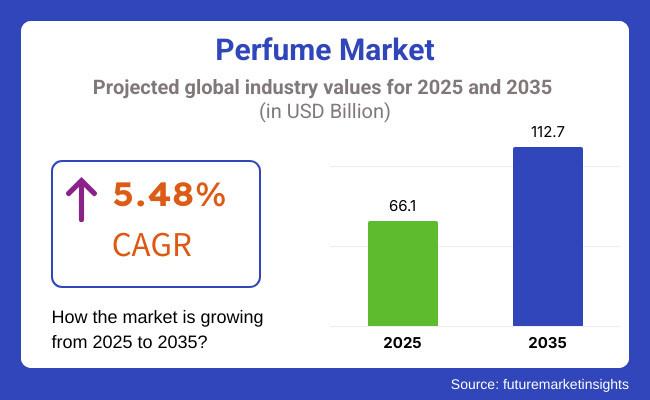

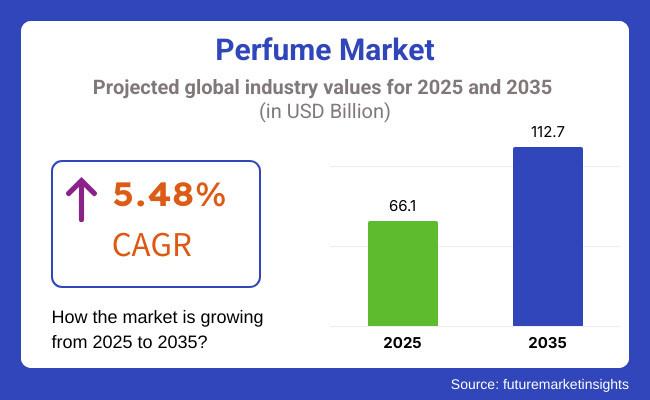

The perfume market is anticipated to grow from USD 66.1 billion in 2025 to USD 112.7 billion by 2035, with a compound annual growth rate (CAGR) of 5.48%. The perfume sector, which worldwide, is thought to go through remarkable growth in the period of 2025 and 2035, is mainly due to the increased demand from customers for expensive perfumes, the increased disposable income, and the rise in sustainable and personalized scent technology.

The development of the industry is seen in the AI-perfume customization, eco-friendly packages, which are substitutes for conventional celebrity-endorsed perfumes. The green approach is built on the sustainability wave, with the brands being focused on cruelty-free, alcohol-free formulas and packaging materials that are biodegradable in nature, to target the environmentally mindful customers, particularly Generation Z, and young people.

The application of AI in fragrances formulation and replacement analysis helps brands for their better flexibility in dealing with the more variable consumer preferences. The companies therefore make use of the technology to produce products which allow the users to decide their own scents by specifying mood, occasion, and scent preferences. New fragrance models that are subscription-based, and the increased interaction with the customers through the online consultations all these give good access to the luxury products and foster customer loyalty.

New fragrance models that are subscription-based, and the increased interaction with the customers through the online consultations all these give good access to the luxury perfumes and foster customer loyalty. The distribution of products directly to the final consumer though means breaking traditional retail patterns like giving a bigger opportunity to the individual market.

Nonetheless, the perfume industry has some constraining factors, a particularly notable one is the counterfeit perfumes returning forces as it were to scare like. Such incidences are primarily common in the Asia-Pacific and Latin America regions more particularly in the weak regulatory environments where counterfeit products are easily penetrated.

Aside from that, these counterfeit items not only hurt the reputations of the brands but also can be harmful to the consumers' health. As a countermeasure brands are putting money into blockchain certification, smart packaging, and digital confirmation to seal up product fitness.

Also, the excess of the market with tons of launches of fresh scents per year takes on a toll. Distinguishing through being elite, small-scale production, and AI-enabled scent personalization are going to be the major forces brands at the first point have to use for giving people value to the interest and loyalty in the future time. In the present time and age, sustainability and AI-powered innovations form the core of the most substantial growth opportunities.

Brands that are biodegradable packaging first, cruelty-free compositions, and zero-waste operation will lead over the rest in the competition due to the masses of consumers including those environmentally concerned buying purely ethical and sustainable products. One more impressive ideology of the distribution of AI in the innovation of fragrances is scent personalization, through which consumers design perfumes for their unique preferences.

Explore FMI!

Book a free demo

Between 2020 and 2024, the global industry grew at a constant rate. More consumers focused on personal care and better products. Demand for niche and craft products increased by a big margin as consumers sought products that are new but would also last long. Companies were launching environmentally friendly packaging, and refillable containers to reduce waste. E-commerce and online selling brought a huge change, with being able to sell directly to customers and receive recommendations for personalized fragrance through AI-driven systems. Celebrity and influencer endorsements also heavily influenced buying trends.

Between 2025 and 2035, the industry will move toward biotech-driven fragrance innovation, with scents produced in labs cutting down on natural resource usage. AI and big data will continue to customize fragrance experiences, adapting scents to personal moods and preferences. Zero-waste and sustainable packaging will be the norm for the industry, while the popularity of gender-neutral and mood-altering fragrances will reshape consumer tastes, presenting new opportunities for brands to differentiate and innovate.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Brands focused on natural, vegan, and clean scent extracts instead of using chemicals. Niche and personalized scents gained popularity. | AI can be used to customize scents. This allows consumers to create unique, mood-based scents. Biotech innovations, such as lab-grown musk and sustainable extraction methods lead. |

| Companies reduced single-use plastics, launched refillable bottles, and introduced eco-friendly, biodegradable packaging. Ethical sourcing of ingredients became a major consumer demand. | Zero-waste product packaging becomes an industry norm. Smart packaging integrates NFC technology for authentication, refills, and digital scent experiences. |

| AI-driven scent suggestions and virtual fragrance trials through AR and VR became popular. IoT-integrated diffusers made home fragrance experiences personalized. | Wearable fragrance technology adjusts products according to body temperature and mood. Nano-fragrance delivery systems provide longevity and customized diffusion. |

| Niche product houses grew internationally through direct-to-consumer (DTC) strategies and influencer marketing. The industry for gender-neutral fragrances grew. | Emerging markets experience exponential growth with local fragrances and AI-based consumer profiling. Adaptive technology redefines user experience with direct-skin scent customization. |

| Greater focus on synthetic fragrance chemicals resulted in reformulation using clean and sustainable materials. Transparency in labeling became a priority for brands. | Regulatory agencies have more stringent sustainability requirements, demanding traceability of full ingredients. Blockchain technology verifies ethical sourcing and compliance. |

| Brands launched mix-and-match product sets and AI-powered quizzes for tailored recommendations. Subscription business models picked up steam. | Brands go full AI-personalized fragrances mainstream, where the scent adapts in real-time according to user choice and environmental conditions. DNA-based personalization of scent becomes popular. |

| Brands hired celebrity perfumers and social media personalities to advertise their products to increase sales. TikTok, Instagram, and YouTube became important marketing platforms. | Metaverse-driven and virtual influencer-led fragrance experiences lead marketing trends. AR-facilitated scent trials and NFT-attached fragrance collections appeal to tech-conscious consumers. |

| Shoppers demanded long-lasting, non-toxic, and multi-use fragrances. Travel-sized and solid products gained popularity. | Biohacking-motivated scents respond to user stress levels and activity throughout the day. Consumers adopt fragrance as a wellness and self-care ritual. |

While AI-powered fragrance personalization promises innovation, the absence of clear regulation for artificial and synthetic fragrances are the problems here. Bioengineered musk, on the other hand - created as a sustainable alternative to the animal-derived variety.

Another risk is supply chain instability, since natural ingredients such as sandalwood and jasmine oil are subject to price ups and downs caused by weather conditions and overharvesting. In addition, there has been an increase in counterfeit perfumes as negative knockoffs which impact a brand's reputation and revenue.

Perfume brands use value-based pricing by leveraging exclusivity and personalization. Luxury high-end brands like Chanel and Dior utilize branding to allow for a high price point, same with mass-market brands that use spotlights and packaging efforts to claim worth. Niche and customized perfumes have emerged as a high-margin segment: personalized AI-generated fragrances reportedly sell at a 30-50% premium compared to standard variants.

Others use a subscription-style pricing model, sending customers personalized scents a few times each year. Affordable variants serve the price-sensitive middle-class consumers, especially in emerging markets, via smaller packaging sizes and refillable bottles. Sustainable perfumes also appeal to a growing segment that is willing to pay 15 to 20% more for ethical eco-friendly scents.

Eau de Parfum (EDP) is being extensively bought because of its long-lasting scent and greater concentration of perfume oils than other forms such as Eau de Toilette or Eau de Cologne. With an oil concentration of 15 to 20%, EDP provides a rich and strong scent that lasts for a long time, which makes it a popular option for buyers who want a long-lasting olfactory experience. This durability cuts down on the need for repeated application, so it is an economical solution even when compared to more affordable alternatives.

Over the past few years, natural products have been highly sought after and have risen to prominence as one of the most popular choices with consumers. This is largely due to a growing awareness of the need for health and wellness.

While traditional products usually comprise synthetic scents and aggressive chemicals, natural products are made using essential oils that are extracted from plants. Not only do these oils give a distinctive and invigorating fragrance but also have the potential to be therapeutic, relieving stress and improving mood. Therefore, people seeking a more natural way of personal care are attracted to natural products as a safer and more eco-friendly option.

Unisex fragrances have also witnessed a steep growth in demand based on their diversity and universal appeal. While the traditional fragrances tend to be gender-based, unisex products are crafted to appeal to all people irrespective of their gender identity. Due to their diverse appeal, unisex fragrances can easily cut across boundaries and appeal to various buyers who desire uniqueness and freedom in terms of their product choices.

Online stores are the go-to for product purchases because of the vast array they provide. In contrast to physical shops with limited space on the shelves, online sites have access to a huge selection of scents, such as niche, luxury, and foreign brands that are not readily available in local markets. This offers consumers the opportunity to try distinctive fragrances and find new alternatives beyond what is conventionally found in physical stores.

In North America, the fragrance industry is thriving, with people in the USA and Canada showing a strong preference for luxury, gender-neutral, and natural products. There is a growing interest in unique scents, leading to a rise in artisanal and limited-edition products, as consumers seek exclusivity.

Subscription services are reshaping how people buy products by letting them try new scents without purchasing full bottles. Sephora and Ulta are enhancing the shopping experience by using AI technology to recommend products, simplifying the process of finding new scents. Additionally, eco-friendly packaging and refillable bottles are gaining popularity, highlighting a regional commitment to sustainability.

Europe is a key player in the global industry, with France, Italy, and the United Kingdom leading the demand for luxury, traditional, and handcrafted fragrances. High-end brands are now incorporating eco-friendly ingredients and creating alcohol-free products to cater to the increasing preference for natural, skin-friendly options.

In these countries, manufacturers are trying innovative selling approaches, such as using AI for personalized scent recommendations and offering interactive in-store experiences. There is a noticeable consumer shift towards oud-based and plant-infused products, indicating a growing fascination with unique, exotic, and natural aromas.

The Asia Pacific region is quickly becoming the fastest-growing industry, with China, India, and Japan playing significant roles. The influence of Korean and Japanese beauty trends is shaping global preferences, favoring light, fresh, and subtle scents that resonate with local tastes.

Online platforms such as Tmall, Shope, and Nykaa are leading the way in product sales, offering personalized scent subscriptions and digital fragrance experiences. Younger buyers are particularly interested in products that are hypoallergenic, natural, and free from alcohol, as these are considered safer for those with sensitive skin.

The Middle East is a key area for luxury products, with oud, musk, and oriental scents being central to the culture. Leading the demand in this region are Saudi Arabia and the UAE, where people prefer strong and unique fragrances. This has led top brands to design collections specifically for the Middle Eastern market, incorporating traditional scents that appeal to local preferences.

Attar-based products are becoming increasingly popular, and there is a rise in high-end shops that specialize in custom-made fragrances. Moreover, airport duty-free stores play an essential role in distributing products to travelers, keeping them an important sales channel

The industry in Latin America is on the rise, with Brazil and Mexico at the forefront. While affordable products dominate sales, there's a growing interest among the middle class in high-end and imported fragrances. Stores selling products are rapidly increasing, especially within pharmacies and department stores, which makes it easier for people to buy them. Concern for the environment is also growing, leading to a surge in popularity for eco-friendly and refillable products, especially among the younger generation.

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| USA | 45.80 |

| China | 24.50 |

| India | 12.30 |

| France | 52.10 |

| United Arab Emirates (UAE) | 60.00 |

The USA industry, valued at USD 15.82 billion, is thriving due to luxury branding, celebrity endorsements, and innovative niche fragrances. Premium and customizable products are the most popular, with an increasing demand for clean and sustainable formulations. Sales are primarily driven by retail chains, department stores, and online platforms, while the revival of artisanal and gender-neutral scents is expected to influence future demand.

Chinese industry, valued at USD 34.77 billion, is experiencing growth due to higher disposable incomes and a growing preference for luxury Western fragrances. Premium and niche brands are on the rise, with online marketing and influencers significantly impacting sales. Additionally, there is a noticeable trend towards locally made products and the use of natural, sustainable ingredients, which is influencing the industry’s long-term direction.

The USD 17.84 billion business in India is expanding quickly as a result of growing urbanization and awareness of personal grooming. There is a high demand for attar-based and Ayurvedic fragrances, and consumers choose reasonably priced yet durable products. The main factors influencing sales in tier-2 and tier-3 cities include e-commerce, regional perfumeries, and multinational fragrance conglomerates.

The USD 3.57 billion industry in France continues to lead the world in high-end and couture scents. Sales are dominated by luxury perfume companies, who have a strong taste for subtle, timeless fragrances. Gender-neutral, environmental, and artisanal products are becoming more popular, and duty-free shopping and exports are major drivers of industry expansion.

The UAE’s industry, valued at USD 582 million, boasts one of the highest per capita spending rates globally, fueled by a deep cultural appreciation for perfumes and oud-based scents. The industry is primarily led by luxury and niche brands, with an increasing interest in personalized and high-end fragrances. Additionally, travel retail and duty-free shops significantly contribute to sales. This analysis provides a realistic view of per capita spending that reflects the current economic landscape and consumer preferences.

The industry is experiencing significant growth, fueled by a rising demand for premium fragrances, a growing consumer preference for natural ingredients, and the expansion of online retail channels. A survey conducted with 250 respondents from the US, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East reveals key trends that are shaping purchasing behavior.

Seventy percent of respondents prioritize long-lasting fragrances, with 65% in the USA and the UK showing a preference for high-concentration products like eau de parfum and extrait de parfum. In Southeast Asia and China, 55% of consumers are on the lookout for affordable yet premium-smelling scents, particularly those with floral and fruity notes. Additionally, 50% of respondents in Korea and Japan prefer minimalist packaging and niche fragrance brands, which aligns with the trend towards premiumization.

Pricing sensitivity varies across regions; 60% of respondents in the USA and EU are willing to spend USD 50 or more on designer and luxury products, while only 40% in Southeast Asia and China are inclined towards high-end options. Globally, 45% of consumers expect products to be competitively priced, balancing affordability with a sense of exclusivity.

E-commerce is transforming the industry, with 65% of respondents in China, the USA, and Southeast Asia purchasing products online through platforms like Amazon, Tmall, and Shope. However, 50% of consumers in Korea and Japan still prefer shopping at department stores and boutique outlets, where they can test fragrances in person. Furthermore, 40% of respondents worldwide trust influencer reviews and celebrity endorsements when choosing products.

Sustainability is becoming increasingly important, with 55% of consumers in the UK and EU favoring eco-friendly, refillable, and cruelty-free products. In China and Southeast Asia, 45% of respondents prefer fragrances inspired by local culture and made with natural ingredients, while 50% of consumers in ANZ and the Middle East prioritize alcohol-free and hypoallergenic formulations, reflecting a shift towards skin-friendly options.

There is a strong demand for premium fragrances priced at USD 50 and above in the USA, UK, and EU, while affordable and locally inspired scents are more popular in Southeast Asia, China, and the Middle East. E-commerce continues to play a crucial role in this evolving industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 4.8% |

| Germany | 5.5% |

| India | 6.7% |

| China | 7.0% |

The USA industry is growing due to greater demand from consumers for luxury and niche products and rising disposable incomes. Sephora, Ulta Beauty, and web-based sellers like Amazon operate to offer the global distribution of products. This, along with the growing demand for premium products is fostering the industry growth. FMI is of the opinion that the USA perfume market is set to witness 5.2% CAGR during the study period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Growing Demand for Luxury and Niche Products | Consumers are opting for high-end, premium products. |

| Online and Subscription Sales Model Growth | It is being made easy and available through internet-based sale. |

| Celebrity and Influencer-Driven Trends | Social media is dominating as a source of brand promotion. |

The UK industry is growing with high demand for sustainable and bespoke scents. Department stores like Harrods, Selfridges, and online players like Amazon UK control sales channels. FMI is of the opinion that the UK industry is set to witness 4.8% CAGR during the study period.

Growth Drivers in The UK

| Key Drivers | Details |

|---|---|

| Rise of Sustainable and Vegan Products | High growth rate consumers with high sustainability drive demand. |

| Bespoke and Custom Fragrance Growth | Personalization trend drives consumer consumption. |

| Impact of Celebrity Fragrance Brands and Social Media | Popularity of brands is increased through digital marketing. |

The industry in Germany is growing with a trend towards luxury and long-lasting fragrances. Distributor players are the large retailers such as Douglas, Rossmann, and Amazon Germany. The increasing inclination of people toward high-end products and the rising disposable income are also contributing to industry growth. FMI is of the opinion that the German industry is set to witness 5.5% CAGR during the study period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Premium and Long-Lasting Fragrances | Luxury products are favored by German customers. |

| Growing Demand for Natural and Organic Ingredients | Clean and hypoallergenic fragrances are more in demand. |

| Expansion in In-Store and Online Channel Distribution | Distribution through numerous channels increases reach. |

The Indian industry is emerging at a rapid rate due to rising disposable incomes, urbanization, and heightened awareness for foreign fragrance brands. Industry growth is fueled by online players like Nykaa, Flipkart, and Amazon India. The growing availability of a wide range of luxury brands is also leading to industry growth. FMI is of the opinion that the Indian industry is set to expand at 6.7% CAGR during the forecast period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Rising Middle Class Drives Up Product Consumption | Heightened affordability spurs demand. |

| Indian and Ayurvedic Fragrance Brands Take Center Stage | Natural and botanical products are becoming increasingly popular. |

| Growing Retail and E-commerce Space | Online availability of products is increased. |

The industry in China is growing well with the growth of luxury consumption, growth in middle-class incomes, and the growth of online retailing in Tmall and JD.com. The surging online availability of luxury products is also contributing to the expansion of the industry in the country. FMI is of the opinion that the Chinese industry is set to observe 7.0% CAGR during the forecast period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Strong Luxury and International Scent Brand Demand | Luxury brands are loved by Chinese consumers. |

| Abruptly Growing Online Sales of Fragrances | Online platforms are dominating. |

| Government Encouragement of Domestic Production | Domestic brand development is promoted by policies. |

The global industry is very competitive, with both established luxury brands and newer niche players continuing to bring innovations to the industry. Important players include L'Oréal, Estée Lauder, Coty Inc., Chanel, and LVMH (which owns Dior, Givenchy, and Guerlain). These companies build their stronghold based on their brand equity, distribution network, and marketing spend. Most are seeking to expand their portfolios by acquiring niche fragrance brands and leveraging celebrity endorsements while also investing in sustainable and personalized fragrance solutions. For instance, Coty has been positioning itself more strongly through influencer partnerships as well as revitalizing heritage brands, while L'Oréal invests heavily in digital transformation and direct-to-consumer sales.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| L'Oréal Groupe | 15-20% |

| Estée Lauder Companies Inc. | 12-16% |

| Coty Inc. | 10-14% |

| LVMH Moët Hennessy - Louis Vuitton SE | 8-12% |

| Chanel SA | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| L'Oréal Groupe | It provides fragrances from different brands such as Lancôme, Yves Saint Laurent, as well as Giorgio Armani. Concentrates on innovation and sustainability programs to reduce the impact on the environment with efforts to adopt eco-friendly packaging. |

| Estée Lauder Companies Inc. | Sells its products through such brands as Jo Malone London, Tom Ford Beauty, and Le Labo. Also invests in these niche and luxury areas for development in personalized customer experiences to show craftsmanship in art. |

| Coty Inc. | Possesses a fairly good portfolio holding brands as Calvin Klein, Marc Jabobs, and Gucci. It now concerns itself with strategic partnerships and licensing agreements to further reach into the markets and suit a wider class of consumers. |

| LVMH Moët Hennessy - Louis Vuitton SE | Providing luxury fragrance lines-in brands such as Dior, Givenchy, and Louis Vuitton. Exclusivity alongside heritage is emphasized, especially in high-quality materials involved and innovative scent compositions. |

| Chanel SA | Known for iconic fragrances such as Chanel No. 5 and Coco Mademoiselle. Focuses on timeless elegance and brand legacy, maintaining a strong presence in the luxury products segment. |

Key Company Insights

L'Oréal (15-20%)

L'Oréal products, such as Lancôme and Yves Saint Laurent, stand at the helm of the industry. R&D is exercised to innovate fragrances that react to shifts in consumer preferences. On the sustainability front, packaging solutions include eco-friendly options, and sourcing is highlighted as responsible. Meanwhile, direct digital engagement along with personalized marketing bolster consumer experience.

Estée Lauder Companies Inc. (12-16%)

Estée Lauder commands a significant share with its luxury fragrance brands, including Jo Malone London as well as Tom Ford Beauty. The company emphasizes artisanal crafting of products and individualistic customer experiences. Strategic acquisitions and investments in niche brands have solidified Estée Lauder's position at the top of the luxury industry. The company is further investing in reaching consumers via digital platforms to expand its reach and build higher consumer loyalty.

Coty Inc. (10-14%)

Coty Inc. has a large portfolio that includes brands such as Calvin Klein and Marc Jacobs. They appear to be working mainly on partnership and licensing arrangements to strengthen position. Marketing investment and product innovation are key towards addressing varying consumer preferences. Revitalizing their key brands and increasing their digital presence are two critical initiatives in their growth strategy.

LVMH Moët Hennessy - Louis Vuitton SE (8-12%)

LVMH is responsible for the luxury fragrances offered under the esteemed brands of Dior and Givenchy. The company stresses exclusivity and heritage, along with investment in premium key ingredients and innovative scent formulations. On the grounds of retail network strength and brand equity, LVMH dominates the luxury landscape. Collaborations with famous perfumers and continuous product innovation are key tenets of its overall strategy.

Chanel is renowned for a few iconic fragrances, including Chanel No. 5. The brand is defined by classic refinement and heritage, exerting considerable influence in the luxury fragrance sector. Chanel invests in high-quality ingredients and traditional fragrance profiles to appeal to consumers seeking sophistication and tradition. A sprinkling of exclusivity added with reserved distribution networks and limited-edition launches enhances the mystique of the brand.

Other Key Players (30-40% Combined)

Emerging and niche companies are continuing to grow in the industry. This subset of players focuses on unique scent profiles, sustainable practices, and personalized experiences.

These companies cater to consumers seeking artisanal craftsmanship, unique fragrances, and personalized services. They leverage storytelling, limited-edition releases, and exclusive retail experiences to build brand loyalty and differentiate themselves in a competitive industry.

The industry is slated to reach USD 66.1 billion in 2025.

The industry is anticipated to witness USD 112.7 billion by 2035.

China, slated to hold 7% CAGR during the forecast period, is set to witness fastest growth.

Eau de Parfum (EDP) is widely sold.

Key companies include Estee Lauder Companies Inc., LVMH Moet Hennessy Louis Vuitton, Coty Inc., Elizabeth Arden Inc., Shiseido Co. Ltd., Puig SL., Perfumania Holdings Inc., Avon Products Inc., Hermes International S.A., Natura Cosmetics S.A., Chanel S.A., Clarins Cosmetics Company, Revlon Inc., and Givaudan.

By product type, the industry is categorized into Eau de Perfume, Eau de Toilette, Eau de Cologne, and Eau Fraiche.

By nature, the industry is segmented into natural and synthetic.

By end use, the industry is divided into men, women, and unisex.

By sales channel, the industry is classified into wholesalers/distributors, hypermarkets/supermarkets, specialty stores, multi-brand stores, independent drug stores, online retailers, and others.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.