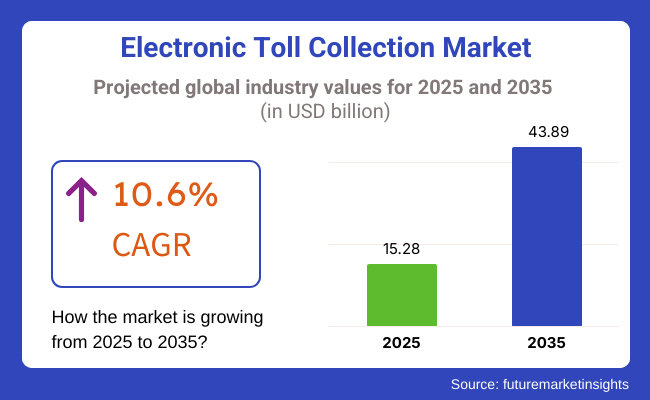

The global electronic toll collection (ETC) market is projected to reach USD 15.28 billion in 2025 and expand to USD 43.89 billion by 2035, reflecting a compound annual growth rate (CAGR) of 10.6% over the forecast period. This strong growth reflects increasing global demand for seamless, automated toll collection and traffic management solutions.

Key drivers include the rapid adoption of advanced tolling technologies, the need to reduce traffic congestion, and the expansion of highway infrastructure worldwide. Government initiatives to modernize transportation systems and promote cashless transactions are further accelerating the adoption of ETC systems, enhancing travel efficiency and revenue collection.

Restraints include high initial installation costs and concerns about data privacy and security. Additionally, compatibility issues between tolling systems across different regions and countries can hinder seamless interoperability, limiting widespread adoption in certain areas with fragmented infrastructure.

Opportunities lie in the integration of ETC systems with smart transportation networks, mobile payments, and vehicle-to-infrastructure (V2I) communication. Emerging economies investing in infrastructure upgrades present significant growth potential alongside the development of multi-lane free-flow tolling systems and connected vehicle technologies.

Trends include the rise of RFID, DSRC, and ANPR-based tolling systems, along with increased focus on cloud-based toll management platforms. The integration of ETC with smart city initiatives, real-time analytics, and mobile app-based toll payments is enhancing user experience and operational efficiency, shaping the future of toll collection worldwide.

Explore FMI!

Book a free demo

In the period 2020 to 2024, the ETC market grew very fast due to technological advancements, urbanization, and the need for convenient tolling solutions. The use of cashless and contactless tolling increased at a rapid rate, and governments began converting traditional manual toll plazas into RFID, GPS, and ANPR-based tolling infrastructure.

National toll interoperability programs in countries like the USA and India allowed seamless cross-border travel without stopping at toll gates. The COVID-19 pandemic increased demand for touch-free payment solutions, prompting investments in cloud-based infrastructure, mobile payment apps, and AI-powered traffic monitoring.

Sustainability was given top priority, with dynamic pricing systems reducing congestion and carbon emissions. The private sector and governments overcame issues such as high initial capital investment, cyber attacks, and compatibility issues with the help of AI-driven antifraud and blockchain-verifications-based payment verifications, with increased security and interoperability.

During 2025 to 2035, the ETC market would be revolutionized with AI, IoT, and blockchain changing the toll operation. Toll optimization using artificial intelligence will dynamically alter tolls based on traffic flow, vehicle class, and environmental conditions, enhancing traffic congestion management. Blockchain payments will improve security and transparency with smart contracts and cryptographically secure digital wallets. Satellite tolling (GNSS) will provide distance-based tolling rather than physical tolls for more equitable charges and more fluid traffic. Tolling with intelligent traffic systems synchronized in real-time will be available through 5G-connected cars.

Discounts on toll prices for electric and hybrid cars will be green, with AI-enabled dynamic pricing facilitating green mobility. Top-grade cybersecurity with quantum encryption and AI-driven threat detection will safeguard vehicle data and payment details. ETC systems will be networked, highly automated, and green by 2035, transforming the transport infrastructure landscape worldwide.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Need for cashless, contactless tolling | AI-optimized, real-time toll optimization and blockchain payments |

| RFID, ANPR, mobile apps for tolling | 5G-based, satellite-linked, intelligent vehicle tolling |

| Less idling, congestion price incentives | Green toll incentives, EV discounts, ride-sharing toll optimization |

| RFID, cloud tolling, AI-driven surveillance | AI-based predictive tolling, secure blockchain transactions |

| Fixed toll rates, localized interoperability | Dynamic pricing plans, congestion management automated |

| High capital investments, integration issues with human intervention | Decentralized satellite-based tolling with AI-based automation |

| Urban congestion, government regulations | Connected mobility solutions with 5G enabling smart city integration |

The remote electronic toll collection (ETC) market is roughly embraced by urbanization and smart transportation initiatives, along with the axiom that to reduce traffic, congestion, and ultimately accidents, quick and economical ITC needs are first-class priorities. Highways and expressways are primarily software-centric; innovators work hard to cover issues such as energy consumption and sensor systems to detect and avoid traffic jams using a cost-efficient, scalable, and reliable ETC system given high traffic volume, etc.

Urban toll roads, bridges and tunnels are laced with more and more high-tech features such as sensors embedded in pre-tensioned struts or LED lights that change color depending on the state of the traffic that they help to manage. Parking facilities need IT solutions that are easy to use and digital payment methods that are compatible with them. Commercial fleets target fleet-wide scalability, and tolls are charged on the basis of tracked miles, thereby enabling a more cost-effective means of toll management. RFID, GNSS-based tolling, and AI-managed traffic are greatly influencing the industry, with a focus on interoperability, contactless payments, and improved cybersecurity, thus striving to satisfy the more advanced transportation requirements.

| Company | Contract Value (USD Million) |

|---|---|

| TransCore | Approximately USD 40 - 50 |

| Kapsch | Approximately USD 35 - 45 |

| Siemens Mobility | Approximately USD 50 - 60 |

| Cubic Transportation Systems | Approximately USD 30 - 40 |

| Conduent | Approximately USD 45 - 55 |

In 2024 and early 2025, the electronic toll collection market witnessed notable advancements driven by the increasing need for efficient, secure, and technology-driven tolling solutions. Key industry players such as TransCore, Kapsch, Siemens Mobility, Cubic Transportation Systems, and Conduent secured significant contracts and strategic partnerships. These initiatives underline the market’s commitment to leveraging digital innovations to streamline toll operations, improve traffic management, and optimize revenue collection in an evolving transportation landscape.

The ETC market faces technological integration hurdles because of the seamless compatibility needs of systems, vehicles, and payment gateways. Discrepancies in system standards between the regions can lead to interoperability issues, which, in turn, can reduce the efficiency and user experience. Investments in standard infrastructure are necessary for governments and private operators as the only way to mitigate this risk.

Cybersecurity threats are another major concern. ETC systems operate with sensitive data, i.e., vehicles and financial data. Hence, it becomes a target for cyber-attacks, data breaches, and fraud. Encryption weaknesses, the possibility of software that has become unpatched, or even insider threats could make a user's information be compromised and this can make both the operator incur monetary losses and damage their reputations.

Regular infrastructure upkeep and operational risks remain challenges. The equipment for the toll collection, such as RFID readers, cameras, and sensors, requires regular maintenance to ensure accurate data. Malfunctions or technical failures can reciprocate losses in revenue, traffic congestion, and public dissatisfaction, particularly given that there are high-volume toll routes.

Regulatory and compliance risks also affect the market. Governments impose strict data privacy issues and toll pricing regulations that the operators have to abide by. Non-compliance may lead to legal penalties, annulment of contracts, or a decrease in public trust. Furthermore, the political opposition to tolling policies may in turn impact the feasibility of long-term projects.

| Segment | Value Share (2025) |

|---|---|

| Transponders | 18.2% |

The transponders market for sales application grew at the highest rate during this period and is projected to account for around 18.2% of the total global market share by 2025, owing to increasing needs in aviation, automotive, defense, and logistics industries. These devices are particularly important for automated identification, communication, and tracking systems used for air traffic control, toll collection, and military operations.

One sector where you see this is the recent regulations around aviation, where all aircraft are required to use Mode S transponders capable of ADS-B (Automatic Dependent Surveillance-Broadcast) for spatial separation, collision avoidance, etc. Equally transformative are RFIDs used as vehicle transponders in electronic toll collection systems, with Kapsch TrafficCom, Siemens, and TransCore at the forefront of innovation in smart mobility. In defense, military transponders play an ever-growing role in friend-or-foe identification (IFF), drone communication, and battlefield situational awareness.

The antennae segment is expected to account for 16.5% of the market share in 2025, driven by the increasing deployment of high-frequency communication networks, satellite systems, and RFID-based tracking solutions. Demand for high-performance antennae is growing across telecommunications, aerospace, and industrial automation sectors, with the expansion of 5G infrastructure, IoT connectivity, and smart logistics. In RFID systems, antennae play a crucial role in improving signal coverage and data transfer rates in retail inventory control, supply chain transparency, and contactless payment systems.

Now, other companies such as Alien Technology, Impinj, and TE Connectivity are transforming how RFID and even ultra-wideband (UWB) and phased array antennae are innovating for increased efficiency for next-generation wireless networks and smart tracking solutions.

| Segment | Value Share (2025) |

|---|---|

| Radio-Frequency Identification (RFID) | 30.5% |

The RFID segment is anticipated to dominate, accounting for around 30.2% of the overall global market share in 2025, attributed to the increasing adoption of automated identification, asset tracking, and contactless payments. Already, new industries, from retail and logistics to healthcare and transportation, are beginning to enable real-time monitoring, inventory management, and supply chain optimization through the use of RFID.

In retail, Walmart, Decathlon, and Zara are also using tagged merchandise with RFID to increase their inventory accuracy and minimize shrinkage. In logistics, RFID-enabled supply chain management is becoming popular among organizations. Big names like FedEx and DHL are already enjoying the benefits of RFID in their package tracking and automated warehousing.

Improve hospital and drug distribution efficiency and security-The healthcare industry has also adopted RFID to identify patients, track medical equipment, and authenticate pharmaceutical production. At high frequencies, the miniaturized RFID solutions driven by innovations from vendors like Impinj, Zebra Technologies, and Avery Dennison have elevated throughput and performance across industries.

Supporting the DSRC segment is expected to capture 27.4% of the global market share around 2025 on account of the rapid deployment of intelligent transportation systems (ITS), vehicle-to-infrastructure (V2I) communication, and toll collection networks. It´s no secret that DSRC-based solutions are quite popular among governments across the globe for smart highways, connected vehicle ecosystems, and real-time traffic management.

DSRC is the underlying technology in Electronic Toll Collection (ETC) systems with high-speed, secure vehicle identification for cashless tolling from companies such as Kapsch TrafficCom, TransCore, and Q-Free. Moreover, DSRC is significant for vehicle-to-vehicle (V2V) and V2I communication, which enhances road safety and decreases road traffic in smart city initiatives.

Toyota General Motors Volkswagen DSRC-based communication connected car technology The way they are doing this is a part of DSRC-based communication connected technologies used or applied in vehicles with highlight and driving assistance systems. The increasing necessity to manage road safety, congestion, and emissions removal is anticipated to create demand for DSRCs in urban mobility and smart transportation networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 6.6% |

| The UK | 7.4% |

| France | 5.7% |

| Germany | 6% |

| Italy | 5.1% |

| South Korea | 7.6% |

| Japan | 6.3% |

| China | 10% |

| Australia | 7.1% |

| New Zealand | 6.5% |

The USA electronic toll collection (ETC) industry is anticipated to post a CAGR of 6.6% from 2025 to 2035. The country's vast network of highways and increasing traffic in urban areas drive the adoption of ETC systems. State and private agencies are investing heavily in upgrading toll infrastructure to provide seamless, cashless transactions. TransCore and Cubic Corporation are USA based market leaders with state-of-the-art RFID and GPS-based toll solutions in the domestic market.

Intelligent transportation systems and open-road tolling conversion demand drive the expansion. Environmental sustainability efforts to reduce emissions, the transition towards toll interoperability among states, and the adoption of artificial intelligence for toll collection further propel the industry. Public-private partnerships continue to be a key driver of growth with long-term infrastructure development.

The UK ETC market is anticipated to expand at a CAGR of 7.4% from 2025 to 2035. Growing focus on smart cities reduced urban congestion, and carbon neutrality has raised the need for efficient toll collection systems. The adoption of the European Electronic Toll Service (EETS) model enables hassle-free toll payment across different zones, driving market growth. Companies such as Siemens and Kapsch TrafficCom have played a crucial role in propelling the growth of tolling infrastructure.

With the increased adoption of electric and hybrid cars, there is an increased demand for intelligent road pricing systems. This is also promoted by the government's commitment to minimizing manual tolling and enhancing road safety through AI-powered traffic surveillance. Further, investment in vehicle-to-infrastructure (V2I) technology contributes to the demand growth for intelligent toll collection.

France's ETC market will develop at a 5.7% CAGR from 2025 to 2035. The country has one of Europe's largest infrastructures of toll roads where there is growing uptake of ETC in conjunction with emphasis on cashless payment and traffic decongestion. The tolling business is led by VINCI and Eiffage, who have RFID and satellite-based tolling technology as the mainstay of their companies.

The deployment of mileage-based tolling and green road pricing schemes further accelerates market expansion. The initiatives by the French government to reduce emissions and improve highway efficiency have generated strong investment in AI-powered tolling systems and the expansion of free-flow networks of tolling. With a focus on concentrating tolling services among the nations of Europe, France is a trendsetter when it comes to ETC innovatio

Germany's ETC market is expected to post a CAGR of 6.0% between 2025 and 2035. The country's vision for strategic investment in smart transportation infrastructure and its commitment to digitalization fuel the market's growth. Toll Collect, a German state-owned ETC operator, has been at the forefront of implementing GPS and satellite-based tolling, particularly for HGVs.

Germany's transition to complete automation of tolling aligns with its sustainability policy. Integration with real-time traffic management systems and AI analysis increases efficiency. Increased use of electronic vignettes and expanded coverage of tolling on additional categories of roads will be anticipated to boost demand further.

Italy's ETC market will grow at a CAGR of 5.1% during 2025 to 2035. The country's extensive toll road network, especially in northern Italy, drives market demand. Autostrade per l'Italia, the market leader in the Italian market, is continuing to boost its ETC services by incorporating DSRC and GNSS-based tolling.

Italy's tolling industry is also undergoing rapid digitalization, with the creation of mobile payment apps and license plate recognition technology. Government initiatives to reduce congestion on primary roads and increase cross-border toll interoperability in the EU further drive market expansion.

South Korea's market for ETC is expected to post a CAGR of 7.6% from 2025 to 2035. The country's robust digital ecosystem and smart city growth drive the extensive use of high-tech toll systems. Skilled market participants like SK Telecom and LG CNS provide AI-assisted toll control solutions.

The massive adoption of RFID-based Hi-Pass tolling and government efforts for intelligent highway systems stimulate market growth. The movement towards a nationwide free-flow toll system for congestion and emission reduction is the main driver. Further, South Korea's leadership in 5G connectivity allows for seamless communication between cars and tolling infrastructure, enhancing the efficiency of ETC systems.

Japan's ETC market is set to grow at a CAGR of 6.3% between 2025 and 2035. Japan has long been a pioneer in electronic tolling, with near-universal adoption of expressways. The notable contributors to AI-based and IoT-based tolling systems are Mitsubishi Heavy Industries and Toshiba.

Japan's initiatives to curtail traffic jams in urban areas and improve traffic efficiency have led to widespread implementation of ETC. The attempt to facilitate connected and autonomous vehicle ecosystems is also shaping the future of toll collection with improvements in car recognition and seamless payment systems. Government subsidies for the adoption of ETC also encourage moving towards fully automated toll infrastructure.

China's ETC market is expected to rise at a 10.0% CAGR between 2025 and 2035 and be among the fastest-growing markets. The intense push by the Chinese government to digitalize and make transportation smarter drives growth. Market leaders, including Huajian Group and ZTE, lead the way with RFID and AI solutions for toll collections.

The rapid growth of highway construction, urbanization, and the widespread use of free-flow tolling systems form the basis of market expansion. The government's emphasis on full digital payment of tolls and the elimination of manual toll booths also increases the use of ETC. In addition, China's dominance in low-cost RFID and vehicle identification technology production ensures continuous innovation in this sector.

The market for ETC in Australia is expected to grow at a CAGR of 7.1% from 2025 to 2035. Australia has been at the forefront of adopting cashless tolling, and leading providers such as Transurban have introduced RFID and ANPR-based tolling systems.

Government expenditure on smart transport networks and congestion charges fuels market growth. The growth of tollways, particularly in Sydney, Melbourne, and Brisbane, raises the demand for seamless electronic tolling. Australia's regulatory push towards national toll interoperability nationally further enhances user convenience and operational efficiency.

New Zealand's ETC market will grow at a CAGR of 6.5% between 2025 and 2035. The country's increasing focus on smart transport and urban mobility solutions drives the adoption of electronic toll collection. The NZ Transport Agency has been investing in sophisticated tolling infrastructure, employing RFID and cloud-based tolling platforms.

As there is a growing need for efficient road pricing and decongestion, New Zealand is witnessing a shift towards open-road tolling. The government's emphasis on reducing reliance on manual toll booths and the integration of tolling with vehicle registration systems also play a role in market growth. In addition to this, the growing adoption of electric vehicles is also resulting in innovative tolling schemes to make roads equitable and sustainable.

The market for electronic toll collection (ETC) instruments has rapidly expanded as governmental and transportation revenue bodies are adopting intelligent mobility solutions, making traffic more efficient and eliminating congestion. Along the road are RFID, GPS, and AI-based analytics, which enable seamless and automated toll payments.

The top brands in the locus are Kapsch TrafficCom, Conduent, TransCore, Thales Group, and Cubic Corporation because they offer an entire range of tolling infrastructure, system integration, and payment processing solutions. Some start-ups and niche providers are thinking of innovative things with contactless payments, blockchain-based tolling, and vehicle-to-infrastructure (V2I) connectivity.

Increased investment in cloud-based tolling platforms, interoperability across toll networks, and EV-specific tolling solutions are trends in the industry. Furthermore, competitors focus on competitive strategies, as governments are also mandating open-road tolling and distance-based charging. Some strategic factors include public-private partnerships, regulatory frameworks, cybersecurity in toll transactions, and the integration of real-time traffic data. Urbanization and initiatives for smart cities increase competitiveness, therefore resulting in more innovation in automated tolling, an AI-driven approach to fraud detection, and mobility as a service (MaaS) integration.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kapsch TrafficCom | 20-25% |

| Conduent Inc. | 15-20% |

| TransCore (ST Engineering) | 12-16% |

| Thales Group | 10-14% |

| Cubic Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kapsch TrafficCom | Provides end-to-end tolling solutions, including RFID-based and GPS-enabled toll systems. |

| Conduent Inc. | It specializes in automated tolling infrastructure and integrates AI and cloud-based payment systems. |

| TransCore (ST Engineering) | Develops intelligent toll collection systems with high-speed electronic payment processing. |

| Thales Group | Focuses on secure, contactless tolling solutions leveraging smart mobility technology. |

| Cubic Corporation | Innovates in open road tolling and smart urban toll management systems. |

Key Company Insights

Kapsch TrafficCom (20-25%)

Kapsch dominates the ETC market with its cutting-edge tolling offerings, which merge RFID, satellite tolling, and AI-fueled traffic management to boost toll collection effectiveness.

Conduent Inc. (15-20%)

Conduent is a leader in automated tolling with cloud-based offerings and AI-driven fraud detection to accelerate toll transactions and enhance payment reliability.

TransCore, ST Engineering (12 to 16%)

TransCore is pioneering the next generation of toll systems through the development of high-speed solutions in ETC, optimizing revenue collection and decreasing congestion on roads.

Thales Group (10-14%)

Thales focuses on secure and contactless technology for tolling and provides quick and seamless transactions on highways, bridges, or within city roadways.

Cubic Corporation (6-10%)

Cubic is transforming tolling through the introduction of open road payment solutions that integrate mobile payments and V2I communication in improving the efficiency of the transportation system as a whole.

Other Key Players (30-40% Combined)

The overall market size for the Electronic Toll Collection Market was USD 15.28 Billion in 2025.

The Electronic Toll Collection Market is expected to reach USD 43.89 Billion in 2035.

The demand will grow due to the increasing adoption of cashless payments, advancements in RFID and GPS-based tolling technologies, and government initiatives for intelligent transportation systems.

The top 5 contributors to the Electronic Toll Collection Market are the USA, China, Germany, Japan, and India.

RFID-based toll collection systems and GPS/GNSS-based tolling solutions are expected to command a significant share over the assessment period.

By product type, the market is segmented into transponders, antennae, communication systems, treadles, inductive loops, scanning devices, weigh-in-motion devices, and cameras and film storage devices.

By technology type, the market is segmented into radio-frequency identification (RFID), dedicated short-range communications (DSRC), video analytics, global navigation satellite system (GNSS), and global positioning system (GPS).

By application type, the market is segmented into highways, urban, and bridges.

By region, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, South Asia, and Middle East & Africa.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.