The Ghost Pepper Salt Market is expected to grow considerably. The budding consumer taste for gourmet and specialty salts is fueling the surge in demand. With the change in food preferences, the demand for unique, spicy condiments has mushroomed, and exotic flavors have grown popular. In home cooking, food-service and gourmet foods, ghost pepper salt, known for its intense heat and distinctively rich taste, rigorously pushed to attract consumers and producers.

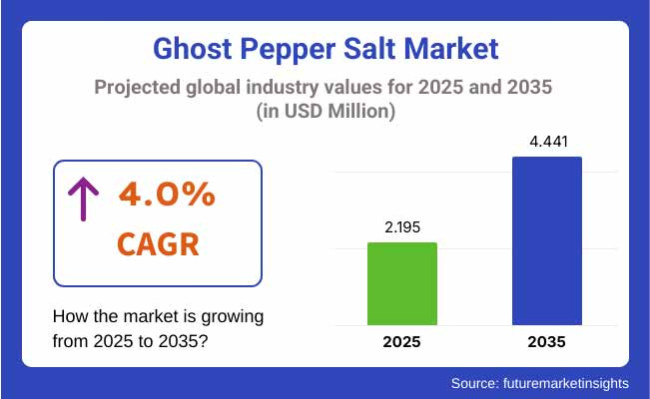

To cater for the health needs consumers, manufacturers are focusing on natural ingredient-based variants and organic offerings. The market is projected to surpass USD 4.441 Million by 2035, growing at a CAGR of 4.0% during the forecast period.

The North American market for ghost pepper salt is in a favourable position. The reason can be referred to as consumer demand is increasing as more people today are used to eating spicy foods on a daily basis. Most of this has taken place in the United States, with folks tending to use exotic spices for their day-to-day meals. Seattle specialty food shops and online stores are both expanding their offerings in response to growing consumer interest.

The use of ghost pepper salt in European markets is picking up due to the increasing interest in spicy and world cuisine. Country by country - Germany, France, and England - demand for yet more exotic seasonings is growing among consumers everywhere. The region reaps benefits from a rising preference for gourmet food as more consumers look for high-quality, small-scale salts.

The Asia-Pacific region is expected to have the highest growth rate for the ghost pepper salt market, driven by increased disposable income and strong cultural preferences in favour of spicy food. Countries such as china, India, Japan and South Korea are all leading in terms of consumption with a distinct emphasis on ghost pepper spiciness. The development of international cooking styles is increasingly popular with foodservice establishments, driving demand.

Challenge

High Production Costs and Supply Chain Constraints

The Ghost Pepper Salt Market faces challenges through high production costs, because most high-quality ghost peppers must be sourced for processing into salt. Inflexibilities in the supply chain, such as natural disasters and delayed transportation mean that any such disturbance will directly impact market stability and prices.

Regulatory and Health Concerns

Strict food safety regulations and labelling requirements pose challenges for manufacturers. As salt such as ghost pepper salt is an extremely spicy product, accurate labelling and compliance with food safety standards are essential to avoid poisoning consumers.

Opportunity

Rising Demand for Spicy and Gourmet Seasonings

Consumer tastes are moving toward richer, more unusual flavors- and the demand for spicy gourmet seasonings such as ghost pepper salt is increasing. People's creativity in adding heat to food has resulted in the development of a market for both home-made and eat-out spicy items.

Expansion of E-Commerce and Specialty Food Retail

High penetration of e-commerce and specialty food stores makes the manufacturers reach out globally. Direct-to-consumer sales channels and digital marketing strategies are creating niche markets and expanding the consumer base of brands.

From 2020 to 2024, the Ghost Pepper Salt Market gained popularity because of scorching hot tastes and spice seasonings. Limited flavors and cooperation with food brands propelled its development. From 2025 to 2035, this market is expected to following the introduction of organic and sustainably grown ghost pepper salts. Sustainable packaging innovations such as reusable containers and opening seal bags will provide both convenience and environmental protection.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food safety and labeling laws |

| Market Demand | Growth in gourmet spice interest |

| Industry Adoption | Small-scale and artisanal production |

| Supply Chain and Sourcing | Dependence on regional pepper farms |

| Market Competition | Dominated by niche spice brands |

| Market Growth Drivers | Rising popularity of spicy food challenges |

| Sustainability and Energy Efficiency | Limited focus on eco-friendly packaging |

| Integration of Digital Innovations | Social media-driven awareness |

| Advancements in Product Design | Basic glass and plastic packaging |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter international health and organic certification requirements |

| Market Demand | Expansion into mainstream markets and health-conscious consumers |

| Industry Adoption | Large-scale manufacturing with sustainable sourcing practices |

| Supply Chain and Sourcing | Diversification of suppliers and climate-resilient farming |

| Market Competition | Entry of large food conglomerates into the specialty seasoning space |

| Market Growth Drivers | Increased demand for organic and premium spice blends |

| Sustainability and Energy Efficiency | Adoption of biodegradable and sustainable packaging solutions |

| Integration of Digital Innovations | AI-based consumer preference analysis and targeted marketing |

| Advancements in Product Design | Smart packaging with resealable, moisture-proof features |

The USA's Ghost Pepper Salt market grows as consumers seek spicy and gourmet seasonings increasing. This culinary trend, joined by the company spread of unique and regional flavors in markets all over North America, has naturally had a knock-on effect on market output: The Ghost Pepper Salt's scale is now expanding well beyond Asia-even Europe as new developing nations such as Thailand are supplied with products sold through e-commerce platforms first launched last year from companies like Amazon (NASDAQ: AMZN)

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

The United Kingdom's Ghost Pepper Salt market is benefiting from an adventurous eating trend and the premium food craze. Consumers are drawn to bold tastes and throw wild red peppers into food dishes right at home.

The growing preference for natural and organic seasonings further fuels market demand-including ghost pepper infused salts on their list of products sold in increasing numbers.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.3% |

Gourmet seasonings and foreign cuisines have found a receptive audience in Europe, with this kind of market trend permeating through our own food franchises. This state now has acquired a taste for spiced condiments that goes beyond that of the French mustard addiction-and is especially popular among the younger generation and more food enthusiasts.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.4% |

Korea's Ghost Pepper Salt market is witnessing rapid growth as its culinary culture takes increasingly toward those bold and spicy flavors. The growing interest in fusion cuisine, coupled with premium condiments that enhance flavour and the sensual enjoyment of food, has helped fuel demand. Consumers want their small-batch, high-end seasonings to taste differently as well with unique flavour profiles; this represents an extra icing on life's cake at present.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

Jar Packaging Leads the Market Due to Convenience and Longer Shelf Life

| Packaging Type | Market Share (2025) |

|---|---|

| Jar | 47.8% |

The global market for Ghost Pepper Salt has seen rapid growth lately. Among both home cooks, professional chefs, and food manufacturers are discovering sea salt incorporated with Bhut Jolokia (ghost pepper) increasingly popular. The market is divided according to the packaging type, including jar and bag packaging.

Of these, jars are the largest market share, retaining 47.8% in year 2025. Unlike bags and other means of packaging, jars offer improved moisture resistance and longer storage periods. Mechanical integrity ensures that these products are easy for consumers to use without running into difficulties during processing at any stage delivery process-that is less cost per package delivered when you think about everything involved with this kind giant purchase Items are perceived to be better quality than they just come out of moulds straight mind remember everything else together and there is little Tracks as result, glass and plastic jars not only sustain the texture and spiciness of ghost pepper salt, but also lend an exquisite appearance to the product.

Another advantage is that cans enable both repeated filling and re-use options, reflecting general package type sustainability trends of today. Major brands release new bottle design innovations including adjustable openings lids grips seals to increase convenience.

Meat Applications Drive the Market with High Consumer Demand for Bold Flavors

| Application | Market Share (2025) |

|---|---|

| Meats | 43.6% |

The main area of use for ghost pepper salt is the meat industry, where it takes up 43.6% of market share in 2025.Ghost pepper salt is widely used in the seasoning of beef, pork, lamb and even grilled meats. It really brings out that extra fiery taste for a standout flavour experience! With the growing popularity of meats grilled food with bold flavour and Smokey or hot tastes, demand for ghost pepper salt has continued to rise.

Restaurants, fast food chains and gourmet food manufacturers are increasingly using ghost pepper salt in meat rubs, marinades and processed meat products alike. Smoked and infused styles of ghost pepper salt are becoming more popular among grillers and capsaicin fans with refined tastes. The vogue for at-home grilling has boosted demand for spice blends; consumers are looking to enjoy flavors beyond the ordinary.

At the same time, as the preferences of end customers move towards clean label products with natural preservative-free ingredients that can be eaten on their own or used in cooking without tasting "off," manufactures have started importing organic GHS-protected salt from countries like India and Mexico (which also produce conventional deliverables).The flexibility of ghost pepper salt has meant that it remains popular as a seasoning for burgers, steaks, jerky or smoked meats in both retail and food service outlets.

Ghost pepper-infused salt has become a hip and trendy culinary indulgence as of late. Sources are telling me that premium salt flavoured with ghost pepper has now become a trendy food ingredient, and consumers increasingly embrace it.

What's happening here is that by putting it in sea salt and marketing the product cleverly, some salt-makers are getting rich. It is also alleged by our informed sources that spice makers and other food product companies are filling over the void with such products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| The Spice Lab | 15 to 20% |

| Jacobsen Salt Co. | 12-16% |

| SaltWorks, Inc. | 10-14% |

| Bourbon Barrel Foods | 8-12% |

| Savory Spice | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| The Spice Lab | In 2024, launched a new ghost pepper sea salt blend targeting gourmet cooking enthusiasts. In January 2025, expanded its online and retail presence to meet growing consumer demand for artisanal salts. |

| Jacobsen Salt Co. | In 2024, introduced a handcrafted ghost pepper-infused salt with sustainable sourcing. In February 2025, partnered with restaurant chains to offer limited-edition spicy seasoning options. |

| SaltWorks, Inc. | In 2024, debuted a fine-grain ghost pepper salt blend for home cooks and professional chefs. In March 2025, announced a new range of all-natural, high-heat gourmet salts with exotic pepper varieties. |

| Bourbon Barrel Foods | In 2024, released a bourbon-smoked ghost pepper salt blend, combining smoky and spicy flavors. In January 2025, expanded distribution to specialty food stores and online gourmet retailers. |

| Savory Spice | In 2024, developed a low-sodium ghost pepper salt alternative for health-conscious consumers. In February 2025, launched a premium spice kit featuring ghost pepper salt alongside other gourmet seasoning blends. |

Key Company Insights

The Spice Lab (15-20%)

A leader in specialty salts, The Spice Lab focuses on premium, all-natural seasonings, appealing to gourmet food lovers and home chefs.

Jacobsen Salt Co. (12-16%)

Known for its artisanal approach, Jacobsen Salt Co. emphasizes sustainable sourcing and high-quality sea salt infused with bold ghost pepper flavors.

SaltWorks, Inc. (10-14%)

SaltWorks pioneers innovative spice blends and gourmet salts, offering a diverse range of fiery, handcrafted seasoning products.

Bourbon Barrel Foods (8-12%)

This brand stands out with its signature bourbon-smoked spice blends, blending unique flavor profiles for specialty food markets.

Savory Spice (6-10%)

Savory Spice caters to a broad audience, including health-conscious consumers, by offering premium, customizable spice blends with varying heat levels.

Other Key Players (35-45% Combined)

The overall market size for Ghost Pepper Salt market was USD 2.195 Million in 2025.

The Ghost Pepper Salt market is expected to reach USD 4.441 Million in 2035.

The demand for ghost pepper salt will be driven by increasing consumer preference for spicy and gourmet seasonings, rising popularity of exotic flavors in meats and seafood, growing demand for premium packaged spices, and expanding culinary experimentation trends globally.

The top 5 countries which drives the development of Ghost Pepper Salt market are USA, European Union, Japan, South Korea and UK.

Jar Packaging demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pepper Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Peppermint Oil Market

Peppermint Leaf Powder Market

Black Pepper Market Analysis - Size, Share & Forecast 2025 to 2035

White Pepper Market Analysis by Product Type, Form, Application and Distribution Channel Through 2035

Examining Market Share Trends in the Black Pepper Industry

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Smoked Black Pepper Market Trends - Flavor Innovation & Demand 2025 to 2035

Demand for Black Pepper in EU Size and Share Forecast Outlook 2025 to 2035

Salt Content Reduction Ingredients Market Size & Trends 2035

Salt Meter Market

Salt Hydrate Market

Basalt Rock Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fibre Market Size & Forecast 2024-2034

Sea Salt Market Analysis – Size, Share & Forecast 2024 to 2034

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Bath Salts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Lemon Salt Market Trends - Citrus-Infused Seasoning Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA