This GHS labels market is taking off rapidly by industries due to the compliance concerns, safety aspect, and crystal clear chemical marking. GHS labels are mostly used in areas of chemicals and pharmaceuticals so that they fulfill the regulatory issues and worker safekeeping.

By 2035, it is expected that the GHS label market of the world will grow past USD 2409.9 million CAGR 3.4%, as producers work to cater for this through robust materials and newer technologies related to printing techniques along with incorporating digital tracking components. As operations of the concerned business have already begun demanding complete adherence to maintaining efficiency along with regulations, labels like GHS offer viable assistance for safety without comprising the flexibility.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 2409.9 Million |

| CAGR during the period 2025 to 2035 | 3.4% |

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Summary

The SWOT analysis highlights the strengths and strategies of leading companies in the GHS label market. Key players such as Avery Dennison, Brady Corporation, and 3M are driving growth through innovation, regulatory expertise, and global distribution networks. Challenges like raw material costs and regional regulatory complexities provide opportunities for technological advancements and market diversification.

Avery Dennison

Avery Dennison specializes in producing hardwearing and customizable GHS labels. Its advanced adhesives and sustainability approach give it a grip on market leadership. However, raw material price fluctuations remain a challenge. New thrust areas could include expansion into emerging markets and developing smart labeling technologies.

Brady Corporation

Brady Corporation is a leader in highperformance labeling solutions for hazardous materials. Its inherent manufacturing capabilities and extensive compliance expertise provide the competitive strength needed. Limited penetration in some regions will be a growth inhibitor but opportunities abound with investment in ecofriendly materials and digital labeling solutions.

3M

3M boasts one of the innovative and flexible GHS labeling products on the market. Key strengths in product portfolios as well as highly innovative R&D support. With rising demand for highly durable and tamperproof labels, the area continues to suffer from high manufacturing costs.

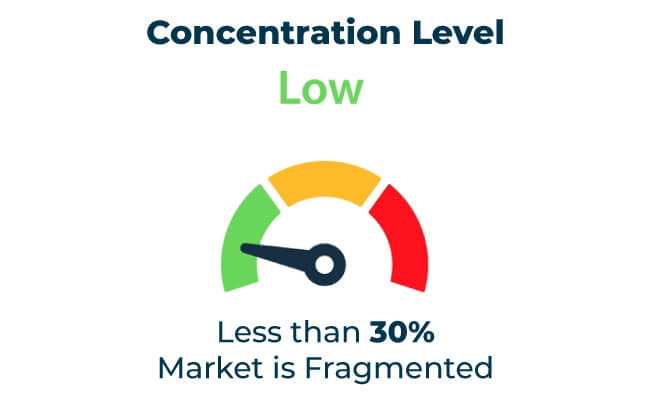

| Category | Market Share (%) |

|---|---|

| Top 3 Players | 13% |

| Rest of Top 5 Players | 6% |

| Next 10 Players | 6% |

Type of Player & Industry Share

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 25% |

| Next 20 Players | 43% |

| Remaining Players | 37% |

Year on Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Growing markets in Southeast Asia, Africa, and Latin America hold great promise. Higher levels of industrialization and increased regulation make for greater demand in more advanced GHS labeling. Companies that comply with local regulations and achieve economies of scale can gain an edge.

In-house vs. Outsourced Manufacturing

The GHS label market varies across regions with industrialization, regulatory enforcement, and sustainability goals. Companies whose strategies are in line with regional demands can leverage maximum growth opportunities.

| Region | North America |

|---|---|

| Market Share (%) | 40% |

| Key Drivers | Leadership in regulatory compliance and safety. |

| Region | Europe |

|---|---|

| Market Share (%) | 30% |

| Key Drivers | Adoption of REACH and circular economy practices. |

| Region | Asia-Pacific |

|---|---|

| Market Share (%) | 20% |

| Key Drivers | Rapid industrialization and export activities. |

| Region | Other Regions |

|---|---|

| Market Share (%) | 10% |

| Key Drivers | Growth in emerging markets. |

The GHS label market will expand with the advent of smart technology, green material formulations, and geographical expansion. Companies adopting ecological measures and innovative designs are going to rule the market.

| Tier | Key Companies |

|---|---|

| Tier 1 | Avery Dennison, Brady Corporation, 3M |

| Tier 2 | UPM Raflatac, CILS International |

| Tier 3 | GA International, SATO Holdings |

Industries would need to be compliant with safety and sustainability. The GHS label market will experience continuous growth with innovators who take the lead on the use of ecofriendly materials and market penetration. This will unlock more potential for growth, especially through partnership with the chemical, pharmaceutical, and manufacturing sectors.

Key Definitions

Methodology

This report is based on primary research and secondary data and acquired expert insights. The information gathered has been validated by experts from the industry and end-users to make it more accurate and reliable.

The GHS label market covers the production and usage of tough, compliant, and ecofriendly labeling solutions for hazardous materials. It focuses on issues of safety, precision, and sustainability.

Rising demand for compliant, durable, and eco-friendly labeling solutions drives growth.

By 2035, it is expected that the GHS label market of the world will grow past USD 2409.9 million CAGR 3.4%.

Avery Dennison, Brady Corporation, and 3M are key players.

Regulatory complexities, high production costs, and market awareness are key challenges.

Opportunities lie in smart labeling technologies, sustainable materials, and expanding into emerging markets.

Explore Tech in Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.