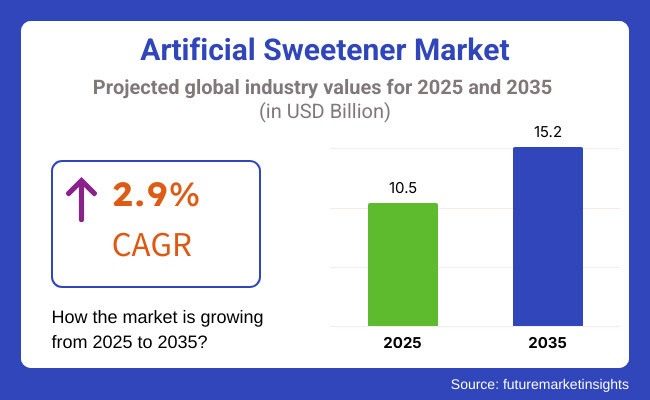

The demand for global Artificial Sweetener market is expected to be valued at USD 10.5 Billion in 2025, forecasted at a CAGR of 2.9% to have an estimated value of USD 15.2 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 2.8% was registered for the market.

As lifestyle diseases like obesity and diabetes become more common consumers are choosing healthier foods to control their calorie intake and enhance their general health. These factors are all contributing to the growth in the market share of artificial sweeteners during the forecast period.

Non-nutritive sweeteners (NNS) also known as artificial sweeteners are food additives that taste sweet like sugar but contain very few or no calories. Chemical synthesis or plant extracts are used to create these substances. Stevia ace-K cyclamate aspartame saccharin and sucralose are examples of artificial sweeteners.

Diet drinks processed foods and tabletop sweeteners frequently contain these sweeteners which the FDA deems safe for consumption. Due to their low-calorie content lack of tooth damage and ability to lower blood sugar these sugary treats are a favorite among diabetics and anyone trying to cut back on calories.

The health effects of artificial sweeteners are still up for debate as some studies have connected them to cancer obesity and other illnesses. Artificial sweeteners should therefore be used sparingly and you should prioritize eating a diet rich in fruits vegetables lean meats and whole grains.

Explore FMI!

Book a free demo

Increase in Diabetes is Driving the Market Growth

The demand for artificial sweeteners is being driven largely by the increasing prevalence of lifestyle diseases like diabetes. Customers are looking for healthier options as they become more conscious of the negative consequences of consuming too much sugar such as obesity diabetes and dental issues. In low- and middle-income nations where more than 80% of diabetics currently reside the prevalence of the disease is predicted to increase the most.

Those watching their weight or cutting back on calories will find artificial sweeteners to be a calorie-free or low-calorie alternative. In response the food and beverage sector has begun adding artificial sweeteners to condiments sodas desserts and snacks.

Awareness in Health Driving the Market Growth

Artificial sweeteners are becoming more and more popular as consumer preferences shift toward healthier options. In the past year 40% of American consumers have cut back on sugar according to the International Food Information Council. 65% of consumers worldwide are consuming fewer sugar-filled beverages.

Consumers who are concerned about their health try to limit their intake of sugar and opt for alternatives that offer sweetness without adding calories. People who want to control their blood sugar levels lose weight or consume less sugar frequently use artificial sweeteners. Another factor propelling the market is the rising incidence of lifestyle diseases like diabetes.

During the period 2020-2024, the sales grew at a CAGR of 2.8%, and it is predicted to continue to grow at a CAGR of 2.9% during the forecast period of 2025 to 2035.

The market for artificial sweeteners provides industry participants with profitable chances to expand their product lines and serve a worldwide consumer base driven by rising urbanization changing dietary habits and rising health consciousness. Convenient low-calorie food and drink options are becoming more and more popular as a result of changing dietary habits and lifestyles brought about by urbanization.

In 2025 35% of diabetics worldwide substituted artificial sweeteners for sugar according to the International Diabetes Federation. This pattern is consistent with the growing number of health-conscious consumers looking for less-processed sugar substitutes. The demand for artificial sweeteners is increasing as a result of shifting dietary habits brought on by things like increased obesity rates and growing awareness of the negative health effects of sugar.

Additionally, there is a growing trend among consumers to seek out products that provide sweetness without the detrimental effects of sugar on health. The growth of functional foods which offer health advantages beyond basic nourishment boosts the market for artificial sweeteners. Artificial sweetener-fortified products appeal to consumers who want to control their blood sugar lose weight or consume less sugar while still enjoying sweet foods.

Industry players can take advantage of these developments by launching cutting-edge artificial sweetener products that satisfy changing consumer demands. To accommodate a range of tastes and preferences for instance businesses can create products with a variety of artificial sweeteners. In order to take advantage of the opportunities brought about by urbanization and shifting dietary habits industry participants will need to invest in R&D to produce competitive products that prioritize quality and affordability.

Tier 1 companies comprises industry leaders acquiring a 40% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 50%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, UK and China come under the exhibit of high consumption, recording CAGRs of 2.4%, 2.4% and 3.2%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.4% |

| UK | 2.4% |

| China | 3.2% |

The consumption of artificial sweeteners is predominantly in the United States. A number of factors are responsible for the rising demand for artificial sweeteners in the USA. Consumers are turning to artificial sweeteners as a result of growing concerns about their health and wellness particularly with regard to sugar intake.

More people are looking for sugar substitutes as they become more conscious of the negative consequences of consuming too much sugar including diabetes obesity and dental issues. People trying to control their weight or cut back on calories will find artificial sweeteners especially appealing because they provide a low-calorie or calorie-free substitute for sugar. Artificial sweeteners are becoming much more popular as a result of this factor particularly among people on diets or weight-management programs.

In order to meet consumer demand for healthier options the food and beverage industry is adding artificial sweeteners to a variety of products such as condiments sodas desserts and snacks. Because artificial sweeteners are widely available and used in packaged foods and beverages the market share of artificial sweeteners in the USA will keep growing.

Chinas artificial sweetener industry is expanding due to a number of factors. These include an increase in the number of cases of diabetes and obesity a rise in consumer health consciousness and a growing desire for foods and drinks that are low in calories and sugar. More people are searching for alternatives to traditional sweeteners as they become more conscious of the negative consequences of consuming large amounts of sugar.

Artificial sweeteners offer this choice since they add sweetness without increasing calorie content which appeals to consumers who are health-conscious. The Chinese population has been moving toward western dietary habits such as a preference for low-calorie and sugar-free products as they become more urbanized and affluent.

The need for artificial sweeteners in a variety of foods and drinks such as dairy products carbonated drinks and confections has increased as a result of this cultural shift.

Over the course of the forecast period the UK is anticipated to hold a 30% market share in artificial sweeteners worldwide. Due to strict food safety regulations and growing consumer awareness of healthy food products the nation is predicted to have the most lucrative market in Europe.

Furthermore, the government of the United Kingdom has successfully carried out a number of programs in recent years that aim to improve people’s lives by launching innovative healthful products that can reduce obesity diabetes and cholesterol. The demand for artificial sweeteners is expected to rise as a result of this initiative supporting the expansion of the artificial sweetener market in the UK.

| Segment | Value Share (2025) |

|---|---|

| Aspartame (Product Type) | 50% |

Due to its high sweetness intensity-200 times that of regular sugar-and ease of use in achieving the desired sweetness aspartame has been the largest shareholder in the artificial sweetener market. Many consumers find aspartame more palatable than some alternatives because it has a flavor profile that is similar to sugar but has the least amount of aftertaste.

It is more appropriate for a wide range of food and beverage applications due to its versatility and stability at different pH and temperature levels which leads to its widespread use. Lastly compared to other artificial sweeteners aspartame has always been a more affordable choice. It is frequently found in gums and other sugar-free goods. This maintains its high demand in the global market and further solidifies its market position.

| Segment | Value Share (2025) |

|---|---|

| Food and Beverages (End-User) | 40% |

Over the course of the forecast period the food and beverage segment is anticipated to dominate the global artificial sweetener market. Sugar has almost entirely been replaced by artificial sweeteners in the beverage industry especially in carbonated drinks. drinks. The market for artificial sweeteners is expanding due to features like natural profiles and clean labels. Additionally, soft drinks sugar content is reduced without sacrificing flavor or appearance. enabling beverage producers to use artificial sweeteners in place of sugar.

To remain ahead of the curve leading producers of artificial sweeteners are embracing innovation. As an example, they are working to create flavors & sweeteners that don’t affect blood sugar levels. In a similar vein new calorie-free sugar alternative are being developed to aid those who suffer from diabetes and obesity.

In order to meet the growing consumer demand for artificial sweeteners significant investments are made in research and development. Businesses use tactics like distribution contracts mergers facility expansions and advertising in an effort to obtain a competitive advantage.

The market is expected to grow at a CAGR of 2.9% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 15.2 Billion.

Rise in Diabetes is increasing demand for Artificial Sweetener.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include DuPont, Tate & Lyle PLC, Cargill Incorporated and more.

By product type, methods industry has been categorized into Aspartame, AcesuIfame-Potassium (Ace-K), Sucralose, Saccharin and Cyclamate

By end-user, industry has been categorized into Food and Beverages, Dairy Products, Bakery & Confectionery, Dietary Supplements, Bread Spreads, Pharmaceuticals and Personal Care Applications

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Fermented Feed Market Analysis by Product Type, Livestock and Fermentation Process Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.