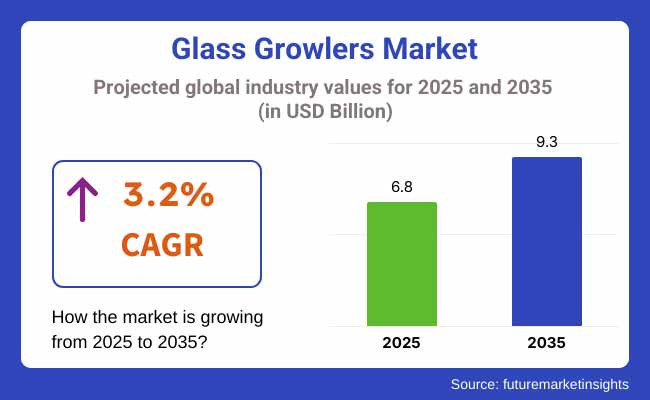

The glass growler market is subject to strong regional differentiation and has enormous untapped potential. Given this, the market is set to reach an estimated USD 6.8 billion by 2025 at a 3.2% CAGR and hit USD 9.3 billion by 2035. Demand is rising steadily, owing to increasing craft beer trends, sustainable beverage packaging solutions, and an increasing consumer preference for reusable and eco-friendly containers.

Glass growlers, by nature, are said to help keep beverages fresh, carbonated, and full of flavor and are extensively used by breweries, cider houses, kombucha makers, and specialty beverage retailers. With modern developments in lightweight glass, UV resistance coatings, and custom branding options, it is expected that the glass growlers market shall expand significantly in the coming decade.

Developments are driven by increasing consumer awareness regarding sustainable packaging, the burgeoning craft beverage industries, and regulatory changes favoring fillers and reusable packaging solutions. The other factors enabling the abrupt adoption of glass growlers include technical advancements in temperature management glass, smart labels, and digital branding integration.

The market expansion is also supported by the premiumization of beverage packaging, reduced plastic waste initiatives, and government policies promoting reusable alternatives. One major engine for the growth of the glass growler market is increased customization of glass growlers with branding and investment in automation and supply chain real-time tracking. Other areas where additional value is added to the market proposition include the integration of smart tracking applications, enhanced durability of glass, and improved mechanisms for the sealing of glass growlers.

Glass growlers are expected to see growing demand in the Asia-Pacific region as craft breweries become increasingly popular, disposable incomes rise, and consumer interest develops toward sustainable packaging. Reusable beverage containers are gaining traction in China, Japan, and Australia, with enhanced emphasis on the reduction of plastic waste.

Ongoing advancements in lightweight, shatter-resistant glass growler designs, followed by cost-effective production processes and automation in bottling, continue to add impetus to market growth in this region. The other push factors include government rules promoting circular economy and reduced packaging waste. On the contrary, the increasing presence of global beverage giants in the Asia-Pacific region also strengthens local production capabilities.

This is also the North American market for glass growlers, where vigorous appetites of the craft beverage industry, growing sustainability awareness, and regulatory policies that favor more reusable packaging solutions are major factors driving demand. Being the two hotspots in the region, the USA and Canada are not just content with custom-branded growlers; they have also unleashed innovations in UV-protected glass and smart-labeling of growlers to boost consumer engagement.

An emerging trend that is changing the market dynamics is that consumers prefer refillable beverage bottles because of their beautifully made but sustainable packaging. Besides, increased spending on R&D for durable, temperature-retaining, and smart-integrated growlers will help to grow the market. In addition, RFID-enabled tracking, digital branding, and premiumized growlers are gaining traction in the improved efficiency and brand loyalty directed at breweries and specialty beverage retailers.

The growlers market, which is made from glass in Europe, holds an important share because of the strict environmental regulations, increasing consumer choice towards reusable beverage containers, and a more embracing attitude towards locally crafted beverages. Some of the leading economies in the region, such as Germany, France, and the UK, are at the forefront of innovations in sustainable packaging, glass recycling programs, and government-initiated refill schemes.

An additional market driver in Europe is the promotion of glass recycling and sustainable alternatives for the beverage trade in reducing the use of plastics. Because of the demand for high-quality, customizable glass growlers, in terms of both durability and insulation, further growth in the market is anticipated.

There are also strong collaborations in the region between breweries, sustainability bodies, and packaging suppliers in order to develop the next generation of glass growlers with enhanced elegance, functionality, and ecofriendliness. AI-fueled production optimization paired with smart QR code integration and refill station initiatives are expected to drive innovations within the market.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Early focus on reducing plastic waste in beverage packaging. |

| Material and Design Innovations | Development of lightweight and durable glass growlers. |

| Industry Adoption | Widely used in craft beer and specialty beverages. |

| Market Competition | Dominated by traditional glass packaging manufacturers. |

| Market Growth Drivers | Growth is driven by demand for refillable, aesthetically appealing packaging. |

| Sustainability and Environmental Impact | Early adoption of refillable and recyclable packaging initiatives. |

| Integration of AI and Process Optimization | Limited AI use in quality control and customization. |

| Advancements in Packaging Technology | Basic improvements in sealing and branding. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies mandating reusable and refillable beverage containers. |

| Material and Design Innovations | Expansion of AI-driven, insulated, and smart-labeled glass growlers. |

| Industry Adoption | Increased adoption of kombucha, cold brew coffee, and ready-to-drink (RTD) beverages. |

| Market Competition | Rise of sustainability-focused startups and high-tech packaging firms integrating digital branding features. |

| Market Growth Drivers | Market expansion fueled by automation, AI integration, and fully customizable premium glass growlers. |

| Sustainability and Environmental Impact | Large-scale transition to carbon-neutral, biodegradable coatings and enhanced glass recycling programs. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated defect detection, and real-time supply chain tracking for glass growlers. |

| Advancements in Packaging Technology | Development of smart packaging with IoT connectivity, refill station integration, and consumer loyalty tracking. |

The rising demand for craft beer, specialty beverages, and sustainable packaging solutions primarily drives the glass growlers market in the USA. The need for high-quality, reusable, and airtight containers has also led to the widespread adoption of glass growlers by breweries, cider houses, and kombucha producers. Moreover, the growing trend of eco-conscious consumers choosing refillable and recyclable packaging is compelling brands to manufacture premium glass growlers with UV protection, pressure-resistant seals, and ergonomic handles.

Advanced features, such as insulated growlers, digital printing customization, and tamper-evident caps, significantly augment the utility and branding options for the product. Meanwhile, the burgeoning homebrew culture and the propensity for beverages on the go are further fueling the development of the market in the USA Besides, breweries are integrating NFC-enabled growlers to enhance consumer experience and product authenticity.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The UK glass growler market is swelling due to an increase in craft beverage consumption, as well as consumers who now prefer to purchase reusable packaging. Demand for the refillable glass growler market is being driven largely by its rising acceptance for beer, cold brew coffee, and kombucha. In addition to government initiatives that promote the end reduction of plastic waste in the circular economy practice, brands are encouraged to develop high-strength yet lightweight and durable glass growlers.

Companies are also including innovative solutions like temperature-control glass, customizable laser engraving, and digital tracking solutions for refill programs. Meanwhile, the switch to lead-free and BPA-free glass materials leads to consumer safety and boosts consumer confidence in the UK market. Besides, anti-slip base designs do innovate usability improvement and spill prevention. Consumers prefer stackable, space-saving glass growlers because they live in an urban setting with limited storage space. Vacuum-sealed lids are now available to preserve beverage freshness long after bottling.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

Japan's glass growlers market is slowly expanding because of precision manufacturing, glasswork quality, and growing consumer interest in specialty beverages. Sleek and minimalist growlers with performance specifications have opened opportunities for innovation in ultra-light, shatter-resistant glass designs. Japanese manufacturers are developing vacuum-sealed insulated growlers with airtight lids to keep the beverage fresh. With the rising demand for sustainable packaging, brands are shifting towards borosilicate glass growlers with refillable bottle programs that aim towards eco-centric solutions. The growth in sake, craft beer, and artisanal tea consumption is impacting consumer tastes in Japan.

The introduction of self-cleaning and UV-sterilized glass growlers adds hygiene and convenience for beverage lovers. Other innovations in double-wall heat-resistant glass growlers are improving thermal retention for temperature-sensitive beverages. Smart pressure-monitoring lids that would ensure craft beers and kombucha maintain appropriate carbonation levels are also in the basket. Growing demand is coming from urban consumers looking for convenience, for aesthetic lightweight, and ergonomically designed growlers being portable beverage storage solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

The glass growlers market in South Korea is expanding quickly by increased interest in high-end drinks, cafe culture, and advanced packaging design in glass. The country has strong movements in craft beers, with an emphasis on alternatives to single-use containers.

This leads individuals to adopt reusable growlers. Government regulations emphasize the reduction of plastic waste and campaigns for eco-friendly packaging, promoting changes in the industry. Businesses integrate smart dispensing caps with anti-slip silicone bases and color-changing temperature indicators into glass growlers to create a better product for users.

The growing demand for compact, travel-friendly, double wall insulated glass growlers for beer, kombucha and cold brew coffee has further increased the market in South Korea. Moreover, the brands are focused on designing high-end, borosilicate glass growlers which are more durable and resistant to thermal shock than regular growlers. Alongside, shatterproof, lightweight glass growlers are targeted at adventure lovers and travelling nomads. Innovations in pressure-regulating caps will also ensure optimal carbonation retention for craft beverages.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Custom-designed, insulated, and standard glass growler segments are positively influencing market growth as industries look for high-performance, durable, and visually attractive packaging solutions. Growler manufacturers are improving growler durability, thermal retention, and design flexibility to address changing consumer tastes.

Standard Glass Growlers Strengthen Market Expansion

Standard glass growlers continue to be the leaders as breweries, coffee houses, and beverage manufacturers look for affordable, refillable, and airtight packaging. Firms are creating high-barrier, impact-resistant, and lead-free glass growlers for enhanced safety and durability. Furthermore, studies on scratch-resistant coatings, UV-resistant glass, and lightweight reinforced constructions are fueling innovation in this category. Also, businesses are looking into reusable standard growlers to meet sustainability programs and waste reduction objectives.

Insulated Glass Growlers Gain Momentum with Temperature-Retaining and Portable Designs

The insulated glass growler segment is on the rise, as consumers are seeking drinkware options that are spill-proof, temperature-retaining, and conducive to travel. Such companies look at responsible investments in innovations encompassing double-walled vacuum insulation arenas, silicone infusions, and copper-glass coatings facilitating thermal retention.

Light weighing, durability, condensation-proofing, innovation, and dishwasher-safe construction are concurrent trends that are creating elaboration in product design. Premium beverages being increasingly served in insulated glass growlers, including specialty coffee, cold brews, and craft cocktails, also hold greater promise in terms of market penetration.

Custom-Designed Glass Growlers Expand Adoption with Personalized and Smart Branding Features

The glass growlers segment of custom-designed glass is picking up speed as companies and consumers look for distinctive, branded, and artistic packaging. Laser-engraved, digitally printed, and hand-painted growler designs are among the areas of focus for manufacturers to promote brand visibility and consumer interaction.

Material engineering through artificial intelligence is also making glass growlers more efficient and customizable for breweries, cafés, and homebrewers. Besides this, companies are also looking at glow-in-the-dark coatings, augmented reality (AR)-enhanced packaging, and interactive NFC tags to offer immersive consumer experiences. The combination of unique, limited-edition, and collector's glass growlers is also propelling market growth.

Investigation of impact-resistant glass, green protective coatings, and AI-powered glass forming technologies is enhancing the longevity, eco-friendliness, and productivity of glass growers. Intelligent growlers with internal freshness indicators, digital refills tracking, and temperature-adjustable alerts are popular among breweries and beer lovers. AI-aided supply chain optimization is also optimizing production and minimizing material losses in glass growler production.

As business focuses on high-quality, sustainable, and technologically sophisticated beverage packaging solutions, the market for glass growlers will rise steadily. Developments in material science, smart branding, and reusable drinkware design will keep evolving the future of this market, and glass growlers will remain a vital element for craft breweries, specialty beverage companies, and environmentally aware consumers.

Glass Growlers Market: A Growing Demand in the Beverage Industry

The glass growlers market is witnessing substantial growth due to the increasing popularity of craft breweries, kombucha, cold brew coffee, and specialty beverages. These containers offer a sustainable, reusable, and aesthetically appealing solution for beverage storage and transport. With consumers prioritizing eco-friendly packaging and businesses seeking branding opportunities through custom-printed growlers, the market continues to expand.

The rapid growth of the craft beer and specialty beverage industries has significantly contributed to the increased demand for glass growlers. Consumers seek fresh, locally brewed drinks, and growlers provide a convenient way to transport and store them. The ability to maintain beverage quality and carbonation has made these containers a preferred choice among breweries, coffee shops, and kombucha producers.

Glass growler manufacturers are introducing enhanced features, such as UV-resistant glass, pressure-sealed lids, and ergonomic handles, to improve functionality and durability. Additionally, customization trends, including laser engraving and screen printing, allow businesses to promote their brand and enhance customer loyalty. Smart growlers equipped with temperature control and digital freshness indicators are also gaining traction among tech-savvy consumers.

With a growing emphasis on sustainability, glass growlers are emerging as a preferred alternative to single-use plastic containers. Many breweries and beverage companies encourage customers to reuse growlers, reducing packaging waste and promoting environmentally responsible consumption. Glass is 100% recyclable, making it an attractive material for brands committed to sustainability.

The market for glass growlers is competitive, with various top players emphasizing product quality, customization, and eco-friendly production processes. Brands are tapping into branding opportunities through offering exclusive design possibilities, including embossed logos and colored glass flavors. Partnerships with breweries, coffee shops, and kombucha brands are enabling manufacturers to increase market penetration.

Moreover, the incorporation of intelligent technology in glass growlers, including freshness monitors and vacuum-sealed caps, is becoming increasingly popular among premium drink consumers. Companies are also investing in environmentally friendly manufacturing methods to minimize their carbon footprints and comply with green initiatives.

Growing demand for limited-release and collectible growlers is another driver of growth, especially among craft beer consumers. Online shopping channels are driving sales to a significant extent, with direct-to-consumer models allowing customized and easy purchase options. Additionally, collaborations with hospitality companies, such as restaurants and bars, are opening up new avenues for market reach.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ardagh Group | 12-16% |

| Owens-Illinois Inc. | 10-14% |

| Berlin Packaging | 8-12% |

| GrowlerWerks | 6-10% |

| Alpha Packaging | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ardagh Group | Produces high-quality glass growlers with sustainability-focused manufacturing. |

| Owens-Illinois Inc. | Develops durable and customizable glass growlers for breweries and specialty drinks. |

| Berlin Packaging | Specializes in premium glass packaging solutions, including personalized growlers. |

| GrowlerWerks | Innovates with vacuum-insulated and pressurized growlers for enhanced beverage storage. |

| Alpha Packaging | Focuses on cost-effective and eco-friendly glass growler production. |

Key Company Insights

Other Key Players (45-55% Combined)

Several specialty packaging manufacturers contribute to the glass growlers market, including:

The overall market size for the Glass Growlers Market was USD 6.8 Billion in 2025.

The Glass Growlers Market is expected to reach USD 9.3 Billion in 2035.

The increasing popularity of craft beverages, sustainability trends, customization demand, and reusable packaging solutions will drive market growth. The expansion of breweries, kombucha brands, and cold brew coffee businesses will further fuel demand.

Key challenges include breakability, transportation costs, and competition from alternative packaging materials such as stainless steel and PET plastic. Additionally, regulatory restrictions on alcohol transportation impact market expansion.

North America and Europe are expected to lead the market due to the strong presence of craft breweries and sustainability initiatives. The Asia-Pacific region is also witnessing growth with increasing beverage innovations and eco-conscious consumer behavior.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Sealing Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Sealing Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Sealing Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Sealing Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sealing Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sealing Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Sealing Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Sealing Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Sealing Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Sealing Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Sealing Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Sealing Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Sealing Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Sealing Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Sealing Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Sealing Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Sealing Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Sealing Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Sealing Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Sealing Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Sealing Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Sealing Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Sealing Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Sealing Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Sealing Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Sealing Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Sealing Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Sealing Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Sealing Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Sealing Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Sealing Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Sealing Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Sealing Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Sealing Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Sealing Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Sealing Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Sealing Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Sealing Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Sealing Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Sealing Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Sealing Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Sealing Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Sealing Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Sealing Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Sealing Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Sealing Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Sealing Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Sealing Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Sealing Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sealing Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sealing Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Sealing Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Sealing Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Sealing Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Sealing Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Sealing Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Sealing Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Sealing Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Sealing Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Sealing Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Sealing Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Sealing Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sealing Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Sealing Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Capacity, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Glass Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA