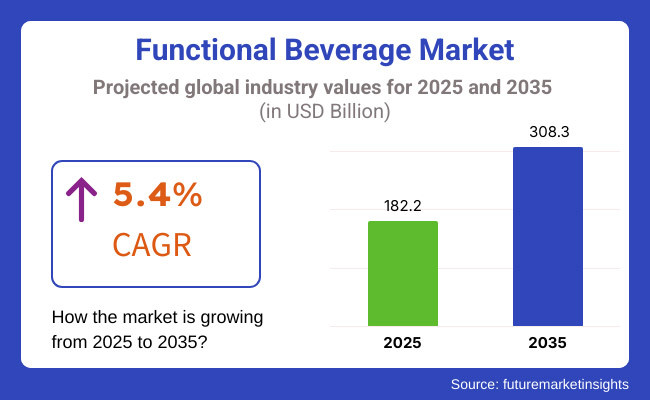

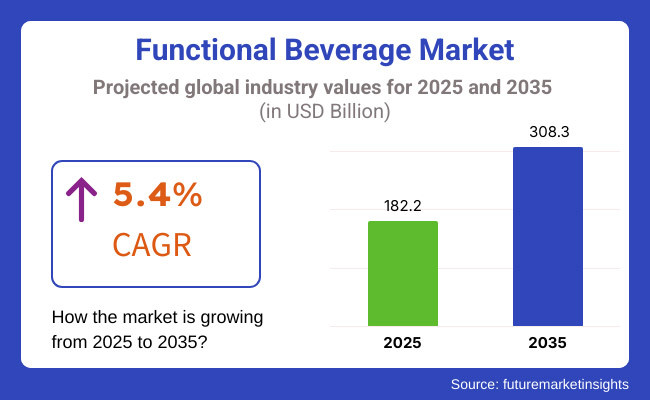

The global functional beverages market is currently growing with the increasing number of health-conscious people who strongly choose to partake in this type of product being the main driver of this trend. The industry has registered a growth of 6.2% in 2024 from that of the last year and by 2025 it is all set to reach a total value of USD 182.2 billion. In the prediction period where 2025 is to 2035, the industry will increase by 5.4% CAGR and is expected to reach USD 308.3 billion.

Making the cut through the competition are flagship brands like PepsiCo, Coca-Cola, and Nestlé, which have raised their sales volume and industry presence with the help of product differentiation, outperformance in the overall supply chain, and investment into eco-friendly sourcing. One can find brands like Rebbl, Bai, and KeVita that are focusing on their organic and functional ingredient-based lines to draw the attention of health-conscious consumers.

Bespoke adaptogens, probiotics, and plant-based proteins have now added functional weight in the beverage industry and among them, the brands like GT's Living Foods and Remedy Kombucha have carried out such initiatives by providing gut-friendly and fermented beverage selections.

The sector is taking a revolutionary turn in the direction of clean label formulation and sustainable ingredient sourcing, which is in line with consumers' demands for visibility and natural products.

The companies such as Hint and Suja Life are the ones who are dealing with the challenge of providing organic and preservative-free product ranges which the audience that is increasingly growing in numbers values the most. Furthermore, the sector is also experiencing a notable trend change, where the semi premium fortified and organic functional beverages achieve higher benchmark prices due to their clean-label formulations and exclusive ingredients.

On the other hand, mass-market energy beverages and electrolyte solutions are now more or less price-stabilized because of the advantages of bulk production. The increasing costs of raw materials, especially in regard to plant-based and organic ingredients, alongside the different ways of separating themselves through ingredient transparency and preserving health claims with clinical evidence, rather than due to pricing aggressiveness, are all means the brands use to avoid negative consequences.

The swing towards convenience-led nutrition has led to a breakthrough with ready-to-drink (RTD) functional beverages, especially among urban professionals, athletes, and wellness enthusiasts. A growing number of consumers are now seeking easy solutions which can deliver quick functional benefits immediately, by simply drinking a beverage, without any preparation time on their part.

This change in consumer preference has been responsible for the increase in the production of RTD protein shakes, herbal infused teas, probiotic-rich beverages, and fortified waters. Besides this, the cold-pressed functional juices and dairy- alternatives have landed in the front line as consumers are calling for clean-label options. The most recent inclusion of meal replacements in functional beverages captures the shifting trend in consumer choices, with RTD products being selected as substitutes for traditional snacks.

Explore FMI!

Book a free demo

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.2% |

| H2 (2024 to 2034) | 5.6% |

| H1 (2025 to 2035) | 5.8% |

| H2 (2025 to 2035) | 5.9% |

The table below provides a comparative analysis of the semi-annual CAGR variation for the base year (2024) and the current year (2025) in the global functional beverage industry. This assessment highlights significant shifts in performance, showcasing revenue patterns that offer key insights into industry growth dynamics. The first half of the year (H1) covers January to June, while the second half (H2) spans from July to December.

During the first half (H1) of the decade from 2025 to 2035, the industry is estimated to expand at a CAGR of 5.2%, followed by a marginally higher growth rate of 5.6% in the second half (H2). Over the subsequent period, from H1 2025 to H2 2035, the CAGR is expected to increase to 5.8% in the first half while maintaining 5.9% in the second half.

The industry recorded a 40 BPS increase in H1 and a 10 BPS increase in H2, indicating sustained momentum across both periods. The functional beverage sector is projected to maintain robust growth, driven by rising consumer demand for health-enhancing ingredients, increased innovation in product formulations, and expanding penetration across various regions.

The global functional beverage industry is highly competitive, with regional players playing a crucial role in shaping industry dynamics. While global brands dominate large-scale distribution, regional manufacturers are capturing significant share by catering to local preferences, introducing innovative formulations, and leveraging traditional ingredients with functional benefits.

In North America, regional players are expanding their presence by introducing organic, plant-based, and clean-label beverages. There is a strong consumer demand for functional drinks infused with probiotics, adaptogens, and nootropics, which has led to the rise of locally crafted beverages that focus on gut health, cognitive function, and natural energy sources.

In Europe, the sector is experiencing a surge in demand for botanical and fermented beverages, with regional producers focusing on kombucha, herbal infusions, and fortified water. Local brands are positioning themselves as premium options by emphasizing sustainable sourcing, recyclable packaging, and reduced sugar content, resonating with health-conscious consumers.

Asia-Pacific is witnessing rapid growth in functional teas, energy boosters, and plant-based dairy alternatives, particularly in countries like Japan, China, and India. Regional manufacturers are using traditional ingredients such as turmeric, ashwagandha, and ginseng, integrating them into modern functional beverage formulations to appeal to both domestic and international markets.

In Latin America and the Middle East & Africa, regional players are capitalizing on superfood-infused beverages, including coconut water, acai-based drinks, and protein-enriched functional juices. These companies are differentiating their offerings through locally sourced ingredients and expanding their reach through partnerships with local retailers.

From 2020 to 2024, expansion of global sales in functional beverages was primarily being driven by increasing consumer demand directed towards wellness and health. Drinks that provide additional nutritional value such as benefiting the immune system, hydration, and mental well-being became more common among people.

The booming demand for plant-based, probiotic, and adaptogenic beverages spurred innovation, especially in the sports nutrition and energy drink categories. Functional beverages fortified with vitamins, minerals, and botanical extracts gained popularity as consumers sought better-for-you alternatives.

From 2025 to 2035, the industry is projected to expand at a CAGR of 5.4%, with brands focusing on nootropic and gut-health-enhancing formulations. Companies are leveraging digital marketing, influencer partnerships, and personalized nutrition trends to strengthen brand loyalty.

Transparency, scientific backing, and natural ingredients will play a crucial role in building consumer trust. As wellness-driven preferences shape the industry, continuous innovation and strategic positioning will ensure the functional beverage industry’s sustained growth in the global beverage sector.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Surge in demand for immunity-boosting beverages, driven by the COVID-19 pandemic. | AI-personalized functional drinks tailored to individual health needs become mainstream. |

| Expansion of plant-based and dairy-free functional beverages due to rising lactose intolerance and vegan trends. | Precision fermentation supports bioengineered functional ingredients for greater health advantage. |

| Greater consumption of adaptogens, nootropics, and probiotics in energy and relaxation beverages. | Nanotech-enabled smart drinks with nanotechnology embedded provide optimized nutrient release. |

| Exponential development of e-commerce and direct-to-consumer (DTC) channels for functional drinks. | Traceability based on blockchain ensures authenticity of ingredients and transparency of sources. |

| Sustainability initiatives led to broader implementation of green packaging and ethical ingredient sourcing. | Edible and compostable packaging are industry norm. |

| Regulatory attention became stronger on health claim and transparency labeling. | More stringent international regulations require AI-certified claims and in-real-time tracking of nutrients. |

The functional beverage industry is fast-growing yet is plagued by high validation claims. Consumers are skeptical of what seem like big claims, like “immunity boosting” or “stress relief,” and want rigorous backings of such claims. This skepticism puts brands under pressure to pay for expensive and time-consuming R&D and clinical.

And the margins are squeezed even further by the high cost of specialty ingredients - adaptogenic herbs, collagen peptides, nootropics, etc. - along with changing prices of those ingredients that can either narrow margins or require a higher retail cost.

An added threat from the DIY health movement makes matters worse because consumers seek out homemade alternatives, including smoothies or herbal teas, rather than purchase ready-to-drink products. As a result, brands are pushed to innovate and differentiate their offerings to keep consumers engaged and ensure consumers still perceive the premium pricing they demand. The broader question is how to innovate without overextending, the credibility to be competitive in a crowded space.

Functional beverages are generally sold at a premium price due to their unique value proposition and quality ingredients. Items that contain specialty ingredients like adaptogens or nootropics are typically 30-50% more expensive than conventional drinks. Brands systematically segment their product lines, with entry-level formulations at lower price points intersecting with more sophisticated formulations with multiple functional benefits at higher price points.

Others are adopting other subscription models and personalized pricing schemes, offering monthly delivery services, for example, that can not only help bring per-unit prices down but increase customer loyalty at the same time. These models work by locking in long-term revenue streams for brands in return for giving consumers an illusion of a discount on resourced goods.

New and inventive pricing strategies-including health product bundling and limited-edition varieties-keep consumers engaged and spur incremental sales to ensure that the sum pricing strategy retains both the cost of the ingredient and the added value and functional benefits that it brings.

| Countries | CAGR |

|---|---|

| The USA | 6.68% |

| China | 7.1% |

| India | 8.5% |

| Germany | 8.6% |

| UK | 7.9% |

As per FMIs research, the USA is the world's largest market driver of the functional beverages category because of strong consumer spending and a health and wellness-focused culture. Consumer consumption is fuelled by increased beverage-based product category consumption that leads to desired health benefits such as improved hydration, cognitive function, and digestive health.

Energy and sports drinks are leading the way, with Red Bull, Monster, and Gatorade being at the forefront of the market. The American market for sports drinks alone was approximately USD 10 billion in 2025 and continues to grow as more people actively opt for this lifestyle.

Probiotic beverages are also witnessing strong growth, with brands GoodBelly, Yakult, and Activia surfing the tide of increasing gut awareness. Plant-based drinks are also on the rise, with oat milk sales reaching USD 2.7 billion in 2025 as dairy alternatives are pursued by consumers. FDA and FTC regulatory oversight ensures label integrity and health claim accuracy, further driving the market.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Sports drink and high energy demand | Value market over USD 10 billion controlled by Gatorade and Red Bull |

| Successful regulatory control | FDA and FTC promoting label openness and claims |

| Use of probiotic drinks growing | Yakult and Activia increasing support with demand for digestive health |

| Drink growth, plant-based | Oat milk sales surged to USD 2.7 billion in 2025 |

China's functional beverage market is growing rapidly on the strength of increasing disposable incomes, urbanization, and changes in dietary trends. Traditional Chinese Medicine (TCM) also contributes to this, with herbal-functional drinks such as ginseng, goji berry, and chrysanthemum drinks being popular.

The probiotic drink market is one of the rapid growing, with backing from top dairy players Mengniu and Yili, who have expanded their probiotic portfolios. The protein and sports beverage market also keeps growing, backed by rising participation in sporting activities.

E-commerce is also a principal driver, with Alibaba and JD.com acting as platforms for online consumption of functional beverages. Livestreaming and influencer marketing have significantly driven penetration and sales.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Impact of Traditional Chinese Medicine (TCM) | Ginseng and goji berry-infused herbal beverages gaining popularity |

| Robust growth in probiotic beverages | Dairy players focusing on gut health products |

| Sports and protein beverages market growing | Fitness trend driving sales of protein shakes |

| Impact of e-commerce and online marketing | Alibaba and JD.com dominating online functional beverage sales |

India's functional beverage market is likely to grow at a CAGR of 8.5% from 2035, spurred by a rising middle class, increasing incomes, and growing health consciousness. Turmeric, ashwagandha, and tulsi are widely used in immunity-boosting drinks due to their cultural significance.

Probiotic beverages made from milk, such as lassi and buttermilk, are also gaining traction, with companies like Amul and Mother Dairy launching new fortified versions. Plant-based beverages made from almond milk and soy milk are growing fast, driven by increased instances of lactose intolerance and veganism.

Government FSSAI regulations are pushing brands towards natural preservatives and safer variants. Trendy sports and fitness movements are also creating demand for protein shakes and electrolyte replenishes.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Rising demand for herbal and Ayurvedic drinks | Turmeric and ashwagandha-infused drinks becoming popular |

| Upward trend for probiotic milk drinks | Lassi and buttermilk seeing sales increases |

| Plant-based drinks becoming mainstream | Almond and soy milk going mainstream |

| Regulatory push towards use of natural ingredients | FSSAI promoting cleaner labels and superior ingredients |

Germany's functional beverage market as per FMIs analysis, projected to achieve an 8.6% CAGR by 2035, is driven by its focus on organic and clean-label beverages. Germany has one of Europe's biggest probiotic and fermented beverage markets, with beverages like kombucha and kefir. Category leaders like Voelkel and Biotta are driving category innovation.

Sustainability is a major driver, with German consumers favouring biodegradable and recyclable packaging. Functional teas with nootropics and adaptogens are in higher demand, as consumers show increasing interest in cognitive health and stress management.

A stringent European Food Safety Authority (EFSA) regulation in Germany ensures high-level transparency of health claims and compels companies to use evidence-based formulations.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Strong demand for organic and clean-label products | Germany leads European sales of natural beverages |

| Probiotic and fermented drinks growing | Growth in kombucha and kefir driven by brands such as Voelkel |

| Focus on sustainable packaging | Consumers preferring biodegradable and sustainable packaging options |

| Functional teas and adaptogens on the rise | Demand for nootropic beverages to boost mental health increasing |

The UK low-alcohol beverage market is dominated by consumers demanding low-sugar and fortified beverages. The government's efforts to combat obesity and diabetes have encouraged the drinks industry to reformulate products with natural sweeteners and supplemented vitamins.

The UK is among the major markets for plant-based functional drinks, with oat milk, hemp milk, and pea protein drinks on the rise. Increased demand for gut-health-oriented drinks like kombucha and probiotic shots indicates rising consumer interest in digestive health.

One of the leading trends is the growing demand for functional beverage alternatives, such as non-alcoholic beer and botanically infused drinks. Three Spirit and Seedlip lead this category, capitalizing on the trend toward responsible consumption.

Growth Drivers in UK

| Key Drivers | Details |

|---|---|

| Low-sugar and fortified beverages maintained demand | Government action driving reformulation |

| Plant-based functional beverages growth | Oat, hemp, and pea protein beverage drinks mainstreaming |

| Gut-health beverages growth | Kombucha and probiotic beverages mainstreaming |

| Functional alcohol alternatives have emerged | Herbal, non-intoxicating drinks gaining popularity |

The higher value ingredient segment is now probiotics, which represents 32% of the global functional beverage market share. The demand for probiotic-based beverages, and the trend is exploding in fermented dairy-based drinks, kombucha, and probiotic-infused juices, as consumers continue to prioritize gut health, digestion, and immunity.

As consumers look to prioritize their microbiome health, beverage manufacturers are coming up with novel, highly stable plant-based and dairy-free probiotic formulations. This shift is especially evident in North America, Europe, and Asia-Pacific as health-conscious consumers are gravitating toward drinks that offer natural, science-backed digestive health benefits.

Increasing awareness of gut health and digestion, along with overall well-being, is likely to boost the prebiotics as a functional ingredient segment for the global functional beverage market. These are non-digestible fibres and compounds that specifically nourish helpful gut bacteria, rearranging them to balance them out while also increasing immune function and metabolic health.

Prebiotic-infused beverages are especially in demand in North America, Europe, and Asia-Pacific, where consumers are increasingly on the lookout for natural, fibre-rich alternatives that can synergize with probiotic formulations. Prominent product segments include fibre-fortified juices, functional sodas, dairy-free milk substitutes and prebiotic-infused kombucha.

Energy drinks continue to be the largest product category of the global functional beverage segment, Anthony mentioned, with 41% share, supported by the increasing inclination of athletes, fitness enthusiasts, and working professionals toward energy drinks. With consumers looking for instant energy boosts alongside functional benefits, innovation around clean-label formulations, natural sources of caffeine and sugar-free options continue.

In terms of energy-boosting ingredients, the industry heading toward usage of plant-based ingredients like matcha, guarana and green tea extracts over synthetic energy boosters to attract the customers who are seeking sustained energy without the help of artificial stimulants. Functional energy drinks, such as those enriched with B vitamins, electrolytes, and nootropics, are also gaining traction, as they tend to be favored by those interested in mental clarity, endurance, and hydration.

The specialty energy product segment, including low calorie and organic products, has also played a significant role in growth, making it the highest-value part of the global functional beverage industry. Due to the high product diversity and emergence of performance-enhancing beverages, this segment is projected to dominate the industry for the next few years.

Sports drinks are fast-growing products in the functional beverage industry that provide hydration and electrolyte replenishment and often promote muscle recovery and are specifically focused on an industry of athletes, fitness enthusiasts, and active consumers. These drinks are designed to replace lost fluids, replenish vital minerals, and improve physical performance, and they have become a key part of the sports nutrition marketplace.

Clean-label formulations are on the rise, with manufacturers sourcing natural electrolytes from coconut water, sea salt and potassium-rich ingredients as opposed to synthetic additives. Moreover, sugar-free and low-calorie sports drinks are also in high demand in the market, in line with the growing popularity of healthier hydration solutions among consumers.

Food functioned in beverages is fast realizing the industry with the ever-growing interest of consumers in health-based drinks. Leading business players are developing product lines with vitamins, minerals, probiotics, and adaptogens, appealing to wellness consumers.

Companies are pouring money into research and development, strategic partnerships, and acquisitions for increased industry presence. Growing popularity for plant-based and low-sugar functional drinks is also negotiating the competitive environment. North America and Europe remain the established industry, while Asia-Pacific is about fast upward development because of increasing health consciousness and disposable income.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| The Coca-Cola Company | 12-16% |

| PepsiCo | 10-14% |

| Red Bull | 9-13% |

| Monster Beverage Corporation | 7-11% |

| Nestlé S.A. | 6-10% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| The Coca-Cola Company | Expanding its functional beverage portfolio with products like 'Aquarius' (mineral-infused) and 'Simply Pop' (prebiotic soda). |

| PepsiCo | Investing in the prebiotic soda category and enhancing its functional drink offerings with sports and hydration beverages. |

| Red Bull | A global leader in energy drinks, incorporating natural caffeine and amino acids for enhanced performance and endurance. |

| Monster Beverage Corporation | Specializes in energy and functional beverages, including drinks enriched with vitamins, electrolytes, and herbal extracts. |

| Nestlé S.A. | Focuses on nutritional beverages, including fortified dairy drinks, plant-based protein shakes, and probiotic-infused beverages. |

Key Company Insights

Coca-Cola Company (12-16%)

A leader in the beverage industry, Coca-Cola has been continuously innovating functional drinks aimed at hydration, gut health, and immunity.

PepsiCo (10-14%)

Targeting prebiotic, health, and wellness drinks, PepsiCo is empowering its functional drinks category to finally fulfil the demands of health-conscious consumers.

Red Bull (9-13%)

Having pretty much established itself as the dominant player in the energy drink segment, strong brand equity and global distribution are factors relied upon way before anything else.

Monster Beverage Corporation (7-11%)

Monster is promising towards being a competitor in the already-functional and energy drink segment and still strives to innovate new and established-performing beverages based on energy enhancement.

Nestlé S.A. (6-10%)

With a prominent position in the beverages targeting nutritional goods, Nestlé manufactures and sells health drinks enriched with probiotics, vitamins, and plant-based substances.

Other Key Players (40-50% Combined)

The landscape is expected to grow at a CAGR of 5.4% over the forecast period from 2025 to 2035.

The market is anticipated to surpass USD 308.3 billion by 2035.

The Probiotics-based functional beverages segment is projected to grow the fastest, owing to increasing consumer awareness regarding gut health and the rising preference for microbiome-friendly drinks.

The industry is driven by rising health consciousness, increasing demand for ready-to-drink beverages, clean-label formulations, plant-based alternatives, and innovations in functional ingredients like adaptogens and nootropics.

Leading players in the market include Red Bull, The Coca-Cola Company, PepsiCo, Nestlé S.A., and Danone.

The market is segmented into antioxidants, minerals, amino acids, probiotics, prebiotics, vitamins, super-fruit extracts, and botanical flavors, catering to diverse functional benefits.

The functional beverage market includes energy drinks, sports drinks, nutraceutical drinks, dairy-based beverages, juices, and enhanced water, addressing hydration, performance, and nutritional needs.

The industry is categorized into supermarkets, hypermarkets, health stores, online retail, departmental stores, and convenience stores.

The global industry is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa (MEA).

Take Out Coffee Market Growth - Consumer Trends & Market Expansion 2025 to 2035

Vegan Protein Market Analysis - Size, Share & Forecast 2025 to 2035

Taste Modulators Market Trends - Growth & Industry Forecast 2025 to 2035

Western Europe Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Country through 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Korea Vanilla Bean Market Analysis byDistribution Channel, Form, Nature, Product Variety, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.