In 2025, the global forage seeds market is set to reach a valuation of USD 14.6 billion, with the demand expected to grow at a CAGR of 9.8%, and the total market size coming to USD 37.2 billion by 2035. One of the main factors owing to the increasing demand for animals' nutrient-rich, high-yield feed has been the impact on the competitive setting.

Industrialists have been adopting a competitive strategy for expansion of market shares through initiating their investments in breeding programs, technical developments as well as the extension of manufacturing capacities in order to match the ever-growing demand coming from livestock and dairy producers globally.

The top suppliers that are involved in the business of forage seeds have widely raised production capacity in order to satisfy the huge industry demand. DLF Seeds, Barenbrug Group, Allied Seed, and Corteva Agriscience are the companies taking active measures like acquisitions, setting up new production units, and augmenting seed processing facilities in their aggressive expansion plans.

In fact, with the launching of the "high-performance" seed types with the have increase drought tolerance and resistance to diseases have a good place in the range of products offered, companies have a path to evolution. The global drive for natural and organic raw materials is impacting the forage seeds market even more.

Chemical-free and non-GMO feed are the preferred choices by the consumers; therefore, the companies should consider broadening their product lines by introducing organic and regenerative seeds. Moreover, the demand-driven by sustainability-minded livestock producers for seeds that can withstand climate changes is the root cause for the creation of innovations within the sector.

Companies are making the most of digitalization technology, including AI based seed selection and tailor-made forage solutions, to achieve further productivity increase. The integration of digital platforms for direct farmer engagement and contract farming models is also becoming a pivotal strategy for increasing market penetration. With growing investments in R&D and sustainability-driven innovation, the global forage seeds market is set to witness dynamic competition over the next decade.

Forage seeds industry is experiencing considerably different prices for the organized and conventional seed products because of the various breeding techniques, certifications, and the levels of efficiency of the supply chain. For instance, stored seed products are more expensive than others, typically generated from DNA engine, since their incubation period is shorter, they require less energy and have higher potency against pests.

However, the products sourced from local farmers through direct sale channels, traditional farming, and cooperatives are generally cheaper. These products may have problems concerning variability and germination rates.

Precision farming and the digital trial of seed operation have been facilitating value addition to the organized products. Nevertheless, in the emerging regions, affordability is still a problem, making it difficult to sell premium forage products. In response to this, both governmental and industrial stakeholders are designing measures, such as the introduction of substitutes and incentives for the adoption of top-quality seeds, that strike the right balance between benefits and costs while enhancing farm productivity.

| Attributes | Description |

|---|---|

| Estimated Global Forage Seeds Business Size (2025E) | USD 14.6 billion |

| Projected Global Forage Seeds Business Value (2035F) | USD 37.2 billion |

| Value-based CAGR (2025 to 2035) | 9.8% |

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global forage seeds market. This analysis highlights key shifts in performance and provides insights into revenue realization patterns, allowing stakeholders to understand the market’s growth trajectory.

The first half of the year (H1) spans from January to June, while the second half (H2) includes the months from July to December. In the first half of the decade (2024 to 2034), the market is projected to grow at a CAGR of 9.4%, followed by an acceleration to 9.9% in the second half of the same decade.

Moving into the subsequent period (H1 2025 to H2 2035), the CAGR is expected to rise to 9.5% in H1 and sustain robust growth at 10.0% in H2. In H1 2025, the industry witnessed an increase of 30 BPS, while in H2 2025, it observed a decrease of 20 BPS.

Semi-annual Market Update

| Particular | H1 |

|---|---|

| Year | 2024 to 2034 |

| Value CAGR | 9.4% |

| Particular | H2 |

|---|---|

| Year | 2024 to 2034 |

| Value CAGR | 9.9% |

| Particular | H1 |

|---|---|

| Year | 2025 to 2035 |

| Value CAGR | 9.5% |

| Particular | H2 |

|---|---|

| Year | 2025 to 2035 |

| Value CAGR | 10.0% |

The global sales of forage seeds increased at a CAGR of 9.2% from 2020 to 2024, driven by increasing global meat and dairy consumption and the need for high-quality livestock feed. Improved awareness of the nutritional benefits of forage-based diets made livestock producers adopt improved varieties of seeds for better crop yields.

In addition, government initiatives in support of pasture development and sustainable agriculture have boosted the industry growth. During this time, consumers' preference for organic dairy and grass-fed meat pulled the farmers towards the non-GMO and climate-resilient forage seed trend.

The industry is estimated to grow at a CAGR of 9.8% between 2025 and 2035, further propelled by advances in seed coating and genetic enhancement, which in turn improve germination rates, disease resistance, and yield efficiency. Greater investment in farmer education and marketing programs further advance adoption. As livestock production ramps up worldwide, the demand for nutrient-dense, high-yielding forage crops will be assured, promoting healthy growth over the next ten years.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Rising demand for high-yield forage seeds due to increasing livestock production. | Precision breeding and gene editing enhance yield, climate resilience, and disease resistance. |

| Adoption of organic and non-GMO forage seeds increased to meet consumer demand for natural livestock feed. | Lab-made forage substitutes become more popular as feed options that are sustainable, are produced more. |

| Climate change issues increased research in drought-resistant and pest-resistant seeds. | AI and satellite-based precision agriculture maximizes forage seed sowing and yield management. |

| Farmers turned to mixed forage cropping systems in order to enhance soil quality and feed variety. | Regenerative agriculture practices integrate forage crops for carbon sequestration and biodiversity. |

| Expansion of forage seed e-commerce platforms and direct-to-farm sales models. | Blockchain and smart contracts streamline seed sourcing, traceability, and fair trade certification. |

| Governments promoted sustainable forage cultivation through subsidies and research grants. | Policy shifts encourage carbon credit incentives for climate-smart forage farming. |

Producers of forage seeds face substantial environmental and regulatory challenges that impact both yield and expansion. Climate change adds uncertainty to the seed production process: erratic weather - from extended droughts to sudden floods - threatens to dramatically reduce the yield and quality of crops.

Although, this environmental uncertainty makes it harder for producers to have a stable supply. R&D investment of thousands of man-hours go into breeding higher-yielding, pest-resistant forage varieties, as the cost of innovation makes it skilfully prohibitive with a high barrier to entry for new products.

The industry is also complicated further by various and uneven certification regulations surrounding genetically modified or hybrid seeds, which are applied differently across territories. Navigating these complex and often strict regulations can lead to problems with getting a product approved and/or limits on which industries a product can be sold in.

Thus, forage seed companies are forced to either grow their investments on research or achieve compliance with a wide range of regulatory requirements, opening up a natural industry expansion process that is difficult at best in an industry-with intense pressure from climate variability and high development costs.

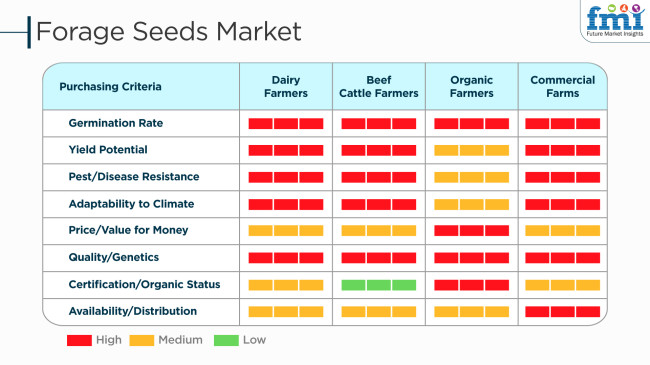

Varying prices according to perceived performance advantages and intended final product is a common approach that forage seed retailers take. Status-based premium pricing is prevalent in the context of advanced hybrid or genetics modified seed that exhibit superior traits like increased yield, better disease resistance, or higher drought tolerance.

Farmers are usually predisposed to paying a higher cost for seeds that significantly enhance pasture output or livestock health. Moreover, the pricing is also tiered according to the specific segment of livestock; a specific seed mix for dairy cattle, for example, might be priced higher than more generic blends for general grazing purposes.

Seed companies may offer bulk discounts and volume-based pricing to appeal to large-scale enterprises, such as commercial ranches or cooperative farms, taking advantage of economies of scale to lower the per-unit cost. This multi-tiered pricing strategy allows producers to capture revenue from a broader spectrum of customers, catering to both premium segments and cost-conscious consumers.

The global forage seeds industry exhibits a moderately concentrated structure, dominated by multinational corporations (MNCs), regional players, and local seed producers.

Multinational Corporations (MNCs)

Large MNCs hold a significant share of the industry, leveraging advanced seed technology, genetic modification, and research-driven breeding programs to enhance productivity. These companies focus on global expansion, strategic collaborations, and mergers to strengthen their foothold. Increasing investment in sustainable and climate-resilient forage seeds is a key growth driver.

Additionally, MNCs are expanding their production capacities in key agricultural regions to cater to the rising demand for high-yield, disease-resistant, and drought-tolerant forage seeds.

Regional Players

Regional manufacturers focus on customized forage solutions tailored to local climatic conditions and soil types. They emphasize affordable seed varieties, non-GMO options, and organic offerings to attract sustainability-conscious consumers.

Many regional players are forming public-private partnerships to improve seed distribution and accessibility. The rising demand for chemical-free, natural livestock feed is further propelling the expansion of regional players in developed and emerging economies.

Local Seed Producers

Local producers cater to small-scale farmers and niche industries, offering cost-effective and indigenous forage seed varieties. They play a vital role in preserving traditional seed varieties and meeting specific demands for organic and regenerative farming practices. As consumer preference shifts toward natural and traceable feed sources, local seed suppliers are capitalizing on direct farmer engagement and digital distribution models.

With increasing competition, MNCs, regional players, and local producers are adopting innovative strategies, technological advancements, and sustainability-focused initiatives to strengthen their positions globally.

| Countries | Value (2035) |

|---|---|

| United States | 26.8% |

| United Kingdom | 7.5% |

| China | 8.1% |

| India | 6.1% |

| Japan | 5.1% |

FMI projects the United States to be the largest and fastest-growing industry for forage seeds, with an impressive CAGR of 26.8% during 2025 to 2035. Its large number of dairy and beef cattle drives the demand for high-yielding forage crops like alfalfa, clover, and ryegrass. According to the USA Department of Agriculture (USDA), the nation had 94.8 million head of cattle in 2023, and forage seeds have a crucial role in maintaining productivity among livestock.

Improvement in precision farming, biotechnological advancements, and hybrid seed technologies are driving the use of genetically enhanced forage seeds that have higher yields and resistance to pest and environmental stresses. Private industry and USDA R&D projects, like those undertaken by Monsanto and Corteva Agriscience, are actively working on creating drought-resistant and pest-resistant seeds.

In addition to this, research grants and farm subsidies by the government motivate producers to invest in improving forage crops, with a special motivation by the Environmental Quality Incentives Program (EQIP), promoting sustainable grazing land management. Expansion in organic livestock production trends is pushing demand for forage seeds with no chemicals or GMOs as consumers increasingly show demand for dairy and meat with grass-fed features.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Such a large stock of cattle | 94.8 million cattle (USDA, 2023) demands high-grade forage. |

| Biotechnology innovation | Firms such as Monsanto and Corteva working on drought-resistant seeds. |

| Government assistance | EQIP and other USDA programs fund sustainable forage production. |

| Organic farming trends in agriculture | Growing demand for non-GMO and organic forage seeds used in grass-fed meat and milk. |

| Sustainability efforts | Regenerative farming and improving soil health in the limelight. |

According to FMI, the industry is expected to register 8.1% CAGR during the forecast period. China is witnessing increasing demand for quality forage seeds, mainly because of the growth of dairy and animal husbandry activities.

China's dairy industry has been growing extremely rapidly, and milk production is at 38 million metric tons in 2023. The government's modernization plans to promote large-scale forage cultivation are propelling it, especially in Inner Mongolia and Heilongjiang, where dairy farming is growing.

China's strong dependence on imported alfalfa (primarily from the United States and Canada) has encouraged greater investment in native seed breeding programs as a means of gaining independence. China imported well over 1.5 million metric tons of alfalfa in 2022, and this will further encourage domestic alternatives. Growing demand for high-protein dairy and meat products is propelling the production of high-nutrient forage crops like alfalfa, ryegrass, and clover to improve livestock welfare.

China is also embracing precision farming and hydroponic fodder production to enhance feed efficiency and reduce environmental pressures. For instance, vertical farming methods are under research to cultivate fodder in compact areas.

Growth Drivers in the China

| Key Drivers | Details |

|---|---|

| Dairy industry growth | Milk production amounted to 38 million metric tons in 2023. |

| Reliance on forage imports | Over 1.5 million metric tons of alfalfa imported in 2022. |

| Government modernization efforts | Investments in Inner Mongolia and Heilongjiang for large-scale forage cultivation. |

| Precision agriculture | Increased adoption of hydroponics and vertical farming to enhance feed efficiency. |

| High-protein livestock demand | Increased meat and dairy consumption calling for nutrient-rich forage crops. |

The UK forage seed industry is likely to expand with a CAGR of 7.5% due to expanding use of sustainable rearing of livestock and organic production of fodder. Grass-milk dairy products and meat products have witnessed surging demand, with customers opting for pasture-reared animals over those raised on grain.

Government initiatives like the Environmental Land Management Scheme (ELMS) are promoting low chemical farming and regenerative farming. The farmers are now more often using greater numbers of non-GMO and organic feed seeds to reach sustainability objectives. Climate change is also among the top priorities, which has caused an increase in drought-resistant and cold-resistant varieties of seeds.

The UK agricultural industry is experiencing a technological revolution, with precision agriculture methods, AI-optimized seed selection, and automated irrigation systems increasing efficiency in forage production. For instance, satellite images are being employed to track soil health and improve grazing patterns

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Consumer demand for grass-fed meat/dairy | Upward trend in demand for pasture-raised animals. |

| Regenerative agriculture policy | ELMS supports sustainability and decreased use of chemicals. |

| Climate change adaptation | Deployment of drought and cold-tolerant seeds. |

| Tech farm | AI, satellite imagery, and robot irrigation optimizing yield. |

| Green organic farm co-ops | Mutual support in rotational grazing and land stewardship. |

The forage seed industry of India is increasing at a decent pace due to its big and increasing dairy and livestock industry. Being one of the world's largest milk producers, India needs quality forage to boost more milk production at high rates. There are marginal and small farmers in India, and thus the questions of usability and affordability of forage seeds arise.

Development of fodder is encouraged by the government proactively with schemes such as the National Livestock Mission (NLM) that offers financial support and subsidies for seed distribution of fodder and grazing land development. Drought and high-growth types such as hybrid napier grass, alfalfa, and sorghum are used extensively for productivity improvement.

Climate fluctuation in various parts of the world has resulted in the cultivation of tropical and temperate forage crops. In addition, the growing use of mechanization in fodder production is cutting down wastage and improving efficiency.

Growth Drivers in the India

| Key Drivers | Details |

|---|---|

| Dairy industry growth | India is the largest milk-producing country in the world. |

| Government subsidy | NLM offers financial support for fodder production. |

| Smallholder farmer need | Affordable and durable forage seeds required. |

| Climate resilience | Forage crops, tropical and temperate, are extensively cultivated. |

| Mechanization of fodder cultivation | Improved productivity and minimized wastage. |

Japan's forage seed industry is stimulated mainly by its highly developed livestock and dairy industries, which are the priority customers in buying quality feeds for maximum animal productivity. Cultivation land is extremely scarce in Japan, and thus it depends largely on imports of feed grains, and therefore forage seed technology is extremely important for domestic production.

The nation gives preference to high-yielding and nutritious varieties of forages like timothy grass, alfalfa, and clover in order to have good cattle feeding. Forage crops resistant to climate and digestible in large quantities have become a result of research in the field of agriculture that has increased feeding efficiency.

Growth Drivers in the Japan

| Key Drivers | Details |

|---|---|

| Scarce arable lands | Heavy reliance on foreign feed crops. |

| Dairy and livestock sector | Focus on high-nutrient, high-quality forage crops. |

| Climate-resilient seed innovation | Development of high-digestibility forage crops. |

| Government policies | Promotion of local fodder production to reduce imports. |

| Sustainable agriculture | Organic and non-GMO forage seed promotion. |

In terms of type segments, alfalfa alone accounts for nearly 42.6% of the global forage seed industry in terms of revenue. It is the most favorable forage crop for dairy cattle, poultry and swine production with its high nutritional value, protein content and digestibility. Alfalfa is desirable for rotational cropping as it fixes nitrogen in the soil, increasing soil fertility.

The high yield potential and ability to enhance animal health makes alfalfa a preferred forage for livestock producers, and therefore an essential component of livestock feeding programs. Moreover, climate resilience and adaptability have exacerbated the spread of alfalfa throughout North America, Europe, and the East Asian region. Drought-tolerant alfalfa varieties are a natural response to address concerns over water scarcity, especially in areas like the United States, Australia, and parts of the Middle East.

Clover is an important forage seed in the world, prized for its protein content, digestibility, and soil enhancement. With a significant portion of total industry revenue, clover is extensively used to supplemental nutrition in dairy cattle, sheep, and poultry production systems without resorting to an expensive and energy-intensive commodity feed, such as maize.

The ability of clover to adapt to climate variability and its resilience have allowed it to be grown all over North America, Europe, and parts of Asia and it grows well in temperate and semi-arid regions. There is a great deal of growing in water-stressed regions world-wide, particularly in parts of Australia, United States, and Latin America with drought-tolerant and disease-resistant varieties now under development.

Growth in the poultry segment is rising demand for forage seeds, as demand for high-quality, protein-rich feed products is rising. For poultry, especially eggs and meat, nutrient-rich forages such as clover, ryegrass and alfalfa are commonly dependent on for health enhancement, digestive health, and optimum growth rates.

As consumers and demand increases in favor of organic and antibiotic-free poultry products, a growing number of farmers are opting for natural, GMO-free forage seeds instead. High-yield forage varieties are thus further adopted by many farms to ensure the required balance of nutrients, given the increasing demand for pasture-raised and free-range poultry.

Strict feed regulations and restrictions on synthetic additives in North America and Europe have accelerated the shift toward natural forage-based poultry diets. On the other hand, in Asia-Pacific and Latin America, small- and medium-scale poultry farmers are replacing cheap protein feed with high-protein forage crops to enhance feed efficiency, and boost poultry output over the input.

The cattle sector is the largest consuming sector of forage seeds, which took up 58.3% of the total demand for forage seeds in the industry. This has been driven in large part by rising global production of dairy and beef products - as cattle are fed large quantities of high-protein forage crops like alfalfa, clover and ryegrass to ensure a good yield of milk and quality meat. In North America and Europe, tightening regulations on synthetic feed additives have prompted a progressive switch towards natural and GMO-free forage crops.

Oversea, in South Asia and Latin America, small farmers have also shown a preference for high-yield hybrid forage seeds aimed at increasing cattle productivity to meet the global increase in dairy demand. Advances in forage seed selection, combined with the adoption of precision farming techniques and rotational grazing, have helped drive these changes.

The global forage seeds industry is witnessing substantial growth, fueled by the rising demand for high-quality animal feed and the adoption of sustainable agricultural practices. Key industry players are focusing on strategic expansions, acquisitions, and product innovations to strengthen their industry positions.

Additionally, advancements in seed technology and increasing investments in research and development are driving industry competitiveness. North America and Europe remain dominant regions, while Asia-Pacific is emerging as a high-potential industry due to expanding livestock industries and increasing awareness of sustainable feed solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| S&W Seed Company | 10-14% |

| BASF SE | 8-12% |

| Dow AgroSciences LLC | 7-11% |

| Allied Seed LLC | 6-10% |

| Germinal GB | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| S&W Seed Company | A leader in alfalfa and sorghum seed production, focusing on high-yield and drought-resistant forage seeds. |

| BASF SE | Offers genetically enhanced forage seed solutions with an emphasis on improved nutritional value and pest resistance. |

| Dow AgroSciences LLC | Develops innovative forage seed varieties with advanced traits to enhance livestock productivity. |

| Allied Seed LLC | Specializes in a wide range of forage and cover crop seeds, ensuring sustainable and efficient animal feed solutions. |

| Germinal GB | Provides high-performance grass and clover seeds for pasture improvement and dairy farming applications. |

Key Company Insights

S&W Seed Company (10-14%)

A leading player in the forage seed industry, specializing in alfalfa, sorghum, and pasture seeds with advanced breeding techniques.

BASF SE (8-12%)

BASF is a major contributor to agricultural biotechnology, offering high-yield and pest-resistant forage seed varieties.

Dow AgroSciences LLC (7-11%)

Focuses on developing forage seeds with enhanced nutritional profiles to improve livestock health and productivity.

Allied Seed LLC (6-10%)

Known for its broad portfolio of forage and cover crop seeds, supporting sustainable farming practices.

Germinal GB (5-9%)

A key supplier of high-performance pasture seeds, contributing to the dairy and livestock industries.

Other Key Players (45-55% Combined)

The market is projected to expand at a CAGR of 9.8% from 2025 to 2035.

By 2035, the market is expected to reach approximately USD 37.2 billion.

The Alfalfa segment is expected to witness the fastest growth due to its high protein content, nitrogen-fixing benefits, and widespread adoption in dairy and beef cattle feed.

Key growth drivers include rising demand for high-protein animal feed, expansion of organic and non-GMO livestock farming, increasing dairy and meat consumption, and advancements in drought-resistant and high-yield forage seed varieties.

Leading companies in the forage seeds market include DLF Seeds A/S, S&W Seed Company, Allied Seed LLC, Barenbrug Group, BrettYoung, and Growmark Inc., known for their innovation, regional expansions, and sustainable seed breeding initiatives.

The global forage seeds market is segmented into Alfalfa, Clover, Ryegrass, Chicory, and Others.

The market is categorized into Poultry, Cattle, Pork/Swine, and Others, with varying forage seed preferences based on dietary needs and feed efficiency requirements.

The forage seeds market spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Catechins Market Trends - Growth & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.