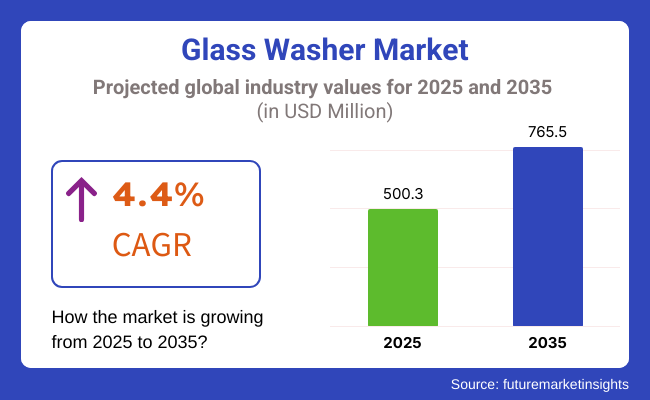

According to the analysis of Future Market Insights, the global glass washer industry is anticipated to cross USD 500.3 million in 2025 and is predictive to reach USD 765.5 million by 2035 surging at a notable CAGR of 4.4%. The increasing adoption across residential, commercial, and industrial sectors, boosted by the increasing hygiene norms and efficiency demands is driving this segment’s growth.

Glass washers, apparently used to quickly clean out a large volume of glassware, are now the most demanded in high-drink order businesses mainly pubs, clubs, and sports bars. This continuous demand from these sectors will fuel the sales of glass washers in the coming future.

Moreover, because of the easy installation and budget-friendly nature, the wash and dump glass washer segment will continue to rule in the industry, mixing accurately with the preferences of domestic consumers and business firms.

Looking region-wise, Europe and North America combined will hold the major part of industry share, driven by the rising demand and establishments of restaurants, bars, and hotels.

Explore FMI!

Book a free demo

Between 2020 and 2024, the international industry for glass washers grew aggressively as companies placed value on efficiency, sanitation, and automation. In order to make their process more precise and meet the stringent cleanliness regulations, hotels, restaurants, and bars improved their utilization of glass washers. Pressure for innovation pushed companies to produce high-speed, compact models with varying commercial requirements.

Moving forward in 2025 to 2035, with the emergence of artificial intelligence and loT-supported solutions the industry will undergo a revolutionary transition. These upcoming advancements will enhance automation by providing real-time monitoring and predictive maintenance.

Sustainability will become the core highlight for the businesses and they will start promoting the manufacturing of environmental friendly glass washers integrated with low water and energy usage. The blend of digital technologies and conventional manufacturing will open gateways to new avenues, expanding the economic growth and curating a more elevated industry landscape.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand from hospitality and food service: The trend of maintaining hygiene and streamline operations in hotels, bars and restaurants is leading the demand of glass washers. | High initial investment and installation costs: The high initial cost of commercial washers remains a hurdle for the deployment of these tools, especially with respect to small businesses. |

| Stricter hygiene and food safety regulations: Automation of glass-washing solutions is being adopted by the businesses due to governments implementing higher sanitation standards. | Ongoing maintenance and operational expenses: With glass washers, costs associated with detergents, turnaround time, and energy consumption, as well as servicing, add to glass washer's long term costs. |

| Advancements in automation and smart technology: The demand for smart touchless operation, real-time monitoring, and automated cycles to boost the efficiency and lower reliance on labor. | Limited adoption in developing markets: Many small businesses in these sectors still rely on washing by hand as they do not have the financial capacity or information to switch to other methods of cleaning. |

| Shift toward energy-efficient and eco-friendly solutions: As sustainability concerns continue to grow, water-saving and energy-efficient models are becoming more popular. | Availability of manual and low-cost alternatives: Many small establishments continue with handwashing or use low-cost dishwashers. |

| Expansion of commercial kitchens and catering services: These factors are driving demand for performance-grade glass washers, with cloud kitchens, catering businesses, and fast-food chains growing quickly. | Fluctuating raw material and production costs: Affordability and profitability can be affected by fluctuating prices for stainless steel, plastics, and electronic components. |

| Government initiatives promoting water conservation: Regulations promoting water-efficient and hygiene cleaning equipment are also facilitating the sectors to expand. | Supply chain disruptions affecting production: Geopolitical tensions, transport delays, material shortages disrupt manufacturing and distribution. |

| Rising adoption in residential and small commercial setups: Compact and under counter glass washers are taking off in home bars, boutique hotels and cafes. | Slower penetration in budget-conscious businesses: Many small to medium-sized restaurants and bars postpone automation investments because of their budget constraints. |

Impact Assessment of Key Drivers

| Key Drivers | Impact |

|---|---|

| Growing demand from hospitality and food service | High |

| Stricter hygiene and food safety regulations | High |

| Advancements in automation and smart technology | High |

| Shift toward energy-efficient and eco-friendly solutions | Medium |

| Expansion of commercial kitchens and catering services | High |

| Government initiatives promoting water conservation | Medium |

| Rising adoption in residential and small commercial setups | Medium |

Impact Assessment of Key Restraints

| Key Restraints | Impact |

|---|---|

| High initial investment and installation costs | High |

| Ongoing maintenance and operational expenses | Medium |

| Limited adoption in developing sectors | High |

| Availability of manual and low-cost alternatives | Medium |

| Fluctuating raw material and production costs | Medium |

| Supply chain disruptions affecting production | High |

| Slower penetration in budget-conscious businesses | Medium |

Dump glasswashers and wash and dump glasswashers will continue to be popular because they are cost-effective and simple to install, making them a favorite among restaurants and bars. Cold rinse glasswashers will become increasingly popular as companies want to save water and save on energy bills. Recirculating glasswashers will continue to grow steadily, especially in areas where there are water usage restrictions, as they provide effective cleaning using minimal resources.

There are a range of designed-for-operation-in-sink glass washers that will cater to small-sized customers, like home bars and small cafés, for whom space and economics are key. In general, under-counter glasswashers will remain popular in commercial kitchens or hospitality locations where high-performance cleaning is required in limited space. Fast moving conveyor glasswashers will become in high demand in high-volume environments including breweries, banquet halls, and large catering operations, where constant cleaning is of utmost importance.

Residential demand will increase with homeowners' investment in convenience-oriented high-quality glasswashers and upscale in-home dining experience. Restaurants, hotels, and bars will continue to be the industry leaders as they seek speed and efficiency in glasses cleaning. The brewery, large-scale food production, and catering industries, where hygiene and efficiency are essential in high-output environments, will drive adoption for industrial use. Other applications such as cruise ships, stadiums and high-end entertainment centres will drive continued industry growth

Automatic and full-automatic glasswashers will see robust demand as companies focus more on labor efficiency and convenience of operation. These models will be equipped with intelligent sensors and IoT features to enable real-time monitoring and predictive maintenance. Fully automatic models will lead in large-scale establishments where human intervention is minimal. Semi-automatic glasswashers will continue to have a steady industry presence, especially in cost-conscious companies that need flexibility between manual and automated operation. Small restaurants, bars, and coffee shops will depend on semi-automatic versions due to their cost and flexibility.

Electric glasswashers will continue to be the preferred choice in the industry because they are highly efficient, automated, and can work with high washing volumes with low manual intervention. Their compatibility with energy-saving technologies and sophisticated filtration systems will add to their popularity.

Mechanical glasswashers will have niche applications in areas where there is unreliable electricity supply or in environmentally friendly installations that emphasize low energy use. Though their use will be restricted in comparison to electric versions, they will still be viable in certain areas where energy prices are an issue.

| Countries | CAGR |

|---|---|

| United States | 4.14% |

| Canada | 4.14% |

| United Kingdom | 4.14% |

| France | 4.14% |

| Germany | 4.40% |

| South Korea | 4.14% |

| Japan | 3.82% |

| China | 5.24% |

| India | 5.24% |

In 2025, the United States will continue to dominated the glass washer industry, mainly the North America region with an approximately 68% of the industry share. The country’s growth will be led by the rising need in the hospitality sectors including, restaurants, bars and hotels. These sectors continuously demand for elevated glass cleaning technologies to meet the operational needs.

As the rigorous cleaning standards and continuous need from consumers for spotless glassware tends to rise, the usage of high-end glass washer technologies in commercial and industrial environments is also expanding. Additionally, the constant sustainability initiatives in USA are directing the foodservice providers to invest in green glass washers to reduce the usage of water and washing items.

In 2025, moderate growth is predicted on Canadian glass washer industry. Demand is bolstered by the expanding foodservice sector in the country, and growing focus on energy-efficient and eco-friendly appliances. Government incentives for green practices prompt business owners to invest in new systems for washing glasswear, increasing business efficiency and improving health compliance.

Additionally, the increasing use of smart kitchen solutions, including water-conserving and energy-efficient glass washers in commercial environments, is propelling the growth of the industry. Moreover, the emergence of hospitality chains and an increase in consumer demand for high-end food options lead to a steady need for advanced glass-washing systems.

The UK glass washer industry is predicted to grow steadily in 2025 owing to active pub and restaurant industry. As the number of food and beverage establishments continues to grow, so does the need for effective glass washing solutions to ensure customer satisfaction while maintaining rigorous health standards. Advanced technologies integrated into glass washers, such as smart features, appeal to companies looking to increase service quality and operational effectiveness.

Emergence of automated kitchens and digital integration in the hospitality sector bolster adoption of high-performance glass washers. Also, stringent government regulations regarding hygiene and water conservation help to push the companies to step into advanced technology.

The French industry will grow moderately in 2025 for glass washing machines and equipment. With the country having a strong economy and vibrant café culture, washing glassware which is both quality and effective creates demand. French companies appreciate machines which symbolize their attention to quality and tradition and thus ensure solid demand for high-end glass washers offering a seamless cleanliness and hygiene.

Also, the rising penetration of luxury fine dining and fine wine culture favors high-end glass washer models. The growing demand for energy-efficient and sustainable appliances motivates companies to introduce green solutions for restaurants, bars, and hotels.

Germany's glass washer industry is to witness high growth in 2025, spurred by the country's engineering proficiency and focus on efficiency. The prevalence of beer halls and breweries, which form an integral part of German life, necessitates sophisticated glass washing technology to provide hygiene and improve service speed. Germany's large industrial base is also a driver for the increased demand for precise and dependable glass washers.

The industry more and more incorporates automated and intelligent glass washers, which are integrated with more comprehensive kitchen automation systems. The increasing customer demand for environment-friendly appliances further fuels innovation in water- and energy-saving glass washers, thereby fueling further industry growth.

South Korea's glass washer industry will register steady growth in 2025, powered by the nation's vibrant entertainment and dining industries. Restaurants, karaoke bars, and high-end eateries make for a steady demand for efficient glass cleansing solutions. The fast pace of smart technology and IoT-powered appliance adoption in South Korea encourages usage of automated washers for glass to enhance efficiency and customer satisfaction.

The increasing demand for upscale dining and upscale beverage service stimulates demand for high-speed and advanced glass washers. Moreover, the increasing trend of Western-style dining and nightlife further increases the installation of highly sophisticated glass-washing systems in commercial places.

The industry for glass washers in Japan is expected to expand moderately in 2025. The country's fastidious focus on presentation and cleanliness in the hospitality industry fuels demand for effective glass washing machines. Izakayas, high-end bars, and contemporary fine dining restaurants require compact yet efficient glass washers that respect space limitations without compromising Japan's high standards of hygiene and service.

There is increasing demand for energy-saving and water-conserving models because Japan is emphasizing sustainability. Moreover, the incorporation of automated and convenient glass washers that are compatible with Japan's technologically driven kitchen systems keeps driving industry growth.

China's glass washer industry will see significant growth in 2025, driven by burgeoning urbanization and the growth of the middle class. The increase in restaurants, bars, and hotels in large cities boosts demand for effective glass cleaning products.

The use of international standards of hygiene and government policies that encourage innovative cleaning technologies also drive the industry forward. In addition, there is an increasing demand for high-speed, automatic, and large-capacity glass washers, particularly in commercial restaurants and big restaurants. There is also increasing integration of smart, IoT-connected glass washers to enable companies to automate operations and enhance efficiency.

In the coming decade, the Indian glass washer industry is anticipated to grow with a moderate compound annual growth rate on account of increased awareness of the benefits of glass washers along with favorable government policies.

The increasing periphery of food and beverage outlets, coupled with incredibly affordable glass washing services from business establishments further supports this growth. As hygiene needs-escalate and the hospitality industry expands, the demand for glass washers in-India can be expected to grow steadily

These industry forces capture the varied drivers of glass washer technology adoption and expansion in various nations, conditioned by cultural, economic, and technological environments.

During the time period of 2025 the key leaders of glass washer industry will focus more on innovation and strategic growth to solidify their industry presence. Major business firms like Ali Group and Hobart are investing in research and development to introduce energy-efficient and portable glass washers to cater the evolving demands in the hospitality sector. These technologies are specially designed with features that offer less cost spending while adhering to the rigid environmental standards.

New startups are coming into the industry with new-age technologies and niche products. For example, some startups are creating IoT-supported glass washers that enable remote monitoring and predictive maintenance, leading to improved operating efficiency for the end-users. Others are going in for sustainable designs, employing biodegradable cleaning chemicals and water-conservation technologies to win over green consumers.

Partnerships and collaborations are also leading strategies in 2024. Established companies are teaming up with tech companies to enrich their products by providing innovative features like automation and smart control. As a result, startups seek partnerships with local distributors to gain better exposure in the industry and be present in competitive environments. The strategic partnerships are a reflection of an evolving glass washer industry that is driven by innovation and a dedication to serving diverse customer requirements.

The demand is rising due to growing hygiene standards, automation in commercial kitchens, and the expanding hospitality sector.

Under-counter and conveyor glass washers are widely used due to their efficiency, compact design, and ability to handle high volumes.

IoT-enabled and energy-efficient glass washers are becoming popular, allowing remote monitoring, lower water usage, and improved cleaning performance.

China and India are witnessing rapid growth due to increasing restaurant chains, urbanization, and rising awareness of hygiene standards.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.