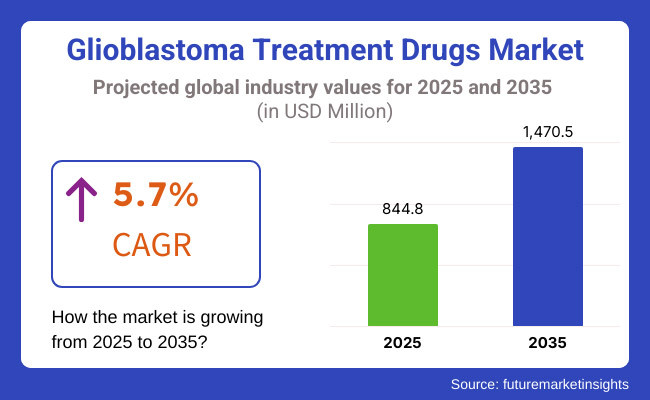

The growth rate of the Glioblastoma Treatment Drugs Market is expected to mark an approximate USD 844.8 million in revenues by 2025 and steadily grow at a CAGR of 5.7% to USD 1,470.5 million by 2035. The Glioblastoma Treatment Drugs Market would have generated nearly USD 799.2 million in revenues in 2024 itself.

The glioblastoma treatment drugs market is set to see high growth from 2025 to 2035 due to the increasing prevalence of glioblastoma multiforme (GBM), advancements in targeted therapies, and increased spending on cancer research.

The major driving factors include the growing application of immunotherapy, personalized medicine, and novel drug delivery systems such as tumor-treating fields (TTFields). Market growth is also driven by improvements in early diagnosis, increasing clinical trial activities, and escalated government funding for brain cancer research.

On the flip side, some restraints for market growth include the high cost of treatment, challenges due to the blood-brain barrier, and the highly aggressive nature of glioblastoma resulting in low survival rates. New openings for industry players are offered with the advent of gene therapy, combination therapy, and AI-enabled drug discovery.

The latest transformation in the glioblastoma drugs market for treatment has been phenomenal in the past decade due to the rapid advancement in science and increased research grants. In addition to this, a better understanding of tumor biology has impacted the market quite a lot.

One such therapy is Optune, FDA-approved and popularly known as a new device for tumor-treating fields (TTFields), which has become the adjunct treatment modality to contribute to increased survival of patients. Few treatment advances were made and frequent recurrences, which remained significant problems.

Research study was done in the early years of the current decade, with many clinical trials being initiated for immunotherapies, targeted molecular therapies, and gene therapy strategies. Early-phase trials with CAR-T cell therapies, immune checkpoint inhibitors, and tumor microenvironment modulators gave rise to a glimmer of hope for potentially better therapies on the horizon.

The way treatment was administered was transformed in 2025 by the progress made in precision medicine, biomarker-targeted therapy, and drug delivery devices, including the incorporation of nanotechnology and blood-brain barrier (BBB)-penetrating materials. Increased collaboration between pharmaceutical companies and research institutes, and actions by regulatory authorities on the acceleration of approvals, have also added to the growth of the market.

Explore FMI!

Book a free demo

The region has the largest market for glioblastoma treatment drugs on account of well-developed research centers, advanced health care systems, and large investments directed toward the oncology drug development industry.

The United States naturally becomes the capitalizing country in North America by having the prominent pharmaceutical companies, keeping pace with the introduction of new treatments, and FDA innovation approvals. These new immunotherapeutic approaches, such as checkpoint inhibitors and CAR-T cell therapy, are transforming the treatment paradigms for glioblastoma.

Germany, France, and the UK are the major national markets. They have sophisticated healthcare infrastructure as well as good regulatory systems. However, stringent drug approval schedules under the European Medicines Agency (EMA) and price control mechanisms operate to the disadvantage of market growth.

Innovations in glioblastoma treatment have been stimulated by factors such as the increasing emphasis on biomarker-based treatment, the increase of gene therapy studies, and the growing links between pharma companies and academic research institutes.

More activity is also seen in the European region in investment in artificial intelligence-enabled diagnosis and precision medicine technologies, thus further boosting treatment approaches. Initiatives for the incorporation of personalized treatment regimens into national health schemes also propel the market.

The Asia-Pacific market for glioblastoma treatment drugs is experiencing growth due to increasing incidence of cancer, improved healthcare access, and rising pharmaceutical R&D spending. Top markets are China, Japan, and India, where greater focus has been laid on early detection improvement, trial expansion, and access to advanced therapies, among others.

Some of the challenges that are however faced by market penetration include high costs for therapies, lack of access to neuro-oncology specialist services, and regulatory hurdles. Growing use of biosimilars to treat cancer, institute-initiated gene-based therapy advancements, and government-sponsored research into brain cancer are key factors driving the market.

Furthermore, new glioblastoma therapies are rapidly making it to market through alliances between local and global pharmaceutical firms. Expanding AI-based screening programs and telemedicine-led consultations also contribute to better detection and improved treatment outcomes.

Challenges

Breaking Down Market Barriers: Aggressive Nature Of GBM, High Recurrence Rates

The glioblastoma drug market is hampered by numerous barriers, including GBM's highly aggressive nature, high recurrence rates, and very low-efficacy therapies. Furthermore, the blood-brain barrier blocks drug entry, making most conventional chemotherapy drugs less effective. Costly new drugs, lengthy regulatory cycles for approval, and side effects of current agents are other obstacles to uptake.

And on top of it, resistance to conventional treatments that include temozolomide is another great challenge, and this results in unfavorable patient outcomes. Lack of standard treatment regimes and a far smaller number of clinical trial facilities in some parts of the geography are also impairing the treatment availability and advancements. On top of all these is the complicating factor offered by glioblastoma biology with many gene mutations that defies efforts towards developing a single-fits-all solution.

Opportunities

The increasing adoption of targeted therapies and personalized treatment

Growing adoption of targeted therapy and personalized treatment regimens are of huge growth potential within the glioblastoma treatment drug market. Advances in technical technologies in gene therapy, oncolytic viruses, and RNA medicines are improving treatment outcomes. Integration of AI and machine learning into drug development is accelerating the process of developing new glioblastoma drugs.

Apart from this, increased investments in combination therapies, i.e., immunotherapy with chemotherapy or radiation, are also enhancing the effectiveness of the treatments. Growth in precision oncology, liquid biopsy diagnostics, and glioblastoma companion diagnostics is also driving market growth.

Favorable government schemes for research into rare cancers and increased access for patients to clinical trials is also boosting innovation in treatment approaches. The surge of patient-centered model drug development through the focus on quality-of-life and symptom control is also impacting the marketplace.

The years between 2014 to 2021 witnessed the introduction of immune checkpoint inhibitors and CRISPR gene-editing technology, which are transforming the therapeutic landscape of glioblastoma by improving survival rates and decreasing toxicity to a considerable extent. Results are also encouraging by creating vaccines-based therapies against glioblastoma-specific antigens to increase patients' survival.

A tech innovation could be found in the development of the Tumor Treating Fields (TTFields) methodology. The growing practice of utilizing TTFields therapy to interrupt cancer cell division by electrical field application provides alternative non-surgical treatment options to enhance survival for glioblastoma patients. Innovations in wearable TTFields devices are increasing convenience and compliance among patients.

Regulatory/Policy Changes: Due to accelerated drug approvals for glioblastoma, funding for brain tumor research, and fast-track designations for promising experimental therapies aimed at improving patient access, governments and regulatory bodies are perhaps playing a larger role lately. Also, initiatives for global clinical trial network creation for rare cancers such as glioblastoma are fostering rapid innovation and quick patient enrollment.

Monitoring for combination therapies because of improved outcomes of treatments: The more we mix therapies, immunotherapy with chemotherapy or target drugs, the higher survival rates are improved while at the same time managing drug resistance in glioblastoma patients.

This glioblastoma pharmaceutical market grew primarily during the period 2020 to 2024 due to the increasing incidence of glioblastoma multiforme (GBM), technological advancements in treatment, and increasing awareness and consequent early detection. Additional growth drivers were the launch of new treatments, i.e., targeted therapies and immunotherapies, that both enhanced patient outcome and treatment choice.

Major trends which would define the market were advancements in personalized medicine approaches, utilization of artificial intelligence to discover drugs, and biosimilar development for improved access to treatment New innovation routes and wider therapeutic pipeline will come from research collaborations between pharmaceutical organizations and research centers.

In alignment with market development, stakeholders will also need to place on the agenda regulatory compliance, affordability, and patient-accepted care models to meet the varied and increasing demands of worldwide glioblastoma patients.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory Framework Accelerated approval mechanisms are granted to innovative therapies that bear potential promise in their ability to satisfy an unmet medical need, with regulators facilitating their rapid entry into the market. |

| Technological Advancements | Technological Advancements Targeted therapy and immunotherapeutic approaches allow for relatively high levels of specificity and efficacy in treatment affecting survival rate and quality of life among patients. |

| Consumer Demand | Consumer Demand Increased awareness of glioblastoma has driven patients to demand more effective and less invasive treatments; patients want therapies that provide better outcomes with minimal side effects. |

| Market Growth Drivers | Market Growth Drivers Rising cases of glioblastoma, having great investments on R&D, and enabling governmental policies fostering innovation in therapeutics. |

| Sustainability | Sustainability First initiatives would include green manufacturing practices and a reduction of the negative impact of pharmaceutical production on the environment, with a few companies working with green chemistry. |

| Supply Chain Dynamics | Supply Chain Dynamics The structure largely relies on existing distribution networks to ensure that therapies are available in urban and peri-urban health facilities with hindrances sometimes being experienced in reaching remote communities. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Comprehensive guidelines for personalized medicine are thereby implemented, as well as for biosimilars, to ensure standardized protocols that would ensure the patient's safety while promoting competition and affordability. |

| Technological Advancements | Further, artificial intelligence and machine learning are used in drug discovery and development to speed the identification of new targets in therapy and the optimization of treatment regimens. |

| Consumer Demand | Increasingly, patients are looking for personalized treatment regimens where they can work with health care providers in tailoring a therapeutic approach based on individual genetic profiles and on disease presentation aimed at enhancing efficacy while minimizing adverse effects. |

| Market Growth Drivers | Exploiter of the potential of emerging markets by establishing healthcare systems, increasing focus on earlier diagnosis and intervention, and strategic partnerships between pharmaceutical companies and research institutions to enhance innovation and accessibility. |

| Sustainability | Sustainability, broadly labelled, would consider biodegradable materials, resource-efficient manufacturing processes, and carbon footprint-cutting measures in drug development and distribution. |

| Supply Chain Dynamics | Supply chains are in the process of being optimized with digital technologies and e-commerce platforms for transparency, efficiency, accessibility, and to ensure that timely delivery of therapies is made to a global citizen including once residing in the remote and underserved regions. |

Market Outlook Very strong growth will be seen for the glioblastoma treatment drugs market in the United States due to the high prevalence of glioblastoma multiforme (GBM) and to the progressive development of therapeutic interventions.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.3% |

Market Outlook

The Chinese market for glioblastoma treatment drugs is likely to grow extensively with the fast growth in healthcare investment and rise in brain tumors.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.7% |

Market Outlook The robust growth in the glioblastoma treatment drugs market can be attributed to increasing disease awareness and improving healthcare infrastructure in India.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.7% |

Market Outlook Germany's glioblastoma treatment drugs market is poised for steady growth, thanks to a well-equipped healthcare system and continued research in neuro-oncology.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.1% |

Market Outlook The gleobalstoma treatment drugs market is witnessing advancements in Brazil due to increased investments in health care and the concomitant increase in brain tumors' prevalence.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.2% |

Alkylating Agents

Alkylating forms the key drug class in the treatment of glioblastoma (GBM). Alkylating drugs are known for their specificity in damaging DNA the main mode of action. Temozolomide (TMZ) is the most popular agent in this category and is often given together with radiation therapy as the first line treatment for newly diagnosed patients with GBM.

The increasing incidence of glioblastoma, the trend toward combination therapies using alkylating agents and immunotherapy, and the ongoing clinical trials of newer mechanisms of drug delivery (such as nanoparticles and biodegradable wafers) are boosting growth in the market.

North America and Europe top the lists in the use of these agents; however, the demand in Asia-Pacific is also expanding due to increasingly available neuro-oncology treatments. Future developments would include AI-powered predictive modeling for alkylating agent response, next-generation drug formulations for improved blood-brain barrier (BBB) penetration, and personalized chemotherapy regimens based on biomarker-driven tumor profiling.

VEGF/VEGFR Inhibitors

Among the Anti tumoriculogenic factors targeting GBM would be the approval of RBPs in the treatment of glioblastoma for blocking vascular endothelial growth factor from developing blood vessels that supply a tumor. This is useful in the treatment since anti-angiogenic therapies reduce blood vessel formation, essential for tumor growth.

Recurrent cases of GBM usually make most of the patients gain anti-angiogenic therapy, especially in instances where tumors become resistant to standard chemotherapy. Factors influencing the market demand are the increased use of anti-angiogenic therapies, growth in research works targeting VEGFR combinations with drugs, and advancement in molecular biomarker-driven treatment decision-making.

North America and Europe bright as the primary regions in terms of MARKETING ADOPTION of VEGF inhibitors, and all these regions possess high-grade clinical evidence for the use of these inhibitors. Future advancements include the use of machine learning in drug repurposing to bring better efficacy of VEGFR inhibitors, combination therapy with immune checkpoint inhibitors and VEGF blockers, and gene therapy approaches to tumor vasculature.

Hospitals

The distribution channel comprising hospitals is the leading channel for glioblastoma drugs as management of GBM is done mostly by the expertise of neuro-oncology which requires a multidisciplinary treatment team and accessibility to advanced surgical and radiation therapy facilities.

Hospital-based chemotherapy, radiotherapy, and surgery are the major procedures in glioblastoma patients making it the primary distribution channel through which drugs are administered. The growing incidence of GBM, increasing clinical trials focusing on novel GBM therapies undertaken by hospitals, and a continuing increase of targeted combination treatment adoption are driving the demand.

North America and Europe have high stakes with respect to hospital-based GBM treatment, while Asia-Pacific is developing due to the betterment of hospital infrastructure and expanding neuro-oncology programs. Future trends will be the hospital introduction of AI-assisted treatment planning, use of wearable biosensors for real-time patient monitoring, and personalized immune therapy regimens for GBM driven by the hospital.

Cancer Research Organizations

Cancer research organizations are a vital part in the development of glioblastoma drugs, as GBM remains one of the most aggressive and treatment-resistant brain cancers. These organizations include clinical trials for experimental therapies (like gene therapy and oncolytic viruses) and the promotion of precision medicines in GBM patients.

Along with these issues, continuous growth in glioblastoma research investment and increases in the collaboration between biotech companies and research institutions will bring all the trends under one platform. North America and Europe dominate glioblastoma research initiatives, while increasing involvement is seen in Asia Pacific because of the expanding government-supported oncology R&D programs.

Competitive Outlook The highly competitive market of glioblastoma treatment drugs is attributed to the aggressive nature of the disease, few choices of treatment available, and further research in targeted as well as immunotherapy-based treatments.

Competition is mainly on the use of chemotherapies, kinase inhibitors, and tumor treating fields for the companies to edge over others in the competitive market. The market is shaped by well-established pharmaceutical firms, biotech innovators, and emerging oncology-focused companies, where every company is contributing to the evolving landscape of glioblastoma treatment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Merck & Co., Inc. | 23.8% |

| Roche Holding AG | 18.4% |

| Bristol-Myers Squibb | 15.9% |

| Novartis AG | 14.8% |

| Bayer AG | 23.3% |

| Other Companies (combined) | 3.7% |

| Company Name | Merck & Co., Inc. |

|---|---|

| Year | 2025 |

| Key Offerings/Activities | Market leader offering Keytruda, an immunotherapy drug being investigated for glioblastoma treatment. |

| Company Name | Roche Holding AG |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Develops Avastin (bevacizumab), an anti-angiogenic therapy commonly used for recurrent glioblastoma. |

| Company Name | Bristol-Myers Squibb |

|---|---|

| Year | 2025 |

| Key Offerings/Activities | Provides Opdivo, a PD-1 checkpoint inhibitor being explored for glioblastoma treatment. |

| Company Name | Novartis AG |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Specializes in targeted oncology therapies, including investigational drugs for glioblastoma. |

| Company Name | Bayer AG |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Offers experimental therapies focusing on kinase inhibitors and immune-modulating treatments for glioblastoma. |

Key Company Insights

Other Major Players The remaining companies outside the leading ones contribute significantly to the marketplace, increasing product diversification and technology advancement.

These include:

These companies focus on expanding the reach of glioblastoma treatment options, offering competitive pricing and cutting-edge innovations to meet diverse patient and healthcare provider needs.

The overall market size for Glioblastoma Treatment Drugs Market was USD 844.8 million in 2025.

The Glioblastoma Treatment Drugs Market is expected to reach USD 1,470.5 million in 2035.

Growing Preference for Glioblastoma has significantly increased the demand for Glioblastoma Treatment Drugs Market.

The top key players that drives the development of Glioblastoma Treatment Drugs Market are Merck & Co., Inc., Roche Holding AG, Bristol-Myers Squibb, Novartis AG and Bayer AG.

Alkylating Agents leading is Glioblastoma Treatment Drugs Market is expected to command significant share over the assessment period.

Antineoplastic, VEGF/VEGFR Inhibitors, Alkylating Agents and Miscellaneous Antineoplastic

Hospitals, Cancer Research Organizations, Long Term Care Centers and Diagnostic Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

Bone Regeneration Market Analysis - Size, Share & Forecast 2025 to 2035

Manometry System Market Overview - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.