The gesture control market is estimated to be USD 17.5 billion in 2025 and is likely to grow to USD 67.8 billion by 2035, with a CAGR of 16.8% during the forecast period. The growing need for touchless human-machine interactions (HMI), which is advanced by technological advances and the increasing consumer use of smart electronics, is one primary contributor to this explosion.

The mass acceptance is further spurred by the different industries utilizing gesture-based control such as automotive, healthcare, gaming, and smart home automation.

The technology is such that it allows the user to control digital equipment through the movements of the user's hand instead of coming in contact with it. The technology makes use of techniques like motion sensors, 3D depth-sensing cameras, infrared sensors, and machine learning-based algorithms to identify and recognize the user's gestures-an easy-to-use and hassle-free experience.

As it makes its way into applications for smartphone navigation and automobile infotainment systems, it is also crossing over to the world of AR/VR, smart TVs, and medical imaging systems. Since it promotes health and safety in next-generation digital ecosystems, it is gaining attention worldwide by enhancing contactless and immersive interfaces.

A variety of factors drive the growth of the industry. Increasingly, interactive devices in personal consumer electronics require touch-free control, as are smartphones, gaming consoles, and smart wearables that are popular today. It is becoming common in infrequent safety and convenience-enhancing applications in the automotive area as manufacturers start to integrate them into infotainment systems.

However, increasing application of gesture recognition in healthcare-for example, in remote diagnostics and medical imaging-also increases industry scope. Growth is being accelerated even further through increased adoption of AI-based motion tracking and deep learning algorithms that have improved both the accuracy and responsiveness of them while making interactions more intuitive and natural.

Though optimistic, the industry faces several alarming challenges that will maintain the problem of high cost of deployment, technological complexity, and precision issues in real-world scenarios. Gesture recognition systems need to be accurately calibrated and sophisticated sensor technologies used, both of which raise manufacturing costs.

Furthermore, fluctuating conditions such as inconsistent lighting, variations in the size and shape of users' hands, and inconsistencies in how users move may affect system performance. At the same time, the technology's diffusion is hampered by low awareness and adoption in some fields as well as privacy issues relating to data gathering and monitoring through biometrics.

Advances in technology and emerging trends will offer new opportunities to the industry. AI-powered predictive analytics only help to increase efficiency in gesture recognition to provide the ideal user experience. By creating smart homes, increasing users can easily use them to control different home appliances, lighting, and security systems. Growth in AR and VR will also increase the scope of applications involving gesture interaction to be more widely used in games, training simulations, and industrial applications. Meanwhile, the top priority by industries remains touchless and intuitive user experiences, which promises continuous innovation and implementation into the industry for the future.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 17.5 billion |

| Industry Value (2035F) | USD 67.8 billion |

| CAGR (2025 to 2035) | 16.8% |

Explore FMI!

Book a free demo

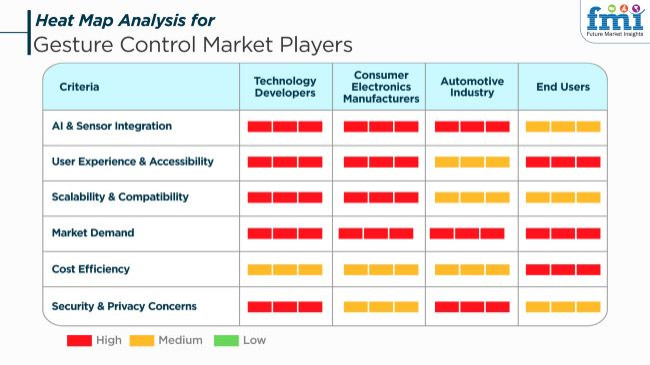

The industry remains in the incredible surge experiencing all the more robust 5 of driving factors, mainly AI, machine learning, and no-touch interaction technologies. Hence, technology developers are concentrating on the refinement of gesture recognition algorithms, which is, in turn, assisting them to improve response accuracy and integrate AI-driven adaptability that is helping end users to improve their overall experience. Consumer electronics manufacturers give priority to the smooth incorporation of them in gadgets such as smart devices and gaming consoles and in applications like AR/VR that are being used today by consumers.

The automotive domain is looking toward implementing them in audiovisual systems for information, driver support, and improved physical vehicle interactivity, which will in turn increase safety on the road and enhance user convenience. People prefer using the most natural and intuitive methods that are hands-free to control machines that thus improve their functionality, comfort and security in diverse areas.

Sensor accuracy, AI-driven adaptability, latency, device compatibility, and cost-effectiveness are the main purchasing factors. With more and more devices becoming truly touchless, such as in smart homes, automotive, and wearable devices, the technology is bound to reshape the interaction between humans and machines, thus propelling the onset of further innovations and the expansion of the industry.

Contract & Deals Analysis – Gesture Control Market

| Company | Contract Value (USD Million) |

|---|---|

| Microchip Technology Inc. | Approximately 70 - 80 |

| Sony Corporation | Approximately 80 - 90 |

| Infineon Technologies | Approximately 60 - 70 |

| Cognitec Systems | Approximately 50 - 60 |

From 2020 to 2024, the industry has shown a good growth due to the rise in the demand for touchless interfaces in consumer electronics, automotive systems, and industrial automation. The pandemic sparked a need for contactless interaction, ultimately influencing the gesture-based controls used in public kiosks, smart appliances, and healthcare devices. Enhanced sensor technology along with improvements in computer vision and AI-powered gesture recognition made the systems even more accurate and responsive.

Nevertheless, huge implementation costs, unavailability of the old systems, and variable accuracy in gesture recognition across environments continue to limit widespread acceptance. From 2025 to 2035, the industry will evolve with the adoption of artificial intelligence in adaptive recognition, edge computing, and 3D depth-sensing technologies. Gesture interfaces will eventually be upgraded to intelligent systems that support multimodal interactions comprising voice gestures and eye tracking for smooth control.

Advanced gesture identification in the automotive setting will provide more safety for any partners involved in navigation, distraction-free. Applications in the extended reality (XR) space will make use of improved gesture capture for greater immersion in the virtual world. With the continued downsizing of hardware and optimization within artificial intelligence, it becomes permanent in smart environments and human-machine interactions.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| With a more stringent privacy policy (the likes of GDPR and CCPA), data security and unauthorized biometric tracking became imperative for this technology. | Privacy-enhancing this systems harnessed AI technology to ensure real-time encryption-on-device processing and quantum-resistant mechanisms for authentication to protect user data. |

| The application has gained popularity in smart and mobile devices such as smartphones, smart TVs, and even gaming consoles to expand touchless interaction and increase user convenience. | Ultra-low latency gesture recognition systems powered by AI provide the level of seamlessness and intuitiveness. Such interactions exist in an AR and VR headset, wearable devices, and an entirely new generation of IoT ecosystems. |

| AI-based gesture control became accurate and realistic, allowing almost natural hand movements in applications such as gaming, cars, and smart homes. | AI-integrated neuromorphic processors enable real-time adaptive gesture learning, allowing hyper-personalized, context-aware interaction across various environments. |

| Automakers introduced in-car gesture recognition for infotainment, navigation, and driver assistance systems. | AI-powered multimodal gesture recognition enables autonomous vehicle control, allowing drivers to manage cockpit functions, smart dashboards, and external communications with hand signals. |

| The COVID-19 pandemic grew the need for gesture-controlled medical devices and public kiosks to minimize contact-based contamination. | AI-powered, non-invasive interfaces enable real-time remote surgery, AI-powered rehabilitation, and contactless interaction in smart hospitals and public spaces. |

| AR/VR platforms incorporated for more immersive digital experiences in gaming, virtual collaboration, and training applications. | AI-driven, full-body gesture tracking enables hyper-realistic interaction in the metaverse, revolutionizing digital twin environments, virtual workplaces, and next-gen gaming experiences. |

| Gesture-based human-machine interaction improved safety and efficiency in manufacturing, logistics, and warehouse operations. | AI-powered predictive gesture analytics enable intuitive robot collaboration, allowing hands-free machine control, real-time hazard detection, and adaptive automation in Industry 5.0. |

| Compact and low-power gesture recognition chips paved the way to integration into smart home appliances, wearables, and mobile devices. | Artificial intelligence -powered, self-powered gesture control sensors capitalize on ultra-low-power edge processing and energy scavenging to provide ongoing gesture-based interaction within battery-free solutions. |

| Financial institutions and companies developed gesture-based biometric authentication for improved security and user authentication. | AI-based, multi-factor gesture biometrics bypass passwords to offer secure and smart home security, and future-generation cybersecurity. |

| Firms concentrated on creating environmentally friendly, low-energy gesture recognition technology to meet sustainability objectives. | Recyclable AI-optimized gesture control hardware aids sustainable electronics production, minimizing e-waste and energy usage in intelligent devices. |

The industry is confronted with challenges brought about by the rapid pace of technological development, issues concerning hardware compatibility, adherence to regulatory requirements, security against cyber-attacks, and acceptance by the industry. The important risk to the industry is of technological advancement, particularly the development of AI-driven gesture recognition, sensor innovations, and deep learning algorithms. Businesses that do not blend in the most contemporary machine learning models, as well as real-time gesture recognition applications are particularly at a high risk and can go to oblivion.

The hardware compatibility issue is very vital since applications are dependent on the use of cameras, infrared sensors, LiDAR, and other motion control devices. To attain successful industry performance, it is highly crucial to ensure proper interfacing across devices such as smartphones, gaming consoles, AR/VR systems, and/or automotive systems. The presence of conflicts in the above respect may result in a subpar customer experience and consequently experiencing a reduction in the acceptance of the product.

Industries vary in terms of compliance with regulations, more so in sectors like automotive (ADAS systems), healthcare (the use of touchless controls in medical equipment), and consumer electronics. Observing safety protocols, privacy regulations including (GDPR, CCPA), and adherence to accessibility modes is essential to prevent legal complications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.2% |

| China | 9.8% |

| Germany | 8.7% |

| Japan | 8.9% |

| India | 10.3% |

| Australia | 8.5% |

The USA industry is expanding significantly as businesses adopt touchless interaction in consumer electronics, car interfaces, and health care systems.The technology industry in the USA is adopting for better user experience, AI-based human-computer interaction, and AR systems. AI-based gesture recognition, 3D motion tracking, and home automation investments crossed USD 12 billion in 2024. FMI is of the opinion that the USA industry is slated to grow at 9.2% CAGR during the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Increased Use by Smartphones, Smart TVs, and Wearable Devices | Smartphone, smart TV use, and wearable devices are making life convenient for consumers. |

| Emergence of AI-Based Motion Recognition | Artificial intelligence is accelerating gaming, automotive infotainment, and healthcare applications' precision levels. |

| Growing Applications in Automotive and AR/VR Systems | Gesture recognition is making man-machine interaction in cars, virtual reality environments, and robots easier. |

China's industry is developing leaps and bounds due to progress in AI-based sensing technology, growing application of touchless payment systems, and government-initiated initiatives for smart city growth. Being the world's biggest consumer electronics industry, China has been experiencing intensified usage of them in smart homes, automobile instrument panels, and security systems. Investment in gesture recognition and motion-tracking technology reached USD 15 billion in 2024.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Government Initiative for AI and Smart City | Policies that enable touchless interfaces across all public places and security solutions are driving adoption. |

| Enlargement of Gesture-Based Auto and Consumer Electronics Solutions | Growing usage by smart TVs, gaming consoles, and home automation provides convenience. |

| Accelerating Use of AI-Based Recognition Systems | Retail, health care, and industrial automation segments leverage gesture recognition to facilitate ease of use. |

Germany's industry is expanding with the automobile sector embracing hands-free control technology. Germany's industry clusters are investing in gesture recognition with AI for use in factory automation, medical imaging, and public transportation. Touchless interfaces application in health care and the public sector continues to rise.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Strong Adoption in Car Infotainment and Driver Assistance Systems | German automotive firms are putting gesture recognition to help drive in-car command and safety. |

| Growing Demand for Human-Machine Interaction Based on AI | It is boosting productivity in operation within manufacturing automation and healthcare. |

| 3D Motion Sensing and AR Solution Innovation | Smart wearables, augmented reality, and robots are driving growth in the sector. |

Japan's industry is increasing with the next-generation gesture-based interaction being accepted by the industries for robotics, artificial intelligence-enabled healthcare platforms, and video games. Japan's miniaturized technology and computer speed have boosted the inclusion of AI-controlled gestures in diversified applications.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Gestation Integration with Robotics and AI Interfaces | Japan has the leadership of gesture-controlled robots that are both human and auto-aid systems. |

| Growth in Gaming and AR/VR Applications | Rising demand for motion-sensing controllers for entertainment and virtual collaboration is driving the industry growth. |

| Development in Smart Home and Healthcare Automation | Increased usage of touchless interfaces in elder care and medical devices is increasing user accessibility. |

India industry is developing at a rapid rate with the support of AI-based human-computer interaction investment, such as the need for smart home automation and government initiative-supported digital technology adoption. Schemes like 'Digital India' and increasing internet penetration are driving the adoption of gesture-based user interfaces on mobile devices, automotive solutions, and smart surveillance systems. FMI is of the opinion that the India industry is slated to grow at 10.3% CAGR during the forecast period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Smart Technology and Digital Transformation Initiatives | Policy to drive integration of AI and IoT makes its usage possible. |

| Consumer Gesture Recognition Systems for Touchless Payment Systems and Consumer Electronics Development | Enhanced transaction security through increased adoption of gesture-based control in mobile, retail, and ATMs. |

| Increased demand for low-cost gesture recognition solutions | Small and medium enterprises are adopting AI-powered systems. |

Australia's industry is growing steadily as industries invest in AI-powered automation, healthcare technology, and smart infrastructure. The healthcare industry, defense industry, and mining industry are using them to enhance security and user experience. Australia's focus on man-machine interaction technology is opening up opportunities in the industry. FMI is of the opinion that the Australia industry is slated to grow at 8.5% CAGR during the forecast period.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Government-funded AI and Digital Health Solutions | Government-funded initiatives for touchless health technology and smart city infrastructure are propelling adoption. |

| Growing in Popularity for Security and Public Services | Deployment of facial recognition and gesture technology is driving public safety programs. |

| Natural Human-Computer Interfaces in Greater Demand | AI-driven motion sensing is virtualizing and energizing interactions across sectors. |

Wearable-based technology is gaining rapid popularity among consumer segments such asgaming, healthcare, and industrial automation. Real-world gesture recognition is made possible through the use of smart wearables, AR/VR devices,motion-sensing gloves, and haptic feedback systems, amongst others.

Wearable-based devices like the Apple Vision Pro and Meta's Oculus Quest series allow users to interact with their hands without the need for a traditional controller, enhancing immersion in their activities.

Healthcare applications are also growing to include gesture-controlled, contactless wearables tomonitor patients, robotic-assisted surgeries, and transportation of remote diagnostics. Responsive haptic gloves are manufactured by companiessuch as Magic Leap and Manus VR for surgical simulations or industrial training.

Vision-based technology employs cameras and infraredsensors along with AI to recognize hand and body movement. In contrast to wearables, vision-based systems do not need an external device and are, therefore, a natural fit for consumer electronics, automotive, and smart home usecases.

At the other endof the scale, big names like Intel, Sony, and Ultraleap keep pace with depth-sensing cameras, AI-based three-dimensional tracking, and LiDAR-based gesture recognition systems. Consumer electronicssegment holds the largest share of the industry othertypes of touchless gadgets. The increasing adoption of touchless gadgets such as smartphones, console gaming, smart televisions, and VR headsets that support touchless navigation is significantly driving up the industry.

The new tech is being built into the new generation of TVs, laptops, and mobile devices from major companies like Samsung, LG,and Sony. Samsung also has a hand-based system called "AirGestures," and LG has its own "ThinQ AI" (an AI platform) to provide users with convenient hand motion control systems. Modern game consoles (Nintendo Switch PlayStation VRKinecttheir own) utilize gesture recognition for a more interactive, immersive play experience.

Another key growth driver is the increasing useof them for smart home appliances. AI-based home assistants have begun to improve upon a no-touch point-and-click way of interacting with smart lighting, thermostats, and security systems using integrated products from Amazon Alexa, Google Assistant, andApple HomeKit.

It is one of the sectors benefiting themost in the automotive industry in terms of delivering improved safety for drivers and reducing distractions. Automakers, in an attempt to improve the overall in-car experience, are introducing gesture-based infotainment controls,dashboard navigation, and AI-powered driver assistance systems.

BMW, Tesla, and Mercedes-Benzare among the companies at the forefront of gesture interfaces. BMW's iDrive system lets drivers control volume, navigation, and calls with handgestures. The demand for intuitivevehicle interactions is harnessed through a vision-based AI with Tesla's Autopilot.

In high-end vehicle models,touchless vehicle control is emerging as a default offering, with manufacturers like Audi, Volkswagen, and Jaguar Land Rover now implementing motion-sensing cameras and LiDAR-based gesture tracking for smart navigation.

The Industryplace has grown significantly and continues to grow because of the rise in demand for touchless human-computer interaction as well as home automation into smart homes in various industries for better human-machine interaction. The latest technologies are Artificial Intelligence (AI) gestures to recognize gestures, sensors for 3D applications, and infrared tracking.

Some of the leaders that contribute enough to the global industry include Microsoft Corporation, Apple Inc., Google, Sony Corporation, and Infineon Technologies, all of them displaying touchless gesture-controlled devices via advanced possible sensor solutions, computer vision algorithms, and AI-driven gesture tracking systems. Furthermore, companies' innovative user engagement features, multimodal interaction, and enhanced motion-sensing accuracy are ways through which these firms are trying to improve their competitive advantage.

Industry growth can be attributed to further advancements in deep learning for gesture analysis, as well as the incorporation of haptic feedback and the development of low-power gesture recognition chips. The increasing sphere of adoption in gaming, augmented reality (AR) and virtual reality (VR) significantly adds to the competition between companies.

Strategic alliances, acquisitions, and product differentiation will determine future competitiveness as companies improve accessibility, enhance user experience, and target new applications across various industries.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft Corporation | 20-25% |

| Google LLC | 15-20% |

| Apple Inc. | 10-15% |

| Sony Corporation | 8-12% |

| Infineon Technologies | 5-10% |

| Microchip Technology | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft Corporation | AI-powered gesture recognition, Kinect technology, and AR/VR integrations. |

| Google LLC | Soli radar-based motion sensing, AI-driven touchless controls, and embedded gesture interfaces. |

| Apple Inc. | Gesture-based control for iOS devices, Face ID, and AR-based motion tracking. |

| Sony Corporation | Advanced gaming controllers, motion-tracking sensors, and interactive entertainment solutions. |

| Infineon Technologies | 3D ToF (Time-of-Flight) sensors for automotive, consumer electronics, and industrial applications. |

| Microchip Technology | High-precision infrared sensors, capacitive gesture detection, and embedded processing solutions. |

Key Company Insights

Microsoft Corporation (20-25%)

Microsoft is in the lead within the AI-fueled gesture recognition space, along with its Kinect technology and futuristic innovations in AR/VR motion tracking, for use both in gaming and industrial contexts.

Google LLC (15-20%)

Among the other players in gesture interfaces, one interesting aspect would be Soli radar-based motion sensing, AI-operated touchless control, and gesture recognition for smart devices by Google.

Apple Inc. (10-15%)

Apple also focuses on intuitive gesture control, such as Face ID, the use of LiDAR technology for motion tracking, and AR applications for user interaction with iOS devices.

Sony Corporation (8-12%)

Sony developed superior motion tracking controllers, gesture-enabled entertainment solutions, and VR applications of interactive systems for gaming and multimedia purposes.

Infineon Technologies (5-10%)

Infineon provides 3D Time-of-Flight (ToF) sensors for accurate gesture tracking in automotive, smart home, and industrial automation applications.

Microchip Technology (4-8%)

Microchip Technology provides high-precision infrared sensors, capacitive gesture recognition, and integrated processing for touchless controlling systems.

Other Key Players (30-38% Combined)

These companies contribute to ongoing advancements in gesture control technology by improving AI-powered recognition, expanding sensor accuracy, and enhancing real-time human-machine interaction. The increasing adoption of touchless interfaces, IoT-enabled smart devices, and AR/VR applications continues to shape the competitive landscape of the Industry.

The industry is slated to reach USD 17.5 billion in 2025.

The industry is predicted to reach a size of USD 67.8 billion by 2035.

India, slated to grow at a CAGR of 10.3% during the forecast period, is poised for the fastest growth.

gestigon GmbH, Ultraleap, Cipla, 4tiitoo GmbH, Logbar, PointGrab, Nimble VR, Intel Corporation, Apple Inc., and ArcSoft Inc. are key players in the industry.

AI-powered gesture recognition is being widely used.

By input devices, the industry is segmented into wearable-based, vision-based, infrared-based, electric field-based, and ultrasonic-based.

By dimension, the industry is segmented into 2-dimension and 3-dimension.

By application, the industry is segmented into consumer electronics, automotive, gaming and entertainment, healthcare, defense, and others.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.