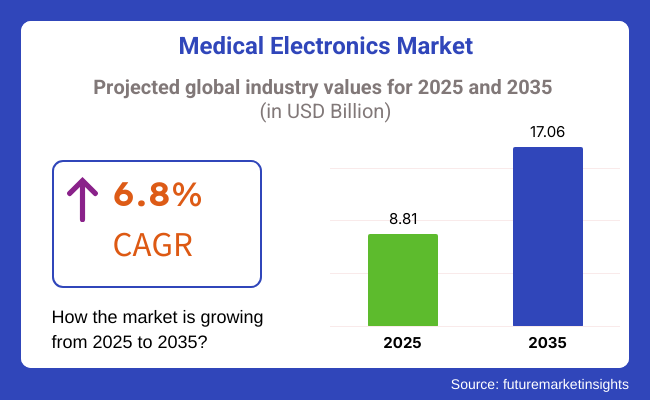

The medical electronic market is expected to grow to USD 8.81 billion in 2025, and to USD 17.06 billion by 2035, with a CAGR of 6.8%. The reason for the growth is the evolution of medical imaging technology, growing acceptance of smart medical devices, and enhanced healthcare infrastructure investments. In addition, the use of telemedicine and distance healthcare services fuels the expansion of medical electronic devices, which subsequently enhances patient care and operational performance in medical ambient.

A wide variety of devices are classified under the industry, ranging from diagnostic imaging systems to patient monitoring systems, wearable health devices, and therapeutic systems. The growing integration of artificial intelligence (AI) and the Internet of Medical Things (IoMT) in these devices is optimizing diagnostic efficiency, real-time monitoring, and personalized treatment options.

Demand for sophisticated products is additionally propelled by emerging requirements for minimally invasive treatments and effective systems for healthcare delivery, and therefore they become an indispensable part of the healthcare ecosystem to transform the care to modernized standards.

There are numerous factors responsible for increasing the growth of the industry. The higher incidence of chronic conditions and an aging population in the world are fueling demand for state-of-the-art diagnostic and monitoring equipment.

Increased technology will make it possible to utilize high-resolution magnetic resonance imaging (MRI), computed tomography (CT) scans, and portable ultrasound devices. Moreover, the transition to digital healthcare adoption, such as remote patient monitoring and networked medical devices, is transforming the sector by expanding access to health services across oceans and among rural and marginalized communities. The industry is also benefiting from government funding and investments in healthcare digitization.

While this presents such an opportunity for strong growth, the industry presents some challenges. Severe barriers to entry - ridiculously high costs of developing and rolling out advanced medical devices - stifle adoption, particularly in the developing world.

Conformity structures and long approval procedures might also hinder the innovation and commercialization stages. Data security and interoperability between various medical devices and healthcare IT infrastructure are also causes for concern and challenge easy integration in healthcare environments.

New technologies and changing healthcare requirements drive the Industry. With the fusion of AI-enabled analytics, blockchain for secure data storage of patient data and telemedicine systems backed by 5G, the industry is likely to revolutionize. Healthcare wearables and home care medical monitoring equipment are becoming universal, pumping up the demand for power- and space-efficient electronics.

In addition, strategic collaborations among medical device firms and technology firms and healthcare providers enhance innovation resulting in more rapid development of next-generation medical technology. The industry will thus remain an innovative field to revolutionize patient care, as well as, clinical work processes and overall healthcare efficiency with digital media of care in the coming decade.

Explore FMI!

Book a free demo

The industry is growing fast due to advancements in digital health, telemedicine, and artificial intelligence-based diagnostics. Hospitals and diagnostic centers need high-precision, long-life, and regulatory-approved, including imaging devices, patient monitors, and surgical equipment.

The home healthcare industry is expanding with the demand for easy-to-use and portable devices, including wearable health monitors and telehealth platforms. Diagnostic and analytical instruments of high accuracy are needed in research laboratories to enable innovation in biomedical research and pharmaceuticals.

Wearable technology, such as smartwatches and biosensors, is concentrated on connectivity, real-time tracking, and AI-based analytics for personal health monitoring. The trend towards IoT-based, cloud-connected medical devices and strict regulatory requirements are driving the industry. Increased investments in AI, robotics, and precision medicine are likely to fuel additional technological innovation in the industry.

Contracts & Deals Analysis

| Company | Contract Value (USD millon) |

|---|---|

| Johnson & Johnson (J&J) | Up to USD 1,700 |

| Stryker Corporation | USD 4,900 |

| Micro-X | USD 8.2 initially, up to USD 16.4 |

The industry expanded significantly throughout 2024 and the first half of 2025 and was buoyed by well-planned acquisitions and innovative development contracts. The USD 1.7 billion potential acquisition of V-Wave by Johnson & Johnson is a strategic trade for the firm that can widen its portfolio in devices meant to treat heart disease replacing firm offers in this field. Stryker's USD 4.9 billion covenant to buy Inari Medical also demonstrates the company’s investment in bolstering its stronghold in the treatment of venous thromboembolism, a major vascular ailment.

Micro-X, which is working for ARPA-H on a portable full-body CT scanner, news that, again, is well into at least September, and marks the development of medical imaging technology I always treasure because it will make not only technology available but also unlock the power of diagnosis. These advances are part of a broader trend across the industry towards consolidation and technological development that aims to enhance patient care and address complex medical conditions.

Between 2020 to2024, the industry grew rapidly due to growing demand for advanced healthcare solutions and wearable medical devices. Developments in AI-based diagnostics, remote patient monitoring, and implantable medical devices drove adoption in hospitals, healthcare providers, and homecare. Medical imaging technologies, smart biosensors, and mobile diagnostic devices improved telemedicine, digital pathology, and personalized medicine. Regulators like the FDA and EMA imposed strict approval procedures to ensure the safety and functionality of medical devices. It was challenging through enormous development costs, regulatory hurdles, and cyber-attacks on networked medical devices.

The industry will advance with AI-based diagnostics, nanotechnology, and bioelectronic medicine during 2025 to 2035. Smart, autonomous medical devices will enable real-time disease monitoring and AI-supported therapy. Quantum computing will enhance medical imaging, and bioelectronic therapy and nanomaterial-based biosensors will improve diagnostic quality and treatment efficiency. Self-reliant wearables and biodegradable implants will lead the way in sustainable healthcare. Blockchain-protected patient records and distributed healthcare infrastructure will provide security and interoperability to enhance patient outcomes and lower prices.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 through 2024 | 2025 through 2035 |

|---|---|

| The regulatory bodies were concerned with AI-based diagnostic-related safety clearances, remote medical monitoring devices, and implantable electronics. | AI-based regulatory compliance automation, blockchain-protected medical device information, and decentralized digital health management will drive future policies. |

| Medical imaging, wearable biosensors, and telemedicine platforms enhanced by AI integration and real-time monitoring. | Quantum computing-based medical diagnosis, nanotechnology-based biosensors, and bioelectronic treatment will revolutionize healthcare applications. |

| The industry became a common use in patient care, AI-supported diagnosis, and robotic surgery. | AI-based personal medicine, bioelectronic treatments for chronic ailments, and precision diagnostics in real-time will create expanded industry uses. |

| Hospitals, clinics, and home healthcare incorporated intelligent wearable devices, telemedicine technology, and auto-diagnostic systems. | AI-integrated remote patient monitoring, autonomous robotic-assisted surgeries, and smart implantable bioelectronics will drive adoption. |

| Companies focused on AI-driven diagnostics, cloud-based medical analytics, and cost-effective electronic healthcare solutions. | Biodegradable medical electronics, AI-assisted automated healthcare workflows, and blockchain-based patient data security will improve sustainability and cost efficiency. |

| AI-based patient risk scoring, real-time medical imaging analysis, and automated anomaly detection helped optimize diagnostics. | Quantum computing-augmented predictive medicine, AI-based disease modeling of progression, and adaptive digital therapeutics will revolutionize predictive medicine. |

| Its challenges were high development costs, cybersecurity threats in networked devices, and strict regulatory barriers. | AI-optimized supply chain operations, decentralized bioelectronic production, and blockchain-protected medical device traceability will make the industry more accessible. |

The industry is growing at a rapid pace with developments in healthcare technology and increasing demand for patient monitoring equipment. The high cost of development, stringent regulatory clearances, and long product clearance times are major barriers to entry into the industry.

Cybersecurity risks pose a major threat with medical equipment increasingly integrated into cloud-based networks and hospital systems. Unauthenticated access, data leakage, and ransomware penetration can jeopardize patient information and device performance. Strong encryption, real-time threat monitoring, and compliance-fit security controls are needed to ensure data protection and operational integrity.

Supply chain interruption, including semiconductor shortages and dependency on specialized components, impacts the production of medical devices. Delayed sourcing for required materials may lead to production slowdowns and increased expenses. Companies should diversify supply chains, invest in local production, and have backup plans in place to mitigate disruptions.

Stringent international standards, for example, FDA and CE certificates, create compliance challenges. Manufacturers of the industry must contend with complex approval systems, which vary by geography. Non-compliance can lead to product recalls, legal issues, and economic losses. Continuous active engagement with regulation bodies and the implementation of strict quality control are essential to industry stability.

The rapid rate of technological advancements gives rise to the threats of obsolescence on the industry. The ongoing updates in AI, IoT, and miniaturization make it incumbent on companies to invest in R&D to be abreast with trends in their respective industries. Innovation is called for while supporting backward compatibility alongside smooth integration into existing healthcare equipment so that a company remains relevant in the industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 6.2% |

| France | 6.3% |

| Germany | 6.5% |

| Italy | 6.4% |

| South Korea | 7.% |

| Japan | 6.7% |

| China | 7.2% |

| Australia | 6.1% |

| New Zealand | 5.9% |

The USA industry is growing based on the fast growth of AI-based diagnostics, healthcare wearables, and IoMT-based remote monitoring technologies. Medtronic, Abbott, and GE Healthcare are investing extensively in biosensors, bioelectronic implants, and minimally invasive medical devices to improve patient care and decrease hospitalization. Growing demand for intelligent implants and wireless monitoring platforms is driving innovation that is enabled by government-led initiatives like NIH's facilitation of digital health. Growth in chronic diseases and a growing aging population are also driving demand for sophisticated diagnostic and therapeutic platforms.

The wearables industry is progressing steadily as neurostimulation smart wearables, continuous glucose monitors, and ECG patches go mainstream. Telehealth is being transformed with the integration of 5G and AI analytics, which provides predictive diagnostics and real-time monitoring. Consumer-led healthcare wearables from American players such as Apple and Dexcom are driving the growth of the industry. Venture capital funding strongly backs the industry to ensure steady growth, coupled with approvals for new-generation medical electronics.

The UK Industry is expanding owing to the rising application of AI-enabled medical diagnostics, intelligent monitoring devices, and telemedicine programs subsidized by the government. National Health Service (NHS) dominates wearable biosensors and implantable devices for distant patient monitoring within telemedicine. Organizations like Smith & Nephew and GlaxoSmithKline are creating the next generation of medical electronics, including intelligent prosthetics and bioelectronic medicine. The emphasis on individualized healthcare solutions and prevention care technology is driving growth in digital health solutions.

The robust R&D environment in the UK, places like Imperial College London, is driving growth in biomedical electronics and AI-based imaging system development. Green technology for medicine is making waves, and studies in biodegradable sensors and low-power sensors are dominating the headlines. Robotics used in surgeries and intelligent assistive technology for the management of chronic diseases are also setting the industry on a firm footing. Growing government and private investment guarantees ongoing advancement in medical electronics and digital health technologies.

France's Industry is growing, backed by digital health efforts encouraged by the government and robust med-tech innovations driven by firms such as BioSerenity and Carmat. Increased demand for AI-based radiology, robot-assisted surgery, and wireless medical devices is also driving growth in the industry. Healthcare sector digitalization, spurred on by the government through investments in AI-based diagnostic technologies, is also driving innovation. Neurostimulation devices, implants, and biosensors are increasingly making waves in the cardiology and neurology spaces.

Rapid growth in application of smart wearable technology in care prevention, growth in adoption of ECG patches and remote healthcare monitoring devices is increasing. The power R&D system of French nations is fueling innovation in AI medical technology as well as in sensor technologies. Thales and Medtech are spearheading development in digital healthcare infrastructure, thereby fueling the industry even stronger. Increased growth in the adoption of telemedicine along with personalized health solutions will enhance the growth in next-gen medical electronics even more.

Germany's industry is growing rapidly due to its robust medical device manufacturing industry and the emergence of AI-based diagnostics. Siemens Healthineers and B. Braun are leading the industry for intelligent imaging solutions, digital therapy, and wireless patient monitoring. Integration of AI into radiology and pathology is simplifying diagnostics, accuracy, and lowering healthcare expenses.

Germany's concentration on digitalized healthcare revolution appears in the context of government patronage of e-health centers and growth in telemedicine. Greater use of robot-assisted surgery and smart biosensors are again driving growth in the industry. Personalized drugs, with constant innovations in nanotechnology-based industry, are also bringing new directions to the medical healthcare industry. German med-tech firms continue to set the pace for future developments with their creation of diagnostic as well as therapy products, facilitating future industry growth.

Italy's industry is growing with further investment in telemedicine, AI technology for diagnosis, and smart implantable devices. Esaote and Sorin Group are among the companies that are dominating medical imaging, cardiac implant, and neurostimulation technology. Government thrust towards digital health adoption, coupled with investment in remote monitoring systems, is promoting growth in the industry.

Italy's elderly population is driving demand for medical assistive electronics, such as wearable ECG monitors and artificial intelligence-driven diagnostic devices. Neuromodulation devices and prosthetics are also picking up, improving mobility and long-term condition management. Green medical technologies such as biodegradable sensors and low-power medical electronics are increasing in Italy, further supporting the industry. Home-care solutions and targeted medicine are also increasing, further supporting the industry.

South Korea's industry is growing with the development of AI-based diagnostics, 5G-based telemedicine, and semiconductor-based smart healthcare devices. Samsung Medison and SK Hynix are leading the charge in high-end medical imaging and biosensor technology. Government investments in digital healthcare infrastructure are encouraging remote monitoring and adoption of wearable health technology.

AI-driven imaging, real-time patient monitoring, and telemedicine solutions are fueling growth, especially in the treatment of chronic diseases. South Korea's robust semiconductor landscape facilitates next-generation biosensors and AI-driven diagnostic platforms. The convergence of smart medical devices with IoT and 5G connectivity is advancing remote care services, propelling South Korea to the forefront of digital health transformation.

Japan's industry is on the rise with robust government backing for healthcare innovation, high acceptance of robotic-assisted medical equipment, and tremendous demand for smart diagnostic devices. Fujifilm, Omron, and Sony are the champions in taking portable medical electronics to commercial production. The Ministry of Health, Labour, and Welfare has made massive investments in health digitization in areas like AI-based diagnosis and wearable biosensors.

Japan's demographic aging is propelling demand for assistive medical electronics such as smart hearing aids, wearable ECG monitors, and AI-based fall detection devices. Robot application in geriatric care and surgery is the flagship of medical technology. Japan's focus on miniature-sized, high-performance healthcare technology is driving the growth of smart implants and bioelectronic medicine to fuel long-term industry growth.

China's industry is thriving with its heavy investment in healthcare based on AI, wearables, medical equipment, and digital health infrastructure. Telemedicine, intelligent diagnostics, and remote patient monitoring are being driven by initiatives like the Healthy China 2030 program initiated by the government. Mindray, Huawei, and Tencent are leading the pack in medical imaging solutions, AI-driven diagnostics, and IoT-enabled healthcare solutions. Increasing usage of AI-enabled radiology and real-time patient monitoring platforms is enhancing the early detection of diseases as well as the outcomes of their treatment.

Domination of Chinese semiconductor manufacturing is propelling research in biosensors, intelligent implants, and wireless medical electronics. Increasing demand for home healthcare equipment is fueling investment in smart wearable technology such as ECG patches and continuous glucose monitoring devices. Besides, the movement of China towards telemedicine services in partnership with 5G technology is enhancing remote healthcare access, foremost in rural places. Robotic surgery and expansion of AI-backed diagnosis platforms is also making China an outstanding achiever in the global medical electronic industry.

The industry in Australia is increasing step by step with the augmenting use of digital health tech, AI-assisted medical diagnoses, and government-supported telemedicine services. Australian government investment in electronic health facilities under the My Health Record initiative is driving the use of intelligent medical devices for patient treatment. Cochlear and ResMed are among the companies that are at the forefront of the uptake of respiratory monitoring and hearing aid technology, which is improving outcomes for patients through novel wearable electronics. The aging population and growing chronic diseases are propelling demands for intelligent biosensors, diagnostic devices based on artificial intelligence, and home monitoring of health.

Australia's strong research culture is propelling the development of advanced medical electronics, such as intelligent prosthetic devices and neuromodulation devices. Also on the increase is the convergence of healthcare technology with IoT, which is boosting real-time patient monitoring, with telemedicine services enhancing accessibility to healthcare services in rural areas. Australia's industry is growing with a focus on preventive care technologies and precision medicine.

New Zealand's industry is growing along with wearable health technology, AI-based diagnostics, and government support for digital health. The nation is moving towards telehealth services and remote patient monitoring, boosting demand for wireless medical devices and smart biosensors. Organizations such as Fisher & Paykel Healthcare are leading the respiratory care and digital health space with new products to heal patients.

Increased consciousness towards preventive care and home-care medical solutions is fueling the acceptance of wearable ECG monitors, AI-based imaging systems, and cloud-based healthcare systems. New Zealand's drive for sustainability is stimulating the growth of sustainable options such as energy-efficient biosensors. The ongoing revolution in digital therapeutics and AI-based diagnosis platforms is also strengthening the industry, with long-term growth opportunities in the industry.

Heavy base monitors are fixed systems designed for continuous use across Healthcare, industrial, and home environments. In the medical field, the devices are high-end patient monitoring systems, diagnostic imaging equipment, and high-performance air purifiers.

Companies like GE Healthcare, Siemens Healthineers, and Philips are leading the way in making hospital-grade monitoring and imaging systems that can provide a constant stream of information about a patient’s health for those focused on smart home features, air purifiers and HVAC-integrated scent diffusers from brands like Dyson and Honeywell help support a healthy indoor air quality. Whether professional or household, these devices promote durability, efficiency, and precision, all essential attributes.

Wearable gadgets are becoming very popular nowadays in the Fitness domain, Healthcare, and Consumer electronics; it would be very easy to carry and monitor data in real-time. Smartwatches, fitness bands, and medical wearables are creating a way for people to keep tabs on their heart rate, ECG, oxygen levels, glucose, etc., and manage their health proactively. Apple, Fitbit, and Garmin - all keep pushing out new and better smartwatches with healthcare features; Abbott, Medtronic, and other medical companies are advancing specialized wearables that can track patients with chronic diseases. AI, IoT, and biometric sensor technologies improve the accuracy and functionality of wearability devices, which are now expanding to healthcare and health regimen personalization.

Great Society Space Integration, together with the Technical Jump of these existing devices, gives birth to the entry of heavy bases, heavy mechanical, dull stationary devices, and wearables into discrete environments. In contrast, the heavier weight balance mobility device establishes effective structure points of ease, and Wearables Bridge into areas of micro-consumer and micro-medical attention.

Imaging applications are critical to a wide variety of industries, particularly in healthcare and consumer electronics. For example, in the medical field, MRI, CT scans, and ultrasound technologies are essential to diagnosis and treatment planning. Companies like Siemens Healthineers, GE Healthcare, and Philips are developing AI-powered imaging tools to increase both accuracy and efficiency.

In consumer electronics, sensor innovation in imaging is revolutionizing smartphone cameras, AR, and LiDAR-based depth sensing, with leading smartphone brands such as Apple and Samsung raising the bar with computational photography.

Real-time monitoring of vitals, like the heart rate, oxygen levels, ECG, glucose levels, etc., is made possible through wearable health monitoring devices that are set to take personal Healthcare to the next level. Major players in the space, like Apple, Fitbit, and Garmin, corner the smartwatch industry with an emphasis on fitness and wellness features.

Applications in medicine such as Abbott’s FreeStyle Libre glucose monitoring device and Medtronic continuous ECG monitors aid in the management of chronic conditions. Wearable health technology is also being pushed into wider use by the integration of AI and IoT, resulting in more complex, accessible devices. Imaging and health monitoring technology in Healthcare and beyond continues to evolve and accelerate through innovation.

The industry is transforming at a blazing speed, backed by the push for value-added healthcare products and patient-centric technology. Increased adoption of AI-driven diagnostic platforms, implantable and wearable medical monitoring sensors, and telemedicine services is transforming the industry. Rapid progress in medical sensors and implantable electronics is allowing real-time health tracking and enabling early disease detection, improving patient care and hospital efficiencies.

With the development of technology, the areas of investment that promote health precision and efficiency of healthcare services delivery are bioelectronics, AI analytics, and IoT-integrated medical devices. Portability and reduced complexity in diagnostic devices facilitate remote management of patients, de-concentrating health interventions. It is particularly crucial in the treatment and management of long-term disease and also in linking geographically distant areas with a quicker, tailored system of response to health.

The competitive industry for the industry comprises global healthcare technology leaders and specialty firms developing high-performance medical components. Strategic partnerships, research and development, and regulatory innovation drive the industry growth trajectory. As increasing demands are made for complex healthcare solutions, companies continuously innovate to meet evolving patient and provider needs, culminating in an efficient, smooth, and technologically sophisticated healthcare system.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic | 12-17% |

| Philips Healthcare | 10-14% |

| GE Healthcare | 8-12% |

| Siemens Healthineers | 5-9% |

| Abbott Laboratories | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic | Produces implantable medical devices, cardiac monitors, and neurostimulators used in managing chronic disease. |

| Philips Healthcare | Specialization in telemedicine, hospital healthcare solutions, patient monitoring equipment, and artificial intelligence-driven healthcare solutions. |

| GE Healthcare | Offers high-end ultrasound, MRI, and CT imaging equipment as well as artificial intelligence-driven diagnostic software. |

| Siemens Healthineers | Makes precision imaging technology, in-vitro diagnostic equipment, and robotic-assisted surgical systems. |

| Abbott Laboratories | Highlights wearable blood glucose monitoring devices, cardiac diagnostic devices, and portable laboratory devices for real-time health monitoring. |

Key Company Insights

Medtronic (12-17%)

Medtronic is a frontrunner in the industry by innovation in implanted devices and remote monitoring technology. It is a frontrunner in AI-enforced diagnostics and personalized treatment platforms for chronic disease.

Philips Healthcare (10-14%)

Philips is a frontrunner in next-generation medical imaging, health analysis with AI, and remote patient monitoring. Philips telemedicine solutions are of paramount importance to improving healthcare services' accessibility.

GE Healthcare (8-12%)

GE Healthcare produces advanced imaging devices and AI-powered diagnostic equipment. It is committed to improving the efficiency of clinical diagnostics and hospitals.

Siemens Healthineers (5-9%)

Siemens Healthineers offers accurate diagnostics and robot-supported solutions, highlighting early disease detection and AI-based radiology solutions.

Abbott Laboratories (3-7%)

Abbott dominates real-time monitoring equipment in healthcare, i.e., glucometer and cardiovascular diagnosis, with a vast emphasis on wearable medical devices.

Other Key Players (45-55% Combined)

The industry is expected to generate USD 8.81 billion in revenue by 2025.

The industry is projected to reach USD 17.06 billion by 2035, growing at a CAGR of 6.8%.

Key players include Medtronic, Philips Healthcare, GE Healthcare, Siemens Healthineers, Abbott Laboratories, Boston Scientific, Baxter International, Becton Dickinson (BD), ResMed, and Omron Healthcare.

North America and Europe, driven by increasing adoption of AI-powered medical devices, government support for healthcare innovation, and a rising geriatric population.

Diagnostic imaging systems dominate due to their critical role in early disease detection, advancements in imaging technologies, and increasing demand for non-invasive diagnostic solutions.

The industry covers handheld devices, heavy base devices, wearable gadgets, wireless connected devices, RFID-based health tracking devices, and RADAR technology-based ultrasound machines.

The industry includes imaging, health monitoring, digital assistance, digital diagnostics, medical therapy, fitness, wellness, and overall healthcare.

The industry consists of sensors, batteries, displays, processors, and memory.

The industry spans North America, Latin America, Asia Pacific, Japan, Western Europe, Eastern Europe, and the Middle East & Africa.

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

POS Receipt Printers Market Trends - Growth & Forecast 2025 to 2035

Personal CRM Market Report - Growth & Forecast 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Property Management Software Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.