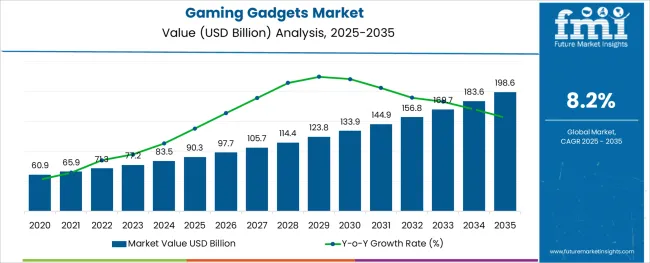

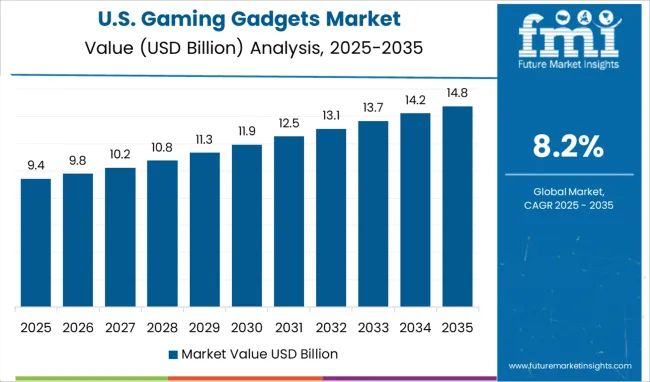

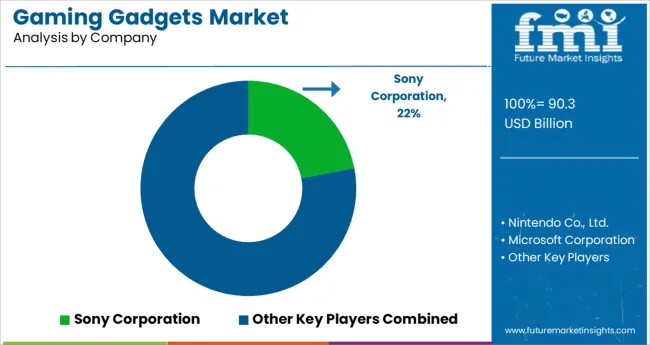

The Gaming Gadgets Market is estimated to be valued at USD 90.3 billion in 2025 and is projected to reach USD 198.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

The gaming gadgets market is expanding steadily, propelled by evolving entertainment consumption patterns, rising esports penetration, and increased investment in immersive gaming experiences. Enhanced internet connectivity, cloud gaming accessibility, and next-gen graphics technology have elevated user expectations, driving demand for sophisticated gaming hardware.

Hardware manufacturers are actively collaborating with software developers to deliver integrated platforms that optimize user engagement and content access. Global chip advancements, combined with AI-driven game mechanics and virtual interaction capabilities, are contributing to a broader adoption across diverse demographic groups.

Sustainability in packaging and modular upgrades are also influencing purchase decisions, as environmentally aware consumers seek future-proof gadgets. The market outlook remains positive, supported by digital distribution models, cross-platform compatibility, and increasing monetization through downloadable content and subscription ecosystems.

The market is segmented by Gadgets Type, Product Type, Age Group, End Use, and Sales Channel and region. By Gadgets Type, the market is divided into PlayStation, Xbox, Wii, and Others. In terms of Product Type, the market is classified into Home Consoles and Handheld Consoles. Based on Age Group, the market is segmented into 21-35 Years, Below 20 Years, 36-50 Years, and 51 Years and Above.

By End Use, the market is divided into Residential/Households and Commercial. By Sales Channel, the market is segmented into Online Retailers, Direct Sales, Specialty Stores, Multi-brand Stores, Independent Small Stores, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

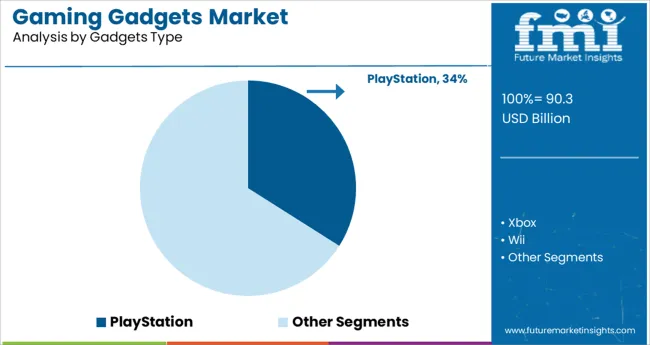

PlayStation is projected to capture 34.0% of the total revenue in the gaming gadgets market by 2025, marking it as the leading gadget type. This segment’s leadership is being driven by consistent platform evolution, strong brand loyalty, and a robust pipeline of exclusive game titles.

Sony's strategic investment in content studios, backward compatibility, and cloud-enhanced playability has reinforced its market foothold. Advanced features like haptic feedback, adaptive triggers, and ray tracing have elevated the console’s gameplay realism, making it a preferred choice among core gamers.

High user retention and global availability have also enabled steady hardware and subscription-based revenue. As multi-device integration and immersive storytelling gain popularity, PlayStation continues to set performance benchmarks for the gaming console segment.

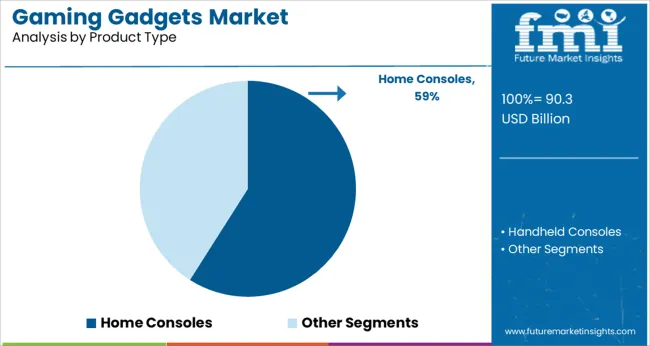

Home consoles are expected to hold 59.0% of the overall market share in 2025, making them the dominant product category in the gaming gadgets space. Their strength is attributed to the ability to deliver high-resolution gameplay, powerful processing, and social gaming features directly into living rooms.

Continued demand for cinematic-quality visuals, coupled with multiplayer experiences, has bolstered household adoption. Hardware improvements such as SSD integration, heat management, and multi-tasking user interfaces have positioned home consoles as future-ready entertainment hubs.

The rise of gaming as a mainstream leisure activity among families and young adults has further amplified this segment’s uptake. As digital game purchases and game streaming continue to grow, home consoles are expected to maintain their pivotal role in the gaming ecosystem.

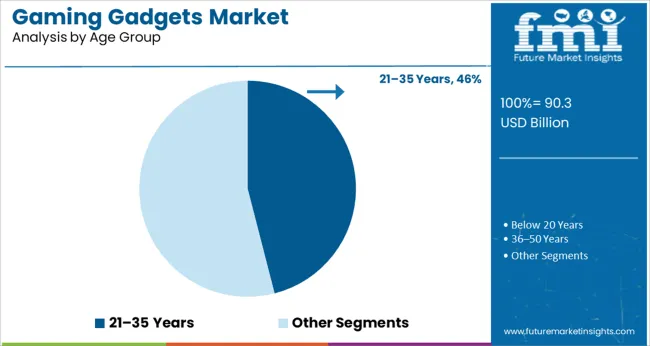

The 21-35 years age group is projected to account for 46.0% of the total revenue in the gaming gadgets market in 2025, establishing it as the leading consumer segment. This group’s dominance is driven by high digital engagement, strong purchasing power, and an inclination toward competitive and immersive gaming formats.

Members of this demographic are early adopters of new technologies, often subscribing to digital ecosystems and cloud-based services. Their active presence on streaming platforms and gaming communities has accelerated peer-driven influence and device upgrades.

The preference for high-performance gear and cross-platform gaming experiences has contributed to elevated demand for premium gadgets within this cohort. As gaming culture continues to evolve from casual to lifestyle-driven behavior, the 21-35 age group is expected to remain a central force in shaping market dynamics.

During the projection period, the USA market is estimated to increase at a 6.3% CAGR. The United States is predicted to account for more than 79.4% of the market share in North America by 2024, owing to increasing affordability and higher discretionary income levels. The region's gaming devices industry is being driven by free-to-play and mobile games.

This country's gaming business is continually changing to stay up with the latest technology, such as augmented reality and virtual reality, in order to grab the interest and imagination of players worldwide. Furthermore, with the introduction of cloud gaming, increased internet penetration and gaming platform usage may offer a favourable atmosphere for development.

Residential gaming device use is estimated to account for a large 70.0% market share of gaming gadgets. The global usage of gaming devices is aided by the rising trend of linked homes. Furthermore, when the global population's income level rises, they will be able to spend more on housing and outfit their homes with new technology items, such as immersive gaming systems, at a quicker rate.

Because of the increased interest in casual leisure, devices for novices account for more than 53% of the market. The professional category, on the other hand, is predicted to increase at a faster rate, with a CAGR of 12.9% throughout the projection period.

In terms of gaming products, active gamers all over the world are spoiled for choice. They are also demonstrating a willingness to spend money on high-end products. The gaming gadgets market is growing as a result of frequent technological innovations such as augmented reality (AR) and virtual reality (VR). According to Future Market Insights (FMI), the gaming gadgets market may grow at a rate of 3.8% year on year.

A Spike in the Proportion of Game-Related Content Creators

Gaming has become a quite popular due to an increase in gaming-related content creators such as live streamers, players, and competitive e-sports players. The growing number of gaming content creators is driving growth in the gaming gadgets market, as these creators buy multiple types of gaming devices to play platform exclusive games and provide various types of content surrounding these devices.

Emergence of a Slew of Competitive E-Sports Organisations

In recent years, many competitive e-sports organisations have emerged, organising and competing in e-sports competitions for games. These competitors necessitate a large number of gaming devices; the sales of which contribute to the gaming gadgets market growth.

Current Market Developments

Some gaming gadgets innovations are more recent and critical to propelling the market forward. For example, the release of the Steam Deck, a portable gaming console with PC-like performance that can also be used as a PC, paves the way for further advancements in the gaming gadgets market.

Due to hardware scalpers, the prices of hardware used in devices are rising. This is causing a rise in the overall price of game consoles, which may negatively impact the gaming gadgets market over the long term.

The rising price of gaming peripherals is a stifling factor in the gaming gadgets market. Gaming is one of the most expensive industries. Gaming consoles and their accessories are more expensive. However, they have become more cost-effective in recent years. Nonetheless, some of the high-end accessories are pricey.

Some more expensive accessories include the DPI mouse and the ghost switch. This high-sensitivity mouse can provide the user with an exceptional gaming experience. Notwithstanding, it is only reasonably priced for a few o game enthusiasts. The high cost may limit demand for gaming gadgets and the gaming gadgets market expansion in the coming years.

Emergence of Next-Gen Nintendo Consoles

The release of next-generation home consoles may drive the gaming gadgets market growth. The leading gaming services are releasing gaming consoles with next-generation accessories. Some of the accessories with next-generation features include the remote, headset, controllers, and media remote. These accessories may draw a large number of end-users to the market.

Introduction of Accessories

The introduction of the accessories may significantly increase the gaming gadgets market supply rate. There may be new game content with a high graphic feature in the coming years. The need for complex hardware is essential for this 4k gaming experience. These gaming assets were created in response to widespread audience demand. Some manufacturers are also working on 8K displays for the new high-resolution gaming content.

Financial Developments

Every one of these economic trends may lead to positive changes. During the forecast period, the adoption of gaming gadgets may skyrocket. Furthermore, rising competition among key players may result in rapid gaming gadgets market expansion. New market players are entering the gaming accessory market. This may spur numerous innovations and increase market competition. These expansion prospects may boost market revenue.

PlayStation and Xbox control a sizable portion of the gaming gadgets market. However, PlayStation is the market leader in the gadget type segment, with 46.3% of the market. Frequent technical and system updates have drawn a larger number of gamers to this brand.

In addition to this, the influence of social media is high on the end users. As a result, manufacturers adopt attractive social media strategy by collaborating with influencers to push the products into the space of end users.

Home consoles accounted for roughly one-third of sales of gaming gadgets and are expected to grow the fastest, with a CAGR of more than 7.1% over the forecast period. To play video games, home consoles can be easily connected to display devices such as televisions and an external power source.

Most consoles have customized components to maximize space and power consumption in order to provide the best gaming performance while lowering costs through reduced storage and memory configurations. Due to their superior portability and lower cost, handheld consoles are expected to grow significantly during the forecast period.

The multi-brand store-based retailing remains dominant, accounting for a significant 28.2% gaming gadgets market share. Customers can now compare and select from a wide range of available products, increasing foot traffic in these stores.

In the midst of the pandemic, market participants have used this opportunity to strengthen their presence through online channels.

Gamers under the age of 20 accounts for a significant gaming gadgets market share of 53.9% of all devices. The Generation Z demographic has had a significant impact on industry trends. Gen Z is increasingly turning to video games for entertainment and recreation.

Many young gamers use games to form social connections. This demographic is more likely to spend money on gaming gadgets, which may boost sales.

Residential gaming device use is expected to account for a sizable 70.0% gaming gadgets market share. The growing trend of connected homes assists the global adoption of gaming devices. Furthermore, the global population's income level is rising, allowing them to spend more on housing and equip their homes with new technological goods, such as immersive gaming devices, at a faster rate.

Due to widespread interest in casual entertainment, gadgets for beginners account for a significant share of more than 53%. However, the professional category is expected to grow at a faster rate, with a CAGR of 12.9% during the forecast period.

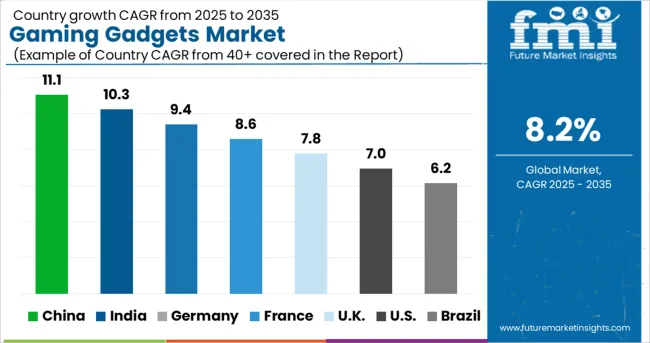

During the forecast period, East Asia is expected to be one of the most appealing markets. China is expected to account for more than 52.6% of the East Asian gaming gadgets market by 2024.

A key factor driving regional growth is China's increasing smartphone penetration and rising demand for entertainment. Due to the growing number of online gamers and online tournaments in East Asia, vendors are launching various platforms that allow gamers to access AAA-rated games.

With the inauguration and growing popularity of eSports in the country, China may overtake the United States as the second-largest Esports market. China has even established an Esports town in Hangzhou to train the next generation of competitive gamers. As a result of the increased demand for online gaming, the market for gaming gadgets has increased.

The USA market is expected to grow at a 6.3% CAGR during the forecast period. Due to increased affordability and higher discretionary income levels, the United States is expected to account for more than 79.4% of the market share in North America by 2024. Free-to-play and mobile games are driving the gaming gadgets market growth in the region.

The gaming industry in this country is constantly evolving to keep up with the latest technologies, such as augmented reality and virtual reality, to capture the attention and imagination of gamers all over the world. Furthermore, with the advent of cloud gaming, rising internet penetration and adoption of gaming platforms may create a favorable environment for growth.

The Indian market is expected to grow at a 14.1% CAGR during the forecast period. India may account for more than 31.2% of the South Asian market. As the gaming industry expands, the Indian government is expected to facilitate and regulate it actively.

Due to the high availability of skilled game developers and the country's rapid growth in the market, India is emerging as a popular outsourcing destination for global gaming companies. The primary reasons for this popularity are growth in the Internet and smart homes, improved digital payment infrastructure, technological advancement, rising income levels, ecosystem upgrades with 4G networks, and game preferences.

Digital gaming includes various genres available on mobile, computer, and console devices. The Indian gaming industry is currently experiencing a paradigm shift from mobile gaming to console gaming as wireless connectivity in the country improves, paving the way for gaming gadget sales.

The gaming gadgets market is thriving. The startups in this space are a diverse mix of hyper-growth scaleups, small creative startups, and everything in between.

The gaming gadgets market is highly competitive due to the presence of a small number of global vendors with a significant market share. To remain competitive in the global market, manufacturers are primarily focused on improving their portfolio of gaming gadgets.

Nintendo Co., Ltd., Sony Corporation, Microsoft Corporation, Atari, Inc., Hyperkin, Inc., Razer Inc., NVIDIA Corporation, SEGA of America, Inc., Valve Corporation, Dell Technologies Inc., and Mad Catz Global Ltd. are key players.

Samsung:

| Date | July 2024 |

|---|---|

| Company | Samsung |

| Strategy | Launch |

| Details | Samsung launched the Odessey Neo G9 gaming monitor with quantum mini-LED technology for HDR applications in July 2024. |

Microsoft Corporation:

| Date | January 2024 |

|---|---|

| Company | Microsoft Corporation |

| Strategy | Product Launch |

| Details | Microsoft Corporation announced the release of Pulse red wireless controllers that can be used on multiple devices to switch between an Xbox console, a PC, and an Android device without having to repeat the setup process each time. |

Logitech G:

| Date | February 2024 |

|---|---|

| Company | Logitech G |

| Strategy | Partnership |

| Details | Logitech G, a Logitech and Herman Miller brand, announced an exclusive partnership in February 2024 to research, design, and manufacture the next generation of high-performance furniture solutions for gamers. Both companies bring years of design and engineering expertise to their respective fields and may address the needs of esports athletes, players, and streamers when combined. |

Sony:

| Date | February 2024 |

|---|---|

| Company | Sony |

| Strategy | Announcement |

| Details | Sony announced a next-generation VR headset for its PlayStation 5 console, which may be available sometime after 2024. The new VR system is expected to have higher resolution, more accurate head-tracking, and a wider field of view. It may also include the latest VR motion controller, as well as some of the new features of the PS5's DualSense pad. |

Amazon:

| Date | October 2024 |

|---|---|

| Company | Amazon |

| Strategy | Launch |

| Details | Amazon launches Luna, a cloud gaming platform. In line with this, Amazon also announced its own Alexa-enabled Luna Controller, which may cost USD 49.99 during the early access period. It has a multi-antenna design that prioritises uninterrupted Wi-Fi for lower latency gaming. When playing Luna Controller with Cloud Direct vs. |

The global gaming gadgets market is estimated to be valued at USD 90.3 billion in 2025.

It is projected to reach USD 198.6 billion by 2035.

The market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types are playstation, xbox, wii and others.

home consoles segment is expected to dominate with a 59.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gaming Simulators Market Size and Share Forecast Outlook 2025 to 2035

Gaming Laptop Market Size and Share Forecast Outlook 2025 to 2035

Gaming Console Market Size and Share Forecast Outlook 2025 to 2035

Gaming Monitors Market Analysis - Size, Share & Forecast 2025 to 2035

Gaming Hardware Market Analysis by Gaming Platform, Product Type, End-user, and Region Through 2035

Web3 Gaming Market Report - Growth & Forecast 2025 to 2035

Wearable Gaming Technology Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Pet Gadgets Market Analysis - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA