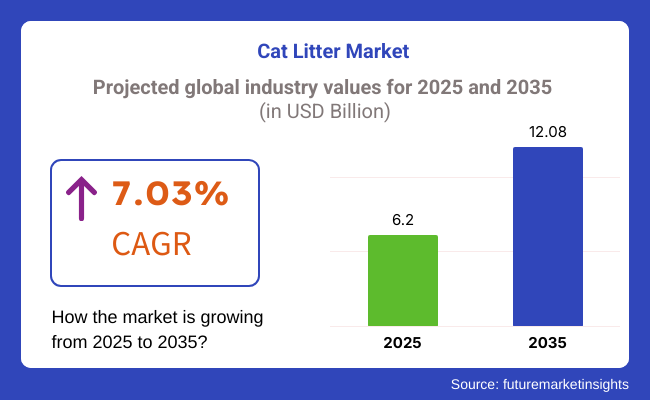

The global cat litter market is projected to grow from USD 6.20 billion in 2025 to USD 12.08 billion by 2035, registering a CAGR of 7.03%. Growth is being driven by a combination of increased pet ownership, urbanization, and the growing emphasis on pet hygiene.

In 2024, the market was valued at approximately USD 5.74 billion, showing a steady rise in consumer demand. Clumping litter remains the most preferred product segment due to its superior odour control, ease of cleaning, and cost efficiency. The market is further supported by rising eCommerce penetration and the premiumization of pet care.

Natural and biodegradable litter products are gaining rapid traction as consumers shift towards sustainable living. Litters made from recycled paper, corn, wheat, walnut shells, and wood are becoming more visible across retail shelves. In response, leading brands are investing in environmentally conscious product lines.

The use of compostable and flushable formulations is becoming more common, appealing to eco-conscious cat owners. With increasing awareness about micro plastic pollution and non-biodegradable waste, alternatives to traditional clay-based litter are expected to see faster adoption in the years ahead.

In 2024, Nestlé Purina’s Tidy Cats launched a plant-based, biodegradable litter using reclaimed fibers, offering compostability and minimal dust. Church & Dwight’s Fresh Step introduced a new product infused with activated coconut charcoal for natural odor control.

These launches reflect a broader industry trend towards clean-label pet products and sustainable sourcing. In 2025, Tidy Cats also partnered with Whisker to create a litter designed for automated Litter-Robot systems. This product features enhanced clumping and a motion-activated scent, highlighting the intersection of sustainability and convenience.

The market is witnessing the emergence of smart litter box technologies, further transforming consumer expectations. In 2025, brands began integrating health-monitoring sensors into litter boxes that detect changes in urination and defecation patterns. These systems can alert pet owners to early signs of health issues such as urinary tract infections or kidney problems.

As health awareness grows, especially among millennial pet owners, such features are influencing buying decisions. Coupled with innovations in odor neutralization and minimal packaging, the industry is aligning itself with broader lifestyle trends. The cat litter market is thus entering a new phase driven by technology, health, and sustainability.

Clumping litter is projected to command 74.8% of the global market share by 2025, owing to its superior absorbency, ease of maintenance, and effective odour control. Primarily composed of sodium bentonite clay, this type of litter forms solid clumps when wet, enabling cat owners to remove waste efficiently while extending the use of remaining litter. This leads to reduced consumption and greater cost-effectiveness over time. As awareness around pet hygiene increases and households with multiple cats become more common, demand for low-maintenance litter solutions has intensified.

Leading brands such as Purina Tidy Cats, Fresh Step, and Arm & Hammer continue to innovate with offerings like dust-free formulas, activated charcoal for odour management, and lightweight packaging. These developments appeal to a wide consumer base seeking convenience and cleanliness. On the other hand, non-clumping litter retains a 25.2% share, primarily driven by its affordability and high liquid absorption. Suitable for single-cat homes and temporary use, its market presence is slowly declining as consumer preference shifts toward long-lasting, user-friendly alternatives.

Clay-based litter is expected to maintain its leadership with a 68.5% market share in 2025, supported by its low cost, broad availability, and effective clumping performance. Made from sodium bentonite, it clumps tightly upon contact with moisture, allowing for easy waste removal and improved cleanliness. It is especially popular in North America and Europe, where cat ownership continues to rise.

The product’s widespread availability and cost-effectiveness make it a preferred choice for households seeking reliable litter solutions. Brands like Purina Tidy Cats, Fresh Step, and Arm & Hammer dominate this segment, consistently enhancing their offerings with low-dust compositions and odour-neutralizing technologies. Silica-based litter, which holds an 18.3% share, is gaining traction for its high absorbency and long-lasting freshness. Comprising silicon dioxide crystals, it absorbs moisture without clumping, thus reducing litter change frequency.

Marketed as lightweight and dust-free by brands like PrettyLitter and FreshMAGIC, silica options appeal to premium buyers. However, health concerns related to inhalable dust may limit wider adoption, even as the demand for health-conscious products grows.

The industry is witnessing rapid growth based on growing pet adoption, increasing pet hygiene awareness, and developments in litter technology. The family home is the key consumer of litter products that provide improved odor control, decent clumping property, and lower dust to give a clean and fresh home atmosphere.

Pet stores and retailers actively engage in bulk purchases with various products and lower prices to accommodate different types of consumers. The veterinary units and the animal shelters need litter material, which is highly absorbent and dust-free, in order to create a hygienic environment for sick or recovered cats.

Risks abound for the industry, such as the instability of raw ingredients. Clays and silica litters depend on mining, which makes them prone to interruptions in the supply chain along with price changes. Environmental problems, which are getting worse and have more regulatory constraints, are also risks because governments advocate the use of biodegradable materials and eco-friendly alternatives.

Quality control is another deciding element. If substandard products are produced, they will cause dust emissions and possible health risks for pets and even customers, along with the dissatisfaction of consumers. The manufacturers have to comply with strict safety, and hygiene standards or the chances of recalls and the consequent reputational issues arise. The problem is aggravated even further by the existence of counterfeit or low-quality alternatives in the industry.

The industry is very competitive, and the largest companies allocate significant amounts of money for both research and development purposes and promotional activities. Small or newly established companies often struggle to succeed without proper R&D and brand resources. Besides, the modules of the consumers who prefer green and natural products and thus compel the company to be involved in regular adaptability are also important.

Cost cuttings can affect the industry in such a way that pet owners will buy cheaper products instead of pets' expensive ones. Also, logistics and distribution channel crossings, especially for e-commerce, are contributing to delays and additional costs in operational processes. Therefore, proper risk control and a reinvigorated supply chain are the two essential tools that guarantee the progress of the industry in the long run.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 6.5% |

| Germany | 6.7% |

| India | 7.4% |

| China | 7.6% |

With a growing number of pet owners in the USA, a strong hygiene focus, and an increasing demand for eco-friendly and odor-control solutions, the USA industry is steadily growing. The American industry is currently controlled by leading brands including Purina Tidy Cats, Arm & Hammer, and Fresh Step that offer innovations in clumping, as well as dustless and biodegradable litter.

Value products will continue to be popular with consumers on a tight budget, but premium and gourmet cat litter-including natural and fragrance-free options-is seeing a sharp increase in sales among consumers who are concerned about their health.

By providing convenient and affordable solutions, subscription-based and auto-delivery services are also helping the sector flourish. The USA industry is expected to expand at a 6.8% CAGR during the forecast period, according to FMI.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Growing interest in environmentally friendly and biodegradable kitty litter | Natural and compostable litter products are becoming more popular as a result of concerns about sustainability. |

| Cat litter subscription and auto-delivery businesses are expanding. | Pet owners with limited time want convenience through scheduled delivery from companies and merchants. |

With an increasing number of pet adoptions, the UK industry is witnessing upward growth, as consumers prefer litter that is high quality, free of dust, and hypoallergenic. From Catsan and Breeder Celect to Ever Clean, these brands have become environmentally friendly because they provide natural, non-toxic, and biodegradable alternatives.

Due to factors like convenience and ease of disposal, the demand for lightweight and flushable options are increasing. Also, the easy availability of premium and specialty litter through e-commerce has aided the industry expansion for pet owners. The UK industry is likely to grow at a 6.5% CAGR during the forecast period, according to FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Increasing demand for natural and non-toxic cat litter | Chemicals-sensitive consumers want litter with less exposure to chemicals. |

| Manufacturer and product expansion of lightweight and flushable options | Due to the convenience and availability of sustainable disposal options, consumers are endorsing the practice more and more, resulting in upward growth. |

Germany's industry is growing due to increasing demand for high-quality, sustainable, and dust-free litter. Well-known companies like Vitakraft, Biokat's, and Cat's Best have responded to pet owners who care about the environment by offering wood-based and biodegradable products.

The demand for ultra-absorbent, high-performance litter solutions has increased due to the rise in multi-cat households. Low-allergen and scent-free litter products are also becoming more and more popular due to veterinary advice and increased awareness of pet health. The German industry will expand at a 6.7% CAGR during the study period, according to FMI.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| High manga for organic and timber-based options | This preference places biodegradable and compostable alternatives that think along the same lines of sustainable objectives in the hands of consumers. |

| The rise of veterinary-recommended and low-allergen offerings | The trends in pet health drive the move towards hypoallergenic and chemical-free litter types. |

The demand is developing in the Indian industry as a result of the nation's growing pet adoption rate, urbanization, and increased disposable income. With the launch of reasonably priced Made-in-India litter products, regional companies like Drools, Catsan India, and Me-O are charting their growth.

The need for odor-controlling and easily cleaned litter is growing as urban houses become more hygienic. E-commerce sites like Flipkart and Amazon have made high-quality kitty litter more accessible, particularly in developing nations where the offline retail sector is still sparse. The Indian industry is expected to expand at 7.4% CAGR during the forecast period, according to FMI.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Growing demand for locally produced and reasonably priced kitty litter | Domestic brands guarantee the quality of their products while aiming to attract price-conscious consumers. |

| Growth of e-commerce and retail distribution networks | The Internet makes it easier to reach both urban and rural markets for sales. |

The industry is thriving in China, driven by a rise in disposable incomes, increasing pet humanization, and awareness of super-premium cat care products.Activated charcoal, clumping clay litter, and high-performance silica gel are the main products of industry leaders Myfoodie, Cature, and Nestlé Purina.

Because Chinese customers have a greater need for imported and cross-border e-commerce items, it is becoming more and more popular with them. Additionally, internet wellness platforms and pet care influencers have helped brands become more well-known and penetrate new markets. FMI anticipates China industry to grow at a 7.6% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Cat litter imports | Demand for international brands is on the rise as consumers look for quality and niche litter. |

| Expanding the influence of pet care influencers and online retail marketplaces | They can rely on digital platforms to promote their products and engage with their consumers. |

Nestlé Purina (Tidy Cats) (20-24%)

Tidy Cats has become the front-runner in terms of provision in the industry with its highly innovative and clumping, lightweight, and multi-cat use types of litter. The brand invests in developing plant-based and recyclable litter packaging as part of sustainable solutions. Also, Tidy Cats develops a digital strategy intended to boost sales via e-commerce platforms, subscriptions, and other means on their own.

Clorox (Fresh Step & Scoop Away) (18-22%)

Fresh Step and Scoop Away concentrate on odor control technology for homes with multiple cats, where Clorox applies activated charcoal and Febreze scent enhancers into the products while also being committed to manufacturing that is carbon-neutral and lessening plastic use in production.

Mars Petcare (Arm & Hammer) (14-18%)

Arm & Hammer separately offers baking-soda-based odor-neutralizing litter options. Arm & Hammer added more biodegradable and natural products that now make available options for pet owners looking for healthier, eco-friendly alternatives. Besides, this will strengthen further loyalty through e-commerce and subscription services.

Ökocat (Healthy Pet) (6-10%)

Ökocat produces sustainable wood-based options that is both biodegradable and compostable. The name continues to grow into the retail and online space towards its target environmentally conscious audience.

Dr. Elsey's (5-9%)

Dr. Elsey's produces high-quality litter formulas that promise dust-free and hypoallergenic conditions in cats' health and wellness. With the high absorption and odor-locking technology, the brand continues to enjoy good visibility within the niche of pet owners whose main concern is hygiene in cats.

Other Key Players (25-35% Combined)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 6.20 billion |

| Projected Market Size (2035) | USD 12.08 billion |

| CAGR (2025 to 2035) | 7.03% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Product Types Analyzed (Segment 1) | Clumping, Non-Clumping, Silica Gel, Natural/Biodegradable, Others |

| Material Types Analyzed (Segment 2) | Clay, Silica, Corn, Wheat, Wood, Paper, Others |

| Sales Channels Analyzed (Segment 3) | Supermarkets/Hypermarkets, Specialty Pet Stores, Online, Convenience Stores, Others |

| End Users Analyzed (Segment 4) | Residential, Commercial (Pet Shelters, Veterinary Clinics), Others |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, Italy, China, Japan, India, South Korea, Australia, UAE, South Africa |

| Key Players influencing the Cat Litter Market | Nestlé Purina (Tidy Cats), Clorox (Fresh Step & Scoop Away), Mars Petcare (Arm & Hammer), Ökocat (Healthy Pet), Dr. Elsey’s, World’s Best Cat Litter, PrettyLitter, Feline Pine, Naturally Fresh, ScoopFree (PetSafe) |

| Additional Attributes | Dollar sales growth fueled by rising pet cat ownership and hygiene awareness, clumping products preferred for convenience, biodegradable options gaining share among eco-conscious buyers, online retail expanding market penetration, premium litter innovations driving brand competition, North America maintaining dominant revenue position. |

| Customization and Pricing | Customization and Pricing Available on Request |

By product type the industry is segmented into clumping, non-clumping, silica gel, natural/biodegradable cat litter, and others.

By material type, the industry is segmented into clay, silica, corn, wheat, wood, paper, and others.

By sales channel, the industry is segmented into supermarkets/hypermarkets, specialty pet stores, online, convenience stores, and others.

By end user, the industry is segmented into residential, commercial (pet shelters, veterinary clinics), and others.

By region, the industry is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The industry is anticipated to reach USD 6.20 billion in 2025.

The industry is projected to reach USD 12.08 billion by 2035, growing at a CAGR of 6.9%.

Key manufacturers include Purina (Nestlé SA), Kent Pet Group, Dr. Elsey’s Cat Products, Church & Dwight Co., Dirk Rossmann GmbH, Fressnapf Tiernahrungs GmbH, dm-drogerie markt GmbH + Co. KG, Arm & Hammer (Church & Dwight), The Clorox Company, Mars Incorporated, J. RETTENMAIER & SÖHNE GmbH + Co KG, H. von Gimborn GmbH, Gruppo Laviosa Minerals Srl, and Tolsa Company.

North America and Europe, driven by increasing pet ownership and growing demand for premium and eco-friendly cat litter products.

Clumping clay-based cat litter dominates due to its superior odor control, easy disposal, and high absorbency.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Life Stage, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Life Stage, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: Global Market Value (US$ Million) Forecast by Brand Type, 2018 to 2033

Table 14: Global Market Volume (MT) Forecast by Brand Type, 2018 to 2033

Table 15: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 22: North America Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Life Stage, 2018 to 2033

Table 24: North America Market Volume (MT) Forecast by Life Stage, 2018 to 2033

Table 25: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 26: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 27: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: North America Market Value (US$ Million) Forecast by Brand Type, 2018 to 2033

Table 30: North America Market Volume (MT) Forecast by Brand Type, 2018 to 2033

Table 31: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 38: Latin America Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 39: Latin America Market Value (US$ Million) Forecast by Life Stage, 2018 to 2033

Table 40: Latin America Market Volume (MT) Forecast by Life Stage, 2018 to 2033

Table 41: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 42: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 43: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 45: Latin America Market Value (US$ Million) Forecast by Brand Type, 2018 to 2033

Table 46: Latin America Market Volume (MT) Forecast by Brand Type, 2018 to 2033

Table 47: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 53: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: Europe Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 55: Europe Market Value (US$ Million) Forecast by Life Stage, 2018 to 2033

Table 56: Europe Market Volume (MT) Forecast by Life Stage, 2018 to 2033

Table 57: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 58: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 59: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 61: Europe Market Value (US$ Million) Forecast by Brand Type, 2018 to 2033

Table 62: Europe Market Volume (MT) Forecast by Brand Type, 2018 to 2033

Table 63: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 65: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 66: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 67: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 68: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 69: Asia Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 70: Asia Pacific Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 71: Asia Pacific Market Value (US$ Million) Forecast by Life Stage, 2018 to 2033

Table 72: Asia Pacific Market Volume (MT) Forecast by Life Stage, 2018 to 2033

Table 73: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 74: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 75: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 76: Asia Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 77: Asia Pacific Market Value (US$ Million) Forecast by Brand Type, 2018 to 2033

Table 78: Asia Pacific Market Volume (MT) Forecast by Brand Type, 2018 to 2033

Table 79: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Asia Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 81: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 82: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 83: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 84: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 85: MEA Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 86: MEA Market Volume (MT) Forecast by Material Type, 2018 to 2033

Table 87: MEA Market Value (US$ Million) Forecast by Life Stage, 2018 to 2033

Table 88: MEA Market Volume (MT) Forecast by Life Stage, 2018 to 2033

Table 89: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 90: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 91: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 92: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 93: MEA Market Value (US$ Million) Forecast by Brand Type, 2018 to 2033

Table 94: MEA Market Volume (MT) Forecast by Brand Type, 2018 to 2033

Table 95: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 96: MEA Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Life Stage, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Brand Type, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 8: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 21: Global Market Value (US$ Million) Analysis by Life Stage, 2018 to 2033

Figure 22: Global Market Volume (MT) Analysis by Life Stage, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Life Stage, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Life Stage, 2023 to 2033

Figure 25: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 26: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 29: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 30: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 31: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 32: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 33: Global Market Value (US$ Million) Analysis by Brand Type, 2018 to 2033

Figure 34: Global Market Volume (MT) Analysis by Brand Type, 2018 to 2033

Figure 35: Global Market Value Share (%) and BPS Analysis by Brand Type, 2023 to 2033

Figure 36: Global Market Y-o-Y Growth (%) Projections by Brand Type, 2023 to 2033

Figure 37: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 38: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 39: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 42: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 43: Global Market Attractiveness by Life Stage, 2023 to 2033

Figure 44: Global Market Attractiveness by Nature, 2023 to 2033

Figure 45: Global Market Attractiveness by Type, 2023 to 2033

Figure 46: Global Market Attractiveness by Brand Type, 2023 to 2033

Figure 47: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: Global Market Attractiveness by Region, 2023 to 2033

Figure 49: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) by Life Stage, 2023 to 2033

Figure 52: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 53: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 54: North America Market Value (US$ Million) by Brand Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 56: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 57: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 58: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 62: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 63: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 64: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 65: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 66: North America Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 67: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 68: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 69: North America Market Value (US$ Million) Analysis by Life Stage, 2018 to 2033

Figure 70: North America Market Volume (MT) Analysis by Life Stage, 2018 to 2033

Figure 71: North America Market Value Share (%) and BPS Analysis by Life Stage, 2023 to 2033

Figure 72: North America Market Y-o-Y Growth (%) Projections by Life Stage, 2023 to 2033

Figure 73: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 74: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 75: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 76: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 77: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 78: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 79: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 80: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 81: North America Market Value (US$ Million) Analysis by Brand Type, 2018 to 2033

Figure 82: North America Market Volume (MT) Analysis by Brand Type, 2018 to 2033

Figure 83: North America Market Value Share (%) and BPS Analysis by Brand Type, 2023 to 2033

Figure 84: North America Market Y-o-Y Growth (%) Projections by Brand Type, 2023 to 2033

Figure 85: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 86: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 87: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 90: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 91: North America Market Attractiveness by Life Stage, 2023 to 2033

Figure 92: North America Market Attractiveness by Nature, 2023 to 2033

Figure 93: North America Market Attractiveness by Type, 2023 to 2033

Figure 94: North America Market Attractiveness by Brand Type, 2023 to 2033

Figure 95: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: North America Market Attractiveness by Country, 2023 to 2033

Figure 97: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) by Life Stage, 2023 to 2033

Figure 100: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 101: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: Latin America Market Value (US$ Million) by Brand Type, 2023 to 2033

Figure 103: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 104: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 107: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 110: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 111: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 112: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 113: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 114: Latin America Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 115: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 116: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 117: Latin America Market Value (US$ Million) Analysis by Life Stage, 2018 to 2033

Figure 118: Latin America Market Volume (MT) Analysis by Life Stage, 2018 to 2033

Figure 119: Latin America Market Value Share (%) and BPS Analysis by Life Stage, 2023 to 2033

Figure 120: Latin America Market Y-o-Y Growth (%) Projections by Life Stage, 2023 to 2033

Figure 121: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 122: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 123: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 124: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 125: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 126: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 127: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 128: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 129: Latin America Market Value (US$ Million) Analysis by Brand Type, 2018 to 2033

Figure 130: Latin America Market Volume (MT) Analysis by Brand Type, 2018 to 2033

Figure 131: Latin America Market Value Share (%) and BPS Analysis by Brand Type, 2023 to 2033

Figure 132: Latin America Market Y-o-Y Growth (%) Projections by Brand Type, 2023 to 2033

Figure 133: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 134: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 135: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 138: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 139: Latin America Market Attractiveness by Life Stage, 2023 to 2033

Figure 140: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 141: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 142: Latin America Market Attractiveness by Brand Type, 2023 to 2033

Figure 143: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 145: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 147: Europe Market Value (US$ Million) by Life Stage, 2023 to 2033

Figure 148: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 149: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 150: Europe Market Value (US$ Million) by Brand Type, 2023 to 2033

Figure 151: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 152: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 153: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 154: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 155: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 156: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 157: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 158: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 159: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 160: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 161: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 162: Europe Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 163: Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 164: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 165: Europe Market Value (US$ Million) Analysis by Life Stage, 2018 to 2033

Figure 166: Europe Market Volume (MT) Analysis by Life Stage, 2018 to 2033

Figure 167: Europe Market Value Share (%) and BPS Analysis by Life Stage, 2023 to 2033

Figure 168: Europe Market Y-o-Y Growth (%) Projections by Life Stage, 2023 to 2033

Figure 169: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 170: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 171: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 172: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 173: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 174: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 175: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 176: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 177: Europe Market Value (US$ Million) Analysis by Brand Type, 2018 to 2033

Figure 178: Europe Market Volume (MT) Analysis by Brand Type, 2018 to 2033

Figure 179: Europe Market Value Share (%) and BPS Analysis by Brand Type, 2023 to 2033

Figure 180: Europe Market Y-o-Y Growth (%) Projections by Brand Type, 2023 to 2033

Figure 181: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 182: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 183: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 184: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 185: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 186: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 187: Europe Market Attractiveness by Life Stage, 2023 to 2033

Figure 188: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 189: Europe Market Attractiveness by Type, 2023 to 2033

Figure 190: Europe Market Attractiveness by Brand Type, 2023 to 2033

Figure 191: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Europe Market Attractiveness by Country, 2023 to 2033

Figure 193: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 194: Asia Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 195: Asia Pacific Market Value (US$ Million) by Life Stage, 2023 to 2033

Figure 196: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 197: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 198: Asia Pacific Market Value (US$ Million) by Brand Type, 2023 to 2033

Figure 199: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 200: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 201: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 202: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 203: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 204: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 205: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 206: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 207: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 208: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 209: Asia Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 210: Asia Pacific Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 211: Asia Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 212: Asia Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 213: Asia Pacific Market Value (US$ Million) Analysis by Life Stage, 2018 to 2033

Figure 214: Asia Pacific Market Volume (MT) Analysis by Life Stage, 2018 to 2033

Figure 215: Asia Pacific Market Value Share (%) and BPS Analysis by Life Stage, 2023 to 2033

Figure 216: Asia Pacific Market Y-o-Y Growth (%) Projections by Life Stage, 2023 to 2033

Figure 217: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 218: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 219: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 220: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 221: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 222: Asia Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 223: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 224: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 225: Asia Pacific Market Value (US$ Million) Analysis by Brand Type, 2018 to 2033

Figure 226: Asia Pacific Market Volume (MT) Analysis by Brand Type, 2018 to 2033

Figure 227: Asia Pacific Market Value Share (%) and BPS Analysis by Brand Type, 2023 to 2033

Figure 228: Asia Pacific Market Y-o-Y Growth (%) Projections by Brand Type, 2023 to 2033

Figure 229: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 230: Asia Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 231: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 232: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 233: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 234: Asia Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 235: Asia Pacific Market Attractiveness by Life Stage, 2023 to 2033

Figure 236: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 237: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 238: Asia Pacific Market Attractiveness by Brand Type, 2023 to 2033

Figure 239: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 241: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 242: MEA Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 243: MEA Market Value (US$ Million) by Life Stage, 2023 to 2033

Figure 244: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 245: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 246: MEA Market Value (US$ Million) by Brand Type, 2023 to 2033

Figure 247: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 248: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 249: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 250: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 251: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 252: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 253: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 254: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 255: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 256: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 257: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 258: MEA Market Volume (MT) Analysis by Material Type, 2018 to 2033

Figure 259: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 260: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 261: MEA Market Value (US$ Million) Analysis by Life Stage, 2018 to 2033

Figure 262: MEA Market Volume (MT) Analysis by Life Stage, 2018 to 2033

Figure 263: MEA Market Value Share (%) and BPS Analysis by Life Stage, 2023 to 2033

Figure 264: MEA Market Y-o-Y Growth (%) Projections by Life Stage, 2023 to 2033

Figure 265: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 266: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 267: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 268: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 269: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 270: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 271: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 272: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 273: MEA Market Value (US$ Million) Analysis by Brand Type, 2018 to 2033

Figure 274: MEA Market Volume (MT) Analysis by Brand Type, 2018 to 2033

Figure 275: MEA Market Value Share (%) and BPS Analysis by Brand Type, 2023 to 2033

Figure 276: MEA Market Y-o-Y Growth (%) Projections by Brand Type, 2023 to 2033

Figure 277: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 278: MEA Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 279: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 280: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 281: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 282: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 283: MEA Market Attractiveness by Life Stage, 2023 to 2033

Figure 284: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 285: MEA Market Attractiveness by Type, 2023 to 2033

Figure 286: MEA Market Attractiveness by Brand Type, 2023 to 2033

Figure 287: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 288: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cat Litter Product Market Size and Share Forecast Outlook 2025 to 2035

Cat Litter Boxes Market Analysis by Product Type, Material, End-User, Distribution Channel and Region, Forecast through 2035

Competitive Breakdown of Cat Litter Providers

Smart Cat Litter Box Market Insights – Growth & Forecast 2024-2034

Natural Cat Litter Products Market

Bentonite Cat Litter Market Analysis by Type, Composition, Distribution Channel and Region Through 2025 to 2035

USA & Canada Cat Litter Market Growth, Demand, and Forecast 2025 to 2035

USA & Canada Cat Litter Box Market Trend, Growth and Forecast 2025 to 2035

Automatic Self-cleaning Cat Litter Box Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Cathode Materials for Solid State Battery Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Protection Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Catalog Management System Market Size and Share Forecast Outlook 2025 to 2035

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Acrylic Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Head Catch Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Catering Management Market Size and Share Forecast Outlook 2025 to 2035

Catecholamines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA