The Germany wireless telecommunication services industry is projected to reach a market value of USD 1,37,446.2 million in 2025 and grow at a CAGR of 7.3%, reaching USD 2,77,407.3 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size in 2025 | USD 1,37,446.2 million |

| Projected Industry Size in 2035 | USD 2,77,407.3 million |

| Value-based CAGR 2025 to 2035 | 7.3% |

This is the largest segment in the wireless telecommunication services industry providing high-speed internet over Germany. Private and government telecom service providers are investing huge amounts in network infrastructure to facilitate the business activities of sectors including BFSI, healthcare, retail, IT & telecom, and manufacturing industries.

Such infrastructural development is critical in terms of increasing productivity and making service delivery better across multiple sectors.

With the deployment of 5G networks across Germany and other regions, more rapid, reliable, and consistent services are availing. New low-latency 5G connectivity-and global low-latency 5G connectivity-enables automotive, healthcare and manufacturing companies, to name a few, to depend on instantaneous data transfer-an advancement that will lead to innovations like self-driving cars, smart factories and enhanced telemedicine applications. This is allowing these sectors to increase productivity, reduce costs and also deliver better business results.

Germany's national focus on Industry 4.0 and digital transformation drive continued demand for seamless and secure wireless solutions. The success of so-called Industry 4.0 initiatives, which prioritize automation, data sharing, and the digitization of cyber-physical systems, depends heavily on sophisticated wireless technologies.

As a result, the demand for business internet continues to grow with the input of secure data transfer and high-speed communication primarily to remain competitive in the ever-changing digital environment.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

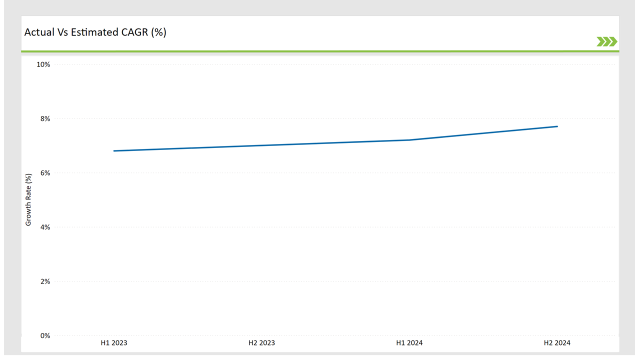

The following table highlights the CAGR trends for Germany’s wireless market over six-month intervals, providing key insights for stakeholders.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 6.8% |

| H2, 2024 | 7.0% |

| H1, 2025 | 7.2% |

| H2, 2025 | 7.7% |

H1 signifies January to June, while July to December analysis is signified through H2.

The consistent rise in 5G usage and cloud-based telecom solutions accelerate the market. In H2 2025, the industry is expected to grow at 7.7% CAGR, which shows how much Germany as a whole is trying to lean into digital transformations.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | Deutsche Telekom expands 5G standalone networks across major German cities. |

| Oct-24 | Vodafone Germany partners with SAP to improve enterprise connectivity solutions. |

| Mar-24 | Telefónica Germany (O2) launches AI-powered network optimization for 5G. |

| Sep-24 | 1&1 AG collaborates with a regional telecom provider to expand rural connectivity. |

| Dec-23 | Germany’s Federal Network Agency introduces new spectrum auction policies to boost competition. |

German telecom providers focus on advanced cloud-managed solutions, AI-powered telecom services, and 5G infrastructure investments to remain competitive. Government regulations further facilitate a fair and dynamic telecom environment.

5G Revolutionizes Connectivity

In Germany the main actors are Deutsche Telekom, Vodafone Germany, Telefónica Germany, (known as O2), and 1&1 AG. 5G connectivity is revolutionizing industries, including automotive, healthcare, and manufacturing, by utilizing real-time data transfer and automation, and they are ushering in its adoption.

For the consumer, boosted streaming, faster downloads, and better connected IoT are just some applications of a 5G rollout, which helps make Germany more digitally aware, one of its central goals. By 2030, telecom providers will cover over 90% of Germany.

Cloud Services Dominate the Market

Cloud adoption is driving digital transformation in finance, healthcare, and IT sectors. BFSI and enterprise clients rely on cloud-based telecom solutions for secure transactions, fraud detection, and real-time collaboration. Germany's data protection laws strengthen cybersecurity measures for cloud-based telecom services.

The telecom-managed services segment is growing at a CAGR of 7.5%, surpassing traditional telecom services as organizations prioritize scalability and security.

IoT and Smart Cities Expand Opportunities

Germany's smart city projects and IoT integration are changing the urban living by automation of traffic systems, improving the energy efficiency in buildings, and connecting public services. IoT optimizes industrial automation, healthcare monitoring, and transportation management.

The nationwide adoption of IoT is led by telecom providers, further enhancing Germany's lead in digital infrastructure.

Investments in Rural Connectivity Increase

The government and private investors are expanding wireless connectivity in rural areas. Germany’s Digital Infrastructure Fund is accelerating broadband and mobile network expansion in remote locations, supporting e-learning, telemedicine, and rural economic growth.

| Service Type | Market Share (2025) |

|---|---|

| Data/Internet Services | 41.5% |

| Fixed Voice Services & Messaging | 22.0% |

| Telecom Managed Services | 20.0% |

| Cloud Services | 16.5% |

The data/internet services segment dominates due to increasing reliance on high-speed broadband for businesses and consumers. Telecom-managed services and cloud services are growing rapidly as businesses transition to digital transformation and cloud-based operations.

| Technology | Market Share (2025) |

|---|---|

| 3G | 12.8% |

| 4G | 50.5% |

| 5G | 36.7% |

As industries commence their journey into the integration of IoT and AI powered applications, 4G continues to play the main role but excitement grows for 5G. Indeed, the decommissioning of 3G networks is opening the door to new and improved networking alternatives.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Major players are investing in 5G rollouts, IoT, and cloud-based services, keeping Germany’s wireless telecom market highly competitive.

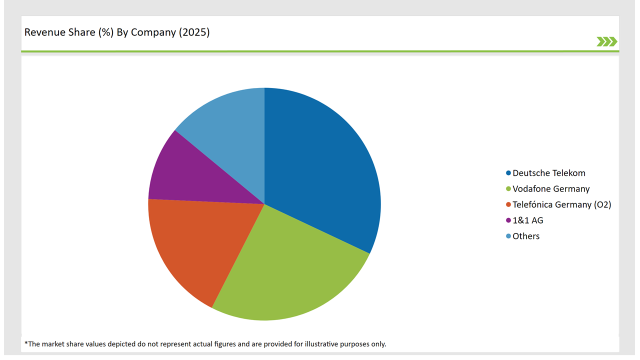

| Vendors | Market Share (2025) |

|---|---|

| Deutsche Telekom | 32.0% |

| Vodafone Germany | 25.5% |

| Telefónica Germany (O2) | 18.2% |

| 1&1 AG | 10.3% |

| Others | 14.0% |

Data/internet services, fixed voice services & messaging, telecom-managed services, and cloud services drive the market. Data services dominate due to growing high-speed internet reliance.

The market comprises 3G, 4G, and 5G technologies. The move from 4G to 5G reflects the need for faster and more efficient connectivity.

BFSI, healthcare, retail & e-commerce, IT & telecom, travel & hospitality and government sectors lead the adoption of wireless solutions.

The industry will grow at a CAGR of 7.3% from 2025 to 2035.

The market will reach USD 2,77,407.3 million by 2035.

Berlin, Munich, and Frankfurt lead due to strong urbanization and tech-driven industries.

Deutsche Telekom, Vodafone Germany, Telefónica Germany (O2), and 1&1 AG dominate the industry.

Explore Semiconductors Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.