The gift packaging business is changing because customers are becoming more interested in premium, green, and personalization packaging. Brands are investing in green packaging materials, digital print, and responsive packaging to give gifting a better experience. The demand is moving from one-time disposable to reusable, biodegradable, and luxurious packaging as people pay attention to form as well as sustainability.

They are using high-quality paperboard, recyclable materials, and intelligent packaging elements like QR codes and augmented reality to personalize to the next level. The market is shifting towards advanced folding boxes, high-end rigid packs, and eco-friendly wrapping materials as part of a growing e-commerce culture and changing consumer behavior.

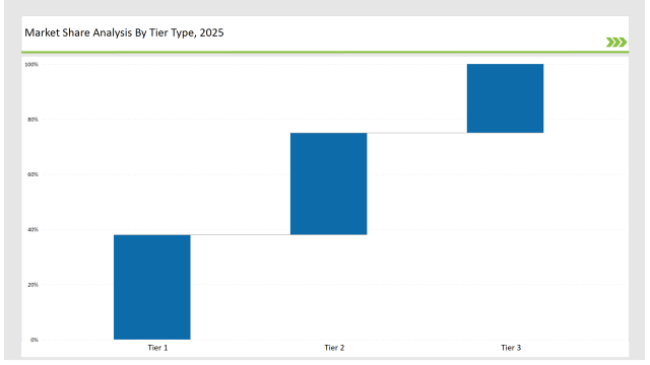

Tier 1 players such as DS Smith, Smurfit Kappa, and WestRock command 38% market share because of their dominance in sustainable and personalized gift packaging solutions, robust distribution channels, and relationships with worldwide brands.

Tier 2 players such as Mondi Group, International Paper, and Stora Enso command 37% market share by providing affordable, high-quality, and visually appealing gift packaging solutions in retail, corporate, and premium segments.

Tier 3 are local and niche players that provide luxury packaging, biodegradable packaging, and digital printing expertise, with a market share of 25%. They focus on localized manufacturing, design creativity, and eco-innovation.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (DS Smith, Smurfit Kappa, WestRock) | 18% |

| Rest of Top 5 (Mondi Group, International Paper) | 12% |

| Next 5 of Top 10 (Stora Enso, PakFactory, GPA Global, Karl Knauer, BellePak Packaging) | 8% |

The gift packaging industry serves multiple sectors where premium presentation, branding, and sustainability play a critical role. Companies are developing innovative and aesthetic packaging solutions to enhance customer engagement.

Manufacturers are optimizing gift packaging with creative designs, high-quality materials, and eco-conscious production.

Sustainability and branding innovation are redefining the gift packaging industry. Companies are integrating AI-driven printing, plastic-free packaging, and smart design elements to enhance aesthetics and reduce environmental impact. They are developing high-quality biodegradable materials to replace traditional wrapping paper and ribbons. Manufacturers are investing in interactive packaging with QR codes and augmented reality to create immersive unboxing experiences. Additionally, firms are optimizing supply chains by using blockchain technology to improve transparency and traceability in sourcing sustainable materials.

Technology suppliers should focus on automation, sustainable material innovation, and personalized branding techniques to support the evolving gift packaging market. Partnering with premium brands and e-commerce platforms will drive market growth.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | DS Smith, Smurfit Kappa, WestRock |

| Tier 2 | Mondi Group, International Paper, Stora Enso |

| Tier 3 | PakFactory, GPA Global, Karl Knauer, BellePak Packaging |

Leading manufacturers are advancing gift packaging technology with sustainable materials, AI-powered design solutions, and high-end finishing techniques.

| Manufacturer | Latest Developments |

|---|---|

| DS Smith | Launched recyclable luxury gift boxes in March 2024. |

| Smurfit Kappa | Introduced premium e-commerce-friendly gift packaging in April 2024. |

| WestRock | Expanded biodegradable decorative wrapping solutions in May 2024. |

| Mondi Group | Released reusable, high-end gift bags in June 2024. |

| International Paper | Strengthened digital printing and embossing for gift packaging in July 2024. |

| Stora Enso | Developed FSC-certified rigid boxes for corporate gifting in August 2024. |

| PakFactory | Innovated interactive subscription box designs in September 2024. |

The gift packaging market is evolving as companies focus on luxury aesthetics, sustainable materials, and digital branding innovations.

The industry will continue integrating AI-driven printing, sustainable coatings, and smart packaging technologies. Manufacturers will refine digital personalization to enhance consumer engagement. Businesses will adopt plastic-free adhesives and inks to improve recyclability. Companies will design collapsible rigid boxes to optimize storage and reduce costs. Smart packaging elements, such as NFC tags, will create interactive gift experiences. Additionally, firms will enhance supply chain transparency with blockchain-enabled traceability.

Leading players include DS Smith, Smurfit Kappa, WestRock, Mondi Group, International Paper, Stora Enso, and PakFactory.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include sustainability, customization, digital printing, and luxury branding.

Korea Premade Pouch Packaging Market Analysis by Closure Type, Material Type, End-Use Industry, and Province through 2035

Korea Pallet Wrap Market Analysis by Thickness, Product, Film, Material, End Use, and Province 2025 to 2035

Japan Pallet Wrap Market Trend Analysis Based on Thickness, Product, Material, Film, End-Use, and Regions (2025 to 2035)

Toy Bag Market Analysis on Material Type, Bag Type, Category, Sales or Distribution Channel, and Region through 2025 to 2035

Non-cushioned Mailer Market by Material Type, End Use, and Region 2025 to 2035

Vietnam Plastic Pail Market Report – Trends & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.