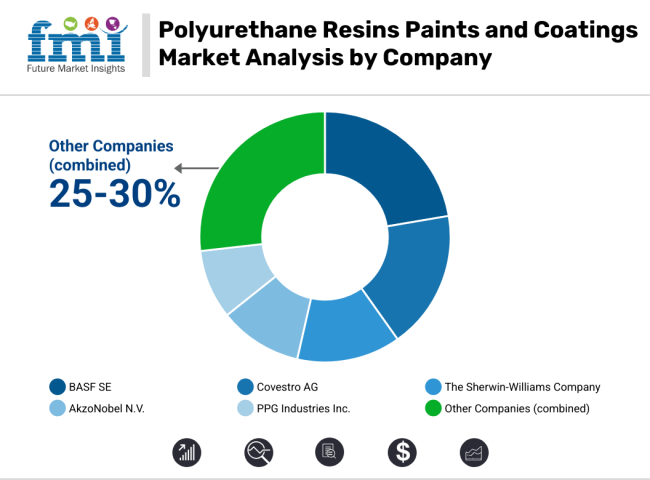

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | In March 2024, launched a bio-based polyurethane coating for automotive applications. In January 2025, expanded its production facility to enhance supply chain efficiency. |

| Covestro AG | In April 2024 introduced a low-VOC polyurethane resin for industrial coatings. In February 2025 worked with research institutes to develop next- generation sustainable coatings |

| The Sherwin-Williams Company | In May 2024further revealed a high- performance polyurethane enamel in the fight against rust. In March 2025 led with such polymers smart coatings featuring self-healing properties. |

| AkzoNobel N.V. | In June 2024yields a UV-resistant polyurethane coating for architectural use. In January 2025 purchased a regional coatings manufacturer in order to strengthen its global footprint. |

| PPG Industries Inc. | In August 2024, introduced a fire-retardant polyurethane coating for infrastructure projects. In February 2025, partnered with automotive OEMs to supply advanced protective coatings. |

Key Company Insights

BASF SE (20-25%)

BASF leads in polyurethane coatings innovation with a focus on both sustainability and performance enhancements. The company continues to invest in R&D, developing eco-friendly solutions.

Covestro AG (15-20%)

Covestro specializes in high-performance polyurethanes, particularly in water-based resins for industrial and other protected coatings and is committed to creating technologies which have lower environmental impact.

The Sherwin-Williams Company (10-15%)

Sherwin-Williams produces top-quality polyurethane coatings for automotive and marine use, bringing new functions to the products using smart technologies.

AkzoNobel N.V. (8-12%)

AkzoNobel has a brand of polyurethane coatings for exterior use that not only last long but are highly weather-resistant, which makes them right for both industrial and architectural sectors.

PPG Industries Inc. (5-10%)

PPG is actively researching fire-resistant and protective polyurethane coatings, which are sold to clients in infrastructure and automotive markets

Other Key Players (25-30% Combined)

The overall market size for Polyurethane Resins Paints and Coatings market was USD 38,555.61 Million in 2025.

The Polyurethane Resins Paints and Coatings market is expected to reach USD 57,071.72 Million in 2035.

The polyurethane resins paints and coatings market will grow due to increasing demand in automotive, industrial, and architectural applications, driven by durability, chemical resistance, and rising infrastructure and construction activities worldwide.

The top 5 countries which drives the development of Polyurethane Resins Paints and Coatings market are USA, European Union, Japan, South Korea and UK.

Polyurethane Coatings demand supplier to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyurethane Coating Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane (PU) Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Precursor Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Adhesives Market Trends 2025 to 2035

Polyurethane Foam Market Size & Trends 2025 to 2035

Market Share Breakdown of Leading Polyurethane Dispersions Manufacturers

Polyurethane Composites Market

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Exterior Polyurethane Varnish Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Soft Touch Polyurethane Coatings Market Trends 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Demand for Exterior Polyurethane Varnish in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Exterior Polyurethane Varnish in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Marine-grade Polyurethane in UK Size and Share Forecast Outlook 2025 to 2035

PE Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Plastic Resins Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA