Advancements in glass prefilled syringes and vials packaging technologies and the increasing demand for biologics and biosimilars are some of the key trends anticipated to support the growth of the European glass prefilled syringes and glass vials packaging equipment industry.

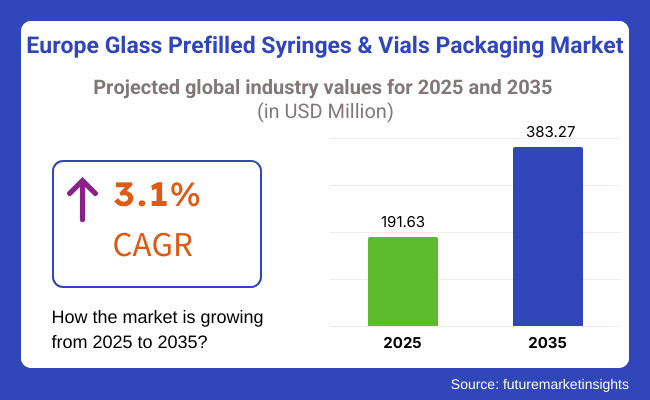

As the market estimates USD 191.63 million in 2025, the sales for Europe's glass prefilled syringes and glass vial packaging equipment are poised to reach a valuation of USD 383.27 million; this amount implies a CAGR of 3.1% from 2025 to 2035.

The incorporation of smart technologies for real-time monitoring coupled with dosage reminders enhances patient adherence to medication schedules. Furthermore, sustainability efforts and increased regulation on drug safety are also changing the landscape, prompting manufacturers to transition to sustainable materials and improved syringe technologies.

As healthcare needs evolve, the European industry will continue to see a stream of innovative solutions that offer safe and efficient drug delivery solutions.

This growth will be driven by rising biopharmaceutical production, expanding vaccination programs, and the demand for high-quality, contamination-free packaging solutions. As pharmaceutical firms strive for efficiency and sustainability, automation will shape the future of the industry.

Explore FMI!

Book a free demo

The European sector for glass prefilled syringes and vials packaging would presumably surge between 2020 and 2024. This is partly due to the fact that smart drug delivery via IoT-enabled glass prefilled syringes is becoming more prominent, and drug safety regulations keep becoming tougher.

Green materials were adopted in the eco-industry within this period, and a focus on the drug's stability and quality due to regulations. Legacy pharma emerged as leaders, effectively integrating devices to improve patient compliance and real-time monitoring.

The period between 2025 and 2035 will mark an era of continued growth and technological innovation. The European pharmaceutical packaging market is projected to register strong growth, with a compound yearly growth rate (CAGR) of 3.1% during the forecast period of 2025 to 2035.

It is a result of the push to be greener and more automated and the development of new, holistic drug delivery methods that are effective and advanced. This time frame would lead us toward a new era in drug delivery systems, including AI-driven persistence monitoring, advanced automation, and other innovations.

Sustainability will be at the forefront of regulatory policies, leading manufacturers to shift to a more biodegradable or recyclable packaging solution. This will lead to competition between nascent biotech companies and established organizations, as they classify prefilled syringes and allocate their industry share.

| Key Drivers | Key Restraints |

|---|---|

| Rising demand for biologics and biosimilars | High manufacturing and material costs |

| Advancements in smart drug delivery technologies | Stringent regulatory approvals and compliance |

| Increasing focus on sustainability and recyclability | Supply chain disruptions and raw material shortages |

| Growth of precision medicine and personalized treatments | Limited adoption in smaller pharmaceutical firms |

| Regulatory push for safer and more efficient packaging | Competition from alternative drug delivery systems |

| Key Drivers | Impact Level |

|---|---|

| Rising demand for biologics and bio similars | High |

| Advancements in smart drug delivery technologies | High |

| Increasing focus on sustainability and recyclability | Medium |

| Growth of precision medicine and personalized treatments | Medium |

| Regulatory push for safer and more efficient packaging | High |

| Key Restraints | Impact Level |

|---|---|

| High manufacturing and material costs | High |

| Stringent regulatory approvals and compliance | High |

| Supply chain disruptions and raw material shortages | Medium |

| Limited adoption in smaller pharmaceutical firms | Low |

| Competition from alternative drug delivery systems | Medium |

Increasing demand for biologic biosimilars is putting a spotlight on high-speed filling and sealing machines that enable manufacturers. However, these machines are essential because they provide precise sterilization, a low risk of contamination, and accurate packaging.

The segment to ramp up investments toward advanced machinery that is more efficient and pollution-compliant and filling machines account for only about 28.6% of the market share. Yet in mature IoT and automation-powered systems built using best-in-class practices across this industry, real-time monitoring, measurement, and quality control modules will become commonplace.

Highly common in the industry to drift toward a completely automated packaging process, which eliminates the manual process. Automation increases speeds, accuracy, and compliance with tight safety measures in production.

Pharmaceutical companies are adopting smart packaging solutions that use integrated IoT and AI-enabled monitoring systems. Minimizes human intervention, enables real-time tracking, and ensures product safety. Many automated systems make them more efficient, but these systems also help businesses achieve sustainability goals, as they tend to generate less waste material.

Pharmaceutical and biotech companies constitute the largest end-use industry for prefilled glass syringes and vial packaging equipment. Key drivers for innovation in packaging solution-related activities include growing demand for injectable drugs, vaccine development, and personalized medicine.

Manufacturers hold a roughly 51.7% market share of all pharmaceutical companies. A growing trend with Luer lock syringes is also being used in hospitals and other healthcare facilities. This is because they are easier to use, less likely to get contaminated, and allow for precise dosage control. As biologics and biosimilars grow their share of the industry, the demand for specialized, high-quality packaging solutions also will grow.

The Spanish pharmaceutical industry is growing at a brisk pace with the strong demand for high-end packaging like glass prefilled syringes and vials. The growing adoption of biologics and biosimilars that demand high-quality, contamination-free packaging to maintain drug stability and ensure patient safety drives the demand.

The Spanish sector for glass prefilled syringes & vials packaging will witness over 4.1% CAGR through 2035, and the growth will be fueled by government focus on domestic pharmaceutical re-packaging and sustainable development goals.

The evolving healthcare landscape and the industry's growth are aided by government initiatives and large-scale investments in drug manufacturing within the country. The regulatory landscape in Spain continues to foster the adoption of advanced packaging technologies to improve drug delivery and compliance.

Finally, we have sustainability trends that are disrupting the industry with a demand for recyclable options, green materials, and reuse packaging solutions.

The UK leads the pharmaceutical industry with its drug safety and regulatory compliance being the foremost priorities. The United Kingdom glass prefilled syringes and vials packaging market will grow at a steady pace of 3.8% CAGR in the forecast period of 2025 to 2035 owing to the increase in the injectable drugs industry and restrictive government regulations arising in the recent years.

When it comes to the biologics and personalized medicine that are the future of the pharmaceutical world, the demand for high-quality, contamination-free packaging is only on the steep ascent.

Some of the world’s best biotech and pharmaceutical companies are based in the country, pioneering new techniques that promise better delivery of drugs and adherence to treatment at home.

With Medicines and Healthcare Products Regulatory Agency (MHRA), the agency responsible for regulation, strict quality and safety standards are required to be followed, and manufacturers are left with no other option but to integrate state-of-the-art packaging solutions.

Smart packaging, enabling IoT devices, real-time monitoring, dosage tracking, and other advancements are being adopted at lightning speed, driving growth and making the UK the global leader in packaging innovation.

Germany is an important player in the production of glass prefilled syringes and vials packaging, as it is the largest pharmaceutical production hub in Europe. Owing to significant advancements in research and development, the country is leading to pharmaceutical innovations, resulting in increasing acceptance of advanced packaging solutions.

The rigid regulatory framework in Germany enables packaging technologies to adhere to the strictest standards regarding safety, sterility, and drug stability, fueling the demand for high-quality glass prefilled syringes and vials.

The growth in packaging production and demand and increasing automation, as well as IoT-based packaging systems that provide operational efficiencies, will contribute to the steady advancement of the industry, which is estimated to grow at a steady 2.8% CAGR through 2035.

The application of these smart packaging technologies also has benefits for quality control, streamlining production, and providing real-time monitoring capabilities, therefore making drug delivery safer and more reliable. Automation is being introduced in production lines to streamline the manufacturing process, minimize human error, and maintain group packaging quality.

The pharmaceutical industry in France is expanding, with a greater focus on injectable medications and on personalized medicine. The demand for contamination-free and high-quality packaging is anticipated to grow through the glass prefilled syringes and vials market.

The industry of France will flourish at a CAGR of 3.4% owing to the demand for injectable drugs. Positive government policies to encourage domestic manufacturing of drugs and innovations in the packaging of pharmaceuticals will create growth opportunities. Furthermore, organizations are putting a fiscal stake in smart containers for improved patient safety and adherence.

The increasing production of generics and biosimilars in Italy has fueled growth in the pharmaceutical packaging sector. The increasing interest in drug stability and shelf life excursion in the country has led to a greater demand for high end glass prefilled syringes.

Driven by generics and biosimilars, Italy's industry will grow at a 2.5% CAGR in 2035. Manufacturers are additionally focusing on automation as well as offering environmentally friendly packaging options to meet up with governing along with environmental standards.

The Europe Glass Prefilled Syringes & Vials Packaging Industry shows a fair consolidation, as the Tier 1 players hold almost 90% of the total market share.

The pharmaceutical packaging segment is highly consolidated in nature, as the leading players, including both multinational and niche manufacturers, leverage extensive distribution networks, a profound understanding of the regulatory landscape, and advanced technological capabilities.

Their domination is because they continue to pour money into research and development. Such investment enables them to comply with Europe's safety standards and enhance operational efficiency through automation and smart packaging solutions.

However, businesses continue to face fierce competition, focusing on innovation to differentiate their offerings. High regulatory requirements and capital- and energy-intensive production processes act as major barriers for smaller players and new entrants.

However, the market has niche opportunities for midsized companies that can focus on eco-friendly packaging or custom syringe designs. This is because of trends toward sustainability and a growing need for biologics production. Over the forecast period, the industry dynamics will be characterized by strategic partnerships, acquisitions, and technological advancements.

The rise in biologics, stricter drug safety regulations, and advancements in smart packaging are key growth drivers.

The UK, Germany, France, Spain, and Italy are major players, with varying growth rates and regulatory influences.

Top players include Schott AG, BD, Gerresheimer, West Pharmaceutical Services, and Stevanato Group, Nipro Corporation, Terumo, SGD Pharma, Catalent, etc.

The growing shift towards sustainable packaging solutions, including the use of eco-friendly materials, recyclable glass, and reduced-waste manufacturing processes to meet environmental regulations.

Cleaning Machine, Filling Machine, Labeling Machine, Closing/Sealing Machine, and Others

Automatic and Semi Automatic

Pharmaceutical Companies, Research Centres, Hospitals, and Other Government Institutes

Germany, Italy, The United Kingdom, France, Spain, Rest of Europe

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.