The market for digital pathology will expand enormously from 2025 to 2035 with rising adoption for clinical diagnostics, research, and education. The developing technology, along with the rising demand for effective and precise diagnostic tools, has served to drive demand for digital pathology solutions.

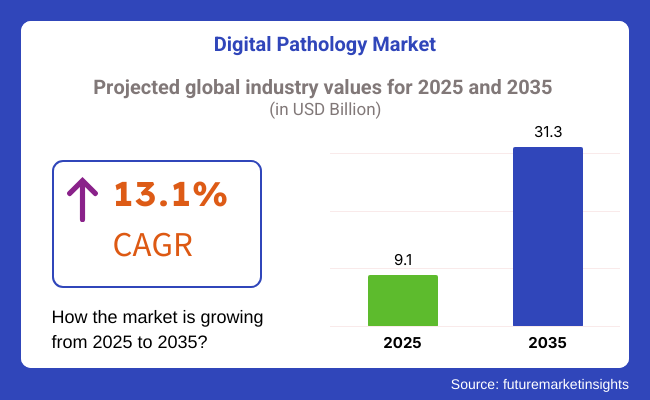

The market will be near about USD 9.1 Billion in 2025 and USD 31.3 Billion in 2035, growing at a CAGR of 13.1% over the estimated period. The introduction of artificial intelligence and machine learning in digital pathology systems has improved diagnostic precision and workflows by allowing pathologists to process more information more efficiently.

Also, the rise in the number of chronic conditions like cancer and autoimmune diseases testing is fueling the need for more advanced diagnostic devices, and digital pathology is a bare necessity. The pandemic also accelerated digitalization, with remote consultation and virtual pathology gaining prominence.

With more investments being placed in healthcare centers, technological advancements in digital imaging technologies, and growing awareness for the benefits of digital pathology among healthcare providers, the market will be expected to witness long-term growth within a decade.

Explore FMI!

Book a free demo

North America dominates the digital pathology market due to the highly developed healthcare infrastructure, massive research and development spending, and good reimbursement policies of the region. The region's high density of industry players has also been a major driving force behind competition and innovation in the digital pathology market.

The United States and Canada are in the lead regarding adopting digital pathology solutions, particularly cancer diagnosis and cancer research. Pushing healthcare digitization through government policies and greater spending on cancer research have been the key drivers.

Cancer cases were estimated to rise exponentially by 2030 by a recent National Cancer Institute report, hence adding further momentum to the call for digital pathology systems.

In addition, the increasing emphasis on value-based care models and patient-centered programs motivates labs and hospitals to invest in digital platforms to improve diagnostic quality, reduce turnaround time, and improve patient outcomes. Integrating cloud-based backup services and tele pathology platforms facilitates end-to-end pathologist collaboration and makes a holistic diagnostic environment.

As a result of continuous advances in imaging modalities, ubiquitous integration of digital solutions within the education sector, and favorable government initiatives, North America's digital pathology market will continue to dominate the market leadership through the forecast period.

Europe has a large market share of global digital pathology, and its influence is driven by very sophisticated health infrastructure, increasing demand for remote diagnostic services, and strict regulatory procedures. Germany, the United Kingdom, and France are spearheading the uptake of digital pathology under their stable health systems and high innovation push.

The increasing incidence of chronic diseases such as cancer and cardiovascular diseases fast-tracked the demand for advanced diagnostic equipment. The European Union's efforts toward digital health technology and healthcare processes' use of AI-fueled the demand for digital pathology machines.

European research centers and hospitals also fast-march digital platforms into their systems to boost workflow, diagnosis speed, and accuracy. The United Kingdom's National Health Service, for example, has initiated several digital pathology projects with a focus on early cancer detection as well as pathology services improvement .In the same way, German investment in new medical technology and infrastructure is making use of digital image systems easier, making efficiency higher and diagnostic error lower.

With increasing investments from the public and private sectors, advances in imaging technology, and increased awareness among healthcare professionals regarding the advantages of digital pathology, Europe is expected to see modest growth over the next two years.

The Asia-Pacific will be a growth-focused digital pathology market with a highly emerging healthcare infrastructure, accelerated growth in adopting new-age diagnostic solutions, and a growing rate of diseases. The heavy healthcare modernization spend of China, Japan, and India will usher in a supporting ecosystem for embracing widespread digital pathology solutions...

The sheer population base in China and state-run health initiatives have seen several world-class medical institutions develop highly equipped with the best diagnostics facilities. Government insistence on accelerating the country's diagnostics and cancer research capabilities has brought pace to deploying computer-aided digital pathology solutions at healthcare and education facilities.

India's growing focus on healthcare digitization is yet another prime mover. Government initiatives under programs like Ashman Bharat and the development of digital health platforms are making advanced diagnostic equipment more accessible. Growth in private diagnostic centers and specialty hospitals is also pushing India's rapid adoption of digital pathology systems.

Japan's advanced healthcare infrastructure and reputation for welcoming cutting-edge medical technologies have positioned it as an important market for digital pathology. Its early disease detection, the country's area of focus, coupled with the growing aging population, has created greater reliance on digital imaging and AI-driven diagnosis platforms.

Overall, the Asia-Pacific region's combination of fast urbanization, increasing health spending, and strong government incentives makes it one of the most promising markets for digital pathology over the next decade.

From 2020 to 2024, digital pathology saw development at a high pace due to the development of AI-based diagnostic solutions, cloud-based pathology, and computerized imaging technology. Healthcare facilities and research organizations used digital platforms for more effective workflow, minimized diagnostic turnaround time, and enhanced pathology assessment accuracy.

Off-site pathology services experienced a rapid surge in demand with the demands for telepathology services, especially with the experience of the COVID-19 pandemic that limited face-to-face diagnosis and increased utilization of digital technology. Such bodies as the USA

The Food and Drug Administration (FDA), European Medicines Agency (EMA), and College of American Pathologists (CAP) revised their guidelines to capture changes in whole slide imaging (WSI), diagnostic aid via AI, and cloud storage of pathology data. The updates raised the use of FDA-approved digital pathology platforms for increased interoperability and regulatory conformity in lab activities.

Clinicians and pathologists were aided by machine learning algorithms that allowed them to identify complicated disease patterns, resulting in improved cancer diagnosis, histopathological diagnosis, and biomarker-based diagnostics. The industry also experienced major investment by biotechnology companies, pharma, and AI start-ups in improving automatic diagnosis, predictive analysis, and real-time consultation in pathology.

The large healthcare providers partnered with AI developers to use deep learning to pathology procedures to reduce diagnostic errors and simplify the detection of diseases at early stages. Cloud storage of pathology made it easier to exchange information among institutions without hassle, improving greater collaboration in clinical research and debates on patient cases.

Despite these developments, cost impediments, data protection issues, and resistance to technological change prevented mass adoption in some areas. Pathology laboratories, especially in less developed nations, found adopting high-resolution scanners, AI-powered analysis software, and secure cloud systems challenging because of resource constraints.

Nonetheless, as research grants expanded and AI-powered pathology solutions became affordable, the market for digital pathology expanded, remaking the diagnostic medicine future.

Between 2025 and 2035, the market for digital pathology will experience a technology revolution through AI-based diagnosis, quantum-enabled imaging, and blockchain-protected patient data management. Greater dependence on end-to-end fully automated pathology systems will reduce manual bottlenecks, making diagnostic errors very low and the efficiency of pathology labs much higher.

Pathologists will incorporate self-improving AI models that continuously update their accuracy, allowing for accurate disease classification and targeted treatment planning.

Future pathology systems will tap quantum computing and edge AI to analyze enormous datasets in real time, enabling improved and quicker cellular examination. AI-powered whole slide imaging (WSI) platforms will identify minute abnormalities within tissue samples, giving deeper insights into disease development and genetic markers.

The applications of Nano-sensors and digital molecular pathology will transform the early detection of cancer, allowing pathologists to diagnose diseases at the pre-symptomatic stage with unprecedented precision.

Regulatory bodies will evolve with these innovations by creating AI compliance standards, blockchain-supported pathology record verification, and interoperability protocols for smooth data exchange between institutions.

Global standardization of digital pathology regulations will provide uniformity in AI-based diagnostics, allowing healthcare providers to implement predictive pathology models for high-risk diseases like cancer, neurological disorders, and rare genetic disorders.

Sustainability will be the driving force behind the future of digital pathology. The sector will move towards cloud-based diagnostics based on green computing, energy-efficient digital imaging equipment, and environmentally friendly pathology laboratory infrastructure.

AI-driven digital pathology solutions will greatly minimize paper-based record-keeping, chemical waste, and physical glass slides, making pathology laboratories more cost-effective and sustainable.

The path to digital pathology is a prospect of completely automatic, AI-oriented, and cloud-connected times to come. From 2020 to 2024, important breakthroughs emerged in remote pathology, AI-influenced diagnoses, and cloud-enabled imaging, but in the period between 2025 and 2035, expect quantum-accelerated diagnosis, self-trained AI pathology equipment, and in vivo molecular pathology platforms. Through healthcare professionals bringing AI-informed predictive models into their workflow, the field is set to approach new standards for diagnostic accuracy, productivity, and scalability.

By 2035, robot-assisted pathology workflows, autonomous AI algorithms, and real-time telepathology platforms will characterize the future of digital pathology. AI, quantum computing, and molecular diagnostics will facilitate hyper-accurate disease detection, real-time predictive analytics, and smooth integration with personalized medicine paradigms.

With pathology now fully digitized, healthcare practitioners will use AI-powered pathology platforms to provide precision diagnostics, remote consultations, and data-driven treatment plans, reshaping the healthcare landscape worldwide.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory agencies introduced FDA approvals for AI-driven diagnostics and whole slide imaging (WSI) systems. |

| Technological Advancements | AI-assisted image analysis, cloud-based storage, and remote pathology consultations gained traction. |

| Industry Applications | Digital pathology improved cancer detection, biomarker analysis, and remote diagnostics. |

| Adoption of Smart Equipment | High-resolution scanners, AI-powered diagnostic tools, and cloud-integrated pathology platforms became mainstream. |

| Sustainability & Cost Efficiency | Labs transitioned to cloud-based pathology records, reducing reliance on physical storage and paper-based documentation. |

| Data Analytics & Predictive Modelling | AI-driven tumour classification, histopathological analysis, and biomarker-based disease detection transformed pathology. |

| Production & Supply Chain Dynamics | Pathology labs faced scanner shortages, cloud storage security concerns, and implementation challenges in AI adoption. |

| Market Growth Drivers | The market expanded due to increased demand for AI-assisted diagnostics, telepathology, and precision medicine. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered compliance, blockchain-backed pathology data management, and global interoperability standards will define regulatory frameworks. |

| Technological Advancements | Quantum-enhanced pathology imaging, AI-driven predictive diagnostics, and Nano-sensor-based disease detection will revolutionize the field. |

| Industry Applications | Expansion into AI-powered molecular pathology, self-learning disease detection models, and automated pathology workflows. |

| Adoption of Smart Equipment | Adoption of real-time digital biopsy analysis, AI-integrated pathology robots, and autonomous disease screening systems. |

| Sustainability & Cost Efficiency | Energy-efficient AI pathology models, biodegradable lab materials, and eco-friendly diagnostic infrastructure will enhance sustainability. |

| Data Analytics & Predictive Modelling | Expansion into real-time AI disease prediction, federated learning for pathology AI models, and continuous data-driven patient monitoring. |

| Production & Supply Chain Dynamics | AI-optimized pathology supply chains, decentralized pathology networks, and real-time pathology data streaming will streamline workflows. |

| Market Growth Drivers | Growth will be fuelled by self-learning AI pathology models, regenerative medicine applications, and fully autonomous diagnostic solutions. |

The USA market for digital pathology is growing at a breakneck speed with the advancement in AI-based diagnostics, increasing whole slide imaging (WSI) solution adoption, and the increasing demand for precision medicine.

With its unusually high rate of cancer and long-term disease cases, the call has been going up for proper and efficient pathology solutions. At an estimated number of over 2 million in the USA alone during 2024, new cases of cancer diagnosed in the nation will be adding to mounting pressures on digital pathology systems that assist with early disease detection as well as patient-level treatment planning.

Integrating machine learning (ML) and artificial intelligence (AI) into pathology labs enhances image analysis, automates the interpretation of slides, and reducing errors in diagnosis. Philips, Roche Diagnostics, and Leica Biosystems are some firms that are funding AI-based digital pathology solutions, enhancing diagnostic work processes, and making them scalable and efficient.

The US healthcare system is rapidly adopting digitization, with heavy spending on electronic health records (EHRs), telemedicine, and cloud-based pathology systems. Government initiatives such as the Cancer Moonshot Program are further propelling research and adoption of digital pathology platforms for early cancer detection and precision oncology.

With robust regulatory backing, growing usage of AI-based pathology, and rising demand for telemedicine-based diagnostics, the United States digital pathology market is set to witness great growth in the coming decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.0% |

The United Kingdom's digital pathology market is growing more and more with government-sponsored healthcare digitization programs, diagnostic technology advancements using artificial intelligence, and surging telepathology use for remote consultations.

The UK National Health Service (NHS) is also heavily investing in digital pathology, including the NHS Digital Pathology Initiative aimed at consolidating whole slide imaging (WSI) solutions and artificial intelligence-driven diagnostic tools. This enhances early disease diagnosis and diagnostic pace, especially in oncology and infectious disease diagnoses.

Growing demand for remote pathology solutions has also accelerated hospital, lab, and educational institution take-up of digital pathology even further. The UK also sees growing investments in AI-driven pathology image analysis as Paige AI and PathAI develop advanced deep learning models for intelligent cancer detection and disease diagnosis.

Along with this, growing research collaborations between pathology, universities, biotech firms, and government departments are fueling the market's growth. As the demand for AI-based pathology keeps expanding, with accelerating digitalization in the healthcare industry and strong government backing, the UK digital pathology market will continue to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.8% |

The European digital pathology market is growing extremely fast, pushed by increasing investment in AI-driven diagnostic platforms, healthcare digitization, and precision medicine growth.

Europe's Horizon Europe program and EU Cancer Plan are funding digital pathology infrastructure, which is opening the door to pharma research, clinical diagnostics, and academic uptake. Germany, France, and Italy are leading European nations to invest heavily in machine learning-based pathology solutions, with hospitals adopting WSI technology and cloud-based diagnosis platforms.

The EU focus on interoperability and data protection has also encouraged wider use of cloud-based digital pathology solutions that allow pathology images to be securely shared between research labs and hospitals. This has greatly benefited cross-border research collaborations for cancer and precision oncology initiatives.

Also, the surge in AI-powered pathology startups and the rising adoption of automated pathology processes in European hospitals are driving market growth. With a strong regulatory base, technological upgradation, and increasing investments in digital pathology equipment, the digital pathology market in Europe is projected to experience constant growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.4% |

The Japanese digital pathology market is expanding steadily with the assistance of technology improvements, the integration of AI into diagnostics, and the increasing acceptance of remote pathology solutions.

Japan is at the forefront of medical imaging and AI diagnosis, and its leaders are Olympus, Nikon, and Fujifilm in next-generation digital pathology solutions. The aging population and increasing prevalence of chronic diseases in Japan have fueled the demand for streamlined, automated pathology workflows that enable early disease identification and remote consultations.

The Japanese government is funding telemedicine and artificial intelligence diagnostic capabilities, as they encourage hospitals and research centers to adopt digital pathology. Rural health networks are adding telepathology solutions that enable remote review of pathology slides and faster diagnoses.

Japan's robust life science & biotechnology industry is also fueling digital pathology adoption in drug development, clinical trials, and precision medicine research. With ongoing innovation, robust government support, and increasing medical imaging and research uses, the Japanese digital pathology market is likely to expand considerably.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.1% |

The South Korean digital pathology market is expanding strongly with the assistance of AI-based automation imaging technologies, healthcare IT spending by the government, and an expansion in telepathology services.

South Korea's leading technology players, LG and Samsung, are making serious investments in medical imaging and artificial intelligence diagnostic software, and that is propelling the adoption of digital pathology solutions. South Korea's healthcare market is migrating easily from traditional physical infrastructures to digital ones, and hospitals are already adopting AI-facilitated pathology processes to speed up diagnoses and improve accuracy.

South Korea's digital health initiatives under government support are also augmenting market growth with extra financing being pumped into cloud-based pathology platforms, cancer diagnosis via artificial intelligence, and telemedicine service. In addition, increased collaboration and partnerships between biotech firms and research institutes are driving the utilization of digital pathology within pharma studies and clinical trials.

With strong government backing, increasing uptake of AI, and increased healthcare digitalization spending, South Korea's digital pathology market is set for significant expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.2% |

The entire slide scanners and cloud-based digital pathology software segments comprise a substantial share in the market for digital pathology due to extensive use by research institutions, pharma, and hospitals of innovative imaging, artificial intelligence-driven analysis, and cloud-based data solutions. These technologies fuel improvements in clinical diagnostics, molecular pathology, drug discovery, and biomedical research through faster turnaround times, higher diagnostic accuracy, and workflow efficiency.

Whole slide scanners are one of the most significant digital pathology technologies, providing high-resolution, fully digitized slide scanning technology that supplants glass slide microscopy with AI-driven digital image analysis. In contrast to human microscopy, WSS allows for remote viewing of tissue samples by pathologists, convenient sharing of cases, and use of AI to rapidly identify disease, all while maintaining its eye on improving diagnostic accuracy and efficiency.

Increasing usage of whole slide imaging in hospital diagnostics, cancer pathology, and research has triggered demand for WSS as medical labs, hospitals, and research centers increasingly adopt all-digital pathology workflow. Research has shown that WSS greatly enhances diagnostic consistency, reduces interobserver variability, and speeds pathology reporting, improving patient outcomes.

Employment of artificial intelligence (AI) and machine learning in whole slide scanners has also given a boost to market demand, as algorithms based on AI help in the automated detection of tumors, analysis of biomarkers, and histopathological categorization, and lower the burden of diagnosis along with enhancing capabilities of precision medicine. AI-based whole slide imaging maximizes workflow automation, supports rapid case triage, and helps detect early disease, facilitating better decision-making among pathologists and oncologists.

The growth of whole slide scanners for telepathology and distant usage has helped sustain market expansion, with pathologists using cloud-based image sharing and remote diagnosis increasingly to enhance pathology service access among underserved patient populations. Integrated digital pathology platforms with whole slide scanners facilitate real-time consultation, second-opinion pathology services, and multidisciplinary case discussion allowing greater collaboration and improved patient care.

The advent of high-throughput whole slide scanners with accelerating scan times, increased resolution, and artificial intelligence-based quality control features has maximized lab efficiency, avoiding bottlenecks and facilitating scalability for large-scale research and diagnostic use.

Although it has the benefits of workflow optimization, whole slide scanning is confronted with limitations like expensive equipment, storage of huge amounts of data, and complexities of integration with legacy laboratory information systems. Nonetheless, new technologies in cloud storage of images, real-time AI-based annotation, and low-cost, miniaturized WSS solutions enhance affordability, accessibility, and usage rates, ensuring the whole slide scanner market growth persists.

Cloud-based digital pathology software has seen strong market uptake, particularly in clinical diagnosis, pharma R&D, and academic research pathology, with healthcare providers and laboratories shifting in increasing numbers away from on-premises platforms to cloud-compatible ones for scaleable, real-time access to and analysis of pathology data. Cloud-based digital pathology software separates itself from traditional manual slide evaluation by providing AI-facilitated image analysis, distant case collaboration, and safe, HIPAA-compliant data storage, providing streamlined diagnostic paths and enhanced efficiency.

Increasing usage of AI-based pathology image analysis software has also stimulated the need for cloud-based digital pathology platforms due to the automation of deep learning models improving tissue segmentation, biomarker measurement, and tumor grading to yield more precise and reproducible pathology reporting. Research has shown that AI-based pathology software lowers diagnostic variability to a considerable degree, enhances case turnaround time, and raises pathologist productivity.

The convergence of cloud-based pathology information systems and electronic health records (EHRs) and laboratory information management systems has combined market demand because healthcare providers must possess interoperable, centralized data management systems that facilitate rapid access to patient records, case tracking, and real-time reporting.

The introduction of telepathology and remote pathology services has also contributed to further boosting cloud-based digital pathology software uptake, as pathologists rely more on cloud-hosted environments for real-time case consultation, group decision-making, and global pathology data sharing. Cloud-supported pathology platforms allow more access to specialist experts, reduce diagnostic delays, and expand global healthcare reach, particularly in remote or poorly equipped regions.

The evolution of blockchain-based cloud storage for digital pathology has improved data security, compliance, and traceability, providing tamper-proof pathology records, patient confidentiality, and efficient pathology audit trails.

The advent of subscription-based cloud pathology platforms and pay-per-use digital pathology solutions has enhanced cost-effectiveness by reducing the cost of expensive on-premise infrastructure while providing scalable, flexible data management capabilities to small, medium, and large laboratories.

Although robust in real-time access and scalability, cloud-based digital pathology software is fraught with several challenges such as data privacy issues, regulatory compliance, and security breaches. Emerging technologies in end-to-end encryption, AI-driven data security measures for cloud environments, and decentralized systems of pathology data management are making data protection, regulatory compliance, and accessibility stronger, thus driving market growth for cloud-based digital pathology software.

The drug development and clinical pathology segments are the two key market drivers, since healthcare professionals, biopharma companies, and research institutions alike continue to apply digital pathology technologies to augment disease diagnostics, accelerate therapeutic research, and maximize precision medicine initiatives.

Clinical pathology is among the fastest-growing digital pathology applications, facilitating computer-aided tissue analysis, disease diagnosis by AI, and telepathology reporting. Compared to the conventional pathology application, digital pathology simplifies case processing, improves the reproducibility of the diagnosis, and allows for pathologists' real-time collaboration, ultimately leading to improved patient care.

The increasing prevalence of cancer, infectious, and autoimmune illnesses has propelled the need for digital pathology solutions within healthcare facilities, and hospitals and diagnostic laboratories are looking for scalable, AI-based platforms to manage high-throughput case management of pathology Studies indicate that digital pathology reduces review time considerably, enhances early disease detection, and enhances diagnostic accuracy in difficult cases.

Integration of artificial intelligence-enabled diagnostic decision support systems (DDSS) and digital pathology has increased predictive analytics, lesion detection by automation, real-time annotation of images, and guaranteed excellent clinical workflow efficacy and diagnostic guarantee.

Although it has clinical diagnostic importance, clinical applications of digital pathology are challenged by reimbursement restrictions, regulatory approval challenges, and high upfront costs of technology adoption. Nevertheless, advancing innovations in automated case triaging of pathology, cloud-based diagnostic decision support, and regulatory-friendly digital pathology platforms are enhancing adoption, affordability, and clinical scalability, with clinical pathology applications ensuring ongoing market growth.

Digital pathology has been broadly adopted in drug discovery, particularly in preclinical studies, biomarker discovery, and toxicity testing, with more pharmaceutical and biotech companies utilizing AI-assisted histopathology interpretation to accelerate drug efficacy testing and target validation. Digital pathology contrasts with traditional drug discovery pipelines by accelerating tissue-based biomarker research, improving accuracy in drug-response research, and expanding real-time pathology data analysis for pharma R&D scientists.

Greater usage of digital pathology in precision medicine and immuno-oncology has driven more profound market demands as biopharmaceutical organizations increasingly utilize AI-driven pathology data for companion diagnostics, personalized therapy development, and optimized clinical trials.

While it enjoys a competitive advantage in pharma innovation, digital pathology in drug development faces data standardization, regulation, and harmonization issues with the existing laboratory workflow. However, progress in AI-based histopathology imaging, deep learning-based biomarker quantification, and cloud-based collaboration for pathology data sharing in global R&D activities is driving efficiency, scalability, and adoption, thereby guaranteeing future market growth in drug development applications.

The digital pathology market is increasing with the increased uptake of AI-based diagnostic platforms, telepathology solutions, and whole slide imaging (WSI) systems. Companies focus on cloud-based pathology platforms, machine learning algorithms, and automatic image analysis for enhanced diagnostic precision, workflow efficacy, and off-site pathology consultation. The market includes global giants and specialized medical imaging vendors, each contributing substantially to technological advancements in digital histopathology, AI-based disease identification, and distant pathology services.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Leica Biosystems (Danaher Corporation) | 15-20% |

| Philips Healthcare (Koninklijke Philips N.V.) | 12-16% |

| Roche Diagnostics (Ventana Medical Systems, Inc.) | 10-14% |

| 3DHISTECH Ltd. | 7-11% |

| Hamamatsu Photonics K.K. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Leica Biosystems (Danaher Corporation) | Manufactures Aperio digital pathology solutions, image analysis with AI, and automated slide scanning technology for clinical and research use. |

| Philips Healthcare (Philips IntelliSite Pathology Solution) | Engages in whole slide imaging (WSI), AI-based pathology workflow integration and remote diagnostics cloud-based. |

| Roche Diagnostics (Ventana Medical Systems, Inc.) | Produces Ventana digital pathology scanners and AI-enabled pathology software for automated tumor detection and biomarker analysis. |

| 3DHISTECH Ltd. | Offers high-resolution digital pathology scanners, virtual microscopy platforms, and cloud-based pathology solutions to clinical and research academia. |

| Hamamatsu Photonics K.K. | Provides Nanozoomer series for whole slide imaging, high-speed scanning, and AI-based histopathology analysis. |

USD 9.1 Billion, the overall market size for Digital Pathology Market in 2025.

Digital Pathology Market Revenue will reach USD 31.3 Billion by 2035.

Increasing adoption AI-driven diagnostics, growing prevalence of chronic diseases, advancements in telepathology and the need for efficient workflow solutions in pathology labs will create demand for the digital pathology market and push the transition to digital imaging and analysis.

USA, UK, Europe Union, Japan and South Korea are the Leading 5 countries which drives the development of Digital Pathology Market.

Whole slide scanners and cloud-based digital pathology software drive market to dominate substantial portion during the assessment period.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.