Worldwide glass tempering system market will derive steady growth in between 2025 and 2035, due to the rise in demand for energy efficient, high-strength and durable glass solutions for end use industries. Tempered glass is gaining audiences in the automotive, construction, and electronics applications, which are also a significant driving factor for the market growth.

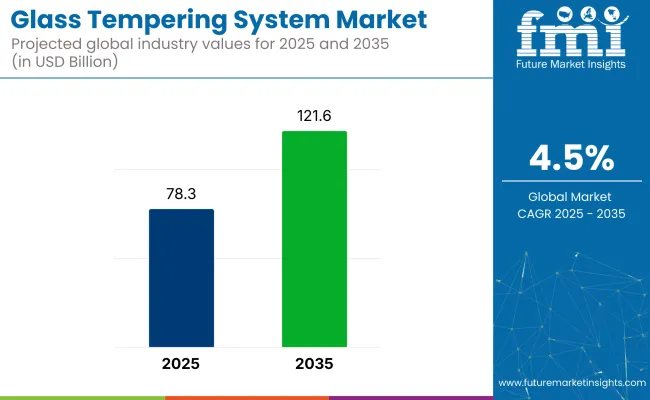

Estimated to be USD 78.3 Billion in 2025, the market is poised to reach USD 121.6 Billion by 2035, recording a CAGR of 4.5% over the forecast period. Demand for innovative glass tempering technologies is being driven by thriving construction industry in various developing economies and rising investments in infrastructure.

They are also planning to come up with strict safety norms in building construction and automotive industries and these plastic and laminated glass sector is expected to develop new automated and energy-efficient glass tempering systems resulting in increased glass strength, thermal resistance, and optical clarity.

The deployment of Industry 4.0 technology solution such as IoT-enabled tempering systems with real-time monitoring is transforming the industry by increasing production efficiency and lowering production and operational cost.

Additionally, the increasing environmental awareness and sustainability efforts are driving the demand for eco-friendly glass tempering solutions that minimize energy usage and carbon footprint. The market is further fueled by progress in smart glass technology, as tempered glass is increasingly adopted in solar panels, touchscreens, and automotive windshields.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 78.3 Billion |

| Market Value (2035F) | USD 121.6 Billion |

| CAGR (2025 to 2035) | 4.5% |

North America leads the glass tempering system market share, with a major chunk taking place in the USA and Canada. This growth in the region has been attributed to the growing demand for the use of safety glass in construction, automotive and electronics industries.

High performance tempering systems are being driven by USA building safety regulations, including ASTM standards for tempered glass in commercial buildings, which are quite stringent. Plus, the growing electric vehicle (EV) industry is driving demand for high-strength tempered glass in automotive windshields and sunroofs.

Breakthroughs in automation of glass processing are allowing manufacturers to deliver high-quality tempered glass while consuming less energy. Companies are adopting IoT based monitoring in tempering machines which trim down the downtime thus optimizing production efficiency.

In addition, sustainability initiatives throughout the region are driving manufacturers to seek investment in energy-efficient tempering solutions that also adhere to LEED certification requirements for sustainable building materials.

Germany, France, Italy and the UK are the major markets in the European glass tempering systems market. The European automotive industry is contributing significantly to the high-quality tempered glass market, especially with manufacturers that include BMW, Mercedes-Benz, and Volkswagen.

Upsurge in Urbanization and Smart city projects: development of construction industry in Europe. The use of energy-efficient building materials was encouraged by governments of several countries such as Germany and France, hence increasing the demand for advanced glass tempering technologies.

The EU has stringent regulations on the type of safety glass adhering to EN 12150 standards and thus manufacturers are concentrating on precision tempering systems enabling them to manufacture flawless, defect-free safety glass for the architectural applications. Research and development (R&D) investment in developing low-emission glass tempering processes is also noticeable across the region.

Furthermore, tempered glass is being increasingly used in photovoltaic (PV) panels as the solar energy sector grows in Europe. Tempered glass would play a significant role in the solar energy infrastructure as countries prepare to make a transition towards renewable energy sources.

The Asia-Pacific region is expected to be the fastest-growing region in terms of glass tempering system market due to rapid industrialization, urbanization, and demand for automotive production. China, India, Japan, and South Korea are the primary sources of this growth.

As the largest consumer and producer of tempered glass, China has strong demand from the construction and automotive industries. Growing initiatives by governments around the world towards energy efficient buildings are shaping the landscape for demand for advanced glass tempering solutions.

In the civil engineering and construction fields, India is fast becoming a driver market due to the rapid growth of infrastructure projects that need high-performance tempered glass. With the Make in India initiative, tempering systems are being manufactured in the nation and that avoids importation.

Japan and South Korea has high-tech manufacturing industries that make use of this smart glass technologies home and abroad, in particular, in consumer electronics, automotive displays, and solar panels. Fully automatic, AI-led glass tempering machines are being increasingly adopted, ensuring high precision and energy efficiency in production.

In summary, Asia-Pacific is a high-potential region for global manufacturers to drive technology innovation and explore new partnership models to better connect with hyper-growth markets.

Challenges

Opportunities

The global glass tempering system market witnessed the highest growth rate from 2020 to 2024 because of increasing demand from construction and automotive and electronics sectors. The upsurge in urban infrastructure projects, along with growing requirement for safety glass in residential and commercial structures are contributing factors to market expansion. Construction of windows, doors, facades and partitions with tempered glass began to spread in popularity.

Furthermore, the automotive sector fueled demand, with tempered glass being increasingly used in the manufacturing of automobiles, including windshields, side glasses, and sunroofs, to improve passenger safety and durability. The consumer electronics industry also began using tempered glass in products including smartphones, tablets, and LED displays, which complimented the growth of the market.

"Beneath the surface of this segment, we found that suppliers were striving to deliver next-generation tempering solutions to improve glass strength, thermal performance, safety, and energy efficiency.

Precision-controlled heating and cooling systems were developed used by companies to successfully temper glass with uniform tempering solutions and reduced risk of breakage during processing. Digitization and automation revolutionized the traditional tempering process through advancements like real-time process monitoring for quality assurance and production optimization.

CNC controlled furnaces, robotic handling systems, and AI driven monitoring solutions ensured streamlines of operations with minimal material waste. Innovations in coated and laminated glass technologies also improved optical clarity, energy efficiency, and scratch resistance of tempered glass.

The global sustainability movement gained momentum, and manufacturers started paying attention to energy-efficient tempering systems that minimized carbon footprints and operational expenses. Glass: eco-friendly production methods results in low-energy glass tempering furnaces, optimized airflow design, improved insulating materials to minimize heat loss.

Stringent safety and environmental regulations imposed by the Government and regulatory bodies forced the companies to invest in innovative glass processing technologies. As sustainability became a fundamental driver in the industry, companies then implemented advanced filtration and waste heat recovery systems to meet evolving environmental standards.

On the other hand, in architecture and automotive sectors, the demand for highly unique and precise smart glass applications have fuelled the need for custom tempering solutions, which in turn has increased the requirements for specialized tempering product.

The period between 2025 and 2035 will see a transition to AI-backed automation, energy-efficient tempering solutions, and connection with smart manufacturing ecosystems. As Industry 4.0 principles gain traction, these glass tempering systems will leverage IoT-enabled sensors, cloud-based data analytics, and predictive maintenance algorithms to improve productivity and reduce downtime.

Digital twin technology is evolving continuously and for manufacturers, it provides the ability to simulate and optimize tempering operations prior to actual manufacture, thereby minimizing defects and wastage of material.

The shift toward carbon neutral glass manufacturing will also accelerate the implementation of energy-efficient tempering methods, including induction heating and heating systems based on infrared radiation, which require less energy than conventional furnaces.

New coating of options as well as advancements in material science will increase the variety of uses for tempered glass. The emergence of self-tinting, anti-reflective and self-cleaning glass technologies in the construction sector will require specialised tempering processes that protect the coatings.

As the demand for electrochromic glass used in dynamic windows and smart facades rises, new methods of tempering will be needed to ensure the structural integrity of the material, and allow for careful modulation of light transmission.

Demand will stem from the automotive industry as self-driving and electric vehicles become popularised, with demand for high quality tempered glass being sought after with embedded heads-up display, augmented reality and noise-cancelling features. At the same time, the burgeoning solar energy sector is creating demand for tempered glass featuring high optical transmission and anti-soiling coatings that are engineered for optimal energy efficiency.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments out in place more rigorous safety and quality standards around tempered glass particularly in the construction and automotive industries. Initial processes were driven by environmental concerns that led to regulations that favoured energy efficient glass processing. |

| Technological Advancements | The introduction of automation and CNC systems revolutionized precision cutting and efficiency in glass tempering. Engineer Adjustable Cooling And Heating Methods Improved Durability. |

| Construction Industry Applications | In commercial buildings and skyscrapers in addition to residential projects, tempered glass is significantly needed. Windproof glass solutions took root. |

| Automotive Industry Trends | The automotive industry adopted a greater level of tempered glass for its responsive strength and durability. Growth in electric vehicles (EVs) were seeking lightweight, impact-resistant, glass solutions. |

| Smart Glass & Electronics Sector | The use of tempered glass in smartphones, tablets and other consumer electronics exploded in popularity. Manufacturers paid attention to a scratch resistance and impact durability. |

| Environmental Sustainability | To reduce emissions, companies launched energy-efficient tempering furnaces. Recycling and reusing tempered glass waste were focal points of this project. |

| Production & Supply Chain Dynamics | Global supply chains were affected by raw material shortages and trade restrictions. Companies diversified suppliers and optimized logistics to mitigate disruptions. |

| Market Growth Drivers | Urbanization, technological progress and a growing use of safety glass drove growth. The construction and automotive sectors were the major drivers of demand. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | The regulatory framework will grow increasingly strict, with a focus on sustainability in production practices and low-carbon emissions. Glass processing companies will have to adopt green manufacturing process. New ecycling initiatives and closed-loop glass production systems will ramp up. |

| Technological Advancements | Predictive maintenance, AI-driven monitoring systems and robotic automation will prevail. IoT in smart factories will improve production efficiency. This will likely lead us to the increased use of 3D printing and digital twin technology for monitoring and process optimization. |

| Construction Industry Applications | Predictive maintenance, AI-driven monitoring systems and robotic automation will prevail. IoT in smart factories will improve production efficiency. This will likely lead us to the increased use of 3D printing and digital twin technology for monitoring and process optimization. |

| Automotive Industry Trends | With the rise of autonomous and EVs, the tempered glass will need to be highly advanced, multifunctional with integrated sensors, augmented reality displays, and better insulation. Ultra-thin tempered glass will gain an advantage in weight reduction strategies. The growth of hydrogen fuel cell vehicles will also open up new glass opportunities. |

| Smart Glass & Electronics Sector | Flexible and ultra-slim tempered glass with features like built-in solar charging and self-healing coatings will find its way inside smart devices. Incorporating graphene-based glass materials enables strength and conductivity enhancements. |

| Environmental Sustainability | The circular economy will be in focus, with greater focus on glass recycling, sustainable raw material sourcing, and carbon neutral production processes. Water-free tempering processes will further minimize environmental impact. |

| Production & Supply Chain Dynamics | Supply chain management AIs will streamline operations while regionalised production models will lessen reliance on certain parts of the world. Supply stability will be enhanced through recycling and secondary raw materials. Mining silica sustainably will become priority. |

| Market Growth Drivers | The market will be driven by innovations in energy efficient and multifunctional glass, growth of smart infrastructure and falling regulatory pressure for sustainable production techniques. Towards novel opportunities owing to glass nano and plasma-enhanced tempering. |

Hence, the glass tempering systems market in the USA is estimated to grow during the forecast period. However, stringent building codes and safety regulations have led to an increasing demand for safety glass in residential and commercial buildings.

Another major driver is the automotive sector's use of tempered glass for windshields and side windows. Technological development in tempering processes, including convection and hybrid heating is also aiding the growth of the market.

Demand for energy-efficient glass solutions is considered one of the most prominent trends in the USA market. The demand for green buildings and energy efficiency has also resulted in tempered Low-E (low emissivity) glass, which improves insulation and lowers energy consumption, being used more and more. In addition, the usage of tempered glass in electronics, such as smartphone screens and display panels, is growing.

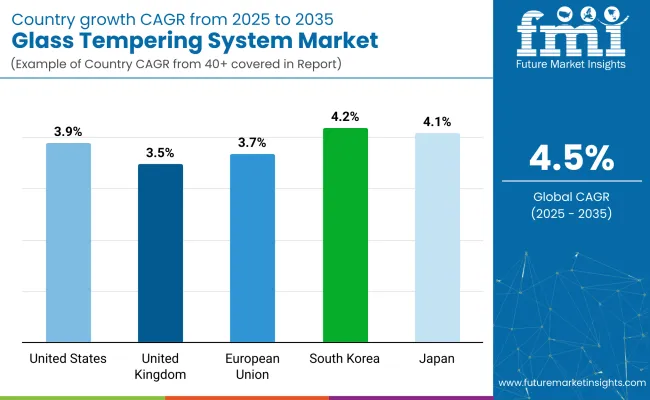

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The UK glass tempering systems market is on the rise as it is adopting in construction, automotive and furniture sectors. Due to the strong government focus on green construction initiatives, increasingly consumers are using tempered glass solutions with energy-efficient properties. Moreover, tempered glass finds its utility in the manufacturing of solar panels, a rapidly growing industry in the UK driven by the demand for renewable energy.

High-performance tempered glass in public and commercial buildings is driven by regulations like UK Building Safety Act and British Standards for glass safety. The automotive industry is another major opportunity, as the demand for lightweight and impact-resistant glass for e Vehicles and hybrids continues to increase. Additionally, growing penetration of efficient glass tempering technology like digital-controlled tempering furnaces also contribute toward increasing production efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

Use of glass tempering systems is governed by strict environmental and safety regulations in the European Union, and supported by strong construction activity and a healthy automotive industry. Germany, France, and Italy dominate the market in this region due to their strong industrial sectors and growing sustainability trends in construction materials.

Tempered glass is the dominant glass type used in windshields, sunroofs and side windows and accounts for the bulk of Europe's €1.3 trillion automotive market. Tempered glass is also an important part of energy-efficient buildings and smart glass applications, which is growing in popularity due to climate-conscious policies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

Japan Glass Tempering Systems Market is experiencing a significant growth owing to the demand from electronics, automotive, high end construction and other segments. Advanced glass tempering solutions, including variable transparency smart glass and ultra-thin tempered glass for electronic devices, have been developed in the country due to its focus on technological innovation.

The electronics sector, with its USD 120 billion-plus market in Japan, is especially dependent on tempered glass for display screens, semiconductors and protective covers. Also, in electric vehicle production, tempered glass contributes towards improved and lightweight vehicle.

During earthquake-resistant building codes are strict in Japan, tempered glass is now utilized in many vertical buildings and infrastructure projects to improve safety. Also, the increasing trends towards sustainable urbanization is expected to the grow the adoption of Low-E tempered glass in buildings to reduce energy consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The South Korea glass tempering systems market is growing at a strong pace powered by its dominance in automotive, electronics, and construction sectors. As the nation focuses on technology, the demand for high-performance tempered glass is soaring for application in high-end electronic devices, automotive safety elements, and contemporary structures.

Exports of semiconductor devices surpassed USD 150 billion during 2024, making the semiconductor industry dependent on tempered glass for components and chip production. Moreover, the increasing surge for smart factories and IoT-enabled applications have propelled the high outing need for quality tempered glass in digital displays and wearables.

(South) Korea, which produces and sells more than 4M vehicles a year, is also a big consumer of tempered glass for both safety and weight-reduction reasons, power window motor makers, etc. The rising utilization of high-performance glass in skyscrapers and smart buildings within the construction industry also propels the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

On the basis of type, CHQE (Convection Heating with Quench & Equalization) & advanced configuration glass tempering systems possess considerable share in the glass tempering system market owing to the high-performance, energy efficiency and precision controlled glass tempering systems required by industries.

These systems are widely applicable in automotive, construction, architectural, and electronics industries, providing optimal glass strength, increased thermal stability, and advanced surface quality.

With its high-performance and energy-efficient glass tempering technology, CHQE leads the market in production technology.

The conventional glass tempering method has inherent drawbacks, such as uneven temperature distribution, high optical distortion caused by the uneven heating rate during its tempering process, and higher ion exchange time, leading to limited properties including stress specification and optical quality of glass tempering technology products. In contrast to conventional heating methods, CHQE systems utilize forced convection heating, which promotes both thermal efficiency and quenching performance.

CHQE tempering systems for safety glass, laminated glass, and energy-efficient glazing solutions are being adopted more by both the construction and architectural industries. With the growing demand for skyscrapers, high-performance facades, and energy-efficient building envelopes, manufacturers are increasingly focused on CHQE technology to ensure building solutions align with industry standards and aesthetic needs.

If you think glass tempering systems of CHQE glass tempering systems play important benefits for automotive sectors, than you are correct as modern automotive needs high-strength, impact-resistant, and optically clear tempered glass for windshields, side windows, and sunroofs. The adoption of advanced glass tempering techniques, such as CHQE, continues to gain momentum as automobile manufacturers are pivoting to lightweight and less fuel-consuming vehicle designs.

What Is CHQE Nothing is more CHQE than CHQE ItselfCHQE technology is employed by smart glass and electronic display manufacturers to make smartphones, tablets, and interactive touchscreens with ultra-thin, scratch-resistant, high-clarity tempered glass panels. As consumer electronics shift towards glass-based user interfaces, CHQE systems are indispensable for ensuring product robustness and optical performance.

Although CHQE glass tempering technology has been an advanced technology with high precision and energy efficiency, on the other hand, the high initial investment and complex process control requirements associated with it poses some challenges.

Nevertheless, continuous advancements in smart temperature monitoring, AI-enabled quenching optimization, and automated process calibration solutions are improving the efficiency and cost efficiency of a range of systems, driving widespread market penetration.

Customized Variant of the Advanced Configuration Glass Tempering Systems (tolua)

Advanced configuration glass tempering systems have been performing exceptionally well in the market, especially in niche glass processing applications that demand excessive customization, multi-step treatments, and enhanced surface quality.

These advanced configuration tempering solutions are integrated with adaptive control mechanisms, precision temperature profiling, and multi-zone convection heating, which help the manufacturer customize the glass tempering parameters according to product requirements, which cannot be done in a standard configuration system.

In the solar energy sector, solar glass panels with high transparency and insulation are produced using advanced configuration glass tempering systems. Its technology offers low optical distortion, high surface hardness, and minimal residual stress and is therefore well suited for solar photovoltaic (PV) modules, stationary and mobile concentrated solar power (CSP) panels, and energy-efficient glazing systems. Rising investment across the globe in renewable energy projects is increasing the market for high-end tempered glass solutions.

Advanced configuration tempering systems are also preferred in the interior design and luxury furniture industries, as products such as decorative glass panels, frameless shower enclosures and high-quality furniture glass demand specific shapes, the highest edge quality and mechanical strength.

Further, the preference for customized tempered glass solutions that are aesthetically pleasing, impact-resistant, and thermally stable among designers and architects is driving demand for high-end glass tempering systems.

Specialized configuration systems are also integral in defense and aerospace applications where the tempered glass must withstand high impacts, such as in military vehicle windows, cockpit windows, and other security enclosures. Multi-step tempering, specialty coatings integration, and controlled stress distribution mechanisms are enabled by these systems, which provide enhanced glass durability for extreme environmental conditions.

However, the need for costly prevention systems in advanced configuration tempering systems, as well as high operational difficulty, extended processing times for a single batch of work pieces, and the requirement for specially trained operators to manage the work pieces also limit the applicability of these methods.

Recent developments in real-time process monitoring, AI-based defect detection, and energy-efficient heat treatment will improve system usability, optimize production throughput and reduce the total cost of ownership.

The need for precision controlled glass tempering products in these industries will continue to strengthen the market position of flat and bent glass tempering systems, a segment under which such a glass is manufactured for a variety of commercial applications.

How Flat Glass Tempering Systems Help Architectural and Industrial Applications on a Large Scale

Flat glass tempering systems have emerged as the most adopted form of glass tempering technology which provides uniform heat and greater optical clarity, as well as mechanical strength, for commercial, residential, and industrial applications. These systems handle flat glass panels in either continuous, oscillating, or batch operations and guarantee identical product quality throughout mass production runs.

Glass tempers the ability of glass to resist shattering in the case of collision or exposure to higher temperatures. High-capacity flat glass tempering lines are being invested owing to a growing demand for low-emissivity (Low-E) glass, smart glass and multi-layer laminated glass.

In the industrial domain, flat glass tempering systems can be used for machine enclosures, display screens, and protective barriers to provide safety to the workforce and increase product life. Popular Uses of Tempered Flat Glass Manufacturers of HVAC systems, lighting enclosures, and industrial safety shields trust tempered flat glass solutions for regulatory compliance and durability requirements.

Similar flat tempered glass panels are widely used in retail and commercial displays such as in storefronts, showcases, and display cases, where aesthetic-enhancing, impact-resistant glass solutions are essential. Segmented by application, the flat glass tempering is experiencing significant growth due to the increasing requirement for upscale retail design, digital displays, and touch-interactive kiosks.

Even though flat glass tempering has a large market share, it has some challenges including high energy consumption, risk of glass breakage, and complexity of process control. With the above in mind, advanced solutions in the field of infrared heating, intelligent furnace calibration and automated glass handling are creating improvements in efficiency, waste reduction and glass quality for flat tempering applications.

Automotive and High-End Architectural Applications Part of the Bent Glass Tempering Systems Trend

Due to offering bonded optically precise bent tempered glass products, the bent glass tempering systems have seen strong market adoption especially in automotive, luxury architectural, and high-performance glass applications. In contrast to flat glass tempering, bent glass tempering systems include the ability to risk hot point temperatures and distribute energy plus an layout or molded type in order to bent the angle and require a consolidate surface tension in our sectors.

The largest consumer of bent tempered glass continues to be the automotive industry (vehicle manufacturers require curved windshields, panoramic sunroofs, and aerodynamically optimized side windows). With changing trends in automotive design towards sleeker, futuristic and aerodynamic styles, the demand for high-precision bent glass tempering solutions is growing.

Bent tempered glass panels are creating unique, eye-catching designs on such luxury architectural projects like contemporary skyscrapers, museum facades, and bespoke interiors. Like bent glass panels, these seamless curved glass panels allow for smooth integration with curved surfaces as well as improved structural strength and movement of light energy to provide a dynamic aesthetic, making these panels ideal in high-gloss commercial and residential construction.

However, the Solid-structure bent glass tempering has higher production complexity therefore the production of bent glass with Solid-structure bent mold has high requirements on heat control and mold design, making the production complex and increasing the manufacturing cost and processing time.

Nonetheless, improving production scalability and cost, empowered by automated glass shaping and AI-driven stress analysis, is expected to support market expansion along with hybrid tempering methods.

The glass tempering system market is expanding due to increasing demand from automotive, construction, and electronics industries. Companies are focusing on high-precision tempering solutions, energy-efficient furnaces, and automation-driven production lines to enhance glass strength, safety, and production efficiency.

The market consists of global leaders and specialized manufacturers, each playing a crucial role in technological advancements, customized glass processing, and sustainable solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Glaston Corporation | 12-17% |

| LiSEC Group | 10-14% |

| North Glass | 8-12% |

| Tamglass (Bystronic Glass/Glasstec) | 7-11% |

| Keraglass Industries | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Glaston Corporation | Manufactures high-performance glass tempering lines with AI-based quality control and energy-efficient heating technology. |

| LiSEC Group | Specializes in automated glass processing systems, integrating cutting, laminating, and tempering solutions for architectural and automotive glass. |

| North Glass | Provides advanced glass tempering furnaces designed for high-strength and low-energy consumption production. |

| Tamglass (Bystronic Glass/Glasstec) | Develops fully automated glass tempering systems with a focus on precision control and low-defect production. |

| Keraglass Industries | Offers modular and customizable glass tempering lines optimized for smart manufacturing and sustainable energy use. |

Key Company Insights

Glaston Corporation (12-17%)

Glaston leads the glass tempering system market, offering AI-enhanced tempering furnaces that ensure uniform heating, reduced energy consumption, and real-time process monitoring. The company’s advanced automation solutions improve glass quality and production speed.

LiSEC Group (10-14%)

LiSEC specializes in fully automated glass processing solutions, integrating tempering, cutting, and laminating technologies. The company’s focus on energy efficiency and high-precision output has strengthened its position in architectural and automotive applications.

North Glass (8-12%)

North Glass is recognized for energy-efficient glass tempering systems, catering to high-strength applications such as skyscraper facades, vehicle windshields, and touchscreens. The company emphasizes low-energy glass processing to align with sustainability trends.

Tamglass (Bystronic Glass/Glasstec) (7-11%)

Tamglass provides intelligent glass tempering solutions, integrating digital monitoring, precision heating, and defect detection technologies. Its modular tempering lines enable customization for different glass applications.

Keraglass Industries (5-9%)

Keraglass focuses on customized glass tempering systems, emphasizing flexibility, automation, and smart controls. The company integrates energy-efficient tempering processes, reducing operational costs for manufacturers.

Other Key Players (45-55% Combined)

Several manufacturers contribute to cost-effective glass tempering solutions, advanced control systems, and region-specific market expansion. These include:

The overall market size for Glass Tempering System Market was USD 78.3 Billion in 2025.

The Glass Tempering System Market is expected to reach USD 121.6 Billion in 2035.

The demand for the glass tempering market is expected to rise due to rapid urbanization, infrastructure development, and increasing applications in industries such as automotive, construction, and electronics, where durability, safety, and energy efficiency are crucial.

The top 5 countries which drives the development of Welding Mechanical Seals Market are USA, UK, Europe Union, Japan and South Korea.

Standard Configuration to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA