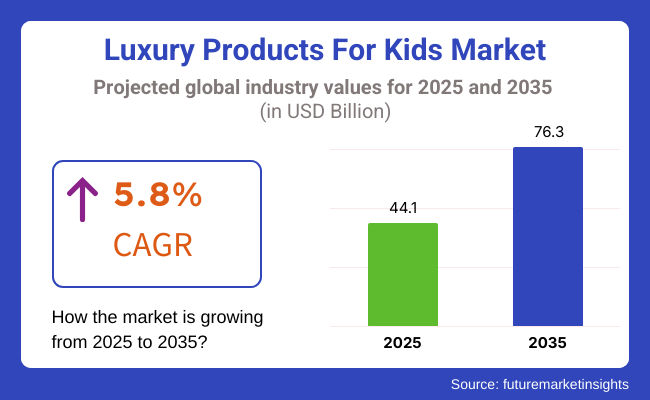

The luxury products for kids market is set for significant growth from 2025 to 2035, driven by rising parental spending, increasing brand consciousness, and premiumization trends. The market size is projected to expand from USD 44.1 billion in 2025 to USD 76.3 billion by 2035, registering a compound annual growth rate (CAGR) of approximately 5.8% over the forecast period.

Key factors fueling this growth include the influence of social media, celebrity endorsements, and the growing demand for exclusive, high-quality products. Luxury kids’ fashion, accessories, premium toys, and high-end nursery products are gaining traction, particularly among affluent consumers. Additionally, sustainability-focused innovations in luxury children's apparel and ethical manufacturing practices are shaping future market trends.

Explore FMI!

Book a free demo

North America is expected to dominate the luxury products for kids market, driven by high disposable incomes, a strong presence of premium brands, and a consumer preference for exclusive, high-end goods. The USA and Canada lead in demand for designer clothing, luxury strollers, and premium educational toys.

Social media and influencer marketing play a crucial role in shaping purchasing decisions, with brands offering limited-edition collections and personalized shopping experiences. Sustainable luxury, including organic fabrics and eco-friendly production methods, is also gaining popularity.

Europe remains a key market, with heritage brands leading in luxury children's fashion, accessories, and nursery products. Countries like France, Italy, and the UK are witnessing strong demand for customized and bespoke luxury products. The region’s strict sustainability regulations push brands toward ethical sourcing and eco-friendly materials.

Additionally, luxury skincare and organic baby care products are gaining traction as parents seek high-quality, chemical-free solutions. Collaborations between high-end designers and children's brands further bolster market expansion.

Asia-Pacific is expected to witness the fastest growth, driven by rising affluence in China, India, and Southeast Asia. The growing number of high-net-worth individuals (HNWIs), coupled with increasing brand penetration, is accelerating market demand.

Luxury baby gear, high-end fashion, and premium educational toys are particularly sought after. Social media, influencer marketing, and flagship store expansions are enhancing brand visibility and market penetration. Additionally, localized marketing strategies and exclusive collections tailored for APAC consumers are strengthening brand engagement.

High Price Sensitivity And Market Exclusivity

The luxury kids’ market caters to a niche audience, with price sensitivity being a key challenge. While affluent consumers prioritize exclusivity and quality, middle-income groups may find premium products inaccessible. Additionally, economic fluctuations can impact discretionary spending, limiting market expansion.

To address this, brands can introduce limited-edition products, flexible payment plans, and exclusive membership benefits. Expanding into emerging luxury markets and leveraging omnichannel strategies can also enhance accessibility and brand reach.

Sustainable And Customizable Luxury Products

The demand for eco-friendly and sustainable luxury in children's products is rising. Parents are increasingly prioritizing organic materials, ethically sourced fabrics, and carbon-neutral manufacturing. Additionally, customization and personalization-such as monogrammed clothing, bespoke furniture, and tailor-made accessories-are becoming popular.

Luxury brands can capitalize on this trend by launching exclusive, sustainable collections and leveraging digital platforms for personalized shopping experiences. Collaborations with eco-conscious influencers and sustainability advocates will further enhance brand credibility and market engagement.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 65.20 |

| Estimated Total Market Size (USD millions) | 22,506.08 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 52.80 |

| Estimated Total Market Size (USD millions) | 74,917.44 |

| Country | India |

|---|---|

| Population (millions) | 1,450.9 |

| Estimated Per Capita Spending (USD) | 21.50 |

| Estimated Total Market Size (USD millions) | 31,195.35 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 59.70 |

| Estimated Total Market Size (USD millions) | 5,021.77 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 57.40 |

| Estimated Total Market Size (USD millions) | 3,921.42 |

The USA USD 22.51 Billion luxury kids’ market thrives on designer clothing, high-end strollers, and premium accessories. Celebrity culture and social media influence drive demand for luxury-branded kids' apparel and toys. E-commerce and boutique retailers play a crucial role in distribution, with parents prioritizing exclusivity and high-quality craftsmanship.

China’s USD 74.92 Billion market leads in premium children’s fashion, high-end toys, and luxury baby gear. Growing disposable incomes, social prestige, and Western brand appeal fuel demand. Luxury malls, digital marketplaces, and personal shopping services cater to affluent parents seeking status-driven, high-quality products for their children.

India’s USD 31.20 Billion luxury kids' market is expanding due to rising affluence, aspirational branding, and premium baby care demand. Affluent urban parents prefer designer baby wear, imported strollers, and organic skincare. Luxury retail and e-commerce are bridging accessibility, while celebrity-endorsed brands continue to gain traction.

Germany’s USD 5.02 Billion market values sustainability, premium craftsmanship, and minimalist luxury. Parents favor organic, eco-friendly baby care, designer fashion, and premium wooden toys. Boutique luxury stores and high-end retail chains dominate, while direct-to-consumer luxury baby brands see increasing traction.

The UK’s USD 3.92 Billion luxury kids’ market is driven by heritage brands, sustainability-focused luxury, and premium baby essentials. Personalized gifting, high-end baby gear, and custom-made children's wear attract affluent buyers. Luxury department stores, online premium retail, and exclusive brand collaborations shape industry trends.

The luxury products for kids market is growing steadily, driven by increasing demand for premium baby essentials, designer kidswear, and exclusive toys. A survey of 250 respondents across the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East highlights key trends influencing purchasing behavior.

72% of respondents prioritize brand reputation and quality, with 68% in the USA and UK favoring premium brands like Burberry Kids, Gucci Kids, and Bonpoint. 65% of parents in China and Southeast Asia seek high-end yet functional baby gear and clothing, while 58% of respondents in Korea and Japan prefer minimalist, premium designs with organic materials.

Pricing sensitivity varies, with 60% of USA and EU respondents willing to spend USD 200+ on luxury kidswear and essentials, while only 45% in Southeast Asia and China opt for high-end options. 52% of global buyers expect luxury products for kids to balance comfort, safety, and exclusivity, making mid-range premium offerings a key market driver.

E-commerce plays a significant role in purchasing trends, with 66% of respondents in China, the USA, and Southeast Asia buying luxury kids' products online via Farfetch, Net-a-Porter, and Tmall. 55% of consumers in Korea and Japan still prefer luxury department stores and boutiques, valuing in-person shopping experiences. 48% of global respondents consider celebrity endorsements and influencer parenting trends as major purchase influencers.

Sustainability is becoming essential, with 57% of respondents in the UK and EU favoring organic, eco-friendly, and ethically sourced luxury kidswear. 50% of buyers in China and Southeast Asia seek customized and heirloom-quality products, while 53% of respondents in ANZ and the Middle East prioritize exclusive, limited-edition collections and premium gifting options.

Premium kids’ products (USD 200+) see strong demand in the USA, UK, and EU, while affordable luxury and designer collaborations dominate in Southeast Asia, China, and the Middle East. E-commerce and influencer-driven marketing continue to expand, making digital engagement, exclusive online drops, and personalized offerings crucial for brands.

Local designers have an opportunity to introduce culturally inspired luxury products, while global brands must emphasize sustainability, craftsmanship, and exclusivity to maintain their market appeal. The luxury products for kids market is evolving, with opportunities in organic fashion, personalized gifting, and digital-first luxury experiences.

| Market Shift | 2020 to 2024 |

|---|---|

| Design Innovation | Brands introduced high-end, sustainable, and ethically sourced luxury kids' apparel, toys, and accessories. Personalized and limited-edition collections gained traction. |

| Sustainability & Materials | Organic, hypoallergenic, and non-toxic materials dominated luxury kids’ products. Brands emphasized ethical sourcing and fair trade manufacturing. |

| Technology & Smart Features | Wearable technology in kids' fashion and smart luxury strollers with IoT-enabled safety features emerged. Augmented reality (AR) enhanced shopping experiences. |

| Market Expansion & Consumer Adoption | Demand for premium kids' products surged in affluent markets, with a growing focus on exclusivity and heritage craftsmanship. E-commerce and boutique retail experiences flourished. |

| Regulatory & Compliance Standards | Stricter safety and quality regulations on luxury kids’ goods prompted greater transparency. Sustainable certifications became a key consumer requirement. |

| Customization & Personalization | Brands launched bespoke services for monogrammed apparel, jewelry, and designer nursery items. Subscription-based personalized luxury boxes gained popularity. |

| Influencer & Social Media Marketing | Luxury brands collaborated with celebrity parents and child influencers to showcase premium kids' products. Instagram and YouTube played a pivotal role in marketing. |

| Consumer Trends & Behavior | Parents prioritized high-quality, durable, and sustainable luxury products for their children. Demand for gender-neutral and minimalist luxury designs increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Design Innovation | AI-driven customization enables hyper-personalized luxury items. Smart fabrics and self-cleaning materials redefine high-end kids' fashion and accessories. |

| Sustainability & Materials | Zero-waste and circular economy practices become the norm. Lab-grown fabrics and biodegradable luxury materials gain mainstream adoption. |

| Technology & Smart Features | AI-powered luxury products adapt to children’s growth and needs. Smart cribs, AI-learning toys, and biometric security in accessories revolutionize the market. |

| Market Expansion & Consumer Adoption | Expansion into emerging markets with AI-driven personalized shopping experiences. Digital luxury experiences in the metaverse redefine brand engagement for young consumers. |

| Regulatory & Compliance Standards | Blockchain ensures full traceability of ethical and sustainable luxury production. Global regulations mandate carbon neutrality and eco-friendly practices in kids’ luxury goods. |

| Customization & Personalization | AI-driven hyper-personalization tailors products based on biometric data and lifestyle preferences. 3D printing enables real-time customization of luxury kids’ products. |

| Influencer & Social Media Marketing | Virtual influencers and metaverse-based luxury showcases transform digital engagement. NFT-linked limited-edition kids’ products and AR-powered shopping experiences dominate marketing. |

| Consumer Trends & Behavior | Biohacking-inspired luxury wear integrates wellness benefits like temperature regulation and skin-soothing properties. Parents seek immersive luxury experiences, blending physical and digital ownership. |

The USA luxury products for kids market is experiencing steady growth, driven by increasing disposable income, demand for premium quality, and brand-conscious parenting. High-end brands such as Gucci Kids, Burberry Children, and Ralph Lauren dominate the sector.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

The UK luxury products for kids market is expanding due to increased focus on sustainable luxury, premium children’s fashion, and high-end nursery products. Key retailers include Harrods, Selfridges, and high-end boutiques.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

Germany’s luxury products for kids market is expanding, with consumers valuing quality craftsmanship, organic materials, and durability. Leading brands such as Hugo Boss Kids, Moncler Enfant, and Armani Junior are key players.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.3% |

India’s luxury products for kids market is witnessing rapid expansion, fueled by increasing affluence, brand-conscious parents, and a rising interest in high-end kidswear. Retailers such as Tata Cliq Luxury, Versace Kids, and Fendi Children dominate the sector.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.7% |

China’s luxury products for kids market is growing significantly, driven by rising disposable incomes, the influence of Western luxury brands, and the expansion of online retail through platforms like Tmall and JD.com.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

Luxury fashion houses, including Gucci, Balenciaga, and Burberry, expand their kidswear collections as affluent parents seek premium clothing for their children. High-quality fabrics, exclusive prints, and celebrity endorsements drive demand for designer outfits, while limited-edition sneaker collaborations fuel the luxury footwear segment.

The market for high-end toys and collectibles, such as handcrafted dolls, miniature designer cars, and luxury-themed playsets, continues to grow. Brands like Fendi, Hermès, and Tiffany & Co. introduce exclusive toy lines, appealing to parents who prioritize quality, uniqueness, and brand prestige in children's products.

Premium strollers, car seats, and baby essentials crafted with high-end materials and superior craftsmanship witness increased demand. Brands such as Bugaboo, Silver Cross, and Stokke dominate this segment, offering ergonomic designs, smart technology integration, and eco-conscious materials. Personalized baby gifts, designer diaper bags, and organic skincare further enhance the luxury appeal.

Luxury children's brands leverage online retail to offer exclusive, limited-edition collections and personalized shopping experiences. AI-driven recommendations, virtual try-ons, and bespoke monogramming services attract high-net-worth consumers. Digital platforms, including Farfetch Kids and MyTheresa Kids, cater to growing online demand, making e-commerce a key driver of luxury kids' product sales.

The global luxury products for kids market is experiencing significant growth, driven by rising disposable incomes, evolving consumer lifestyles, and an increasing inclination towards premium and high-quality products for children.

Parents are increasingly investing in luxury items such as apparel, footwear, accessories, and toys for their children, viewing these purchases as a reflection of status and a desire to provide the best for their offspring. The market is characterized by both established luxury brands expanding into children's lines and emerging players focusing on niche segments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| LVMH Moët Hennessy - Louis Vuitton SE | 15-20% |

| Kering SA | 12-16% |

| Hermès International S.A. | 10-14% |

| Burberry Group plc | 8-12% |

| Dolce & Gabbana S.r.l. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| LVMH Moët Hennessy - Louis Vuitton SE | Offers a range of luxury children's products under brands like Dior and Fendi, including apparel, accessories, and footwear. Focuses on high-quality materials and craftsmanship, appealing to affluent consumers seeking premium products for their children. |

| Kering SA | Provides luxury kids' apparel and accessories through brands such as Gucci and Balenciaga. Emphasizes contemporary designs and brand heritage to attract fashion-conscious parents. |

| Hermès International S.A. | Known for its timeless designs, offers children's clothing and accessories that reflect the brand's commitment to quality and exclusivity. Focuses on limited production runs to maintain exclusivity. |

| Burberry Group plc | Features a dedicated children's line offering apparel and accessories that incorporate the brand's iconic designs. Utilizes digital marketing and e-commerce platforms to reach a global audience. |

| Dolce & Gabbana S.r.l. | Provides vibrant and stylish children's clothing and accessories, often featuring bold prints and designs. Engages in collaborations and limited-edition releases to create unique offerings. |

Strategic Outlook of Key Companies

LVMH Moët Hennessy - Louis Vuitton SE (15-20%)

LVMH leads the luxury products for kids market with a diverse portfolio of brands offering high-end children's apparel, accessories, and footwear. The company focuses on maintaining the exclusivity and quality associated with its brands, appealing to affluent consumers seeking premium products for their children. LVMH continues to expand its children's lines, leveraging its strong brand recognition and global retail network.

Kering SA (12-16%)

Kering holds a significant market share through its luxury brands like Gucci and Balenciaga, which offer contemporary and stylish children's products. The company emphasizes innovative designs and brand heritage to attract fashion-conscious parents. Kering invests in marketing campaigns and collaborations to enhance brand visibility in the luxury children's segment.

Hermès International S.A. (10-14%)

Hermès is renowned for its timeless and exclusive designs, offering children's clothing and accessories that reflect the brand's commitment to quality. The company maintains limited production runs to preserve exclusivity and appeal to discerning consumers. Hermès focuses on craftsmanship and the use of premium materials in its children's products.

Burberry Group plc (8-12%)

Burberry features a dedicated children's line that incorporates the brand's iconic designs into apparel and accessories. The company utilizes digital marketing and e-commerce platforms to reach a global audience, catering to the growing demand for luxury children's products. Burberry continues to innovate in design while maintaining its classic appeal.

Dolce & Gabbana S.r.l. (6-10%)

Dolce & Gabbana offers vibrant and stylish children's clothing and accessories, often featuring bold prints and designs. The company engages in collaborations and limited-edition releases to create unique offerings that appeal to fashion-forward parents. Dolce & Gabbana focuses on creating distinctive and high-quality products for the luxury children's market.

Other Key Players (30-40% Combined)

Several other companies contribute to the luxury products for kids market's growth by focusing on niche segments, sustainable practices, and innovative designs. Notable brands include:

These companies leverage their unique brand identities and customer insights to offer luxury children's products that cater to specific consumer preferences. They employ strategies such as limited-edition releases, sustainable material usage, and targeted marketing to enhance their market positions.

The Luxury Products for Kids industry is projected to witness a CAGR of 5.8% between 2025 and 2035.

The Luxury Products for Kids industry stood at USD 43,700 million in 2024.

The Luxury Products for Kids industry is anticipated to reach USD 76.3 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 7.1% in the assessment period.

The key players operating in the Luxury Products for Kids industry include Gucci Kids, Burberry Children, Armani Junior, Dolce & Gabbana Kids, Baby Dior, and others.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.