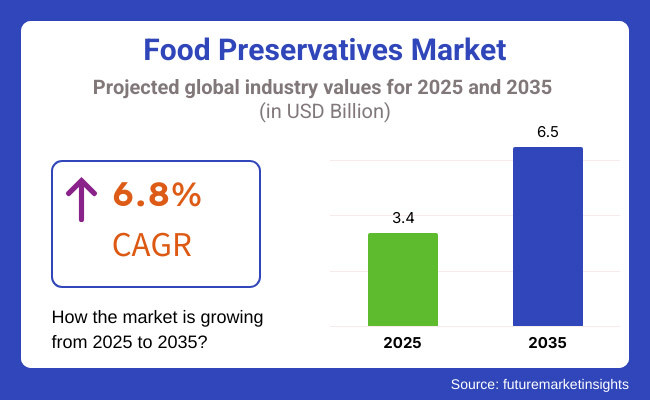

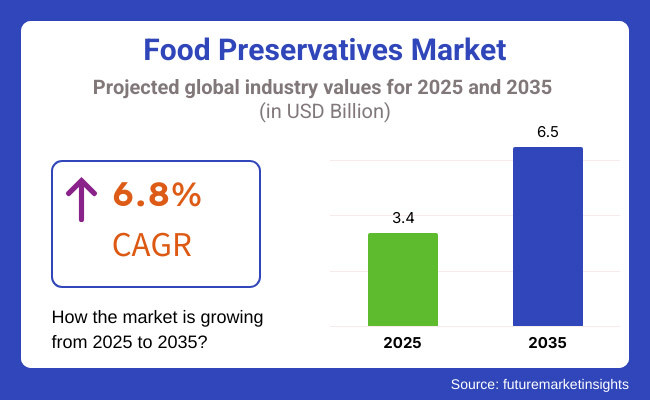

By 2025, the global food preservatives market is set to reach around USD 3.4 billion. Steady growth of the market is expected to be supported by the rising interest of consumers in clean-label and longer-shelf-life food products. As a result of the increasing consumer preferences for natural and organic food preservatives, producers are now concentrating on reformulating their product lines to cooperate with the new industry dynamics. Throughout the projection period (2035 to 2025), global food preservatives are estimated to record a 6.8% growth rate in sales, which is expected to rise to a total value of USD 6.5 billion by 2035.

The major players are increasing their production capacity to gain an extra edge in the fiercely competitive environment. The leading companies such as Corbion NV, Kemin Industries, and Kerry Group are the ones that have invested a lot in research and development to unveil the new types of natural preservatives that are derived from plant extracts, fermentation methods, and bio-based antimicrobial agents.

Since synthetic preservatives like BHA and BHT are facing increased regulatory scrutiny, companies are tactically turning to rosemary extract, citrus-based antioxidants, and cultured dextrose as natural substitutes.

Growing consumer inclination for natural materials is another driver of the industry expansion, and as a result, brands have been focusing on the messaging of clean-label formulations and transparency in sourcing the ingredients. For example, DuPont and Cargill that is collaborating with the fermentation technology to produce naturally derived food preservatives, which are in demand with the consumers who prefer food that is minimally processed.

In addition, the distribution of food manufacturers and supplies of ingredients are the ones responsible for the growth of product innovation which offers the solutions to maintain food safety while at the same time fit into the consumer demands for healthier and chemical-free products.

On top of that, one of the prime movers of the industry is also the increasing request for convenience foods and the long-shelf-life products. Retailers and food service are now interfacing with preservative solutions that interject the stability of food processing with no risk of quality loss. Facing the ever-changing issues in the food preservatives industry, the unique blend of creativity, regulatory adaptability, and consumer-driven changes is assumed to be the driving force behind the industry growth over the next decade.

The quick move to the consumption of ready-to-eat (RTE) food is the main driver of the radical changes in the food preservatives business. Urban area consumers, who primarily are simplifiers of life spending their valuable time, in turn, cause the demand for long shelf life with not many preservatives foods. This increase is what forces the manufacturers to look for the ways of preservation that will not have any effect on the frais, the texture, and, finally, the nutritional value.

Explore FMI!

Book a free demo

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.6% |

| H2 (2024 to 2034) | 7.0% |

| H1 (2025 to 2035) | 6.9% |

| H2 (2025 to 2035) | 7.5% |

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global food preservatives industry. This analysis highlights critical shifts in performance and revenue realization patterns, providing stakeholders with insights into the iindustry's trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

In the first half (H1) of the decade from 2025 to 2035, the industry is projected to expand at a CAGR of 6.6%, followed by an accelerated growth rate of 7% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is expected to increase to 6.9% in the first half and remain high at 7.5% in the second half.

In the first half (H1), the sector witnessed an increase of 40 BPS, driven by the rising demand for natural food preservatives and stricter regulations on synthetic additives. In the second half (H2), the industry recorded a 20 BPS increase, attributed to innovations in formulation technologies and expanding applications across processed food categories.

The first half of the year was influenced by rising consumer demand for preservative-free and clean-label food options, while the second half saw an increased focus on sustainable ingredient sourcing and formulation advancements. As the industry adapts to evolving consumer preferences and regulatory shifts, continuous innovation in preservation technologies will drive long-term growth in the global food preservatives industry.

The global food preservatives sector is characterized by a fragmented competitive landscape, with a mix of regional and international players. Regional manufacturers play a crucial role in the industry, catering to the growing demand for natural, clean-label, and locally sourced preservatives. These companies are leveraging their proximity to raw material sources and evolving consumer preferences to strengthen their positions.

Across North America, regional producers focus on plant-based and fermentation-derived preservatives to meet the increasing regulatory scrutiny on synthetic additives. They emphasize sustainable production and localized distribution to gain a competitive edge. In Europe, smaller players are investing in organic and bio-based preservatives, capitalizing on the region's stringent food safety regulations and consumer demand for chemical-free alternatives.

Meanwhile, in Asia-Pacific, local manufacturers benefit from the region’s vast agricultural resources, offering naturally sourced preservatives at competitive prices. The high demand for convenience foods in this region has further accelerated the need for cost-effective preservation solutions.

In Latin America and the Middle East & Africa, regional players cater to traditional and ethnic food processing industries, providing preservative solutions suited to regional dietary preferences. The increasing consumption of processed and packaged foods has driven local companies to innovate with natural antimicrobial agents, leveraging botanical and spice extracts as preservatives.

Regional players continue to expand production capacities and collaborate with food processors to develop customized solutions. Their ability to adapt to key trends, regulatory changes, and consumer preferences positions them as key contributors to the evolving global food preservatives industry landscape.

Food preservatives sales have grown globally between 2020 and 2024. Between 2025 and 2035, the spending on food preservatives is expected to grow at a CAGR of 6.8% because of growing consumers' demand for longer shelf life and food safety. The increase in the consumption of processed and packaged foods globally has, for the most part, been the major reason for the demand for preservatives that keep the products fresh and avoid food wastage.

Health consciousness in consumers has been the basis for increasing demand for natural food preservatives such as rosemary extracts, citric acid, and vinegar. Clean-label requirements are pushing manufacturers to develop alternative techniques for preservation that substitute for synthetic additives without changing the efficacy of the product. Dynamic changes are being brought to the industry by the rising use of high-pressure processing and other non-thermal preservation technologies.

Food preservative companies increasingly channel their marketing and educational efforts toward promoting the food safety advantages and compliance with global regulatory standards (FDA, EFSA, and FSSAI). These brands are breaking brand allegiance and sharing profit with the brand users or money losses to gain consumer trust and increase their share. Long-term industry growth will be instigated by these so that food preservatives are often essentials in the otherwise dynamic global food supply chain.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The trend for natural preservatives such as rosemary extracts, citric acid, and vinegar is growing among consumers. | Bio-preservation technology is advancing through the application of probiotics, antimicrobial peptides, and fermentation-derived solutions. |

| The increased scrutiny of synthetic preservatives is being imposed by regulators and involves BHA, BHT, and sodium benzoate. | Stricter global regulations drive the complete phase-out of certain artificial preservatives. |

| Clean-label movement encouraged reformulation of processed foods with fewer additives. | AI-driven food formulation enhances shelf life while maintaining clean-label appeal. |

| Rising adoption of plant-based antioxidants and antimicrobials in food preservation. | Nanocapsule technology is such an improvement on a focused delivery system of natural preservatives. |

| With the rise of e-commerce and global supply chains, the demand for long-shelf-life foods increased even more. | Real-time freshness indicators develop smart packaging and minimize food waste. |

| The food manufacturers continued their investment in R&D to focus on the safe, tasteful, and long-time use of foods without the use of synthetic chemicals. | Precision fermentation and lab-grown preservation compounds are changing the definition of food safety and stability. |

Food preservatives producers follow a stringent industry characterized with changing regulations and dynamic consumer behavior. Many synthetic preservatives have fallen under intense regulatory scrutiny, especially in industries where authorities have banned or restricted additives such as BHA and BHT. The subsequent push for reformulation by companies, in light of regulatory pressure, translates to rising R&D costs. Meanwhile, consumer demand is increasingly trending toward “clean label” products, forcing manufacturers to look for natural substitutes.

Natural preservative sources, for example, plant extracts or fermenters, have their own supply chain vulnerabilities based on seasonality and changing agricultural yields. As the price and availability of agricultural products change, companies will have to adjust their suppliers and procurement levels, potentially causing price volatility or shortages that may render certain products inconsistent in quality and quantity, affecting product development and production continuity.

Overall, the preservatives industry faces challenges to balance the stringent regulatory requirements, higher costs, and lack of predictability of natural ingredients with consumer demand for healthier, cleaner products.

Strong price differentiation between synthetic and natural solutions in the food preservatives industry influences pricing strategies. Natural preservatives fit the clean-label trends but are premium-priced, as they cost more to produce and are seen to have additional health benefits. This often means that food manufacturers are even willing to pay 2-3 times more for natural options because it secures the desired "clean" image, even though they tend to not be as powerful as synthetic counterparts and therefore require higher usage levels.

Unlike synthetic preservatives, which employ a cost-plus pricing model that leverages lower production costs and economies of scale, particularly for bulk purchases to large bakeries and beverage companies.

Suppliers also used bundled pricing, combining preservatives with complementary additives like antioxidants or emulsifiers in a package deal at a discount compared with the separate purchase of the components. In addition, tiered pricing based on order size has become common, with larger discounts provided for high-volume contracts, and thus providing an incentive to maintain long-standing relationships with the large food producers.

| Countries | Value (2035) |

|---|---|

| The USA | 5.0% |

| China | 4.67% |

| India | 4.62% |

| Germany | 4.5% |

| Brazil | 4.1% |

As per FMI, the United States is one of the leading contributors to the global industry of food preservatives, which is expanding at 5.0% CAGR. Rising intake of processed foods and convenience foods, which require additives to impart shelf life and safety, triggers demand for preservatives. Processed foods comprise almost 70% of the American diet, as quoted by the USDA, thus triggering demand for preservation methods.

A move towards natural and clean-label preservatives is transforming the industry with growing health awareness and FDA regulation of food. Kerry Group and Corbion are among the players investing in plant-based preservatives, including rosemary extract, vinegar, and cultured dextrose, to address consumer needs. The American food industry is also embracing fermentation-based preservation technologies like bacteriocins as a substitute for artificial additives.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Increased consumption of processed foods | Processed foods constitute ~70% of American diet |

| Regulatory effect | FDA restrictions on synthetic preservatives |

| Increasing demand for natural alternatives | Appearance of plant-based preservatives such as vinegar and rosemary extract |

| Investment in fermentation-based technologies | Companies producing bacteriocins as substitutes |

According to a study by FMI, China is anticipated to see growth in its food preservative industry at a CAGR of 4.67% on the basis of urbanization and changing lifestyles. Urbanization is pushing the growth in the consumption of processed food, with sharper spikes being felt in urban agglomerations. Food safety regulations have consequently been tightened in China after food contamination scandals rocked the nation, leaving firms with a necessity to tone down artificial preservatives and instead explore traditional preservation techniques.

While synthetic preservatives still dominate with economic benefits, local giant firms are also investing in natural ones like tea polyphenols and plant-source antioxidants. Angel Yeast is one of the firms investing in fermentation preservation technology in a bid to fight rising consumers' demand for healthy food.

Growth Drivers in the China

| Key Drivers | Details |

|---|---|

| Rapid urbanization | Rising demand for convenience food and packaged foods |

| Rising regulation on food safety | Tightening restriction on the use of synthetic preservatives |

| Degree of demand for natural preservatives | Growth in use of tea polyphenols and plant antioxidants |

| Investment towards fermentation process | Domestic players concentrating on value-added preservation process |

India's food preservative industry is growing at a 4.62% CAGR with rising disposable incomes, urbanization, and demand for ready-to-eat foods. Multicultural cuisine needs multiple solutions for preservatives to cater to a variety of regional food.

Conventional preservation methods such as salt, spices, and fermentation are common in the industry, but commercially relevant natural preservatives are becoming the trend. Laws such as the food safety rules by FSSAI are imposing tighter regulations on artificial preservatives, and the industry is being compelled towards safer and natural preservatives. Turmeric and neem extracts are emerging as increasingly popular products in Indian markets.

Growth Drivers in the India

| Key Drivers | Details |

|---|---|

| Convenience food growth | Growing demand for processed and ready-to-use foods |

| Government regulations | FSSAI encouraging natural and safer preservatives |

| Natural preservation due to cultural preference | Higher use of turmeric, neem, and spice extracts |

| Price-sensitive market | Cost-effective preservation methods to be used for driving mass usage |

Germany's food preservation sector is based on high demand for natural ingredients and stringent EU regulations. Its food processing sector is very well established in dairy processing, bread production, and meat product processing, where the use of preservatives is the foundation of their process.

The European Food Safety Authority (EFSA) maintains tight controls on man-made preservatives, pushing the industry to shift towards natural preservatives like tocopherols (Vitamin E), rosemary extract, and vinegar.

Germany is the largest organic food industry in Europe, with more than €15 billion sales in 2022. Demand for clean-label spurs innovation of alternative preservation technologies, such as fermentative preservation and antimicrobial peptides. Increased demand for vegan and plant-based foods also fuels demand for natural preservatives.

Growth Drivers in the Germany

| Key Drivers | Details |

|---|---|

| Regulatory pressure | EU strict regulations, EFSA limits application of synthetic preservatives |

| Largest European organic food market | Organic food sales over €15 billion in 2022 |

| Meat industry change | Shift from nitrites to natural alternatives |

| Emerging plant food industry | Emerging demand for natural preservatives for plant foods |

It is the Latin America region's fastest-growing food preservative sector, driven by its humongous food processing industry that accounts for nearly 10% of GDP for Brazil. Food spoils quicker under the country's tropical and humid climatic conditions, so it becomes increasingly reliant on natural and artificial preservatives to extend shelf life.

Brazil is the world-leading nation in beef and chicken exportation, wherein natural preservatives such as nitrites and lactates are central to product preservation quality. Production of soft drinks, also on enormous scales, is done in Brazil with tremendous outputs creating natural preservatives demand, e.g., ascorbic acid and citric acid. Clean labeling trends generate a shift away from using artificial additives to plant-based preservation.

Growth Drivers in the Brazil

| Key Drivers | Details |

|---|---|

| Food processing industry is growing | Food and beverage industry contributes ~10% to GDP |

| Extremely high production of meat and dairy | Excessive use of nitrites, lactates, and sorbates |

| Climate-related preservation requirements | Hot and humid climatic conditions enable food to spoil quicker |

| Natural drink preservative growth | Ascorbic acid and citric acid enhanced usage |

Clean label segment is the most rapidly growing segment, with a market share of 58.3% Globally, consumers are demanding more familiar, natural ingredients and manufacturers are replacing artificial additives with plant based, fermentation driven, and enzyme based preservatives.

Regulatory pressures are accelerating this transition, too, as governments in markets such as North America and Europe are introducing stricter labelling requirements for synthetic additives. To address these changing consumer demands, as well as regulatory pressures, food manufacturers are working with rosemary extract, citrus-derived antioxidants and vinegar-based antimicrobials to reformulate products. These solutions allow for an extended shelf life without losing consumer faith in the food.

Segments like Asia-Pacific and Latin America still constitute important markets for traditional preservatives, where price and functional efficacy take precedence over the rising consumer trend for clean-label formulations. Furthermore, the development of processed as well as packaged food industries in underdeveloped countries has bolstered the market for traditional preservatives, especially in ready-to-eat food, snacks, and beverages.

Conventional preservatives most commonly used include sorbates, benzoates, nitrites and sulfites and have large applications in bakery, dairy, meat and beverage products. Due to their effective antimicrobial properties and ability to increase product stability, these compounds are essential components of high-volume food production.

Meanwhile, growing regulatory scrutiny and health alarms surrounding long-term exposure to synthetic additives has caused manufacturers to take a fresh look at hybrid preservation solutions, layering conventional and natural preservatives together toachieve an effective preservation profile while taking consumer concerns into account. Consequently, the traditional preservatives segment is robust, evolving with market trends while remaining a mainstay segment for the mass-market food industry.

Segment of the natural and organic preservatives market with Reducing the impact of the growth of microorganisms, as they provide outstanding cost-effectiveness and efficiency, achieving 62.7% share of the market.

Synthetic antioxidants such as BHA, BHT and propyl gallate are still widely used in processed foods, bakery products, and meat products due to their lower price than natural antioxidants and their longer shelf life and superior stability, which make them an essential food preservative.

Synthetic preservatives are still favored in Asia-Pacific and Latin America as affordability and functional efficiency continue to take precedence over the increasing demand for clean-label formulations. The quick growth of packaged food industries, especially in emerging regions, continues to drive dependence on synthetic alternatives.

The natural preservatives market is getting a strong boost since the demand for clean label, minimally processed and health-oriented food products is on the rise. Food processors are responding to the demand as consumers look for natural alternatives to synthetic food additives, turning instead to plant-based, microbial, and enzyme derived preservatives for the development of their formulations.

Availability of food preservation technology from industrial markets analyzed, regional estimates calculated for North America & Europe, the leading markets of natural preservatives, where strict regulations for the food safety and food safety of clean-label are ailments for the manufacturers to reform on the formulation with non-synthetic preservation methods.

Adoption in the Asia-Pacific and Latin America is rising fast with organic food and beverages demand increasing and regulatory standards gaining higher ground to give way for the health-conscious consumer.

The global food preservatives market is highly competitive, with key players focusing on innovation, market expansion, and regulatory compliance to strengthen their market positions. As consumer demand for natural and clean-label preservatives increases, companies are investing in research and development to introduce advanced and sustainable solutions.

North America and Europe lead the market due to stringent food safety regulations, while the Asia-Pacific region is witnessing rapid growth due to expanding food processing industries and changing consumer preferences. Mergers, acquisitions, and partnerships are playing a crucial role in shaping the competitive landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 12-16% |

| Kerry Group Plc | 10-14% |

| BASF SE | 8-12% |

| IFF Nutrition & Biosciences | 7-11% |

| Lallemand Inc. | 6-10% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | Develops natural and synthetic food preservatives, focusing on clean-label solutions and food safety innovations. |

| Kerry Group Plc | Specializes in natural preservatives and antimicrobial solutions for dairy, bakery, and meat products. |

| BASF SE | Offers chemical and natural preservatives with an emphasis on extending shelf life and maintaining product quality. |

| IFF Nutrition & Biosciences | Provides bio-based and synthetic food preservatives with strong R&D capabilities in fermentation technology. |

| Lallemand Inc. | Focuses on fermentation-derived preservatives, probiotics, and yeast-based antimicrobial solutions. |

Key Company Insights

Cargill, Incorporated (12-16%)

A global leader in food ingredients, Cargill focuses on developing innovative, natural, and synthetic preservative solutions for multiple food categories.

Kerry Group Plc (10-14%)

Kerry Group is known for its expertise in natural preservation and antimicrobial systems, catering to the growing demand for clean-label food products.

BASF SE (8-12%)

BASF provides a diverse range of food preservation solutions, ensuring extended shelf life and food safety compliance.

IFF Nutrition & Biosciences (7-11%)

A key player in bio-based and fermentation-derived preservatives, focusing on sustainable and natural food preservation methods.

Lallemand Inc. (6-10%)

A leader in yeast and fermentation technology, Lallemand offers natural preservatives for various food and beverage applications.

Other Key Players (40-50% Combined)

The market is projected to grow at a CAGR of 6.8% during the forecast period from 2025 to 2035.

By 2035, the market is anticipated to reach approximately USD 6.5 billion, driven by increasing demand for clean-label and natural preservatives.

The clean-label preservatives segment is expected to witness the fastest growth.

Key drivers include increasing demand for processed and convenience foods, regulatory restrictions on synthetic preservatives, rising health-consciousness, and advancements in natural preservation techniques.

The market is led by Cargill, Incorporated, Kerry Group Plc, BASF SE, IFF Nutrition & Biosciences, and Lallemand Inc.

The market is segmented into clean label and conventional preservatives.

The market is categorized as synthetic and natural preservatives.

The segmentation includes antioxidants, antimicrobial, and others.

The market is divided into meat & poultry products, bakery products, dairy products, beverages, snacks, and others.

The industry is segmented into North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa.

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.