The supplier’s quality management applications in Germany is expected to be valued at USD 1,966.8 million by 2025 and the market will grow at a CAGR of 10.5% till 2035 with a projected market value of USD 5,338.2 million by 2035. The growth is driven by a growing focus on supplier compliance, rising quality standards, and digital transformation of supply chains across industries.

| Attributes | Values |

|---|---|

| Estimated Germany Market Size in 2025 | USD 1,966.8 million |

| Projected Germany Market Size in 2035 | USD 5,338.2 million |

| CAGR (2025 to 2035) | 10.5% |

Cloud-based applications, AI-powered analytics, and stringent regulatory compliance, coupled with rising demand from end-use industries like automotive, aerospace & defence, electronics, healthcare, and food & beverage are the key growth enablers for the Germany supplier quality management applications market. Many organizations are leveraging sophisticated quality management solutions in an effort to improve supplier collaboration, reduce risks and streamline production.

Growth is driven by the Industry 4.0 revolution along with the growing demand for real-time monitoring of supplier performance. Blockchain integration for transactions between suppliers in a transparent manner & predictive analytics for IoT-based ensuring the quality of the supplier are expected to further revolutionize the market.

Explore FMI!

Book a free demo

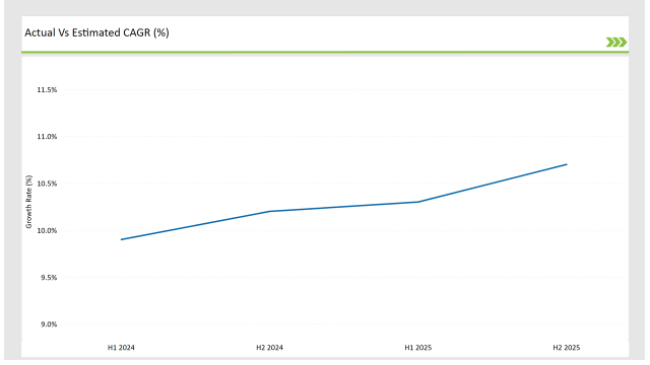

The table below provides insights into the compound annual growth rate (CAGR) of the German market over six-month intervals, allowing stakeholders to track trends effectively.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 9.9% |

| H2, 2024 | 10.2% |

| H1, 2025 | 10.3% |

| H2, 2025 | 10.7% |

H1 signifies January to June, while H2 signifies July to December.

The market is showing a steady rise in growth momentum, mainly attributed to enhanced supplier traceability, automation in quality management, and integration of AI-driven compliance monitoring.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | SAP introduced AI-powered supplier quality monitoring tools for real-time defect detection. |

| Oct-2024 | Siemens partnered with a cloud provider to enhance supplier compliance tracking and analytics. |

| Mar-2024 | Bosch launched a blockchain-based supply chain transparency solution for automotive suppliers. |

| Sep-2024 | TÜV Rheinland acquired a local quality management software firm to strengthen digital compliance services. |

| Dec-2023 | The German government introduced new supplier quality standards for aerospace and food & beverage sectors for enhancing traceability. |

Several German software providers have begun leveraging AI, cloud, and blockchain-based solutions to collaborate with suppliers, manage risk, and ensure EU compliance. As such, the proliferation of automated quality inspection tools are anticipated to provide the businesses with enhanced operational efficiency and diminishing supply chain disruptions.

Cloud-Based Supplier Quality Solutions Drive Growth

The increasing use of cloud quality management applications is changing the way companies manage supplier quality. These solutions are moving from on-premises to cloud platforms that improve scalability, collaboration, and data security for the enterprise.

The move facilitates quality processes for organizations, with integrated real-time monitoring and centralized access to critical supplier data from various locations. Varieties of suppliers are needed for industries like automotive, aerospace & defense or healthcare and these industries particularly benefit most from cloud-based solutions where suppliers must be continually assessed to maintain high-quality standards and high safety standards.

Adopting cloud technology can drive operational efficiencies, mitigate compliance risks, and increase transparency into supplier performance.

AI-Powered Supplier Analytics Transform Quality Management

The artificial intelligence (AI) has created to transform supplier quality management with these capabilities: predictive analytics, automated defect detection, and AI-powered audits. In fact, organizations are turning to AI-driven insights to catch supplier risks before they become production problems that lead to defects-enhancing supply chain reliability.

Major technology players such as SAP, Bosch, and Siemens, have been implementing machine learning algorithms aiming at improving supplier evaluation and fraud detection. These A.I.-driven tools assess vast bodies of data, identifying and flagging potential quality issues in real time and automating corrective actions.

AI-based supplier quality management systems further improve efficiency by automating documentation, minimizing human errors, and optimizing resource allocation. According to research, AI can decimate the number of hours spent in vendor assessment and cut the time in about four years in their supply risk assessments, this integration can uplift the operational efficiency of the organizations up to 40% through improvement in their supplier rating and compliance scores.

Integration of Blockchain Enhances Transparency

Blockchain technology can disrupt supplier quality management, especially in sectors where transparency, traceability, and compliance enforcement are paramount. Industries including aerospace, automotive, and food & beverage are already deploying blockchain-based systems to gain visibility into their entire supplier base, understanding transaction histories, contract terms, and quality certifications.

Storing supplier interactions on an immutable ledger allows businesses to maintain provenance records, check documentation of quality, and prevent fraudulent behaviour along the supply chain. Blockchain solutions allow for interoperability between suppliers, manufacturers, and regulators- keeping compliance data both tamper-proof and readily accessible.

Using Blockchain for Supplier Quality Management: Creating a transparent paradigm of accountability - ISGTW with the increasing adoption of blockchain technology, businesses will continue to invest in decentralized quality tracking systems to strengthen supplier relationships and regulatory compliance.

Regulatory Compliance Becomes More Stringent

The growing regulatory requirements are becoming more stringent, leading industry to adopt automated compliance tracking solution for supplier quality management. Germany has led the charge, rolling out tighter quality control requirements for companies to adopt real time measurement instruments to comply with changing EU directives and supplier compliance.

Automotive and food & beverage industries are under increased scrutiny, leading to the adoption of digital audit management platform for real-time tracking, documentation and reporting. These automated compliance tools assist businesses in risk mitigation by identifying possible regulatory violations, simplifying audit procedures, and minimizing manual oversight loads.

Others are developing AI powered compliance management platforms which not only assess regulatory changes in real time but also adjust supplier quality programs as required. Automated solutions allow businesses to take a proactive approach to compliance issues, keeping up with quality standards and avoiding fines for not complying to regulations.

With regulations constantly changing all over the world, organizations must be ahead with digital transformation in supplier quality management to be competitive and compatible with regulatory needs.

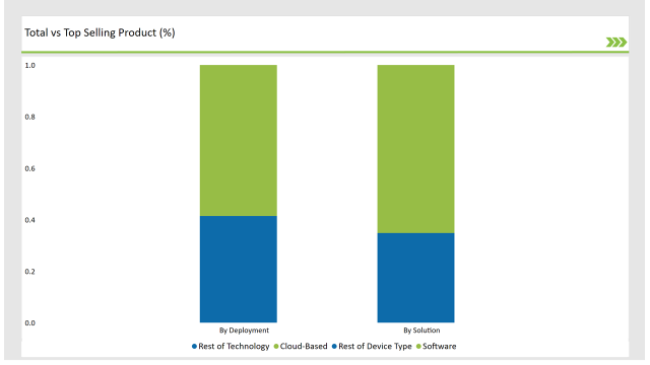

| Solution | Market Share (2025) |

|---|---|

| Software | 65.2% |

| Services | 34.8% |

The high demand for AI-powered assessment and cloud-based data analytics platforms push companies to invest in software-based solutions. Compliance-oriented sectors (healthcare, aerospace, etc.) are growing for managed services & consulting.

| Deployment | Market Share (2025) |

|---|---|

| Cloud-based | 58.6% |

| On-premises | 41.4% |

Cost-effective, real-time analytics, and scalability are several factors leading towards adopting cloud-based solutions. On-premise solutions are still relevant in regulated industries such as defense and pharmaceuticals, where data security is non-negotiable.

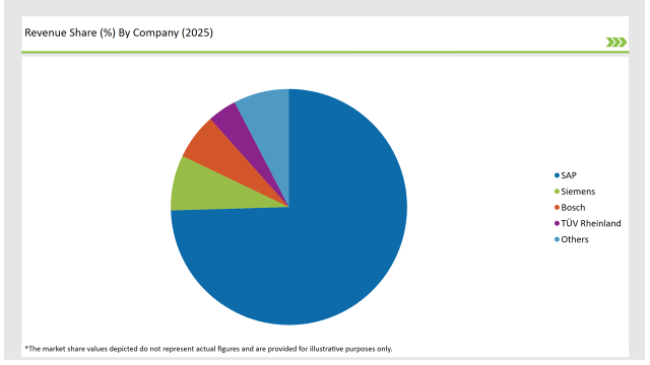

Germany’s supplier quality management applications market is highly competitive, with leading domestic players driving technological innovation and strategic partnerships.

| Vendor | Market Share (2025) |

|---|---|

| SAP | 210.5% |

| Siemens | 21.4% |

| Bosch | 17.8% |

| TÜV Rheinland | 11.2% |

| Others | 21.5% |

The market will grow at a CAGR of 10.5% from 2025 to 2035.

The industry is projected to reach USD 5,338.2 million.

Automotive, healthcare, and aerospace & defense are the key sectors.

SAP, Siemens, Bosch, and TÜV Rheinland dominate the market.

Software and Services.

Cloud-based and On-premises.

Automotive, Aerospace & Defense, Electronics & Semiconductors, Healthcare, Food & Beverage, and Others.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.