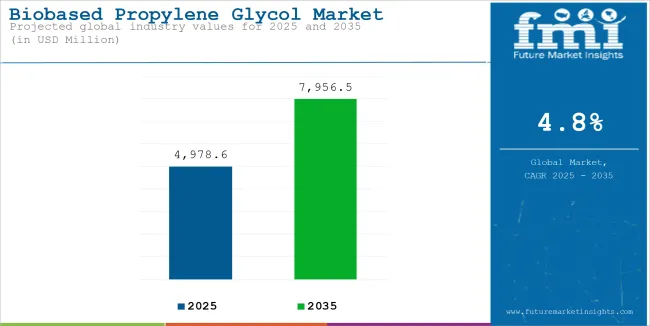

The global biobased propylene glycol sales are on a steady upward trajectory, with a forecasted CAGR of 4.8% from 2024 to 2035. The value reached USD 4,533.0 million in 2023 and is projected to grow to USD 7,956.5 million by 2035. Historically, the industry saw a CAGR of 3.6%, and a 4.5% YOY growth is anticipated in 2025, with a value of USD 4,978.6 million.

Bio-based propylene glycol is growing in use for eco-friendly industries like food, cosmetics, and others. Biobased sources like corn and sugarcane help decrease its dependency on petroleum-based products. Its non-toxic and biodegradable properties are making it attractive for those manufacturers who want to come under environmental regulations.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 4,978.6 million |

| Projected Size, 2035 | USD 7,956.5 million |

| Value-based CAGR (2025 to 2035) | 4.8% |

The increasing demand for sustainable construction materials is promoting biobased polypropylene glycol (PPG) as the next-generation sustainable material for application in eco-friendly adhesives and sealants. Industries today are in high demand for eco-friendly alternatives to traditional, petroleum-based products since green building programs are picking pace. Biobased PPG is a renewable and environmentally friendly option that fulfills the requirement of reducing the carbon footprint of the construction industry.

Biobased PPG enhances the properties of adhesives and sealants by possessing excellent bonding properties, durability, and compatibility with other green materials. Therefore, it constitutes a key material in meeting sustainability standards for current construction projects. With governments worldwide and regulatory bodies promoting green building practices, this demand is to increase significantly over time.

The table below displays the annual growth rates of the global Biobased Propylene Glycol industry from 2025 to 2035. With a base year of 2024 extended into the current year 2025, the report analyzes how the sector's growth trajectory evolves between the first half of the year, January to June, H1, and the second half, July to December, H2. This analysis shall provide the interested stakeholders with industry performance over time, thereby exhibiting potential developments to emerge.

These figures represent the development of the sector in each half year, in the years between 2024 and 2025. During H1-2024, the industry grew by a CAGR of 4.2%, and the rate of growth will increase in H2.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.2% (2024 to 2034) |

| H2 2024 | 4.9% (2024 to 2034) |

| H1 2025 | 4.4% (2025 to 2035) |

| H2 2025 | 5.2% (2025 to 2035) |

Moving into the next period from H1 2025 to H2 2025, the CAGR is expected to increase by approximately 4.4% for the first half and relatively grow by 5.2% during the second half. For H1 and H2, a growth of 20 BPS and 30 BPS was achieved respectively.

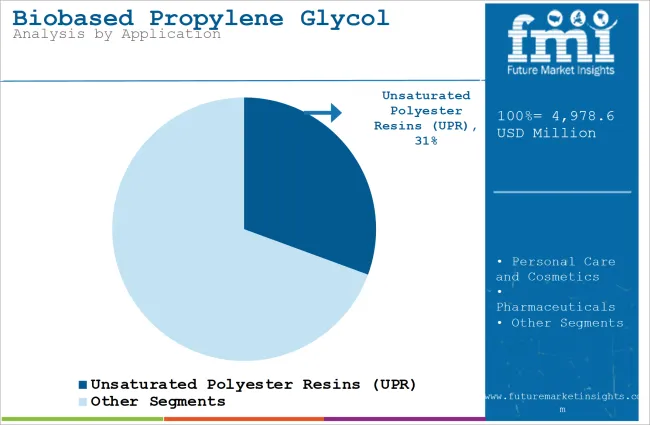

In the bio-based propylene glycol industry, corn-based sources are expected to dominate with a value share of 41.7% in 2025. In terms of application, unsaturated polyester resins (UPR) will lead, accounting for 30.6% of the total sales.

| Segment | Value Share (2025) |

|---|---|

| Corn-based propylene Glycol (by Source) | 41.7% |

The global market for PG derived from corn is growing significantly due to the surging demand for sustainable and renewable chemical alternatives. While industries are trying to reduce their dependence on petroleum-based products, the increasing awareness regarding their depleting stocks has resulted in an eco-friendly alternative with almost identical performance characteristics in the form of corn-derived PG. This trend can be seen in the automotive, construction, and personal care industries, where pressure for the greener variant is significant.

Government policies focusing on bio-based products and sustainability are driving up the adoption rate of corn-based PG. The initiative towards reducing greenhouse gas emissions as well as efforts toward renewable resource usage have given impetus to R&D for bio-based chemicals. This facilitative regulatory atmosphere is encouraging new investment and innovations in the market for corn-based PG, with its prospects looking bright in the future as well.

| Segment | Value Share (2025) |

|---|---|

| Unsaturated Polyester Resins (by Application) | 30.6% |

The global market of unsaturated polyester resins has been showing increasing growth because it is on-demand in most industries. This is the property of a set of excellent thermosetting polymers. There are lots of applications that benefit from them and include, though not exclusively, construction, the automotive and marine industries, as well as the electrical industry, given their superior mechanical properties and excellent chemical resistance.

Bio-based unsaturated polyester resins are also driving market growth. As a renewable resource-based product, it offers environmental benefits and supports the growing trend towards sustainability. Initiatives such as the BioPreferred Program of the USA Department of Agriculture (USDA) have promoted the use of biobased products, enhancing the purchase and use of these products. This program has identified over 100 bioplastic resins as USDA-Certified Biobased Products, a significant shift toward sustainable materials in the industry.

Eco-Friendly Aviation Revolution with Biobased PPG in Deicing Solutions

Ethylene glycol-based traditional deicing fluids have long been environmental adversaries because of their toxicity and ecosystem impacts. Thus, regulatory agencies such as the Federal Aviation Administration (FAA) have focused on finding biodegradable alternatives. An indicator that there is an urgency to substitute deicing chemicals with environmentally friendly alternatives is the FAA's Ground Deicing Program.

The biobased PPG provides a safer, more sustainable way to achieve high performance on the back of requirements for high environmental standards. Its application in deicing solutions supports the recommendations of the FAA to increase environmentally friendly practices in aviation. The Advisory Circular by the FAA on Ground Deicing and Anti-icing programs emphasizes that airlines should observe considerably less harmful deicing agents. Biobased PPG not only helps alleviate these issues but also ensures reliable performance even in severe winter conditions.

This is a giant leap towards making aviation sustainable with the introduction of biobased PPG in aircraft deicing. This helps airlines to safely operate in winter while minimizing the environmental footprint of their operations. It also ensures that airlines adhere to the requirements of regulations while demonstrating their commitment to sustainability and ecological responsibility.

Renewable Feedstocks Driving the Transition to Sustainable Biobased PPG

Biobased products like corn, sugarcane, and soy are being consumed by industries in their increasing quest to reduce their dependence on fossil resources. This drive is based on the premise of sustainability and reducing environmental impacts attributed to petroleum-based products. Rules and corporate sustainability mandates are further propelling the consumption of renewable feedstocks. This is helping spur biobased polypropylene glycol (PPG) demand across different applications.

Biobased PPG from renewable feedstocks, while helping the industry meet ecological standards, offers products with equivalent performance to those derived from conventional sources. Businesses are using this material to service growing consumer demand for environmentally responsible products. The move supports larger global efforts to decarbonize industrial supply chains, setting an enabling backdrop for the expansion of biobased PPG production.

The shift towards the use of renewable feedstocks is a breakthrough for sustainable long-term industries. Increasing focus on resources such as corn, sugarcane, and soy makes sure that a steady supply of raw materials remains available while contributing to lowering carbon emissions. This seals the argument for biobased PPG as an integral component in enabling a greener and more sustainable future.

Challenges in Securing Biobased Feedstocks for Sustainable PPG Production

A challenge lies in the dependency on renewable feedstocks, including corn, sugarcane, and soy for biobased PPG. Agricultural uncertainties like variable weather conditions, unstable crop yields, and seasonality threaten such feedstocks. All these can negatively impact supply chains and compromise constant production to support the increasing demand for biobased materials.

Competition from food supply chains further complicates the matter because these feedstocks are often directed to human consumption and biofuel production. This creates a difficult balance for industries reliant on those resources, which must navigate the ethical and logistical complications of allocating feedstocks for industrial versus food-related applications. As demand for renewable materials increases, these constraints could limit the scalability of biobased PPG production.

Biobased Propylene Glycol's Growing Impact in Sustainable Bioplastics Industry

The industry sees opportunities where the focus on preventing plastic pollution is greater. From renewable resources, such as corn and sugarcane, it can be found that biobased propylene glycol significantly contributes to functional and environmentally friendly bioplastics. Its properties facilitate the manufacture of plastics that break down more easily and safely in the environment, which minimizes long-term plastic waste impact.

As governments worldwide from the EU's Plastics Strategy to individual national bans on single-use plastics begin to formulate regulations around plastic waste, this is a pressing need for sustainable material production. This change from the former situation compels industries to seek out bioplastics as an alternative to conventional plastics, which can either be more easily recycled or composted.

Biobased propylene glycol fills an important niche within the framework of bioplastics that aims for sustainability. The ban by the EU on certain single-use plastics, coupled with the encouragement of green manufacturing practices, will make biobased propylene glycol an ideal solution for a more sustainable and eco-friendly global market.

The global bio-based propylene glycol market has exhibited steady growth from 2020 to 2024, with an average annual growth rate of 3.6%. The market value rose from USD 4,030.0 million in 2020 to USD 4,533.0 million in 2024, driven by its diverse applications across industries such as pharmaceuticals, food & beverages, automotive, and personal care.

A strong driving factor behind market growth is consumer preference towards sustainable and bio-based products. Bio-based propylene glycol, sourced from renewable resources like corn, sugarcane, and soy, carries a very favorable profile toward the environment and appeals to industries in efforts to minimize their impact on the environment. With increased awareness related to climate change and sustainable operations, growth in the bio-based propylene glycol market is likely to remain supported by the continued efforts of the government, industry, and end users seeking a greener alternative.

Looking ahead, the bio-based propylene glycol market is expected to grow between 2025 and 2035 with a forecast compound annual growth rate of 4.8%. The demand for sustainability products, the surging demand for pharmaceutical, food, and automobile industries, and higher investment in green technologies would be some major drivers of the growth. With industries becoming increasingly concerned with decreasing their carbon footprint and new regulations that focus on sustainability, the trend of a rising bio-based and renewable material trend is probably going to help propel the market forward.

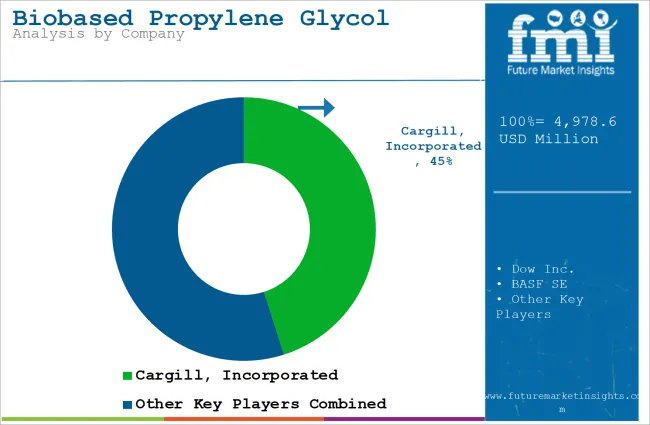

The bio-based propylene glycol market is divided into three key tiers, each with distinct characteristics in terms of revenue, value share, and influence. Revenues exceed USD 200 million by Tier 1 companies holding value shares between 30-35%. Companies such as Cargill, Incorporated; Dow Inc., BASF SE, ADM - Archer Daniels Midland, and LyondellBasell Industries are top-ranking players belonging to this Tier.

They achieve a leadership status with a large manufacturing scale, newest technology, and wider product variety. Their global reach, with a commitment to sustainability, has made them cater to applications in personal care, food & beverage, and industrial coolants and hence influence the trends of the industry.

The 15% to 20% value share falls between Tier 2 companies with USD 50 to 200 million in revenues. Here, some other key players Huntsman Corporation, Repsol S.A., and SK Global Chemical can be seen as part of these large companies having huge regional presence across specialized applications such as automotive coolants, pharmaceuticals, and adhesives.

These will not have as big a worldwide footprint as those of Tier 1 players; however, by offering customized solutions and innovative products to specific industries, they retain a strategic footing. Their ability to serve niche segments with a focus on cost-effectiveness and sustainability further strengthens their role in the market.

Tier 3 companies, with revenues below USD 50 million, contribute to 40-50% of the value share. Companies like P&G Chemicals and GLOBAL BioChem Technology Group are part of this tier. These players focus on regional or specialized industries, offering competitive pricing and localized bio-based propylene glycol products.

Although they are smaller in size, they are still crucial to the system since they meet the specific needs of local sectors and offer niche solutions that the larger companies may not be able to provide. Their flexibility and customer-oriented nature enable them to survive in niche sectors.

The bio-based propylene glycol market is booming globally, especially in the United States, China, Brazil, India, and Germany. This is because sustainability trends in personal care and pharmaceuticals are currently driving the markets in the USA and China, and agricultural resources abound in Brazil for corn and sugarcane-based production. India and Germany see steady growth with increasing adoption in automotive and industrial applications, driven by a shift toward eco-friendly alternatives.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

| China | 6.0% |

| Brazil | 5.8% |

| India | 5.5% |

| Germany | 5.0% |

The construction industry in China is highly booming and the size reached nearly USD 4.80 trillion in 2023. Its growth rate for the period between 2024 to 2032 stands at 6.0% CAGR. This expansion of industry has increased its demand for biobased materials for sustainable construction, which naturally encompasses biobased propylene glycol too.

Biobased propylene glycol has low environmental effects and is also nontoxic being a by-product from renewable resources so is used in paints, adhesives, and sealants, among others. It is aligned with the trend in the industry toward green construction.

The Chinese government continues to promote green building materials, supporting this trend. The total annual operating revenue of sectors engaged in green building materials is projected to exceed USD 42.2 billion by 2026, a plan released by Chinese authorities. This initiative encourages the utilization of renewable materials such as biobased propylene glycol while promoting sustainable development within the construction industry.

The China Green Building Evaluation Label program assesses projects based on aspects like land, energy, water, resource/material efficiency, indoor environmental quality, and operational management. Such a program requires the use of environment-friendly materials, such as biobased propylene glycol, to get certified in the green building certification standards. With increased urbanization and expansion of infrastructure projects, sustainable material integration is highly important to cater to environmental requirements as well as for the achievement of green building certification.

In Brazil, the biobased propylene glycol industry is set to grow at a steady CAGR of 5.8 percent, reaching USD 178.8 million by 2035, driven by its rising use in eco-conscious packaging innovations.

Smart coatings doped with biobased propylene glycol provide multi-functional benefits such as moisture resistance, antimicrobial activity, and shelf-life extension for packaged goods. These coatings benefit product quality and collaborate with the rising interest in Brazil towards eco-friendly packaging solutions. Being a renewable-source-derived biobased propylene glycol, it ensures reduced levels of toxicity and negatively impacts the environment, making it a preferred choice for advanced packaging technologies.

The Brazilian government's actions to remove waste and promote development complement this trend. The National Policy on Solid Waste underlines the use of recyclable materials, or biodegradable ones, which will directly create a friendly environment for biobased smart coatings. As the world of packaging changes, the integration of biobased propylene glycol into smart coatings is to lead in terms of sustainability and innovation.

By 2035, the biobased propylene glycol sales in the USA are poised to reach USD 952.0 million, growing at a robust CAGR of 6.0 percent, fueled by surging demand in the personal care sector for sustainable formulations.

The growth in the United States is fueled by increased consumer awareness of sustainability and the desire for natural and non-toxic ingredients in personal care products. The USA Department of Agriculture's Certified Biobased Product Label further supports this transition by certifying products with high biobased content, encouraging manufacturers to prioritize renewable materials like biobased PPG.

The adoption of biobased PPG in the personal care industry indicates that the sector is moving toward sustainability and innovation. Besides environmental merits, biobased PPG offers a means to enhance product functionality and, thus, is an essential ingredient in developing high-performance, green personal care products. Given increasing regulatory initiatives and consumer preferences favoring eco-friendly formulations, biobased PPG is well-positioned to increasingly redefine the personal care industry in the United States.

Some of the important players in this industry are producing higher volumes since there is great demand in several sectors to boost their respective productions. A good number of firms are utilizing the latest technologies; hence, in turn, streamlining the manufacturing procedures to ensure highly reliable and standard quality bio-based propylene glycol. This ensures that they remain competitive and address the growing demand for sustainable and renewable chemical solutions, especially in applications like automotive coolants, personal care, and food & beverage industries.

Besides production improvements, large companies are entering strategic alliances and joint ventures to encourage innovation and develop new products. Such alliances enable companies to tap into each other's strengths in research and development, manufacturing capabilities, and regional knowledge.

Through such collaborations, these firms can expand their product lines and explore new opportunities. Access to emerging industries and the capacity to address specialized needs in industries such as pharmaceuticals, automotive coolants, and personal care, among others, are also strategic partnerships.

The second critical strategy is the geographic expansion strategy for the top players in the market for bio-based propylene glycol. Global demand for environmentally friendly products continues to grow. Companies expand into untapped geographies and seek opportunities for diverse revenue streams by reducing their vulnerability to saturation and growing demand from developing geographies. Thus, companies are building on these emerging markets as well as riding on the wave of global acceptance of eco-friendly alternatives.

Industry Updates

In terms of Sources, the industry is divided into Corn-Based, Sugarcane-Based, Soy-Based, and Others.

In terms of Application, the industry is divided into Unsaturated Polyester Resins (UPR), Personal Care and Cosmetics, Pharmaceuticals, Food and Beverage, Automotive and Industrial Coolants, Adhesives and Sealants, Deicing Fluids, and Others.

The bio-based propylene glycol industry is expected to reach a valuation of USD 4,978.6 million in 2025.

The bio-based propylene glycol market is projected to attain a valuation of USD 7,956.5 million by 2035.

The bio-based propylene glycol market is anticipated to grow at a rate of 4.8% over the forecast period from 2025 to 2035 in terms of value.

The top countries driving the bio-based propylene glycol demand include the USA, China, Brazil, India, and Germany.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

Biobased Biodegradable Plastic Market Growth - Trends & Forecast 2025 to 2035

Biobased Transformer Oil Market

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Propylene Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Propylene Tetramer Market Size and Share Forecast Outlook 2025 to 2035

Propylene Market

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Propylene Glycol Methyl Ether Market

Polypropylene Yarn Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Random Copolymers Market Growth – Trends & Forecast 2025 to 2035

Polypropylene Packaging Films Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among Polypropylene Woven Bag and Sack Manufacturers

Polypropylene Woven Bag and Sack Market from 2024 to 2034

Polypropylene Screw Caps Market

Polypropylene Film Market

Polypropylene Fibre Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA