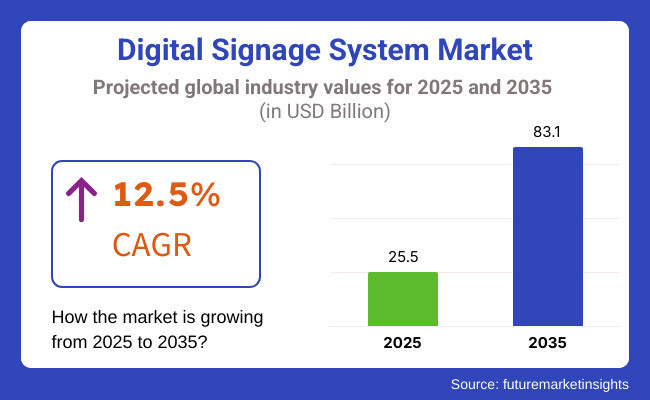

The digital signage system market is due to take off massively by 2025, with the rise in the number of shoppers opting for interactive advertising, changes in digital boards on the fly, and AI-powered analytics being the main reasons for that. The increase, which is projected to go from USD 25.5 billion in 2025 to sell more than USD 83.1 billion in 2035 with a CAGR of 12.5%, will be mostly due to the display technology breakthroughs, AI integration, and the smart cities evolution.

The transition to cloud-based digital signage systems is one of the major drivers, and this is because it allows businesses to control the content remotely and scale up operations better. The North American region is benefitting from the technological backbone, Europe is expanding because of the approval of regulations that advocate digital transformation, and the rapid urbanization in Asia-Pacific has made the region a key factor in the market's growth.

Even if things look very promising, that may not be the case since the major challenge is high initial investment costs which are particularly faced by SMEs. Implementing a digital signage system needs very high expenses in top-quality displays, network infrastructures, and dedicated software for content management. Cloud-based platforms are being contacted also, which, in addition to cutting down on the hardware dependency, make digital signage more cost-effective in businesses of all scales.

AI personalizing is the driving factor in the market since it unlocks the door for the companies to adjust their content relevant to the customers. Cookies can do this thanks to people’s insights, among which we can find what they like to eat, how tech-savvy they are as well as how they feel about ads that are targeted and really engaging. For example, the stores at Amazon Go use AI-powered displays that dynamically change offers according to customers in-store preferences.

Cloud-based digital signage offers the centralized management of content, which is a big trouble for the companies that operate increasingly across many screens located in different places. This feature is significantly beneficial for internationally operating retail companies and fast-food chains like Starbucks and Burger King, which easily manage offers and menu displays by using cloud-based digital signage.

AI-powered audience measurement tools are very informative for marketing strategies as they provide detailed consumer insights, which in turn helps businesses to become more effective in their campaigns. Sectors such as transportation and hospitality are reaping benefits from digital signage utilized in real-time informative ways.

For instance, with the help of artificial intelligence, they not only write the flight schedule but even insert more targeted advertisements, thus affecting the traveller's experience. The market growth that is expected in the future will be brought by the continuous upgrade of AI and cloud computing making the whole thing more interesting, digitized, and cost-effective.

Together with the companies moving forward digital transformation paradigm, the demand for signage solutions, which use AI, and are cloud-integrated is likely to go sky-high opening a new window for innovation and market expansion.

Explore FMI!

Book a free demo

The four stakeholder groups being compared-retailers, advertisers, IT managers, and end-consumers-in the table are the key players in the digital signage system market and provide essential insights based on important criteria. Retailers, advertisers, and end consumers all rate display quality and resolution highly - sharp, engaging visuals are important for communicating ideas and interacting with customers.

Content and integration are also high scorers, especially among retailers, advertisers and IT managers, and it stresses the need for streamlined software UI that allow for rich content refresh. Scalability and flexibility are particularly important for IT managers, who need systems that can fit into expanding digital networks, while end consumers rank these factors lower.

Energy efficiency and cost/return on investment rated medium for most groups, indicating a tradeoff between performance and use costs. Ease of installation and maintenance rates high with IT managers, highlighting the practical complexities of system deployment.

During the years 2020 to 2024, the digital signage system market showed fast growth, encouraged by growing demand for interactive screens, content management using AI, and cloud-based sign solutions. Companies in the retail, transportation, healthcare, and corporate industries started using digital signage to improve customer interaction, facilitate communication, and making advertises more effective.

The inclusion of real-time data analytics and IoT connectivity enabled dynamic content distribution, while LED and OLED technology developments enhanced display quality and power efficiency.

Between 2025 and 2035, the market will witness higher implementation of AI-personalization, 8K ultra-HD screens, and holographic projections. Sustainability will also be in the spotlight more with energy-saving screens and recyclable materials. The toll they will have in projects regarding smart cities will include digital signage in city infrastructure, in public transport, and in smart stores.

The integration of augmented and virtual reality will provide immersive experiences, and cloud-based far-end management will stream content even farther. As digital signage continues to evolve, so too will the insights from data to provide even more engaging and targeted communications.

| 2020 to 2024 | 2025 to 2035 |

| AI-enhanced content management and IoT-based real-time monitoring were gradually integrated, enabling automated and data-driven content displays. | AI-driven predictive analytics and machine learning personalize content dynamically based on audience behavior. IoT connectivity expands real-time interaction with users, enabling hyper-targeted messaging. |

| Widespread adoption of LED, OLED, and interactive touch screens, improving display quality and energy efficiency. | MicroLED and transparent displays are fast establishing new paradigms of interaction characterized by high-res images, low power consumption, and embedding in brainy spaces. |

| Digital signage create important aspects of in-store experience building and marketing products by means of interactive kiosks and queue management systems. | With AI in charge, personalization ensures that real-time customer engagement is achieved through adaptive pricing, targeted promotions, or virtual try-ons. |

| Digital billboards and transit signage have now emerged as fulcrums of advertising and communication for public service announcements, directions, and wayfinding into the bustling city streets. | 5G-enabled smart-signage seamlessly weaves into the urban IoT infrastructure to provide live updates on traffic status, weather conditions, and emergency alerts. Augmented Reality (AR) signage then empowers easy navigation around the city. |

| Digital signage are the last mile of omnichannel strategies integrating brick-and-mortar retail with online retail. | Real-time inventory update and QR code purchase are all parts of seamless integration to the e-commerce platforms. The digital displays have dynamic changes according to the browsing behavior of the online user. |

| Energy-efficient display systems adopted today are also geared towards controlling brightness in reducing power consumption. | New digital signage solutions powered by renewable energies such as solar or kinetic energy are being developed to protect the environment against its harms. Recycling e-waste is improving. |

| Remote centralized control and updates of digital signage networks are possible via a cloud-based content management system (CMS). | AI content automation customizes messages depending on the weather, demographics, and real-time analytics. Along with edge computing, reduced latency guarantees a much faster content delivery. |

| The approach for addressing the data security issues raised by interactive displays and signage connected to the IoT proved to be improved encryption measures. | Blockchain-based secure solutions provide content integrity, preventing any cyber attacks or unwanted data breaches from affecting digital signage networks. |

| An increasing demand for DOOH advertising, real-time bidding, and geofencing came into play. | AI makes DOOH campaigns far more powerful due to real-time ad optimization: audience engagement effectiveness could be measured through facial recognition and sentiment analysis. |

| Digital signage in hospitals and offices was directed toward patient information, employee communication, and branding. | AI wayfinding and automated health screening stations will solve hospital navigation challenges and be enhanced by holographic signage in corporate presentations. |

Risks are also involved in this market due to the fast technological advancements leading to equipment becoming obsolete and new systems not integrating with older systems. Businesses putting money into signage would probably have to make expensive upgrades when their systems become outdated within a few years. Through the interactive signage, companies are bringing user data in accordance with strict guidelines stipulated under privacy regulations like GDPR, lest they be penalised.

Adoption is affected by market volatility, as economic downturns lead companies to curtail non-essential investments such as digital signage. On the contrary, industry booms can overwhelm suppliers struggling to keep up with demand. The competition pressure is high with big display manufacturers integrating their own software and the likes of tech companies offering low-cost alternatives.

Cheap signage alternatives such as smart TVs and media sticks also threaten the professional-grade systems. Innovative business models such as signage-as-a-service will lead some companies to adapt while other owners will lose out on market share as their competitors embrace more agile and forward thinking business models.

Digital signage pricing can vary according to revenue models, either hardware-based or software-based. Hardware is generally a one-time buy - although some vendors provide leasing options - whereas software usually operates under a subscription model, charging by screen per month. More advanced platforms that offer interactivity and analytics fetch higher prices, while elements of basic scheduling software remain affordable.

Value-based pricing focuses on business results, not on hardware and software components; to justify prices, vendors tout revenue growth, engagement, or branding improvements. Multiple-tiered pricing structures are available to meet the needs of different clients - ranging from small businesses to enterprise networks - providing scalable plans with different features and support levels. Vendors win contracts through competitive pricing strategies, including volume discounts and bundling software with hardware.

Companies take advantage of low initial prices to attract customers and then announce price rises after demonstrating value. Fringe solutions, such as signage-as-a-service, convert capital expenditures into manageable operational costs, while ad-subsidized solutions can reduce costs for certain environments.

Hardware prices have naturally fallen due to economies of scale, though they have been temporarily higher due to supply chain disruption and inflation. Premium providers must therefore demonstrate an exceptional feature set, better service, and a higher level of reliability as digital signage goes more mainstream, and the availability of low-cost solutions drives the price down.

| Countries | CAGR (2025 to 2035) |

| USA | 7.8% |

| China | 9.2% |

| Germany | 6.5% |

| Japan | 7.1% |

| India | 8.9% |

| Australia | 6.8% |

FMI is of the opinion that the USA market is slated to grow at 7.8% CAGR during the study period. The USA digital signage market is witnessing a robust growth led by industries like retail, healthcare, hospitality, and transportation. Signage powered by the cloud, AI-driven analytics, and interactive displays are transforming the engagement of customers.

Programmatic advertising through digital billboards is transforming the out-of-home (OOH) ad market. The retail industry worth USD 7.1 trillion in 2025 overuses digital signage for product promotion and customer interaction. Second, AI-enabled computerized digital displays now make it possible for companies to present relevant content according to real-time demographic and behaviour information of customers.

Growth factors in the USA

| Key Drivers | Details |

|---|---|

| Retail Industry Growth | The USD 7.1 trillion retail market where digital signage is one of the primary marketing channels. |

| AI & IoT Convergence | AI-fueled digital signage increases customer targeting and content relevance through demographic profiling. |

China's digital signage market is booming with comprehensive urbanization, growing retail business, and massive government-scale projects. The country is dominating 5G technology applications in digital signage networks to elevate the transfer speed of content. FMI is of the opinion that the market is slated to grow at 9.2% CAGR during the study period.

China has more than 3 million 5G base stations within the country and has transformed the way digital signage networks function, facilitating quicker and smooth content transfer. Furthermore, China dominates the world's production of LED displays, leading to mass implementation of high-definition digital billboards across cities.

Growth factors in China

| Key Drivers | Details |

|---|---|

| 5G-Enabled Digital Signage | More than 3 million 5G base stations across the country boost digital signage efficiency. |

| LED Display Growth | China dominates global high-definition LED display production, powering digital signage growth. |

The German digital signage market is growing with increasing digital out-of-home (DOOH) advertising, intelligent transport systems, and Industry 4.0 solutions. The adoption of interactive digital signage in the public transport systems, industrial factories, and corporate offices in the country has fueled demand for digital signage.

The German DOOH advertisement market saw an increase of 16% in 2025, and this also created momentum to the industry. Moreover, digital signage also plays an important role in Industry 4.0 by offering real-time industrial process and manufacturing information.

Growth factors in Germany

| Key Drivers | Details |

|---|---|

| DOOH Advertising Growth | The growth of the DOOH market at 16% increases the demand for digital signage. |

| Industry 4.0 Applications | Digital signage is being used more and more by smart factories and automation systems to offer real-time information. |

Japan's digital signage market is adopting the newest technologies like holographic screens, high-definition OLED displays, and AI-based content selection. Retail, gaming, and hospitality industries are the first to adopt such next-generation solutions, with Japan's major cities like Tokyo witnessing huge rollouts of interactive billboards.

Japan also dominates the installation of smart vending machines, with more than 5.5 million machines being equipped with interactive digital displays to boost customer interaction.

Growth factors in Japan

| Key Drivers | Details |

|---|---|

| Holographic Digital Signage | USD 500 million or more investment anticipated for 3D holographic screens by 2030. |

| Smart Vending Machines | Over 5.5 million vending machines are currently equipped with in-built digital signage for customer interaction. |

India's digital signage market is expanding at a fast pace, driven by rising adoption in retail, banking, education, and government. Growth of digital banking kiosks along with the government's Smart City program is fueling high usage rates for public digital displays.

The USD 30 billion Smart City initiative has hastened the adoption of digital signage to support urban administration, traffic signals, and emergency alerts. Digital out-of-home advertisement in QSRs and e-commerce too is picking up steam with AI-driven interactive signage solutions.

Growth factors in India

| Key Drivers | Details |

|---|---|

| Digital Banking Kiosks | More than 500,000 digital banking kiosks deployed in India utilize interactive signage. |

| Smart City Projects | Public acceptance of digital signage due to the USD 30 billion Smart City Mission for city administration. |

Australia's digital signage industry is driven by increasing investments in outdoor digital billboards and intelligent infrastructure initiatives.

Retail, entertainment, and government sectors are leveraging digital signage to promote, interact with consumers, and educate. In addition to driving digital out-of-home (DOOH) spending, Australia is also embracing green digital signage solutions, including solar-powered outdoor screens and e-paper-based outdoor transit signs, as part of the nation's sustainability agenda.

Growth factors in Australia

| Key Drivers | Details |

|---|---|

| DOOH Outdoor Growth | Outdoor DOOH advertising revenue was USD 1.5 billion in 2024, fueling market demand. |

| Sustainability Programs | Development of solar-powered and e-paper sign solutions for green advertising. |

LED & OLED Display Technology is Transforming the Digital Signage Landscape with the Ability of Higher Brightness, Power Efficiency, and Greater Contrast Ratio than Standard LCD & Plasma Monitors. LED signage is being adopted in hospitality, retail, healthcare, and transport companies due to interference-free mounting, sturdiness, and color strength that enrich consumer experience.

Today, LED video walls are the go-to solution for large displays because they are scalable to various sizes, have narrow bezels, and offer cost savings in the long run. Mini-LED & Micro-LED Display: With advancements in the display technology of mini-LED and micro-LED, today manufacturers provide ultra-high-definition (UHD) digital signage solutions with improved color accuracy and longevity.

Based on bendable ultra-thin screens with self-emitting pixels, the OLED display offers unique and immersive signage experiences in upscale shopping surroundings and upscale corporate surroundings.

Digital signage based on LEDs is also driven due to the smart city programme. High brightness LED panels for outdoor legibility Dynamic billboards, live traffic information, and DOOH advertisements rely on high-brightness LED panels to facilitate the information delivery on the outdoor display. Authorities and urban planners have sponsored LED signage solutions to publish real-time public information as well as to phase out prints.

LCD display technology continues to be a fundamental player in the digital signage sector, especially for enterprises looking for budget-friendly options that deliver dependable performance. LCD screens tend to be less expensive, easy to find, and bright enough for indoor and semi-outdoor applications.

The easily accessible and integration with existing display setups make LCD-based digital signage a common choice at retail stores, corporate offices, and educational establishments. Although offering less contrast ratio and flexibility than OLED displays or LED displays, LCD panels still offer a well-suited solution for deployments where budget is an issue.

Content management software (CMS) is rapidly becoming a vital part of digital signage systems, allowing organizations to schedule, manage, and display dynamic content in a streamlined way. Advanced CMS platforms are employed in retail, corporate, healthcare and transport companies to create content refresh automatically, encode view-through rates, and alter to display records according to audience demographics.

Increased demand for scheduling software Smart technology itself is becoming a quintessential item for controlling screens that are changing the direction of digital signage. Scheduling software is used by different elements of industries such as retail, corporate offices, healthcare, and transportation for companies that enable timely messaging, minimize manual intervention, and optimize content workflows.

The digital signage system industry is very competitive; players which have established themselves have done so through technological advancements, strategic alliances, and geographic expansion. Samsung and LG mainly exploit OLED and Micro-LED display product lines to penetrate different sectors, such as retail, hospitality, and transport.

This includes focusing on high-resolution (4K and 8K) displays, leading-edge artificial intelligence in content management, and energy efficiency to meet changing customer needs. This is, meanwhile, contrasted with NEC Display Solutions which uniquely marries hardware and software solutions to make user experience in digital signage management seamless.

Cisco Systems is known to be bringing lots of expertise in networking and cloud, where it also has offered an AI-based analytic service meant to improve signage efficiencies. Broad sign International offers its ground in digital out-of-home advertising using programmatic ad-buying capabilities, which includes fully autonomous and personalized campaign delivery.

As the business assimilates digital signage into education, health care, and public infrastructure, market leaders in AI-enhanced content automation, IoT interactivity, and cloud-based scaling will have a solid competitive edge. Data-driven personalization, immersive visual experiences, and eco-display technologies will define the future of the market, with the major players in endless innovation, redefining the parameters of engagement in dynamic digital environments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cisco Systems Inc. | 15-20% |

| Samsung Electronics Co., Ltd. | 12-17% |

| NEC Display Solutions Ltd. | 10-14% |

| Broad sign International, Inc. | 7-12% |

| LG Electronics | 5-9% |

| Other Companies (combined) | 34-46% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cisco Systems Inc. | Provides cloud-based digital signage solutions with integrated security and network capabilities. Leading in enterprise-level digital signage for corporate communication and smart city applications. |

| Samsung Electronics Co., Ltd. | Offers high-resolution displays and AI-powered content management solutions. Focuses on interactive displays and ultra-HD LED signage for retail and hospitality industries. |

| NEC Display Solutions Ltd. | Specializes in commercial-grade displays with advanced connectivity features. Strong presence in digital menu boards, healthcare information displays, and transportation sectors. |

| Broad sign International, Inc. | Cloud-based digital signage platform provider. Enables programmatic advertising, data-driven content automation, and seamless integration with advertising networks. |

| LG Electronics | Develops OLED and LED signage solutions with AI-powered content control. Enhances user engagement through touchscreen and smart signage solutions. |

Key Company Insights

Cisco Systems Inc. (15-20%)

Cisco is a dominant force in digital signage for enterprise communication and public infrastructure projects. The company integrates signage with AI-driven network security and real-time content delivery. Cisco’s latest expansion in smart city deployments reinforces its leadership in scalable and secure digital signage networks.

Samsung Electronics Co., Ltd. (12-17%)

Samsung remains a leading player with its high-end LED and QLED displays tailored for retail, hospitality, and entertainment applications. The company’s focus on AI-enhanced content optimization and interactive digital signage strengthens its market influence. Samsung’s continued investment in high-brightness outdoor displays aligns with the growing demand for dynamic outdoor advertising.

NEC Display Solutions Ltd. (10-14%)

NEC excels in delivering professional-grade digital signage with robust display solutions for high-traffic environments like airports and healthcare facilities. Its emphasis on energy-efficient displays and cloud-integrated signage platforms gives it a competitive edge. NEC’s collaborations with software providers improve digital signage interoperability across industries.

Broad sign International, Inc. (7-12%)

Broad Sign is a key player in cloud-based digital signage software, driving programmatic advertising in the DOOH (Digital Out-of-Home) market. The company’s partnerships with major advertisers and media networks enable automated ad placement and campaign optimization, increasing its relevance in the expanding digital advertising space.

LG Electronics (5-9%)

LG focuses on high-resolution OLED and LED signage for immersive experiences in retail and corporate sectors. The company’s innovations in flexible signage and transparent OLED screens position it as a major player in next-generation digital signage solutions. LG’s AI-integrated content management system further strengthens its competitive advantage.

The market is projected to witness a CAGR of 12.5% between 2025 and 2035.

The market is estimated at USD 25.5 billion in 2025.

The market is anticipated to reach USD 83.1 billion by 2035 end.

The key players operating in the Global Digital Signage Systems industry include Cisco Systems Inc., Samsung Electronics Co., Ltd., NEC Display Solutions Ltd., Broadsign International Inc., LG Electronics, and others.

In terms of technology, the segment is segregated into LCD or plasma and OLED and LED display technology.

In terms of software, the segment is distributed into content management software, distribution, and scheduling software.

In terms of type, the segment is categorized into indoor and outdoor.

In terms of application, the segment is divided into corporate and commercial sector, manufacturing, educational institutes, government, banking and financial institutes, transportation, retail and wholesale, media and entertainment, and healthcare.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA) have been covered in the report.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.