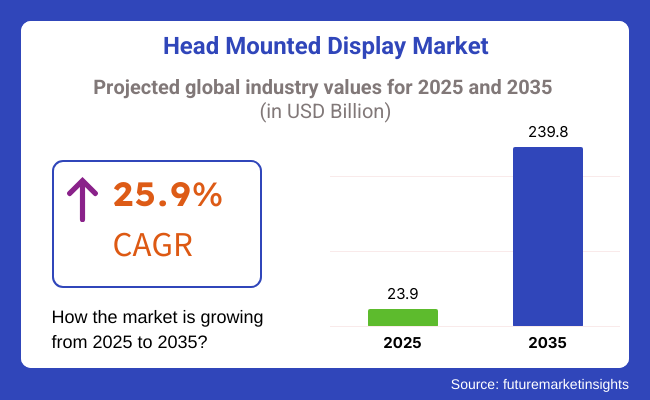

The Head Mounted Display (HMD) market is projected to reach USD 23.9 billion by 2025 and is likely to reach USD 239.8 billion by 2035 at a massive compound annual growth rate (CAGR) of 25.9% through the forecast period. This rapid growth is driven by continuous advancements in microdisplay technology, increasing adoption of augmented reality (AR) and virtual reality (VR) applications, and increasing investments in immersive technologies, particularly in the metaverse.

The growth of the gaming, entertainment, healthcare, and defense industries is mainly responsible for the increased demand for HMDs, as these industries seek enhanced visualization, real-time data interaction, and immersive training environments.

Key market drivers include the integration of AI capabilities within AR/VR solutions, growing consumer demands for the consumption of experiential content, and the proliferation of smart wearable technology. The requirement for smaller, lighter, and higher-resolution HMD devices is fueling innovation in hardware as well as software spaces. HMDs are additionally applied in sectors such as healthcare for simulation in surgeries, treatment of patients, and tele-diagnosis, and defense agencies utilize HMDs for training and battlefield awareness.

However, with advancement comes obstacles in the form of device cost, poor battery life, motion sickness-related problems, and fears over privacy based on continuous data collection and processing. The demand for improved content ecosystems and standardization also provides hurdles to wide-scale adoption, especially for broad consumer markets.

Uses include education, in which HMDs can facilitate interactive learning sessions, and business applications for remote collaboration, virtual prototyping, and design. Large-scale deployment of 5G networks will probably enhance the performance of HMDs with reduced latency and increased data transfer, providing even more potential applications.

Some of the most important trends transforming the industry include component miniaturization, the rise of mixed reality (MR) solutions, and the development of standalone HMDs with inbuilt computing capabilities. Strategic partnerships between technology firms, content creators, and telecom operators are fueling product adoption and innovation. As the metaverse expands, HMDs will be at the forefront of shaping digital interactions, entertainment, and remote work, positioning the industry for even more growth and change globally.

Explore FMI!

Book a free demo

Between 2020 and 2024, there was strong growth, fueled by the increasing adoption of virtual reality (VR), augmented reality (AR), and mixed reality (MR) across gaming, healthcare, military, education, and enterprise sectors. Technologies in optics, display resolution, and motion tracking improved user experience with greater fidelity of images, lower latency, and increased comfort. Investment in waveguide optics, micro-OLED, and eye-tracking technologies based on AI improved HMD performance and usability.

Cloud computing and AI-based interfaces further enhanced functionality. The ETSI and the FCC developed standards to offer safety, data confidentiality, and user-friendliness. Use in medical training, remote surgery, and rehabilitation drove demand, and cost, motion sickness, and short battery life were the main challenges.

AI-driven adaptive optics, incorporation of brain-computer interfaces (BCIs), and super-light materials will revolutionize HMD sales between 2025 and 2035. Eye comfort, depth perception, and visual acuity will be enhanced using AI-powered optics. Quantum dot displays, AR cloud networks, and neuromorphic computing will increase the processing power of HMDs, and flexible displays based on nanomaterials will allow for foldable, lightweight devices.

Brain-computer interfaces and haptic feedback will facilitate growth in the future in virtual collaboration, immersive therapy, and digital twin simulation. Independent HMDs by energy harvesting from temperature, movement, and illumination will support independent usage. Sustainability will be the enabler through recyclable parts, green hardware, and AI-driven automated production decreasing environmental footprints. Decentralized metaverse platforms and blockchain-secured content management will yield superior security, simplicity, and cross-platform integration, making HMDs an indispensable device for next-generation immersive experiences.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments gave high priority to safety standards, data security, and electromagnetic conformance for AR/VR headsets. | All subsequent policy-making will be supported by AI-enabled regulatory compliance automation, blockchain-secured digital identity, and standards for ethical use of brain-computer interfaces. |

| Optics advancements, AI-enabled motion tracking, and increased field-of-view enriched AR/VR experiences. | Spatial computing, with the assistance of quantum computing, neuromorphic HMD processing, and real-time holographic display systems, will revolutionize the way users interact. |

| HMDs were also applied extensively in gaming, corporate training, healthcare simulation, and military missions. | The industrial metaverse, combined with AI, real-time 3D medical imaging, and complete remote immersive workspaces, will broaden market usage. |

| Gaming systems, simulators for training, and remote guidance tools embedded in HMD technology provide increased immersion. | Holographic conferencing with AI, adaptive medical AR overlays, and decentralized spatial computing platforms will drive adoption. |

| Companies were focused on power-efficient, lightweight HMDs and low-cost manufacturing. | Biodegradable display materials, AI-assisted automated AR/VR processes, and blockchain content authentication will drive the way forward in terms of sustainability and affordability. |

| AI-powered gaze tracking, spatial analysis in real-time, and predictive visual rendering for optimal user experience. | Predictive visualization with the help of quantum computing, behavior modeling with AI assistance, and adaptive neuromorphic AR interfaces will transform immersive technology. |

The market of Head Mounted display is growing at a rapid pace driven by increasing virtual reality and augmented reality technology. Gaming and entertainment are the main movers, with a priority on wide FOV, low latency, and high resolution for immersion. Healthcare usages, such as remote patient monitoring and surgical simulation, emphasize low latency and high resolution for accuracy.

In defense and military applications, HMDs are a must for greater situational awareness, training, and AR-enabled battlefield operations, with a focus on ruggedness and high-end optics. Industrial and business use entail distant support, learning, and maximizing the efficiency of work, where the concern is on ease and economics.

Educational and training applications use HMDs in simulations and interactive courses, where they require both low cost and optimum performance. Lighter, wireless, AI-driven HMDs with maximized user interface and lower pricing drive the future evolution of the industry.

Contracts & Deal Analysis

| Company | Contract Value (USD million) |

|---|---|

| Microsoft and Anduril Industries | Not specified |

| Meta Platforms | Over USD 20,000 |

| Apple Inc. | Not specified |

In 2024 and early 2025, there was a significant growth, driven by substantial investments and technological advancements. Microsoft's collaboration with Anduril Industries to enhance the USA Army's IVAS underscores the increasing adoption of HMDs in defense applications, aiming to improve situational awareness and operational efficiency.

Meta Platforms' commitment to investing over USD 20 billion in developing advanced smart glasses and VR headsets reflects the company's strategic focus on establishing a strong presence in the AR/VR consumer market. Similarly, Apple's introduction of the Apple Vision Pro headset signifies a major leap in consumer-grade augmented reality devices, offering users an immersive experience that integrates digital content with their physical surroundings. These developments highlight a broader industry trend towards the integration of advanced HMD technologies across both defense and consumer sectors, driving innovation and expanding the market landscape.

The HMD (Head Mounted display) market is facing numerous challenges, notably high production costs, fast technological updating, and user acceptance issues. Producing top-tier HMDs necessitates the use of ultra-modern parts like OLED microdisplays, sensors, and processing units, which inevitably inflates costs and limits sales.

The expiration of technology is one of the chief prospects of danger. In order to maintain their competitive edge, companies should always be on top of the game and need to introduce new technologies like AR, VR, and MR upgrades regularly.

Their inability to match advancements in industry standards may lead to a reduction in industry share. Likewise, the motion sickness factor, limited field of view, and high energy consumption that comes with the hardware are some of the drawbacks to the wide acceptance.

Moreover, the user acceptance is limited as a result of the customer perception and the issue of price. Despite the fact that HMDs have found a stronghold in gaming and enterprise applications, their general acceptance by consumers is still quite slow due to the issue of costs and a dearth of practical use cases.

Additionally, supply chains that struggle, especially with semiconductor components, can throw a wrench into production and delivery schedules which, in turn, can adversely affect their profitability.

| Segment | Value Share (2025) |

|---|---|

| Head Mounted Display (HMD) | 84.5% |

By component, the Head Mounted display (HMD) segment is projected to lead with around 84.5% share in 2025, expanding from 82.3% share in 2023. This explosion is fueled by increasing demand for VR and AR headsets in gaming, healthcare, military simulations, and industrial training. Moreover, Meta (Quest 3), Sony (PlayStation VR2), HTC (Vive XR Elite), and other companies are actively making cropped, lightweight, high-def, and even AI-powered HMDs to provide users with unique experiences.

5G, cloud gaming, and AI-driven spatial computing accelerate the adoption of immersive and accessible HMDs. Microsoft’s HoloLens 2, for example, is finding increasing use in remote medical procedures, defense training, and smart manufacturing, allowing for real-time collaboration while also optimizing efficiency in what would have formerly been analog environments. Even outside of gaming, HMDs are finding their place in metaverse and enterprise uses.

At the same time, the Eyewear segment will continue to decrease its share, accounting for approximately 15.5% by 2025 compared to 17.7% by 2023, as immersive HMDs will gain higher adoption. Nevertheless, growth in logistics, field services, and healthcare continues to fuel interest in AI-integrated smart glasses. Enterprises are investing in lightweight, voice-controlled AR glasses, looking at Google (Glass Enterprise), Apple (Vision Pro), and Vuzix (Blade 2) to increase productivity.

Smart glasses will become a crucial component of enterprise applications, realizing hands-free operations and providing real-time data overlays, as well as AI-driven insights through gesture-based interfaces.

| Segment | Value Sharer (2025) |

|---|---|

| Discrete HMD | 26.5% |

Discrete HMD is anticipated to take 26.5% of the share by 2025 due to increasing demand for high-performance, standalone virtual and augmented reality (VR/AR) headsets. The game is still the biggest driver, with devices like Meta's Quest 3, Sony's PlayStation VR2, and HTC's Vive XR Elite pushing the envelope of immersive experiences. They can generate more out of better resolution, refresh rates, and AI-based spatial computers with a higher degree of throwaway reality. However, outside of gaming, adoption is being driven by VR-based training simulations for the aviation, defense, and healthcare sectors. Boeing and Lockheed Martin employ VR in pilot training; medical institutions use it for surgical simulations. Standalone HMD capabilities are evolving along with the proliferation of 5G connectivity and hand-tracking technology, expanding their applicability across a range of industries.

Integrated HMD will grow to 16.8% of the share by 2025 as enterprises combine their mixed reality (MR) solutions for increased productivity. Microsoft’s HoloLens 2 is commonly used in smart manufacturing, remote assistance, and military training, letting workers receive real-time holograms of instructions. With its new AR-focused Vision Pro, Apple is poised to transform spatial computing and integrate it into enterprise functions. Significant Growth Areas in Healthcare and Medical Training Surgeons are utilizing MR for pre-operative preparation as well as therapy. Although the enterprise AR space is steadily growing, companies like Magic Leap have made continued progress toward lightweight, high-resolution AR headsets and solutions that are tuned for enterprise collaboration and industrial use cases.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 9.2% |

| The UK | 8.5% |

| France | 8.7% |

| Germany | 9% |

| Italy | 8.6% |

| South Korea | 9.5% |

| Japan | 9% |

| China | 9.8% |

| Australia | 8.4% |

| New Zealand | 8.2% |

The CAGR from 2025 to 2035 stands at 9.2%, foreseeing the advancements in virtual reality (VR), augmented reality (AR), and mixed reality (MR) technologies. Entertainment and gaming are still leading applications for high-performance HMDs, and here, Meta, Apple, and Microsoft are the focus with AI-powered lightweight headsets. Increased uses of metaverse platforms and AI-based visualization software programs are further accelerating the growth, particularly in enterprise training, healthcare, and defense-related applications.

Government investment in AI-driven research and high-end manufacturing, including DARPA-funded programs, is propelling local production and technological expertise in this segment. Enterprise and defense applications are a key driver, with top technology providers embedding HMDs for remote collaboration, simulation-based training, and real-time data visualization. AR and VR technologies are used in the defense and aerospace industries in the United States to train pilots, conduct battle simulations, and enhance mission planning. Artificial intelligence-based medical visualization software and virtual reality-based training solutions in the healthcare sector also fuel the nation's growing HMD industry. As technology innovators continue to advance their offerings, the industry will expand with increasing enterprise adoption and consumer interest.

CAGR in the period 2025 to 2035 will be 8.5% due to growing investments in immersive technologies and business learning solutions. The National Health Service (NHS) is driving top-level adoption of AR-based surgical hardware, VR-facilitated medical training, and telemedicine technologies. In the education sector, organizations such as Imperial College London are utilizing HMD-based learning environments for research and industrial purposes.

The gaming industry in the nation also fuels HMD adoption, with Rebellion and Codemasters being some of the organizations that produce VR-enabled games, which results in high-end headset demand.

Defense initiatives and corporate solutions also fuel expansion, as HMDs are utilized in pilot training simulation and battlefield visualization enhancement. British government digital transformation initiatives guarantee the uptake of AR/VR in smart manufacturing and industrial training. As more firms are innovating based on AI-created content and real-time immersive collaboration, the country is a prominent participant in Europe.

CAGR for the 2025 to 2035 forecast period is anticipated at 8.7%, with strong growth in the defense, automotive, and entertainment industries. French companies like Dassault Systèmes are pioneers in VR-based prototype development of designs and intelligent manufacturing solutions. The gaming industry led by Ubisoft is also driving HMD adoption, with new VR games leading consumer demand.

Government efforts within the Horizon Europe Programme are hastening research on light AR/MR devices and AI visualization software, enhancing France's competitive position in the development of immersive technology.

The medical sector is increasingly using VR-based rehabilitation training and AR-assisted surgery. Moreover, the nation's aerospace industry, such as Airbus, applies HMDs to train pilots, perform maintenance, and simulate design. As there is more interest in industrial metaverse applications and city technologies, France's market is growing.

2025 to 2035 CAGR will be 9.0% and will be driven by the automotive, industrial automation, and defense sectors leadership in Germany. German companies such as BMW and Siemens are adopting AR-based manufacturing and design tools for efficient production and enhanced training of employees. Business application deployment of HMD is gaining traction through the use of remote maintenance and industrial simulation in Germany, given its focus on digitalization and smart manufacturing.

The game and entertainment industry is also expanding, with companies like Crytek developing VR-based gameplay. For military use, the Bundeswehr is applying AR/VR technology to train soldiers and conduct virtual combat simulations. With unparalleled state backing for AI-based industrial use and hugely augmented consumer demand for new entertainment, Germany can anticipate long-term growth.

It is expected to be at 8.6% CAGR during 2025 to 2035, and increased uses are witnessed in industrial design, fashion, and cultural heritage uses. Among the Italian companies, Ferrari and Luxottica utilize AR/VR for design, engineering, and retail. The national focus on smart manufacturing and digitalization has created a scope for HMDs in industrial training and maintenance in the country.

The cultural heritage industry is also exploiting immersive technologies to improve tourism experiences, with AR-fortified museum exhibitions and historic reconstructions becoming increasingly popular. Further, Italy's gaming sector is growing, with independent developers investing in VR applications. Government-backed research programs and rising enterprise investment in digitalization also form the foundation for growth.

2025 to 2035 CAGR is anticipated at 9.8%, and it is among the most lucrative revenue-generating HMD markets. Company and consumer AR/VR app innovation is spearheaded by sector leaders such as Huawei, Tencent, and ByteDance (Pico's owner). AI-generated content-based metaverse expansion and 5G-supported immersive experiences are compelling demands for the next-gen headsets.

Chinese government initiatives for smart city deployments and AI-driven manufacturing are fueling enterprise adoption. Its booming gaming industry, supported by a strong electronics manufacturing base, positions it as a world leader in HMD manufacturing and development.

2025 to 2035 CAGR will be 8.4% with increasing application in mining, healthcare, and education sectors. Australian universities and research centers are at the forefront of applying AR/VR to remote learning and medical education. HMDs are being used by mining organizations for enhanced site visualization and safety training.

The entertainment segment is also seeing growing adoption as Australian game developers move into the domain of VR-based gaming. Government-funded digital transformation initiatives and rising investments in immersive learning environments are fueling growth.

CAGR during 2025 to 2035 is likely to be 8.2%, driven by growing film production, healthcare, and agriculture. New Zealand's globally renowned film industry, headed by Weta Digital, is driving technology development in VR-based storytelling and production techniques. New Zealand's agriculture sector is also adopting AR-based monitoring and training technology.

With a focus on education and remote collaboration, HMD adoption is growing in universities and research institutions. With continued research into immersive applications by local firms as well as startups, New Zealand is set to continue its growth.

The industry is witnessing a booming phase as it rises under the impact of the increased usage of augmented and virtual reality applications in gaming, healthcare, military, and enterprise applications. Other driving factors include advancements in display technique, artificial intelligence-powered interaction, and emerging metaverses, which will create demand for high-performance and immersive experiences.

There is a domination by leading players such as Meta (Oculus), Sony, Microsoft (HoloLens), HTC (Vive), and Apple (Vision Pro) features such as key cutting-edge optics, enhanced resolution, and integrated tracking systems. Startups and niche providers will focus on lightweight, wireless designs and long battery life and supply solutions for specific enterprises geared toward the needs of industries.

New trends in competition are being shaped by developments in micro-OLED and pancake optics, as well as by spatial computing. These technologies improve the clarity and comfort of display and enhance the precision of interactions. The growing innovation takes the form of adding AI-driven eye tracking, haptic feedback, and a more complex grasp of gestures to offer unique user engagement.

The competitive factors include strategic integration of the hardware-software ecosystem and partnerships in content for the AR and VR applications, as well as the cloud-based XR (extended-reality) solutions. Companies will make great efforts to speed up their R&D investments, including acquisitions and platform expansion strategies when this immersive technology is adopted.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Meta (Oculus) | 12-17% |

| Sony Corporation | 10-14% |

| Microsoft (HoloLens) | 8-12% |

| HTC Corporation | 5-9% |

| Apple Inc. | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Meta (Oculus) | Develops advanced VR headsets, focusing on immersive gaming, social VR, and metaverse integration. |

| Sony Corporation | Specializes in PlayStation VR with high-resolution displays and optimized gaming experiences. |

| Microsoft (HoloLens) | Provides mixed reality solutions for enterprise, healthcare, and defense applications. |

| HTC Corporation | Manufactures high-end VR headsets for gaming, enterprise training, and virtual collaboration. |

| Apple Inc. | Focuses on AR-driven smart glasses and HMDs, integrating AI-powered spatial computing. |

Key Company Insights

Meta (Oculus) (12-17%)

Meta is the leading HMD vendor in the space with its Oculus VR headsets targeted at gaming, social, and enterprise applications. The company is investing considerably in the development of metaverse and AI-based virtual environments.

Sony Corporation (10-14%)

The PlayStation VR developed by Sony is quite the competitor in terms of immersion into the game due to the high resolution and motion tracking that further enhances the experience.

Microsoft (HoloLens) (8-12%)

Microsoft emphasizes mixed reality solutions using HoloLens for enterprise, industrial, and defense purposes, with deep AI and cloud integration.

HTC Corporation (5-9%)

HTC excels at high-end VR solutions, especially for professional training, simulations, and shared workspaces.

Apple Inc. (3-7%)

Apple is building AR and MR headsets based on AI-enabled spatial computing for both consumer and enterprise use.

Other Key Players (45-55% Combined)

The overall market size for the industry was USD 23.97 billion in 2025.

The industry is projected to reach USD 239.81 billion by 2035.

The demand will be driven by the rapid adoption of augmented reality (AR) and virtual reality (VR) technologies, increasing use in gaming and entertainment, growing applications in defense and healthcare for training and simulations, and advancements in lightweight, high-resolution display technologies.

The top 5 countries driving the development of the industry are the USA, China, Japan, South Korea, and Germany.

Augmented reality (AR) and virtual reality (VR) headsets are expected to dominate the market, particularly in gaming, healthcare, defense, and industrial applications, driven by enhanced user experience, improved connectivity, and increasing enterprise adoption of immersive technologies.

The segmentation includes Head Mounted devices (HMDs) and eyewear.

The segmentation includes discrete HMDs, integrated HMDs, and slide-on HMDs.

The segmentation spans various applications, including gaming, media, and entertainment; aerospace and defense; healthcare and medical devices; engineering and industrial applications; education; and other sectors.

The report covers North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.