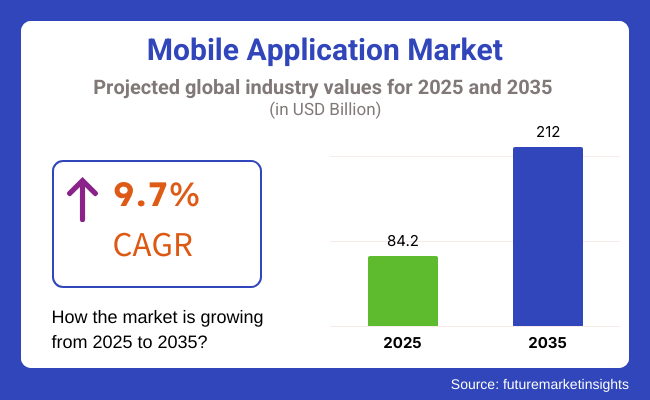

The mobile application market is likely to experience significant growth in the period between 2025 to 2035. This growth will be driven by rapid expansion in smartphone technology, rising penetration of the internet and an increase in demand for mobile-based services. As per research analytics, the market size is anticipated to reach USD 84.2 billion in 2025 and increase to USD 212.0 billion by 2035, with a CAGR of 9.7 throughout the forecast period.

Trending technologies such as artificial intelligence (AI), augmented reality (AR), and cloud-based solutions are certainly adding an adventure to the mobile app ecosystem. The rollout of 5G technology is also driving app performance to new heights, as well as bettering user experiences and allowing for smooth digital interactions. Many industries - especially healthcare, gaming, fintech, and e-commerce - are investing big in mobile apps for better user engagement and business workflows.

Among the countries, North America witnesses the growth of digital services, the Asia-Pacific region sees the rise of super apps, and Europe observes the backing of regulatory frameworks favourable to digital transformation. The mobile application space will flourish across industries, marking its place as a pioneer of the digital economy.

Explore FMI!

Book a free demo

| Company | Contract/Release Details |

|---|---|

| SAP Ariba | SAP Ariba secured a contract to develop a comprehensive procurement mobile application for a leading global retailer, aiming to streamline supply chain operations. |

| IBM | IBM agreed to create a mobile banking platform for a major financial institution, enhancing user experience and security features. |

| Oracle | Oracle was contracted to develop a mobile healthcare application for a national healthcare provider, focusing on patient data management and telehealth services. |

| Conga | Conga partnered with a multinational corporation to implement a mobile contract management solution, improving contract lifecycle processes. |

In 2024 and early 2025, the mobile application industry observed a significant expansion through lucrative contacts and new releases. Leading technology firms such as SAP Ariba, IBM, Oracle and Conga have remained at the forefront, securing contracts across various sectors like retail, finance, healthcare and corporate services. However, these contracts are typically valued between USD 30 million and USD 80 million in a takeover of 3-5 years.

This shift represents the growing dependence on mobile solutions to drive operational efficiency and promote user engagement and service delivery across various sectors. Despite the focus on multi-year contracts, it conveys a strong sense of willingness to direct efforts towards building better mobile applications for Wrike.

North America continues to be the leading market for mobile apps. This has been made possible due to the high penetration of smartphones and a developed digital ecosystem. AI-powered apps, subscription-based services, and mobile-first business models developed in the USA and Canada. In the region, fintech apps, neobanks and cryptocurrency wallets have been widely adopted. Meanwhile, apps for entertainment, from streaming to short-form video, are also seeing record growth.

Further, seamless payment integrations and personalised user experiences also led to the growing emergence of mobile commerce. On the other side, strict regulations and growing concerns related to data privacy are still a limitation for the developers.

However, adopting compliance with the legal environment and stricter security protocols and transparency will play an integral role in the industry’s continued success. Businesses are striving to maintain balance and adherence among regulatory bodies to keep consumers and keep marketplace trust.

The mobile application market in Europe is growing smoothly, backed by the various digital transformation initiatives and data protection regulations, such as GDPR. Apps related to business productivity, cybersecurity, and health are in high demand. Enterprise App Adoption by Country: Germany, France, and the United Kingdom Lead; Cloud Adoption Drives Collaboration and Workflow Automation Snapp, a home-delivery service with thriving mobile commerce, is looking to take a step forward by expanding its app for more personalised shopping.

Furthermore, smart home solutions and connected applications are also gaining momentum as IoT adoption surges. However, regulatory complexities and challenges to innovate while ensuring data security and compliance. With digital transformation, businesses are ensuring to establish a fair use of consumer data through comprehensive privacy policies, insurance of data breaches, and maintaining transparency in its usage.

By region, Asia-Pacific accounts for the biggest portion of the mobile application market by far, with China, India and Southeast Asian countries as the fastest-growing segment. Super apps that combine messaging, e-commerce, ride-hailing, and financial services are changing the nature of mobile engagement.

Cheap smartphones and access to the internet have increased demand for mobile-based education, gaming and fintech apps. Digital wallets and instant payment schemes are the largest, fostering mobile commerce take-off. Also, short-form video and social commerce platforms are changing how consumers interact with brands.

Challenges remain, such as fragmentation in the market due to disparate consumer behaviours and regulations. For the businesses to enter and abide by compliance aspects, they should devise localised strategies. By investing in regional partnerships, cultural adaptation, and tailored user experiences, companies can better position themselves to take advantage of Asia-Pacific’s rapidly growing digital economy.

Challenge: Data Privacy and Security Risks

The dependence on mobile applications has, in turn, raised fears about data security, online fraud and unauthorised access. With rising cyber threats, system developers are needed to ensure stronger security protocols, such as end-to-end encryption, multi-factor authentication and AI-backed threat detection.

Additionally, compliance with regulations such as GDPR, CCPA, and new cybersecurity laws is necessary to prevent legal liabilities and reputational damage. Moreover, tougher app store policies require extensive security audits and privacy-first development, adding to business complexity.

To gain user confidence, companies need to invest in secure coding practices, regular security updates, and transparent data practices. Neglecting such threats can result in data breaches, financial losses, and diminished consumer trust, creating severe challenges for mobile app developers and service providers in the digital ecosystem.

Opportunity: Growing Demand for AI-Based and AR Applications

The integration of AI-powered and AR-based mobile apps is revolutionising user experiences across industries. The benefits of AI in personalisation include predictive analytics, voice assistants, and smart automation, giving an impression of engagement in e-commerce, finance, and healthcare.

There are chatbots with AI capabilities that are transforming customer service and sales. AR is working in transforming sectors such as retail, education and healthcare by providing immersive experiences, virtual try-ons and interactive learning tools.

The gaming industry is also a major beneficiary of AR, driving its growth rate. Such companies laying bets on AI and AR can later leverage it to bleed into solutions ahead of time and gain an edge. With every advance in hardware and the wider rollout of 5G, the potential for the power of AI and AR on mobile devices will only continue to grow exponentially.

| Market Shift | 2025 to 2035 |

|---|---|

| App Monetization Models | AI-driven personalised pricing and blockchain-powered microtransactions revolutionise monetisation. Web3-based decentralised apps (DApps) create new revenue models. |

| User Engagement & Retention | Advanced AI-powered virtual assistants and AR/VR immersive experiences increase engagement. Emotion AI analyses user sentiment to tailor content dynamically. |

| Development & Deployment | No-code/low-code development and AI-generated app code reduce time-to-market. Web3 integration enables decentralised applications with blockchain-based security. |

| Security & Privacy Regulations | Quantum-resistant encryption and zero-trust architecture redefine security standards. AI-driven fraud detection prevents data breaches. More stringent global regulations enforce transparent data handling. |

| AI & Machine Learning Adoption | AI-generated content, hyper-personalization, and autonomous decision-making redefine app experiences. Generative AI creates real-time, adaptive user interfaces. |

| Augmented Reality (AR) & Virtual Reality (VR) | Full-fledged AR/VR ecosystems emerge, integrating digital and physical worlds for commerce, education, and healthcare. AR-based navigation and virtual collaboration spaces become common. |

| Super Apps & Mini Programs | Expansion of AI-powered super apps that dynamically adapt to user preferences, integrating financial services, social networking, and productivity tools into unified experiences. |

| 5G & Edge Computing Impact | Widespread adoption of 6G and edge AI further reduces latency, enabling seamless AR/VR experiences, real-time medical applications, and hyper-personalized digital services. |

| Evolving Consumer Preferences | AI-driven interfaces anticipate user needs, enabling hands-free, voice-controlled, and gesture-based navigation. Ethical AI frameworks prioritise user trust. |

| Mobile Commerce & FinTech Integration | Cryptocurrency payments, decentralised finance (DeFi) apps, and biometric-based financial authentication redefine mobile commerce security and accessibility. |

The mobile application market continues to evolve rapidly, driven by technological applications and shifting consumer expectations. Over the next decade, the integration of AI, mobile security, and decentralised applications is going to reshape mobile users, paving the way for a more personalised and secure mobile experience.

The United States continues to be the largest and most innovative mobile app market worldwide due to the factors involving high smartphone use, widespread 5G coverage, and a strong digital economy. In 2024, more than 85% of the people were using smart devices in the USA alone, making it a huge user base for application developers.

The proliferation of super apps, AI-driven personalisation, and mobile-based financial services have propelled revenue growth. Lastly, the USA is one of the largest mobile gaming markets, with a whopping 210+ million active mobile gamers and driving a large portion of the mobile market.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 9.7% |

China’s mobile application market is the biggest in the world, with more than USD 1.2 billion smartphone users and a thriving mobile-first consumer ecosystem. The explosive growth in apps is powered by the rise of super apps, short-video platforms, and mobile commerce.

China is also going from the top when it comes to its gaming industry, with the largest segment out there in the world with 60 Billion in revenue Lea. AI-powered mobile applications are changing sectors such as education, healthcare and finance with the advent of AI results powered by the government.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.2% |

Germany ranks among the top 5 fastest-growing mobile application markets globally and the fastest in Europe, owing to a tech-skilled population, digital transformation in enterprises, and a flourishing FinTech ecosystem. The country’s mobile commerce industry is growing quickly, with mobile payments making up 40% of e-commerce transactions in 2024. Last but not least, AI-powered health apps, digital wallets, and corporate SaaS apps are faster to take off.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.9% |

Japan mobile app market| Emerging mobile gaming, e-commerce growth, and AI-led apps Japan has a consumer base who are unrepentantly high-end, with a smartphone penetration rate of 91% demanding the quality, safety, and seamlessness of mobile experiences. The country’s elderly population has also spurred innovation in digital health and elderly care applications. Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.5% |

Powered by cheap smartphones, inexpensive mobile data plans and an increasingly digitally literate population, India is among the fastest-growing markets for mobile apps. India has the world’s biggest untapped app user base, with more than 900 million smartphone users. The market is propelled by mobile gaming, UPI-based digital payments and edtech platforms.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 10.1% |

Several trends are contributing to Australia’s growing mobile application market, including smartphone adoption, more people using digital banking services, and the increasing popularity of 5G networks. Strong cybersecurity regulations in the country have driven the development of mobile applications that maintain privacy. Besides that, health & fitness applications, digital banking platforms and mobile government services are on the rise.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 6.7% |

The Apple App Store continues to be a major player in the mobile application marketplace, catering to a large user demographic that prioritises security, quality, and premium experiences. The App Store, with its rigorous app review process and conscientious privacy policies, has become the preferred venue for developers aiming for high-value users. Apple’s profit monetisation models around in-app purchases, subscriptions, and paid apps, starting with iOS apps, are favoured by many businesses and developers.

Using Apple’s proprietary technologies such as ARKit, Metal and CoreML, developers build high-performance applications that run best in gaming, productivity and entertainment. Attracting more eyes to their mobile games and in-app purchases is a huge source of income for the brain category, which continues to generate the bulk of App Store revenue. Media & entertainment applications are also top drivers due to the continued obsession with streaming platforms and, digital content subscriptions, and new integrations like Apple Arcade and Apple TV+.

A dedicated consumer base is just one of the advantages that the App Store has, one that, by the way, comes in a particular form of areas with high penetration of iPhone, like the United States, Europe and some parts of Asia.

When it comes to enterprise applications, in particular, those in healthcare, finance, and education, Apple's stringent security measures and seamless integration with macOS (as well as iPads and other Apple devices) make it a favoured platform. The App Store is projected to continue experiencing steady growth as Apple diversifies its services ecosystem with subscription-based applications and AI-driven features for future revenues.

Mobile applications for quality control and inspection are transforming the industrial and enterprise sectors by providing real-time monitoring, defect detection, and compliance verification. Metrology-driven mobile applications are penetrating industries like manufacturing, automotive, and construction to enrich accuracy in the measurement, inspection, and testing of products.

Technicians and inspectors can leverage AI-enabled mobile applications to utilise image recognition, thermal imaging, and AR-assisted inspections on their smartphones or tablets. The manual labour involved in these processes is substantially reduced, leading to better accuracy and efficiency with these innovations. The mobile apps in this domain are also integrated with the IoT-enabled sensors, the Cloud databases, and the ERP systems to facilitate continued data collection and predictive maintenance.

Cloud-based Quality control applications have high demand currently, specifically in regulated industries such as aerospace and pharma, industries where it is necessary to comply with international standards such as ISO, FDA, and CE marking. As companies move towards smart factories and digital transformation, mobile applications that enable automated inspections and immediate reporting will grow across industries.

It is to be noted that the mobile app market is a highly contested field, with each player bringing out new and exciting innovations to improve user experience and monetise their market. The market is dominated by entrenched tech giants competing through ecosystem lock-in, app store pipelines, and subscription-based services.

The five companies that dominate - Apple Inc., Google Inc., Microsoft Corporation, Amazon Inc. and Netflix Inc. - use their platforms, cloud capabilities and AI-based services to keep their hands around the throat of the market. Although these companies hold a large portion of the market, numerous independent developers and startups exist in a highly fragmented market space, creating vibrant competition.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Apple Inc. | 18-23% |

| Google Inc. | 20-25% |

| Microsoft Corporation | 10-15% |

| Amazon Inc. | 8-12% |

| Netflix Inc. | 5-9% |

| Other Companies (combined) | 35-42% |

| Company Name | Key Offerings/Activities |

|---|---|

| Apple Inc. | Dominates through the App Store, offering premium applications, in-app purchases, and Apple Arcade. Focuses on user privacy and security, integrating AI-driven recommendations. |

| Google Inc. | Controls Google Play Store, facilitating Android application development and distribution. Advances in AI, Play Protect security, and extensive advertising monetisation. |

| Microsoft Corporation | Provides Microsoft Store and enterprise-focused mobile apps. Expands cloud-based applications (Microsoft 365, Teams) and gaming with Xbox cloud gaming integration. |

| Amazon Inc. | Enhances the Amazon App Store, focusing on e-commerce, Kindle apps, and entertainment. Expanding cloud services and Fire OS applications. |

| Netflix Inc. | Leads in mobile streaming applications with personalised content recommendations. Invests in mobile gaming and AI-based content optimisation. |

Strategic Outlook

Apple Inc. (18-23%) Apple Inc.Exercises Control over its App Store Ecosystem It receives a significant portion of its sales revenue through app and subscription purchases as it prioritises security and privacy premium experiences.

On the more advanced side, recent iterations of iOS have blended in an unprecedented number of AI-enhanced capabilities and AR implementations that are opening new doors in how apps interact with your life. Apple’s services, including its subscription-based Apple Arcade and Fitness+, keep expanding its ecosystem, ensuring high user retention.

Google Inc. (20-25%) Google Inc. is the king of the Android ecosystem with Google Play Store. The focus on AI-driven app recommendations and enhanced security with Play Protect improves the overall experience for users. Thorough integrations of Google Cloud and Firebase always earning publishing’s, plus Google Play Pass for gaming material, make for a solid ad-based revenue model here. The open-source nature of Android drives its adoption, which guarantees its growth.

Microsoft Corporation (10-15%) Microsoft Corporation is solidifying its foothold via enterprise and gaming applications. In the business segment, business applications like Office 365, with their growing web and cloud-based mobile applications, as well as the Microsoft Store in Windows, make them a significant player. On the gaming front, the Xbox Game Pass expansion into mobile cloud gaming gives it a competitive edge as well.

Amazon Inc (8-12%): Amazon uses its ecosystem by incorporating mobile apps into its e-commerce, streaming, and cloud offerings. The Amazon Appstore is still a good alternative for Fire OS users, and the Kindle and Prime Video apps round out its digital offerings. Amazon continues to drive engagement with its investment in cloud-based mobile gaming and AI-powered shopping experiences.

Netflix Inc. (5-9%) Netflix continues to play a dominant role in mobile entertainment, leveraging AI to provide recommendations as well as a smooth streaming experience. Its foray into mobile gaming is a long-awaited step for Rails to diversify and grow its user base. Netflix has solidified its position in mobile through traditional features like interactive storytelling and personalised content delivery.

Other Major Players (together 35% - 42%) Apart from these major companies, the mobile application industry also has a highly fragmented landscape where independent software developers and mid-sized firms add high value. Market trends continue to be directed by companies active in social media, gaming, fintech and health applications. As they do so, innovative monetisation models, unique content offerings, and AI-driven personalisation all distinguish these competing firms and make the mobile app market dynamic and ever-evolving.

The Global Mobile Application industry is projected to witness a CAGR of 9.7% between 2025 and 2035.

The Global Mobile Application industry stood at USD 84.2 billion in 2025.

The Global Mobile Application industry is anticipated to reach USD 212.0 billion by 2035 end.

Asia-Pacific is expected to record the highest CAGR in the assessment period, driven by smartphone penetration and digital transformation.

The key players operating in the Global Mobile Application industry include Apple Inc., Google Inc., Microsoft Corporation, Amazon Inc., Netflix Inc., and others.

In terms of Store Type, the segment is segregated into Apple App Store, Google Play, and Others.

In terms of End Use, the segment is distributed into Games, Media & Entertainment, Healthcare, Education, Travel, Shopping, and Others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA) have been covered in the report.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.