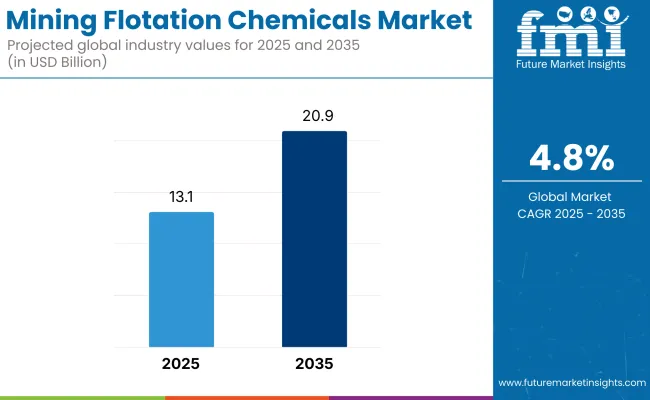

The mining flotation chemicals market, valued at USD 13.1 billion in 2025, is likely to reach USD 20.9 billion by 2035, at 4.8% CAGR during the forecast period 2025 to 2035. Growth is driven by copper, gold and battery-metal expansions where lower ore grades are forcing mineral processors to raise reagent dosages and embrace more selective chemistries. Collectors remain the most valuable reagent segment, accounting for the largest share of spending; this segment is likely to grow at a CAGR of 5.9% during the forecast period.

The mining industry is witnessing a shift toward complex, finely disseminated ore bodies, driving increased demand for precision surface chemistry. Non-sulphide ores-including phosphate, barite, and rare-earth minerals-are gaining prominence as energy-transition supply chains diversify, fueling the need for fatty-acid collectors and hydroxamate-based formulations. This trend reflects the sector’s adaptation to evolving resource profiles and the critical role of specialty reagents in efficient mineral processing.

Environmental considerations are increasingly influencing procurement strategies. Stricter discharge regulations and ambitious carbon-reduction commitments are accelerating the adoption of low-toxicity, biodegradable reagents and closed-loop water management systems. Producers demonstrating reduced greenhouse-gas emissions or lower aquatic toxicity are securing specification advantages, particularly in regions aligning with EU REACH and similar regulatory frameworks.

Digitalization is emerging as a key enabler of operational efficiency and sustainability. AI-powered dosing controls, inline spectroscopy, and machine-vision froth analyzers are being deployed in concentrators, allowing real-time optimization of reagent consumption. These technologies help minimize overdosing, enhance concentrate grades, and support traceability initiatives demanded by green finance stakeholders.

Regionally, investment in lithium, nickel, and copper mining-driven by electrification trends-is particularly robust in Asia Pacific and Latin America, while Europe and North America continue to lead in regulatory innovation and adoption of sustainable processing solutions.

Looking ahead, open-innovation partnerships between mining companies, chemical formulators, and process-control technology providers are expected to accelerate the commercialization of novel reagents. With rising capital expenditures in critical minerals and ongoing integration of smart-plant technologies, the outlook for collectors and specialty reagents remains highly constructive. The sector is poised for sustained growth through 2035, anchored by value creation in both sulphide and non-sulphide applications and propelled by digital and environmental advancements.

The market is segmented based on ore type, chemical type, and region. By ore type, the market is divided into sulphide ore and non-sulphide ore. In terms of chemical type, it includes collectors, frothers, dispersants, activators, depressants, flocculants, and others (pH modifiers, sulphidizers, defoamers, grinding aids). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The non-sulphide ore segment is expected to grow at the fastest CAGR of 5.5% from 2025 to 2035. This growth is fueled by the increasing exploitation of oxide ores and industrial minerals such as phosphate, barite, fluorite, and feldspar across Asia-Pacific and Africa.

As high-grade sulphide deposits decline, miners are shifting to non-sulphide sources, demanding customized flotation reagents. Specialized chemicals like fatty acid collectors and hydroxamate-based compounds are used for non-metallic mineral recovery, particularly in phosphate fertilizer and rare earth value chains.

Meanwhile, the sulphide ore segment continues to dominate by volume and value due to its widespread use in extracting copper, lead, zinc, and gold. The segment benefits from decades of reagent optimization, making its operations more cost-efficient. Sulphide ores rely on xanthates, dithiophosphates, and thiocarbamates, particularly in Latin America and North America, where copper and gold extraction remain vital.

However, the segment faces challenges in adapting to ore complexity and environmental regulations. The rise of non-sulphide ore processing, coupled with advancements in reagent compatibility and recovery optimization is expected to create new market opportunities across emerging economies.

| Ore Type Segment | CAGR (2025 to 2035) |

|---|---|

| Non-Sulphide Ore | 5.5% |

The collectors segment is projected to grow at the fastest CAGR of 5.9% between 2025 and 2035. Collectors are vital for altering mineral surface properties and selectively enhancing flotation yield. Innovations in biodegradable and more selective collector chemistries are helping reduce environmental impact while improving efficiency in low-grade ore extraction. These chemicals are increasingly demanded in copper, gold, and rare earth mining, especially in sulphide-rich deposits.

Frothers maintain stable growth as they optimize froth structure and particle adhesion. Used in both sulphide and non-sulphide flotation, frothers play a key role in maintaining recovery consistency, particularly in low-airflow flotation systems. Dispersants and activators continue to be used for modifying slurry rheology and boosting mineral reactivity, particularly in complex multi-metal ores.

Depressants help control unwanted mineral flotation and are essential in selective separation, especially for separating gangue from molybdenum and zinc. Flocculants serve water recycling and tailings management purposes, supporting the sustainability goals of modern mining. The others category includes pH modifiers, defoamers, and sulphidizers each crucial in fine-tuning specific operational variables, though with slower growth trajectories due to their auxiliary roles.

| Chemical Type Segment | CAGR (2025 to 2035) |

|---|---|

| Collectors | 5.9% |

The USA is witnessing steady growth due to the increasing demand for minerals and metals, fuelled by the expansion of construction, automotive, and electronics industries. The rising need for high-grade ore beneficiation and the adoption of environmentally sustainable mining practices are driving the demand for advanced flotation chemicals, including collectors, frothers, dispersants, and depressants.

The country is one of the world’s largest producers of coal, copper, gold, and iron ore, making flotation chemicals crucial for efficient mineral recovery and processing. The implementation of strict environmental regulations by the Environmental Protection Agency (EPA) and sustainability initiatives by major mining corporations are also shaping the market, leading to the adoption of eco-friendly and biodegradable flotation reagents.

In addition, the growth of the battery metals industry, particularly for lithium and rare earth elements used in electric vehicles (EVs) and renewable energy storage, is increasing demand for specialized flotation chemicals. Several companies are investing in research and development (R&D) to create selective flotation agents that enhance metal recovery while reducing water and energy consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

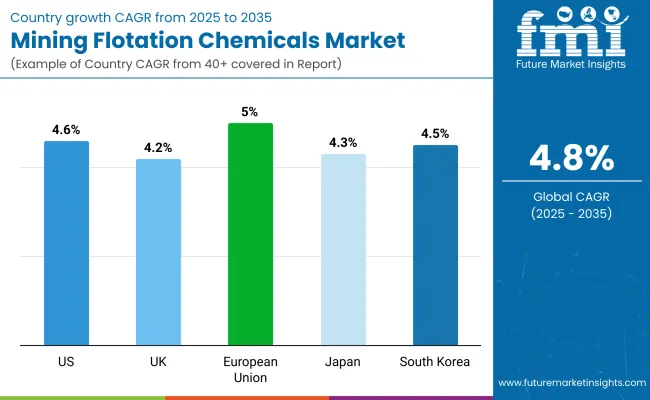

| USA | 4.6% |

The UK is evolving as the country increases its focus on domestic mineral extraction and sustainable mining solutions. The UK is a major importer of minerals, but recent policies have emphasized developing local mining operations to reduce dependence on foreign resources. This shift is driving demand for advanced flotation chemicals, particularly in the recycling of metals and the extraction of rare earth elements (REEs).

With the Net Zero 2050 initiative, the UK government is encouraging the use of environmentally friendly mining chemicals, leading to a surge in demand for biodegradable frothers, depressants, and dispersants. Additionally, the rising investment in urban mining (recycling metals from electronic waste) is increasing the use of flotation techniques to recover precious and base metals from discarded electronics.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The European Union is undergoing significant transformation due to stringent environmental regulations, increased investment in domestic mining, and the rising demand for battery metals. With the EU's goal of reducing reliance on imported raw materials, countries like Germany, France, Sweden, and Finland are ramping up their mining and mineral processing activities, thereby increasing demand for flotation reagents.

The EU Green Deal and Circular Economy Action Plan are also influencing market trends, pushing for the adoption of sustainable mining practices and the use of eco-friendly flotation chemicals. The growth of the electric vehicle sector and the expansion of lithium and cobalt mining operations in Portugal, Spain, and Finland are further driving demand for selective flotation collectors and frothers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Japan's is witnessing steady growth due to rising demand for high-purity metals in electronics, semiconductors, and advanced manufacturing. While Japan has limited domestic mining operations, its metal recycling and urban mining sectors are thriving, increasing the need for specialized flotation chemicals for metal recovery.

The country is a leader in high-tech mineral processing, with companies developing customized reagents for selective flotation to improve metal purity. Additionally, Japan’s commitment to reducing reliance on imported rare earth elements (REEs) has driven investment in advanced mineral separation technologies, boosting demand for precision flotation reagents.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The South Korean is expanding due to growing demand for rare metals, urban mining, and government-backed sustainability initiatives. South Korea is a major consumer of lithium, nickel, and cobalt, and with limited domestic mining resources, it has heavily invested in advanced flotation techniques for metal recycling and secondary metal processing.

The country’s automotive and electronics sectors, led by Hyundai, Samsung, and LG, require high-purity metals, further driving innovation in selective flotation reagent development. Additionally, South Korea’s smart mining initiatives, including the use of AI and big data in flotation plants, are optimizing chemical usage and improving recovery rates.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

The mining flotation chemicals market is an important market in the global mining industry, facilitating the efficacious separation of precious minerals from ores. The increased demand for minerals and metals, modernization in the mining process, and stricter environmental regulations advocating sustainable chemical formulations have driven the market.

Heavy investments in R&D are made by major players to enhance flotation efficiency at the same time as minimization of environmental footprint. Market players include from established chemical manufacturers to specialized suppliers catering to various applications in mineral processing.

On the basis of ore type, the industry is categorized into sulphide ore and non-sulphide ore.

By chemical type, the industry is divided into collectors, frothers, dispersants, activators, depressants, flocculants, and others.

By region, the industry is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The overall market size for the market was 13.1 billion in 2025.

The market is expected to reach USD 20.9 billion in 2035.

The increasing requirement for effective mineral processing, better ore recovery, environmentally friendly chemical solutions in the mining industry, and innovation in flotation technology is fueling growth in the market for mining flotation chemicals, mainly in copper, gold, and iron ore production.

The top 5 countries which drives the development of the market are the USA, UK, Europe Union, Japan and South Korea.

Sulfide Ore is projected to command significant share during the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Ore Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Ore Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Chemical Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Ore Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Ore Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Chemical Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Ore Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Ore Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Chemical Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Ore Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Ore Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Chemical Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Ore Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Ore Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Chemical Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Ore Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Ore Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Chemical Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Ore Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Ore Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Chemical Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Ore Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Ore Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Chemical Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Chemical Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Ore Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Chemical Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Ore Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Ore Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Ore Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Ore Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Chemical Type, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Chemical Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Chemical Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Chemical Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Ore Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Chemical Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Ore Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Chemical Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Ore Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Ore Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Ore Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Ore Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Chemical Type, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Chemical Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Chemical Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Chemical Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Ore Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Chemical Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Ore Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Chemical Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Ore Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Ore Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Ore Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Ore Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Chemical Type, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Chemical Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Chemical Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Chemical Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Ore Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Chemical Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Ore Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Chemical Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Ore Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Ore Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Ore Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Ore Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Chemical Type, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Chemical Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Chemical Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Chemical Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Ore Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Chemical Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Ore Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Chemical Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Ore Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Ore Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Ore Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Ore Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Chemical Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Chemical Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Chemical Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Chemical Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Ore Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Chemical Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Ore Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Chemical Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Ore Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Ore Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ore Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ore Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Chemical Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Chemical Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Chemical Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Chemical Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Ore Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Chemical Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Ore Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Chemical Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Ore Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Ore Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Ore Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Ore Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Chemical Type, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Chemical Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Chemical Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Chemical Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Ore Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Chemical Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Ore Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Chemical Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Ore Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Ore Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Ore Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ore Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Chemical Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Chemical Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Chemical Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Chemical Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Ore Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Chemical Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Shovel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mining Drill Market Growth – Trends & Forecast 2025 to 2035

Mining Explosives Consumables Market Growth – Trends & Forecast 2025 to 2035

Mining & Construction Drilling Tools Market Growth – Trends & Forecast 2024-2034

Mining Locomotive Market

Mining Vehicle AC Kits Market

Mining Collectors Market Size & Demand 2022 to 2032

Demining Tool Kits Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA