Global demand for pearlescent pigment is expected to witness slow-paced growth between 2025 and 2035, backed up by soaring demand for pearlescent pigment across automotive, cosmetics, and packaging industries.

Increasing consumer preference for high-quality aesthetics, durability, and sustainable solutions and driving up pearlescent pigments adoption across various applications. Synthetic mica pigments also solve environmental issues of natural mica extraction, helping increase the market.

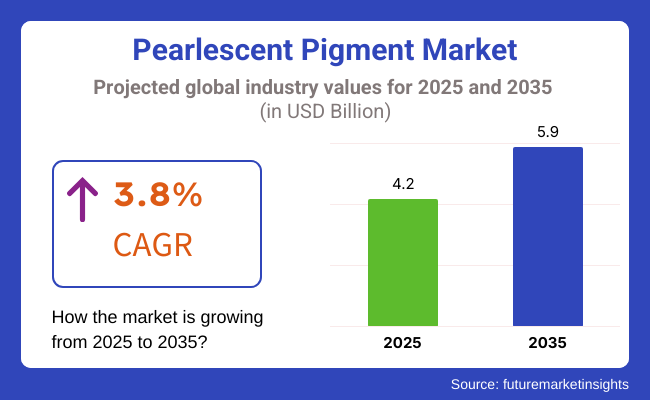

The market is expected to be worth USD 4.2 billion in 2025, equivalent to a 2035 market value of USD 5.9 billion with a CAGR of 3.8%. This growth path is supported by innovations in developing new pigment technologies that deliver brighter, longer-lived and environmentally friendlier colour usage. In addition, with the advent of smart packaging and 3D printing technologies, they are expected to create many opportunities for pearlescent pigments for interactive, bespoke, and luxury product designs.

(Sustainable cost) An analyst said that manufacturing synthetics is also more economical than mining as its high cost and processes are under the scanner. One of these trends is the growing consumer preferences towards eco-friendly and non-toxic pigments, which will force the industry to seek biodegradable pearlescent pigments, opening avenues for the gradual growth of this market.

The projected 3.8% CAGR is attributed to increased pearlescent pigments usage in premium automotive coatings, high-end beauty care, and advanced packaging materials. With rapid urbanization and a stable increase in disposable income in emerging economies, demand for luxurious and visually attractive products is surging, propelling market growth.

The growing use of nano-based pearlescent pigments is anticipated to propel market growth, which has the potential to improve brilliance, dispersion, and adhesion across diverse application areas, like high-end coatings and digital printing. The increased adoption of biodegradable pigments in the cosmetics industry is driving the switch to sustainable alternatives, which will subsequently increase the market for pearlescent pigments.

Explore FMI!

Book a free demo

The North American region, specifically, is an important growth engine for the Pearlescent Pigments market that's only expected to continue with steadily increasing product demand across automotive, personal care, and end-use sectors. Several luxury automotive brands, including Tesla and Cadillac, which use pearlescent coatings extensively in premium car finishes, have based themselves in the region.

Moreover, growing awareness towards eco-friendly cosmetic products in the country are driving the sustainable mica alternatives: USA and Canada market.

North America has a huge demand for unique, high-quality branding solutions and a growing use of pearlescent pigment in the regional packaging industry. Now firms are also using customizable, colour-shifting labels to make a product pop off the shelf and give consumers a lasting experience.

The increasing demand for pearlescent pigments in industrial coatings is another factor accelerating the market growth, as they are also used in architectural coatings and home decor, helping as UV and anti-corrosive agents.

Europe is the biggest buyer of pearlescent pigments because of premium vehicle production and luxury cosmetics. The shift to synthetic and ethically sourced mica pigments that the region’s markets are increasingly focusing on tells a story of sustainability and responsible brand development in making its products.

Luxury automotive brands in Germany, France, and Italy are incorporating pearlescent pigments into their vehicles to enhance the aesthetics of their brands, thus propelling market growth. With the increase of clean beauty in focus, it should come as no surprise that eco-friendly pearlescent pigments have found their way into the European cosmetics industry, where leading beauty names such as L’Oréal, Chanel, and Dior are located.

In addition, sustainable packaging initiatives across the region are also supporting the use of pearlescent pigments for biodegradable and compostable materials, which is exerting an additional push to the market's growth.

Regional Analysis of Pearlescent Pigment Market The Asian-Pacific region's pearlescent pigment market is expected to witness the highest growth owing to rapid urbanization, increasing disposable income, and the booming industrial sector. Dominant Regions Major consumers and producers, China, India, Japan, and South Korea lead the pearlescent pigments prospects, primarily in automotive, cosmetics, and synthetic products.

The cosmetic industry in the Asia-Pacific has witnessed a meteoric rise, with South Korea and Japan being at the forefront of beauty and skincare innovation. Increasing utilization of pearlescent pigments in cosmetics formulations provides a glowing and wondrous appearance, which is anticipated to drive the demand for pearlescent pigments in cosmetics, especially in foundations, lip glosses, and highlighters.

The growing middle-class society in India and China is revolutionizing the automotive industry by registering an increase in the sales of mid-range and high-end cars, which in turn is generating demand for pearlescent pigments for coatings in the automotive sector. Using pearlescent pigments for high-end branding and differentiation will also gain momentum with improvements in packaging technologies, especially in China.

Challenges

The high production costs are a key consideration for the pearlescent pigment market - Producing pearlescent pigments, particularly high-purity synthetic variants, is expensive. Natural mica and other raw material prices directly impact market competition. The ethics aspect has emerged due to environmental concerns associated with mica mining, prompting regulatory intervention and awareness campaigns from consumers to reject child labour in the mica procurement process.

Opportunities

However, such challenges offer a route to an extension, particularly with bio-based pearlescent pigments that offer green and sustainably harvested options to their mineral counterparts. In high-performance applications, next-generation pigments with improved colour durability and better UV resistance are expected to drive wider adoption.

The rise of smart packaging and anti-counterfeiting solutions has also opened new avenues for pearlescent pigment demand, especially in the luxury goods and pharmaceutical sectors. Pigments Manufacturers Join Forces with Technology Firms to Expand Market Reach and Diversify Product Applications

The pearlescent pigment market witnessed strong growth during 2020 to 2024 owing to the demand for novel finishing options, immaculate aesthetics, and premium product differentiation across industries. In the cosmetic, automotive, textile, and packaging industries, pearlescent pigments were increasingly included for achieving luxury, shimmery, and iridescent effects, among others.

Market growth can be attributed to technological developments in coatings, new formulations, and the growing transition toward sustainability. Consumers wanted non-toxic, sustainable, and biodegradable pigments, and the manufacturers were responding with eco-friendly alternatives.

Synthetic Mica Based Pearlescent Pigment, Titanium diboride Coated Pearlescent Pigment, and Silica-Coated Pearlescent Pigment is the synthetic pearlescent pigment now focused on the market because they improve durability, brightness, and color stability. These pigments would become critical to automotive coatings, specialty inks, ceramics, and plastics.

Automakers did this on the paint side, mostly with white pigments, creating highly reflective europium-activated cerium oxide, or VIA, paints, reaping aesthetic benefits for their vehicles. The cosmetics industry introduced these pigments into products such as lipsticks, eyeshadows and nail polishes, creating eye-popping products.

Although definitions of microplastics vary considerably, they rarely consider food contact applications, arguably the best workaround for temporarily adopting carbon nanomaterials as food packaging. Driven by a demand for sustainable packaging, biodegradable pearlescent pigments were also incorporated into eco-friendly and compostable materials.

Despite the fast-growing pace, manufacturers are faced with challenges like escalation of raw material costs, compliance to complex and demanding regulatory regimes, and sustainability-related challenges, among others, the state of Karnataka’s report.

Regulatory Bodies: Organizations including the Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA) implemented strict labelling and safety criteria, requiring adherence from industry stakeholders. Heavy metals are used to make pigments, raising environmental concerns, prompting the industry to adopt green chemistry and towards natural alternatives.

Manufacturers have moved to develop high-performance next-generation pearlescent pigments due to investment in nanotechnology and functional coatings. Moreover, growing consumer awareness about ethical sourcing and transparency pressured brands to adopt responsible sourcing practices and increase the sustainability of their supply chains.

A sustainable trend of high-performance solutions exists across industries, whether that be luxury aesthetics, sleek colors, advanced smart coatings, or eco-friendly ingredients, and pearlescent pigment technologies will follow suit. Increased acceptance of biodegradable, and multifunctional pigments would also revolutionise the industry thus paving a path for expansion and growth of the market in the upcoming years.

Innovate to 2035 - Pearlescent Pigment Market: Disruptive Innovations 2025 to 2035 Industries will target high-performance, biodegradable pigments adapting to changing consumer preferences and regulatory developments. The future market will be based on active color-changing pigments, smart coatings, and AI/ML-based formulation levels by ensuring higher efficiency and environmental responsibility.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments imposed rudimentary environmental and safety standards. |

| Technological Advancements | Companies introduced synthetic mica and pigments with titanium dioxide. |

| Industry Applications | Companies introduced synthetic mica and pigments with titanium dioxide |

| Environmental Sustainability | Fractures began looking into low-VOC coatings and non-toxic formulations. |

| Market Growth Drivers | Luxury aesthetics and beauty industry trends drove demand even further. |

| Production & Supply Chain Dynamics | Dependence on overseas crude substances and complicated universal inventory stockpiling. |

| End-User Trends | Consumers gravitated toward high-gloss, shiny finishes in beauty and automotive products. |

| Investment in R&D | Slow funding limited green chemistry progress. |

| Infrastructure Development | Reproduction of pigments depended on conventional energy-affluent processes. |

| Global Standardization | The regulations were far from standardized across regional and market borders. |

| Supply Chain Transparency | Lack of sourcing transparency for raw materials. |

| Application Expansion | After defense, cosmetics and automotive are conventional. |

| Consumer Awareness | Moderate awareness of sustainable dyes. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Authorities will mandate heavy metal-free, biodegradable, and sustainable pigments. |

| Technological Advancements | Future innovations will include bio-based, AI-optimized, and adaptive colour coatings. |

| Industry Applications | The market will expand into functional textiles, smart packaging, and biomedical applications. |

| Environmental Sustainability | The industry will achieve zero-waste pigment production and circular economy integration. |

| Market Growth Drivers | Eco-conscious consumer behaviour and regulatory incentives will shape future demand. |

| Production & Supply Chain Dynamics | Companies will shift to localized, traceable, and ethical pigment sourcing. |

| End-User Trends | Future demand will prioritize biodegradable, smart-adaptive, and multi-functional pigments. |

| Investment in R&D | Increased R&D in bio-based, non-toxic, and performance-enhanced pigment solutions. |

| Infrastructure Development | The industry will transition toward solar-powered and water-efficient manufacturing. |

| Global Standardization | A unified framework for cosmetic, food and pharmaceutical pearlescent pigments will be enforced. |

| Supply Chain Transparency | Blockchain-powered tracking systems will ensure ethical and sustainable pigment production. |

| Application Expansion | Emerging applications in biotechnology, anti-counterfeiting, and electronic displays will drive new growth. |

| Consumer Awareness | Increased demand for clean-label and eco-certified pigments will reshape purchasing preferences. |

The upsurge in demand for pearlescent pigments in the automotive, cosmetics, packaging, and coatings industries is propelling in the United States for this particular product. The high demand for premium products with luxury aesthetics and finishing, such as those used in luxury products, automotive coatings, and personal care products, is one of the primary factors spurring growth in this market. Furthermore, developments in pigment production, including eco-friendly and synthetic pearlescent pigments, are fostering adoption in end usage industries.

The automotive sector is the key market grower in the pearlescent pigments market owing to the high-quality vehicle coatings employed by the automotive manufacturers to enhance iridescent and metallic effects. Moreover, an increase in the demand for pearlescent pigments from the cosmetic segment on the back of the high use of these pigments in lipsticks, eyeshadow, nail polishes, skincare products, etc., is anticipated to increase consumer demand for natural, luminous, and shimmering appearances.

Just like market trends, civil regulations are also up at play. Tightening environmental regulations on heavy metal-based pigments has led to the development of non-toxic, biodegradable, and sustainable alternatives. The growing demand for these products is likely to drive the growth of the bio-based pearlescent pigments market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The growth of the United Kingdom's pearlescent pigment market is driven by the demand for high-end cosmetics, automotive coatings, and specialty printing applications. One major factor fueling growth in the market is the country’s robust luxury goods industry, which encompasses fashion, jewellery, and premium packaging.

A large shift towards bio-based and natural-derived pearlescent pigments is now being observed in cosmetics, personal care and food packaging categories as a result of the UK commitment to sustainability and green chemistry. Many companies have been investing in alternative formulations for pigments that can be playful and high-performance while minimizing damage to the environment.

There is also an increasing trend towards the use of specialty pigments in automotive coatings in the UK, particularly for luxury cars and custom paint jobs. The rise of electric vehicles (EVs) is also driving the popularity for cutting-edge, shiny and sparkling coatings that boost vehicle styling, as well as surface protection.

Moreover, the rise in demand for pearlescent pigments in specialty inks, decorative prints, and holographic security applications due to the growth of digital printing packaging further contributes to the market growth. Fruits and vegetables with coveted premium appearances dominate the UK luxury goods market as brands push the boundaries on how to incorporate pearlescent pigments for striking aesthetics.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

One of the largest market for pearlescent pigments are in Europe, especially the European pearlescent pigment market, which is forecasted to remain constant while being mainly driven by demand in luxury cosmetics, high-end automobile coatings, and premium packaging applications. Intense amount of usage for pearlescent pigments in automotive and fashion industries hold Germany, France, and Italy at the top leading countries on their overall market.

EU policies such as the Green Deal initiative are directed towards sustainable production of non-toxic and eco-efficient pigments. These factors are fuelling the demand for synthetic mica and plant-based pearlescent pigments. Likewise, strict reach dictates force pigment producers out of toxic materials, driving up the demand for safer substitutes.

France and Italy are the only remaining major contributors to the overall investment flow for aesthetic-enhancing pigments for the luxury and high-end consumer goods industry, which is primarily used for perfumes, fashion accessories and premium brand packaging. Furthermore, digital and 3D printing is leading to a growing demand for specialty inks with pearlescent effects.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

Japanese pearlescent pigment is witnessing a surge in demand owing to the growing automotive, electronics, and cosmetics industries. Japan’s emphasis on precision and high-tech manufacturing has made pearlescent pigments common in automotive coatings, consumer electronics and high-end cosmetics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

South Korea is witnessing a flourishing demand for pearlescent pigment with rapidly growing automotive, cosmetic, packaging, and electronics industries. South Korea is the leading international country in beauty and skin care products, where names like Amor Pacific, LG Household & Health Care, and Innisfree all make heavy use of pearlescent pigments in foundations, lipsticks, and eyeshadows to achieve glistening and gleaming effects.

With an increasing popularity of K-beauty among all age groups, it is further boosting the demand for Nano-sized, bio-compatible pearlescent pigments in cosmetic formulations, as K-beauty mainly focuses on glowing /dewy skin.

Another industry driving demand for pearlescent pigments is the automotive industry, which uses the pigments to make exterior paints more eye-catching. According to the latest market research, Korean car manufacturers such as Hyundai, Kia, and Genesis are also investing money in premium finishes with growing market demand for metallic, new iridescent, or UV-resistant coats.

Furthermore, the growing popularity of electric vehicles (EVs) and smart cars has resulted in the adoption of advanced filtering pearlescent pigments in interior trims, dashboards, and electronic display coatings to improve aesthetics.

Pearlescent pigments are also employed in the packaging and printing industries to brand luxury products, especially in electronics and skincare. Pearlescent pigments are also used extensively in high-end electronic devices, smartphone casings, and OLED displays to give them sleek and futuristic finishes (South Korea is home to electronics juggernauts like Samsung and LG).

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Based on the end-use industry, the automotive segment is projected to witness major demand for pearlescent pigments during the forecast period due to the constantly rising demand for decorative and functional coatings. Depending on purity types, the Synthetic Pearl Pigments and Glass Flake Pearl Pigments segment holds the command of global liquid pearl pigment demand due to its high durability, bright visual luminous appeal, and multiple formulation capabilities.

These pigments exhibit a metallic lustre and may reflect light and have wide applications in paints and coatings, printing inks and plastics industries, giving an aesthetic and increasing the market value of a product.

Synthetic pearl pigments are among the most widely used types of pearlescent pigments because they offer consistent quality, excellent chemical stability, and the ability to produce a wide range of optical effects. Typically, these pigments are produced by coating flakes of their mica, silica, and/or alumina with TiO₂ or iron oxide, resulting in excellent iridescence and colour-change properties.

Synthetic pearl pigments also have been adopted as the new workhorse in the automotive coatings industry, widely used in metallic and pearlescent paints that exhibit a changing colour effect with changes in viewing angle and lighting.

Luxury and premium automotive brands use these pigments to create unique, premium gloss paints that offer an extra layer of visual depth and richness. Additionally, rising consumer preference for customized vehicle aesthetics has led to a rise in demand for specialty coatings supporting the further adoption of synthetic pearl pigment.

The cosmetics and personal care industry extensively uses synthetic pearl pigments for lipsticks, eyeshadows, nail polishes, skincare formulations, and more. This is also the reason why premium cosmetic brands have sought these products a lot: because they can create a shiny or shinier effect, which is extremely desirable in beauty. This latter has been an important driver for the increased demand for non-toxic, eco-friendly mica alternatives to synthetic pearlescent pigments due to the increasing trend towards clean and cruelty-free beauty products.

Additionally, synthetic pearl pigments have found their way into the cosmetics and food packaging often used in luxury products, as well as printing inks and labels, giving a premium look and feel that enhances the brand's perception. Paralyzed finishes are also widely used in packaging for perfume bottles, premium beverage packaging, and product labelling of high fashion products to attract consumers as well as convey a perception of premium features.

Synthetic pearlescent pigments also face barriers because of high production costs and metal oxides used in coatings are strictly regulated. However, new sustainable manufacturing processes and alternative raw materials will make it more accessible and sustainable in the market.

Glass Flake Pearl Pigments have entered industries requiring high durability, chemical resistance, and additional light reflection. These beautiful pigments are ultra-thin glass flakes that are coated with titanium dioxide, iron oxide, or some other metal oxide in order to create a truly remarkable and complex pearlescent effect.

Glass flake pearl pigments have gained widespread application in the industrial and institutional coatings industry due to their excellent stability against UV exposure, light, and corrosive environmental effects. Pearlescent pigments based on glass are being added to coatings, especially use for marine, aerospace and heavy machinery degreasers, to provide protection/maintenance, colour, and gloss stability.

Glass flake pearl pigments find wide applications in the textile and fashion sector for high end-use products, fabric and synthetic leather, specialty fashion accessories. Luxury apparel companies use pearl based textile coating to create twinkling effects on the surface area of garments, shoes, and bags; they look good and fetch higher prices in the market.

The demand for glass-based pearlescent pigments in printing and graphic arts applications playing an important role, such as security printing, holographic effects, and decorative features, has also increased. It is also widely used in banknotes, passports and high-value packaging materials to embed authenticity markers and anti-counterfeit elements.

In contrast, glass flake pearl pigments offer superior performance properties but at elevated manufacturing costs and complicated processing techniques, which restrict their use in mass-market applications. However, recent advances in pigment dispersion technologies and innovative coating formulations should result in wider application potential and reduced costs for these pigments.

Recent developments in substrate-free pearlescent pigments offer a competitive and customizable alternative to traditional mica-based pigments. As these pigment types are made of pure metal oxides, they do not possess any supporting substrate, hence lead to a lightweight, flexible, and versatile across several formulations.

In the cosmetics field, non-substrate dependent pearlescent pigments have been extensively employed for high-definition makeup, skincare products and higher end formulations. Their sleek structure and even distribution make them ideal for fluid foundations, lights powders and high-performance elegance goods demanding a sleek glitter result.

In automotive applications, substrate-free pigments are increasingly incorporated into high-end coatings and detailing applications as firms look to create unsaturated colour effects and improved dimensionality of reflection in high-end auto finishes.

On the other hand, substrate-free pigments might encounter limitations with mass production scalability and cost-effectiveness. However, the development of engineered nanoparticles and metal oxides is believed to enhance both availability and cost.

Multilayer pearlescent pigments have gained a lot of attention in the domain of pigments owing to their potential to produce elaborate optical effects (including colour shifting), along with excellent stability. It is these pigments that have stacks of alternating layers of metal oxides and transparent coats that strongly interfere with each other, causing heavy colour shifts with alterations in light incidence and observation angles.

However, this also opens up the possibility of innovative strategies by manipulating multiple layers using different, specifically designed silica-based multilayer pearlescent pigments for the use in automotive and aerospace industries for providing custom-fitted, colorshifting coatings to support brand identity and design innovation. These colour pigments are of particular merit in coatings for luxury and sports cars, where manufacturers seek a high standard of colour-effect durability.

Multilayer pearlescent pigments have been incorporated into high-end product labels, premium cardboard packaging, and designer branding in the luxury packaging market. The foam base in multilayer penalized coatings makes them a common choice for perfume bottles, limited-edition product packaging, and fine wine labels that want to suggest that they're exclusive and sophisticated.

There is a plethora of applications. However, multilayer pearlescent pigments are limited due to high cost and formulation, where each component must be deposited in consecutive alternating layers and subjected to a certain processing condition; However, due to the constantly evolving capabilities of these technologies, they will become increasingly utilized in various industries, as they can provide better results in terms of pigment layering and deposition processes.

Manufacturers are working to sustainably formulate pigments, finding sustainable alternatives to mica, and investing in pigment dispersion technologies to mitigate these issues. Research on biodegradable and bio-based pearlescent pigments is also expected to emerge, which will make such pigments more eco-friendly.

The market for pearlescent pigments is competitive as the applications for high quality aesthetic coatings, automotive, cosmetics, packaging, etc. proliferate. It focuses on innovative, green products and expanding your offering to meet the changing needs of the consumer. The market is projected to gain from the increasing demand for sustainable and high-performance pigments and technological advancements in the manufacturing process.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Merck KGaA | 18-22% |

| BASF SE | 12-16% |

| Altana AG (ECKART) | 9-13% |

| Sudarshan Chemical Industries | 6-10% |

| CQV Co., Ltd. | 4-8% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Merck KGaA | Manufacturer of high-performance pearlescent pigments for use in cosmetics, automotive and industrial coatings. Identified as sustainable and innovative solutions |

| BASF SE | It specializes in a wide variety of pearlescent pigments and places a great focus on eco-friendly and regulatory-compliant formulations. |

| Altana AG (ECKART) | Focuses on effect pigments for printing, coatings, and plastics with metallic and pearlescent effects. |

| Sudarshan Chemical Industries | Signed to provide inexpensive pearlescent pigments for emerging markets including paints, plastics, and cosmetics. |

| CQV Co., Ltd. | Providing new effects pigments of high quality with emphasis on technology in optical properties and unique effects of colour- shifting. |

Key Company Insights

Merck KGaA (18-22%)

The company manufactures and produces combined balanced pearlescent pigments, a complete range of high resistance for the use impact of your product in the market of effect pigments for cosmetics, automobile coatings, and industrial applications. With stringent regulations adopted globally, the company is investing heavily in developing sustainable and innovative pigments.

BASF SE (12-16%)

BASF SE primarily focuses on sustainable, high-performance, and regulatory-compliant solutions. The company, including personal care and coatings, continually expands its pearlescent pigment line to match the growing expectations for high-end applications.

Altana AG (ECKART) (9-13%)

Its ECKART division specializes in metallic and pearlescent pigments for various industries like printing, packaging, plastics and automotive. Kremer Pigments specializes in best-in-class pigment technologies for aesthetics and durability performance in coatings and inks.

Sudarshan Chemical Industries (6-10%)

Sudarshan Chemical Industries plays a key role in emerging markets, offering cost-effective solutions due to the variety of finishes of pearlescent pigments currently available, leading to new applications. The company's goal to expand its product line addresses the increasing demand for paints, plastics, and personal care applications.

CQV Co., Ltd. (4-8%)

A new leader in effect pigment innovation, such as high performance and special colour-shifting pearlescent pigments. The firm focuses on niche uses, like luxury cosmetics and high-end car paints.

Some market players can be categorized as regional and niche which nurtures innovation, cost, and product diversification in driving growth over a wide sector of the market. Key players include:

The gross market value for Pearlescent Pigment Market was USD 4.2 Billion.

Pearlescent Pigment Market to USD 5.9 Billion by 2035.

Demand for aesthetic and high- performance coatings, coatings in automotive, cosmetics industries and packaging is expected to act as a key growth factor for pearlescent pigment market. Greater demand in areas like printing inks, plastics, and consumer goods makes projected expansion stronger. The increase in investment in new colour solutions and pigment technology will also accelerate the pigments & dyes market growth.

Top 5 countries as producers and consumers in Pearlescent Pigment Market are the USA, UK, European Union, Japan and South Korea.

Synthetic Pearl Pigments and Glass Flake Pearl Pigments: Among these two types of Pearl Pigments, synthetic pearl pigment and glass flake pearl pigment is expected to form a significant share, having a maximum share during the forecast period.

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Advanced Surface Treatment Chemicals Market Analysis by Chemical, Surface, End-Use Industry and Region: Forecast from 2025 to 2035

Active Oxygens Market Analysis by Product Type, Application and Region: Forecast for 2025 to 2035

Piezoelectric Ceramics Market Analysis by Type, Application and Region: Forecast for 2025 to 2035

Polycide Market Growth – Trends & Forecast 2025 to 2035

Plaster Accelerator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.